Daily Market Outlook, June 19, 2024

Daily Market Outlook, June 19, 2024

Munnelly’s Macro Minute…

“Nvidia Topples Microsoft As The World's Largest Company ”

Asian stocks rose on Wednesday, driven by optimism for AI, while the dollar remained stable. The MSCI Asia Pacific index increased by 0.8%, led by chip and artificial intelligence-related stocks. Taiwan and South Korea's chipmakers saw their share prices rise by 1.5% and 1% respectively. Mainland Chinese equities fell while Hong Kong stocks advanced. Japan's exports also increased at a rapid rate due to the weakening yen, which had not moved much after a four-session decline.

UK Investors will have another opportunity to assess whether the global disinflation trend gains more momentum with the focus shifting to UK inflation data on Wednesday. However, the outcome was uninspiring as it came in inline with expectations, with Core 2% year over year, this data isn't expected to have a significant impact on the Bank of England's policy review Thursday. The print 2% year over year, is in line with the BoE's target, following April's 2.3%. This easing in prices is attributed to a decrease in household energy bills. Despite this, the central bank is expected to maintain current interest rates as policymakers concentrate on wage growth and service sector inflation, which is forecasted to be at 5.5% in May.Recent data revealed that British wages increased at a faster pace than expected, adding pressure on the central bank to keep interest rates higher for a longer period. The upcoming inflation report and subsequent policy decision will offer investors clarity ahead of the general elections in July, especially as the blue-chip FTSE 100 has declined by 3% since reaching a record high in May.

The UK data is reminiscent of last week when mild U.S. inflation readings were followed by a generally hawkish stance from Federal Reserve officials, who revised their median projection for rate cuts from three quarter-point reductions to just one for the year. With U.S. markets closed, trading activity may be subdued throughout the day. The value of sterling remains stable trading just above 1.27, while the dollar softened after retail sales data on Tuesday suggested consumer exhaustion in the U.S. This data slightly raised expectations for a rate cut in September, although given the Fed's data-dependent approach, these expectations are likely to fluctuate in the near term. Earlier this year, traders had priced in up to 160 basis points of cuts by 2024, but now anticipate only 48 bps of easing.

Meanwhile, Nvidia has surpassed tech giant Microsoft to become the world's most valuable company with a market cap of $3.335 trillion. The rally in technology stocks extended into Asia, lifting regional stocks, particularly those focused on the tech sector.

Overnight Newswire Updates of Note

BoJ’s Minutes Show Debate On Rate Hikes With Close Eyes On Yen

Japan’s Exports Grow Most Since 2022 On Boost from Weak Yen

RBNZ’s Conway Says Inflation To Keep Easing As Economy Struggles

Fed Officials Urge Patience On Rate Cuts, Offer Hints On Timing

Japan's FinMin Urges Govt To Issue Shorter Term Debt

China Studying Implementation Of PBoC Bond Trading, Pan Says

Japan Is Said To Consider Issuing Bonds With Shorter Maturities

Oil Holds Advance As Risk-On Mood Eclipses US Stockpile Build

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0715 (711M), 1.0745-50 (2.1BLN), 1.0765-70 (1.2BLN)

USD/CHF: 0.8830 (600M), 0.9010 (690M)

EUR/GBP: 0.8435-40 (359M)

GBP/USD: 1.2725 (597M), 1.2740 (302M)

AUD/USD: 0.6660-65 (359M). NZD/USD: 0.6070 (500M)

USD/CAD: 1.3565 (663M), 1.3690 (1.4BLN), 1.3755-65 (1.1BLN)

USD/JPY: 156.00 (510M), 158.00 (218M)

CFTC Data As Of 14/06/24

Equity fund speculators increase S&P 500 CME net short position by 20,612 contracts to 352,937

Equity fund managers raise S&P 500 CME net long position by 13,149 contracts to 967,970

Euro net long position is 43,644 contracts

Japanese yen net short position is 138,579 contracts

British pound net long position is 52,121 contracts

Swiss franc posts net short position of -42,863

Bitcoin net short position is -1,138 contracts

Technical & Trade Views

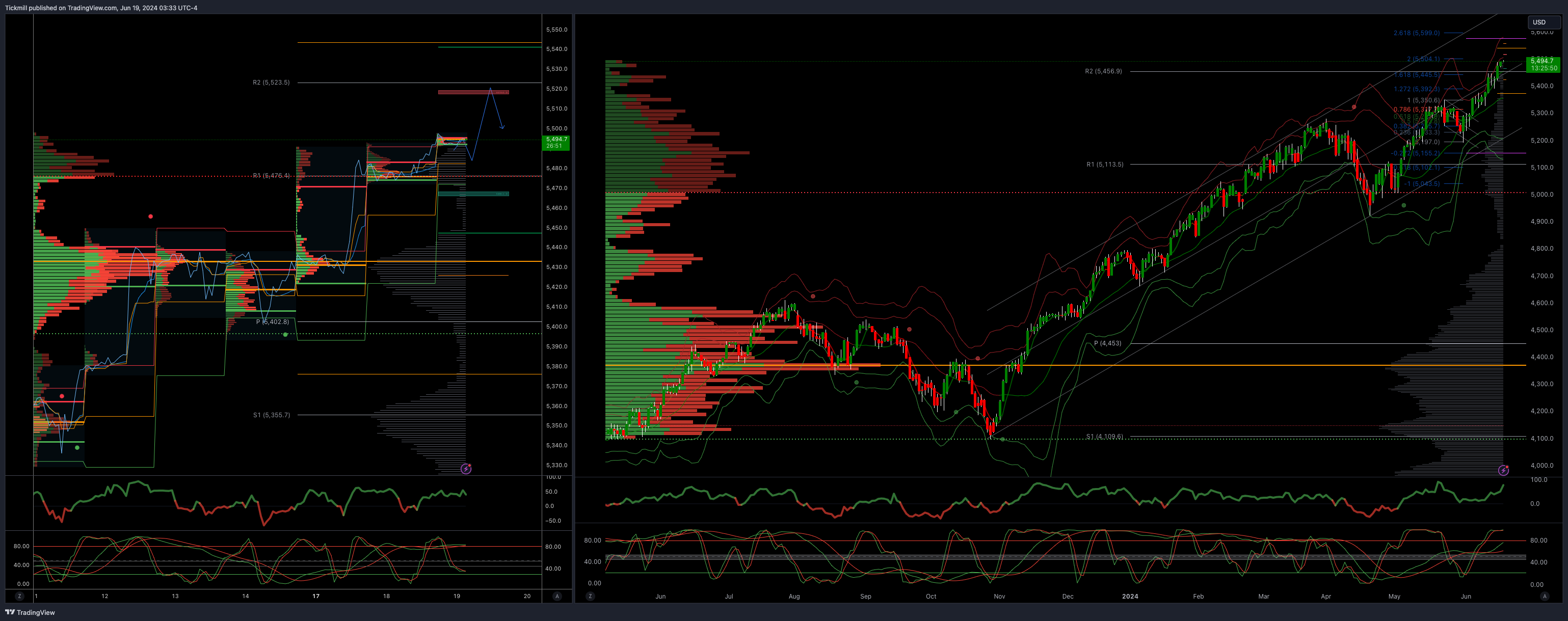

SP500 Bullish Above Bearish Below 5480

Daily VWAP bullish

Weekly VWAP bullish 5354

Below 5475 opens 5450

Primary support 5370

Primary objective is 5520

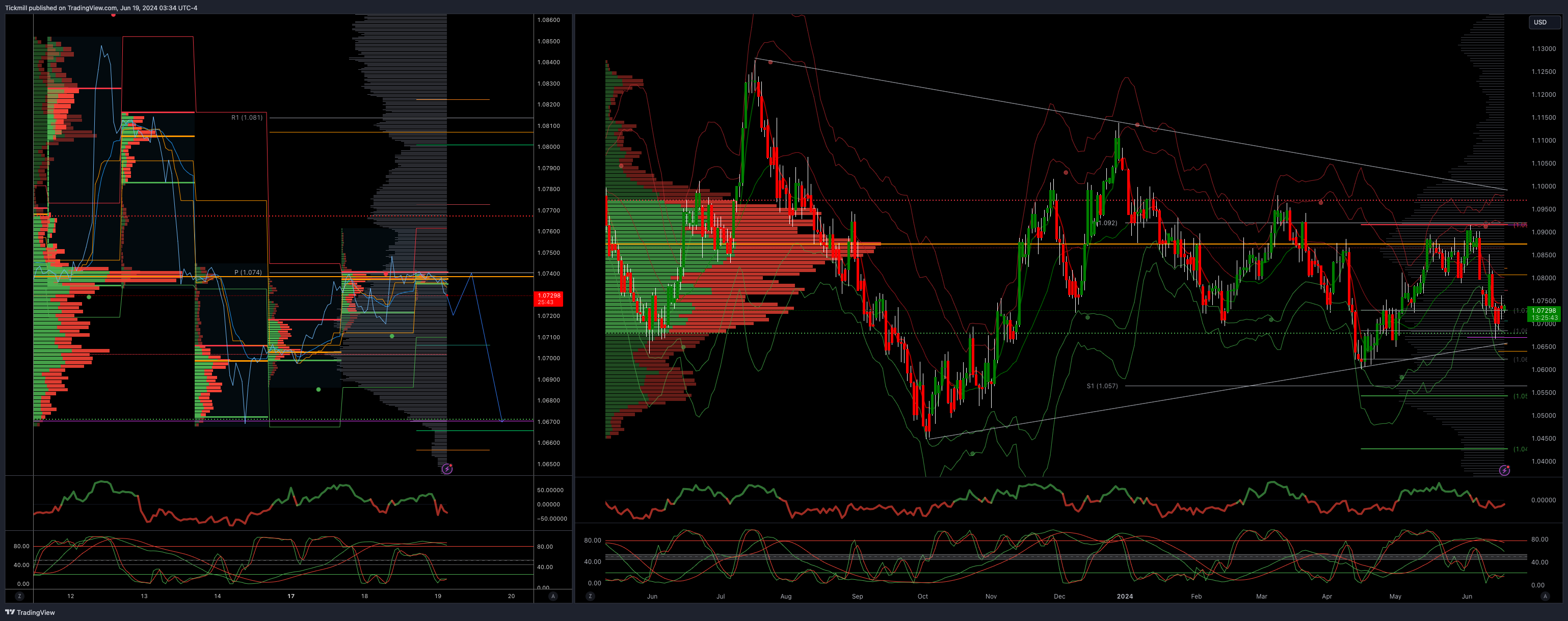

EURUSD Bullish Above Bearish Below 1.0780

Daily VWAP bearish

Weekly VWAP bearish 1.0788

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

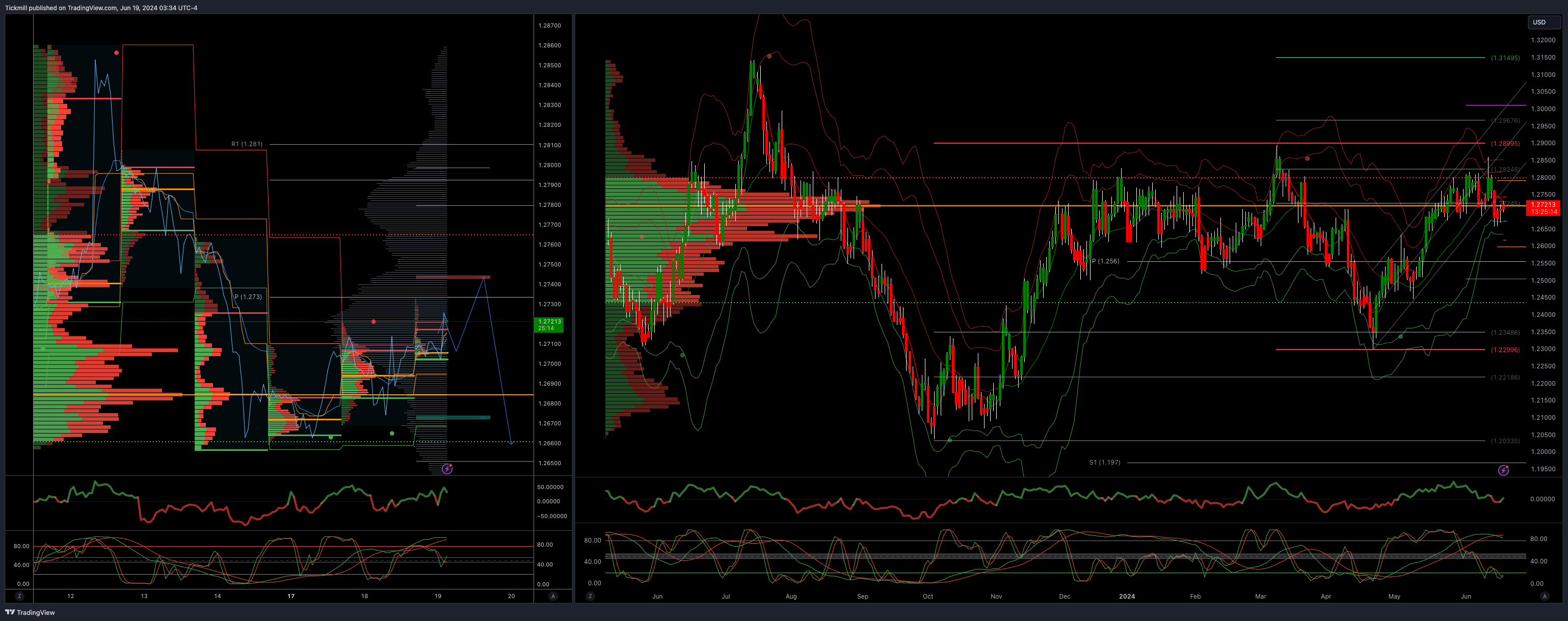

GBPUSD Bullish Above Bearish Below 1.2760

Daily VWAP bullish

Weekly VWAP bearish 1.2715

Below 1.2740 opens 1.2690

Primary resistance is 1.2890

Primary objective 1.2640

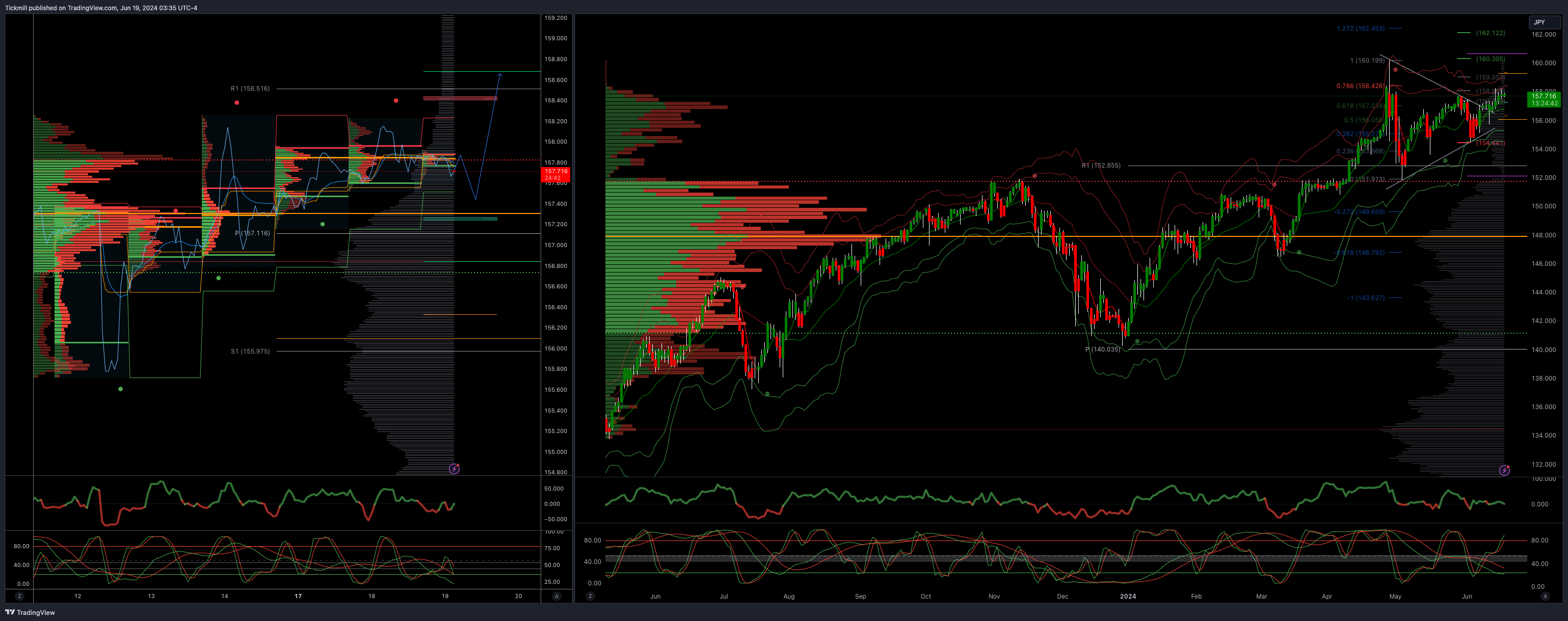

USDJPY Bullish Above Bearish Below 157.20

Daily VWAP bullish

Weekly VWAP bullish 156.60

Below 156.80 opens 155.80

Primary support 152

Primary objective is 160

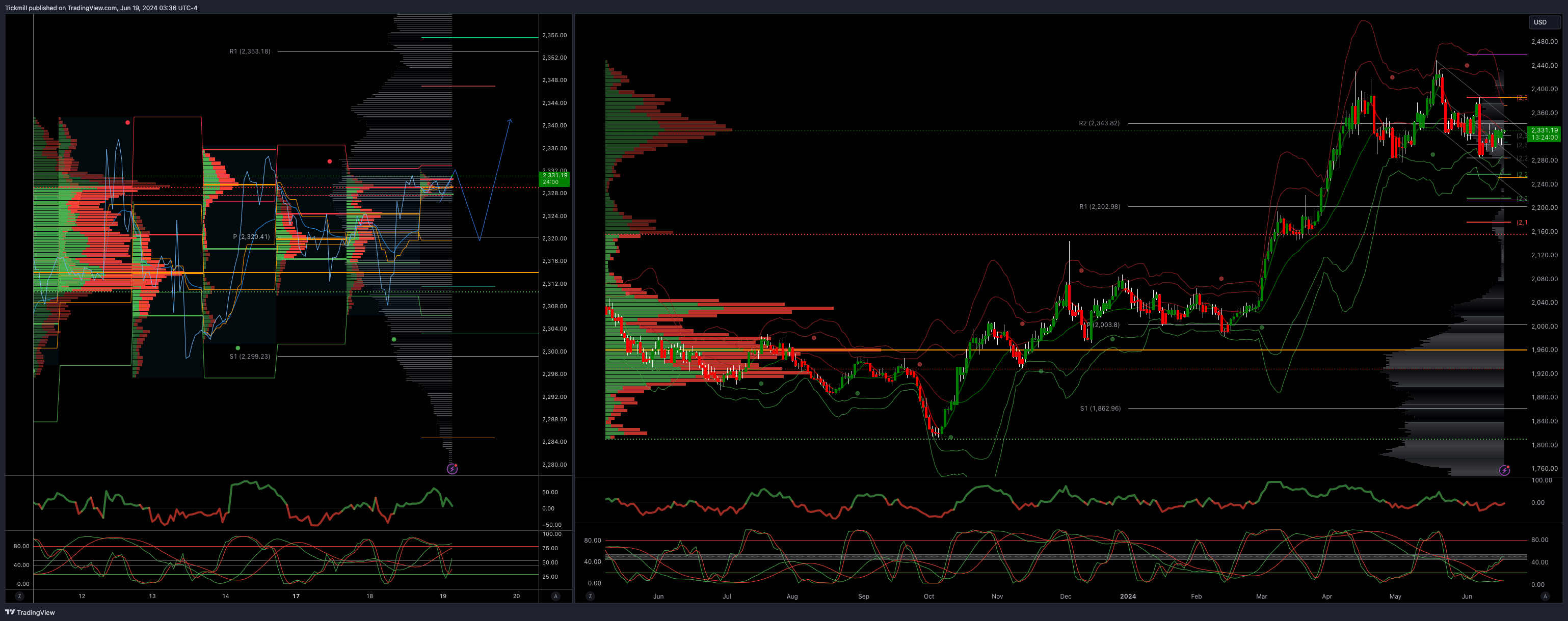

XAUUSD Bullish Above Bearish Below 2310

Daily VWAP bearish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary support 2300

Primary objective is 2262

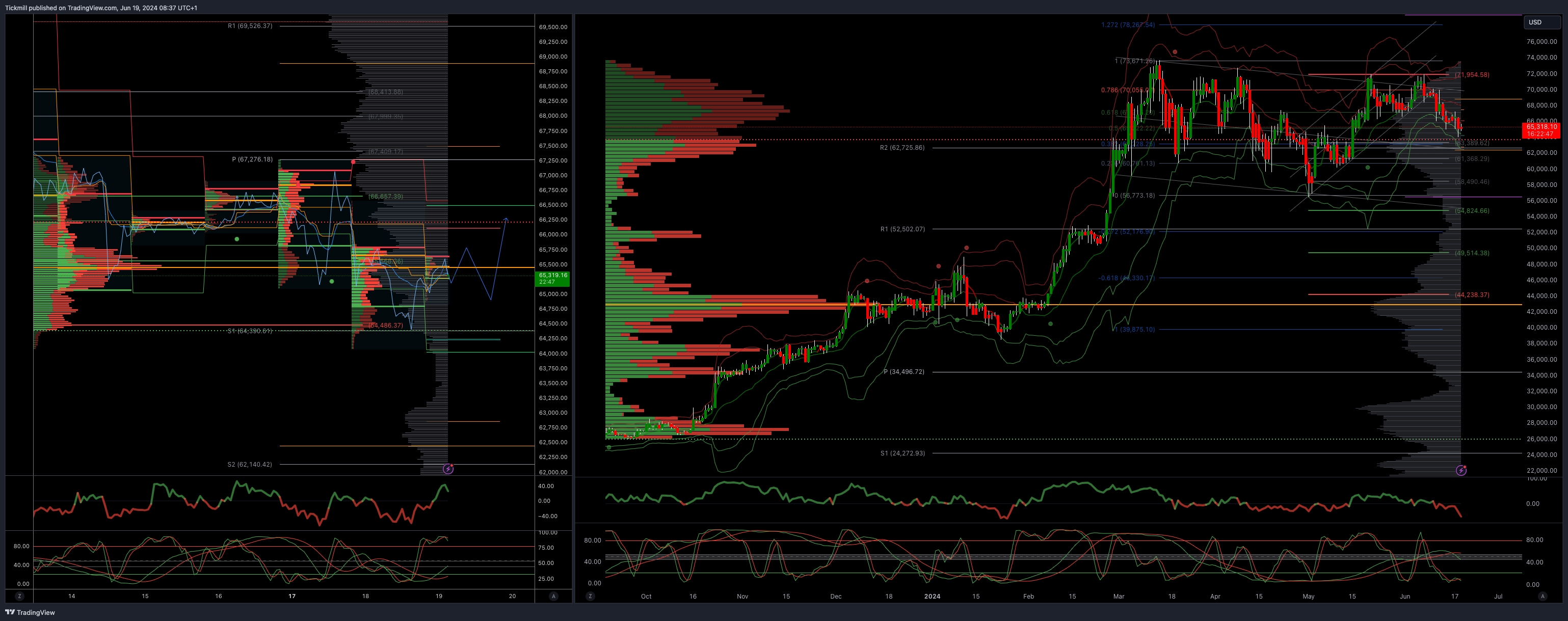

BTCUSD Bullish Above Bearish below 67250

Daily VWAP bearish

Weekly VWAP bearish 68015

Below 66300 opens 64500

Primary support is 64481

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!