Daily Market Outlook, June 7, 2021

Daily Market Outlook, June 7, 2021

Overnight Headlines

- U.S. TsySec Yellen – G7 commits to global minimum corp tax rate, tech giants, tax havens targeted Yellen – urges G7 to keep up fiscal support for recovery, climate investments, inflation to pass

- U.S. job growth picks up, wages boosted, leisure-hospitality pay surges to record

- Clock is ticking for Republicans on infrastructure, Biden officials say

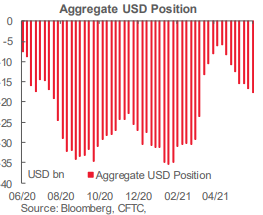

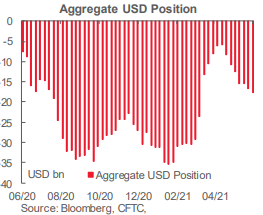

- Speculators decrease short dollar bets in latest week – CFTC/Reuters

- China's imports grow at fastest pace in decade as materials prices surge • CN May Exports YY, 27.9%, 32.1% f'cast, 32.2% prev; Imports YY, 51.1%, 51.5% f'cast, 43.1% prev • CN May Trade Balance, 45.53 bln, 50.50 bln f'cast, 42.83 bln prev

- Former China FX official says "opportune moment" to launch yuan futures. China blocks several cryptocurrency-related social media accounts amid crackdown

- Japan to pledge fiscal reform in economic blueprint, action to avert deflation – draft

- S&P upgrades outlook on Australia's AAA rating to stable from negative • Australian job advertisements jump 7.9% in May – ANZ • Australia's Victoria logs biggest rise in COVID-19 cases in a week

- Conservative win in German state election boosts Laschet’s chancellery hopes

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.2050 (677M), 1.2175 (591M), 1.2215 (624M), 1.2250 (650M)

1.2290-1.2300 (1BLN)

USD/CHF: 0.9125 (600M). EUR/GBP: 0.8615 (275M)

AUD/USD: 0.7650 (266M), 0.7675 (238M), 0.7700 (467M), 0.7730 (248M)

USD/CAD: 1.2000 (895M). EUR/JPY: 133.40 (439M)

USD/JPY: 109.20 (670M), 109.50 (1.25BLN), 110.00 (781M), 110.50 (825M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.2150 bullish above

Overnight trade: Consolidates as post-US jobs hangover fails to inspire • EUR/USD opened +0.33% after reversing higher following US payroll report • After opening at 1.2167, it traded in a tiny 1.2160/72 range in Asia • Resistance is at the 21-day MA at 1.2175 and 10-day MA at 1.2194 • EUR/USD will need to break above 1.2200 to regain upward momentum • A break below 1.2155 will likely see post-US jobs gap filled to 1.2130/35 • Range trading likely to continue until market finds fresh catalyst

Flow reports topside offers congested through to the 1.2300 level with weak stops limited through the 1.2320 area and long term trend line around the 1.2345 area likely to see strong offers before weak stops opening the topside to further gains through the 1.2400 level. Downside bids into the 1.2140-60 level likely to be light and then increasing through the 1.2120 level to 1.2080 before weak stops appear and open up a deeper move through to the 1.2000 level with very little congestion until that point.

GBPUSD Bias: Bullish above 1.41 bearish below.

Overnight trade: Heavy in a low key start, as risk appetite cools • -0.15% at the base of a 1.4139-1.4170 range with only occasional interest • Risk cools with softer commodities, mixed stocks – firmer US Treasury yields • Britain's lowest-paid workers face highest jobless risk • UK calls for pragmatism and EU seeks trust into N.Ireland talks • This week's N.Ireland talks will be key for the EU-UK relationship this year • Charts; 5, 10 & 21 DMAs coil, momentum studies slip – neutral setup • 1.4080-1.4250 range in place since mid May could be vulnerable • Tight 21 day Bollinger bands contract, which suggests a breakout is due

Flow reports suggest topside offers light through the 1.4250 area with some congestion increasing on any move to the 1.4300 and stronger offers in the area, a break above the 1.4310 area will likely see weak stops and breakout stops coinciding and the topside open to a quick squeeze through the 1.4350 level and an attempt on the possibly weak 1.4400 area and stronger stops again through the level. Downside bids likely to increase on a move through to the 1.4100 with a couple of weeks of congestion building up in the area with weak stops on a break through the 1.4090-80 area and opening to the 1.4000 level with very little support other than limited sentimental bids, however, the move through will then start to see stronger bids into the 1.3950-1.3900 area limiting any further loses.

USDJPY Bias: Bullish above 108 targeting 112

Overnight trade: claws back after plunge to 109.37, good bids • USD/JPY claws back up after plunge to 109.37 after another US NFP miss • To @109.54 at NY close, Asia 109.47-63 EBS, good bids below from 109.30 • Bids trail down, large around 109.00, more interest eyed below • USD/JPY back to low-altitude flight, base 108.30-40 lows post-April NFP • Offers in above too, large at 109.65, Japanese exporters included • Option expiries help contain action today, $1.7 bln between 109.45-70 • US yields off again to lows of last week, Treasury 10s @1.571%

Flow reports suggest downside light through the 108.50 before opening the market to a new test of the 108.00 level, stronger bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, topside offers through to the 110.00 level with light congestion through the figure level and weak stops possibly limited and stronger offers likely increasing on a move higher towards the 111.00

AUDUSD Bias: Bearish below .7790 bullish above

Overnight trade: eases slightly in quiet Asian session • AUD/USD opened 0.7745 after rising 1.07% after Friday's US jobs miss • After trading at 0.7748, the AUD/USD attained an offered tone • It traded down to 0.7731 before settling around 0.7735 into the afternoon • Support is at the 10-day MA at 0.7732 and close below eases upward pressure • Resistance is at the 21-day mA at 0.7750 where sellers are tipped • Range trading likely after Thursday's false break

Flow reports topside offers into the 0.7800 area with weak stops through the 0.7820 before opening for a new run higher and strong offers likely through the 0.7840-60 area to build for the 79-cent level. Downside bids into the 0.7700 level with weak stops on a move through the 0.7680 area however, stronger bids then start to show through into the 0.7650 and ultimately the 0.7600 area and likely to continue in that fashion through to the 0.7550 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!