Daily Market Outlook, June 21, 2024

Daily Market Outlook, June 21, 2024

Munnelly’s Macro Minute…

“Summer Solstice Sees Markets Spooked Ahead Of Today's Options Witching Event”

Asian stocks declined after technology equities dragged the S&P 500 lower overnight. The yen was the focus of attention after a six-day decline that increased the likelihood of intervention. The Hang Seng Index dropped as much as 2%. Mainland indexes also declined amidst Beijing's hesitancy to increase stimulus. The government's decision to raise levies related to renewable energy resulted in an acceleration of inflation in Japan, supporting the BoJ's argument to consider hiking interest rates in the upcoming months. At their meeting a week ago, policymakers kept interest rates unaltered and refused to provide specifics on reducing bond purchases.

Following a weather-related decline in April, UK retail sales volume surged in May, with both the headline and ex-fuel measures increasing by 2.9% month-on-month. Additionally, April's figures were revised to be less negative than initially reported, with the headline measure adjusted from -2.3% to -1.8% month-on-month. The 10% increase in the National Living Wage, which took effect in April, appears to have boosted spending power in May. Given these factors, the month-to-month fluctuations are not surprising.

Stateside Goldman Sachs ‘estimate this options expiration will be the largest ever with over $5.1 trillion of notional options exposure expiring, driven by a record $870 billion notional in single

stock options. This exceeds the notional value of options that expired in December

2023 ($4.9T), which was the prior record high’

Overnight Newswire Updates of Note

New EU Debt Rules Can Only Work With Political Support, IMF Says

Yellen Says Trump’s Proposed Tariffs Will Raise Consumer Costs

Putin Says Russia May Send North Korea High-Precision Arms

Sheinbaum Names Ex-Foreign Minister Ebrard As Economy Chief

Dollar Firms On Recovering Risk Sentiment, Prospects Of Easier Overseas Rates

Kroger’s Stock Pops After Better-Than-Expected Earnings

Engine Fire On Boeing 737 Forces Emergency Landing In India

Boeing Is Shifting Engineers Away From X-66A Development

Nikola Plans 1-For-30 Reverse Stock Split To Comply With Nasdaq Listing Rules

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600-10 (2.03BLN), 1.0650-60 (4.2BLN)

1.0680-90 (1.17BLN), 1.0695-1.0705 (2.59BLN)

1.0720-30 (1.4BLN), 1.0735 (478M), 1.0750 (509M)

1.0775 (926M), 1.0790 (347M), 1.0795-05 (1.0BLN)

USD/CHF: 0.8900-05 (1.6BLN), 0.8950 (463M), 0.8980 (500M)

EUR/CHF: 0.9500 (511M), 0.9545-50 (321M), 0.9625 (1.03BLN)

0.9675 (400M), 0.9700 (355M), 0.9750 (416M), 0.9800 (430M)

GBP/USD: 1.2665 (462M), 1.2740 (2.0BLN), 1.2760 (246M)

1.2780 (1.15BLN)

EUR/GBP: 0.8400 (631M), 0.8440 (460M), 0.8450-55 (371M)

0.8475 (1.0BLN)

AUD/USD: 0.6600-05 (421M), 0.6640-50 (323M), 0.6675 (225M)

0.6710 (386M). NZD/USD: 0.6125 (330M)

USD/CAD: 1.3630 (205M), 1.3645-50 (717M), 1.3655-65 (1.4BLN)

1.3675-80 (1.04BLN), 1.3700-20 (2.1BLN), 1.3740-55 (1.24BLN)

1.3800 (1.5BLN)

USD/JPY: 156.75 (801M), 157.00-10 (1.68BLN), 157.20-25 (934M)

157.50 (1.48BLN), 158.00 (772M), 158.25 (738M), 158.40-50 (532M)

159.00 (1.05BLN), 159.15-25 (547M), 159.50 (300M), 160.00 (430M)

CFTC Data As Of 14/06/24

Equity fund speculators increase S&P 500 CME net short position by 20,612 contracts to 352,937

Equity fund managers raise S&P 500 CME net long position by 13,149 contracts to 967,970

Euro net long position is 43,644 contracts

Japanese yen net short position is 138,579 contracts

British pound net long position is 52,121 contracts

Swiss franc posts net short position of -42,863

Bitcoin net short position is -1,138 contracts

Technical & Trade Views

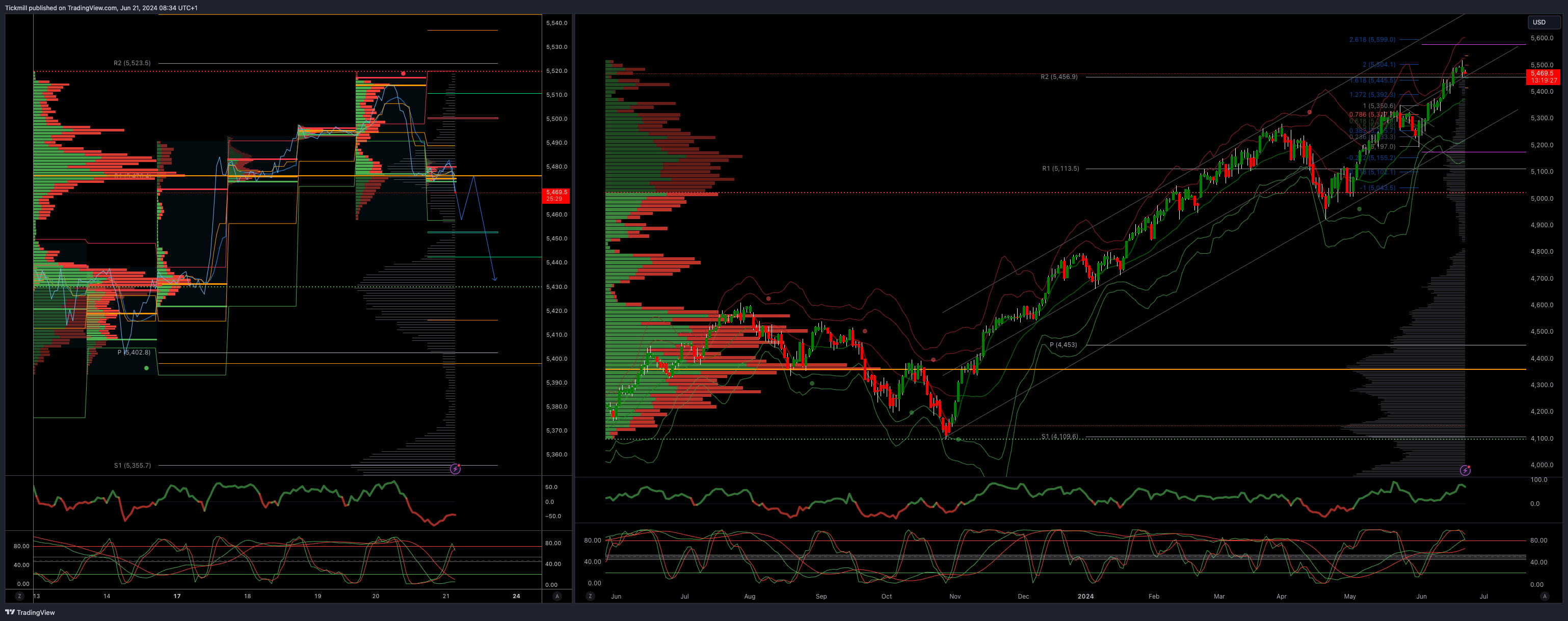

SP500 Bullish Above Bearish Below 5488

Daily VWAP bullish

Weekly VWAP bullish 5354

Below 5475 opens 5450

Primary support 5370

Primary objective is 5520 TARGET HIT NEW PATTERN EMERGING

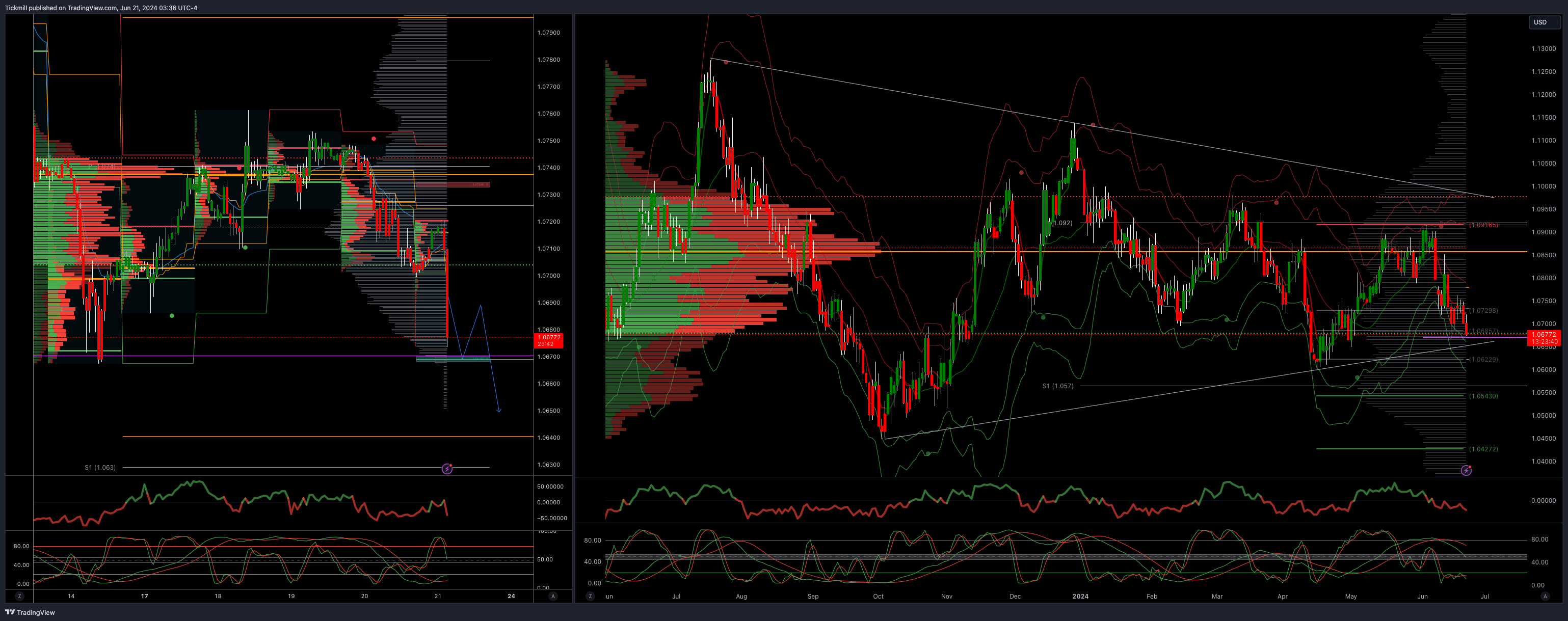

EURUSD Bullish Above Bearish Below 1.0780

Daily VWAP bearish

Weekly VWAP bearish 1.0788

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

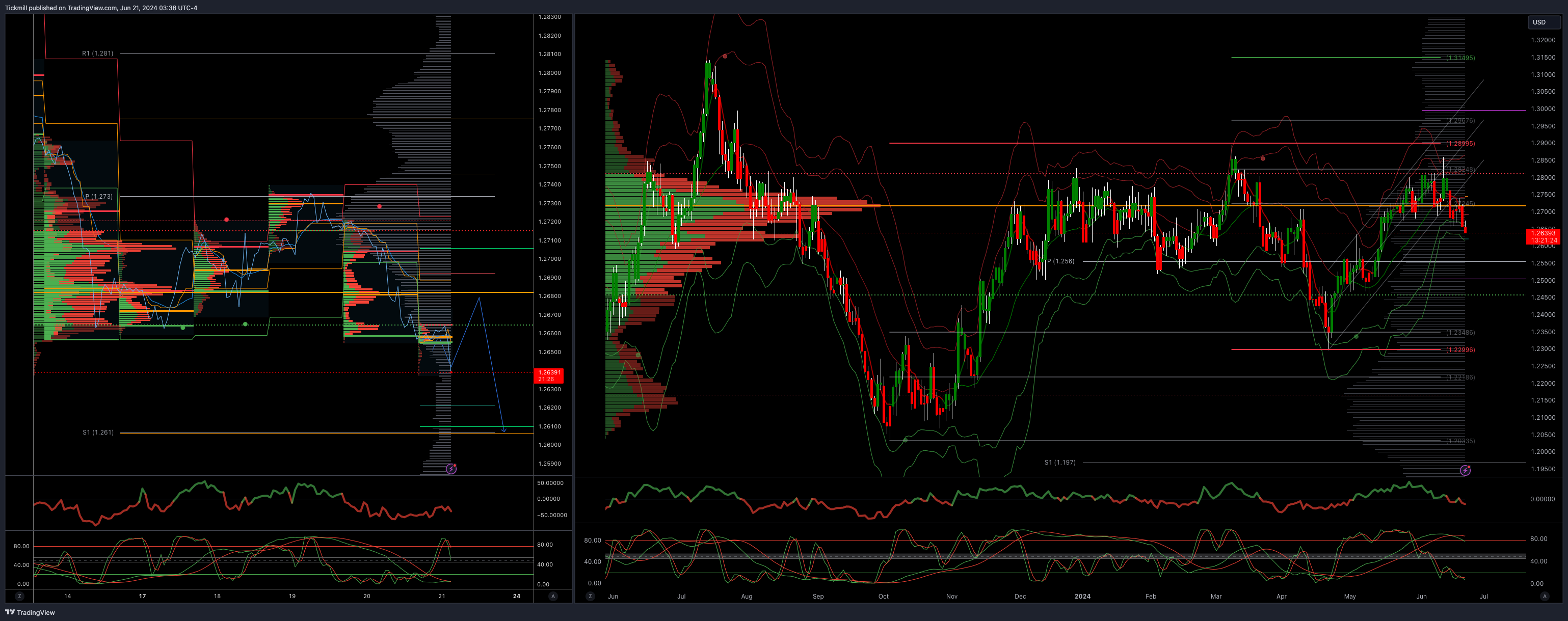

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish 1.2715

Above 1.27 opens 1.2730

Primary resistance is 1.2890

Primary objective 1.2640 TARGET HIT NEW PATTERN EMERGING

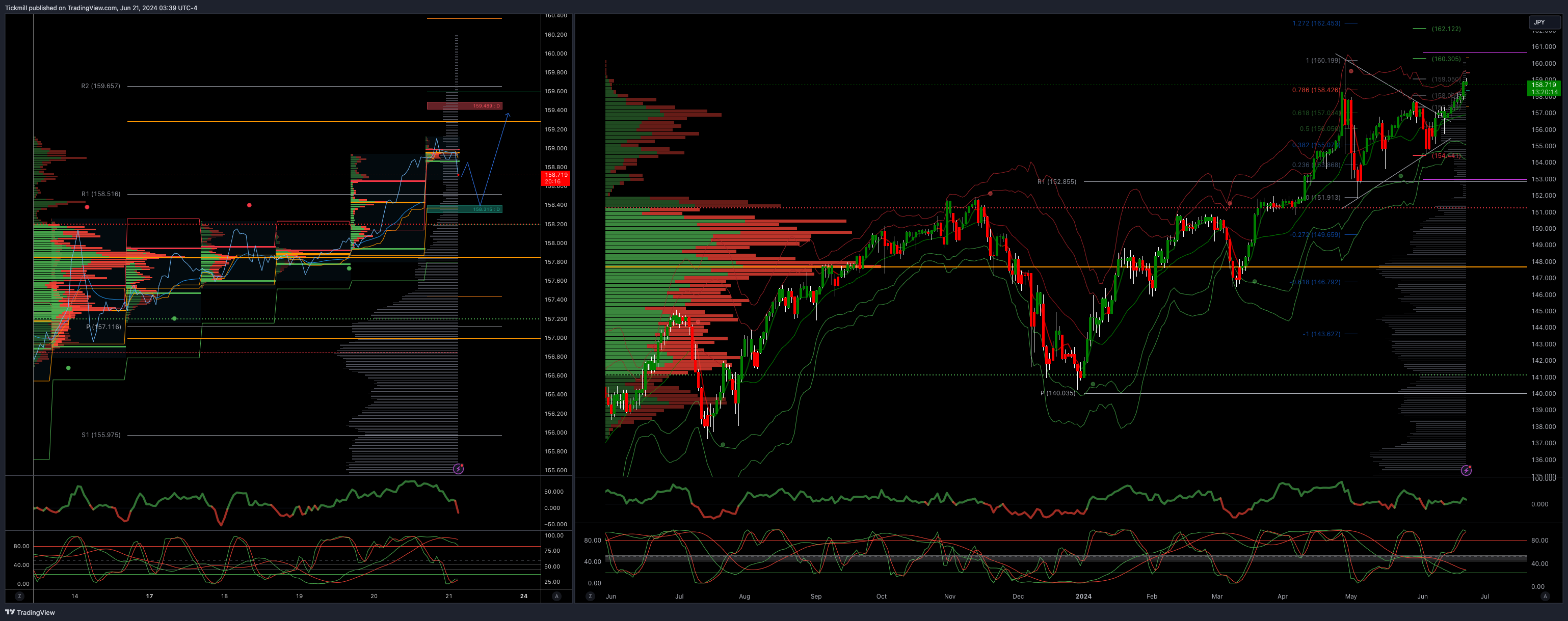

USDJPY Bullish Above Bearish Below 158.40

Daily VWAP bullish

Weekly VWAP bullish 156.60

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160

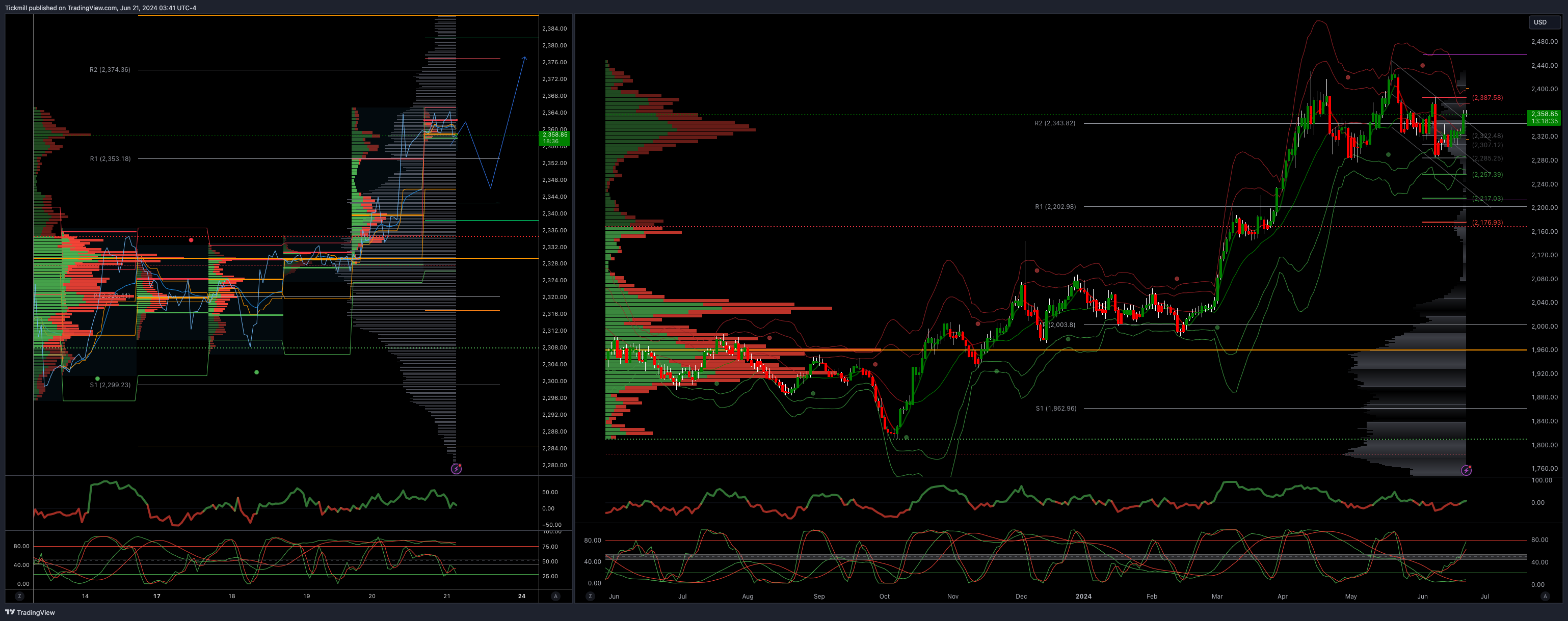

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary resistance 2387

Primary objective is 2262

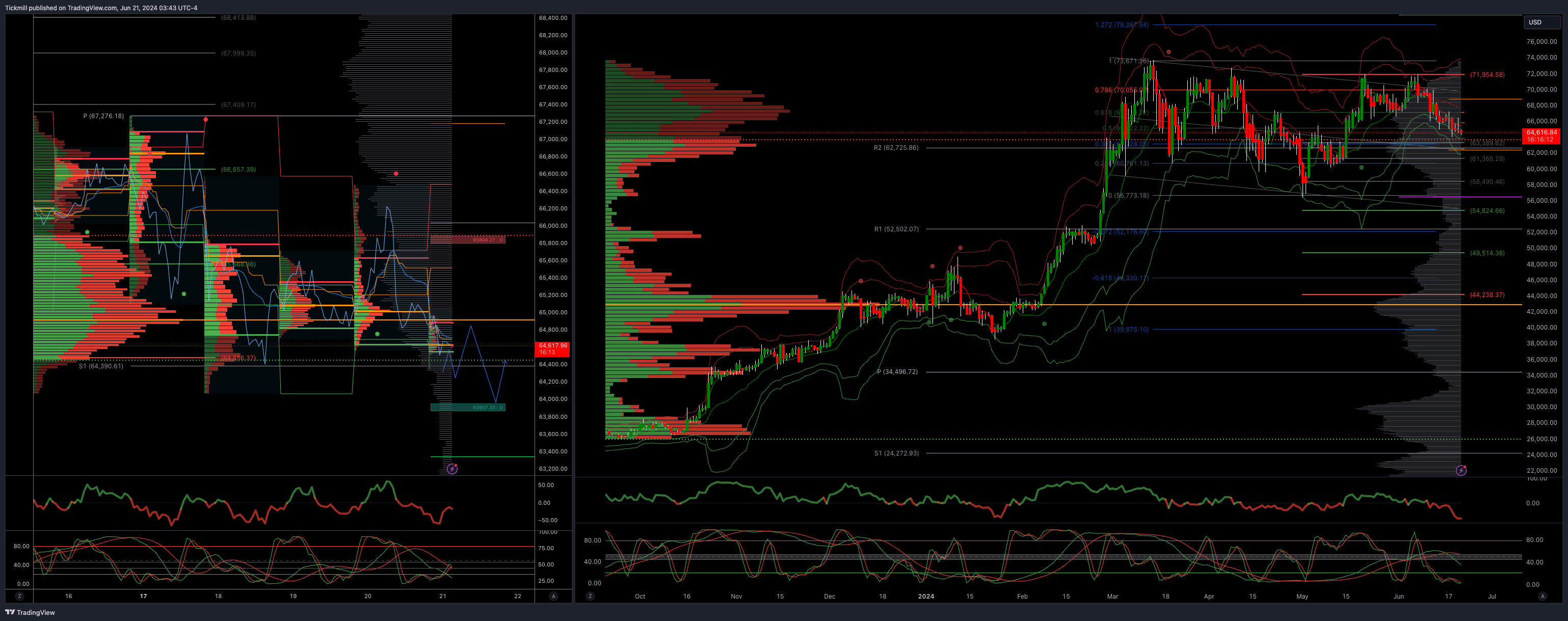

BTCUSD Bullish Above Bearish below 65840

Daily VWAP bearish

Weekly VWAP bearish 68015

Below 63800 opens 62400

Primary support is 64481

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!