Daily Market Outlook, June 5, 2024

Daily Market Outlook, June 5, 2024

Munnelly’s Macro Minute…

“Bank of Canada On Deck Ahead Of ECB & NFP’s”

Wednesday saw a general rise in Asian stocks, with the dollar holding steady, driven by increasing expectations of a Federal Reserve interest rate cut in September due to signs of a weakening U.S. labor market. Investors are eagerly awaiting the upcoming crucial payrolls report, but concerns about a slowing U.S. economy have tempered risk appetite. Indian markets are receiving significant attention, with Indian stocks being volatile following a sharp decline in the previous session, as voting results indicated a narrower-than-expected victory margin for Prime Minister Narendra Modi.

Looking ahead to tomorrow’s ECB meeting, the Governing Council is widely expected to lower interest rates for the first time since September 2019, reducing the deposit rate to 3.75%. Today's focus shifts to the Bank of Canada's policy decision, with the likelihood of a quarter-point cut surging to over 80%. Should the Bank of Canada proceed with a rate cut, immediate attention will turn to their future plans, which remain uncertain as Governor Macklem and the rate-setting committee have provided little guidance on the pace of future cuts. Currently, the market is pricing in between two and three quarter-point cuts this year, with the second cut expected by the October meeting. Therefore, today's communication, including comments from Governor Macklem during the press conference, will be closely watched.

Conversely, markets are postponing their expectations for U.S. interest rate cuts, with the first quarter-point reduction not fully priced in until November, whereas a June cut was previously deemed likely. This shift reflects persistent inflation and a resilient, though slowing, economy and labor market. Today's U.S. ADP private payrolls report is expected to support the Federal Reserve's stance to maintain current interest rates, with a forecasted increase of 180,000 in private sector payrolls. Additionally, the ISM non-manufacturing report is projected to provide further insight in to the strength of the services sector Stateside.

Overnight Newswire Updates of Note

China Caixin PMI Signals Fastest Services Activity Growth In 10 Months

Australia Economy Remains Weak On Household Spending Squeeze

Australian Treasurer Chalmers: Q2 GDP To Be Similarly Difficult'

RBA Won’t Hesitate To Act if Inflation Is Stickier, Bullock Says

US Seeks EU Sanctions Guarantee To Back $50Bln Ukraine Loan

Bank Of Canada Prepares For Interest-Rate Cut Pivot

Sunak ‘Beats’ Starmer In Debate By Narrow Margin, Snap Poll Claims

Bitcoin Posts Longest Winning Run Since March On Rate-Cut Wagers

New Texas Stock Exchange Takes Aim At New York’s Dominance

HPE Jumps After Reporting Strong Sales On AI Server Demand

Intel To Sell 49% Of Irish Venture To Apollo For $11 Billion

Bayer’s Weedkiller Payout Slashed To $400M From $2.25B

Samsung Stock Gains As Nvidia Works To Certify Its HBM Chips

Chinese AI Chip Firms Downgrading Designs To Secure TSMC Prod.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0775-85 (1.5BLN), 1.0790-00 (1.5BLN)

1.0810-20 (538M), 1.0835-45 (836M), 1.0850-60 (2.06BLN)

1.0870-80 (1.83BLN), 1.0890-00 (2.2BLN)

1.0910-20 (1.52BLN)

USD/JPY: 154.25 (350M), 154.60 (970M), 154.70-75 (411M)

154.95-00 (464M), 155.30 (1.15BLN), 156.60 (509M)

157.00 (353M), 157.00-10 (775M)

USD/CHF: 0.8950-60 (340M)

EUR/CHF: 0.9590-00 (861M), 0.9700 (400M)

GBP/USD: 1.2695-00 (480M)

AUD/USD: 0.6580-85 (585M), 0.6590-00 (1.23BLN)

0.6710-20 (523M). USD/ZAR: 19.00 (214M)

19.20 (270M). EUR/SEK: 11.40 (280M)

USD/CAD: 1.3500 (290M), 1.3590-00 (544M)

1.3625-35 (306M), 1.3655 (446M), 1.3675-90 (638M)

CFTC Data As Of 31/05/24

Japanese yen net short position is -156,039 contracts

Euro net long position is 57,572 contracts

Swiss franc posts net short position of 44,366 contracts

British pound net long position is 25,402 contracts

Bitcoin net short position is -756 contracts

Equity fund managers raise S&P 500 CME net long position by 31.431 contracts to 978,007

Equity fund speculators increase S&P 500 CME net short position by 12,145 contracts to 330,057

Gold NC Net Positions increased to $236.6K from previous $229.8K

Technical & Trade Views

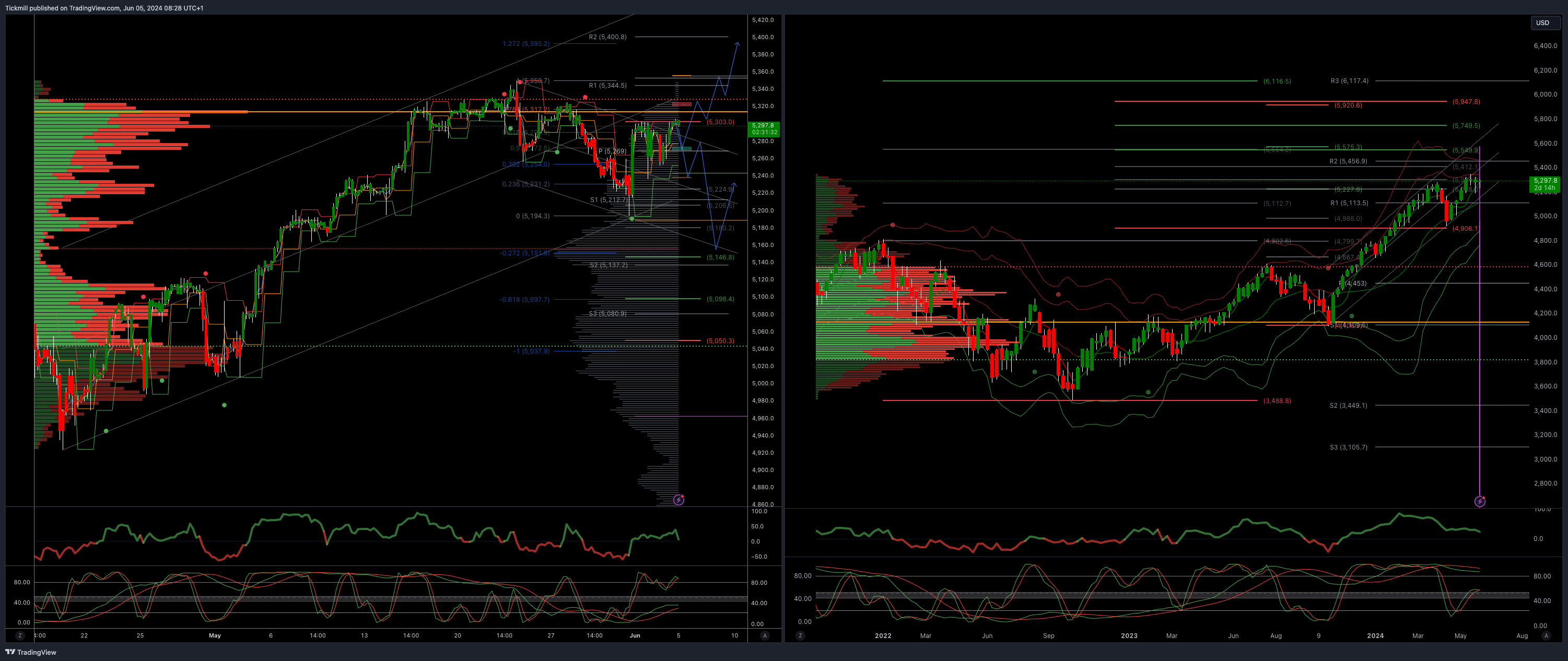

SP500 Bullish Above Bearish Below 5303

Daily VWAP bullish

Weekly VWAP bullish

Above 5310 opens 5379

Primary resistance 5303

Primary objective is 5146

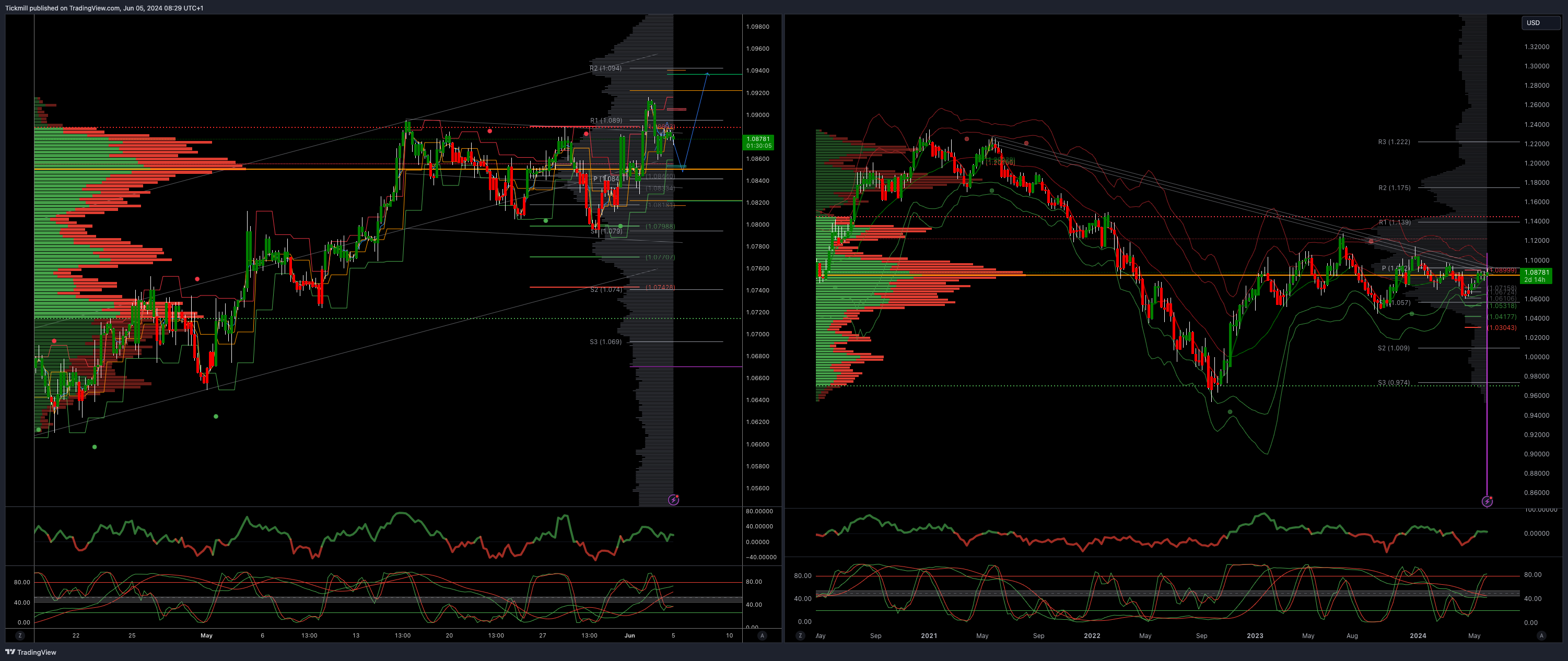

EURUSD Bullish Above Bearish Below 1.0860

Daily VWAP bullish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0550

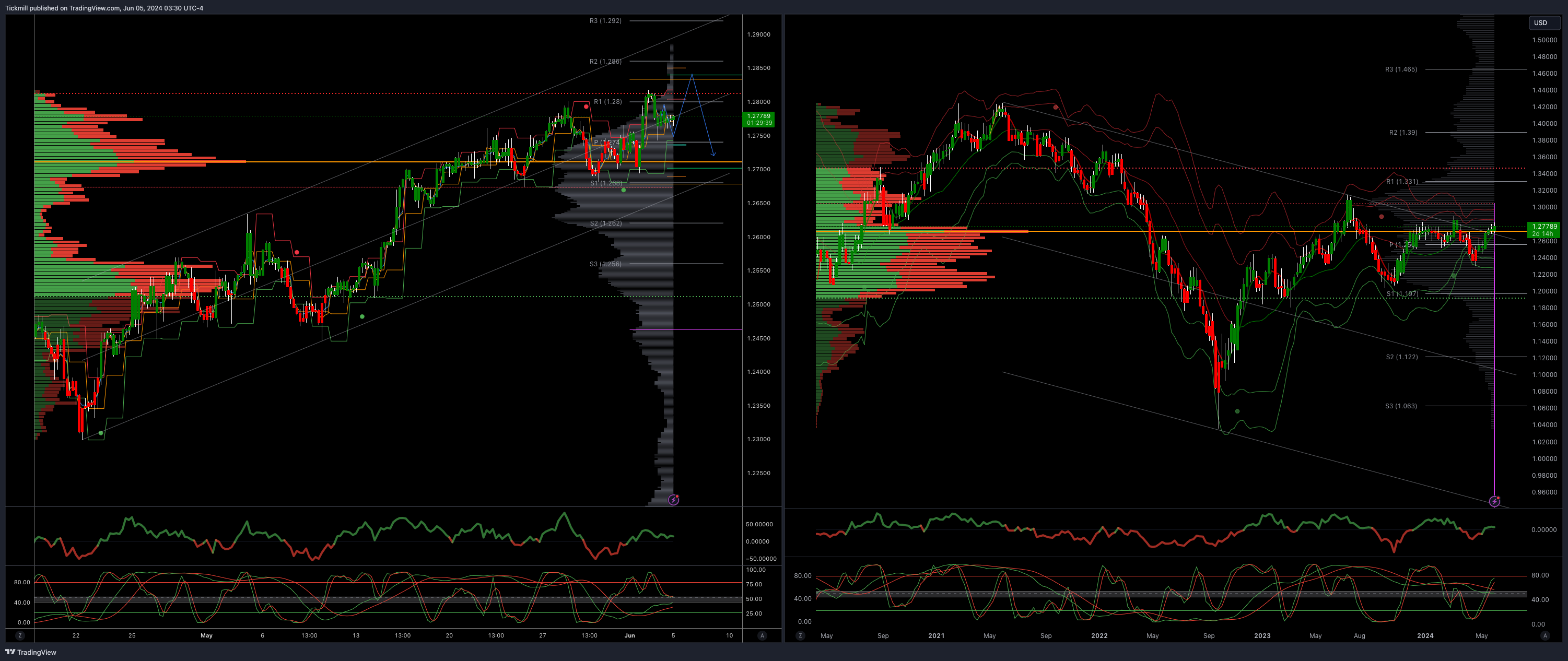

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2850

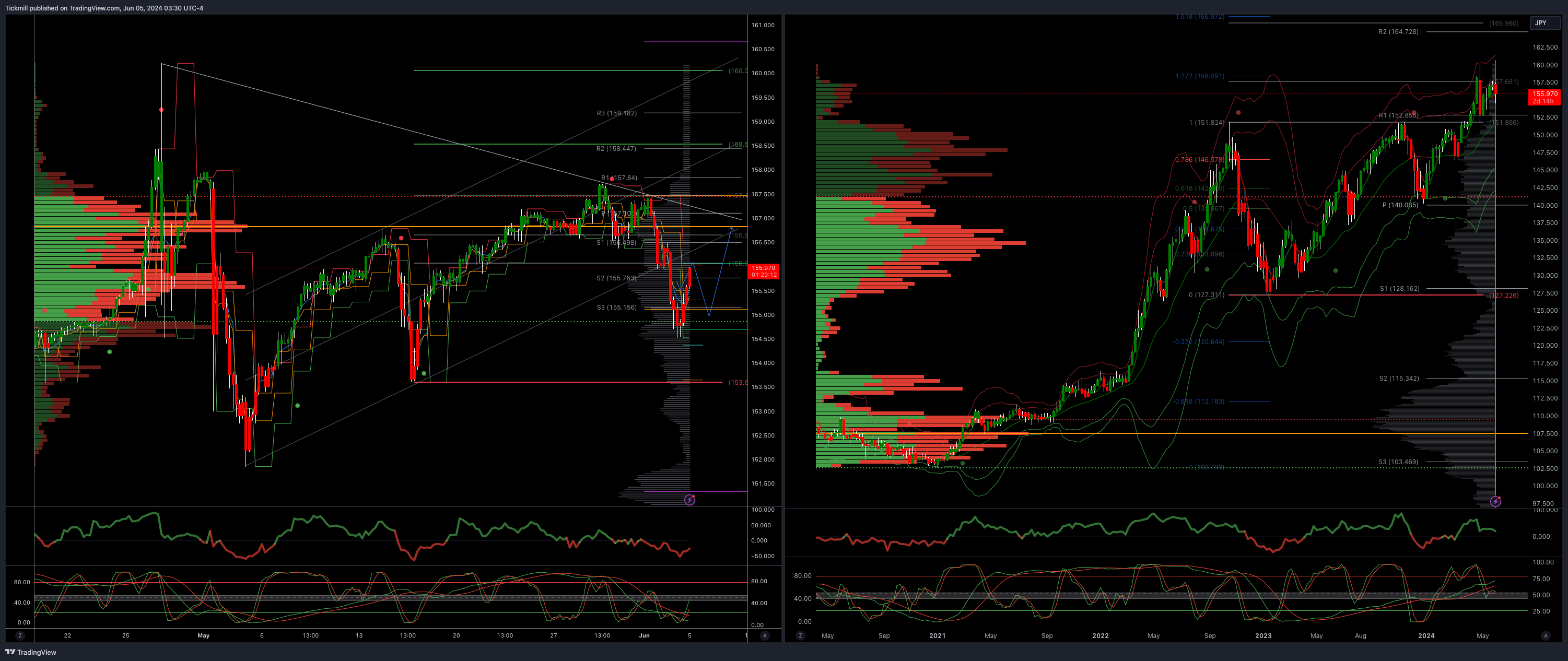

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bullish

Below 156 opens 154.50

Primary support 152

Primary objective is 165

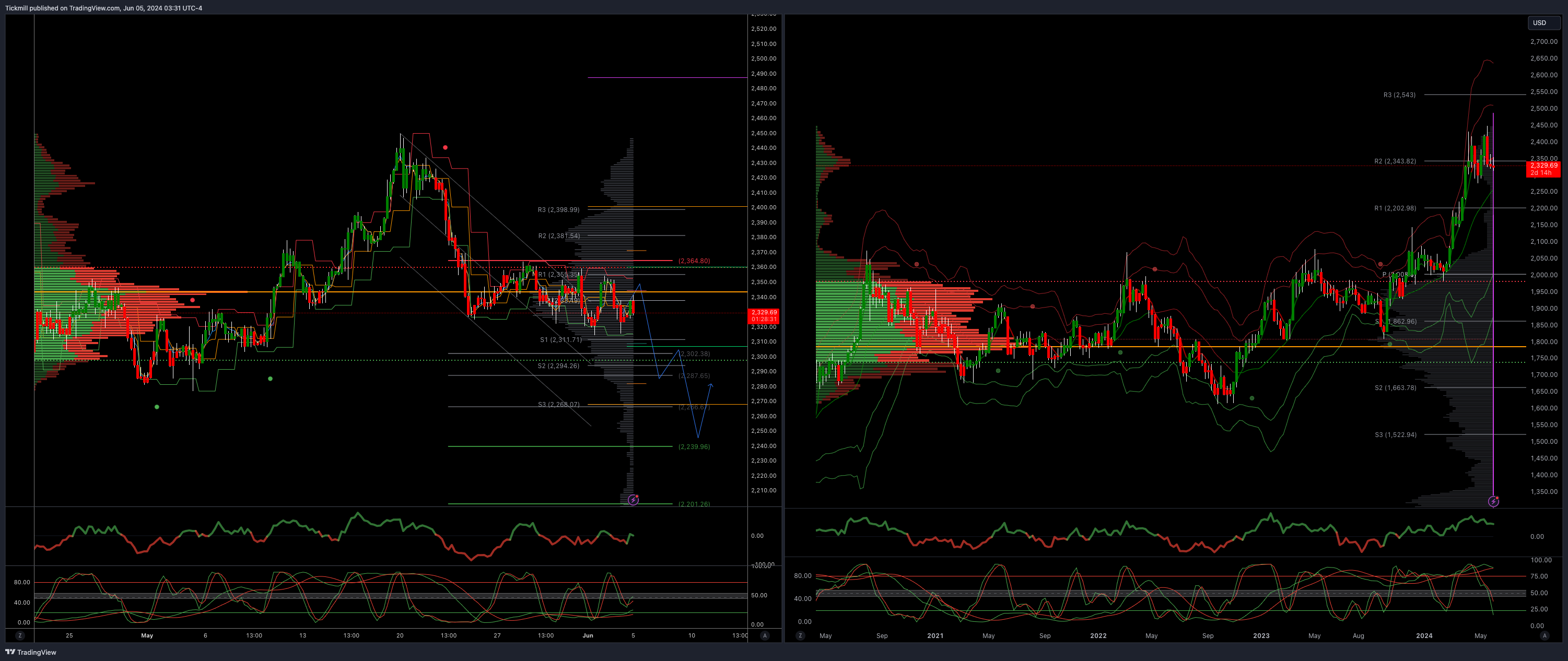

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bearish

Above 2365 opens 2390

Primary support 2300

Primary objective is 2239 Below 2300

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bullish

Weekly VWAP bullish

Below 67000 opens 65500

Primary support is 65000

Primary objective is 73400

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!