Daily Market Outlook, March 9, 2021

Daily Market Outlook, March 9, 2021

Asian equities are mixed with most markets up but Chinese indices sharply lower. Reports suggest that Chinese state funds have been buying in the market to arrest the decline. In the UK, the British Retail Consortium’s February sales measure is up 9.5%y/y, pointing to some reversal of the previous month’s plunge in spending. UK new coronavirus cases fell on Monday to their lowest since late September.

The House of Representatives, the lower chamber of the US Congress, will hold what will probably be a final vote on President Biden’s fiscal stimulus package either later today or tomorrow. The Senate voted in favour of the bill on Saturday but, because it contained some amendments from the original package, another vote is required. Some ‘progressive’ Democratic Representatives have threatened to vote against the bill if they feel it has been watered down but the likelihood is that it will pass. If so, that will further boost markets expectations for US economic growth that have already been lifted by some recent stronger than expected data. However, It may also fuel concerns that the bond market sell-off still has further to run.

Today’s data calendar is light with nothing of note in the UK. In the Eurozone, Italian industrial production data for January are expected to post a modest rise. However, already released data for Germany and Spain both recorded falls which may point to downside risks for Italy. French data is due tomorrow and the Eurozone aggregate on Friday. The Q4 Eurozone GDP and employment updates are both final numbers that are not expected to be revised from the previous releases. Those showed a fall in output but a modest rise in employment.

In the US, the NFIB’s small business optimism index for February will be watched for further indications that US economic growth is accelerating. Some of the subcomponents regarding the labour market have already been released and they noted increases in hiring plans, wage payout expectations and the numbers of job vacancies that are hard to fill.

Chin’s February CPI and PPI inflation estimates will be released overnight. So far, both have remained subdued despite the rebound in economic activity which took GDP beyond its pre-pandemic peak before the end of last year. The producer price measure is expected to have picked up sharply this month due to the rise in commodity prices but consumer price inflation is still forecast to be negative.

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: $1.1610-15(E653mln), $1.1620-25(E562mln), $1.1640-50(E552mln), $1.1800(E652mln), $1.1835-50(E710mln), $1.1880-00(E662mln)

AUD/USD: $0.7700(A$524mln)

USD/CAD: C$1.2450($620mln), C$1.2550($545mln), C$1.2595-00($742mln), C$1.2725-30($828mln)

USD/CNY: Cny6.56($500mln)

----------------

Larger Option Pipeline

EUR/USD: Mar10 $1.2000-10(E1.3bln); Mar11 $1.1800(E1.2bln), $1.1900-15(E1.5bln); Mar12 $1.1995-1.2000(E2.1bln), $1.2100-10(E1.2mln)

USD/JPY: Mar10 Y105.80($1.4bln); Mar11 Y107.75($1.7bln); Mar12 Y105.95-106.00($2.7bln), Y108.30-35($1.8bln)

AUD/USD: Mar10 $0.7500(A$1.3bln); Mar11 $0.7600(A$1.7bln), $0.8000(A$1.8bln)

AUD/NZD: Mar11 N$1.0730(A$1.96bln-NZD puts); Mar18 N$1.0770-75(A$1.3bln-AUD puts)

USD/MXN: Mar12 Mxn20.30($1.1bln)

Technical & Trade Views

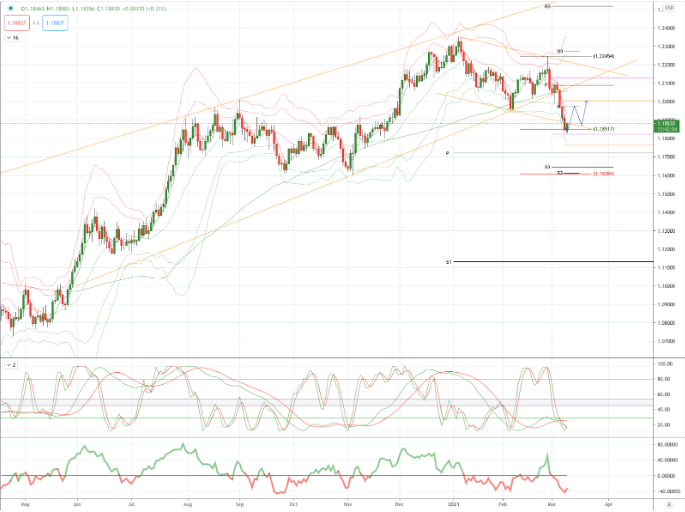

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the closing breach of 1.21 and the descending trendline is a bullish development opening a retest of prior highs at 1.2350, only a move back through 1.20 would suggest further downside opening a potential test of 1.17 yearly pivot

Flow reports suggest congestion through the 1.1820-1.1780 area with weak stops possibly being cleared up quickly through to the 1.1750 and again stronger congestion and likely to continue through the 1.1700 level, topside offers light back through the 1.1920 area and weak stops possibly setting up a small short squeeze through to the 1.1980 area before stronger offers start to appear.

GBPUSD Bias: Bullish above 1.3750 targeting 1.44

GBPUSD From a technical and trading perspective, as 1.40 now acts as support bulls will target a test of 1.44 as the next upside objective. Below 1.40 opens a retest of 1.3750 pivotal trend support.

Flow reports suggest topside offers weak back through the 1.3900 level and light stops limited at best before running into light offers around the 1.3950 area and then increasing resistance through to the 1.4000 before slightly stronger stops appear and the market opens to the 1.4050-1.4100 with patchy resistance until closer to the topside of that range and stronger offers thereafter, downside bids into the 1.3800 level with weak stops likely on a dip through the 1.3780-40 levels with congestion likely to soak up much of the selling through to the 1.3700 level with possibly strong congestion then around the 1.3700 level increasing into the 1.3650 level before being able to make a move to the 1.3600 area and strong bids again.

USDJPY Bias: Bullish above 107.30 targeting 109.85

USDJPY From a technical and trading perspective, as 104.50 supports there is potential for a further squeeze higher to test offers towards 107. A loss of 103.50 would negate further upside and suggest a resumption of trend. Target achieved, look for a profit taking pause to develop above 108.60, as 107.30 support bulls will target a test of 109.85 next

Flow reports suggest topside congestion is likely to soak up some of the weak stops above through to the 109.50 area where strong congestion is likely to appear and increasing offers into the 110.00 and like the previous spikes at the beginning of last year any move is likely to find resistance above and continuing through the 110.00 with break out stops likely to be a little more nervous, downside bids light through to the 108.00 level with weak stops on any retrace through the 107.80 level and opening a dip to the 106.00 area possible over the coming week.

AUDUSD Bias: Bullish above .7560 bullish targeting .8000

AUDUSD From a technical and trading perspective, as the major trendline support at .7560 now acts as support, look for target wave 5 upside objective towards .8000. A closing breach of .7730 of the internal descending trendline will encourage the bullish thesis.

Flow reports suggest topside offers through the 0.7700-20 area with limited potential for stops however, the offers don’t really look that strong until the 0.7800-20 areas with weak stops likely beyond that area to open up the potential for another higher run, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!