Daily Market Outlook, June 15, 2022

Daily Market Outlook, June 15, 2022

Overnight Headlines

- ECB to hold an ad-hoc Governing Council meeting this morning

- ECB to discuss the recent sell-off in government bond markets

- Largest Rate Hike In Years Likely As FOMC To Tackle Inflation

- China Puts Monetary Easing On Hold With Fed To Hike Rates

- China Industrial Output Recovers While Consumers Still Wary

- Beijing Virus Cases Remain Elevated In Threat To Covid Zero

- Pres Biden Ally Floats Oil Profits Surtax To Moderate Inflation

- US Awaits 'Constructive' Response From Tehran On Iran Deal

- Japan Manufacturers' Mood Expands Amid Resilient Demand

- Australia Minimum Wage Rises 5.2% Amid Inflation Pressures

- ECB’s Schnabel: No Limits In ECB Fight Against Fragmentation

- UK PM Johnson Tells Cabinet ‘De-Escalate’ Protocol Stand-Off

- Global Bonds On Cusp Of Bear Market As Fed Face Reckoning

- Dollar Towers Versus Peers As Markets Bet On Large Fed Hike

The Day Ahead

- Asian equity performance is mixed this morning. Chinese indices are up but most markets are down again. That follows another set of falls in European and US stocks yesterday as markets remain very nervous ahead of tonight’s US monetary policy update. Chinese equities may have been supported by better-than-expected data releases for May industrial production and retail sales, which suggested that economic activity may have bottomed out during the month.

- Today’s US Federal Reserve policy announcement seems set to add to the recent spate of aggressive tightening moves by central banks. A third consecutive interest rate increase tonight is seen as a virtual certainty by markets but there has been considerable debate in the last few days over the likely size of the move. Fed policymakers have been signalling their intention to make a second consecutive 50 basis points increase today ever since their last meeting in May. However, on the back of last Friday’s higher-than-expected May CPI inflation print, markets are now speculating about a bigger rise of 75 or even 100bp. That would be an uncharacteristic move as the Fed likes to flag its policy changes well in advance but cannot be ruled out. Of almost equal interest will be what is said of the plans for future policy meetings. Since the May meeting Fed policymakers have also been indicating that rates are likely to rise by a further 50bp in July. That seems at the very least likely to be confirmed today but there is a chance of a signal that the Fed may opt for a larger increase.

- Additionally Fed policymakers updated economic forecasts, particularly the ‘dot plot’ of interest rate projections, will provide indications of their policy intentions for September and beyond. The last ‘dot plot’ update in March showed a median expectation amongst policymakers of rates reaching about 1.875% by the end of 2023 (its potential level after the July meeting) and rising further to a peak of 2.875% by end 2024. Expectations now are that the Fed will raise this year’s end rate, possibly to 3.0% and project further increases in 2024. That would send a signal that another 50bp increase in September is possible and crucially that rates are likely to be pushed above their estimated ‘neutral rate’ of 2-3%. Overall, the market is braced for a hawkish policy message from the Fed with the uncertainty being just how hawkish.

- According to Reuters, The European Central Bank's rate-setting Governing Council will hold an unscheduled meeting on Wednesday morning to discuss the recent sell-off in government bond markets, a spokesperson said. Bond yields have risen sharply since the ECB promised a series of rate hikes last Thursday and the spread between the yields of Germany and more indebted southern nations, particularly Italy, soared to its highest in over two years. "The Governing Council will have an ad-hoc meeting on Wednesday to discuss current market conditions," an ECB spokesperson said.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0415 (264M), 1.0500-10 (665M

- USD/CHF: 0.9950 (400M). AUD/USD: 0.7050 (651M)

- NZD/USD: 0.6100 (381M). AUD/JPY: 94.85 (295M)

- USD/ZAR: 15.60-70 (300M)

Technical & Trade Views

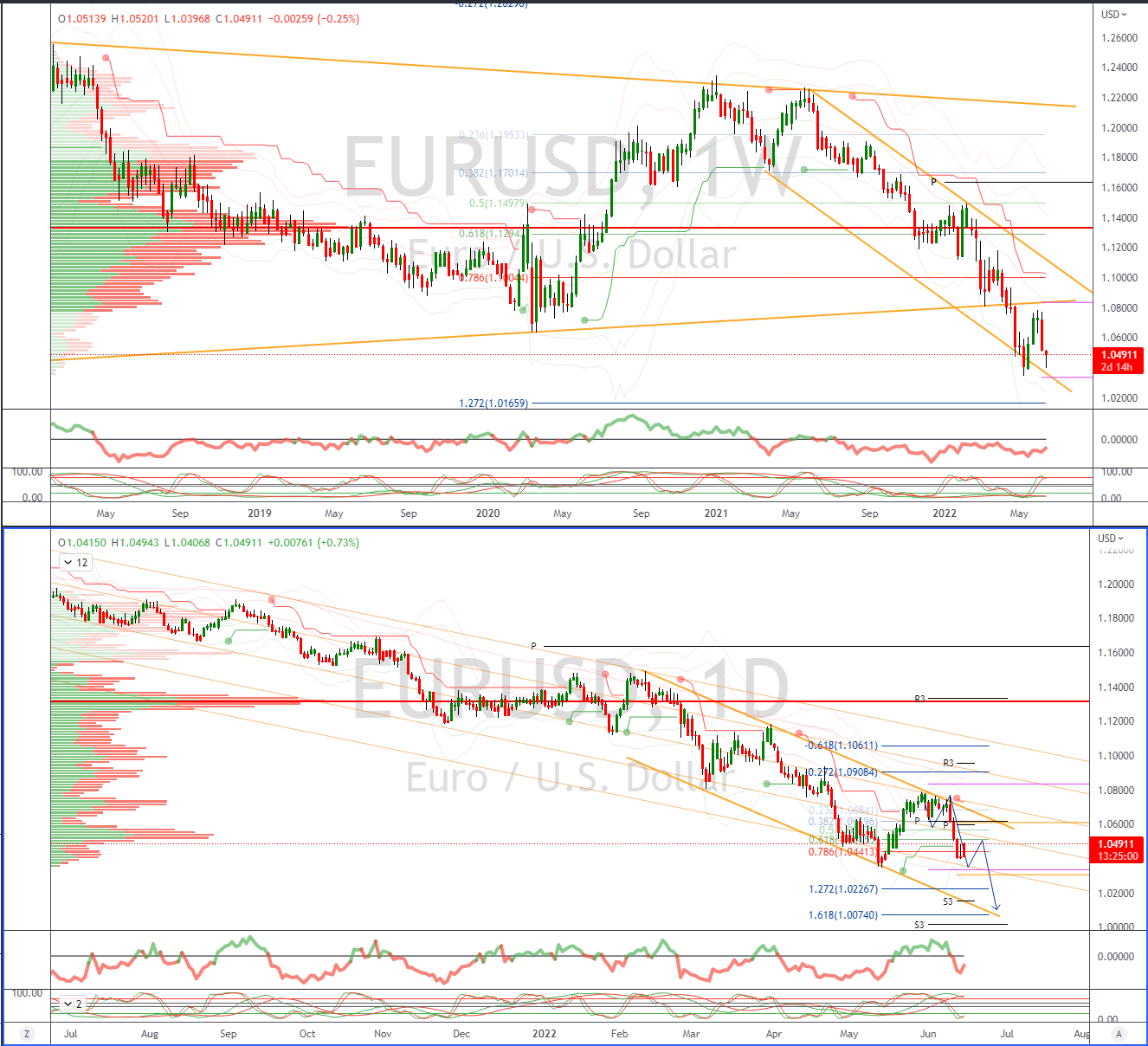

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR spikes on announcement of ad hoc ECB meeting on bond route

- Concern about a surge in yields may limit tightening, not add to it

- EURO bears view upside push as selling opportunity into FOMC

- Traders are running long EUR/USD into the event

- EUR/USD has fallen 1.0713-1.0397 since last IMM positioning data

- A pause today ahead of the Fed statement possible

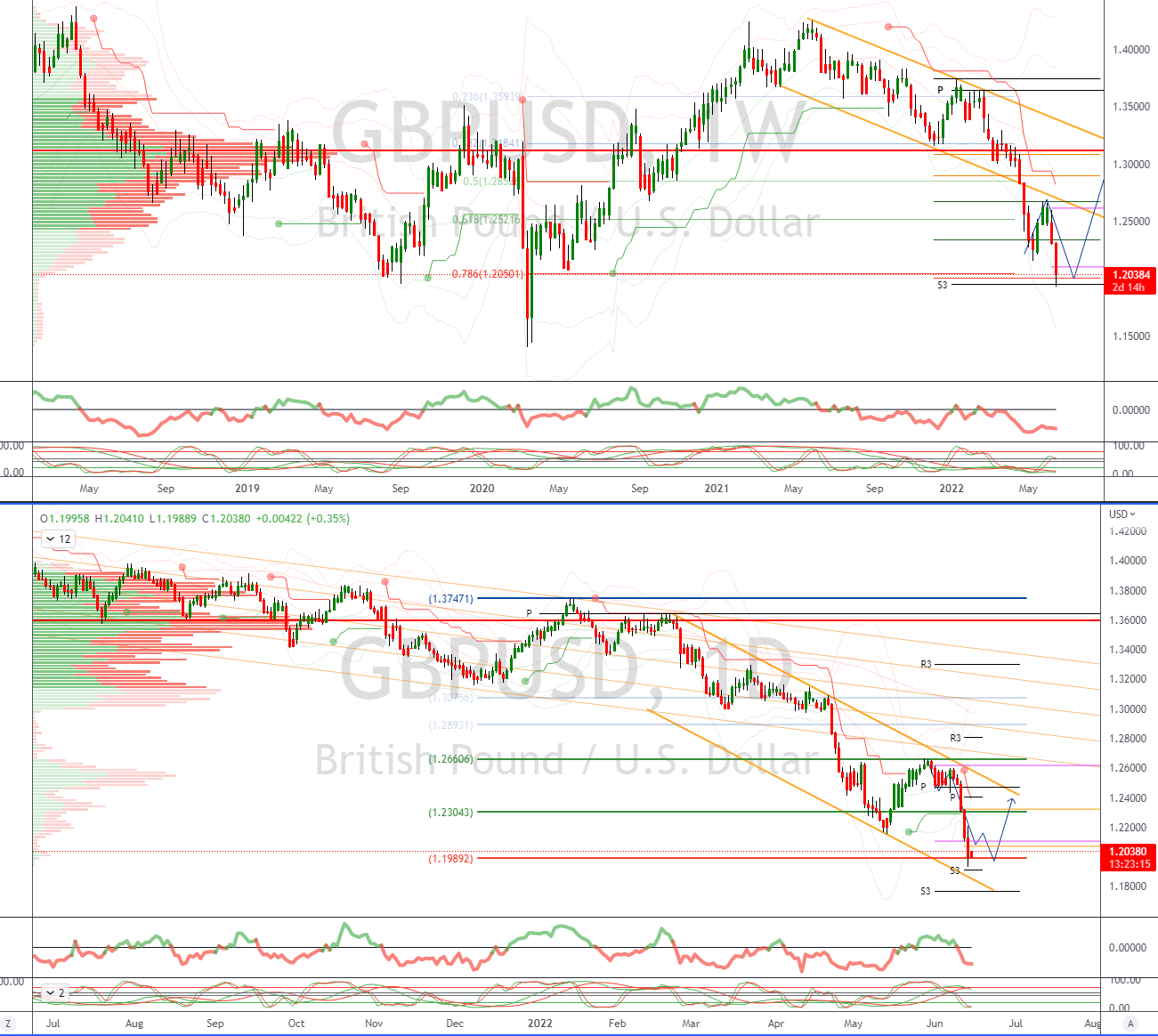

GBPUSD Bias: Bearish below 1.26 Bullish above.

- Traded in a 1.1993-1.2040 range with plenty of interest on D3

- +0.25% with the USD index off 0.25%, E-minis +0.5%, 10yr UST -4bp 3.430%

- Position adjustments into the FOMC - 0.75% hike expected

- VWAP is bearish

- Momentum studies head lower, which is a strong bearish trending setup

- 1.2085 lower 20 day VWAP band suggests sterling oversold short term

- Bids seen towards 1.1930’s offers at 1.2210

- Cable under pressure, unless the Fed disappoints

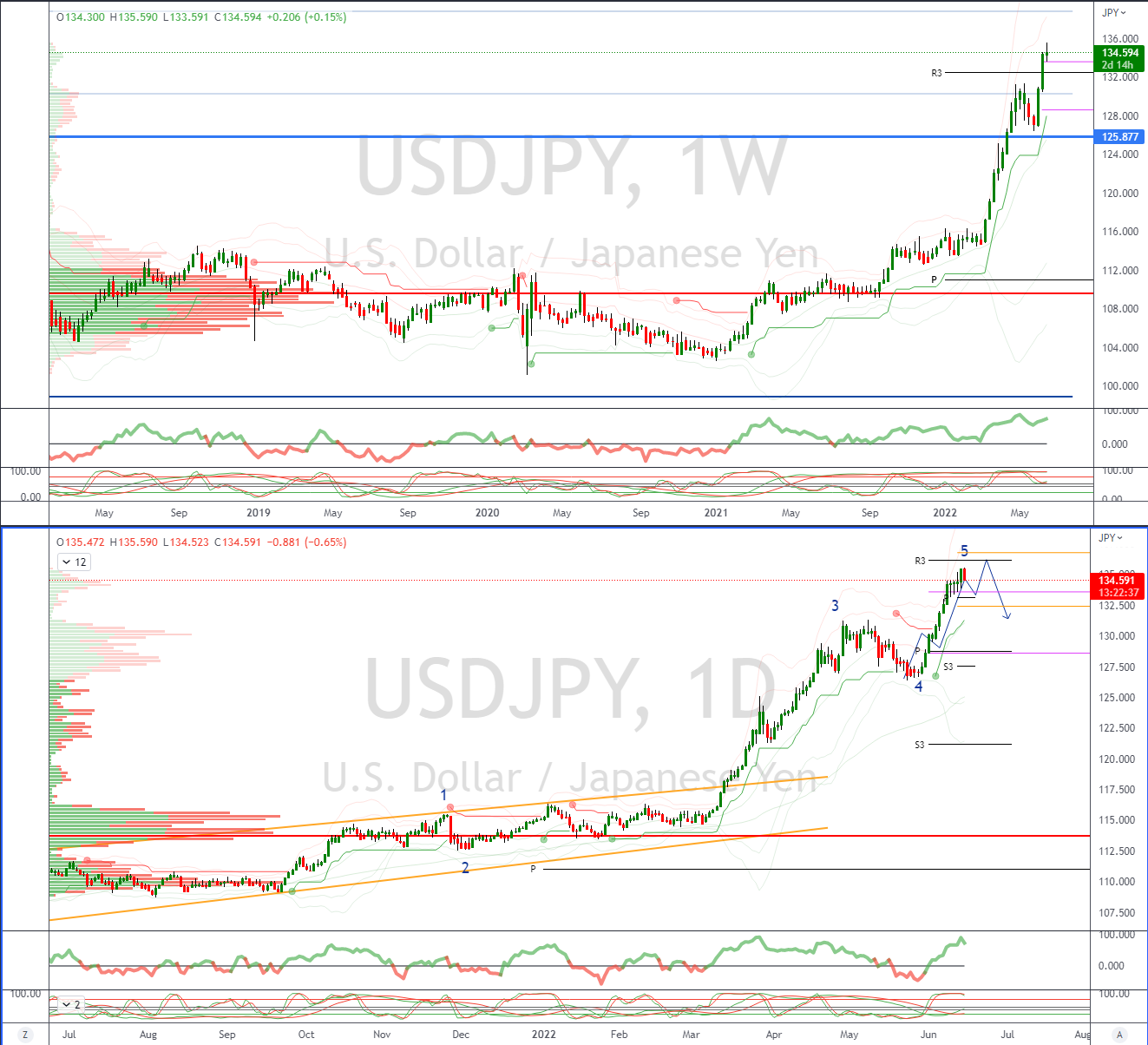

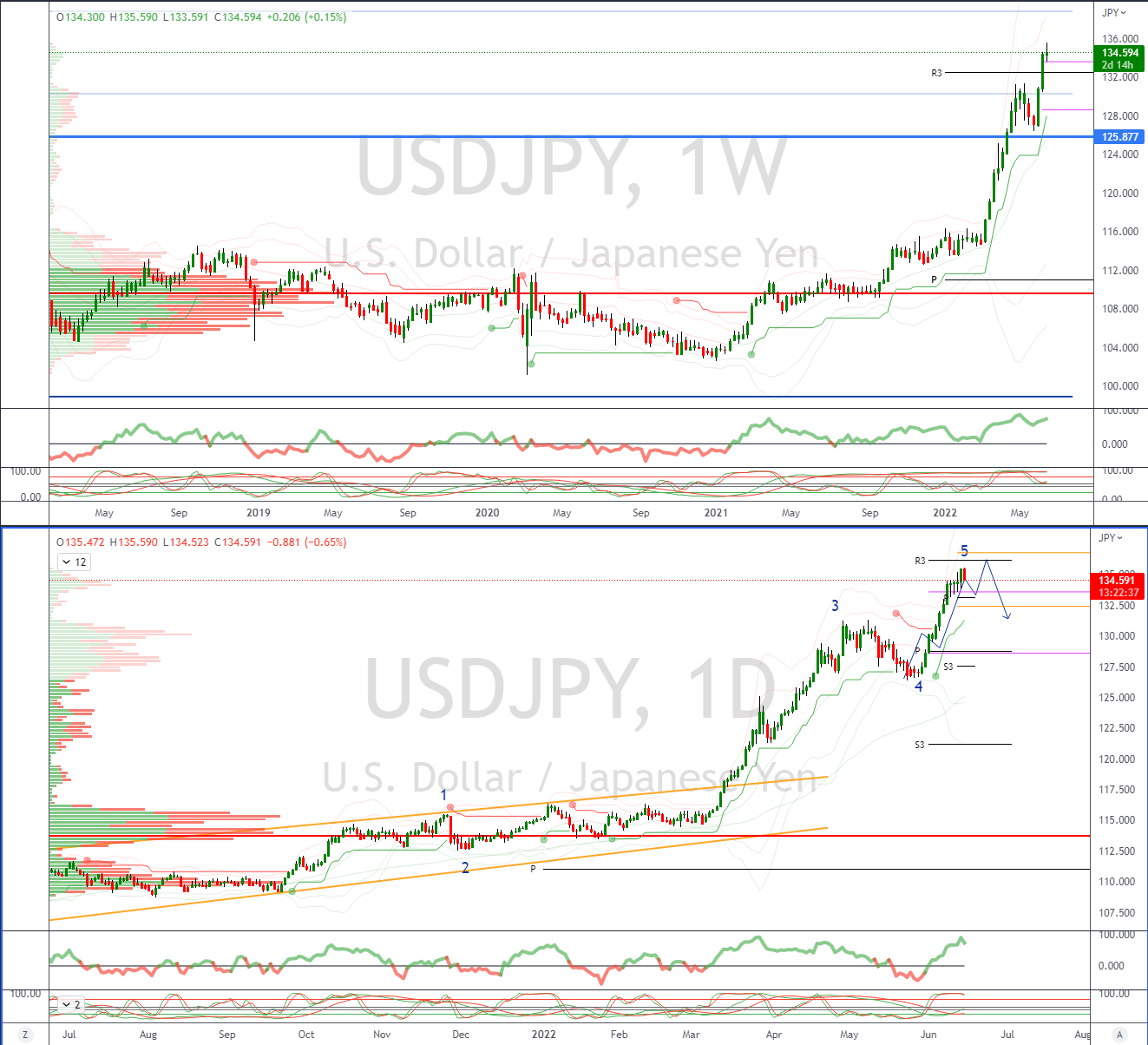

USDJPY Bias: Bullish above 127 Bearish below

- USD/JPY retreats after push to 135.60 in early Asia trade

- Low limited to 134.87 however despite Chief CabSec Matsuno jaw-boning BOJ action

- Japanese importers remain in buy the dip posture

- Japanese exporters on the offer above 136, market chatter of M&A activity also noted

- Firm US yields also supportive, Treasury 2s @3.369%, 10s @3.426%

- BoJ operations keep JGB yields pressured

AUDUSD Bias: Bullish above .7200 Bearish below

- Higher on hawkish RBA

- AUD/USD opened -0.81% @ 0.6870 as weak stocks and higher US yields weighed

- Hawkish RBA Governor Lowe supported AUD in Asia trade

- AUD/USD given a further boost by calming equities and broad USD selling

- Position squaring ahead of FOMC decision likely

- AUD/USD offers at yesterday's 0.6970 high and stops seen above 0.7015

- Support seen at year to date lows with bids highlighted towards 0.6850

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!