Daily Market Outlook, March 8, 2024

Daily Market Outlook, March 8, 2024

Munnelly’s Macro Minute…

“Dovish Take On Fed & ECB Supports Risk Sentiment ”

This morning, Asian equity markets are experiencing an increase after significant gains in US markets yesterday, driven by comments from US Federal Reserve Chair Powell during his testimony to Congress. Powell suggested that the Fed is still likely to cut US interest rates this year and that they are close to having enough confidence that inflation is returning to target levels to make a move. European Central Bank President Lagarde also indicated the likelihood of an ECB rate cut before its summer break, but mentioned that an April move may be premature.

The upcoming US labor market report is considered a crucial indicator of economic conditions. The last report for January showed stronger-than-expected growth in employment and wages, which contributed to more cautious expectations for Federal Reserve interest rate cuts for the year. Therefore, the February report is expected to attract even more attention than usual. Look for a February increase in payrolls of 210k. While this would be lower than the previous two months, it would still be consistent with the average gain over the past year, indicating continued strength in the US labor market. Despite reports of rising job layoffs, most indicators suggest that the market remains robust, supporting the forecast of another decent jobs gain. Additionally, there has been no significant increase in unemployment benefit claims so far. The strength of the labor market argues against the need for early interest rate cuts. However, Fed Chair Powell reiterated this week that while the Fed intends to move cautiously, it still intends to reduce rates if inflationary pressures continue to ease. Therefore, the most critical update today is the wage number. We anticipate a slowdown in monthly wage growth to 0.3% from 0.6%. Another positive surprise would lead to expectations on the timing of rate cuts being pushed out.

The rest of today’s data docket is relatively light. The Q4 Eurozone GDP release is not expected to be revised, but will provide more details on the drivers of growth. The February Canadian labor market report is also expected to show a modest uptick in the unemployment rate amid only a small rise in employment.

Overnight Newswire Updates of Note

Biden Attacks Trump On ‘Democracy And Freedom’ In Fiery SOTU Speech

Powell Says The Fed Is ‘Not Far’ From The Point Of Cutting Interest Rates

Fed’s Mester Sees Rate Cuts This Year If Inflation Keeps Cooling

ECB’s Nagel Sees Rising Chance Of Rate Cut Before Summer Break

Japan Not Planning To Add Chip Export Control For Now, Minister Says

Japan FinMin Suzuki: Too Early To Mention Additional Fiscal Targets

Broadcom Expects AI Demand To Help Offset Weakness Elsewhere

Costco Wholesale Misses Quarterly Revenue Estimates

Huawei Chip Breakthrough Used Tech From Two US Gear Suppliers

Boeing To Tie More Of Employees’ Pay To Safety

NYCB Says It Lost 7% Of Deposits In Past Month, Slashes Dividend To $0.01

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (EU1.38b), 1.0700 (EU1.31b), 1.0770 (EU1.11b)

USD/JPY: 150.00 ($730m), 151.00 ($640m), 150.50 ($479.1m)

USD/CNY: 8.0000 ($961.8m), 6.9750 ($700m), 7.1000 ($650m)

AUD/USD: 0.6375 (AUD610m), 0.6400 (AUD443m), 0.6620 (AUD333.8m)

USD/CAD: 1.3600 ($913.4m), 1.3500 ($812.9m), 1.3570 ($322m)

USD/MXN: 17.20 ($819.8m), 16.90 ($310m)

GBP/USD: 1.2580 (GBP451m), 1.2550 (GBP400m), 1.3100 (GBP341.2m)

FX option prices have recently risen from their lowest levels in two years. FX option implied volatility is an indicator of realized volatility and expectations. It's not surprising to see it reaching new 2-year lows, especially with the Chinese yuan hitting a 7-year low. However, the USD setback and upcoming event risk have finally caused a rebound. There are growing expectations of action from the Bank of Japan on March 19, leading to an increase in JPY volatility. The focus is now on the US NFP data, and only a very strong number would support the USD. The US CPI data is up next on Tuesday, before the Fed meeting on March 20, which is now within a 2-week expiry.

CFTC Data As Of 27/02/24

Euro net long position is 62,854 contracts

Japanese yen net short position is -132,705 contracts

Swiss franc posts net short position of -11,981 contracts

British pound net long position is 46,358 contracts

Bitcoin net short position is -1,967 contracts

Equity fund managers cut S&P 500 CME net long position by 5,157 contracts to 942,123

Equity fund speculators increase S&P 500 CME net short position by 14,679 contracts to 434,512

Technical & Trade Views

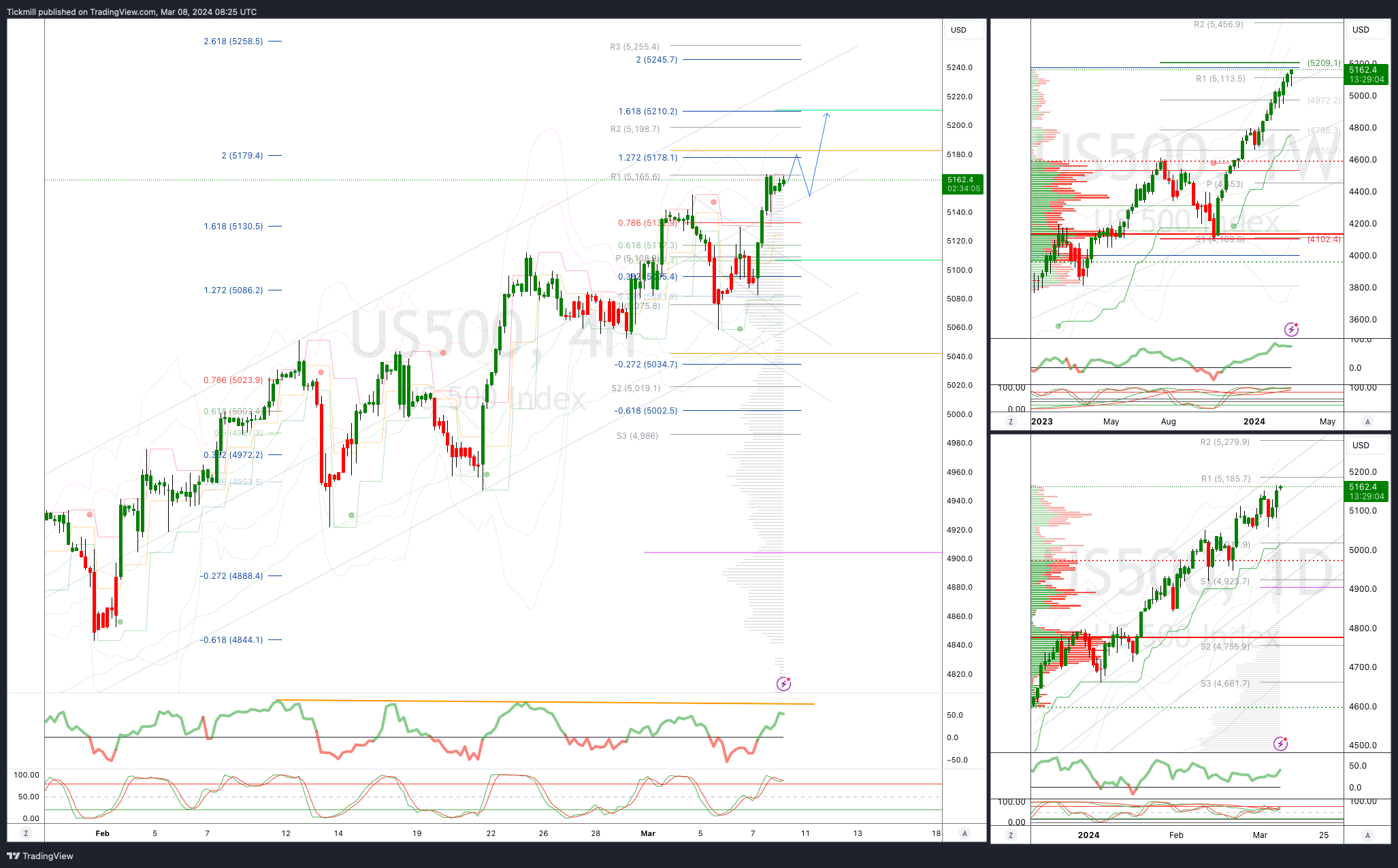

SP500 Bullish Above Bearish Below 5110

Daily VWAP bearish

Weekly VWAP bullish

Below 5050 opens 5038

Primary support 5050

Primary objective is 5180

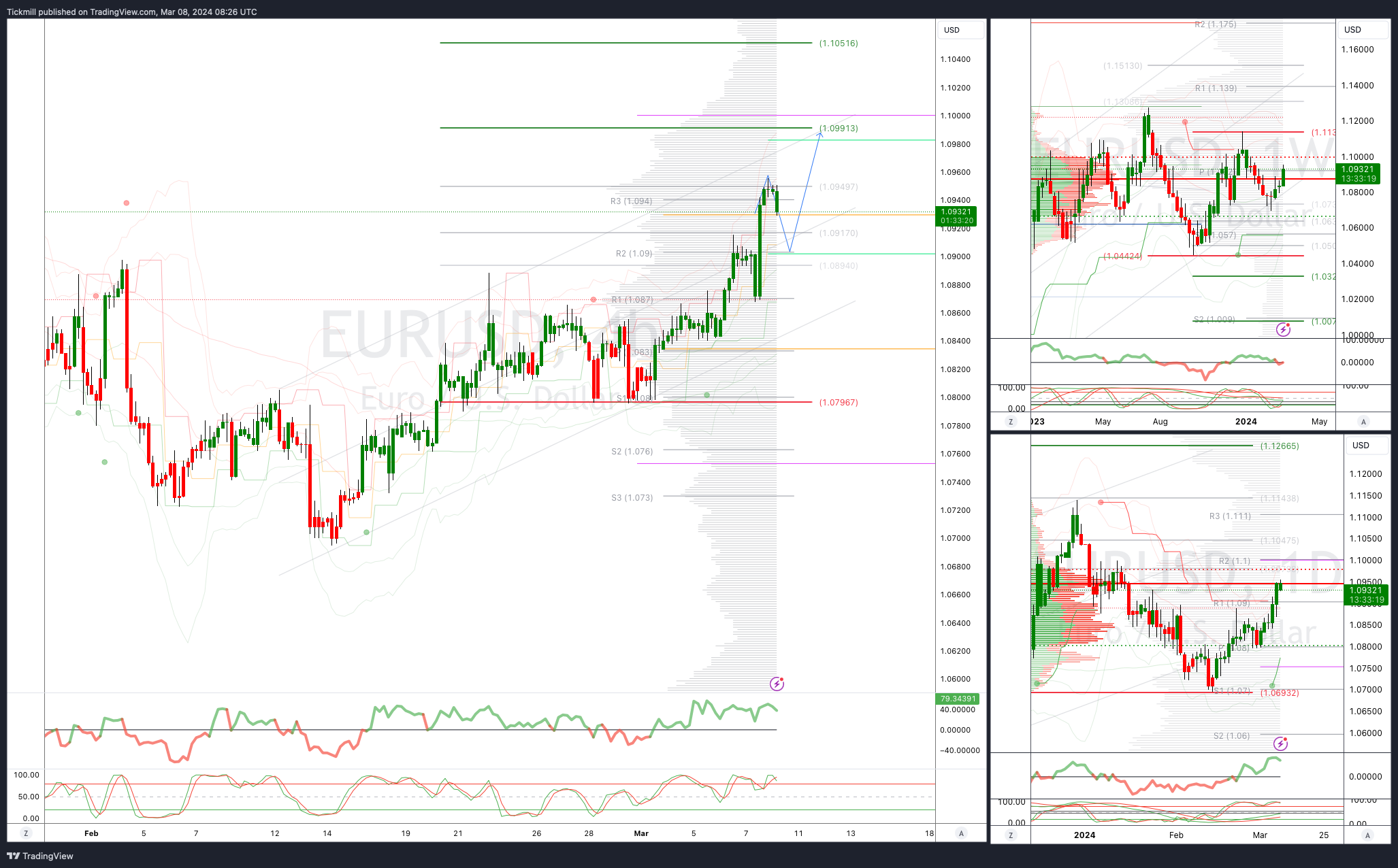

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0990

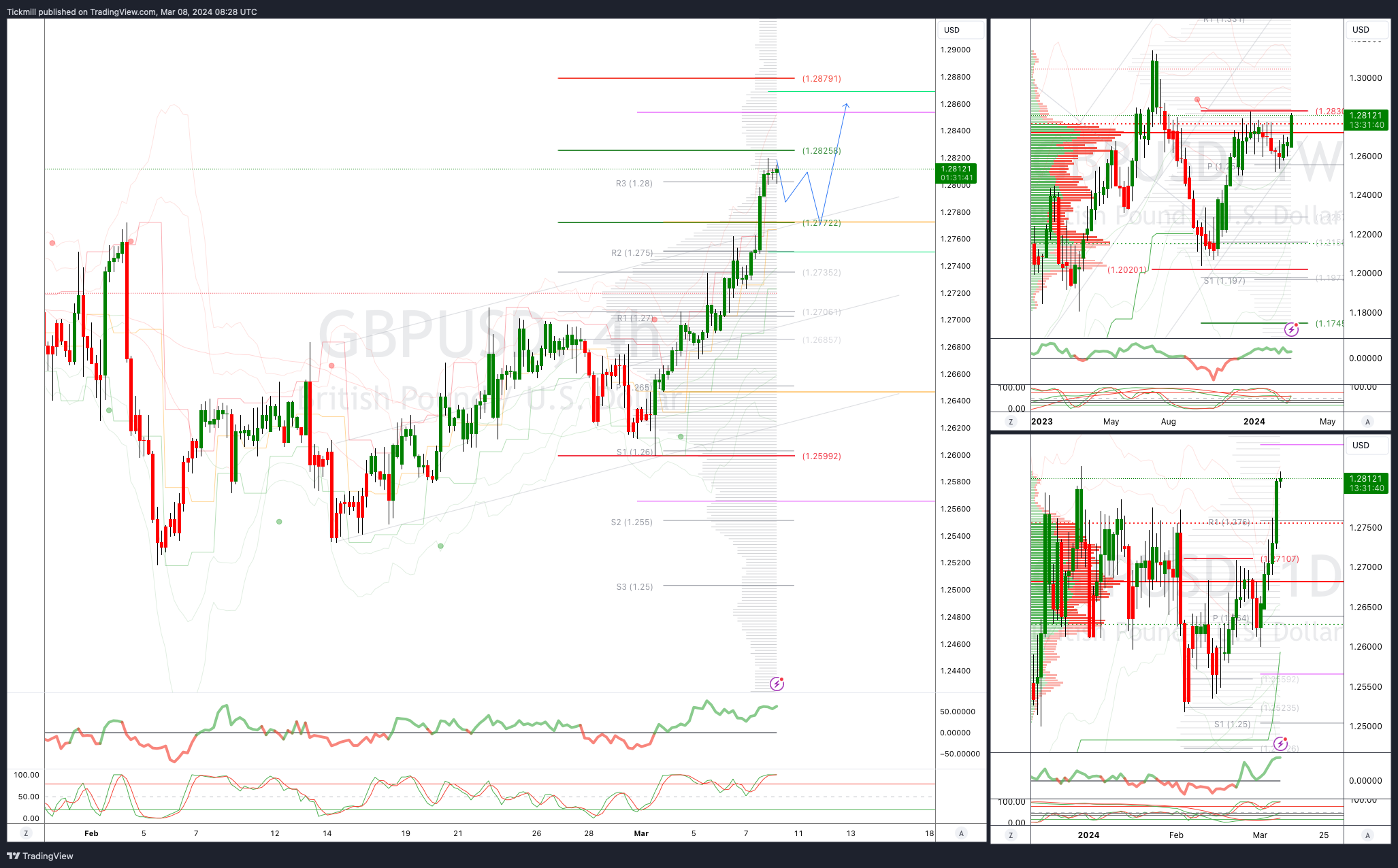

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bullish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

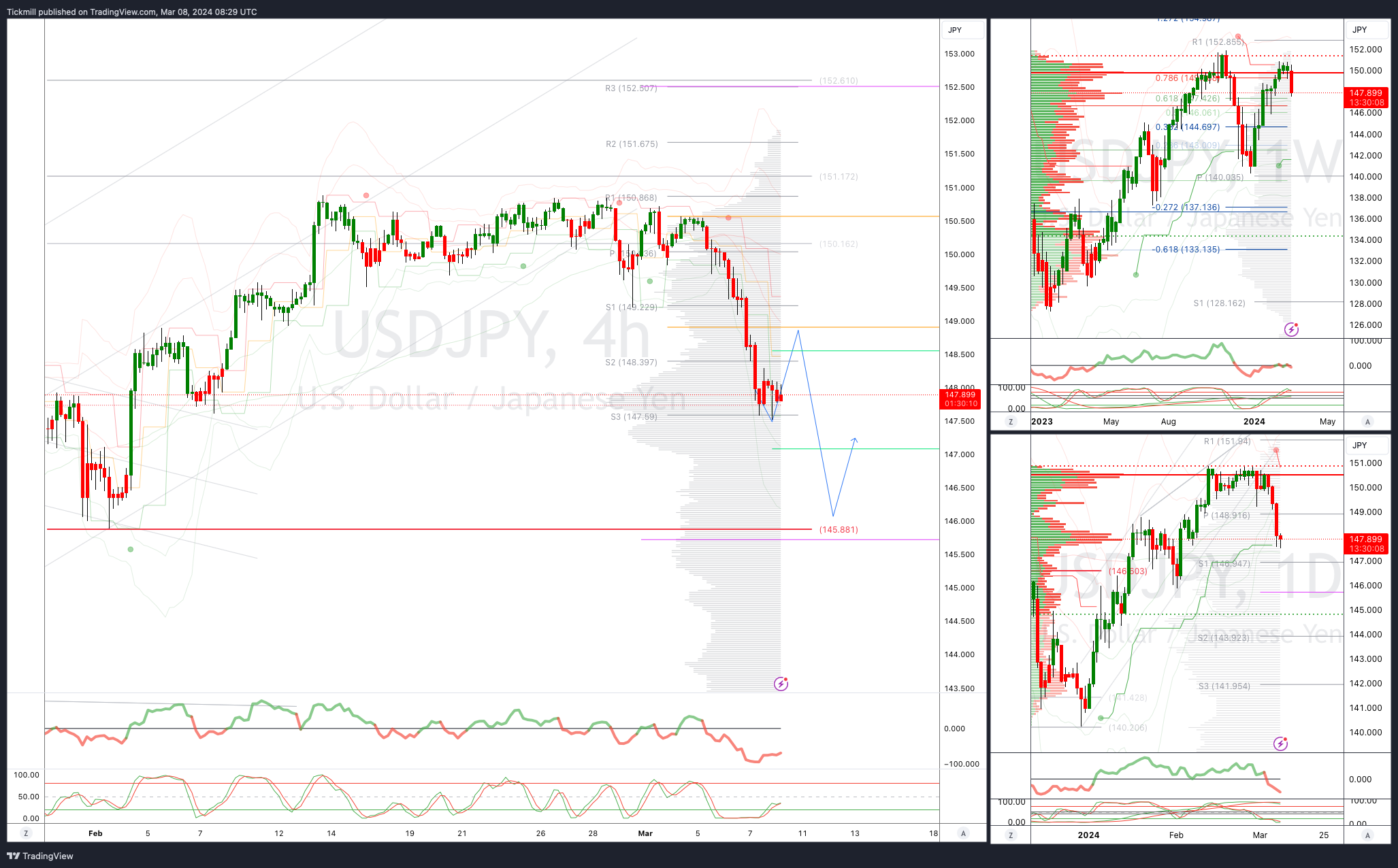

USDJPY Bullish Above Bearish Below 149

Daily VWAP bearish

Weekly VWAP bearish

Below 147.50 opens 145.88

Primary support 145.85

Primary objective is 152

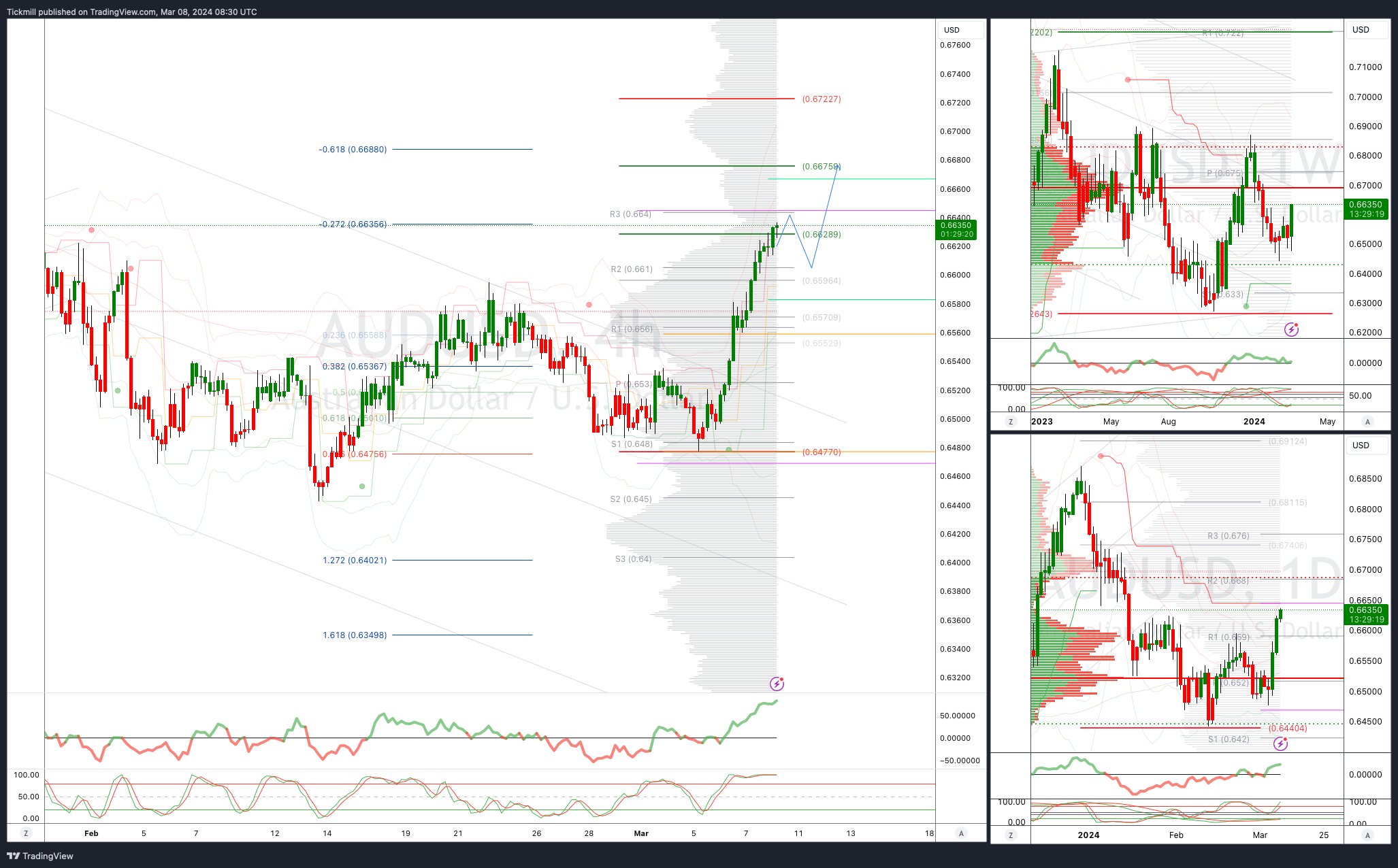

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bullish

Weekly VWAP bullish

Above .6640 opens .6700

Primary support .6477

Primary objective is .6700

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 52800

Primary objective is 72000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!