Daily Market Outlook, March 7, 2022

Daily Market Outlook, March 7, 2022

Overnight Headlines

- US Weighs Acting Without Allies On Ban Of Russian Oil Imports

- US, Venezuela Discuss Ease Of Sanctions, Scant Progress Made

- President Biden Advisers Weigh Saudi Arabia Trip For More Oil

- Congress To Explore Russian Oil Ban, Enact $10Bln Ukraine Aid

- US To Begin Review Of Tariffs On $300 Billion Of China Imports

- China Sets Lowest Growth Target In 30 Years As Fallout Looms

- China Report Most New Daily Covid Cases In Over Two Months

- Russia Demands US Guarantees Over Iran Nuclear Deal Revival

- Poll: ECB To Wait Until Q4 To Raise Rates As Inflation Rampant

- UK Mulls An Instant Asset Freeze On Russians Facing Sanctions

- UK Defence Chief: Putin Forces In Ukraine War Are Decimated

- Commodities Rack Up Stunning Gains As Supply Fears Deepen

The Week Ahead

- Uncertainty surrounding the worsening Russia-Ukraine conflict will ensure markets remain volatile in the week ahead. The events will also feature prominently at the European Central Bank meeting on Thursday.The conflict threatens to drag on and there is little clarity regarding Russian President Vladimir Putin's endgame. Complicating the investor landscape are the ramifications of the conflict and growing number of sanctions placed on Russia by the West Traders will keep a close eye on soaring energy costs and the blowback on Western, especially European, banks from financial sanctions on Russian entities.

- The ECB meets on Thursday as the euro zone economy is being threatened by stagflationary forces, with energy prices soaring and the Russia-Ukraine conflict set to weigh on growth.The ECB is expected to remain on hold and the conflict will likely prevent it from signalling a rate hike is on the cards in the coming months. President Christine Lagarde's comments will be scrutinised for any hint of a dovish pivot in the ECB outlook

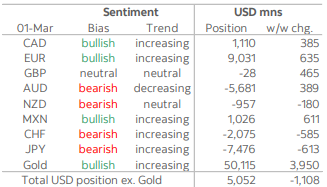

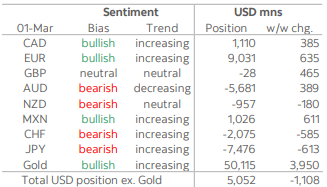

CFTC Data

- CFTC positioning data released Friday showed a decline in USD bullish sentiment despite elevated market anxiety owing to the Russian invasion of Ukraine. Across the currencies that we cover, investors trimmed the aggregate USD long position by USD1.1bn to total USD5.1bn as of Tuesday, its lowest point since mid-August. The weekly adjustment against the dollar compares to similar moves of USD1.0bn and USD1.3bn in the previous two weeks.

- With the EUR sliding through 1.12 on the downside, investors increased their short EUR holdings the most since November but simultaneously placed increased longs the most since August. On net, then, the aggregate EUR bullish position rose by USD635mn to total USD9bn, an eight-month-high. The EUR’s 1.8% decline over the period made it the second worst performing currency of those in this report, following the GBP’s decline of 1.9%. Losses for the EUR to an eventual decline under 1.09 have followed and positive drivers are limited, so the possibility of further downside may see investors trim the overall bullish position in next week’s data, particularly ahead of a dovish ECB decision on Thursday given the risks posed by the Russian invasion of Ukraine. Sterling positioning is now sitting at ‘neutral’ as accounts reduced the aggregate net GBP short by USD465mn to -USD28mn; here, total shorts were practically unchanged while an increase in longs did the heavy lifting.

- Bullish positioning in the CAD climbed above the USD1bn mark on the back of a USD385mn move in its favour on the balance of geopolitical risks and stronger crude oil prices in the lead up to the BoC’s policy decision on Wednesday, where it delivered a widely expected 25bps rate increase. Its crude oil peer, the MXN, also saw its net long climb above the billion mark thanks to USD611mn increase owing to a large reduction in shorts.

- The AUD and NZD led the majors over the week, with respective gains of 0.5% and 0.3%, but only the AUD saw a reduction in its net short while the NZD short widened to near the USD1bn mark. The AUD short fell by USD389mn to a still large negative position of USD5.7bn, as it benefited from strong commodity prices and a slightly hawkish change of tone from the RBA on Tuesday. The NZD short climbed by USD180mn to USD957mn.

- Despite the risk-off mood in markets, investors added to the large CHF and JPY shorts, evidencing limited signs of haven-seeking activity (as far as positioning goes, at least). The CHF’s net short climbed by USD585mn to USD2.1bn as investors likely positioned against the currency given its greater exposure to geopolitical risks in Eastern Europe (outstanding shorts at a 14-week high). Negative JPY positioning rose by USD613mn as the increase in long contracts was only about two-fifths of the increase in short contracts.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.0900 (357M), 1.1100 (496M), 1.1150 (457M) 1.1160-65 (460M), 1.1175-80 (913M), 1.1210 (368M) 1.1250 (788M)

- USD/JPY: 114.20-30 (890M), 114.40-50 (405M) 115.00-10 (817M)

- GBP/USD: 1.3000 (420M), 1.3350 (201M)

- EUR/GBP: 0.8230-35 (600M), 0.8300 (340M)

- USD/CAD: 1.2715-20 (330M). AUD/USD: 0.7325-30 (515M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- As of Mar 1 EUR/USD traders were still increasing bets the pair would rise

- EUR/USD dropped to 1.1090 on Mar 1 and has since dropped to 1.0822 EBS

- The reason the pair hasn't collapsed is because it is technically oversold

- Traders have been buying EUR/USD since SNB resumed intervention last Nov

- It seems downtrend's pause resulting from SNB action was misinterpreted

- The oversold situation may slow EUR/USD or may lead to a minor bounce

- Pressure builds as rising oil threatens EZ economy

- EUR/USD opened 1.0967 after falling 1.20% Friday on outflows sparked by Ukraine war

- Brent crude gapped 10% higher in Asia on reports US and EU considering Russian oil band

- EUR/USD plunged below 1.0900 and EUR sold off against JPY, CHF and AUD

- EUR/USD fell to 1.0822 before settling above 1.0855 into the afternoon

- The EUR/AUD cross was down 2% at one stage after falling nearly 5% last week

- There isn't any solid support for the EUR/USD ahead of the 2022 low @ 1.0636

- Resistance at former support @ 1.1040 and sellers are tipped ahead of 1.1000

- EZ stagflation concerns may force ECB into dovish pivot this week

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Heavy and busy, as oil jump fuels inflation fears

- -0.25%, surging oil, Brent $127.59 +8% hit risk appetite, E-mini S&P -1.6%

- EUR/GBP -0.4% - Ukraine invasion shows no sign of compromise

- Cable trades toward base of a 1.3187-1.3267 range with heavy flow

- Charts; momentum studies, 5 10 & 21 day moving averages head lower

- 21 day Bollinger bands expand - signals suggest the base is the weak side

- Targets major 1.3161-66 support, December 2021 low and 38.2% 2020-2021 rise

- Sustained 1.3150 break opens the door to 1.2831, 50% 2020-2021 climb

- Close above the falling 1.3384 10 day moving average would end downside bias

USDJPY Bias: Bullish above 114.50 Bearish below

- USD/JPY sees some bounce but upside limited with risk very much off

- Asia 114.77-115.16 EBS, mostly around 114.90, Japanese bids still on dips

- Holding mostly above top of 114.44-74 daily Ichi cloud, 100-DMA 114.47

- Risk very much off in Asia, Nikkei -3.2% @25,166, Russia-Ukraine in focus

- US yields off sharply too, Treasury 10s @1.691%, lowest since January 5

- Option expiries help contain action again, large 114.20-50 and 115.00-10

- EUR/JPY off another leg, Asia 125.60 to 124.41 EBS, more downside eyed

- GBP/JPY 151.43-152.13, heavy, AUD/JPY bid, 84.40 to 85.50 before easing back

- Japan end-Feb foreign reserves down some from end-Jan

AUDUSD Bias: Bullish above .7100 Bearish below

- Moves higher as rising commodities and EZ outflows support

- AUD/USD opened 0.7375 after rising 0.57% Friday due to rise in commodities

- It dipped to 0.7355 when E-minis opened 1% lower but dis was short lived

- Brent crude futures soared 10% higher and AUD/USD spiked to 0.7390/95

- EUR/AUD selling added further support as the cross fell close to 1.5%

- AUD/USD stops were triggered to 0.74440 at one stage before sellers returned

- The AUD/USD was overbought and it eased back to 0.7405/10 into the afternoon

- AUD benefiting from rise in energy and geographic distance from Europe

- EUR/AUD has fallen close to 10% since the start of Feb

- AUD/USD support is @ 200-day MA @ 0.7323 & break would ease upward pressure

- There isn't any resistance of note until the Oct 28 high at 0.7555

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!