Daily Market Outlook, June 14, 2024

Daily Market Outlook, June 14, 2024

Munnelly’s Macro Minute…

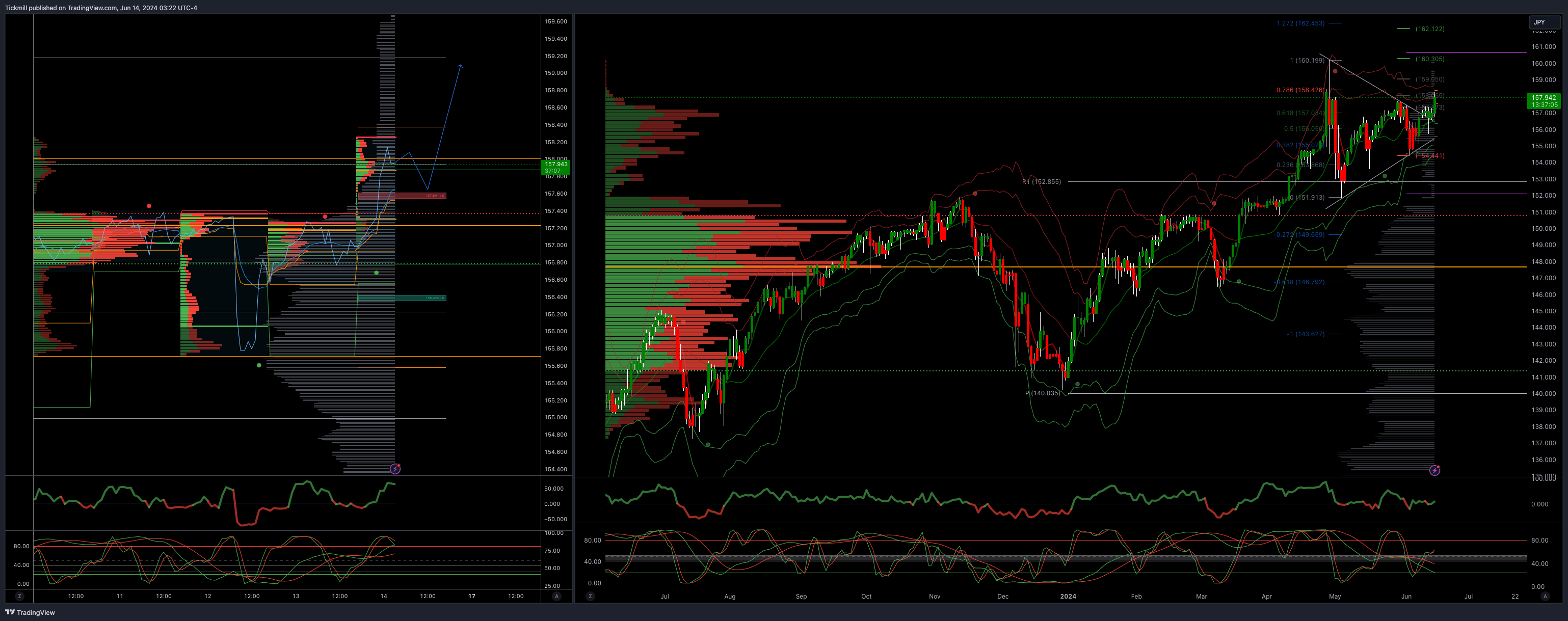

“BoJ Hesitation Hampers JPY ”

The Bank of Japan surprised the market by announcing a plan to reduce bond buying in the future, but the specifics will be revealed at the next meeting in July. It will continue buying government bonds at the current pace, but details of the tapering plan for the next one to two years will be discussed in July.

Despite gains in Japan's market, MSCI's Asia Pacific index declined due to losses in Australian and Chinese companies. Mainland Chinese stocks continued to decline for the fourth week, prompting calls for policy loosening by the country's central bank. Meanwhile, the S&P 500 set a new record driven by tech stocks, but US stock futures only saw slight gains in Asia. The value of the dollar remained stable relative to other major world currencies.

The G7 leaders will hold their final day of talks on Friday, with China being the main topic before Pope Francis makes a historic appearance to discuss artificial intelligence. The focus will also be on European automakers following the European Commission's decision to impose tariffs on imported Chinese electric vehicles, which China has criticized as protectionist. However, China still faces a tougher stance from the U.S., which leans towards complete separation from China.

The Euro has been facing pressure due to the political uncertainty in Europe following French President Emmanuel Macron's announcement of a snap election in France. Meanwhile, Tesla shareholders have given their approval for CEO Elon Musk's $56 billion pay package, demonstrating the strong support Musk receives from Tesla's retail investors, many of whom are enthusiastic followers of the unpredictable billionaire. Despite resistance from certain major institutional investors and proxy firms, the proposal was successfully passed.

In his press conference BOJ Governor Ueda emphasizes uncertainties and the need for appropriate policy. He reiterates previous policy statements, stating that the current policy is suitable given the economic and price uncertainties. The BOJ plans to announce tapering plans at the next Policy Board meeting, taking into account market conditions and player views. It seems that he is suggesting a slow and gradual process of tapering quantitative easing, and does not rule out future rate hikes when necessary. Regarding foreign exchange, they are monitoring the impact of yen movements on the economy and prices, and are aware of the negative effects of recent yen movements on prices. Governor Ueda is not introducing any significantly new information, and the policy will remain accommodative for now.

Overnight Newswire Updates of Note

Yen Falls As BoJ Say To Specify Bond-Buying Plan Next Month

China’s Rate-Cut Calls Surge, Testing Resolve To Defend Yuan

RBA To Hold Rates Through September, Deliver First Cut In Q4

Reform UK Overtakes PM Sunak's Conservatives In Opinion Poll

France’s Left Unites To Challenge Le Pen, Pres Macron For Power

ANC Say South African Parties Still Discussing Unity Government

Oil’s Run Of Gains Comes To Abrupt Halt On Risk-Off Sentiment

Apple Tops Microsoft In Value After Best 3-Day Run Since 2020

Tesla Investors Back Musk’s $56Bln Pay Deal, Move To Texas

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0660-70 (2.51BLN), 1.0700 (1.0BLN), 1.0725 (359M)

1.0750-55 (855M), 1.0795-1.0810 (3.22BLN), 1.0825-30 (821M)

1.0850 (217M), 1.0880-85 (590M), 1.0890-00 (2.54BLN)

1.0925-35 (2.44BLN), 1.0945-50 (2.96BLN)

USD/JPY: 157.00 (461M), 157.25 (689M), 158.00 (745M)

158.25 (314M), 159.00 (415M)

USD/CHF: 0.8750 (600M), 0.9000 (1.8BLN). EUR/CHF: 0.9800 (231M)

GBP/USD: 1.2790-1.2805 (775M). EUR/GBP: 0.8440 (1.13BLN)

AUD/USD: 0.6595-0.6600 (942M), 0.6615-20 (1.44BLN)

0.6640-45 (704M). NZD/USD: 0.6035 (378M)

USD/CAD: 1.3700 (571M), 1.3725-35 (732M), 1.3740-50 (1.63BLN)

1.3760 (1.65BLN), 1.3775-80 (500M) 1.3800-15 (1.68BLN)

EUR/SEK: 11.45 (500M)

CFTC Data As Of 07/06/24

Bitcoin net short position is -1,119 contracts

Swiss Franc posts net short position of -45,763 contracts

British pound net long position is 43,210 contracts

Euro net long position is 67,870 contracts

Japanese yen net short position is -132,101 contracts

Equity fund managers cut S&P 500 CME net long position by 23,186 contracts to 954,821

Equity fund speculators increase S&P 500 CME net short position by 2,269 contracts to 332,326

Gold NC Net Positions up to $237.3K from previous $236.6K

Technical & Trade Views

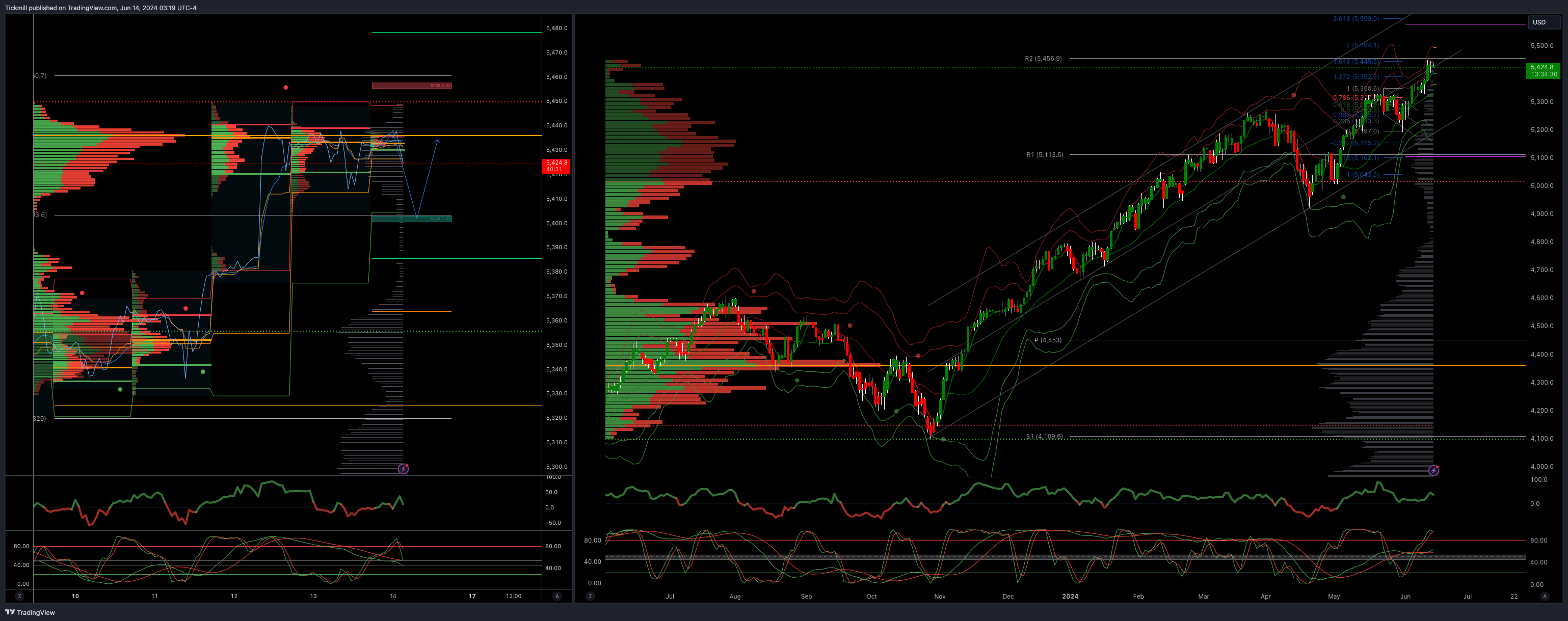

SP500 Bullish Above Bearish Below 5414

Daily VWAP bullish

Weekly VWAP bullish 5319

Below 5400 opens 5385

Primary support 5370

Primary objective is 5403 TARGET ACHIEVED NEW PATTERN EMERGING

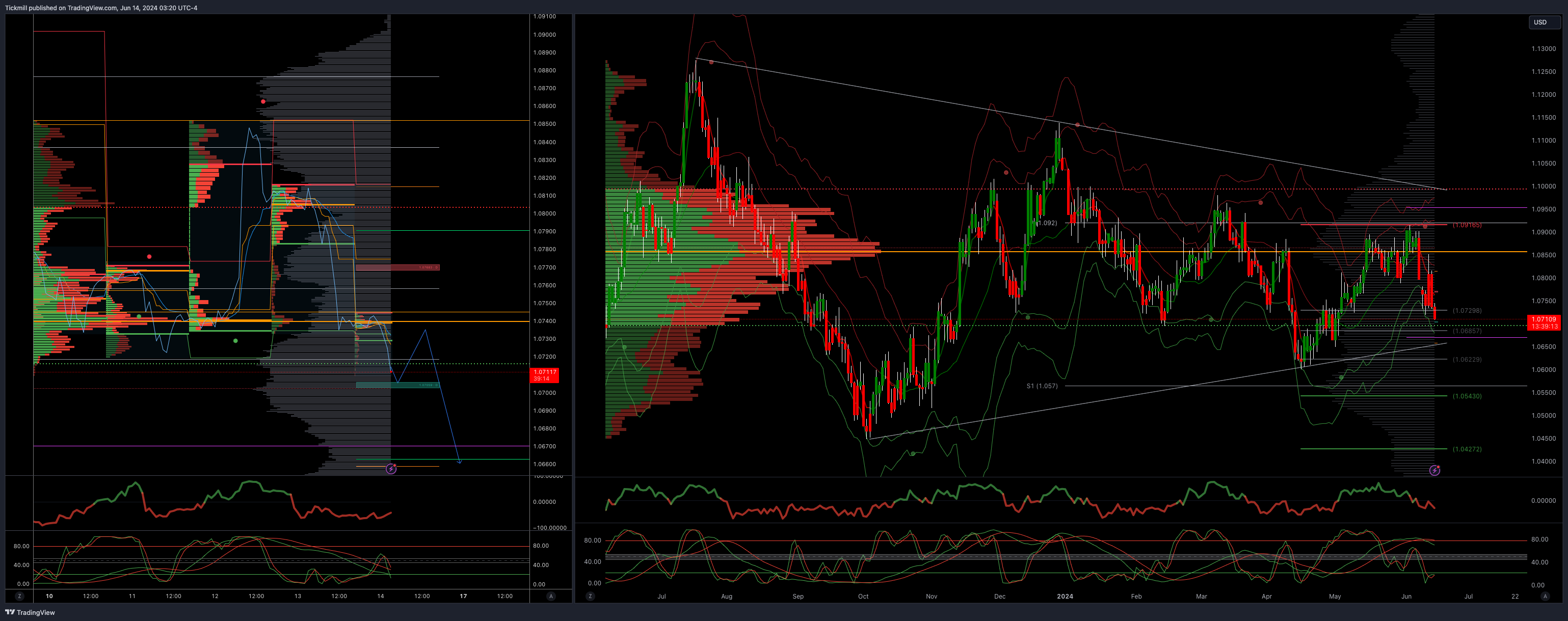

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish 1.0830

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

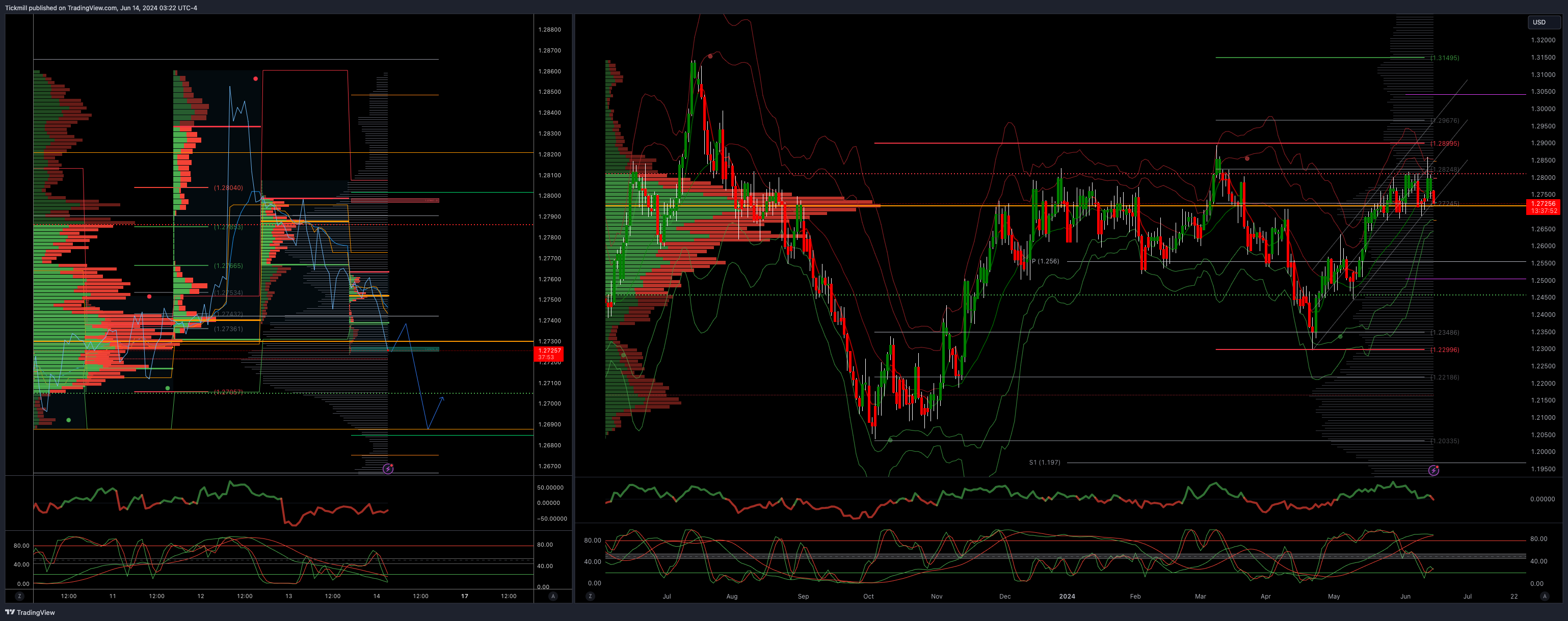

GBPUSD Bullish Above Bearish Below 1.2760

Daily VWAP bullish

Weekly VWAP bearish 1.2720

Below 1.2740 opens 1.2690

Primary support is 1.2670

Primary objective 1.2850 TARGET ACHIEVED NEW PATTERN EMERGING

USDJPY Bullish Above Bearish Below 157.20

Daily VWAP bullish

Weekly VWAP bullish 156.60

Below 156.80 opens 155.80

Primary support 152

Primary objective is 160

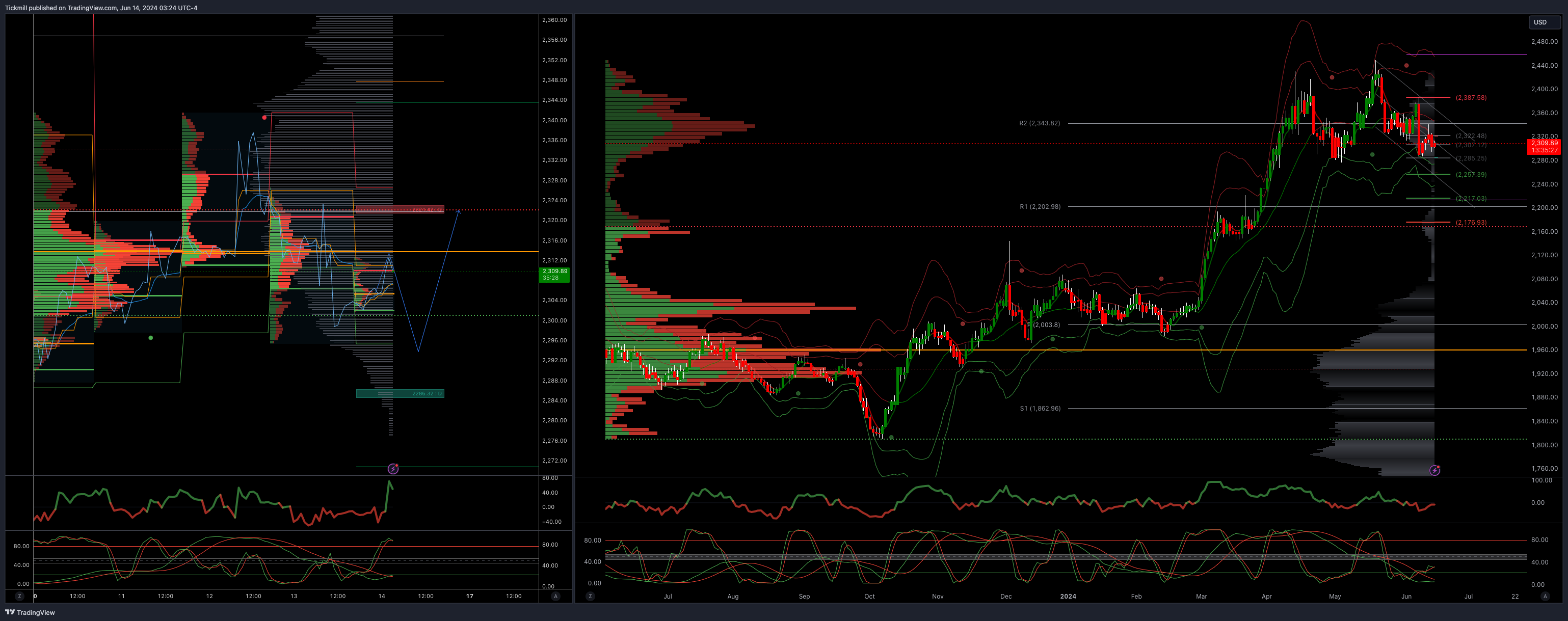

XAUUSD Bullish Above Bearish Below 2320

Daily VWAP bearish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary support 2300

Primary objective is 2262

BTCUSD Bullish Above Bearish below 70000

Daily VWAP bearish

Weekly VWAP bearish 68015

Below 66300 opens 64500

Primary support is 65000

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!