Daily Market Outlook, May 14, 2024

Daily Market Outlook, May 14, 2024

Munnelly’s Macro Minute…

“Markets Consolidate Ahead of Powell & US PPI Catalysts”

Asian equity markets showed a mix of performance, while European futures displayed moderate softness. The global spotlight remains fixed on inflation, with anticipation surrounding today's release of US producer price data and tomorrow's consumer price report, as investors gauge potential shifts in central bank policies for the year. Later today, Federal Reserve Chair Powell is scheduled to deliver a speech. In the UK, attention is drawn to the latest monthly labor market figures, particularly wage growth.

Today's UK official data unveiled subdued labor market activity, with a decline of 178k jobs over the three months leading to March, and an anticipated increase in the unemployment rate to 4.3% from 4.2%. However, wage growth surpassed expectations, holding steady at 6.0% instead of the predicted decline to 5.9%. Notably, this data does not reflect the impact of April's National Living Wage and National Minimum Wage increases, which will be addressed in next month's report, preceding the Bank of England's June policy decision. Additionally, April and May CPI data will be included. The Bank of England has indicated a close monitoring of these figures before any decision regarding interest rates.

On the continent, the German ZEW survey, based on responses from financial professionals, offers insight into the economy's performance in May. Recent months have seen significant increases in the ZEW index's expectations component, suggesting optimism for a strengthening recovery. However, the current situation index is expected to remain negative, indicating ongoing tepid economic activity.

Stateside , attention is on today's release of producer prices data, the upcoming release of U.S. PPI on Tuesday will precede the CPI report on Wednesday, which is a rare occurrence, happening only six times out of 40 occasions since the beginning of 2021. Consequently, the PPI figures are expected to carry more weight than usual, as traders will use them to assess the potential outcome of the CPI report. The headline PPI figure is projected to increase slightly to 2.2% from 2.1%, with a monthly rate of 0.3%. On the other hand, the CPI headline rate is anticipated to decrease to 3.4% from 3.5%, while maintaining a monthly rate of 0.4%. Given the uncertainty surrounding policy easing in both the markets and among Federal Reserve officials, the upcoming inflation data holds significant importance. Historically, there is no strong predictive power in PPI for CPI based on monthly data since the beginning of 2021, as it is essentially a 50/50 chance. However, when the monthly PPI deviation from expectations is 0.2 percentage points or more, there is a 64% likelihood of CPI moving in the same direction. Therefore, a larger surprise in the monthly PPI figures makes it more probable for CPI to follow suit. Policymakers remain cautious as disinflation has shown minimal progress this year. Additionally, the NFIB small business optimism survey is due today.

Key central bank figures to watch include Bank of England Chief Economist Pill, who will deliver opening remarks at an event this morning. Federal Reserve Chair Powell and the ECB's Knot are also scheduled to appear at an event in the Netherlands.

Overnight Newswire Updates of Note

Investors Crowd Into Soft-Landing Trade Ahead Of Inflation Prints

Donald Trump Leads Pres Biden Across Crucial 2024 Swing States

Yellen Hopes China Doesn’t Mount A ‘Significant’ Trade Retaliation

US Senators To Seek Billions For AI Research, Push For Regulation

Top Biden Official Doubts Israel Can Achieve 'Total Victory' In Gaza

US Assesses Ample Troops Amassed For Full-Scale Rafah Incursion

Japan’s FinMin Suzuki Sees Need To Keep Close BoJ Coordination

Japan Wholesale Inflation Steady As Weak Yen Boost Import Costs

Japan 20-Year Yield Reaches Highest Since 2013 On BoJ Policy Bets

Oil Steadies As Traders Look To OPEC Report And US Inflation Data

Walmart To Cut Jobs And Ask Remote Workers To Return To Offices

Volkswagen Said To Eye Traton Stock Sale After Share Price Surges

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0750-60 (2.3BLN), 1.0770-80 (903M), 1.0790-1.0800 (2BLN)

1.0820 (379M), 1.850 (1.2BLN)

USD/CHF: 0.9000 (521M), 0.9100 (1.9BLN)

GBP/USD: 1.2495-1.2500 (2BLN), 1.2525-30 (1BLN), 1.2550 (338M)

1.2650-55 (1.8BLN). EUR/GBP: 0.8585-90 (380M)

AUD/USD: 0.6590 (2.3BLN) , 0.6600 (576M)

USD/CAD: 1.3700 (735M), 1.3750-55 (800M)

USD/JPY: 155.15 (602M), 155.40-50 (455M), 156.95-157.00 (480M)

CFTC Data As Of 10/05/24

British pound net short position is -21,813 contracts

Euro net long position is 4,590 contracts

Japanese yen net short position is -134,922

Swiss franc posts net short position of -41,787

Bitcoin net short position is -783 contracts

Equity fund speculators increase S&P 500 CME net short position by 69,524 contracts to 238,456

Equity fund managers raise S&P 500 cme net long position by 44.751 contracts to 860,694

Gold NC Net Positions: $199.6K vs previous $204.2K

Technical & Trade Views

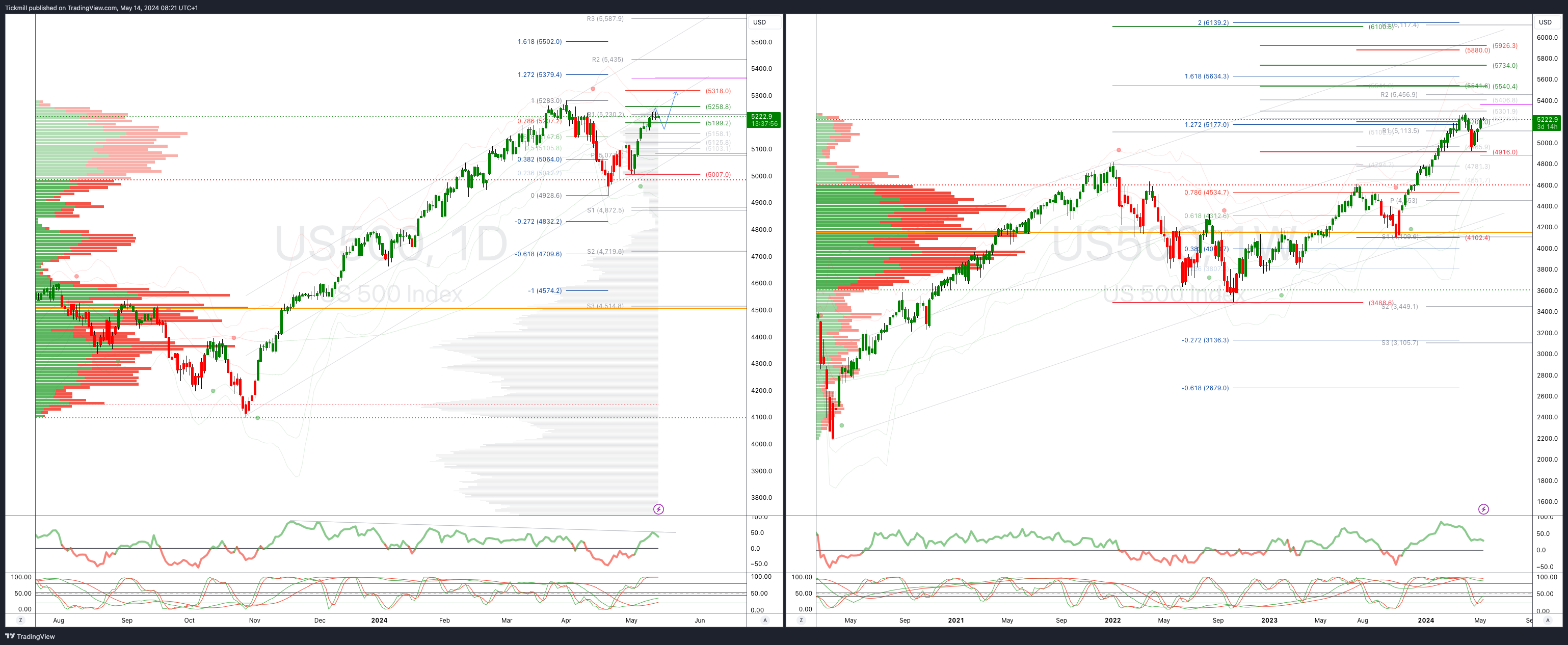

SP500 Bullish Above Bearish Below 5200

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5156

Primary support 4987

Primary objective is 5258

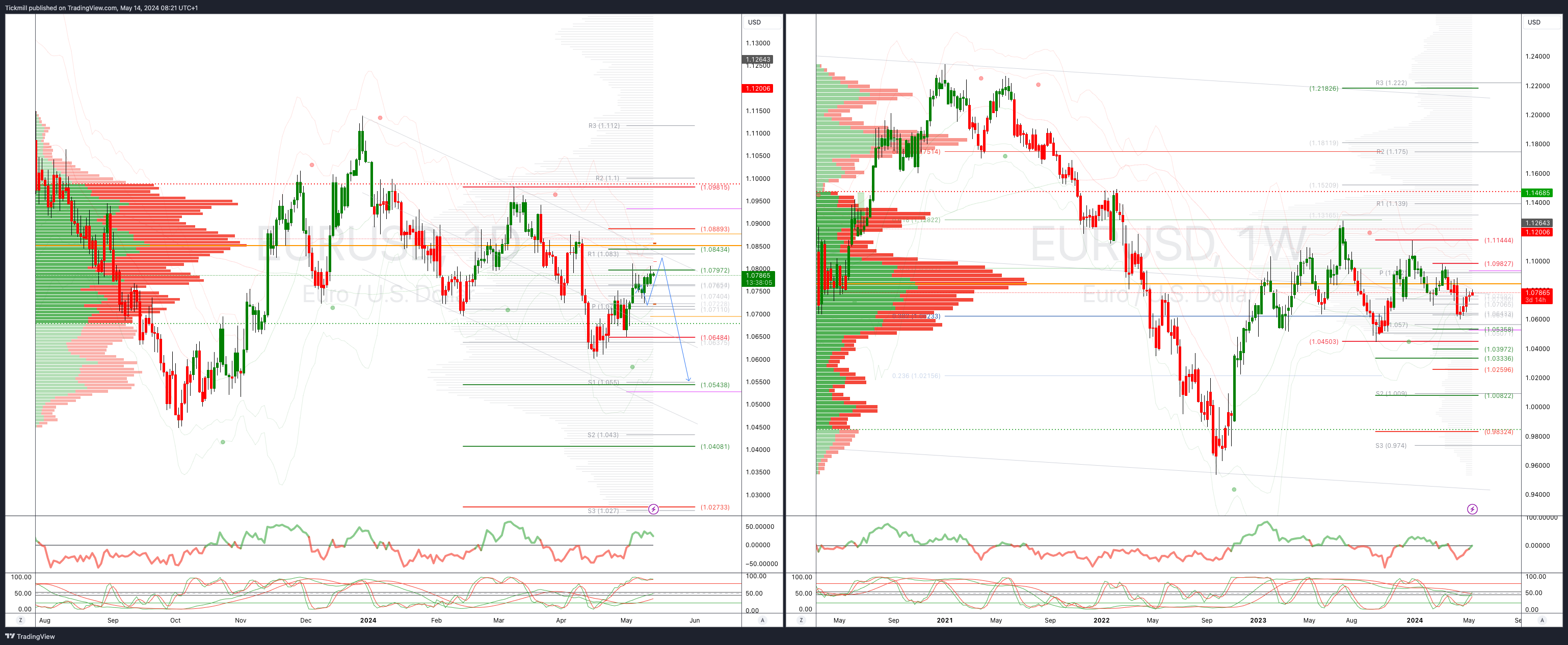

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.0843

Primary resistance 1.850

Primary objective is 1.0550

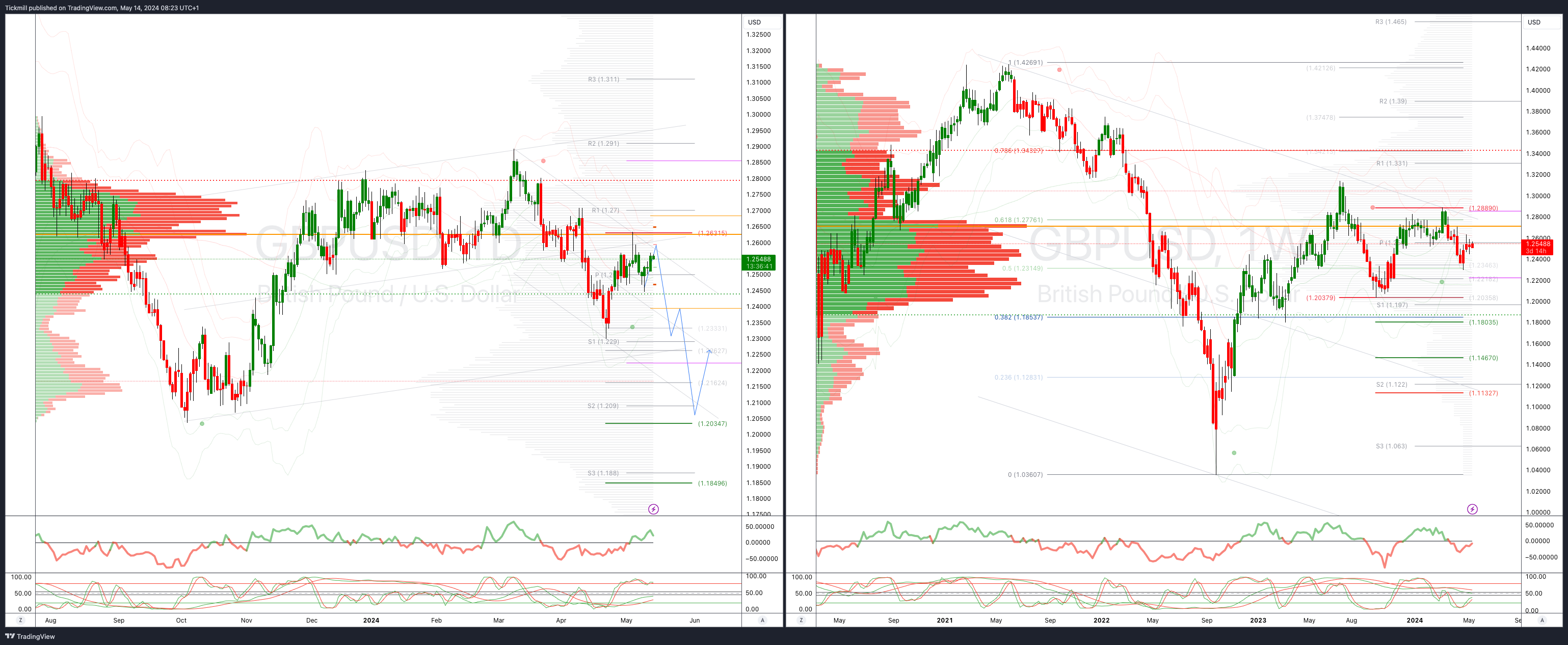

GBPUSD Bullish Above Bearish Below 1.2635

Daily VWAP bullish

Weekly VWAP bearish

Above 1.2590 opens 1.2640

Primary resistance is 1.2710

Primary objective 1.2034

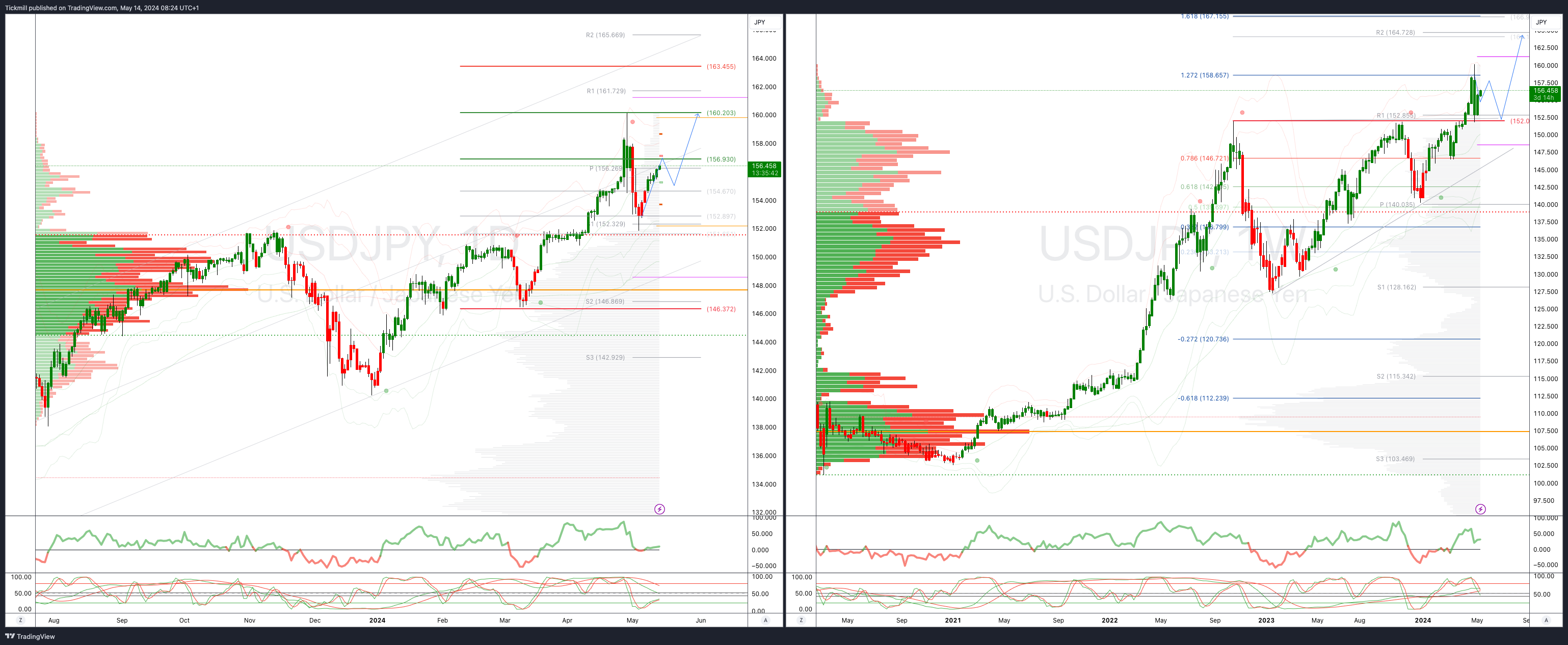

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

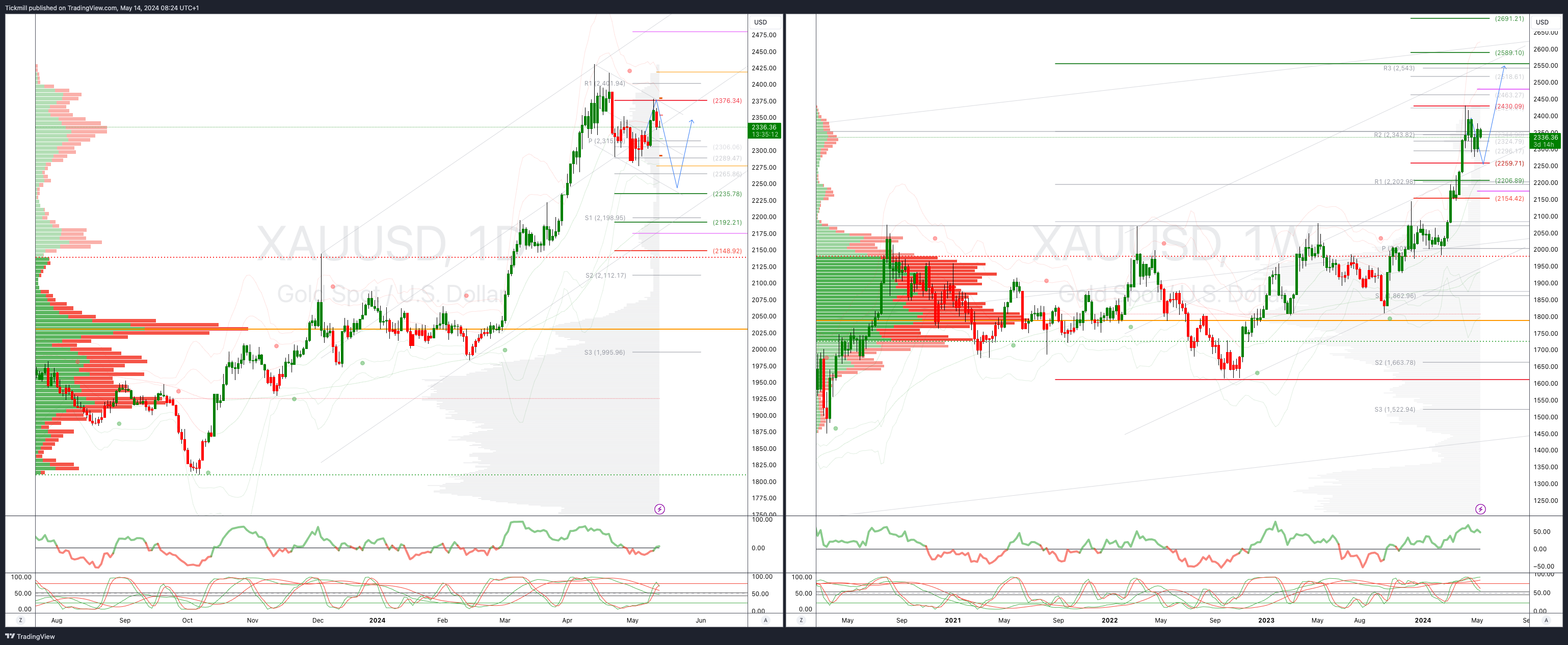

XAUUSD Bullish Above Bearish Below 2376

Daily VWAP bullish

Weekly VWAP bullish

Above 2376 opens 2425

Primary support 2260

Primary objective is 2560

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bearish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 63000

Primary objective is 53877

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!