Daily Market Outlook, June 24, 2024

Daily Market Outlook, June 24, 2024

Munnelly’s Macro Minute…

“Geopolitical Uncertainty Weighs On Risk Sentiment”

Asian markets saw a decline overnight as traders prepared for a week of political uncertainty and upcoming inflation data that could impact bets on global interest rates. Japanese currency official Masato Kanda announced that authorities are ready to intervene to support the yen 24/7 if needed, leading to the yen trading below 160 per dollar.

This week, financial markets will be driven by the U.S. Federal Reserve's preferred inflation gauge and a series of speeches by Fed officials as investors look for insights into the future of interest rates. In the U.S., important data releases include consumer confidence on Tuesday, final Q1 GDP, jobless claims, and durable goods on Thursday, followed by the core PCE price index, Chicago PMI, and final June University of Michigan consumer sentiment on Friday. The lineup of Fed speakers includes San Francisco Fed President Mary Daly, Fed Governors Lisa Cook and Michelle Bowman, and Richmond Fed President Thomas Barkin.

Japan also has a busy schedule with releases such as services PPI and leading indicators, retail sales, Tokyo CPI, jobs, and industrial production. The Bank of Japan's summary of opinions from its June 13-14 policy meeting is due on Monday.

In the Eurozone, the focus will be on sentiment indices, final June consumer confidence, and the German Ifo business climate as there are no major data releases scheduled.

The UK will only see the release of Q1 GDP data, with attention also on Bank of England Governor Andrew Bailey's press conference on the Financial Stability Report.

China is set to publish industrial profits on Thursday and official June PMIs on Sunday. It is expected that profits for January to May will slow from the 4.3% growth in January-April as China's economic recovery faces challenges. The manufacturing PMI will be closely watched for any signs of improvement after factory activity contracted in May.

Overnight Newswire Updates of Note

Schnabel Says Potential Shocks Mean ECB Can’t Precommit On Rates

French Trust Marine Le Pen’s Rn Most On Economy, FT Poll Suggests

Russian Saboteurs Behind Arson Attack At German Factory

BoJ Summary Signals Chance Of July Hike Amid Upside Price Risks

Japan’s Kanda Says Ready To Intervene 24 Hours A Day If Needed

NZ Exports Reach New High In May, Pass $7 Billion For First Time Ever

Apple And Meta Have Reportedly Discussed An AI Partnership

US Prosecutors Recommend DoJ Criminally Charge Boeing

China Agrees To EV Tariff Talks As EU Fights To Avoid Trade War

ByteDance Working With Broadcom To Develop Advanced AI Chip

Chinese Property Developer Kaisa Liquidation Hearing Adjourned To Aug

Netanyahu: 'Intense Fighting' Phase Ending In Gaza But War Not Over

Netanyahu Walks Back Proposal For Gaza Hostage-Ceasefire Deal

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0625 (446M), 1.0650 (477M), 1.0690 (1.44BLN)

1.0700-10 (2.3BLN), 1.0720-30 (1.37BLN), 1.0750-55 (817M)

USD/JPY: 159.00-05 (465M), 159.15-25 (264M), 160.00 (323M)

USD/CHF: 0.8910 (1.15BLN), 0.8925 (262M), 0.8950 (301M)

GBP/USD: 1.2630 (570M). EUR/GBP: 0.8485 (235M)

AUD/USD: 0.6500 (427M), 0.6540-55 (567M), 0.6650 (395M)

0.6700 (340M)

USD/CAD: 1.3585-90 (636M), 1.3695-00 (1.6BLN), 1.3800 (277M)

CFTC Data As Of 14/06/24

Equity fund speculators increase S&P 500 CME net short position by 20,612 contracts to 352,937

Equity fund managers raise S&P 500 CME net long position by 13,149 contracts to 967,970

Euro net long position is 43,644 contracts

Japanese yen net short position is 138,579 contracts

British pound net long position is 52,121 contracts

Swiss franc posts net short position of -42,863

Bitcoin net short position is -1,138 contracts

Technical & Trade Views

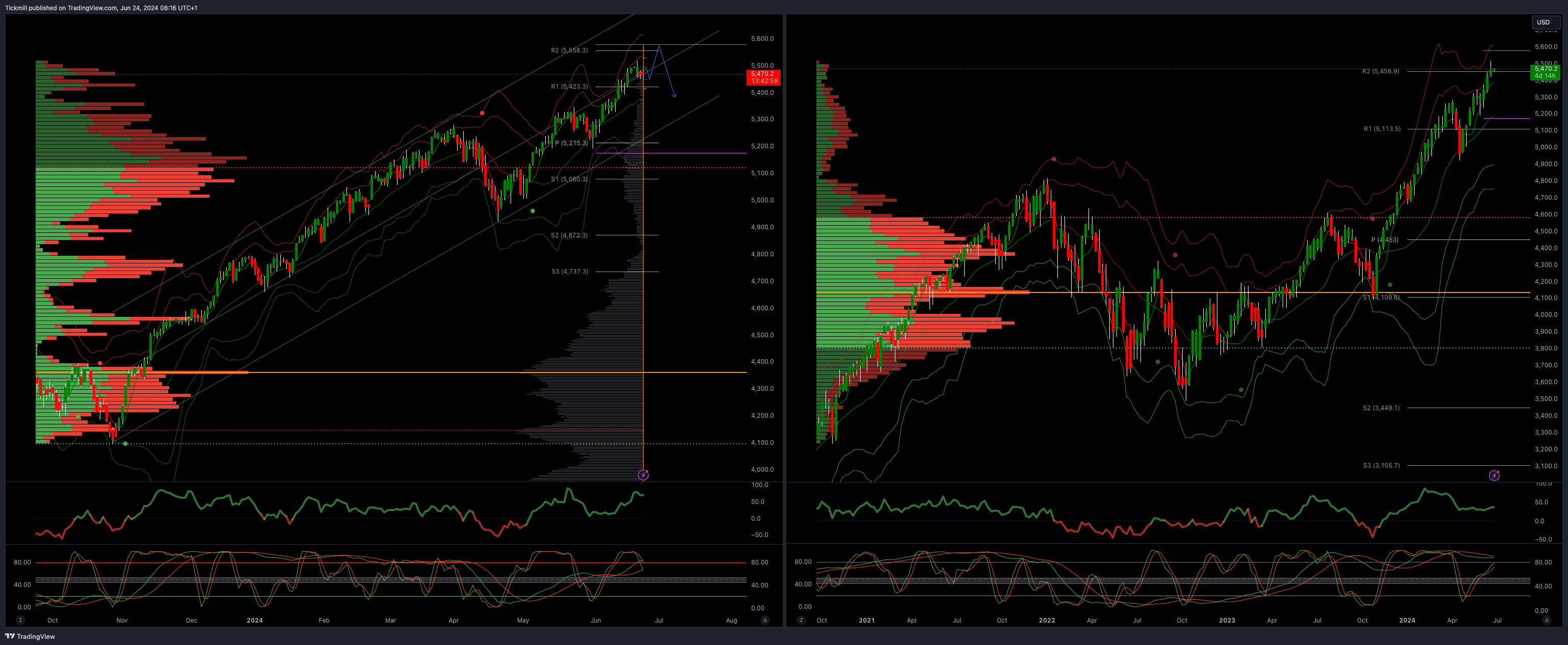

SP500 Bullish Above Bearish Below 5450

Daily VWAP bearish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580

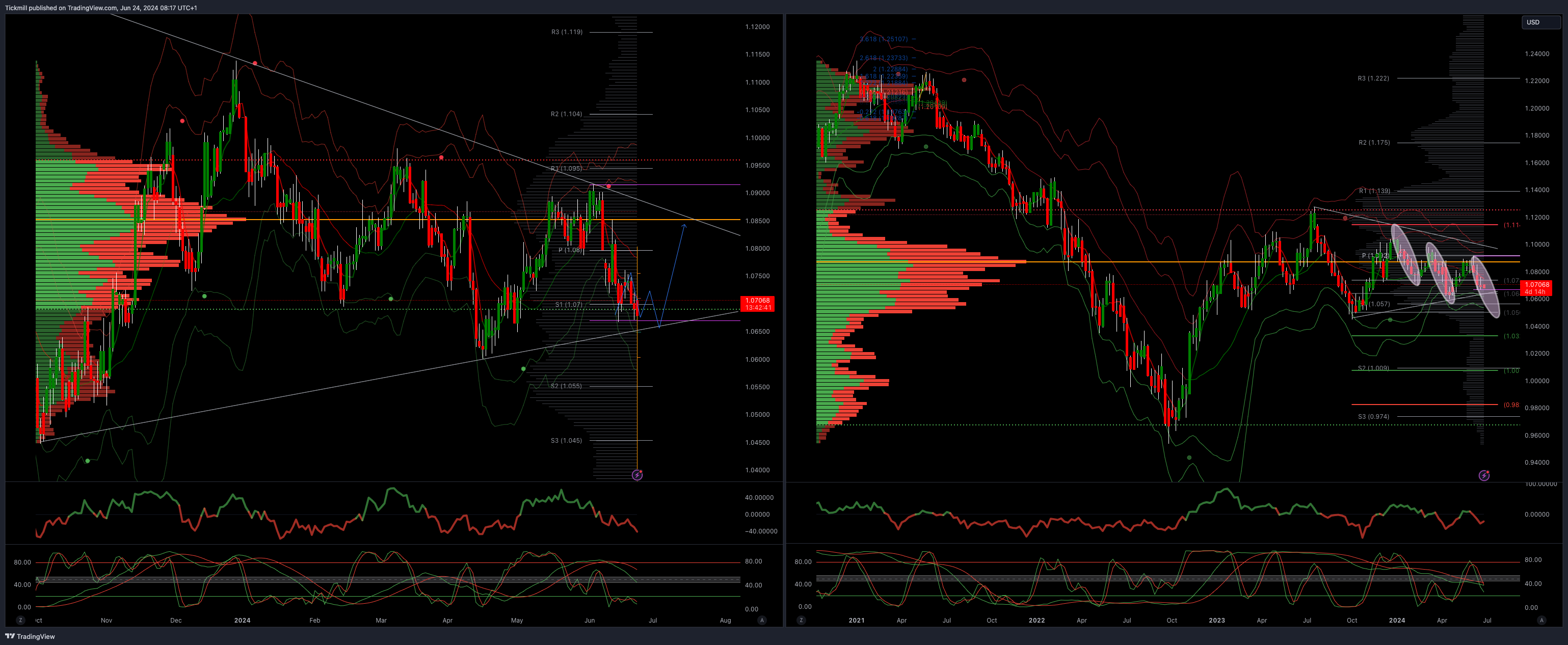

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

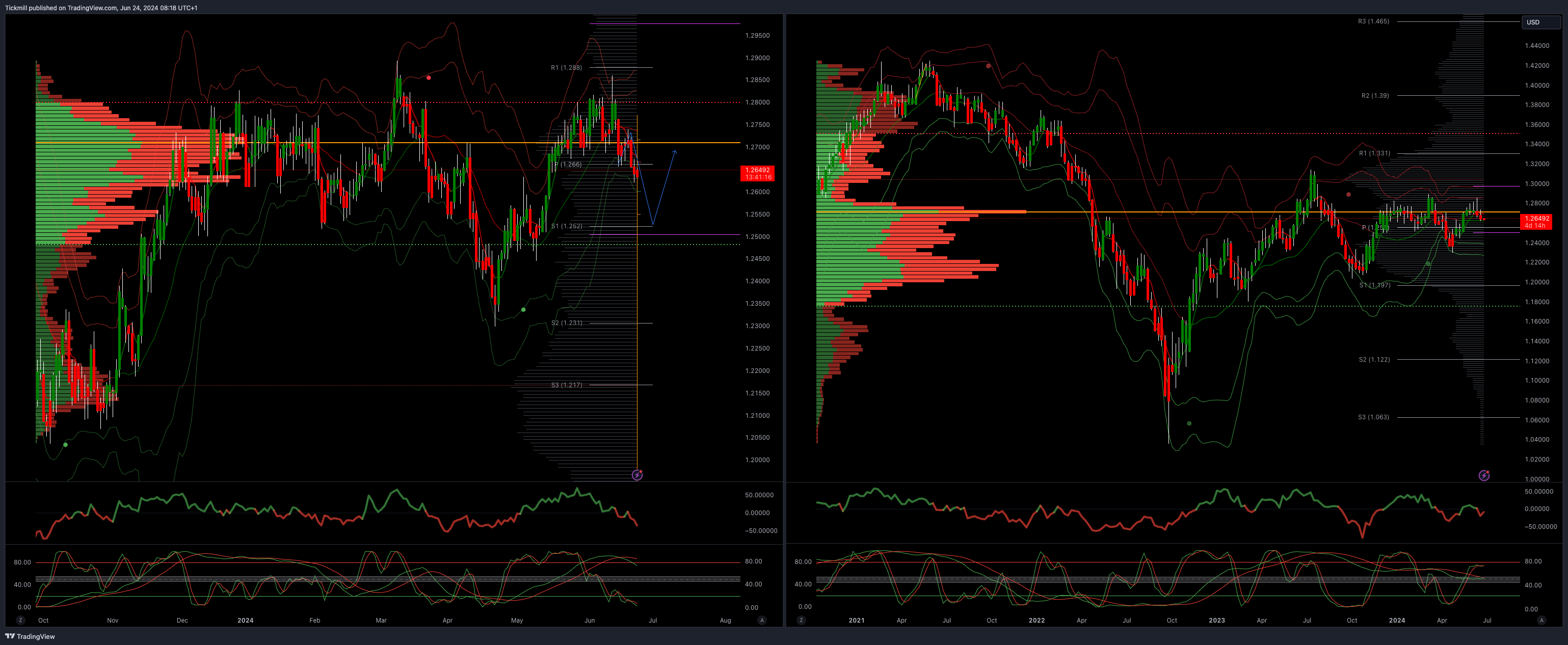

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2730

Primary resistance is 1.2890

Primary objective 1.2570

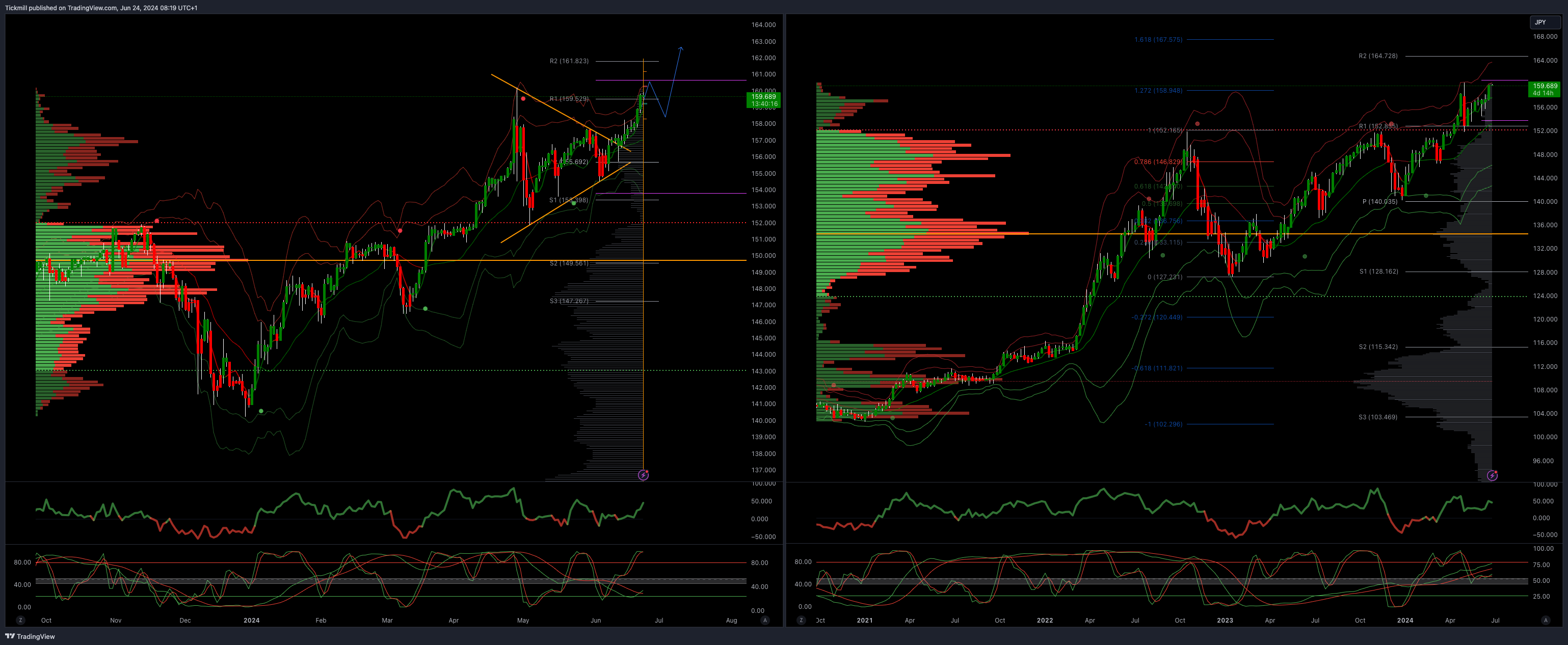

USDJPY Bullish Above Bearish Below 158.40

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160

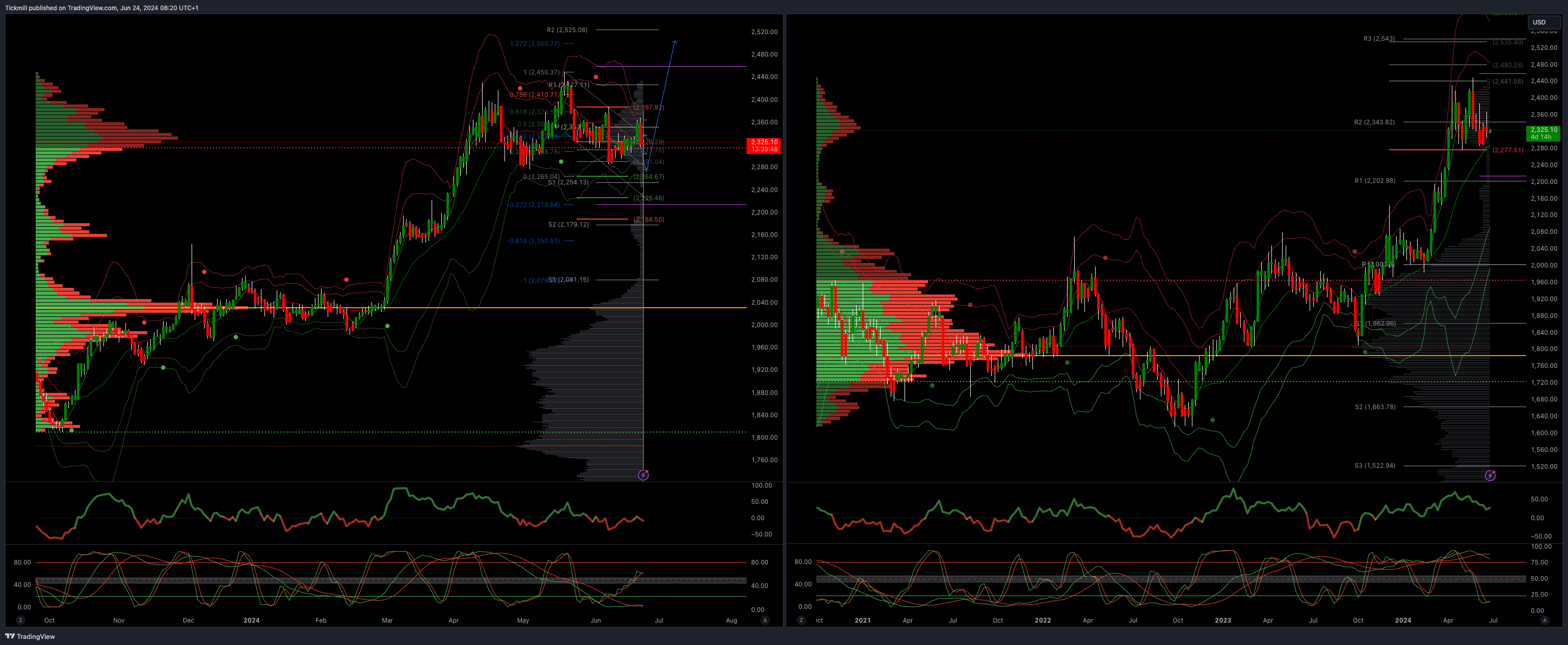

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary resistance 2387

Primary objective is 2262

BTCUSD Bullish Above Bearish below 65840

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 64481

Primary objective is 54500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!