Daily Market Outlook, June 17, 2022

Daily Market Outlook, June 17, 2022

Overnight Headlines

- S&P 500 plunges more than 3% Thursday hits new 2022 lows

- Pres Biden: Recession Not Inevitable As Fed Fights Inflation

- White House Consider Fuel-Export Limits Amid Prices Surge

- US Energy Sec To Talk Pump Price With Refiners Next Week

- US Steps Up Heavy Crude Imports, Biden Blasts Profiteering

- China Up Covid Tests As US Envoy Warn Of Investment Chill

- BoJ Keep Policy Ultraloose Amid Risen Inflation, Falling Yen

- ECB's Lagarde Tells Ministers Plans For Bond Spreads Limit

- German Finance Min Spars With ECB On Bond Market Risk

- Markets Believe BoE Interest Rate On Course To Reach 3%

- UK Job Vacancies Hit Another High In Signs Of Tight Market

- US Junk-Bond Spreads Hit 500 Basis Points, First Since 2020

- US Banking Stress Indicator Could Become Worse After Hike

The Day Ahead

- Asian equity markets are mostly lower this morning, although Chinese indices are up. That follows another day of big declines in European and US markets. US President Biden said a recession isn’t inevitable but Americans are “really, really down”. European Central Bank President Lagarde is reported to have told EU finance ministers that the central bank's new anti-crisis tool will kick in if borrowing costs of weaker nations rise too far or too fast.

- In contrast to the tightening actions of other central banks, the Bank of Japan, as expected, left monetary policy unchanged. It noted that it needs to watch the impact that the yen weakening had but otherwise showed no inclination to tighten policy.

- With all of this week’s monetary policy updates now out of the way, it could be a relatively quiet end to a fraught week in markets. Today’s data calendar is relatively light, particularly in the UK, and there are only a few central bank speakers. Markets will be looking for further clarification on the thinking behind some of this week’s central bank moves but they are more likely to get that next week when there is a plethora of speeches by policymakers, particularly in the US.

- Today’s May Eurozone CPI reading is a second estimate and domestic prints for component countries suggest that it is unlikely to be revised. The first reading showed another larger-than-expected rise in both headline and core inflation as both hit their highest levels in the history of the single currency area. That news probably helped prompt the European Central Bank’s announcement that several interest rises are now likely in the second half of this year.

- US May industrial production data is forecast to post a solid increase of 0.5%. Several other US economic releases including retail sales and housing starts surprised on the downside this week. However, despite that Federal Reserve Chair Powell said that he thinks the majority of evidence still points to activity remaining robust. That leaves the Fed still much more concerned about upside inflation risks.

- A couple of Bank of England policymakers are scheduled to speak today at a workshop on household finances. This may provide insight into the hit to consumer spending power from the current rise in inflation but possibly not into their current thinking about current economic conditions more generally or on the outlook for monetary policy.

- Over the weekend the second round of elections to the French National Assembly will determine how much leeway President Macron has to further his policy agenda. Polls point to his party achieving only a slim majority, at best.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0425 (292M), 1.0495-00 (1.13BLN), 1.0600 (315M)

- 1.0650 (317M)

- USD/JPY: 132.00 (365M). USD/ZAR: 15.80 (185M), 16.05 (520M)

- 16.2500 (440M)

- GBP/USD: 1.2175 (244M), 1.2200 (328M), 1.2400 (318M)

- EUR/GBP: 0.8610 (270M), 0.8630 (387M), 0.8650 (566M)

- EUR/CHF: 1.0350 (274M)

- AUD/USD: 0.7000-05 (385M), 0.7145-50 (900M)

- 0.7250 (695M). USD/CAD: 1.2840-50 (549M)

Technical & Trade Views

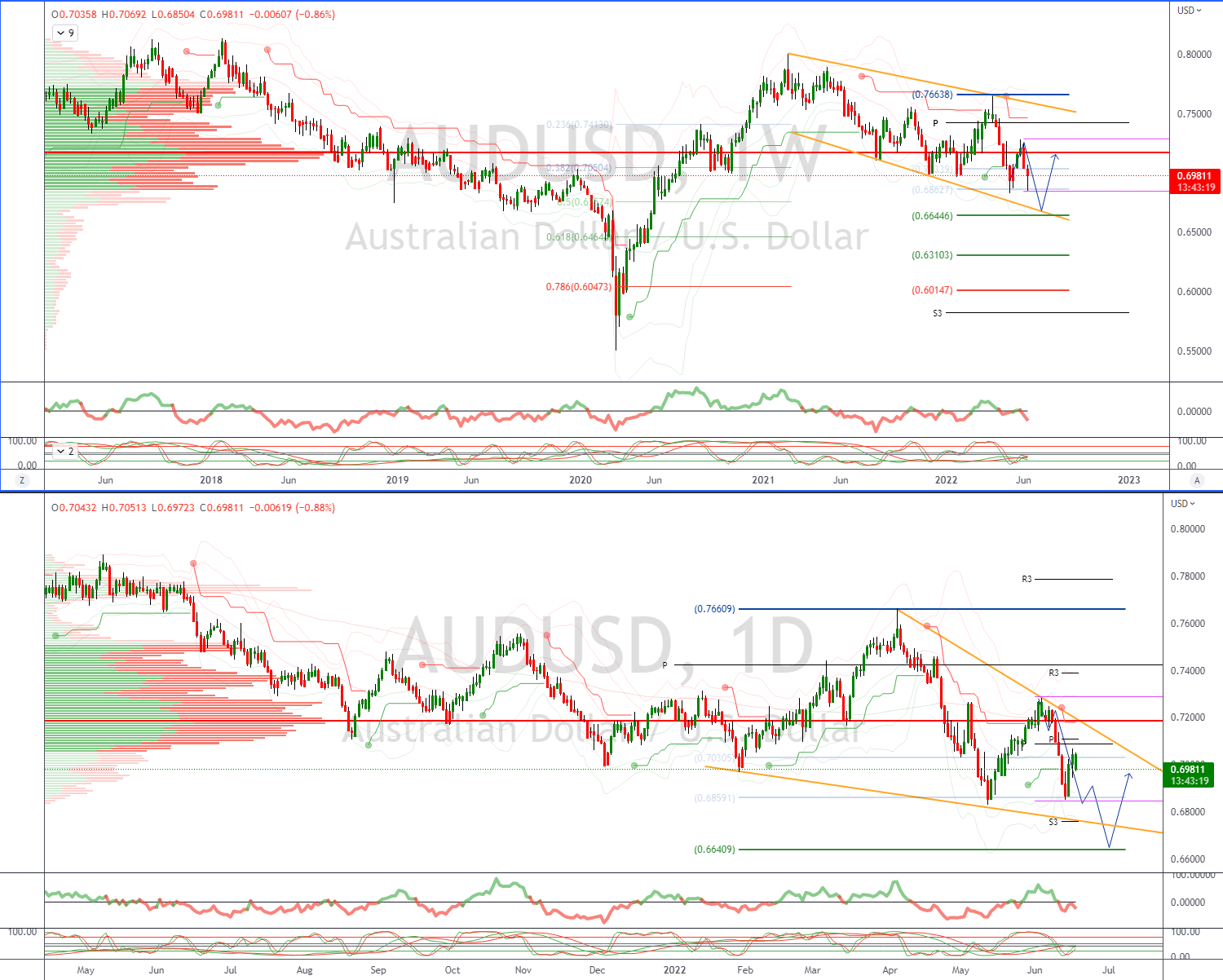

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD on back foot in Asia, backs away from 1.0601 spike high in NY

- Asia 1.0560 to 1.0522 EBS, falls into range between large option expiries

- E1.3 bln between 1.0490-1.0500, E904 mln alone at 1.0500 strike, supportive

- Total E550 mln between 1.0550-75 strikes, to help cap alongside offers

- Broad USD weakness yesterday looks to have subsided, ECB still behind curve

- Below 1.0560’s sees sellers in control

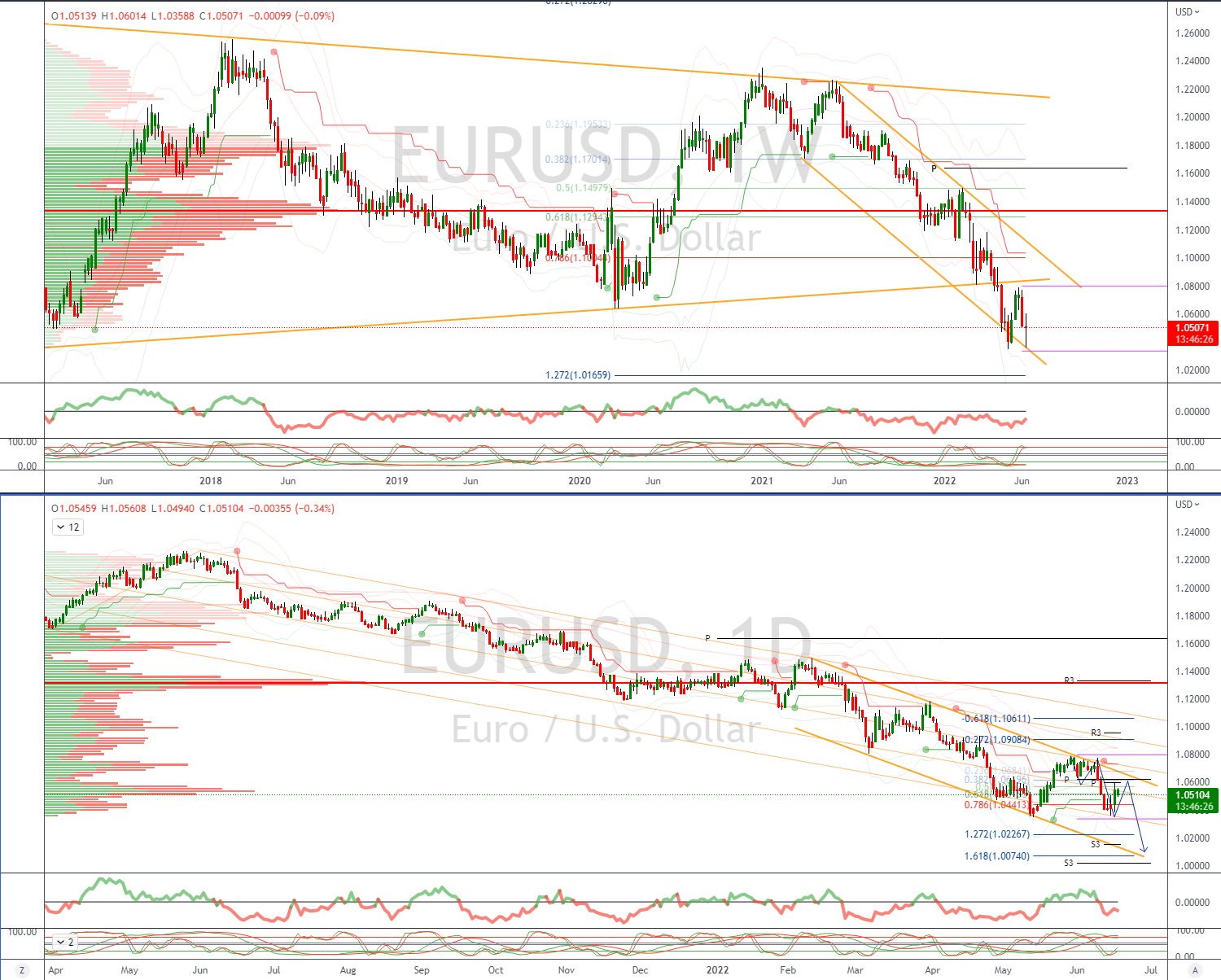

GBPUSD Bias: Bearish below 1.26 Bullish above.

- Cable falls to 1.2258 in early London trade, as high volatility persists

- 1.2258 is lowest level since Thursday's 1.2405 intra-week high (at 1647 GMT)

- Jump to 1.2405 followed drop to 1.2042 low after 25 bps BoE hike at 1100 GMT

- Hawkish shift in BoE expectations lifted GBP as USD longs were lightened

- BoE ready to act "forcefully" on rates if needed

- MPC members Tenreyro and Pill due to speak today, as is Powell

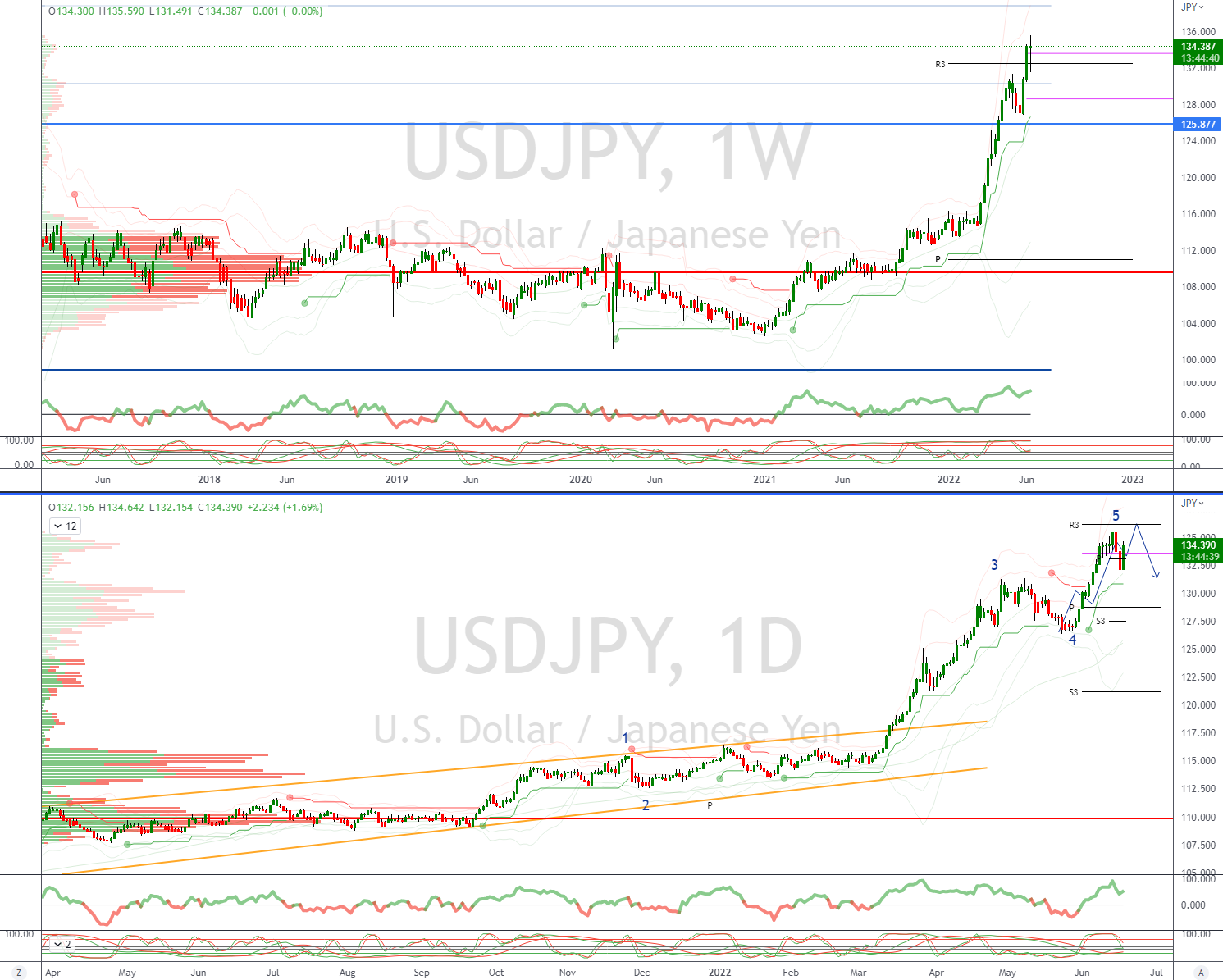

USDJPY Bias: Bullish above 127 Bearish below

- BOJ prepared statement bland, sticks to long-held mantra on policy

- Economic view unchanged - recovery continuing, inflation still capped

- Will continue with policies to ensure steady inflation around 2% target

- Risks still skewed to the downside - COVID, supply disruptions, Ukraine

- Won't hesitate to ease more if found necessary

- Asked about wages, household pain, noted BoJ monitoring situation

- Emphasizes wage gains needed for stable prices, to lessen household pain

- FX, bond markets volatile, stability desired will continue with JGB ops

- Notes recently weaker yen but still more positive for economy

- Suggests weak JPY OK if reflection of fundamentals

- Talk suggests BoJ to remain hands-off on FX

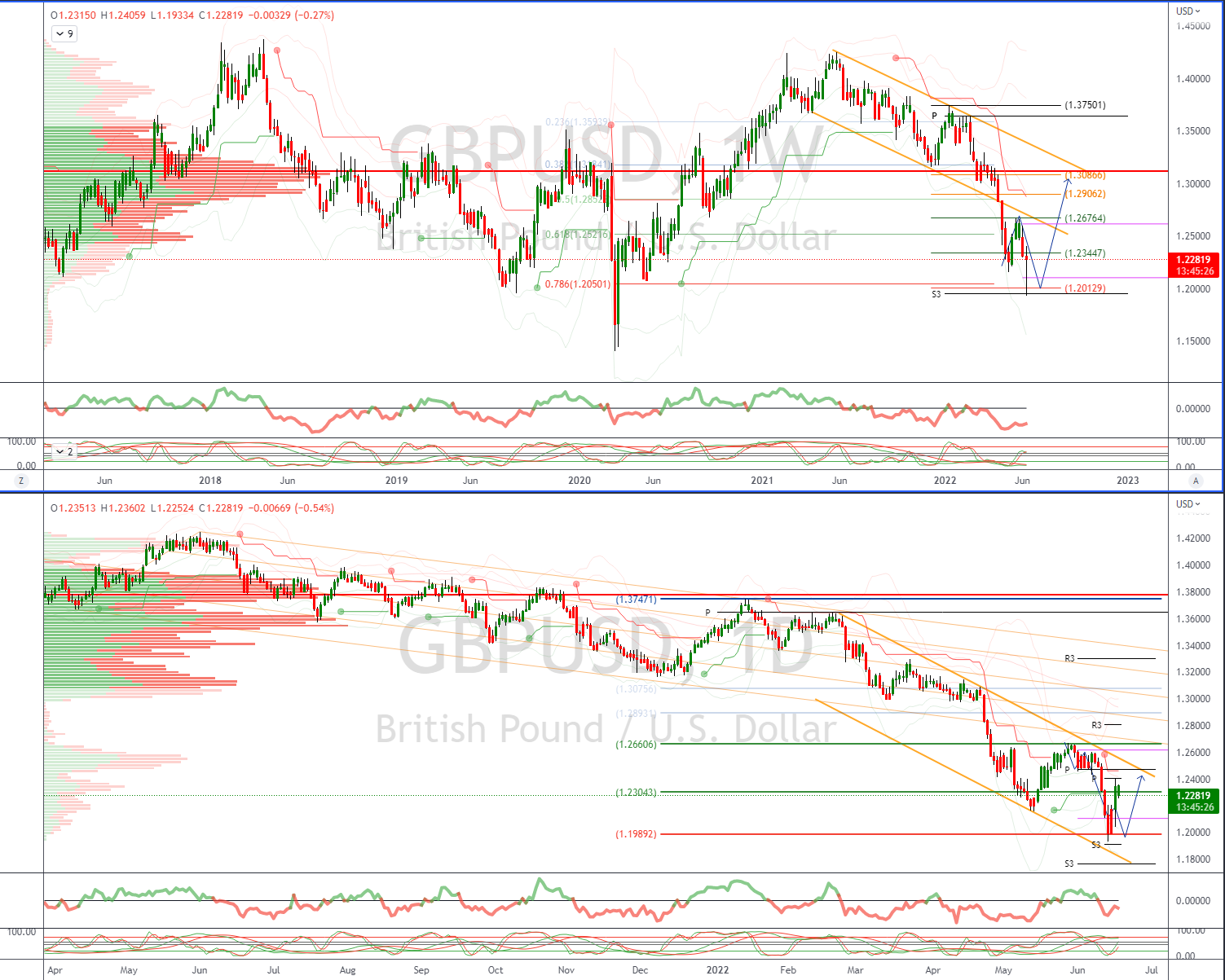

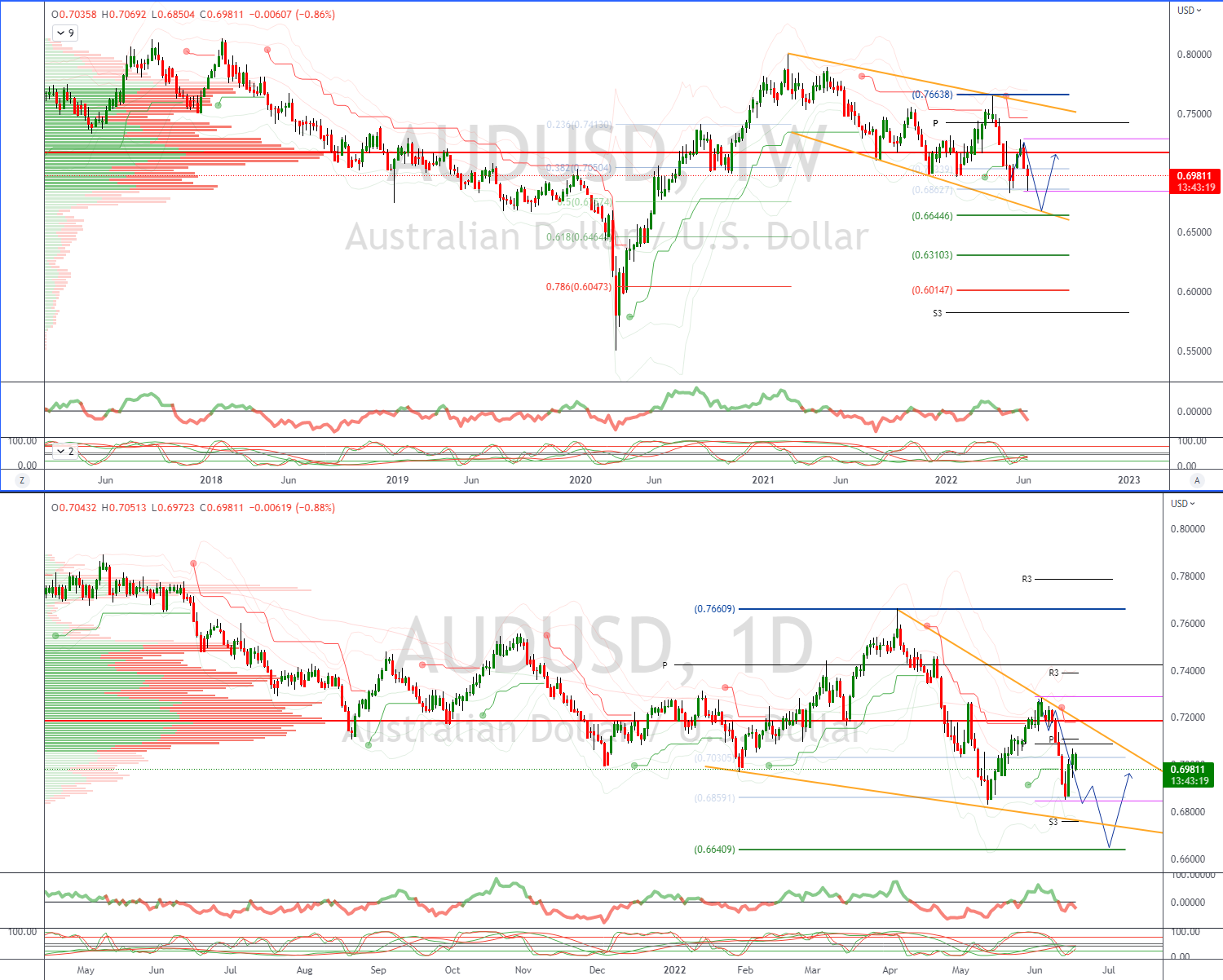

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD dunked below 0.7000 watermark again, last 0.6998

- Teases entry into VWAP downtrend channel at 0.7008

- Fri close below cements near-term bearish bias

- AUD/USD might head for May low 0.6829 if signal confirmed

- USD broadly stronger as UST yields recover from risk-off

- S&P futures rising modestly, last +0.5%, after Thurs wipeout

- Offers seen towards.7100, support sited towards 0.6850 and current cycle low at 0.6829

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!