Daily Market Outlook, June 25, 2024

Daily Market Outlook, June 25, 2024

Munnelly’s Macro Minute…

“Nvidia Three Day 13% Decline Dampens Risk Appetite”

Asian stocks, including Japan's stock market, saw gains on Tuesday despite a mixed day on Wall Street. There are rumors that the tech sector's rise might be ending. US equity contracts increased slightly during Asian trade on Monday, following gains in non-tech US sectors. Nvidia has experienced a three-day loss of around $430 billion. Investors in Asia are shifting focus from the technology sector to other areas of the market, with a growing number in Japan buying value stocks like financials. This shift is due to the belief that the country's central bank will tighten its policies.

European stocks may face a setback on Tuesday after starting the week with gains. Tech stocks, particularly Nvidia, are expected to take a hit following a sell-off in the high-flying chip sector on Wall Street. On Monday, the S&P 500 lost 0.3% while the Nasdaq dropped more than 1%, and the SOX semiconductor index slid more than 3%. However, value stocks, as seen in the 0.7% rise in the Dow, have benefited from the tech sector's loss.

Geopolitical developments in France's snap elections this weekend could quickly shift sentiment. The far right's efforts to reassure the markets about fiscal restraint have been effective so far. European investors will also monitor the European Commission's interactions with Apple and China. China is urging the EU to cancel proposed tariffs on Chinese electric vehicle imports before July 4, and negotiations are ongoing in Brussels. Apple must modify its App Store operations to avoid significant fines for antitrust violations.

Stateside consumer confidence data is due with markets eyeing further potential weakness in consumer confidence which has started to soften in recent reports. Fed Governors Michelle Bowman and Lisa Cooks are scheduled to speak at separate events. Governor Bowman will be speaking at the Policy Exchange event in London, while Governor Cooks will be speaking at the Economic Club of New York.

Overnight Newswire Updates of Note

Fed's Daly Warns Of Labor Market Risks, Nearing Inflection Point

Bank Of Canada Looks For Further Wage-Growth Slowdown, Macklem Says

Australia’s Households Remain Pessimistic On RBA Rate-Rise Fears

Empty Wellington Shops Send Grim Economic Message To RBNZ Hawks

Forget 160, Traders See Yen Slumping As Far As 170 This Time

Nvidia Shares Fall 6.7% To Close With Biggest Drop In 2 Months

Apple Spurned Idea Of iPhone AI Partnership With Meta Months Ago

Pfizer Is Testing New Non-Glp-1 Mechanism For Weight-Loss Drug

Boeing Talks To Buy Back Spirit AeroSystems Have Last-Minute Twist

Paramount+ To Increase Prices For Its Streaming Plans

US Warned Hezbollah It Can't Hold Israel Back If Escalation Continues

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0700 (1.7BLN), 1.0730-40 (795M), 1.0750 (334M)

USD/CHF: 0.8875 (277M). EUR/CHF: 0.9700 (710M)

AUD/USD: 0.6610 (246M), 0.6625-30 (281M), 0.6670-80 (935M)

USD/CAD: 1.3640 (220M), 1.3655 (310M)

USD/JPY: 158.55 (330M), 159.00 (360M), 160.00 (1.7BLN)

The French election risk is still present in the euro FX options market, as implied volatility measures the risk for FX options based on actual volatility. Any difference between implied and actual volatility can be traded. Changes in implied volatility can indicate upcoming FX risks. One-month expiry euro volatility saw a significant increase after the French election announcement, and one-week expiry options included the first round vote from Monday June 24. The gains in one-week implied volatility highlight the related actual volatility risk, but the current lack of actual volatility is dampening broader implied volatility.

CFTC Data As Of 21/06/24

Bitcoin net short position is -723 contracts

Swiss Franc posts net short position of -37,390 contracts

British Pound net long position is 47,621 contracts

Euro net long position is 7,951 contracts

Japanese Yen net short position is -147,753 contracts

Equity fund speculators increase S&P 500 CME net short position by 112 contracts to 353,049

Equity fund managers cut S&P 500 CME net long position by 7,915 contracts to 960,056

Technical & Trade Views

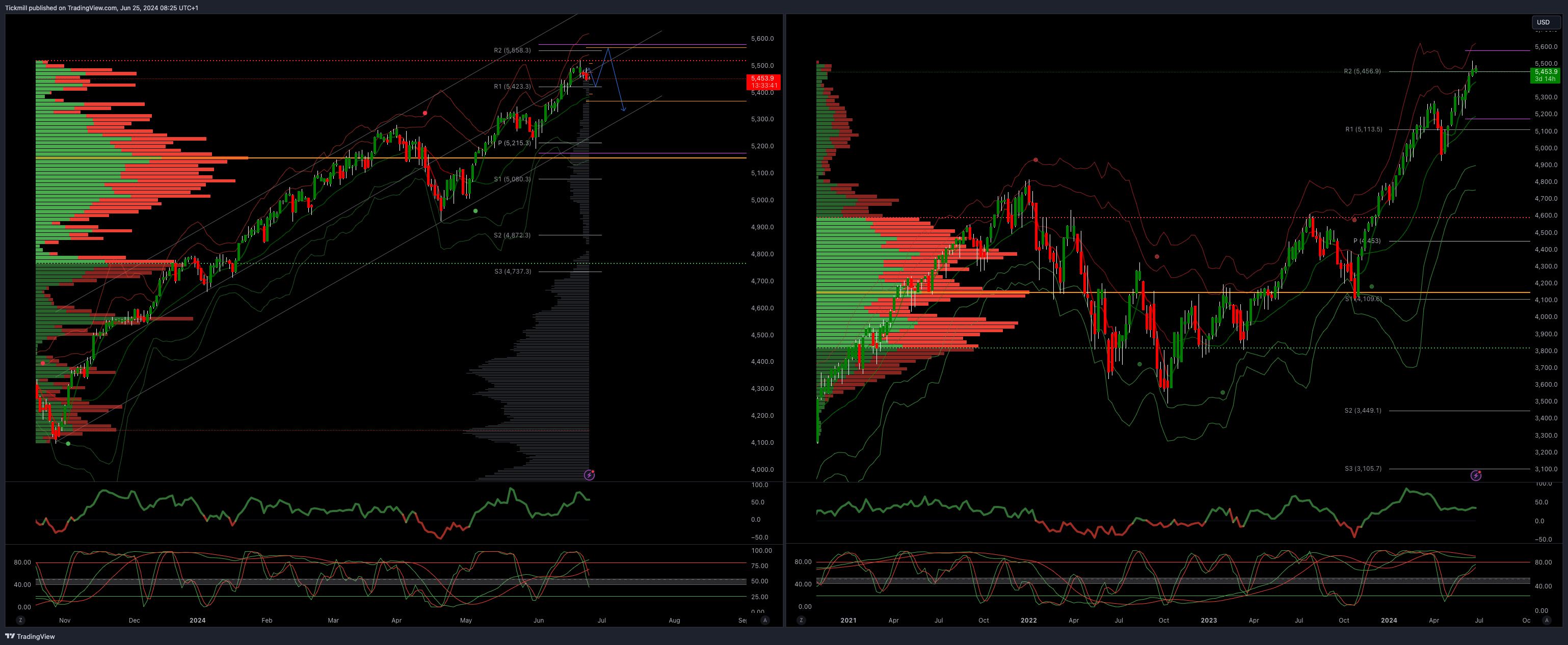

SP500 Bullish Above Bearish Below 5450

Daily VWAP bearish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580

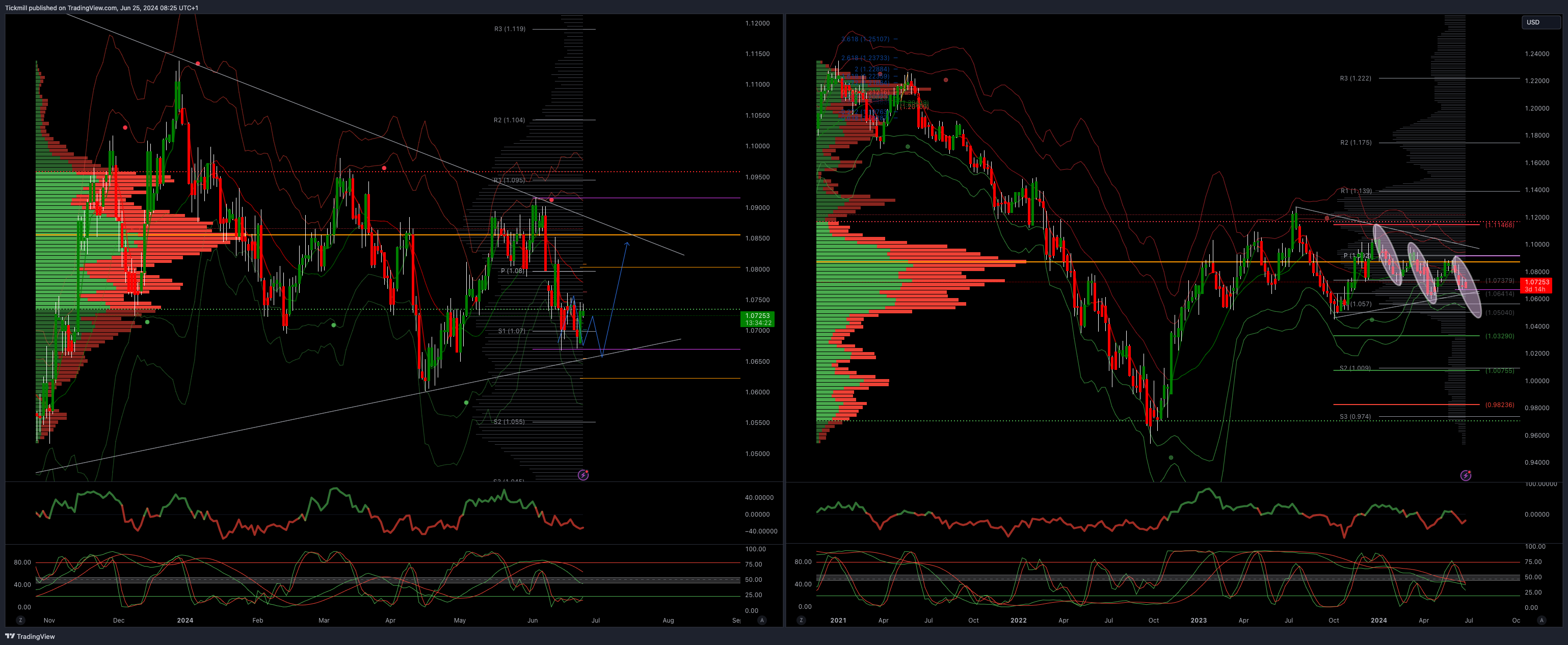

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

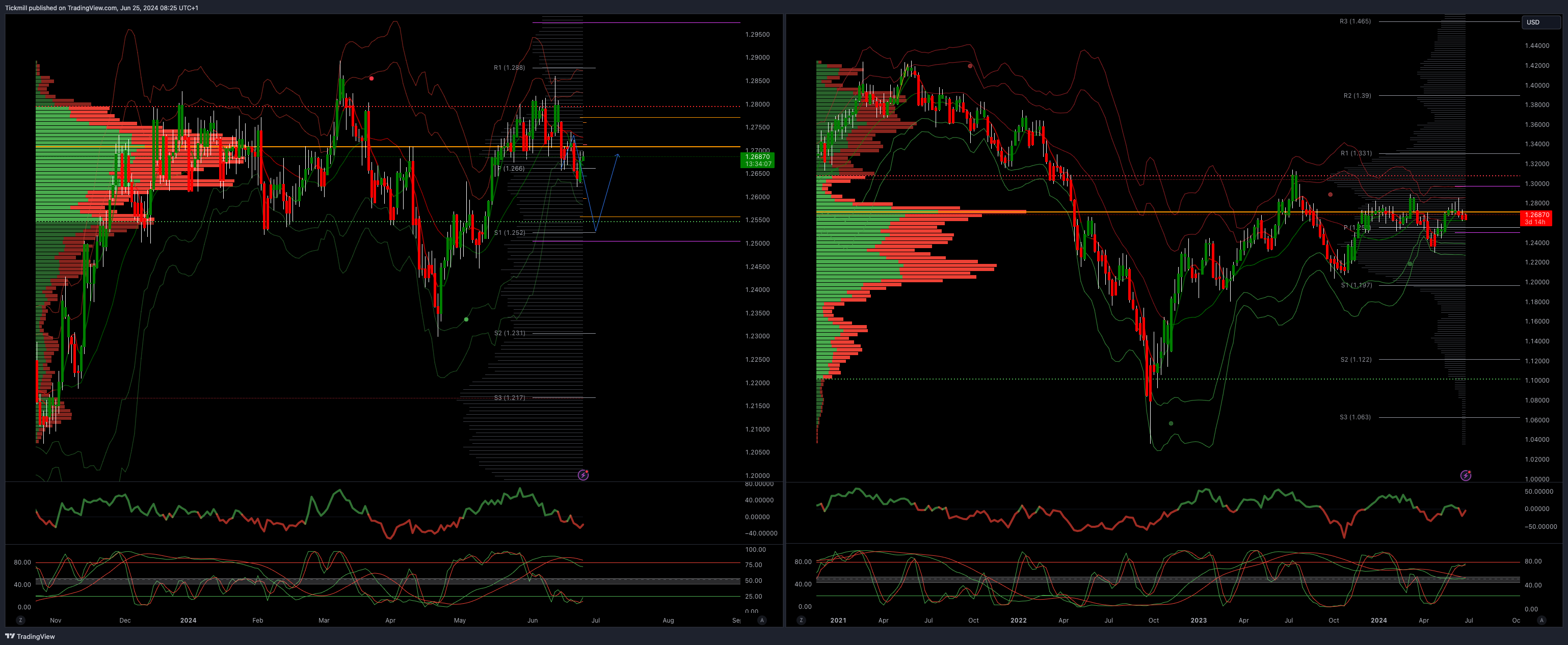

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2730

Primary resistance is 1.2890

Primary objective 1.2570

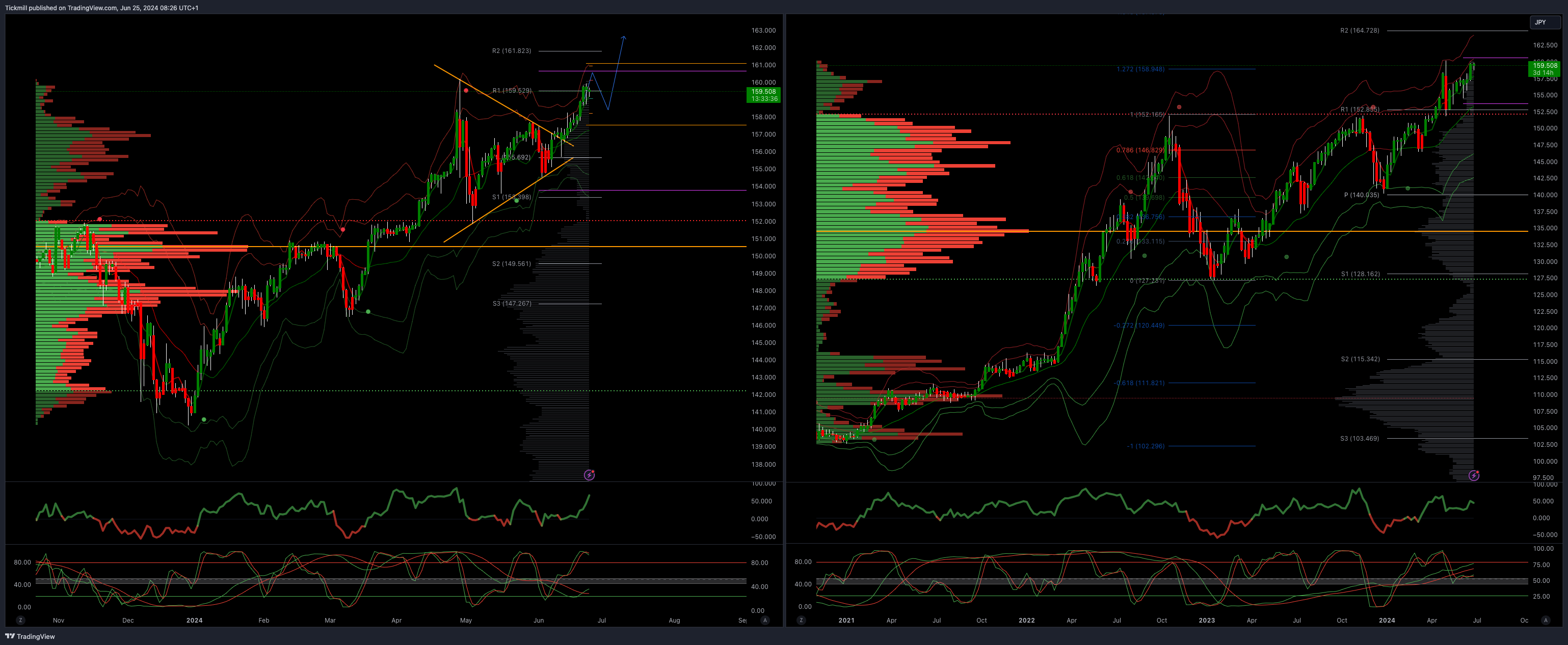

USDJPY Bullish Above Bearish Below 158.40

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160

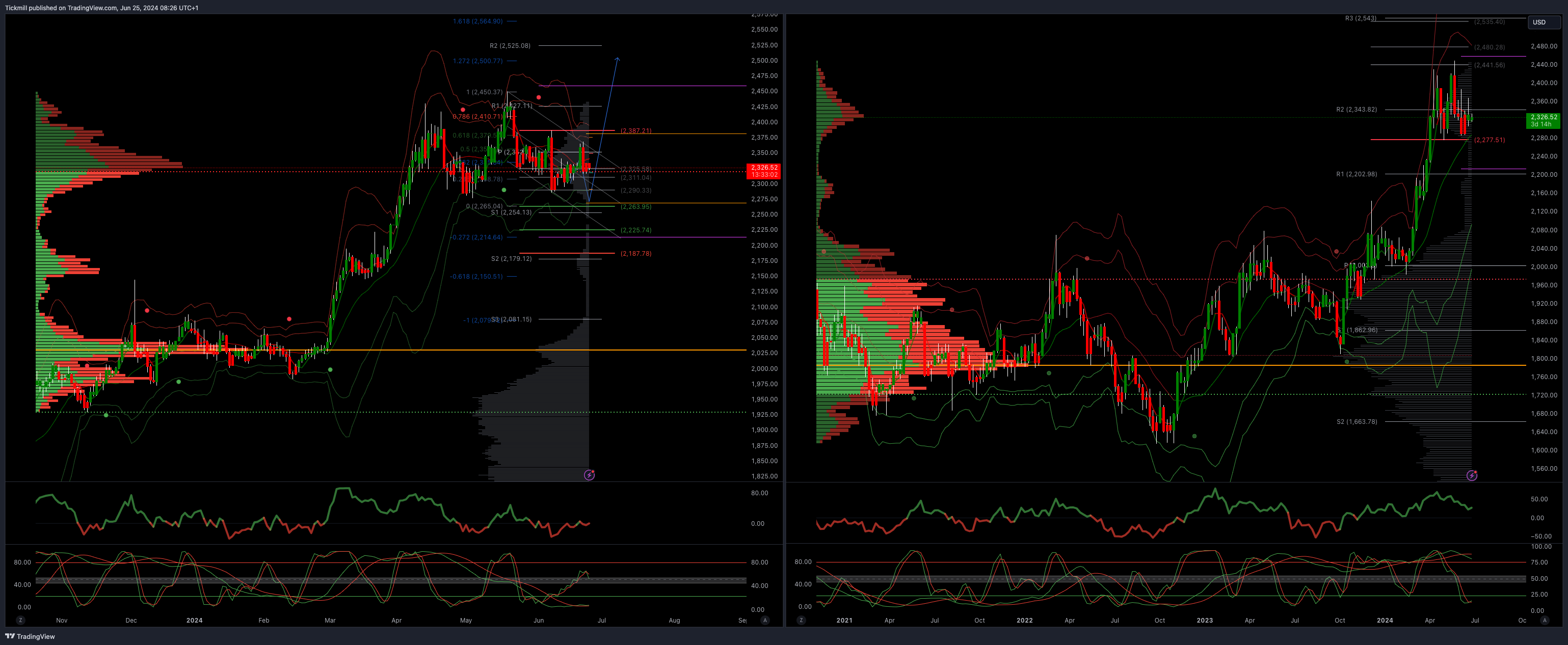

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary resistance 2387

Primary objective is 2262

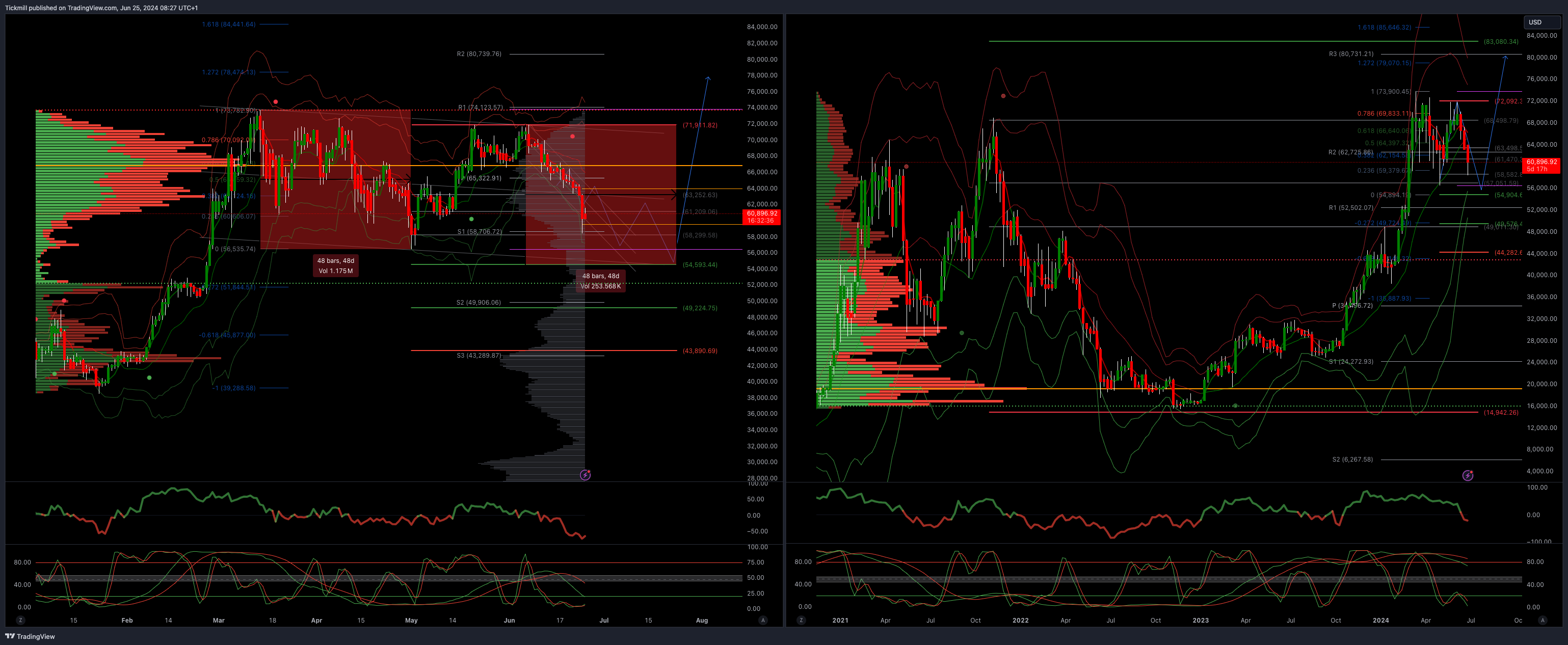

BTCUSD Bullish Above Bearish below 65840

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 64481

Primary objective is 54500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!