Daily Market Outlook, May 10, 2024

Daily Market Outlook, May 10, 2024

Munnelly’s Macro Minute…

“Jobless Claims Uptick Boosts Rate Cut Hopes Supporting Risk Sentiment ”

The Asia-Pacific equity markets showed overall optimism following a positive session in the US. The MSCI Asia Pacific Index rose by 0.7%, with Hong Kong's benchmark index reaching its highest level since September. Shares in Japan, South Korea, and Australia also advanced. US futures slightly increased as the S&P 500 index finished less than 1% below its all-time high on Thursday. The Hang Seng rose after authorities considered excluding private investors from paying taxes on income earned from Hong Kong equities purchased through Stock Connect. Onshore Chinese equities dipped as investors reviewed a story claiming that the US President Joe Biden's administration is set to announce a broad decision on China tariffs as early as next week. Unexpectedly strong US weekly initial jobless claims, reaching their highest level since August, added to expectations of potential easing in Fed policy later this year. Concurrently, the Bank of England hinted at the possibility of an interest rate cut next month, although it's not assured and depends on forthcoming data.

Earlier official UK data confirmed a robust rebound in Q1 following a technical recession late last year. The Office for National Statistics reported a 0.6% increase in Q1 GDP, surpassing both our and consensus forecasts of 0.4%. This rise was significantly stronger than anticipated earlier in the year, driven by a solid 0.4% monthly increase in March, surpassing forecasts of 0.1%, primarily fueled by services activity. Moreover, the February data was revised upwards. Looking forward, PMI survey evidence indicates continued momentum in UK activity early in Q2. Business confidence, as indicated by the Lloyds Business Barometer, remained above its long-term average in April, and the GfK consumer confidence index improved. The Bank of England expects Q2 expansion to continue, albeit at a slower pace of 0.2%. Following the recent Bank of England policy announcement, Chief Economist Pill and fellow MPC member Dhingra are scheduled to speak today. Pill, who voted with the 7-2 majority for no rate change, stated yesterday that the Bank is not yet inclined to cut interest rates. In contrast, Dhingra, voting for an immediate cut for the third consecutive meeting, was joined by Ramsden this time.

On the European front, the ECB will publish the minutes of its last April policy meeting, where interest rates remained unchanged. However, a rate cut at the June meeting has been heavily suggested. What remains uncertain is the extent of policy easing in the latter half of the year and beyond, with divergent opinions within the Governing Council. The minutes will be scrutinized for any indications regarding the potential policy outlook beyond June.

In the US, various Fed speakers are scheduled, with the University of Michigan consumer sentiment report being the only notable data release. Expect a slight decline in the headline sentiment index, although recent drops in global oil prices might pose an upside risk to the forecast and could potentially lead to a decrease in one-year ahead inflation expectations.

Overnight Newswire Updates of Note

Biden Poised To Impose Tariffs On China EVs, Strategic Sectors

Japan’s Households Cut Outlays As Inflation Remains Sticky

Japan’s Suzuki: Appropriate Actions Will Be Taken On FX If Needed

New Zealand’s Manufacturing Sector Remains In Contraction

AUD/USD Pulls Back Due To An Upward Correction In The US Dollar

Yields Ease On Solid Demand At Treasury Bond Auction

Fresh Gush Of US Oil Drives Down The Price Of Crudes In Europe

Biden Urged To Halt Oil Export Projects After Terminal Approved

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0730 (384M), 1.0750 (306M), 1.0770-80 (324M), 1.0825 (1.3BLN)

USD/CHF: 0.9115 (351M)

GBP/USD: 1.2500 (812M), 1.2525 (1.1BLN), 1.2600 (518M)

1.2625 (383M), 1.2650 (405M)

EUR/GBP: 0.8550 (400M), 0.8600 (536M), 0.8645-55 (600M()

AUD/USD: 0.6540 (721M)

USD/CAD: 1.3645-50 (2.2BLN), 1.3680-85 (3.1BLN), 1.3700-10 (1.4BLN)

1.3750 (1BLN), 1.3770 (1.1BLN),1.3795 (1.5BLN)

USD/JPY: 155.08 (300M), 155.50 (300M), 156.00-05 (395M), 156.50 (253M)

CFTC Data As Of 5/05/24

Japanese Yen net short position is -168,388 contracts

British Pound net short position is -28,990 contracts

Euro net short position is -6,777 contracts

Bitcoin net long position is 6 contracts

Swiss Franc posts net short position of -41,786 contracts

Equity fund managers cut S&P 500 CME net long position by 17,130 contracts to 815,943

Equity fund speculators trim S&P 500 CME net short position by 14,932 contracts to 168,931

Gold NC Net Positions increased to $204.2K from previous $202.9K

Technical & Trade Views

SP500 Bullish Above Bearish Below 5200

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5156

Primary support 4987

Primary objective is 5258

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.0843

Primary resistance 1.850

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.2450

Daily VWAP bullish

Weekly VWAP bearish

Above 1.2590 opens 1.2640

Primary resistance is 1.2710

Primary objective 1.2

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

XAUUSD Bullish Above Bearish Below 2376

Daily VWAP bullish

Weekly VWAP bullish

Above 2376 opens 2425

Primary support 2260

Primary objective is 2560

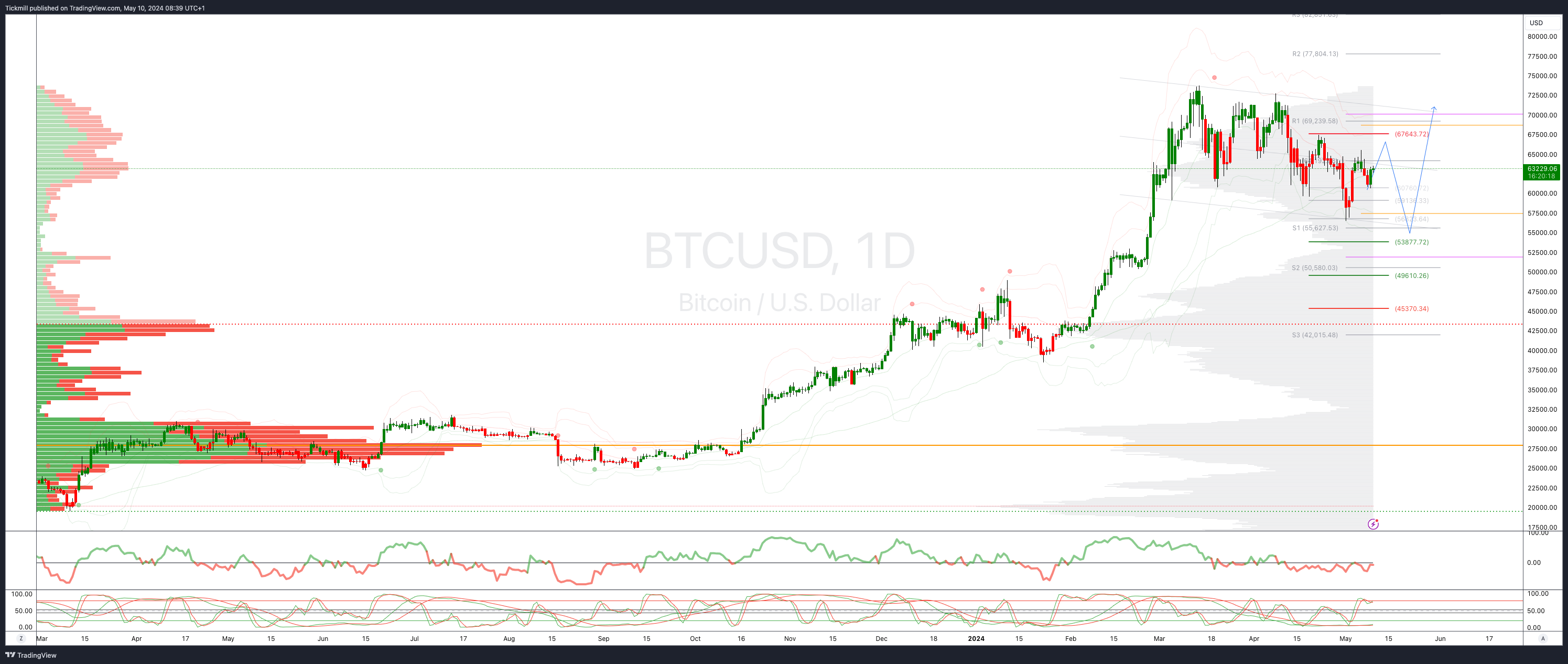

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bearish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 63000

Primary objective is 53877

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!