Daily Market Outlook, May 16, 2024

Daily Market Outlook, May 16, 2024

Munnelly’s Macro Minute…

“Markets Buoyant With Goldilocks Inflation & Retail Sales Data”

Equity markets in the Asia-Pacific region continued to rise, reflecting the positive momentum in US and European markets. The latest US data, which showed a slow start to Q2 for retail sales and no surprises in April CPI inflation, played a key role in this trend. As a result, there is now a growing expectation of Fed rate cuts later in the year, with two quarter-point reductions already being fully accounted for.

Looking ahead, there are no major data releases from the UK or Eurozone today. Market attention remains focused on analyzing yesterday's US CPI inflation and retail sales figures to assess their impact on monetary policy expectations. These data have eased concerns about a resumption of Fed interest rate hikes, potentially strengthening the current stance of maintaining rates at their current levels while waiting for further data.

In the US, today's data releases include industrial production, housing starts, and building permits for April. A modest 0.2% increase in industrial production is expected, along with a rebound in housing activity following a lackluster performance in March. The release of the Philadelphia Fed manufacturing survey for May is also eagerly anticipated, particularly after the softer-than-expected outcome of yesterday's NY Empire State manufacturing survey. The US weekly jobless claims numbers will also receive significant attention following last week's spike to 231k, the highest since August. A sustained increase could indicate a cooling labor market.

Central bank speakers scheduled for today include the Bank of England's Greene, who will discuss the UK labor market. Her voting history and previous comments suggest a hawkish stance. Four regional Fed heads: Thomas Barkin, Raphael Bostic, Loretta Mester, and Patrick Harker. Additionally, Fed Vice Chair for Supervision Michael Barr will testify before the Senate. European Central Bank (ECB) speakers include Vice President Luis de Guindos, Bank of Spain Governor Pablo Hernandez de Cos, and Bank of Portugal Governor Mario Centeno.

Overnight Newswire Updates of Note

Fed’s Goolsbee Praises Disinflation, Says More Progress Is Needed

US Inflation Data Accidentally Released 30 Minutes Early, BLS Says

China Recovery Likely Picked Up With Outlook Buoyed By Stimulus

Japan Economy Sputters As Dismal Run Extends To Three Quarters

RBA’s Hunter Warns Of No ‘Quick Fix’ To Australia’s Housing Crisis

Australia Unemployment Rises As More Workers In-Between Jobs

Oil Advances On US Stockpile Decline And Broader Risk-On Mood

Cisco Gives Upbeat Forecast In Sign Of Network Spending Pickup

GameStop, AMC Shares Drop As Raucous Meme Rally Evaporates

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

FX option strikes expire at 10-am New York/3-pm London - Thursday May 16

EUR/USD: 1.0820-25 (1.7BLN), 1.0845-50 (2.2BLN), 1.0875 (1.7BLN)

1.0900 (1.6BLN), 1.0915-20 (1.9BLN)

USD/CHF: 0.9025 (464M), 0.9060-70 (429M), 0.9080 (396M), 0.9100 (702M)

EUR/CHF: 0.9675 (334M), 0.9710 (200M)

GBP/USD: 1.2600 (643M), 1.2605-15 (713M)

EUR/GBP: 0.8575-80 (528M)

AUD/USD: 0.6600 (1.1BL), 0.6625-30 (608M), 0.6640-50 (1.1BLN), 0.6725 (507M)

NZD/USD: 0.6000 (674M), 0.6040 (347M)

USD/JPY: 153.00 (1.9BLN), 153.50 (587M), 153.80-85 (1BLN), 154.00 (770M)

154.40 (500M), 155.00-05 (1.7BLN), 156.00 (661)

EUR/JPY: 169.00 (400M), 169.40 (400M), 158.00 (560M)

CFTC Data As Of 10/05/24

British pound net short position is -21,813 contracts

Euro net long position is 4,590 contracts

Japanese yen net short position is -134,922

Swiss franc posts net short position of -41,787

Bitcoin net short position is -783 contracts

Equity fund speculators increase S&P 500 CME net short position by 69,524 contracts to 238,456

Equity fund managers raise S&P 500 cme net long position by 44.751 contracts to 860,694

Gold NC Net Positions: $199.6K vs previous $204.2K

Technical & Trade Views

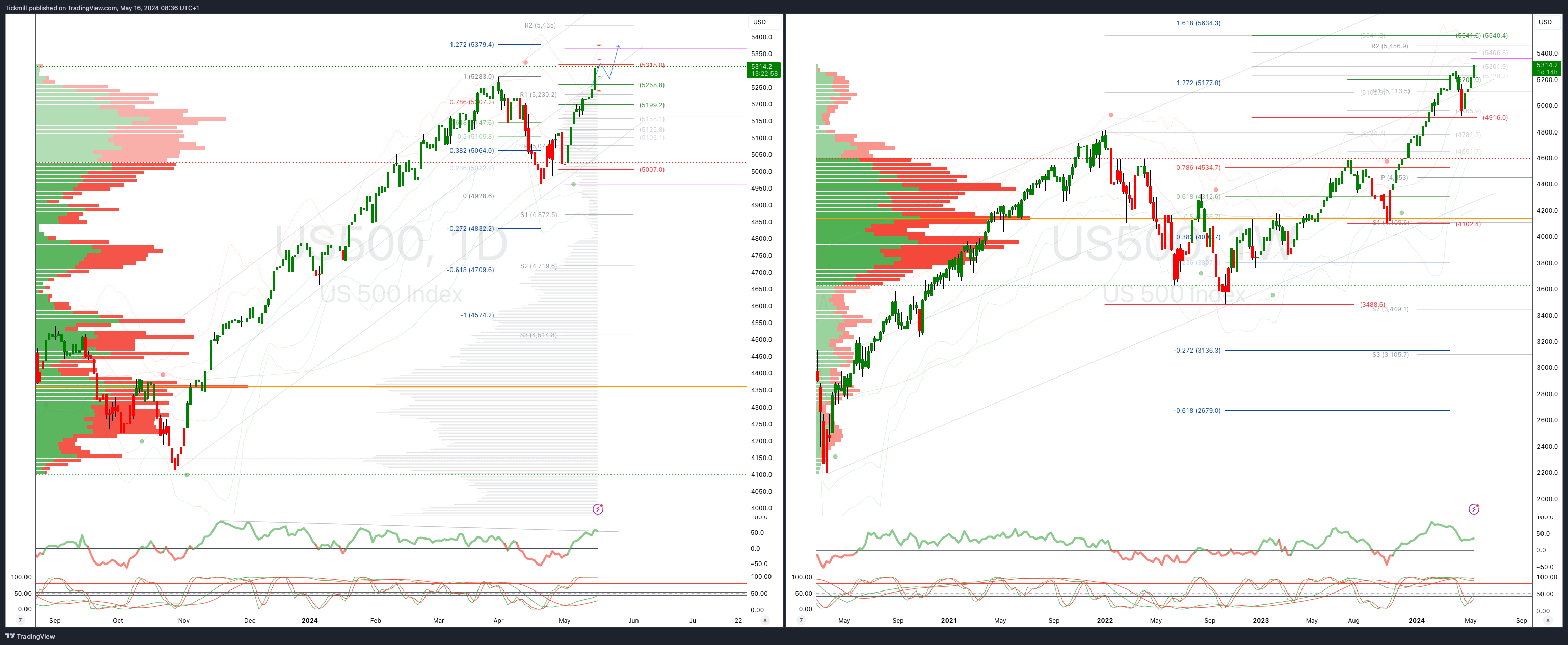

SP500 Bullish Above Bearish Below 5280

Daily VWAP bullish

Weekly VWAP bullish

Below 5258 opens 5200

Primary support 5160

Primary objective is 5258 TARGET HIT NEW PATTERN EMERGING

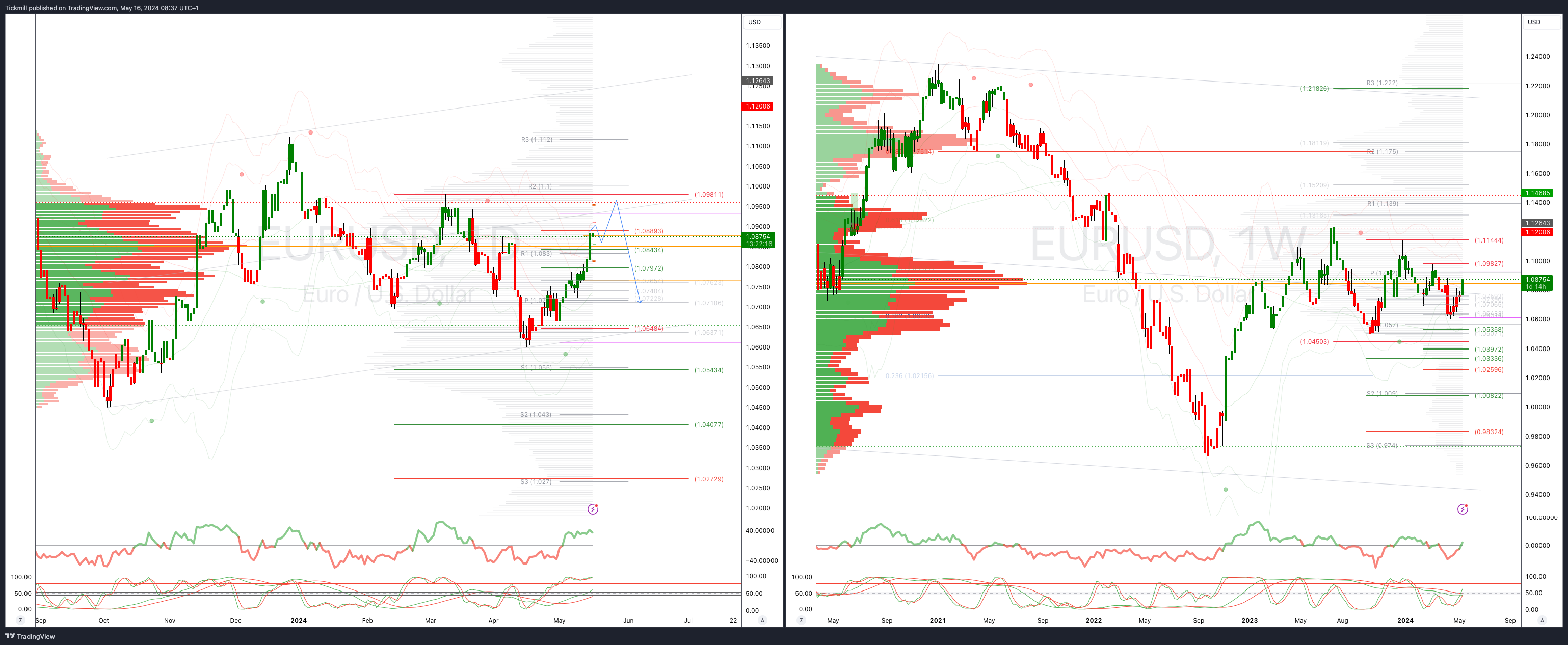

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10 opens 1.11

Primary resistance 1.0981

Primary objective is 1.0550

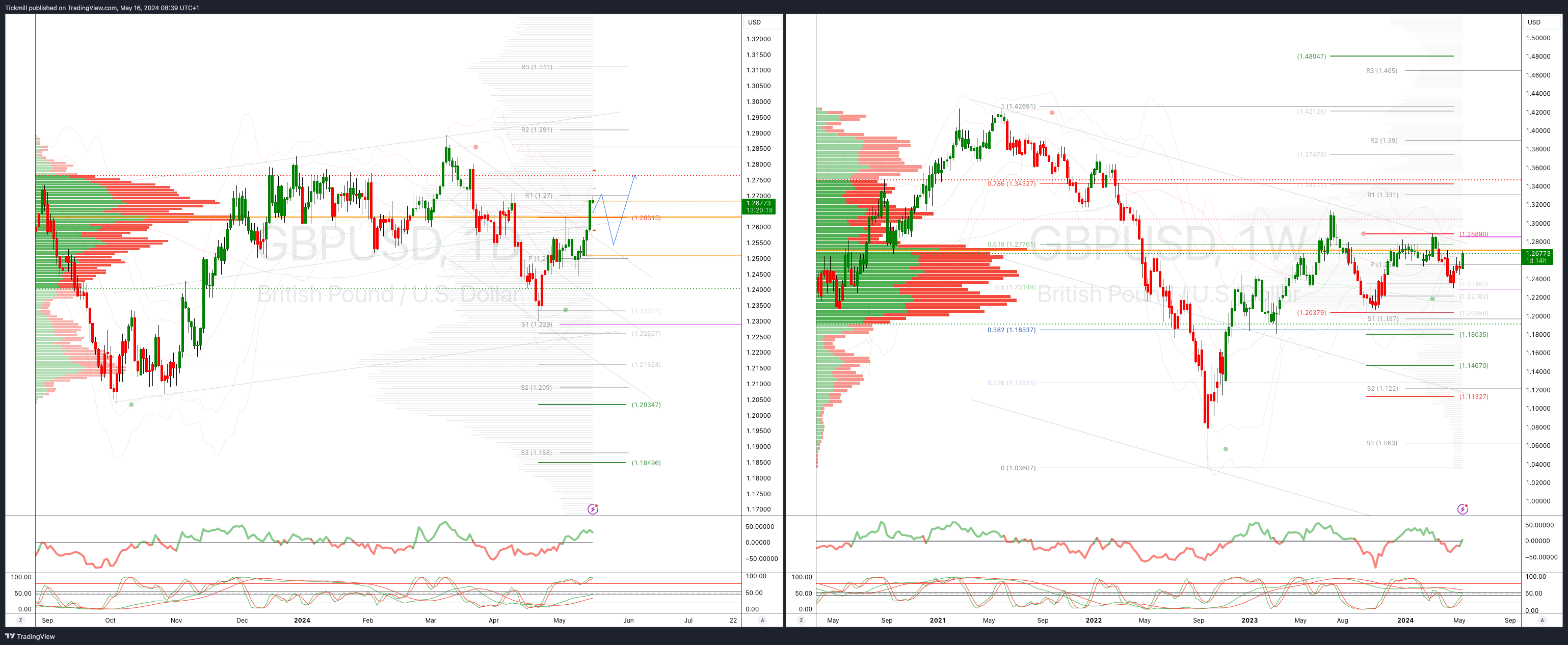

GBPUSD Bullish Above Bearish Below 1.2630

Daily VWAP bullish

Weekly VWAP bearish

Above 1.27 opens 1.2750

Primary resistance is 1.2889

Primary objective 1.2034

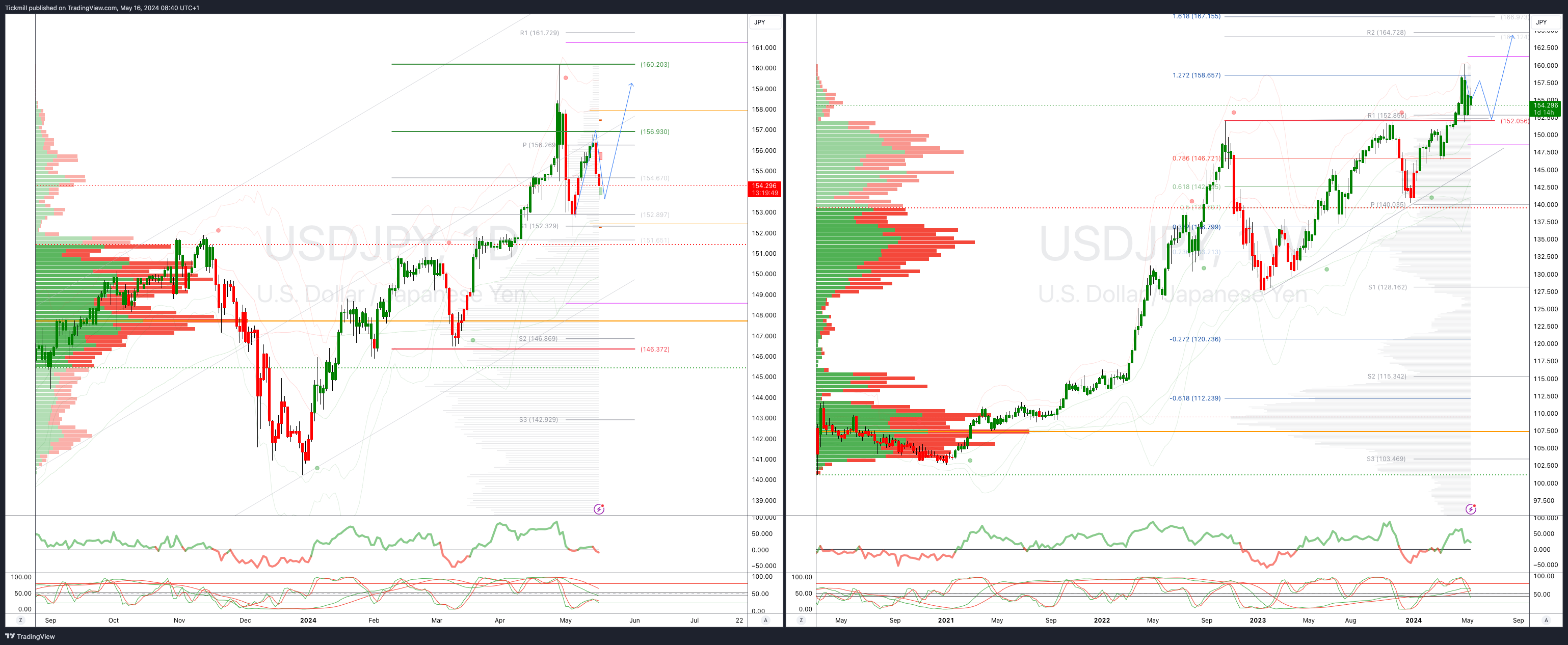

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

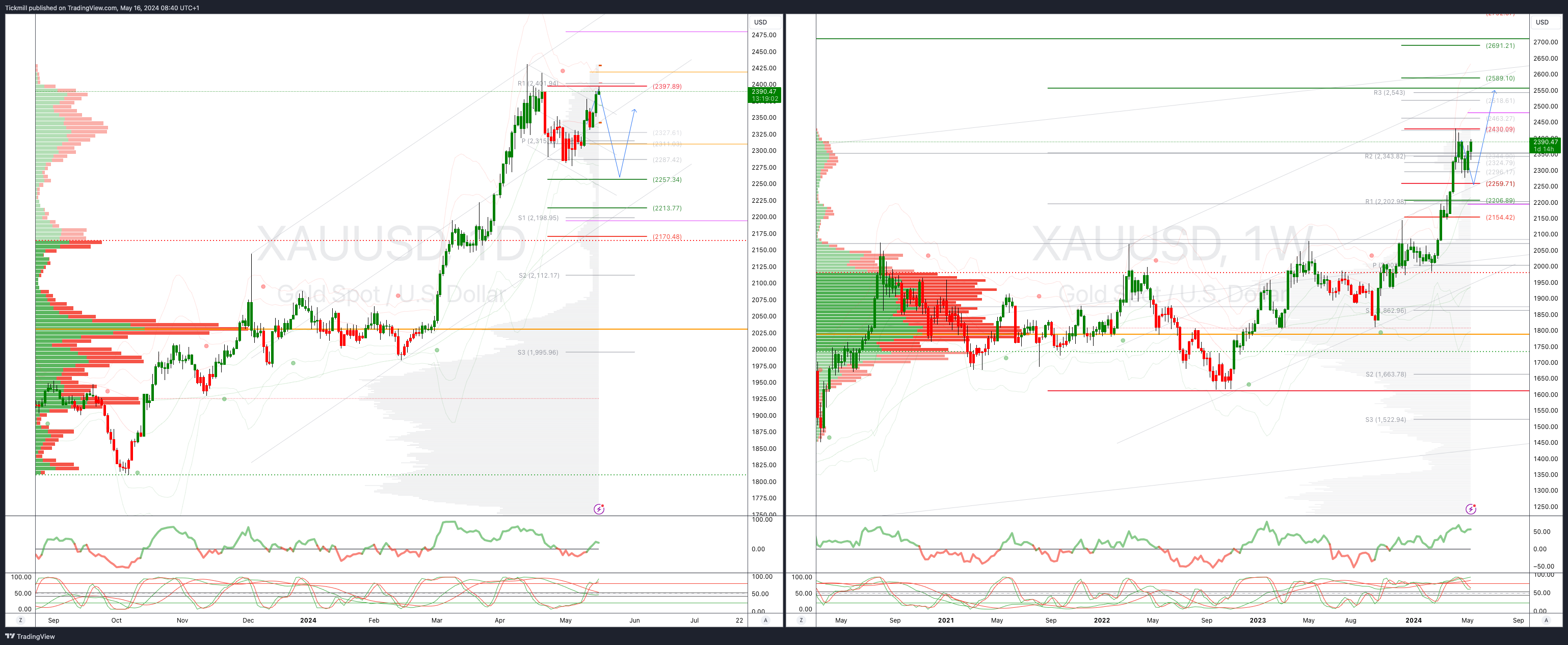

XAUUSD Bullish Above Bearish Below 2376

Daily VWAP bullish

Weekly VWAP bullish

Above 2376 opens 2425

Primary support 2260

Primary objective is 2560

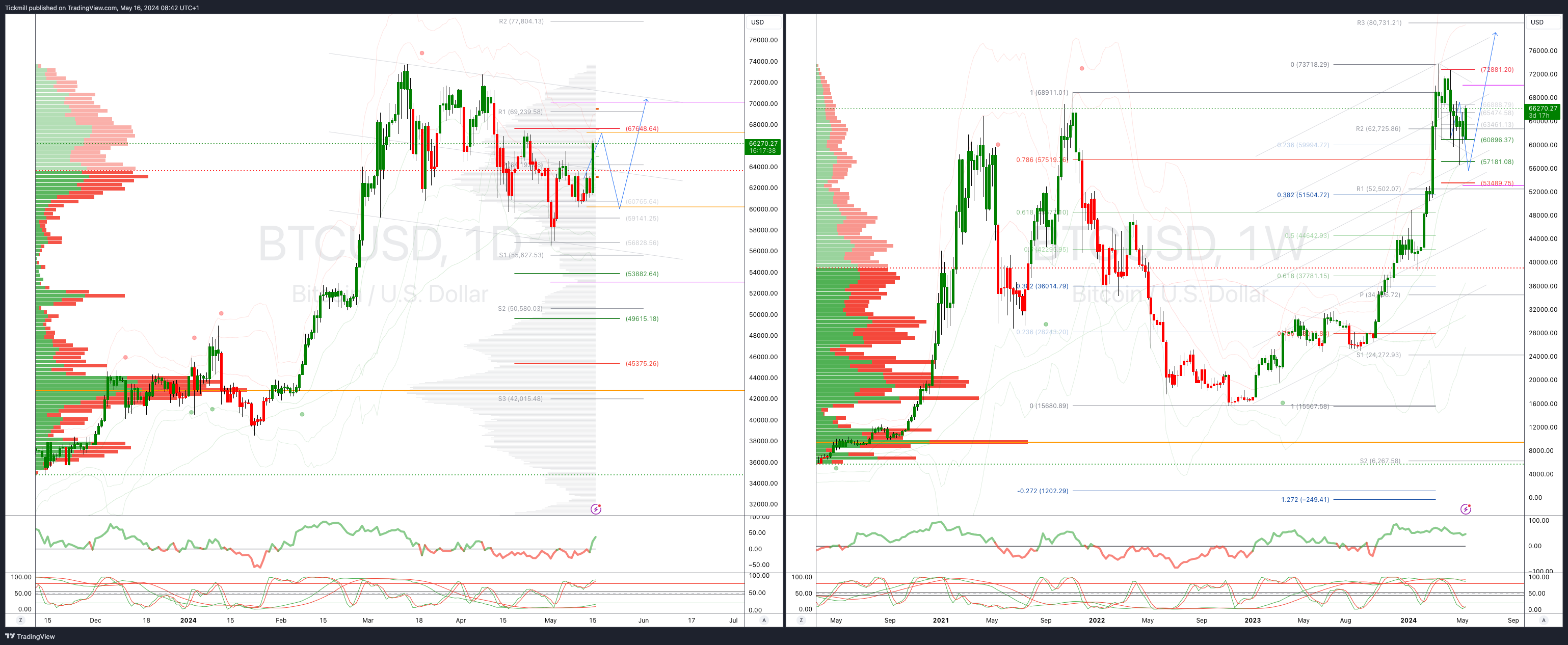

BTCUSD Bullish Above Bearish below 64000

Daily VWAP bullish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 67648

Primary objective is 53877

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!