Daily Market Outlook, May 10, 2021

Daily Market Outlook, May 10, 2021

Most Asian stocks and equity futures across Europe and the US traded higher in response to expectations that monetary policy will remain loose for some time, following Friday’s disappointing US payrolls report. Commodity prices continue to surge, led by iron ore, in response to strong demand. Meanwhile oil prices have also risen sharply in response to a cyberattack on the largest oil-products pipeline in the US.

Over the weekend, Scotland’s first minister Nicola Sturgeon reiterated her desire to push for a second independence referendum. This follows the outcome of the regional elections, which saw the Scottish National Party (SNP) win the most number of seats (64 out of 129) but fall short of a majority by 1.

A key focus of last week’s Bank of England (BoE) policy meeting was the upgrade to GDP growth forecast for this year from 5% to 7.25%, reflecting a much smaller contraction in Q1 than previously assumed. Much of this reflected a quicker lifting of Covid restrictions, providing households with more opportunities to spend a higher proportion of savings balances accumulated over the past year.

Today, the UK government is expected to announce a further easing in restrictions across England from the 17th May, largely due to the continuous progress made in rolling out the vaccine and the decline in the rate of infections. In line with the previously published roadmap, the latest relaxation will provide welcome support to those areas of the economy most impacted by restrictions. Notably, pubs and restaurants will be allowed to serve indoors, while large parts of the arts and entertainment sector will also be allowed to resume operating including cinemas, outdoor sports venues and children’s play areas.

The rest of the day remains exceptionally quiet in terms of data with just the Eurozone Sentix investor survey for May due. A further increase is expected to 15.0 from 13.1 reflecting an improvement in sentiment due to the continued rollout of the vaccine and an easing in restrictions. There are no data releases in the US; however, Chicago Fed President Evans will discuss the economic outlook during an online event.

CFTC Data

Net CAD Longs Rise to Highest Since Pre-Pandemic Data cover up to Tuesday May 4 and were released on Friday May 7.

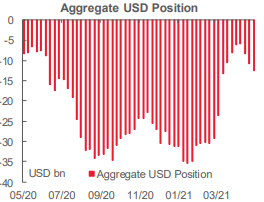

The USD net short increased once again, for the third consecutive week according to CFTC data for the week through Tuesday. The aggregate USD short rose by USD1.7bn—about USD750mn less than the average increase in the previous two weeks—to a total of USD12.5bn across the major currencies that we cover in this report. The net USD short now stands at its highest mark since mid-March.

The shifts in positioning were mixed in terms of direction across the various currencies with the net CAD long seeing the largest week-to-week increase. At USD840mn, the net long increase took the overall position to USD2.1bn— representing its highest mark since early-2020 and the biggest bullish position in this report after the EUR’s net long of USD12.7bn. The net bet in favour of the CAD was on the back of a 17k increase in long contracts—but shorts also added 7.4k contracts—and likely contributed to the CAD’s majors-leading gain of 0.7% over the week.

The aggregate EUR long rose by USD502mn after staying unchanged in the previous week while the USD12.7bn position remains far from its peak of USD31.3bn last August. Its European counterparts, the GBP and CHF saw respective net adjustments of USD818mn and +USD102mn—with sterling positioning and price action holding relatively flat since early-March.

The JPY saw the second largest sentiment adjustment of the currencies we cover with a USD834mn reduction in its still quite sizable USD4.7bn net short, which has nevertheless fallen from USD6.7bn in mid-April.

Positioning was little changed in the other currencies with the AUD position flipping back to net long on a USD223mn net bullish bet while the net NZD long rose by USD111mn. Positioning in the MXN turned marginally bearish with a USD134mn net bet against it for a net MXN short of USD110mn.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.2040 (682M), 1.2200 (384M), 1.2265 (415M)

USD/CHF: 0.9075 (320M)

EUR/GBP: 0.8770-80 (570M)

GBP/USD: 1.3800 (678M), 1.3950 (251M), 1.4000 (200M)

AUD/USD: 0.7825 (200M), 0.7850 (220M), 0.7875 (241M), 0.7900 (639M), 0.7950 (628M)

USD/CAD: 1.2100 (370M), 1.2150 (425M), 1.2250 (205M)

USD/JPY: 108.00 (415M), 109.00-05 (594M), 109.35-50 (1BLN)

Technical & Trade Views

EURUSD Bias: Bearish below 1.2120 bullish above

EURUSD From a technical and trading perspective, the close through 1.2120 is constructive but bulls must defend 1.21 to set up a test of 1.2240/50. Failure to find sufficient support at 1.21 would suggest a false upside break opening a retest of 1.2050.

Flow reports suggest topside congestion through to the 1.2160 level from the highs and then while there maybe some weak stops just beyond stronger offers are likely through the level to the 1.2200 area with weak stops again appearing but very limited and the 1.2250 again seeing the stronger offers through to the 1.2300 level with the market then having the ability to test this year’s highs, downside bids light through to the 1.2000 area and then weak stops on a move through the 1.1920 level opening the market to the 1.1850 area where stronger congestion appears.

GBPUSD Bias: Bullish above 1.39 bearish below

GBPUSD From a technical and trading perspective, as 1.3960 now acts as support bulls will target a retest of 1.4230’s

Flow reports suggest further offers likely to be into the 1.4000 area with stops likely through the 1.4020 area and opening a stronger move higher, downside bids strong into the 1.3800 with congestion likely to continue through the level and while there may be some stops that congestion is likely to continue through to the 1.3750 level, light bids through the level but increasing again into the 1.3700 level with congestion then continuing through the level

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as 107.50 acts as support there is potential for a test of the pivotal 108.50, through here will open another look at 110.

Flow reports suggest downside bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, topside offers through to the 110.00 level with light congestion through the figure level and weak stops possibly limited and stronger offers likely increasing on a move higher towards the 111.00

AUDUSD Bias: Bearish below .7790 bullish above

AUDUSD From a technical and trading perspective, as .7790 now acts as support bulls will target a retest of prior cycle highs above .80 cents

Flow reports suggest topside offers in the 0.7850 area however, while there maybe some offers in the area the market looks to be fairly open through to the 79 cents level and ultimately ranges from the end of Feb, downside bids light through the 0.7700 level with weak stops likely on a move through the 0.7680 before stronger bids around the 0.7650 area and continuing through to the 0.7600 likely increasing in size, any further moves are likely to see strong support into the 0.7550 to calm the situation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!