Daily Market Outlook, May 17, 2024

Daily Market Outlook, May 17, 2024

Munnelly’s Macro Minute…

“China Data A Mixed Bag, Property Developers Bid On Stimulus Talk”

Overnight the Asian equity market showed a mixed performance. China's April data revealed conflicting economic trends, with industrial production growth surpassing expectations while retail sales growth unexpectedly slowed. This divergence is unlikely to alleviate pressure on Chinese authorities to implement additional measures to stimulate the domestic economy. Chinese property developer stocks rose on Friday as investors anticipated more government measures to stabilize the crisis-hit sector. New data revealed the fastest decline in new home prices in over nine years. Vice Premier He Lifeng announced that China will allow local government authorities to purchase homes at "reasonable" prices to provide affordable housing during an online meeting on housing policy. In the US, Federal Reserve policymakers cautioned that despite this week's lower-than-expected inflation report, interest rates might need to remain high for a prolonged period. On the other hand, Bank of England policymaker Greene indicated evidence of a more balanced UK labor market, hinting at potential support for an interest rate cut.

Looking ahead, there are no significant releases in the UK today. In the Eurozone, the second reading of the April CPI is not expected to differ from the initial estimate, showing annual inflation at 2.4%, unchanged from March. Although both overall and core inflation rates in the Eurozone have decreased significantly from their peaks, they remain above the European Central Bank's target. The ECB's next policy update on June 6 may see interest rate cuts, as suggested by policymaker comments, but caution remains about future actions.

Stateside, the only notable release is the April update for the leading index, which predicts future economic trends based on various indicators. It has had little market impact recently, with a similar decline expected for April. This week, the U.S. consumer price index (CPI) showed a decrease, causing market participants to quickly anticipate at least two interest rate cuts this year. However, Federal Reserve officials have indicated that rates may need to remain higher for a longer period, and a report indicating a tight labor market has led to a change in expectations. Currently, markets are fully expecting one rate cut in November, with a 68% chance of a cut in September, bringing us back to where we were before the CPI data in terms of U.S. rate expectations.

Overnight Newswire Updates of Note

Fed Officials Suggest Interest Rates To Stay High For Longer

China Retail Sales Slow As Industrial Output Beats Forecasts

China Home Prices Fall At Faster Pace Despite Revival Efforts

BoJ Has No Immediate Plan To Sell ETF Holdings, Ueda States

BoJ Keeps Bond Buying Unchanged After Surprise Monday Cut

BoJ May Hike Rates As Soon As June, Ex-Chief Economist Says

ECB’s Schnabel: July Interest Rate Cut Doesn’t Look Warranted

Hunt Vows Conservatives Will Cut Taxes If They UK Win Election

Oil Set To Eke Out Weekly Gain As Supply And Inflation Set Tone

Applied Materials' Third-Quarter Forecast Disappoints Investors

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800-10 (1.4BLN), 1.0820-25 (1.2BLN), 1.0850 (3BLN)

1.0875 (1.2BLN), 1.0915 (1.1BLN)

USD/CHF: 0.9000 (605M), 0.9040 (209M), 0.9050 (375M), 0.9060 (300M)

EUR/CHF: 0.9925 (403M)

GBP/USD: 1.2600 (235M), 1.2640-50 (354M), 1.2745 (200M)

AUD/USD: 0.6600 (524M), 0.6625-30 (1BLN), 0.6650-60 (1.3BLN), 0.6680 (318M)

NZD/USD: 0.5880 (1.5BLN), 0.5950 (948M), 0.6085-95 (427M)

USD/CAD: 1.3550 (381M), 1.3600 (508M), 1.3640-50 (509M), 1.3675 (887M)

USD/JPY: 154.00 (2BLN), 154.80 (500M), 155.00 (2BLN), 155.50 (891M)

156.00 (790M), 156.35 (537M), 156.60 (475M), 157.00 (1.4BLN)

CFTC Data As Of 10/05/24

British pound net short position is -21,813 contracts

Euro net long position is 4,590 contracts

Japanese yen net short position is -134,922

Swiss franc posts net short position of -41,787

Bitcoin net short position is -783 contracts

Equity fund speculators increase S&P 500 CME net short position by 69,524 contracts to 238,456

Equity fund managers raise S&P 500 cme net long position by 44.751 contracts to 860,694

Gold NC Net Positions: $199.6K vs previous $204.2K

Technical & Trade Views

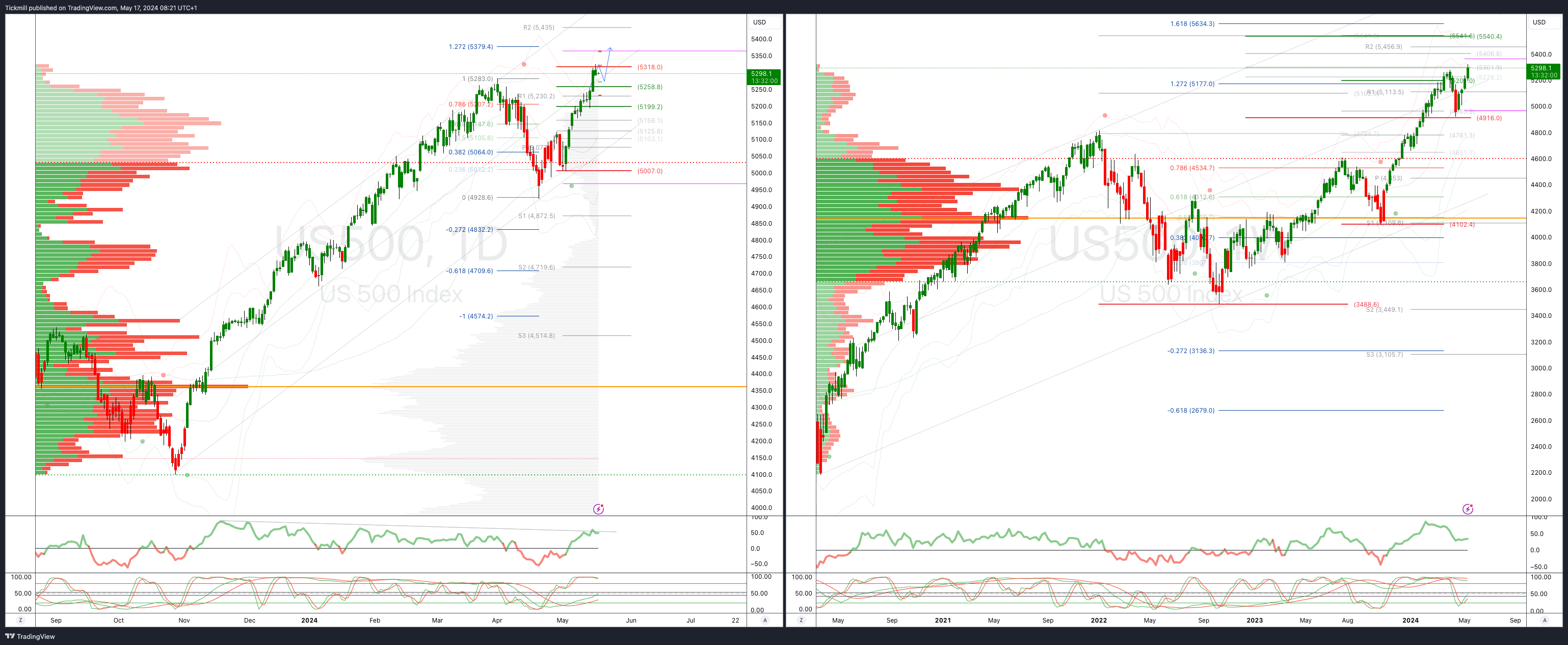

SP500 Bullish Above Bearish Below 5280

Daily VWAP bullish

Weekly VWAP bullish

Below 5258 opens 5200

Primary support 5160

Primary objective is 5258 TARGET HIT NEW PATTERN EMERGING

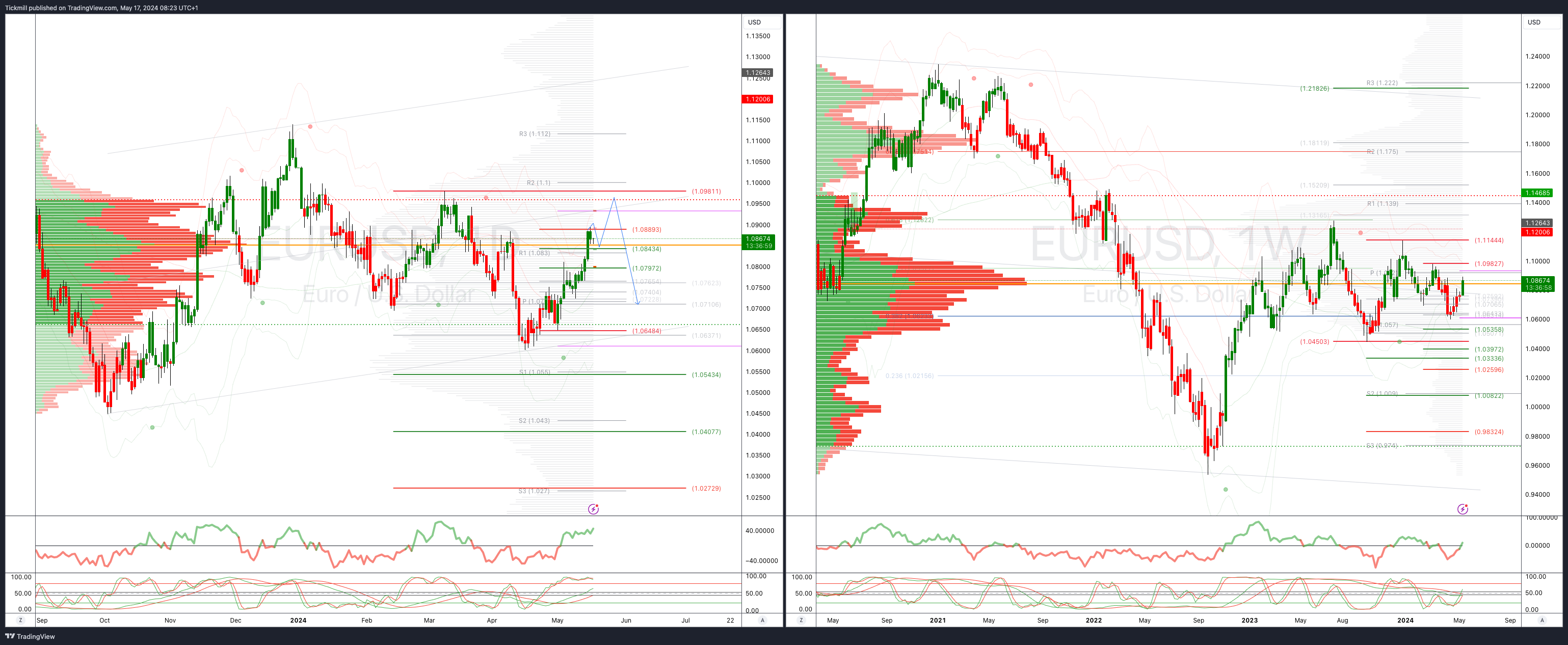

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

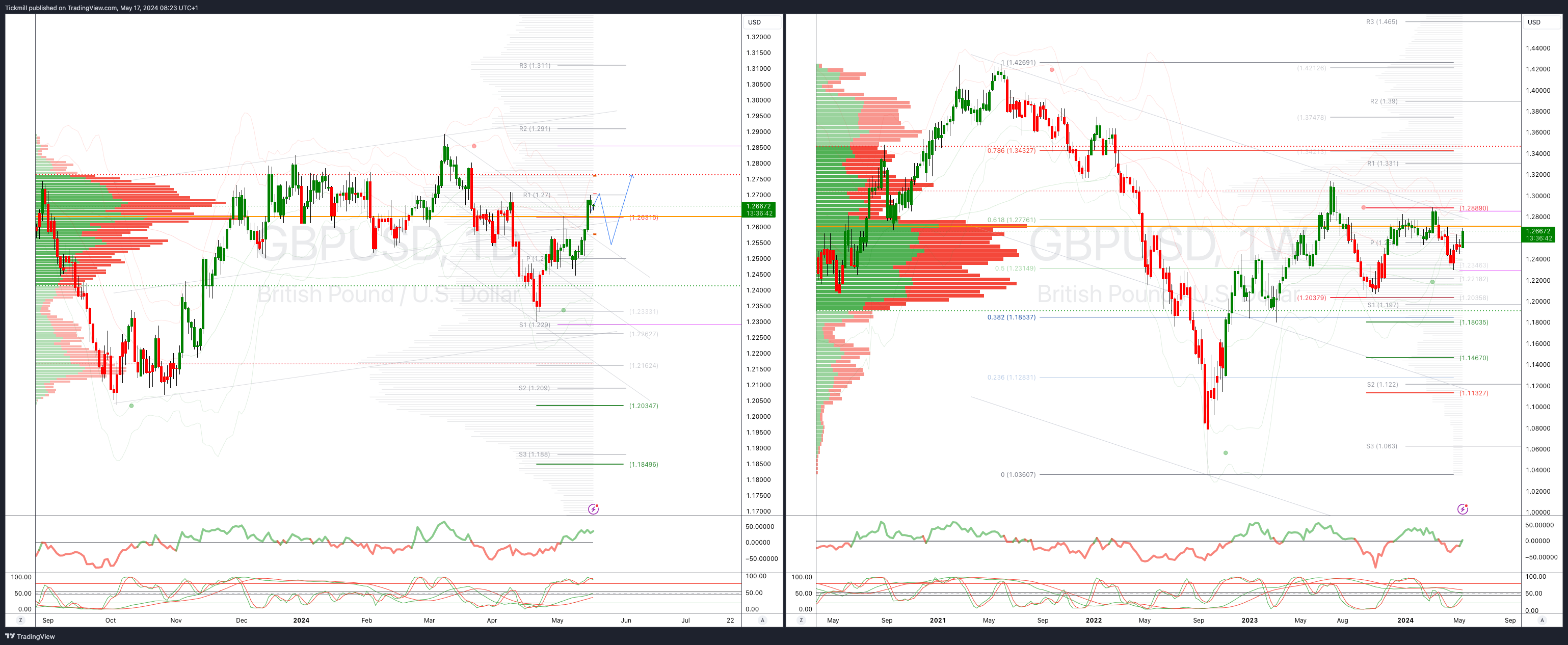

GBPUSD Bullish Above Bearish Below 1.2630

Daily VWAP bullish

Weekly VWAP bearish

Above 1.27 opens 1.2750

Primary resistance is 1.2889

Primary objective 1.2034

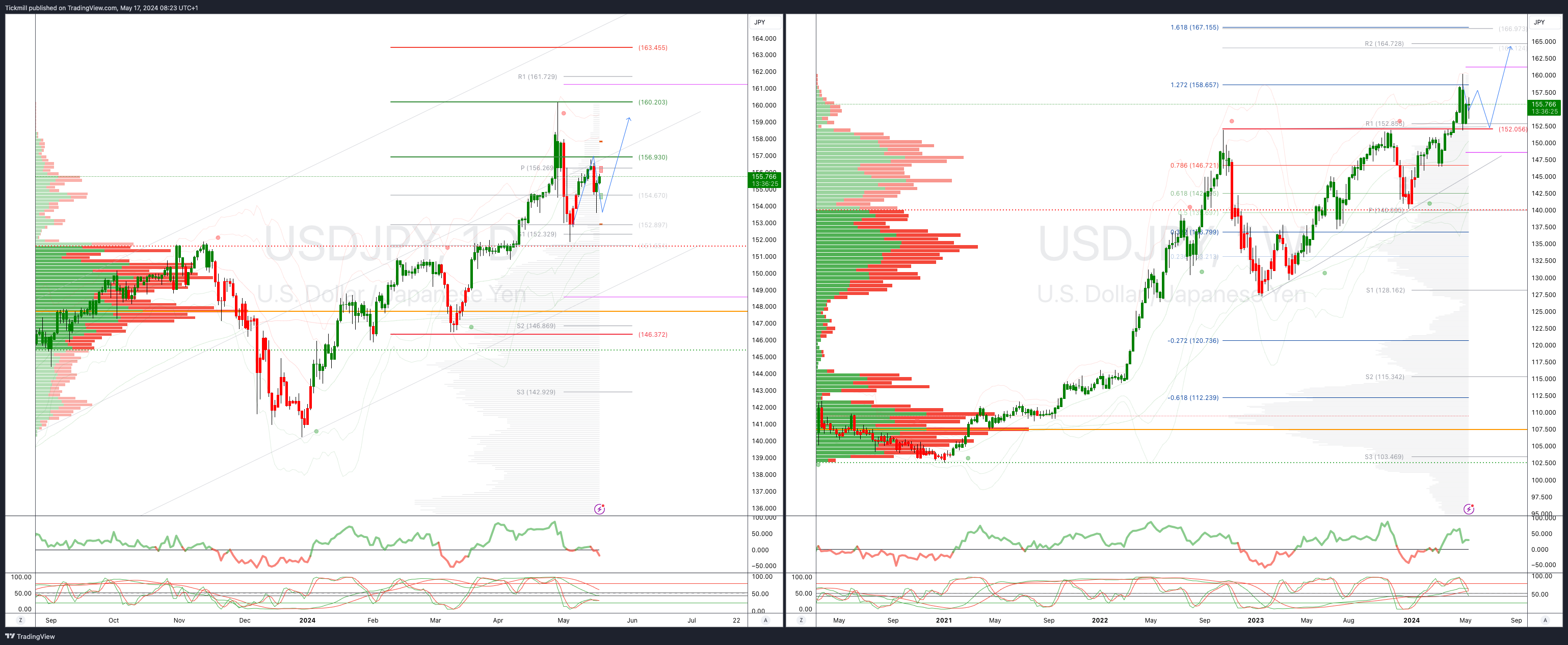

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

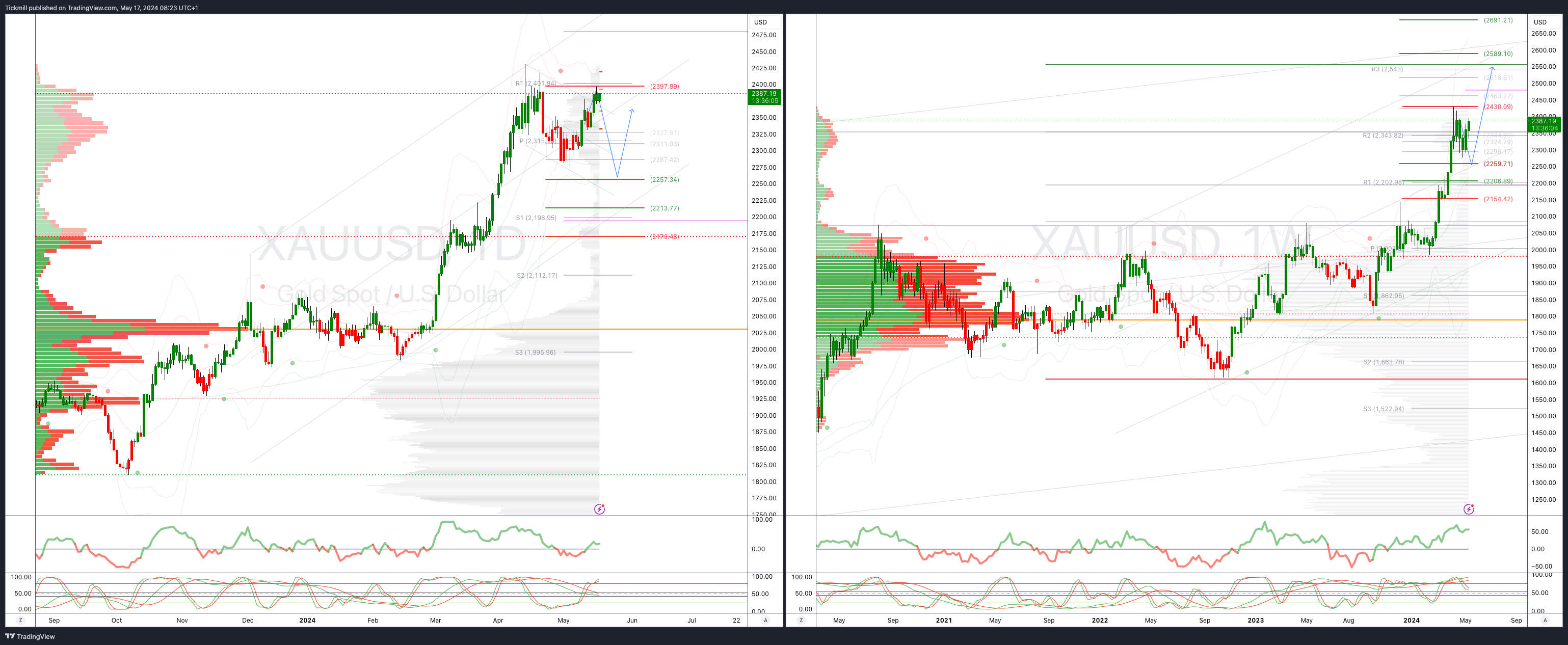

XAUUSD Bullish Above Bearish Below 2376

Daily VWAP bullish

Weekly VWAP bullish

Above 2376 opens 2425

Primary support 2260

Primary objective is 2560

BTCUSD Bullish Above Bearish below 64000

Daily VWAP bullish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 67648

Primary objective is 53877

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!