Daily Market Outlook, June 20, 2024

Daily Market Outlook, June 20, 2024

Munnelly’s Macro Minute…

“Asian Markets Soggy On Tech Doubts. BoE On Deck”

Asian stocks weakened as investors weighed the sustainability of the recent surge in technology, which had driven a major benchmark to over two-year highs. The weakest regional equities were Chinese and Japanese markets. The Hang Seng Tech Index fell over 1%, reflecting weakness in the region's technology stocks. The People's Bank of China's setting of the Yuan's daily reference rate was the weakest since November, suggesting a potential relaxation of monetary policy.

British inflation may have reached the Bank of England's 2% target for the first time in almost three years, potentially leading to a cut in interest rates by the Bank of England. However, the central bank remains concerned about wage growth and underlying pricing pressure, emphasizing that a return of inflation to its target is not sufficient on its own to warrant cutting interest rates. May's data revealed that annual consumer price inflation slowed to 2% from April's 2.3%, while services price inflation, seen as a better indicator of medium-term inflation risk by the BoE, was at 5.7%, surpassing estimates. This mixed picture leaves Bank of England Governor Andrew Bailey with little choice but to wait, as markets are only fully pricing in a rate cut in November. While Bailey had hinted at a potential rate cut early last month, recent data has been less convincing.

European investors will be watching French markets following the European Commission's announcement on Wednesday that France, along with six other countries, will face consequences for exceeding EU budget deficit limits. French stocks and the euro have been experiencing pressure due to political instability in France and the potential for a parliament dominated by far-right parties, following President Emmanuel Macron's decision to call for a snap vote.

Stateside jobless claims are the data point for the afternoon along with Central Bank speakers Kashkari and Barkin who speak later in the US session.

Overnight Newswire Updates of Note

Chinese Banks Hold Lending Rates Following PBoC’s Caution

China Loosens Grip On Yuan With Weakest Fixing Since November

PBoC’s New Tools May Spur Big Shift In How It Manages Money

New Zealand’s Economy Emerges From Recession In First Quarter

BoE Rate Cut Expected To Be Pushed Back By Election And Inflation

Brazil CenBank Pauses Cycle Of Interest Rate Cuts In Unanimous Decision

Australian Dollar Gathers Strength As RBA Tone Leans Hawkish

Oil Steadies Ahead Of US Stockpile Data As Volatility Declines

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0650 (570M), 1.0665-75 (650M), 1.0690-00 (2.6BLN)

1.0705 (436M), 1.0725-30 (1.05BLN), 1.0745-50 (1.05BLN)

1.0760-75 (1.05BLN), 1.0800 (1.4BLN, 1.0855-60 (1.2BLN)

USD/CHF: 0.8815-20 (810M), 0.8850 (912M), 0.8880-90 (432M)

0.8900 (530M), 0.8925 (300M)

EUR/CHF: 0.9550 (366M), 0.9630 (620M), 0.9790 (604M)

GBP/USD: 1.2700 (1.05BLN), 1.2715-20 (544M), 1.2750 (350M)

1.2800 (284M)

EUR/GBP: 0.8450-55 (580M), 0.8475 (350M), 0.8500 (670M)

AUD/USD: 0.6500 (1.5BLN), 0.6525-35 (708M), 0.6550-60 (344M)

0.6570 (533M), 0.6590-00 (446M), 0.6645-65 (911M)

0.6680-90 (680M), 0.6770 (545M)

NZD/USD: 0.6080 (462M), 0.6100 (320M), 0.6125 (268M)

AUD/NZD: 1.0925 (652M)

USD/CAD: 1.3645-50 (376M), 1.3660-65 (744M)

USD/JPY: 156.00 (1.3BLN), 156.90-05 (3.22BLN), 157.25-30 (376M)

157.50 (350M), 157.75 (534M), 158.00 (621M)

USD/ZAR: 17.50 (851M), 18.00-05 (1.41BLN)

CFTC Data As Of 14/06/24

Equity fund speculators increase S&P 500 CME net short position by 20,612 contracts to 352,937

Equity fund managers raise S&P 500 CME net long position by 13,149 contracts to 967,970

Euro net long position is 43,644 contracts

Japanese yen net short position is 138,579 contracts

British pound net long position is 52,121 contracts

Swiss franc posts net short position of -42,863

Bitcoin net short position is -1,138 contracts

Technical & Trade Views

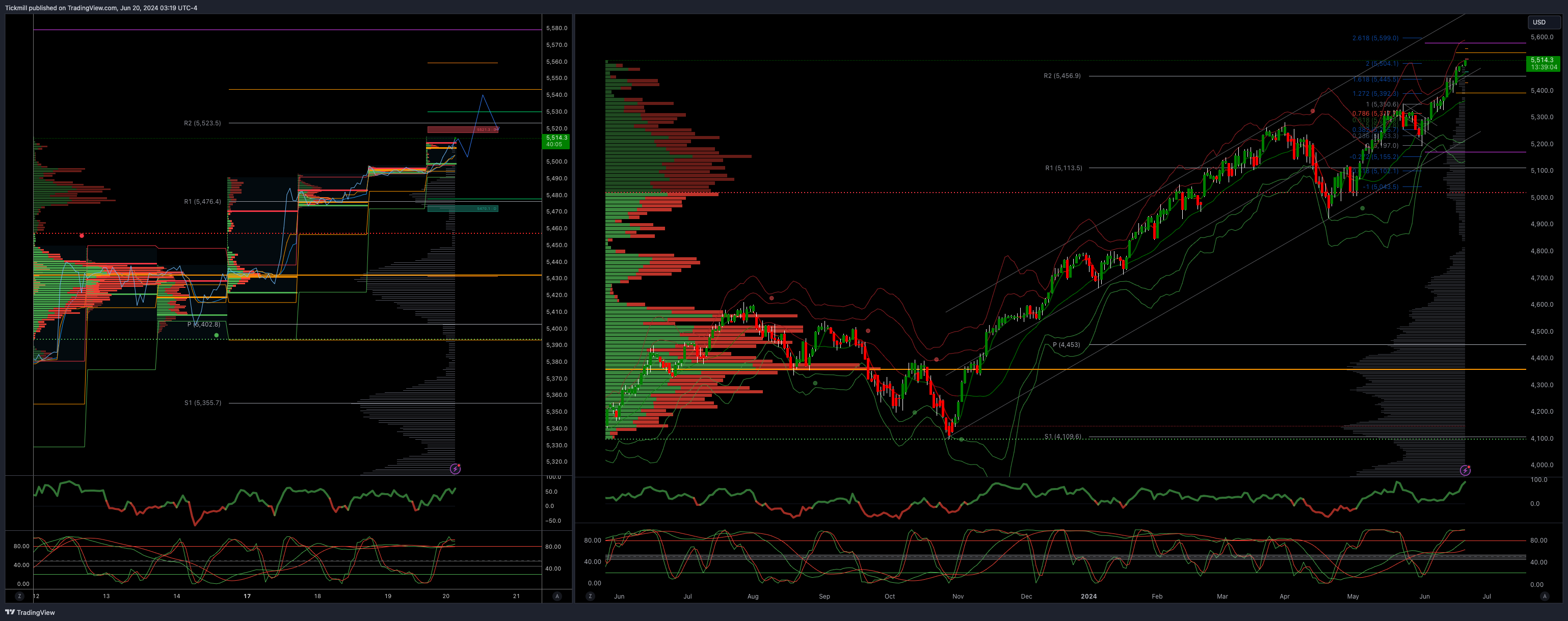

SP500 Bullish Above Bearish Below 5500

Daily VWAP bullish

Weekly VWAP bullish 5354

Below 5475 opens 5450

Primary support 5370

Primary objective is 5520

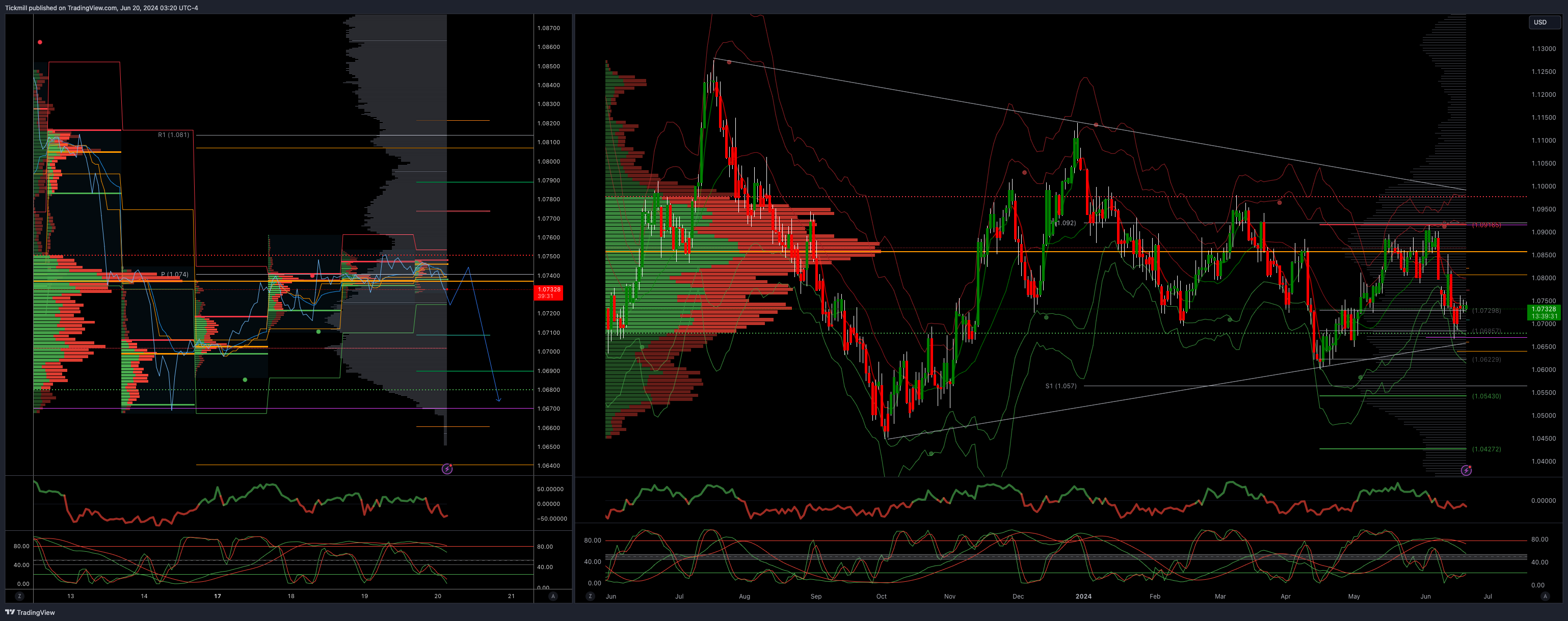

EURUSD Bullish Above Bearish Below 1.0780

Daily VWAP bearish

Weekly VWAP bearish 1.0788

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

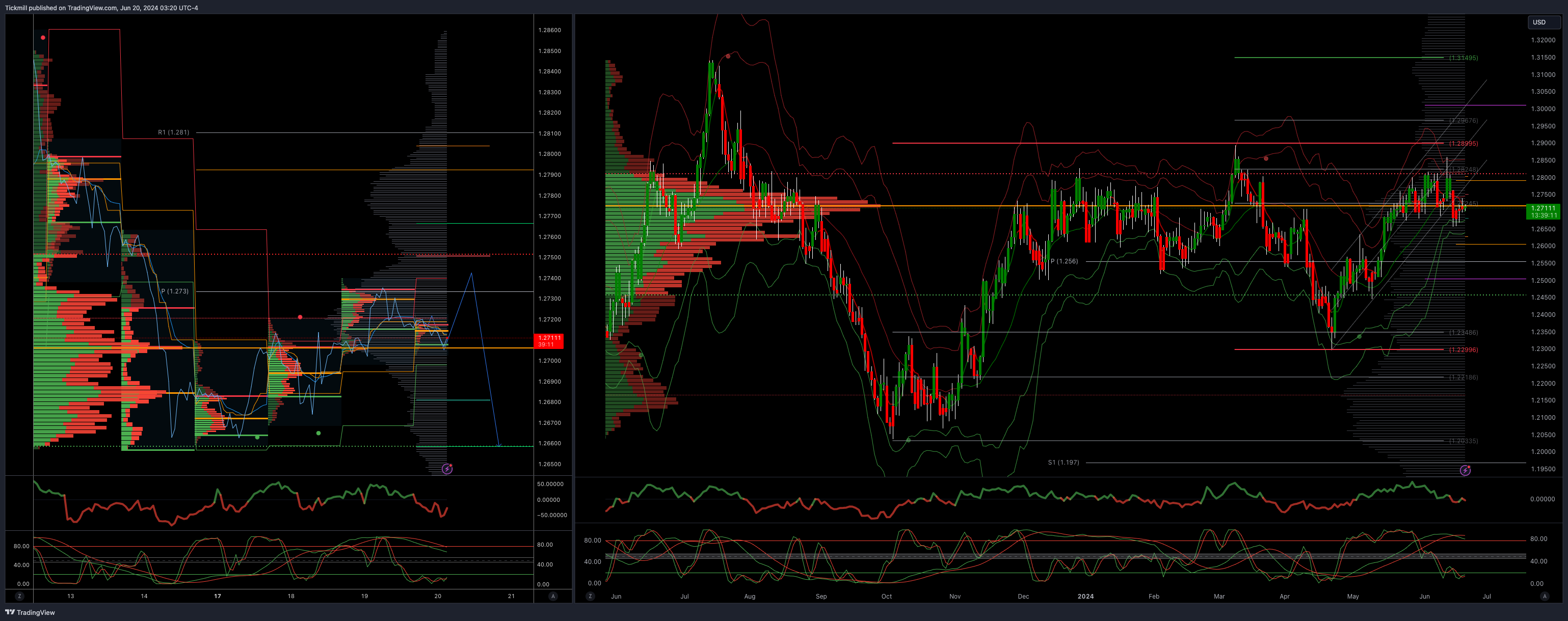

GBPUSD Bullish Above Bearish Below 1.2760

Daily VWAP bullish

Weekly VWAP bearish 1.2715

Below 1.2740 opens 1.2690

Primary resistance is 1.2890

Primary objective 1.2640

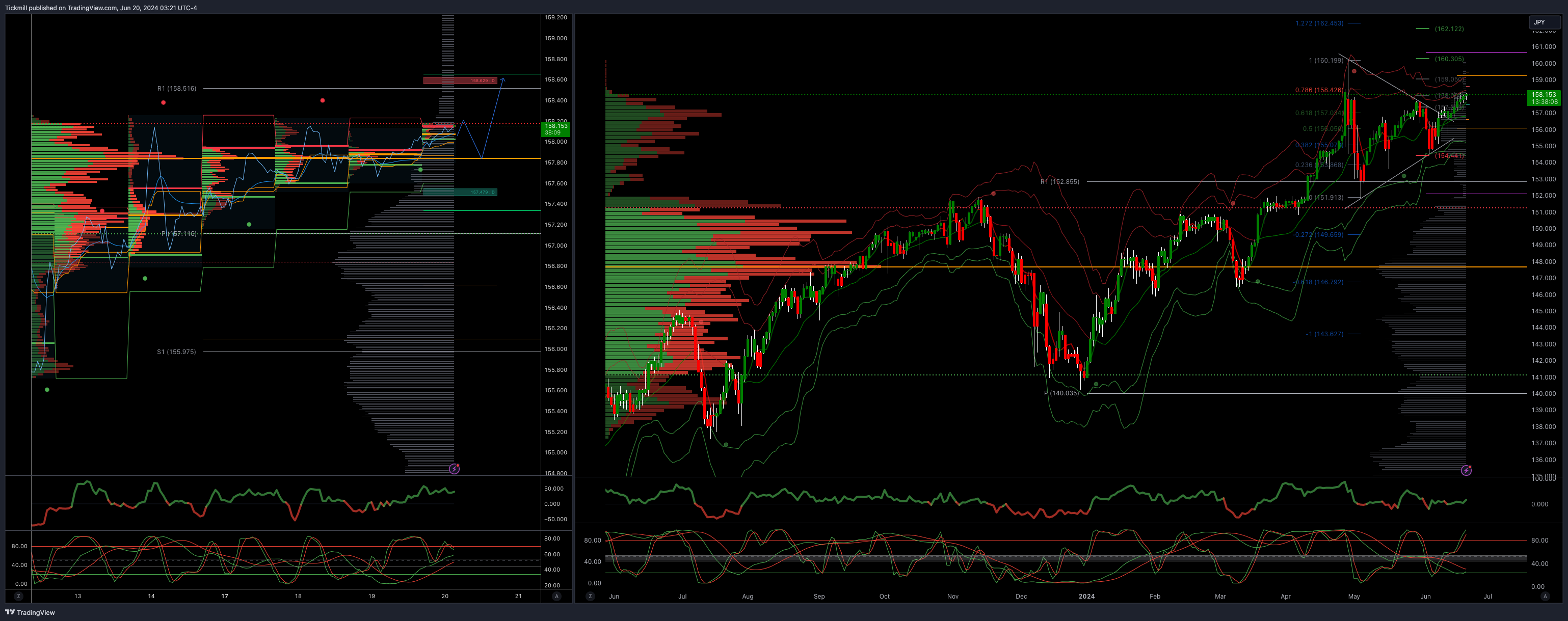

USDJPY Bullish Above Bearish Below 157.50

Daily VWAP bullish

Weekly VWAP bullish 156.60

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160

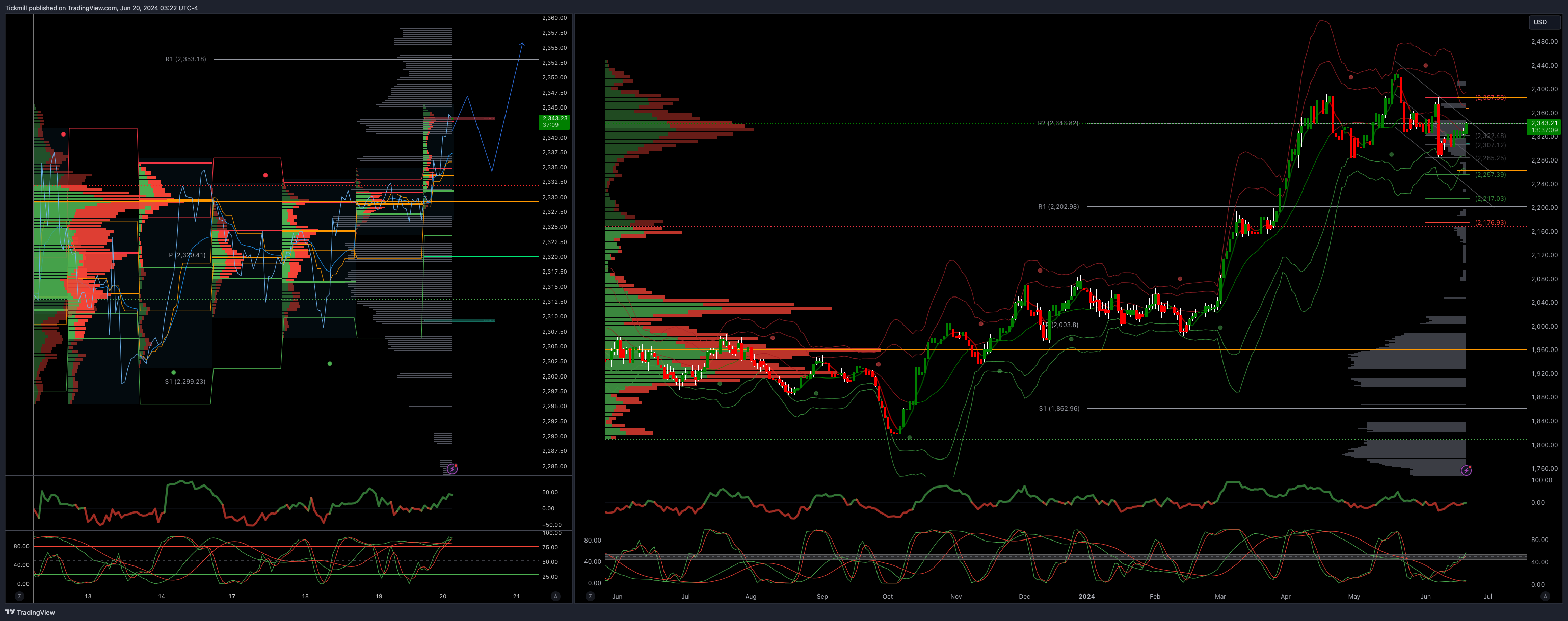

XAUUSD Bullish Above Bearish Below 2310

Daily VWAP bearish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary support 2300

Primary objective is 2262

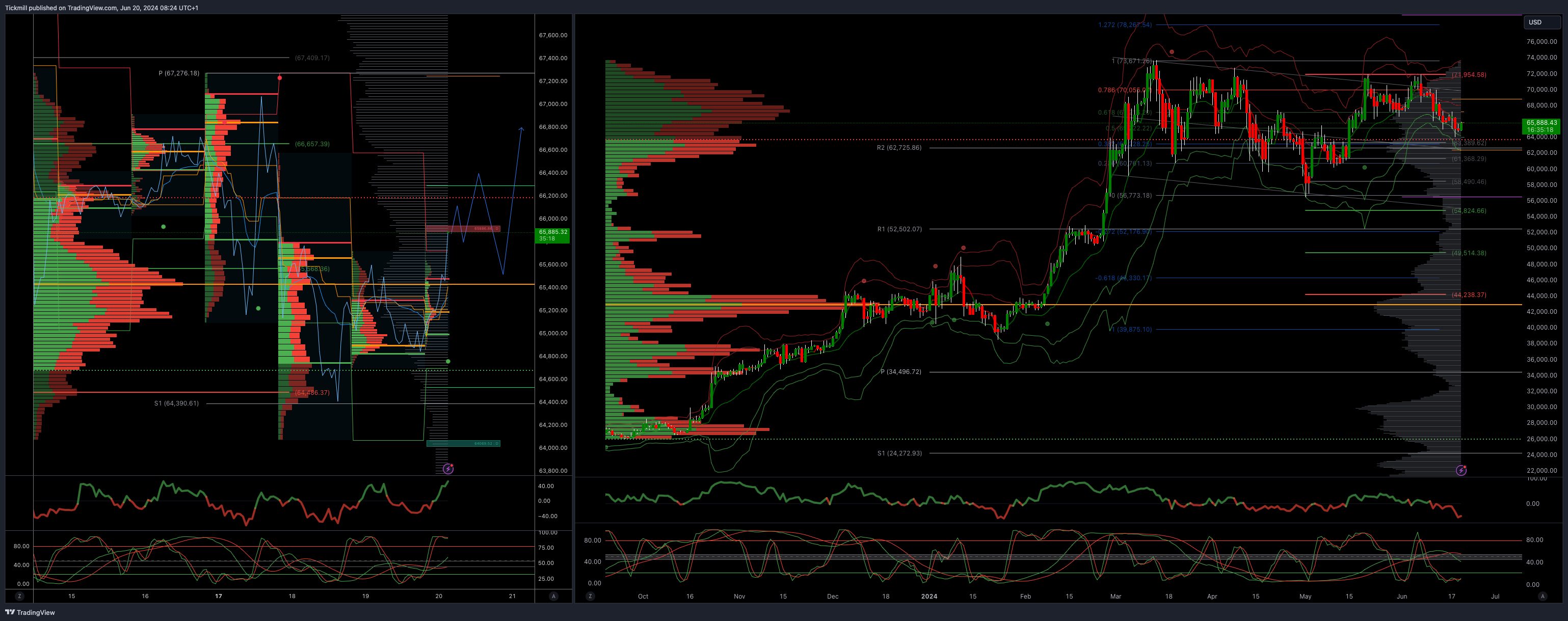

BTCUSD Bullish Above Bearish below 67250

Daily VWAP bearish

Weekly VWAP bearish 68015

Below 66300 opens 64500

Primary support is 64481

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!