Daily Market Outlook, May 1, 2024

Daily Market Outlook, May 1, 2024

Munnelly’s Macro Minute…

“Market MAYDAY, Will Powell Come To The Rescue?”

Asian markets are trending downward this morning, a reaction to the previous day's downturn in both European and US markets. These shifts appear to be driven by a larger-than-anticipated increase in a key indicator of US labor costs during Q1, fueling concerns that today's US monetary policy update may adopt a more hawkish stance. In the UK, the Nationwide index for April revealed a second consecutive monthly decline.

Today's US monetary policy update by the Federal Reserve occurs amidst significantly altered circumstances compared to its last update in March. Even then, market expectations regarding the extent of anticipated interest rate decreases in 2024 had been substantially reduced compared to the beginning of the year. However, Fed Chair Powell previously hinted at potential interest rate cuts in June. Given subsequent surprises in inflation and certain activity measures, such a scenario now appears less likely. Market probabilities for a June cut are now below 10%, with the first anticipated move not fully priced in until December.In light of these developments, Powell is expected to adopt a more hawkish tone today. The pivotal question is the degree of this shift. While he can rightly argue that Fed policymakers had cautioned about the volatile nature of the path towards lower inflation, consistently upbeat inflation data may be harder to dismiss as mere anomalies.This particular meeting does not include new forecasts from Fed policymakers, meaning no fresh interest rate projections. At the previous update, Fed policymakers discussed the possibility of three cuts this year, which now seems less probable. Powell is unlikely to offer an alternative forecast at this stage, instead emphasizing the need for caution in cutting rates until more supportive data, particularly regarding inflation, emerges. While his message may lack specificity on the interest rate trajectory for the remainder of the year, it is likely to signal a higher bar for rate cuts.One reassuring aspect is Powell's probable avoidance of suggesting an upward shift in interest rates. Given the market's existing expectation of a cautious Fed, today's update may not contain overly alarming elements. However, it is also unlikely to provide strong market support.

Prior to the Fed update, the forecast for the ISM manufacturing survey in April suggests it will surpass the 50 expansion threshold for the second consecutive month. This would signify a crucial indication of a rebound in activity within a previously sluggish segment of the economy. In the UK, the April manufacturing PMI, expected to remain unchanged in its second reading, is another significant metric to watch.

Overnight Newswire Updates of Note

Fed Set To Signal It Has Stomach To Keep Rates High For Longer

Senate Passes Russian Uranium Import Ban, Sends Bill To Biden

Israel Set To Send Delegation For Last-Chance Cease-Fire Talks

RBNZ Warns Risk Of Sticky Inflation Keeping Global Rates High

NZ Q1 Jobless Rate Hits Three-Year High As Interest Rates Bite

Extreme Bond Market Shorts Gamble On Hawkish Powell Pivot

Bitcoin See Worst Month Since FTX Crash, ETF Demand Cools

Oil Extends Fall On Mideast Cease-Fire Prospects, US Inflation

Traders See Biggest Fed-Day Move In S&P Since 2023, Citi Say

Amazon Reports Strong Cloud Unit Sales On Rising AI Demand

AMD Gives Tepid Forecast In Weak Demand For Gaming Chips

Tesla Axes Most Of Supercharger Team In Blow To Other Autos

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600-10 (1BLN), 1.0650 (1.2BLN), 1.0680-85 (1.2BLN)

1.0700-05 (1.2BLN), 1.07450-60 (1.2BLN), 1.0795-1.0805 (1.5BLN)

GBP/USD: 1.2335 (552M), 1.2350 (816M), 1.2425 (301M)

AUD/USD: 0.6400-15 (723M). 0.6445-50 (480M), 0.6495-0.6500 (1.2BLN)

0.6530-35 (400M), 0.6545-50 (1BLN)

NZD/USD: 0.5845-55 (1.1BLN), 0.5940-50 (2.9BLN)

USD/CAD: 1.3800 (326M), 0.3825 (279M)

USD/JPY: 155.75 (941M), 156.50 (250M), 156.75 (401M), 158.00 (250M)

FX options are set for increased volatility in the EUR/USD pair due to the upcoming Fed policy decision. The overnight FX option expiry now takes into account the potential impact of the Fed's statement and press conference, which could result in increased volatility. The implied volatility for EUR/USD has surged from 8.0 on Tuesday to 12.0 on Wednesday, indicating heightened risk. Implied volatility is a measure of the expected fluctuation in the exchange rate and is used to determine the premium for options. The premium/break-even for a straddle is now at 53 USD pips in either direction, compared to 35 USD pips previously. Other expiry dates are also influenced by the Fed, NFP event risk, and a stronger USD. The benchmark 1-month expiry has rebounded from Monday's 6.1 to 5.9 on Tuesday. Overall, FX options are supported by a stronger USD and the potential volatility from the Fed and NFP events.

CFTC Data As Of 26/04/24

Japanese yen net short position is -179,919 contracts

Euro net short position is -9,989 contracts

Swiss Franc posts net short position of -42,562 contracts

British Pound net short position is -26,233 contracts

Bitcoin net position is 0 contracts

Equity fund managers cut S&P 500 CME net long position by 16,969 contracts to 833,074

Equity fund speculators trim S&P 500 CME net short position by 9,927 contracts to 183,864

Gold NC Net Positions: $201.9K vs previous $202.4K

Technical & Trade Views

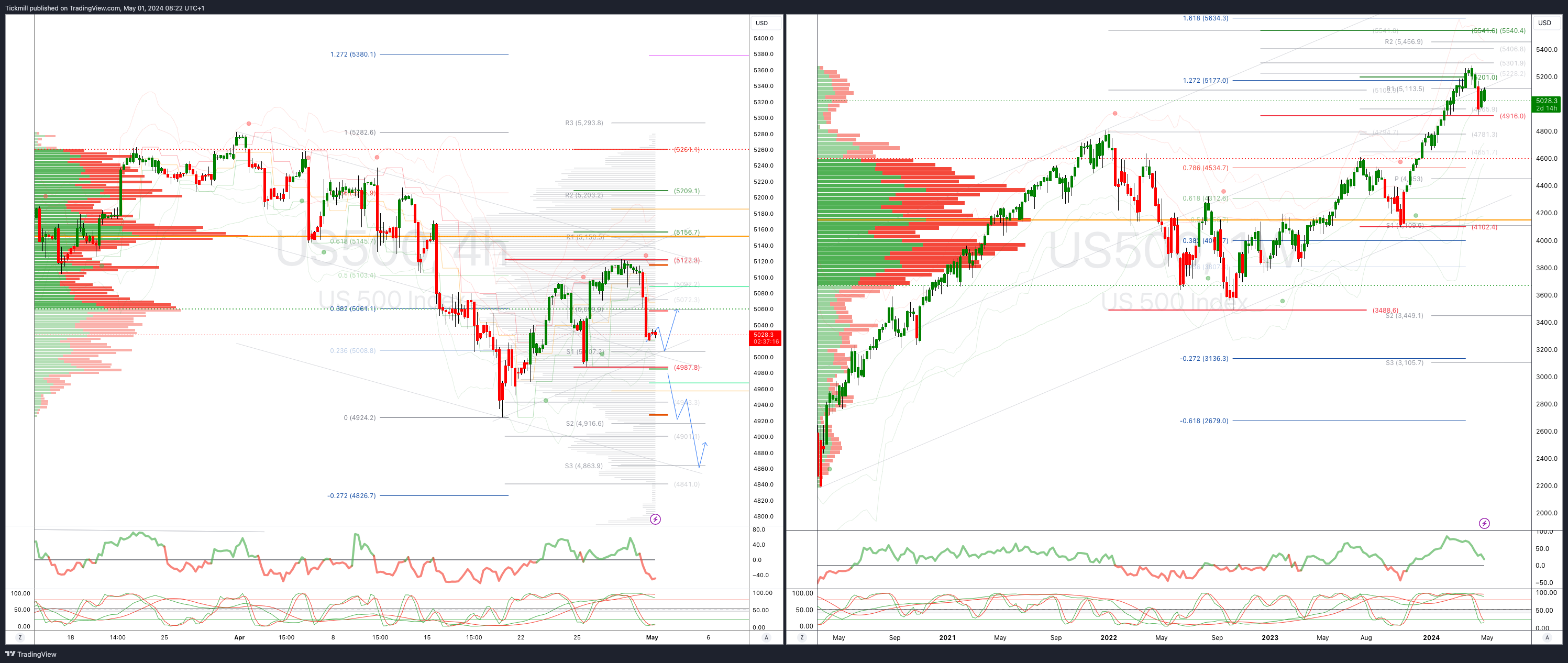

SP500 Bullish Above Bearish Below 5060

Daily VWAP bearish

Weekly VWAP bullish

Below 4987 opens 4920

Primary support 4987

Primary objective is 5150

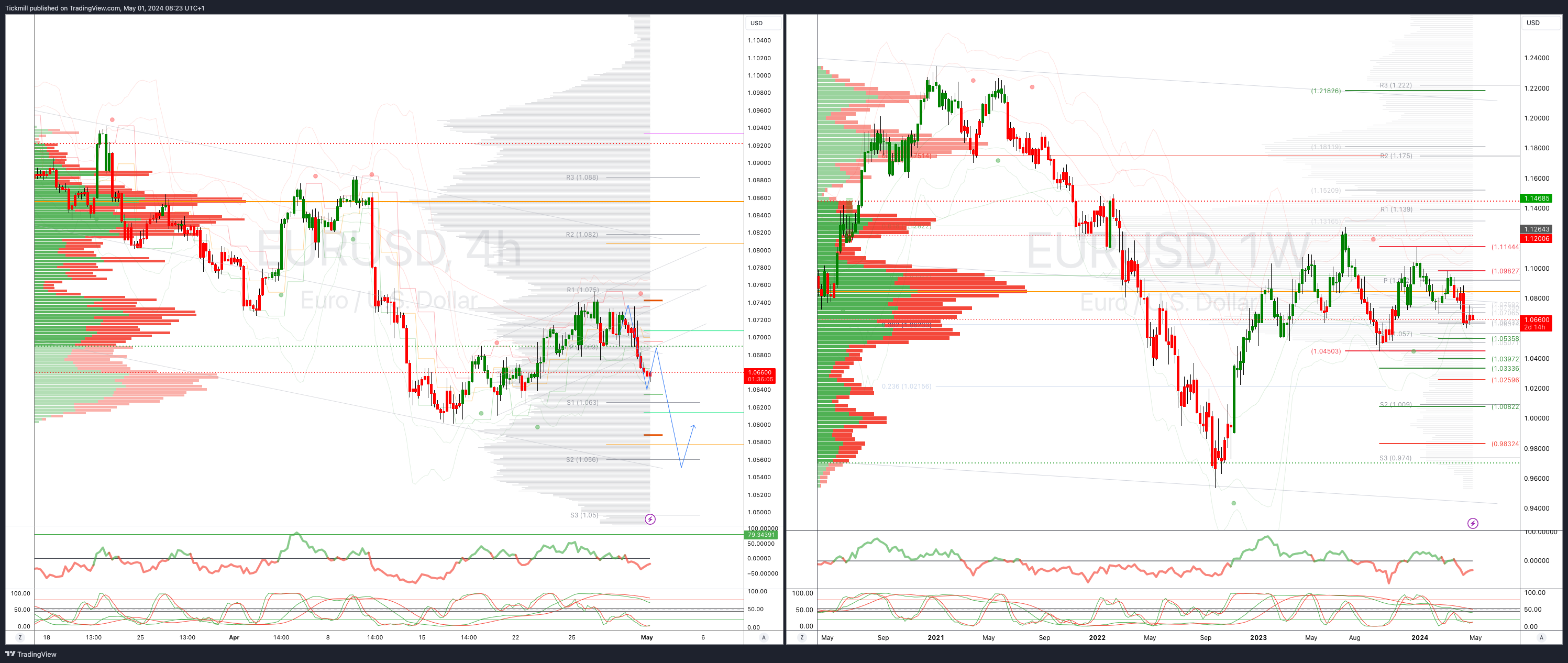

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.088

Primary resistance 1.850

Primary objective is 1.0550

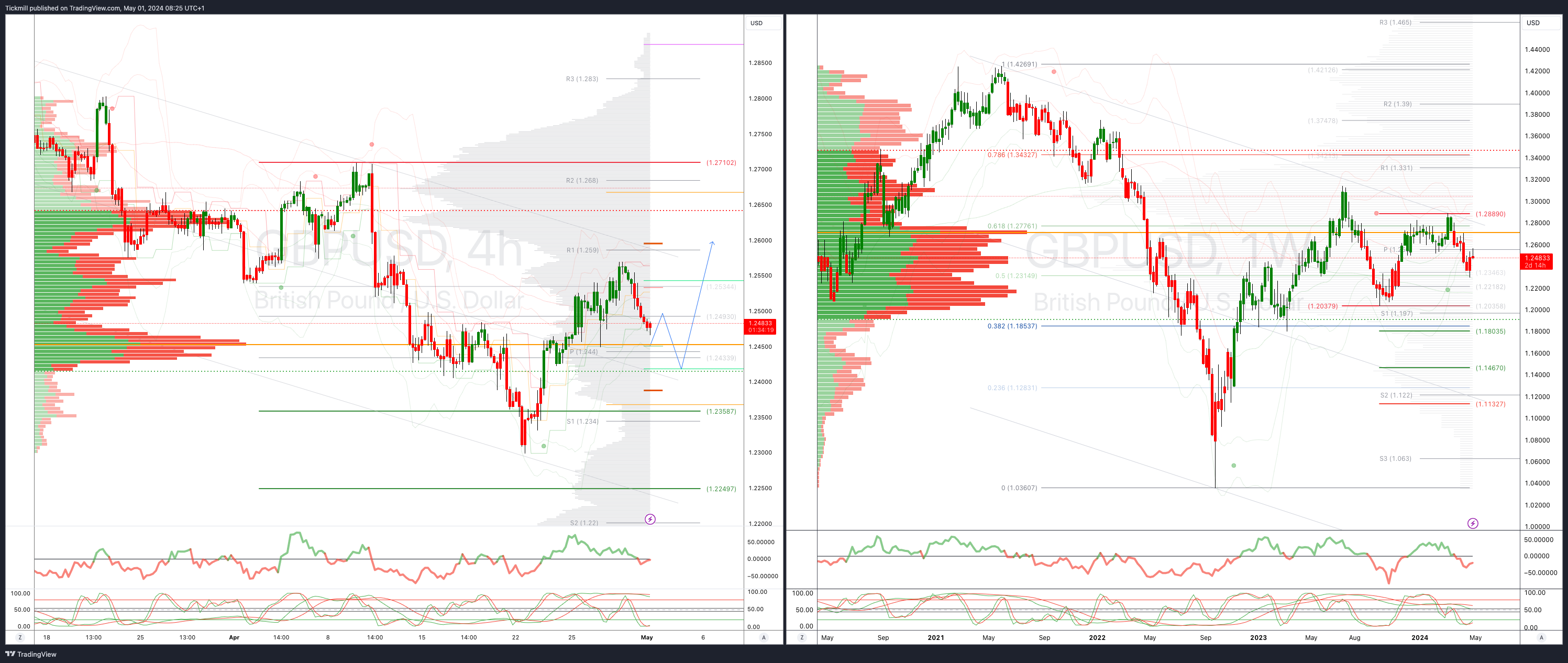

GBPUSD Bullish Above Bearish Below 1.2450

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2590 opens 1.2640

Primary resistance is 1.2710

Primary objective 1.26

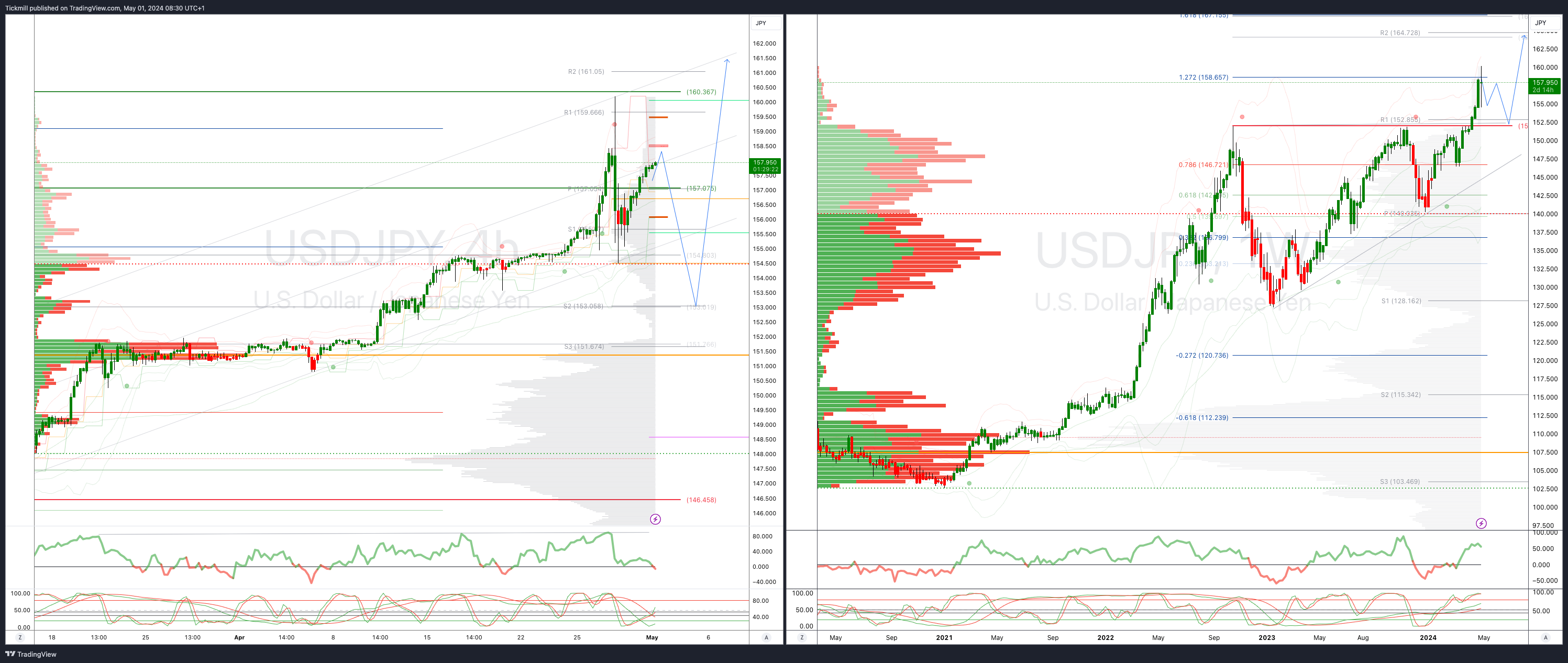

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

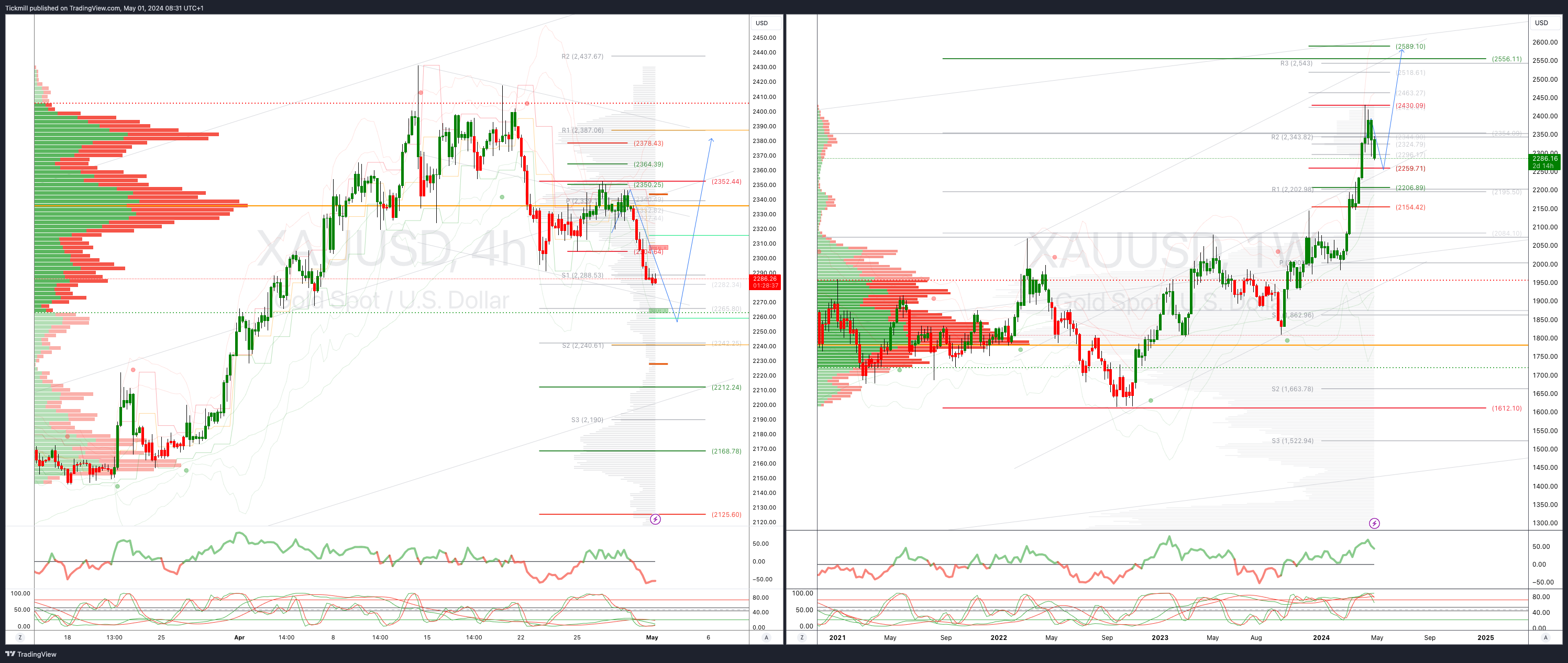

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Above 2360 opens 2400

Primary support 2260

Primary objective is 2560

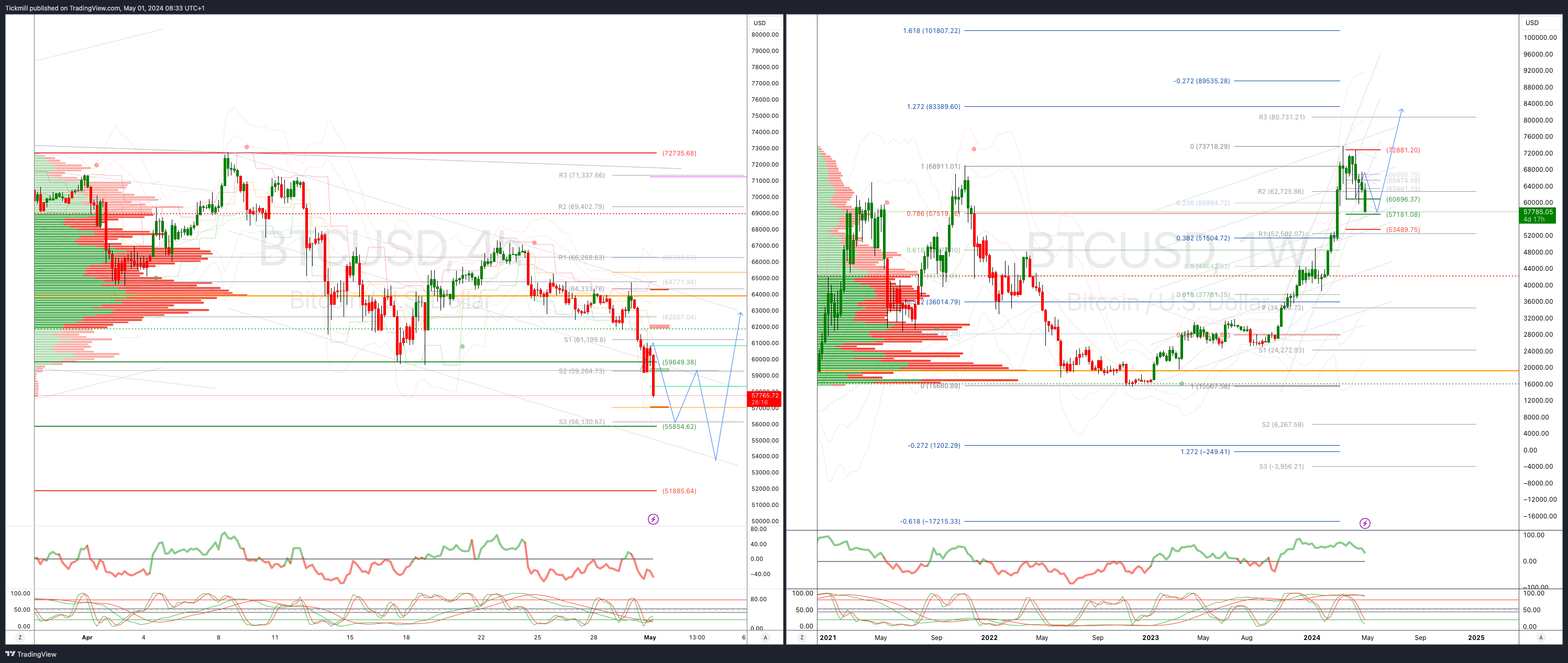

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bearish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 63000

Primary objective is 5150

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!