Daily Market Outlook, June 4, 2024

Daily Market Outlook, June 4, 2024

Munnelly’s Macro Minute…

“When Bad News Means Bad News…”

Asian stock markets experienced a downturn following the release of a weaker-than-expected US ISM manufacturing survey on Monday, reversing the prior market dynamic where the market perceived bad news as good news for market sentiment as it prompted the markets to believe that the Fed would step in with rate cuts, recently we are witnessing a reversal of this response. This survey's results have cast a shadow over the market's risk appetite, fueling worries about the US economy's deceleration. Moreover, there's an anticipation that the Federal Reserve might maintain elevated interest rates to effectively combat inflation. While equity markets are uncertain about the news, the bond market shows a clear decrease in yields. The likelihood of a September rate cut has increased from 50:50 to 60:40, according to the CME Group's FedWatch Tool.

Investors are setting their sights on the upcoming ECB monetary policy announcement and the US employment data, expected on Thursday and Friday, respectively. The British Retail Consortium disclosed its informal retail sales data for May overnight, indicating a recovery after April's sales were dampened by inclement weather. The figures showed a modest 0.4% increase year-over-year, a rebound from April's 4.4% decline, yet still falling short of projections. This aligns with the recent CBI distributive trades survey, which also noted improved sales in May. No additional UK economic data is slated for release today.

In the Eurozone, the absence of significant data releases today means there's little chance of altering expectations for an ECB rate reduction this Thursday. However, today's German unemployment report is likely to garner interest. The consensus is that jobless claims for May increased by 7,000, with the unemployment rate predicted to hold steady at 5.9% for the fifth consecutive month, following a rise throughout 2022 and 2023. Given that wage growth indicators are still relatively high historically, there may be a cautious approach to further ECB rate reductions later this year.

Sateside, the spotlight will be on this afternoon's factory orders and the JOLTS report. Factory orders are projected to have seen a 0.6% uptick in April, largely inferred from durable goods data. The JOLTS report is anticipated to provide insights into whether there's a cooling off in labor demand.

Overnight Newswire Updates of Note

BRC & Barclays Say Wet Weather Keeps Cloud Over UK Spending In May

Sunak And Starmer Set To Clash In First UK Election Leaders’ Debate

BoJ’s Ueda: Will Adjust Degree Of Support If Inflation Moves As Expected

Japan's Govt To Warn Of Weak Yen Pain In Policy Roadmap, Draft Shows

Australian Consumer Confidence, Inflation Expectations Nudge Higher

JPMorgan Sees Ample Demand For Growth In Treasury Bill Supply

Oil Pushes Lower As OPEC+ Plan Spurs Concerns About Ample Supply

E*Trade Considers Kicking Meme-Stock Leader Keith Gill Off Platform

Maersk Lifts Guidance Again On Surging Freight Rates

Netanyahu Signals Openness To Cease-Fire But Wants Option To Resume

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0805-10 (975M), 1.0850-60 (755M), 1.0870-80 (1BLN)

1.0890-00 (1.64BLN), 1.0915-25 (581M)

USD/CHF: 0.9090-00 (1.15BLN)

EUR/CHF: 0.9650 (401M), 0.9800 (400M), 0.9925 (532M)

EUR/SEK: 11.6800 (425M). EUR/GBP: 0.8500 (793M)

GBP/USD: 1.2680 (322M), 1.2690-05 (560M)

AUD/USD: 0.6545-50 (951M), 0.6650 (302M), 0.6670-75 (560M)

0.6690 (279M)

USD/JPY: 155.00 (523M), 155.50 (220M), 155.75 (251M)

156.40-50 (635M), 157.00 (372M)

USD/ZAR: 18.1600 (335M), 18.1900 (308M), 18.6850 (234M)

CFTC Data As Of 31/05/24

Japanese yen net short position is -156,039 contracts

Euro net long position is 57,572 contracts

Swiss franc posts net short position of 44,366 contracts

British pound net long position is 25,402 contracts

Bitcoin net short position is -756 contracts

Equity fund managers raise S&P 500 CME net long position by 31.431 contracts to 978,007

Equity fund speculators increase S&P 500 CME net short position by 12,145 contracts to 330,057

Gold NC Net Positions increased to $236.6K from previous $229.8K

Technical & Trade Views

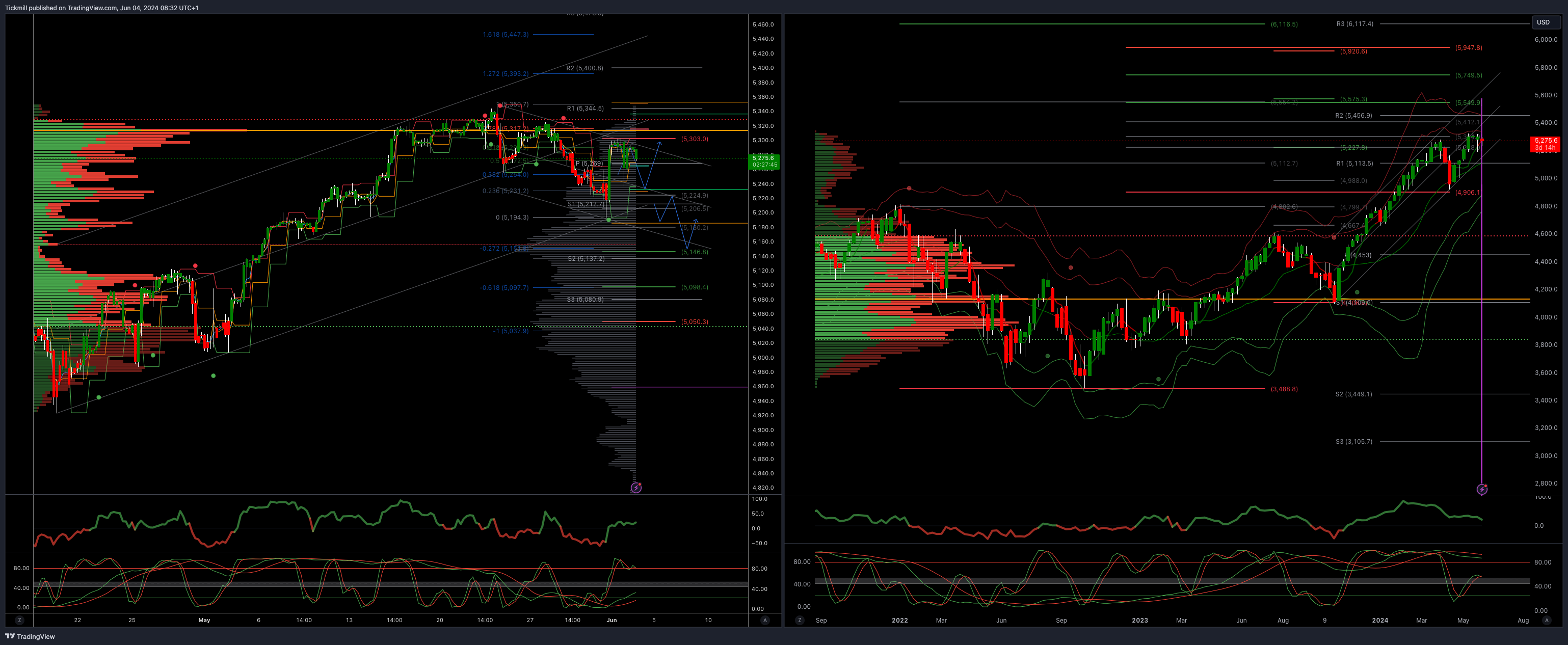

SP500 Bullish Above Bearish Below 5303

Daily VWAP bullish

Weekly VWAP bullish

Above 5310 opens 5379

Primary resistance 5303

Primary objective is 5146

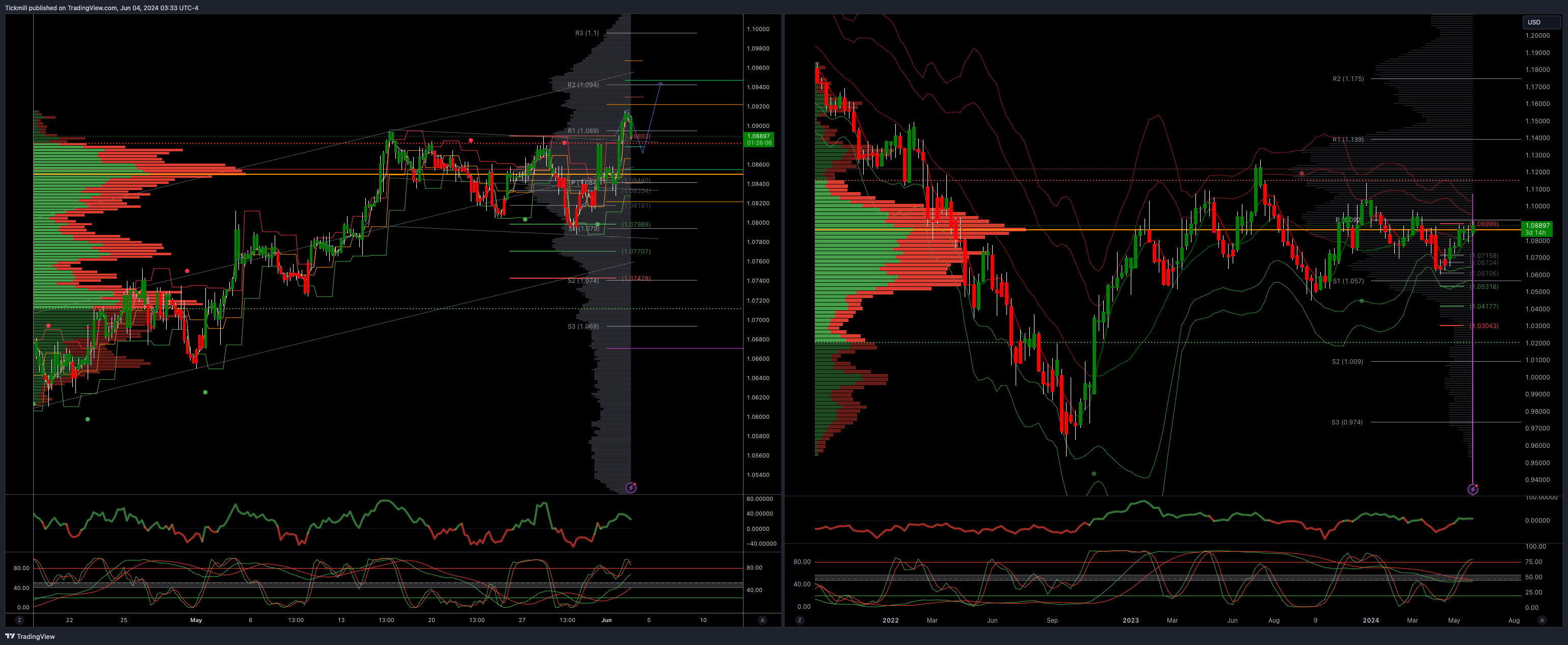

EURUSD Bullish Above Bearish Below 1.0860

Daily VWAP bullish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0550

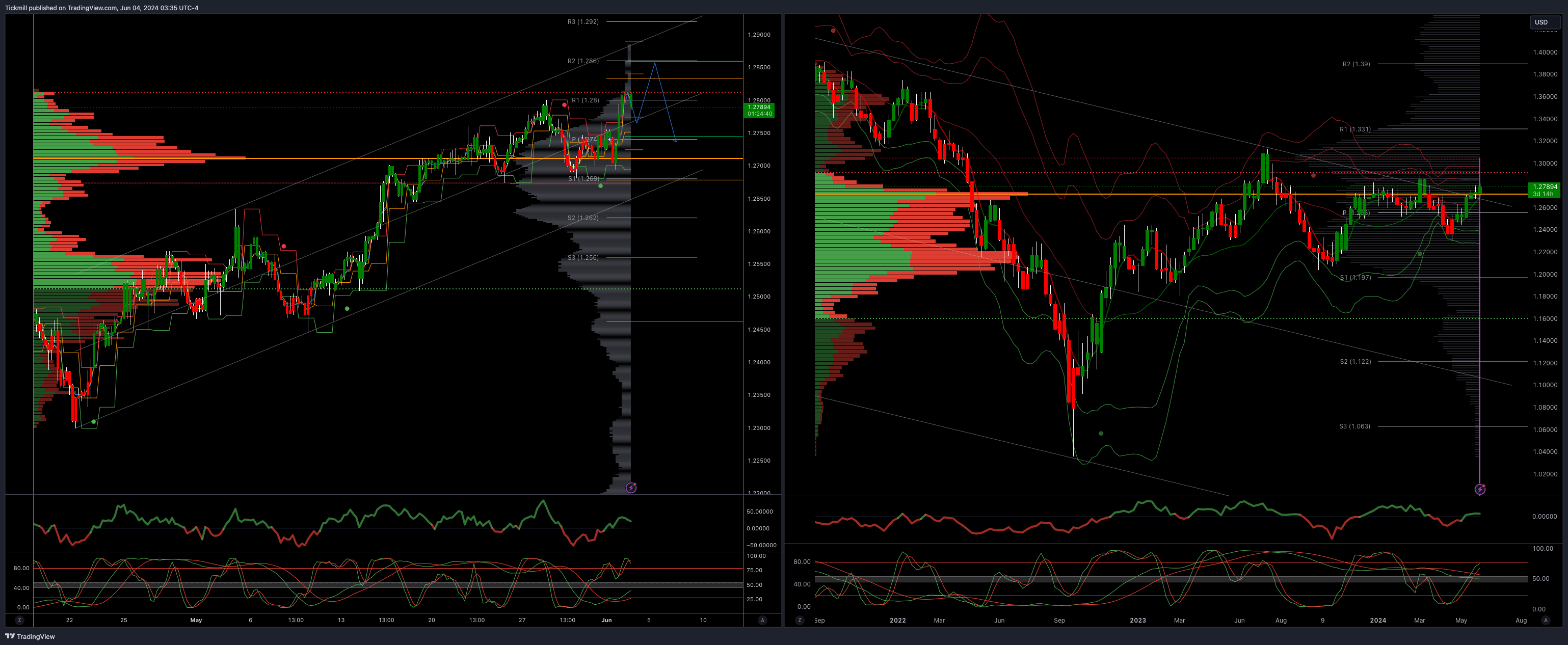

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2850

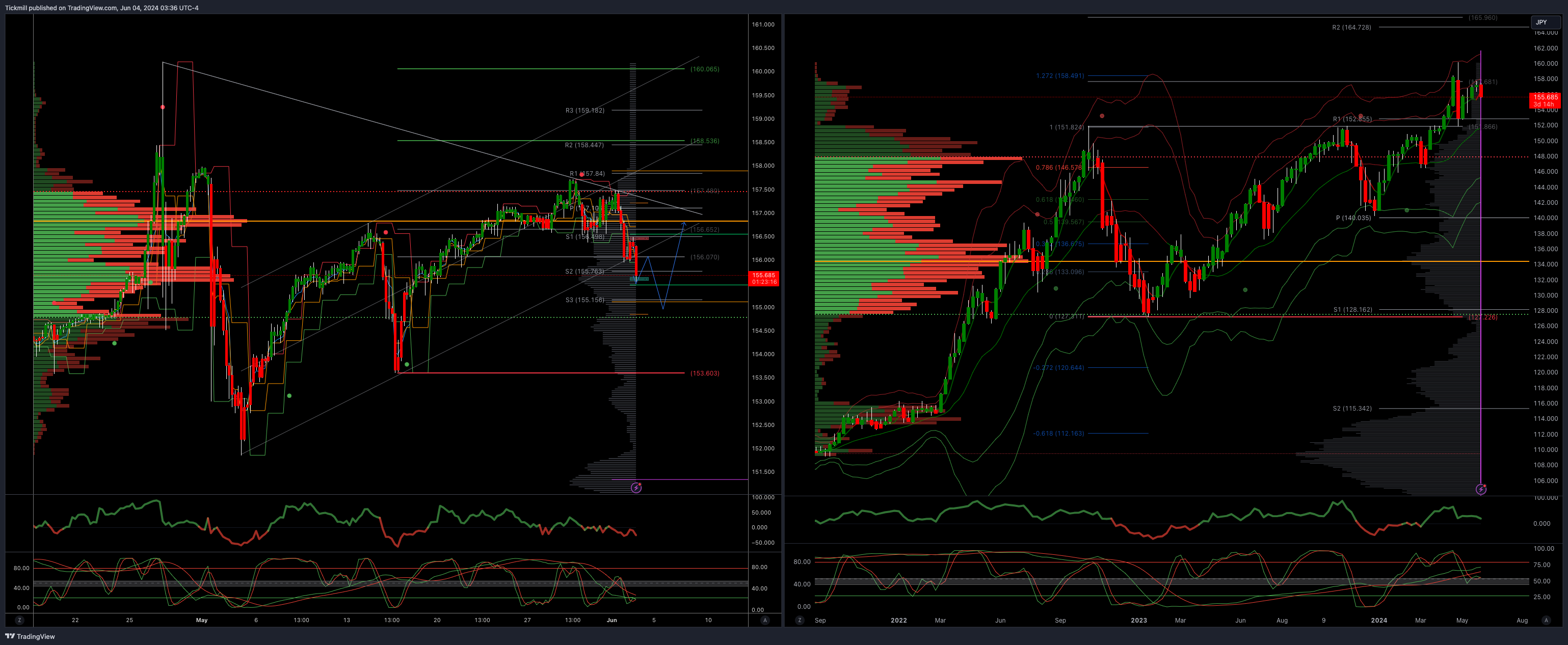

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bullish

Below 156 opens 154.50

Primary support 152

Primary objective is 165

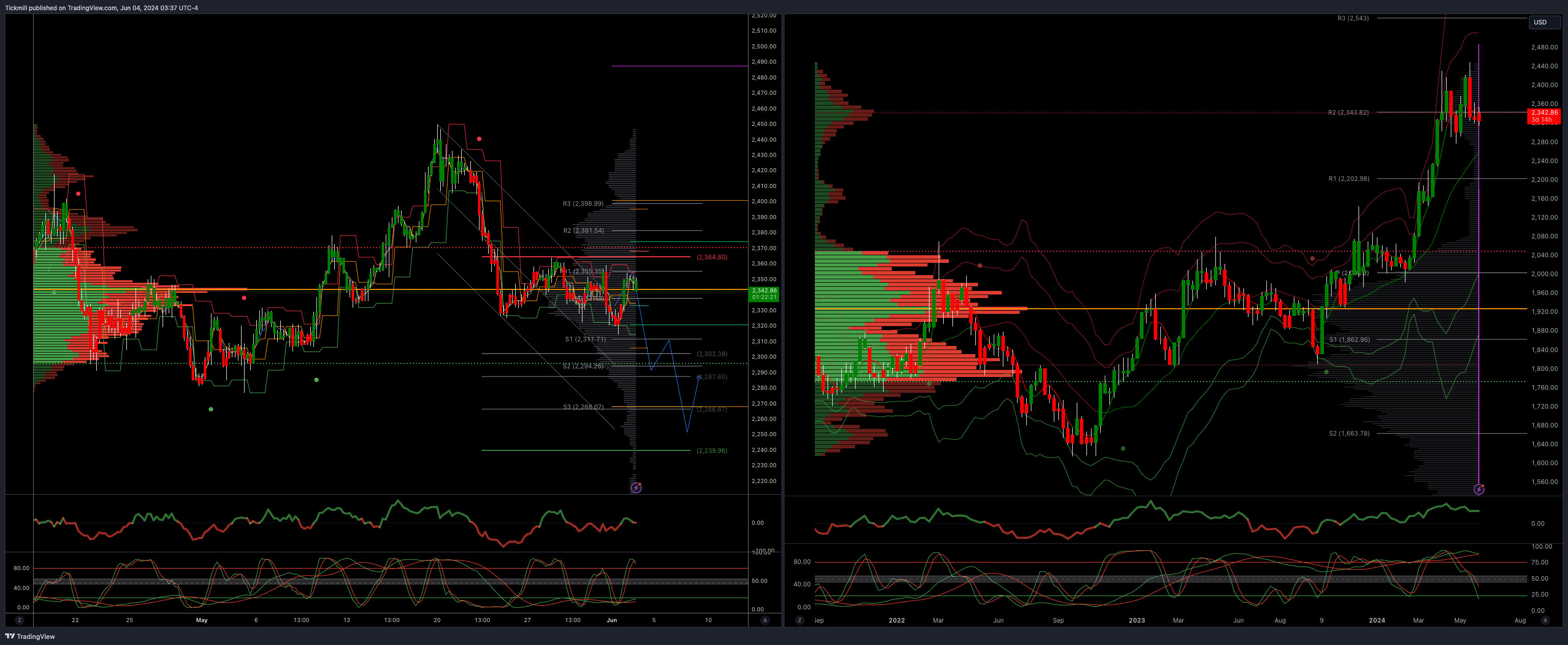

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bearish

Above 2365 opens 2390

Primary support 2300

Primary objective is 2239 Below 2300

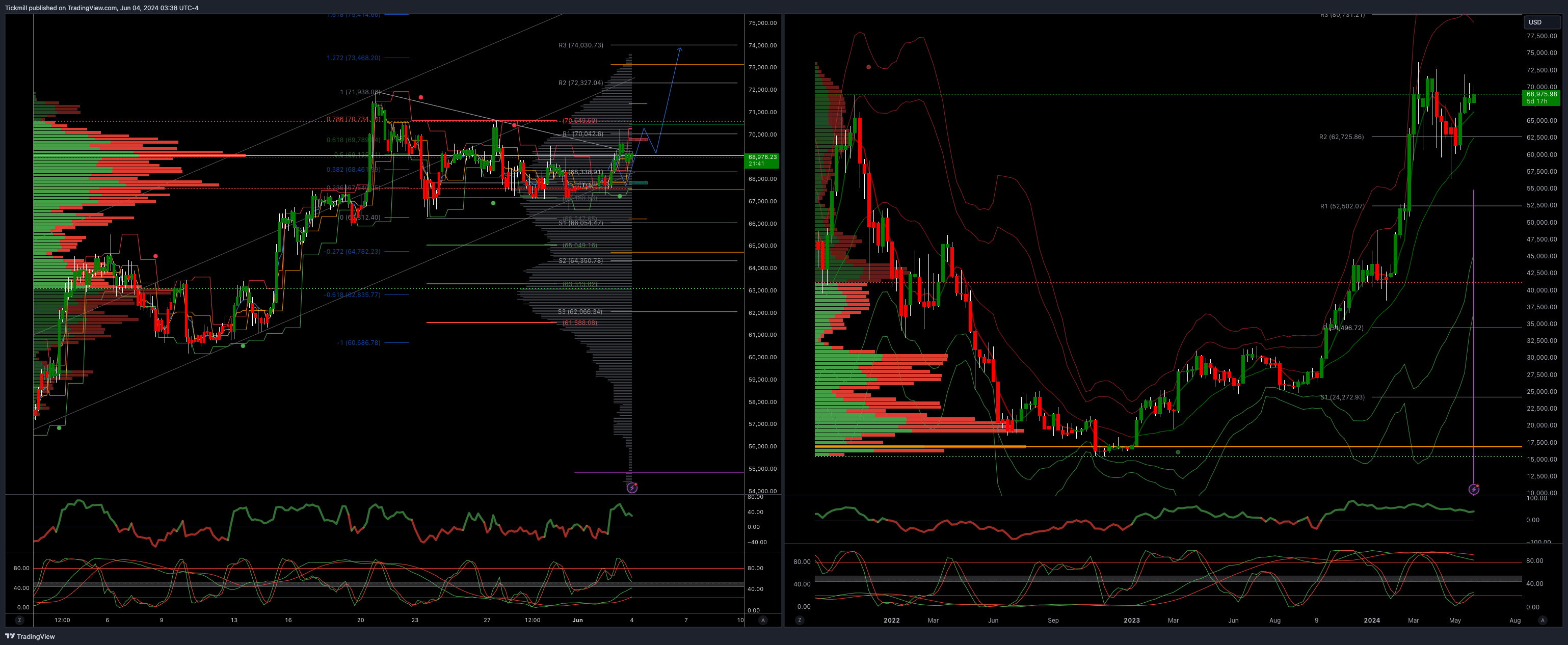

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bearish

Weekly VWAP bullish

Below 67000 opens 65500

Primary support is 65000

Primary objective is 73400

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!