Daily Market Outlook, June 27, 2022

Daily Market Outlook, June 27, 2022

Overnight Headlines

- BIS: Leading Economies At Risk Of Falling Into High-Inflation Trap

- US And G-7 Allies Detail Infrastructure Plan To Challenge China

- KPMG: Inflation Tipped To Push UK Economy Into Recession

- UK Proceeds With Legislation To Change N Ireland Trading Regime

- BoJ Focused On Wages, Yen, No Debate On Tweaking Yield Cap

- China’s Economy Improves In June From Lockdown-Induced Slump

- China’s PBoC Makes Biggest Daily Cash Injection In Three Months

- China's Industrial Profits Slump For Second Month In May

- PBoC Adviser: China GDP Target ‘Difficult’ To Achieve

- Australian Treasurer Chalmers Sees Inflation ‘Problem’ Worsening

- Iran Launches Rocket Into Space As Nuclear Talks To Resume

- Russia Defaults On Foreign Debt For First Time Since 1918

- Dollar Shelters Under Recession Clouds As Investors Put Safety First

- Crude Oil Prices Gain, Supported by Tight Supply

- Ecuador Energy Ministry: Oil Production Could Stop In 48 Hours

- G-7 Weighs Russia Oil-Price Cap Via Insurance, Shipping Ban

- Asian Stocks Buoyed By Wall Street Gains, Futures Follow Suit

- Tesla, Ford and GM Raise EV Prices as Costs, Demand Grow

- Bitcoin Stable Over The Weekend Above 21,000

- JPMorgan: BTC Miners To Sell BTC Into Q3

The Day Ahead

- Equities have started the week on a positive note with almost all stock exchanges across the Asia-Pacific region registering gains. This continues to reflect the positive risk sentiment backdrop that has prevailed of late in response to the scaling back in interest rate expectations globally.

- Meanwhile, Russia defaulted on its foreign debt for the first time since 1918, largely a result of Western sanctions that had shut down payment routes for the nation. G7 leaders at their summit in Bavaria are expected to commit to providing support for Ukraine for “as long as it takes” according to a draft statement.

- Over the past week, signs of moderating economic activity saw financial markets scale back on their expectations over the extent to which monetary policy will be tightened. Nevertheless, money markets continue to forecast US policy rates to rise above 3.5% by the middle of next year, while UK Bank Rate is expected to rise a further 175bp over the same period, in a bid to bear down on elevated inflationary pressures. How much central bankers should raise interest rates, in the face of slowing economic growth, will be a key focal point at this week’s ECB forum in Sintra (Portugal) entitled ‘Challenges for monetary policy in a rapidly changing world’, which kicks off later today, with ECB President Christine Lagarde set to deliver opening remarks.

- Ahead of the Ms Lagarde’s comments this evening, ECB member Villeroy (Governor of the Bank of France) is scheduled to speak this morning. In comments last week, Mr Villeroy reiterated a commitment to do what was needed to bring inflation back to target in 2024, supporting expectations that eurozone policy rates will be lifted out of negative territory.

- Data wise, the economic calendar is fairly limited. However, pending home sales in the US are forecast to have fallen for a seventh consecutive month in May, as higher rates continue to dampen activity in the housing sector. Meanwhile, the US durable goods orders report for May will be watched for signs that business investment has softened in the second quarter, also in response to the ongoing increases in US interest rates.

IMM: USD net spec long rises as CAD, EUR selling trumps yen buying

USD net spec long rose in Jun 15-21 period; $IDX -0.22%...

EUR specs -9,587 contracts now short 15,605; EUR$ +1.09% in period

Yen specs -11,301 contracts now -58,454; specs buy into yen weakness

GBP$ +2.35% in period, GBP specs buy 2,349 contracts now -63,247

$CAD -0.25% in period, specs -19,097 contracts now long -4,105

AUD & NZD specs pare shorts AUD specs +2,648, NZD specs +1,415 contracts

BTC -5.13% in period anchored by $20k, specs -15 contracts now long 1,046,

(Source: Reuters)

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0445-55 (983M)

- USD/JPY: 134.50 (375M), 135.00 (363M), 137.00 (450M)

- AUD/USD: 0.7050 (284M). USD/CAD: 1.2820 (200M)

- 1.2870-75 (200M)

- Tuesday June 28

- EUR/USD: 1.0450-60 (600M), 1.0595-00 (736M)

- USD/JPY: 135.00 (350M). GBP/USD: 1.2185 (247M)

- USD/CHF: 0.9425 (480M), 0.9550 (471M), 0.9645 (260M)

- EUR/CHF: 1.00 (280M), 1.0125 (276M), 1.0200 (280M)

- AUD/USD: 0.7000-05 (378M), 0.7040-50 (423M)

Technical & Trade Views

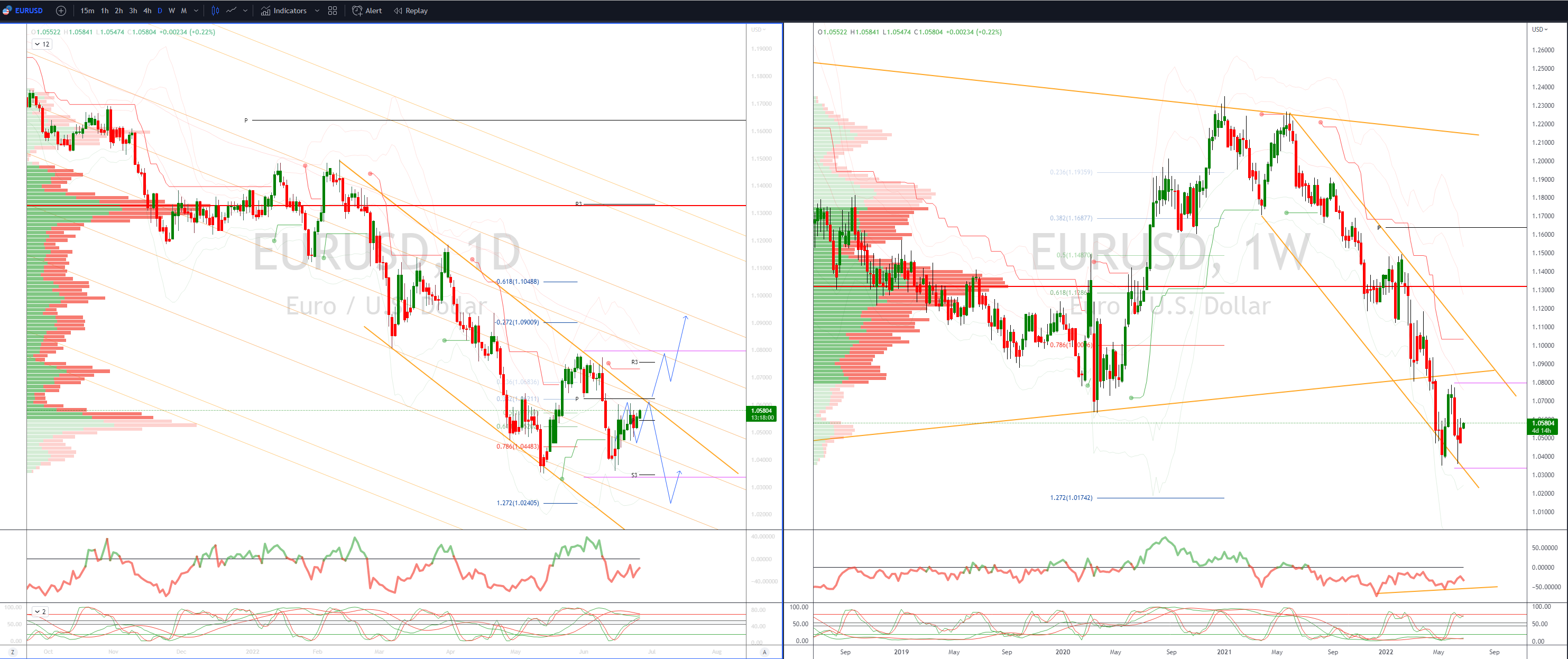

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD trades above Friday’s highs 1.0570’s

- EUR/USD resistance is at the 21-day MA at 1.0593 and break would be bullish

- EUR/USD bid supported by improvement in risk sentiment

- Market eyeing ECB and Fed comments as ECB summit in Sintra starts

- Initial offers are seen at 1.0615/20 ahead 1.0650

- Bids eyed towards 1.05/15 ahead of cycle lows

- 20 Day VWAP is bearish, 5 Day bullish

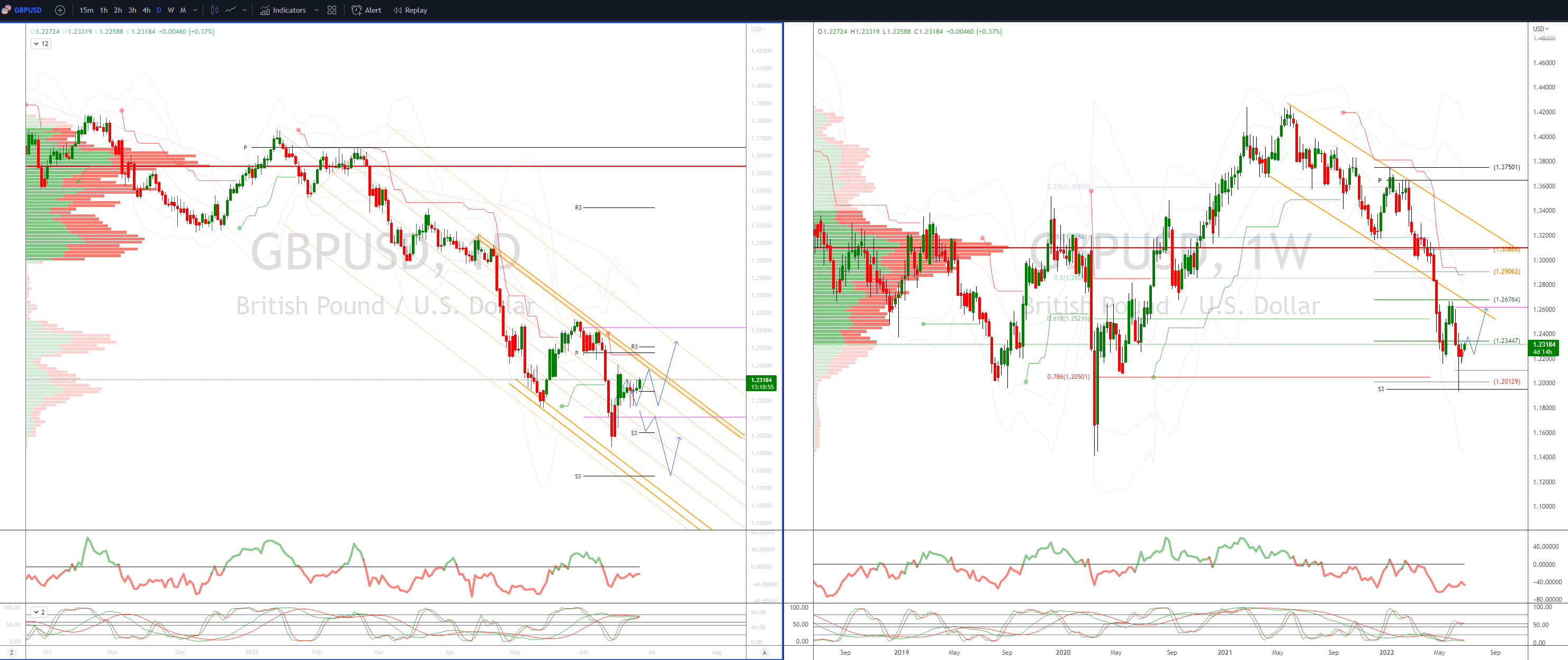

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBP catches a bid in early LDN trade testing Friday’s highs

- No GBP data cable taking its lead form generally improved risk sentiment

- Tomorrow notable options expiries GBP/USD 1.2000 GBP664 mln and on Wednesday sizeable GBP1.5 bln at 1.2750

- Despite ongoing negative headlines, weak econ data, strikes & partygate GBP holds up

- Resistance remains sited at 1.2410

- Support eyed at 1.2180

- 20 Day VWAP is bearish, 5 Day bullish

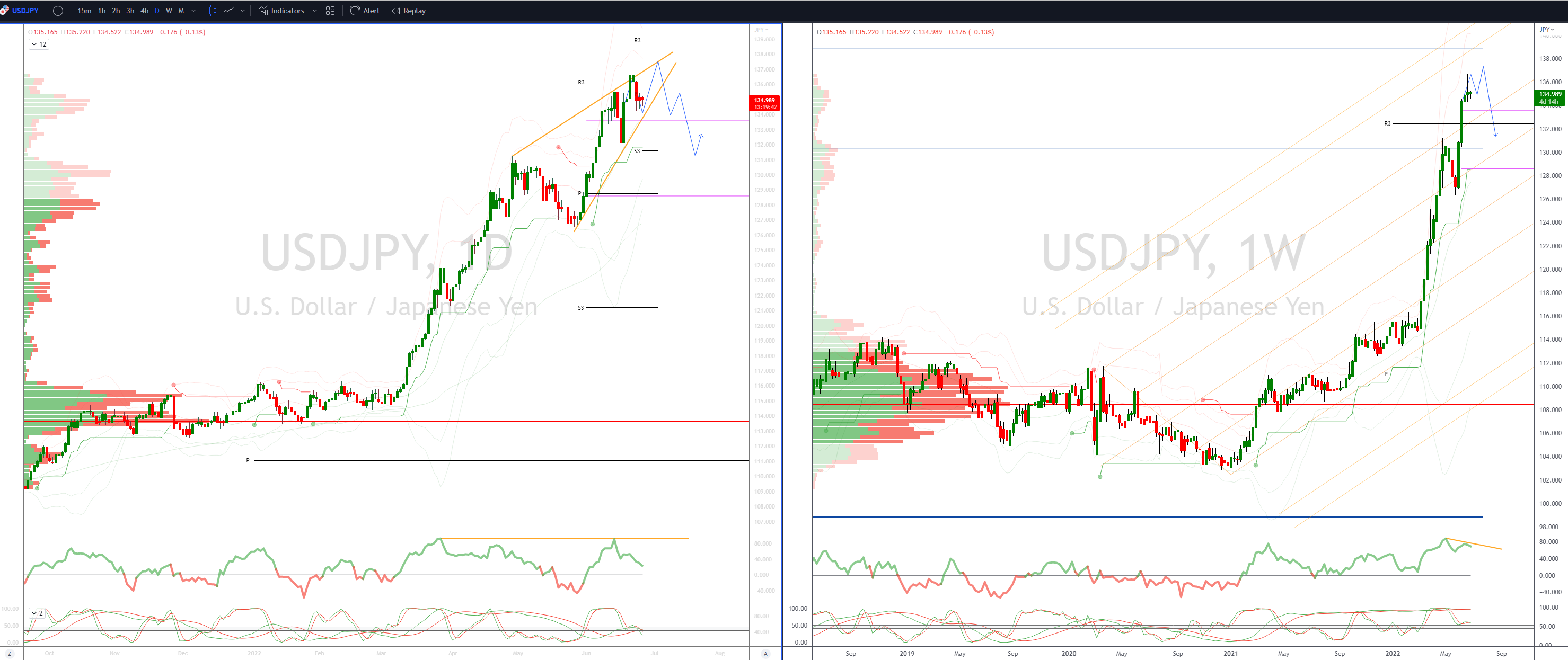

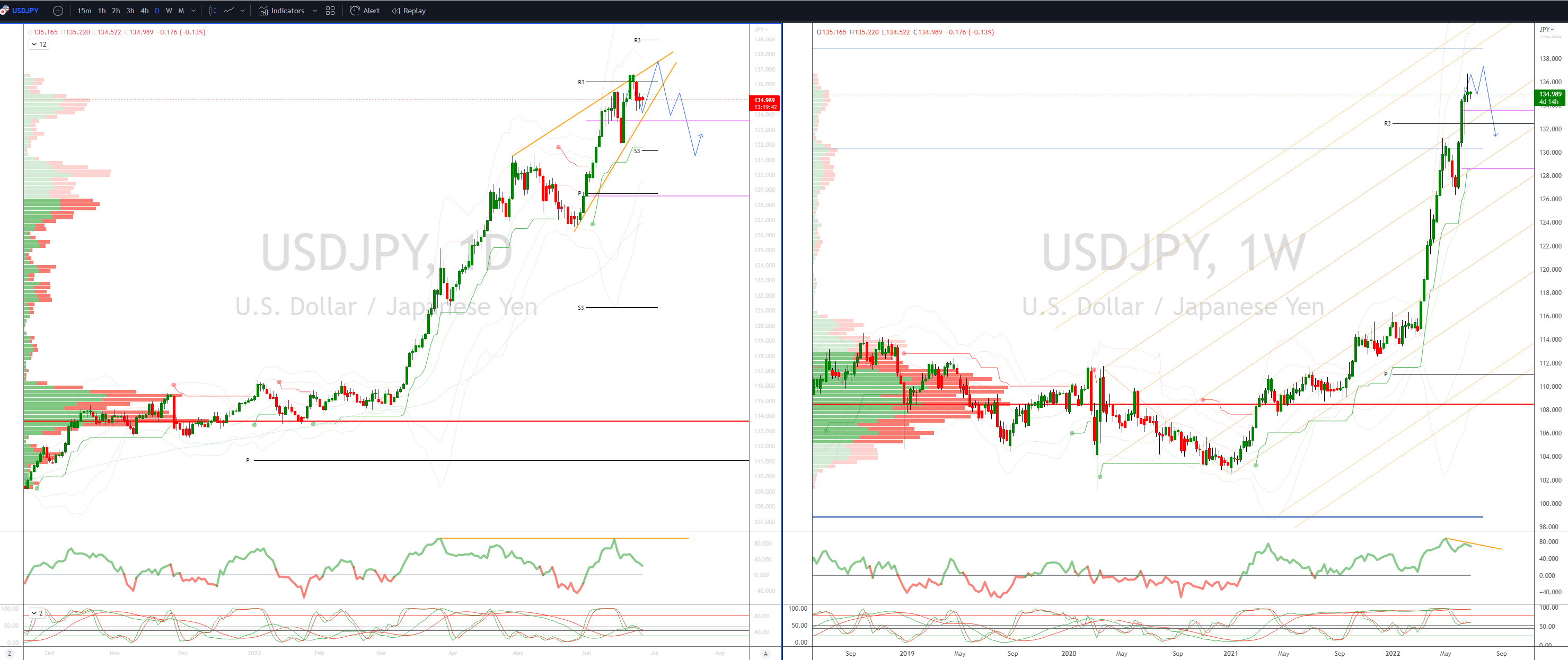

USDJPY Bias: Bullish above 132 Bearish below

- USDJPY took an early hit in Asian trade on Exporter sales

- USD/JPY recovers 135 handle as LDN gets underway

- Importer bids seen sitting toward 134.50

- Notable options expiries at 133.50 and 134.00 strikes go off Friday

- US yields firming supporting USDJPY

- Global equity sentiment continues to strengthen

- 20 Day VWAP is bullish, 5 Day bearish

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD opens the week with a bid tone

- Aussie supported by recovery in risk and commodities

- 3.2% pop in Iron ore sees AUD testing Friday’s highs

- 20 Day VWAP remains untested confirming downside

- Bears now targeting a test of the base towards 0.6840’s

- Offers seen towards .6960, bids eyed back at .6850

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!