Daily Market Outlook, May 2, 2024

Daily Market Outlook, May 2, 2024

Munnelly’s Macro Minute…

“Recent Data Leaves Powell Boxed In, Further JPY Intervention Eyed”

In Asian trade, equities mostly climbed following remarks from Fed Chair Powell following the latest US Federal Reserve policy meeting. Powell's comments dampened speculation about an imminent interest rate hike, despite acknowledging recent robust data and a halt in disinflation trends. He hinted at continued policy restraint, suggesting that any cuts might take longer than previously anticipated. While his stance was more assertive than the Fed's March update, it fell short of the hawkishness feared by the markets.

Today's data docket lacks significant data releases in the UK. In the Eurozone, attention turns to final April manufacturing PMI estimates, with interest particularly in country-specific breakdowns beyond Germany and France. Initial figures for April showed Eurozone manufacturing PMI dipping to a four-month low of 45.6, underscoring ongoing contraction, while the services PMI signaled a third consecutive month of expansion.

Stateside, focus shifts to March trade figures, factory orders, and weekly jobless claims, though anticipation primarily centers on tomorrow's April labor market report. Recent data have consistently surpassed expectations, notably Q1 employment costs, prompting a scaling back of Fed rate cut predictions for the year, with only one cut fully priced in.

The OECD will unveil its economic outlook report, following its interim report in February highlighting global growth resilience in 2023 but revising down the 2024 forecast to 2.9%. The IMF's projection of 3.2% global growth for 2024 suggests a potential upward revision by the OECD. However, the broader outlook indicates global growth remaining below pre-pandemic averages.

Overnight Newswire Updates of Note

Powell Keeps Rate Cuts On Table, Leaves Timing Less Certain

US Dems Beg For Higher China Tariffs For Swing State Voters

Sec Blinken Pushes For Gaza Cease-Fire Deal In Visit To Israel

China Rejected US Efforts To Resume Talks On Nuclear Arms

BoJ Minutes: Many Saw Need For Yields To Be Set By Markets

Yen Swings Stir Talk That Japan In The FX Market Once Again

Japan Ex-Official: FX Intervention Show 160 Yen Line In Sand

Bank Of Canada’s Macklem Says Getting Closer To Rate Cuts

ECB’s De Cos: Increasingly Sure Inflation Will Slow To 2% Soon

PM Sunak’s Political Fate Hangs On Results Of Local Elections

Apple Set For Big Sales Decline As Investors Await AI In iPhones

Qualcomm Gives Solid Outlook In Sign Of Smartphone Recovery

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600-10 (1.35BLN), 1.0630 720M), 1.0645-50 (648M)

1.0660-65 (1.1BLN), 1.0670-75 (2.09BLN), 1.0680-90 (1.26BLN)

1.0695-00 (2.1BLN) 1.0710-25 (1.46BLN), 1.0745-55 (3.4BLN)

1.0775-85 (3.93BLN)

USD/CHF: 0.8835-50 (1BLN), 0.9000 (346M), 0.9150 (310M)

0.9165 (511M), 0.9225 (1.33BLN), 0.9250 (666M)

EUR/CHF: 0.9600 (1.3BLN), 0.9750 (410M), 0.9775 (570M)

0.9850 (372M)

GBP/USD: 1.2415-25 (506M), 1.2450-65 (652M), 1.2500 (317M)

1.2575-80 (547M)

AUD/USD: 0.6400 (1BLN), 0.6450 (433M), 0.6470-75 (748M)

0.6490-00 (1.5BLN), 0.6520-40 (921M), 0.6550 (521M)

NZD/USD: 0.5960 (782M). AUD/NZD: 1.0850 (348M)

1.0900 (354M)

USD/CAD: 1.3560-65 (502M), 1.3740-50 (729M), 1.3850 (1.16BLN)

USD/JPY 152.50 (1.35BLN), 153.00-10 (472M), 154.20 (402M)

154.75 (300M), 156.05 (662M), 156.75 (625M), 157.20 (310M)

AUD/JPY: 100.00 (565M)

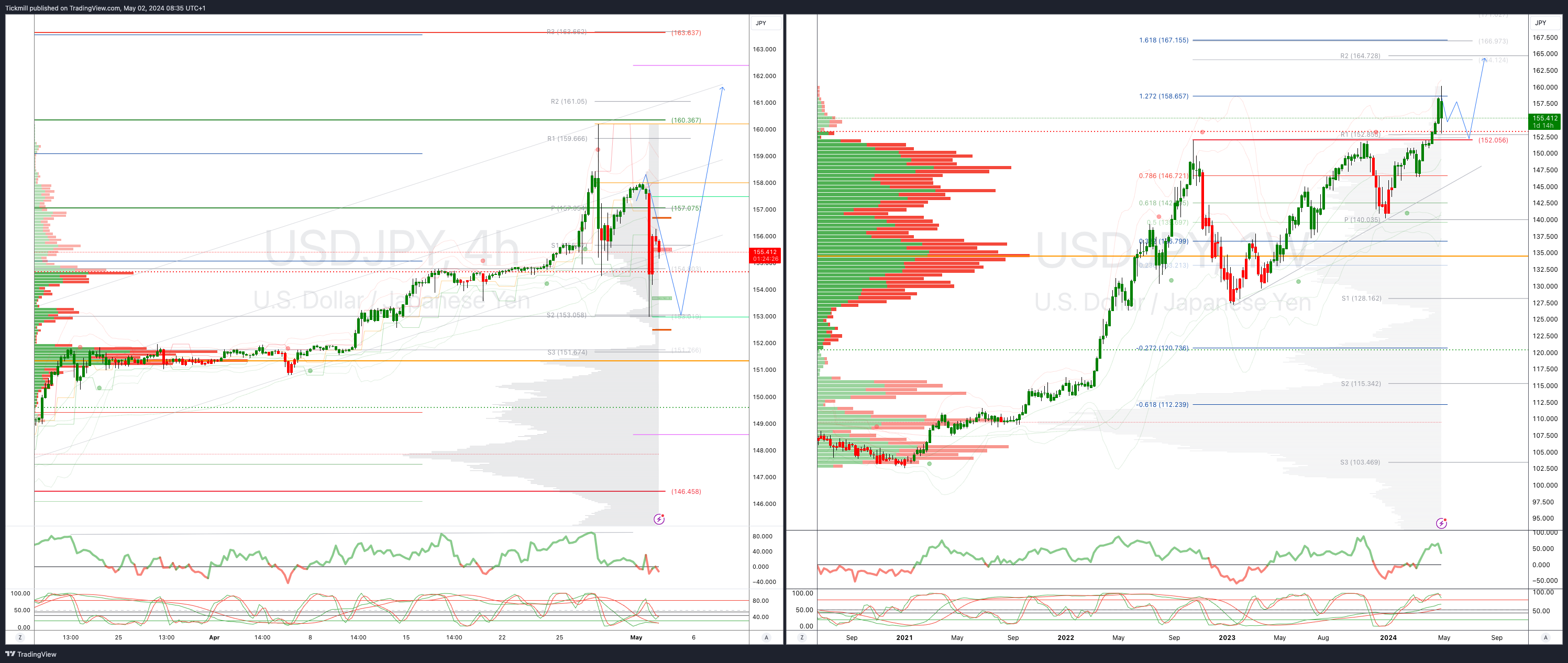

Japan may have intervened in the foreign exchange market by buying yen early on Wednesday, which could be a surprising continuation of their previous action on Monday. This move is expected to slow down the yen's decline and potentially reverse its downward trend. The timing of this intervention aligns with Japan's recent commitment to addressing foreign exchange issues around the clock, showing their willingness to use new strategies to achieve their goals. The U.S. dollar dropped nearly five yen in volatile trading at the end of the New York session, following the Federal Reserve's decision to keep interest rates unchanged and express concerns about inflation. By intervening during the illiquid period between the New York close and the Asian open, Japan may have caught traders off guard and undermined confidence in short-yen positions. Despite the yield differentials and accommodative policy of the Bank of Japan providing support for the dollar, repeated interventions could impact investor sentiment until a shift in fundamentals leads to a reversal in the yen's long-term downtrend. The USD/JPY pair has risen above 156.00 but faces resistance at 156.62, with a potential decline to 152.61.

CFTC Data As Of 26/04/24

Japanese yen net short position is -179,919 contracts

Euro net short position is -9,989 contracts

Swiss Franc posts net short position of -42,562 contracts

British Pound net short position is -26,233 contracts

Bitcoin net position is 0 contracts

Equity fund managers cut S&P 500 CME net long position by 16,969 contracts to 833,074

Equity fund speculators trim S&P 500 CME net short position by 9,927 contracts to 183,864

Gold NC Net Positions: $201.9K vs previous $202.4K

Technical & Trade Views

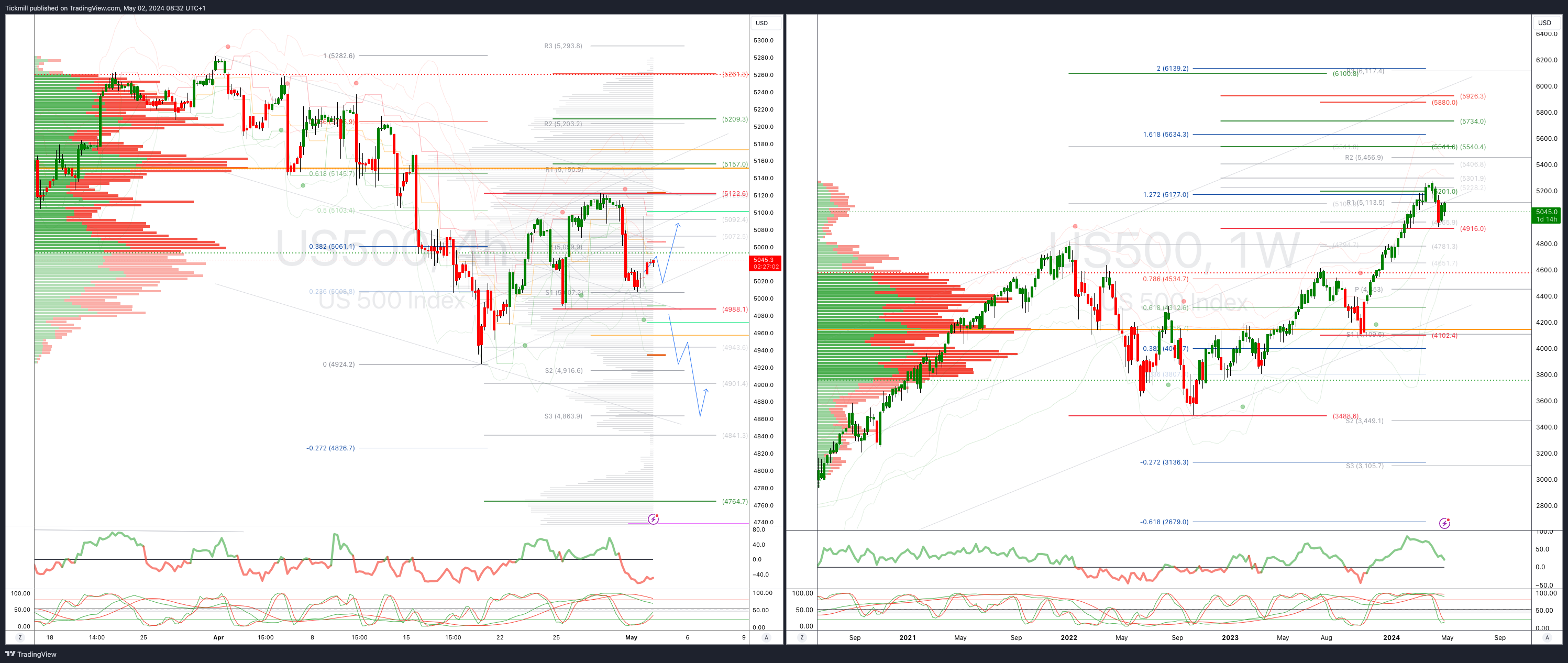

SP500 Bullish Above Bearish Below 5060

Daily VWAP bearish

Weekly VWAP bullish

Below 4987 opens 4920

Primary support 4987

Primary objective is 5150

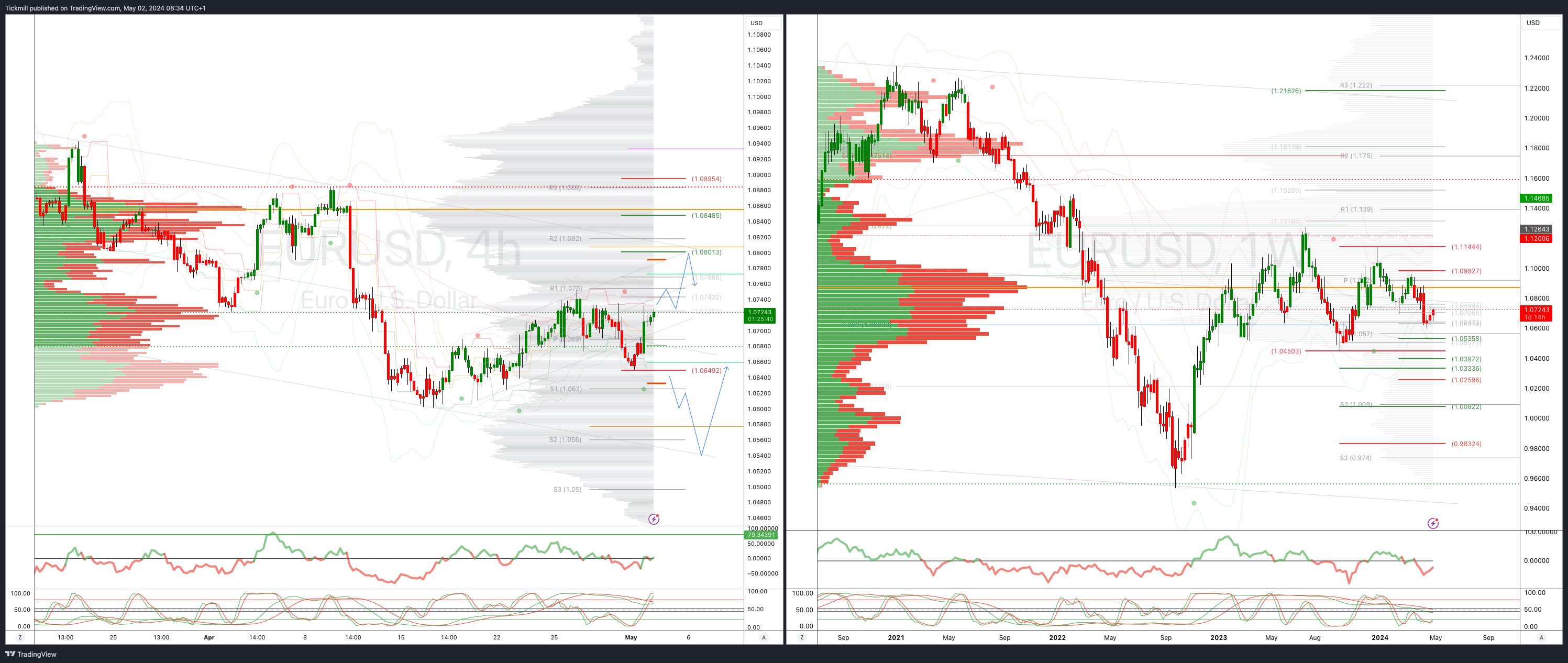

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.088

Primary resistance 1.850

Primary objective is 1.0550

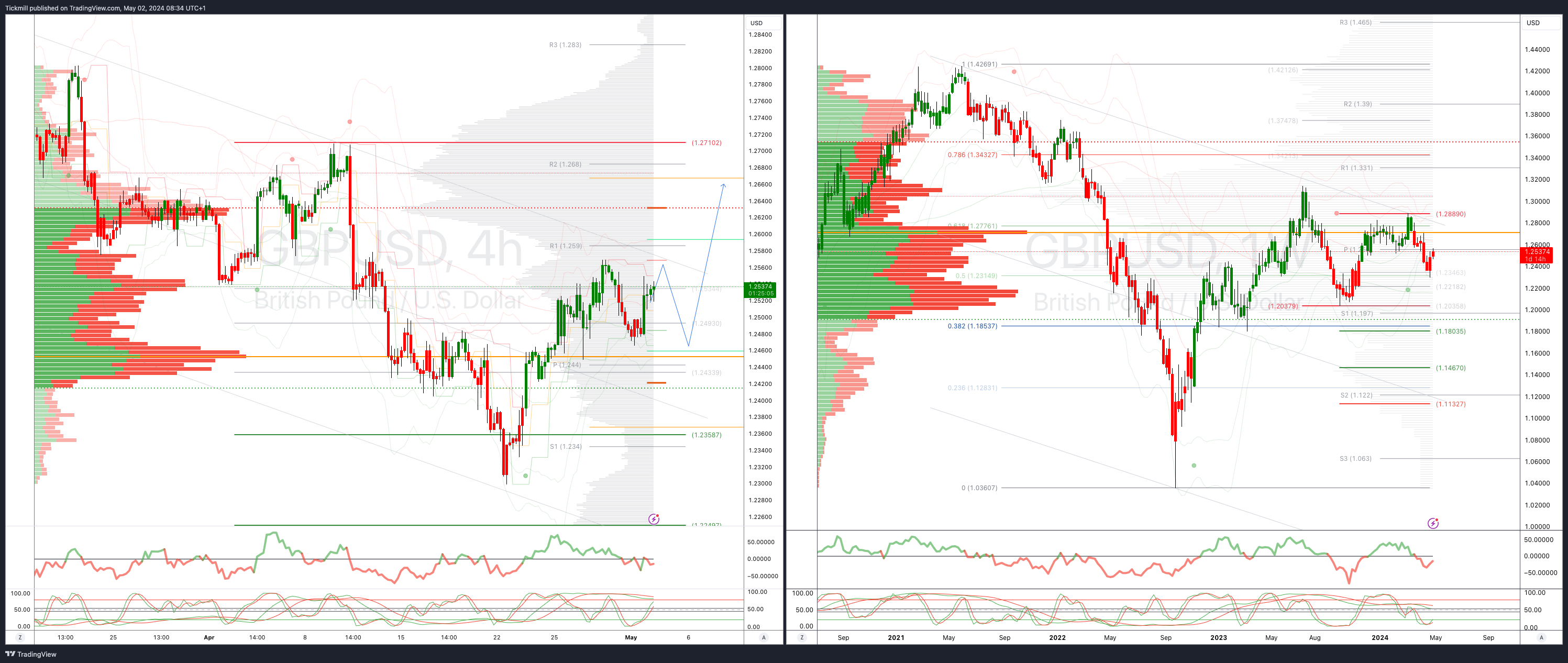

GBPUSD Bullish Above Bearish Below 1.2450

Daily VWAP bullish

Weekly VWAP bearish

Above 1.2590 opens 1.2640

Primary resistance is 1.2710

Primary objective 1.26

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

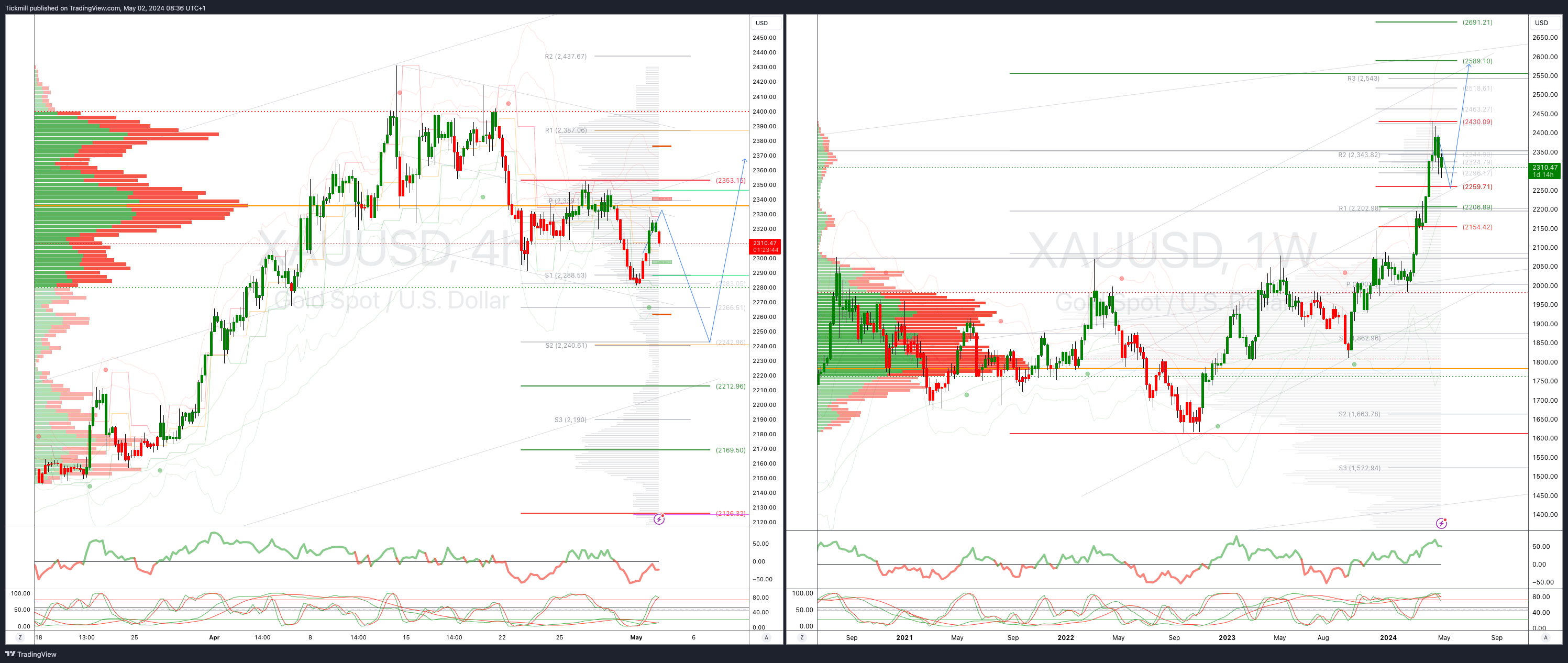

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Above 2360 opens 2400

Primary support 2260

Primary objective is 2560

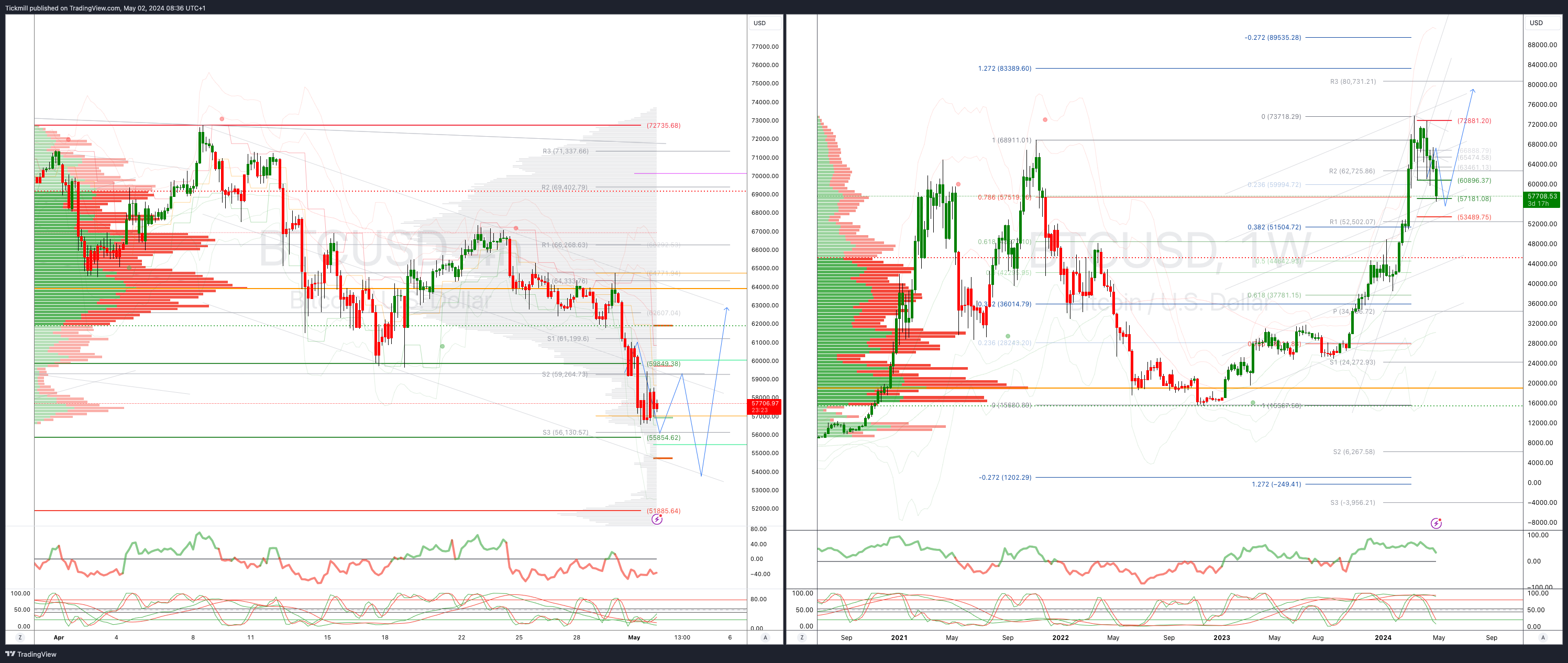

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bearish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 63000

Primary objective is 51500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!