Daily Market Outlook, March 22, 2024

Daily Market Outlook, March 22, 2024

Munnelly’s Macro Minute…

“Markets Digesting A Bevy Of Central Bank Cross Currents”

Asian equity markets are displaying mixed performance this morning, despite gains seen in European and US markets yesterday. Bank of Japan Governor Ueda stated that the BoJ will allow longer duration bond yields to be determined by markets and may reduce purchases at some point. In a continuation of yesterday's monetary policy update, Bank of England Governor Bailey, in an FT article, indicated that interest rate cuts were under consideration, suggesting that markets are justified in anticipating multiple rate reductions this year.

In today's agenda, newly released UK retail sales data for February showed a 0.2% increase excluding fuel, with overall performance remaining flat. While this is notably less than January's 3.6% monthly surge, it surpassed consensus expectations for a decline, adding to the evidence of a pick-up in economic activity this year. The GfK consumer confidence measure earlier this morning reported no change in its overall reading for March, yet consumers' optimism regarding their future finances reached a two-year high. The CBI industrial trends survey will offer further insights into the UK factory sector conditions in March. While yesterday's manufacturing PMI hinted at stabilization as the overall index hovered just below the 50 expansion/contraction threshold, the February CBI reading indicated a significant decline in orders. Observers await March's data to assess any potential improvement. Additionally, February saw a rise in the selling price index, possibly reflecting supply chain disruptions from issues in the Red Sea. Hence, the latest update will be scrutinized for signs of whether this trend persisted.

The German IFO survey, the final unofficial March update for the Eurozone this week, is anticipated today. Previous ZEW and PMI surveys suggested challenging current economic conditions but also expressed optimism for improvement throughout the year. Similarly, the IFO survey is expected to show a significant rise in the expectations index, albeit with a smaller increase in the current conditions measure.

Stateside, there are no notable data releases scheduled on the docket. However, a couple of Federal Reserve policymakers will provide their perspectives on this week's US monetary policy update. European Central Bank Chief Economist Lane is also slated to deliver a lecture on inflation, likely discussing the ongoing disinflation process in the Eurozone and potentially offering insights on the timing of interest rate adjustments in the region.

Overnight Newswire Updates of Note

Japan CPI Rises As Expected In Feb, Stays Well Above BoJ Target

BoJ Will Eventually Scale Back Bond Buying, Says Gov Ueda

BoJ Watchers See Next Rate Hike By October, Risk Of Faster Moves

RBA: More Borrowers To Feel The Squeeze Than Initially Forecast

New Zealand’s Trade Deficit Narrows To Smallest In 20 Months

German Ifo Outlook Set To Rise, Little Change Exp For View Of Present

BoE’s Bailey Says Rate Cuts ‘In Play’ In Upbeat Take On UK Economy

UK Households Most Upbeat About Personal Finances Since 2021

China’s Yuan Weakens To Four-Month Low After Key Level Breached

BTC On Track For Worst Week In Months As ETF Demand Falters

Biden’s LNG-Permit Halt Challenged By 16 States In Lawsuit

Apple Loses $113 Billion In Value After Regulators Close In

FedEx Beats Estimates As CEO’s Overhaul Plan Gains Traction

Enel Posts 12% Rise In 2023 Core Profit Thanks To Renewables

Netanyahu Would Face Widespread Boycott On Capitol Hill

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (EU1.54b), 1.0825 (EU1.33b), 1.0870 (EU1.03b)

USD/JPY: 148.80 ($1.32b), 145.00 ($1.19b), 149.55 ($1.14b)

AUD/USD: 0.6750 (AUD2.59b), 0.6825 (AUD2.56b), 0.6650 (AUD1.68b)

USD/CAD: 1.3480 ($1.22b), 1.3370 ($1.1b), 1.3500 ($836m)

USD/CNY: 7.2200 ($1.21b), 7.1500 ($1.05b), 7.2000 ($809.9m)

NZD/USD: 0.6050 (NZD1.28b), 0.6060 (NZD497.5m), 0.6100 (NZD389m)

GBP/USD: 1.2750 (GBP547.4m), 1.2625 (GBP389m), 1.2700 (GBP350m)

USD/MXN: 17.75 ($453m)

Global easing cycle starts with Swiss National Bank cutting rates by 25bps to 1.5% due to significant CPI undershoot. Bank of Japan finally delivers a rate hike. Bank of England holds rates, but risks of earlier rate cut in June increase. Federal Reserve likely to cut rates in June despite some hawkish signals. Fed Chair Powell remains dovish about inflation reports.

CFTC Data As Of 15/03/24

Bitcoin net short position is -994 contracts

Euro net long position is 74,407 contracts

Japanese Yen net short position is -102,322 contracts

Swiss Franc posts net short position of -17,870

British Pound net long position is 70,451 contracts

Equity fund managers cut S&P 500 CME net long position by 3.983 contracts to 913,990

Equity fund speculators increase S&P 500 CME net short position by 71,149 contracts to 474,044

Technical & Trade Views

SP500 Bullish Above Bearish Below 5200

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

EURUSD Bullish Above Bearish Below 1.0940

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0840 opens 1.0795

Primary support 1.08

Primary objective is 1.10

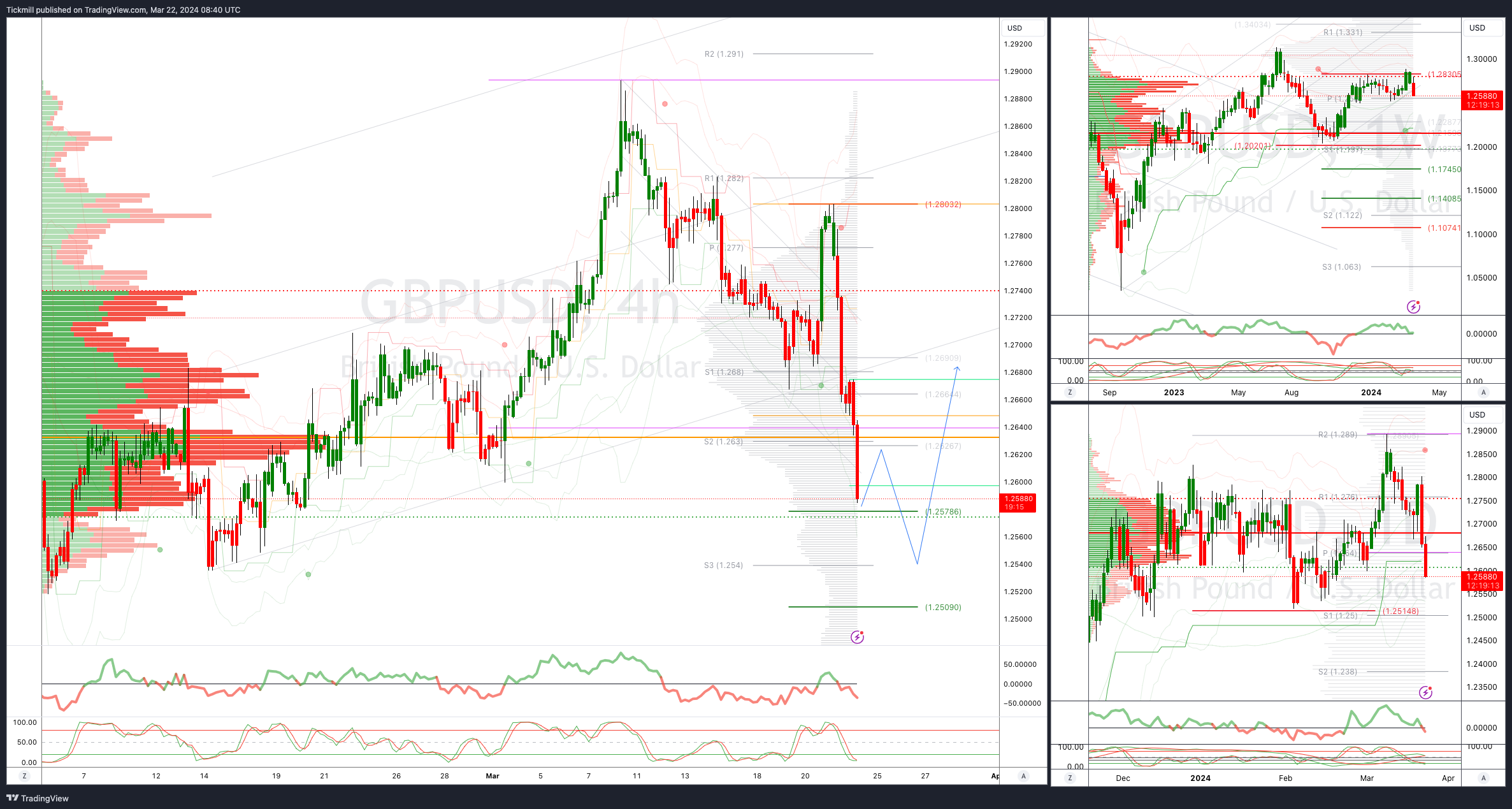

GBPUSD Bullish Above Bearish Below 1.2740

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2514

Primary objective 1.29

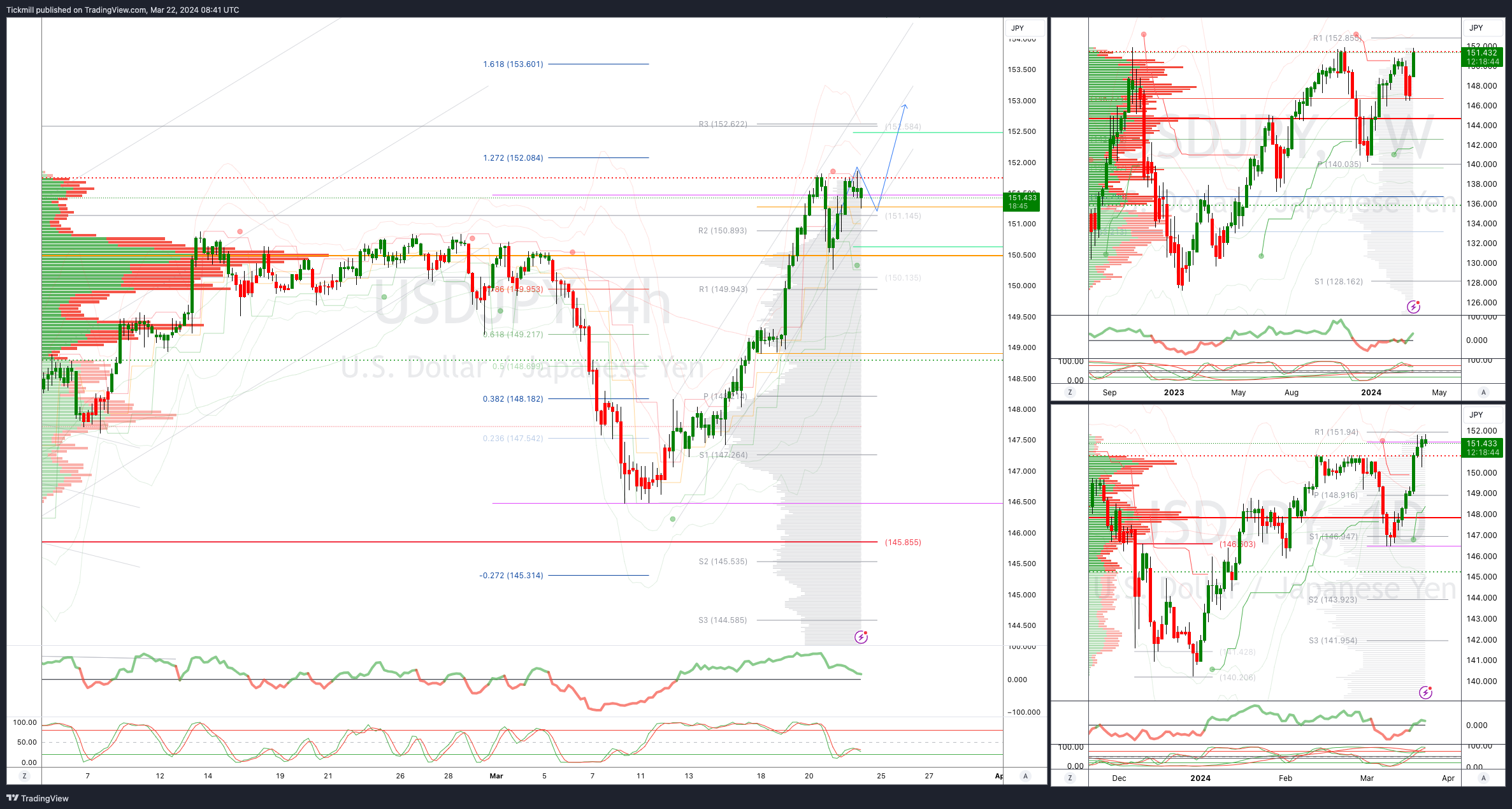

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

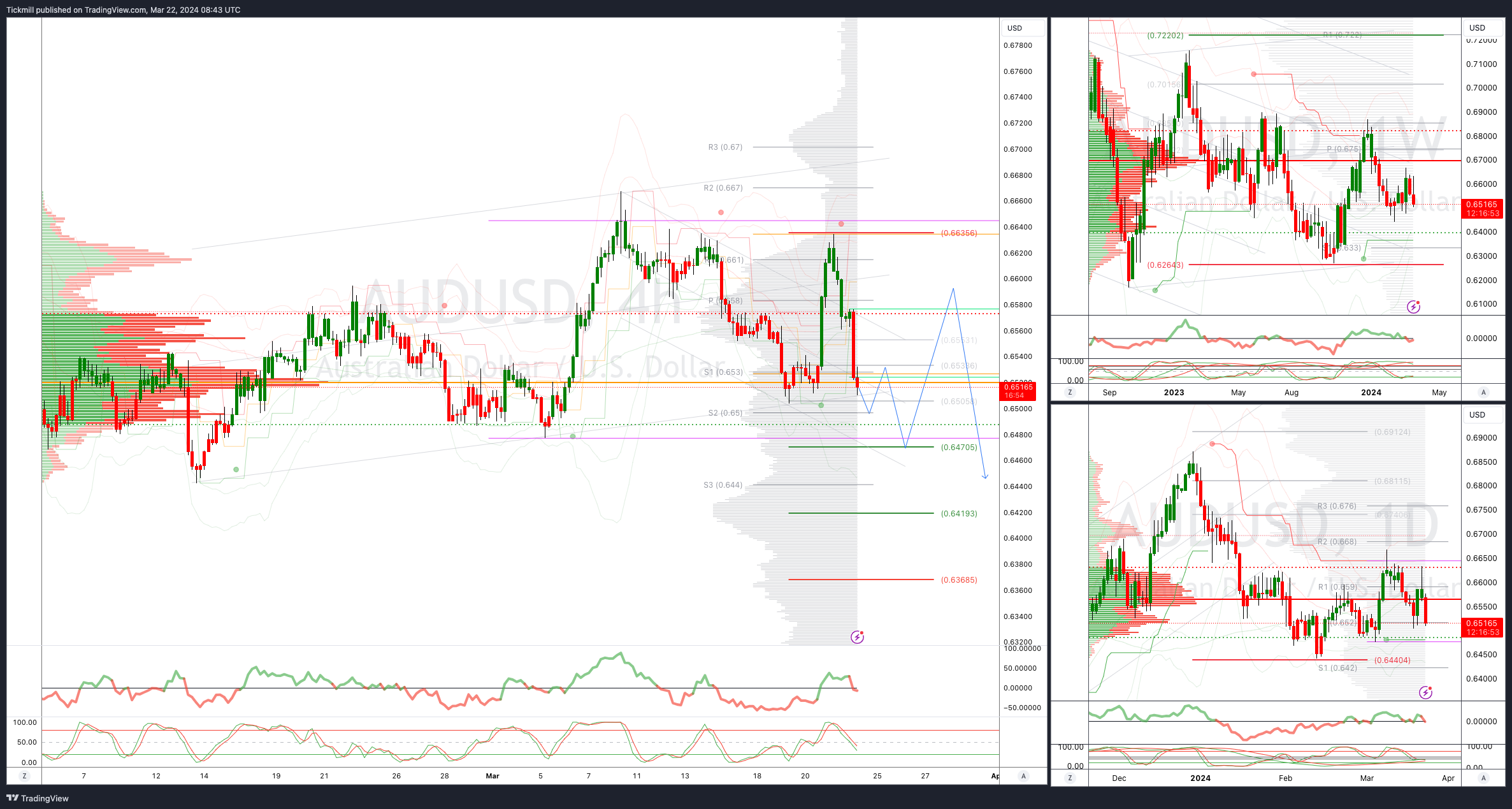

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6470

Primary support .6477

Primary objective is .6700

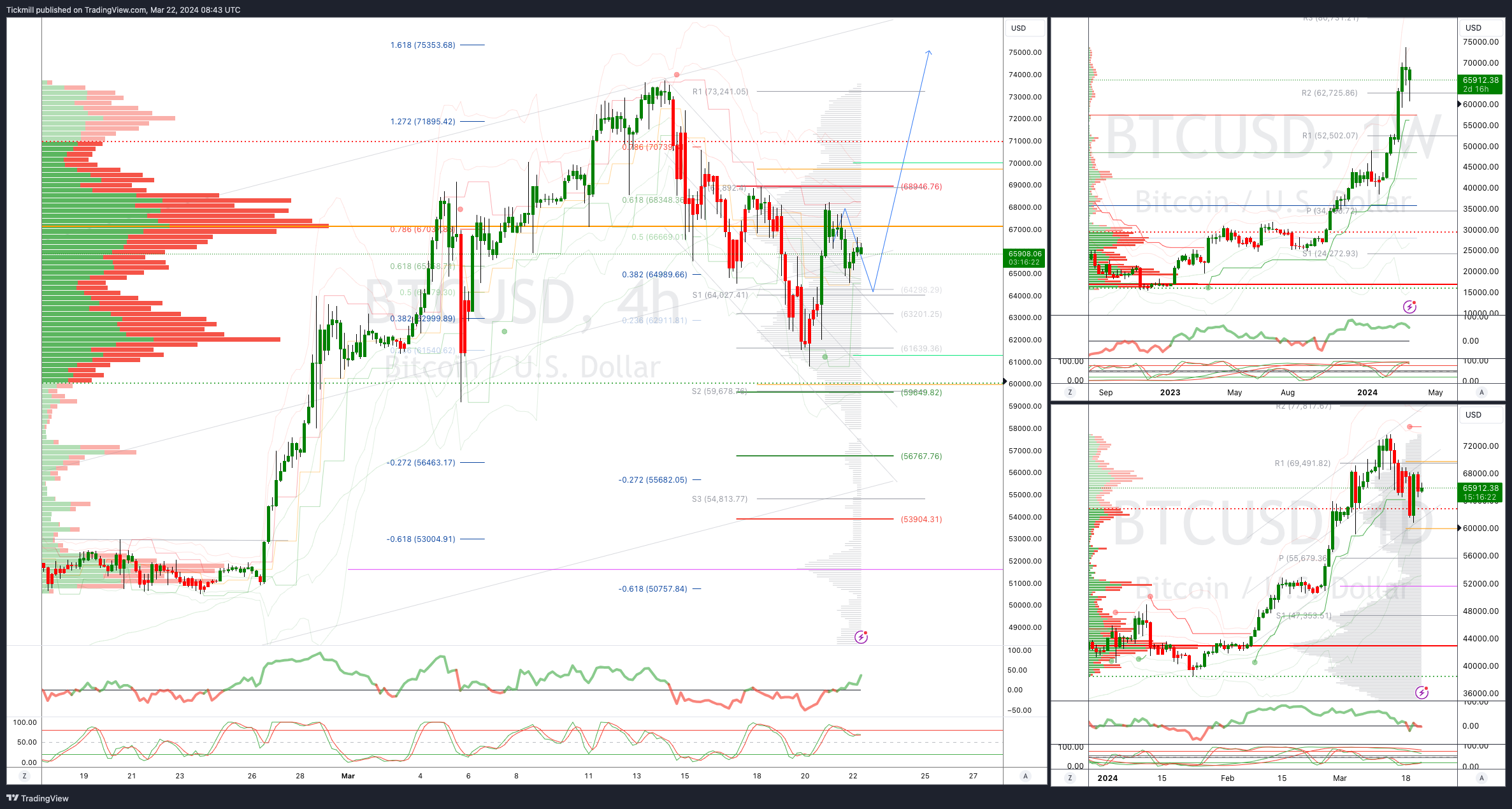

BTCUSD Bullish Above Bearish below 68900

Daily VWAP bearish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!