Daily Market Outlook, June 12, 2024

Daily Market Outlook, June 12, 2024

Munnelly’s Macro Minute…

“A Potentially Wild Wednesday WIth US Inflation & FOMC On Deck ”

During the Asian session, China experienced a 0.1% decrease in its consumer price index in May compared to the previous month, which was below expectations. This decline is attributed to price competition intensifying deflationary pressures in the world's second-largest economy.

Meanwhile, Japan saw a significant increase in wholesale inflation in May, marking the fastest annual growth in nine months, partly due to the weakening yen putting upward pressure on prices. This data adds complexity to the Bank of Japan's upcoming decision on when to raise interest rates. The overnight implied volatility for the USDJPY pair surged to its highest level in six weeks, indicating that traders are preparing for a potentially turbulent market.

The markets are expected to be cautious during the morning hours in Europe, with anticipation for a significant session in the U.S. This session includes the release of inflation data before the Federal Reserve's meeting to determine interest rates and share its economic forecasts. This is likely to overshadow the final German CPI figures and the UK's monthly GDP data scheduled for release earlier in the day.

Market watchers predict that the U.S. headline inflation will remain stable in May. A higher inflation rate may not be well-received by the stock markets, especially if it appears to reverse the previous cooling trend seen in April. Markets anticipate a decrease in the US headline CPI inflation month-on-month rate to 0.2% in May from 0.3% in April, primarily due to reduced gasoline prices. As for the core rate (excluding energy and food), markets project the monthly rate to remain unchanged at 0.3%, while the annual rate is anticipated to decrease to 3.5% from 3.6%.

With regards to the FOMC announcement this evening the focus will be on the economic projections and Federal Reserve Chairman Jerome Powell's explanation during the press conference, as it is expected that the Fed will maintain the current interest rates. The Fed's previous projection in March suggested three rate cuts for the year, but this is likely to change due to persistent inflation and a strong economy. Currently, the market anticipates approximately 40 basis points of rate cuts in 2024. If the median projection decreases to just one 25bp cut, it would be viewed negatively, while a projection of zero cuts would be seen as very hawkish. How Powell presents this information will be crucial - will fewer cuts this year imply more next year, or not? The March projections also indicated longer-term interest rates between 2.4% and 3.8%, with a slight increase from the previous figures. If these projections start to rise, it could disrupt the bond rally that was already impacted by last week's unexpectedly strong jobs report.

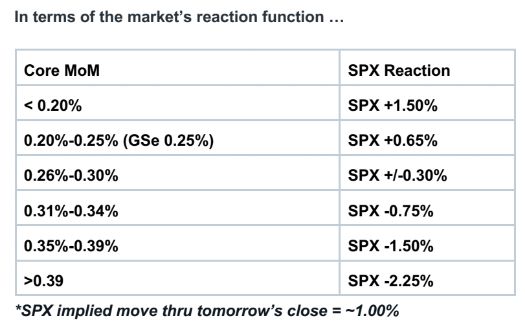

Below is an excerpt from Goldmans Sachs Research note to clients with scenario analysis for SPX reaction to US CPI

Overnight Newswire Updates of Note

Overnight Newswire Updates of Note

FOMC Faces Dot-Plot Cliffhanger As May Inflation Report Looms

US Weigh More Limits On China’s Access To Chips Needed For AI

China's Mild Inflation Fails To Quell Concerns Over Weak Demand

BoJ Set To Keep Ultra-Low Rates, Debate Huge Bond Buying Fate

Japan Wholesale Inflation Rises, Complicates BoJ Rate Hike Path

Aussie Consumer Confidence Posts Biggest Weekly Fall This Year

Bank Of France Cuts Growth Outlook As Budget Cuts Seen Biting

Le Maire Warns Of French Debt Crisis If Le Pen’s Party Wins Vote

Hamas Says Creates Broad Prospects For Ceasefire Deal In Gaza

Oil Holds Gain As Industry Report Points To Lower US Stockpiles

Peso Crushed As Investors Worry Sheinbaum’s Win Was Too Big

Oracle Sees Strong Bookings, Signals Further Cloud Momentum

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0700 (636M), 1.0750 (350M), 1.0760-70 (714M), 1.0800 (377M)

1.0820-30 (1BLN)

USD/CHF: 0.8950-55 (720M), 0.9000 (301M)

EUR/CHF: 0.9700 (316M), 0.9725 (1.1BLN)

AUD/USD: 0.6615-20 (1.1BLN), 0.6650 (340M), 0.6665-80 (516M)

AUD/CAD: 0.9060 (431M)

USD/CAD: 1.3695-1.3700 (1.2BLN), 1.3755-60 (429M),

USD/JPY: 158.00-10 (420M), 158.25 (259M)

EUR/USD: 1.0665-75 (722M), 1.0700 (567M), 1.0725 (490M), 1.0740-45 (402M)

1.0800-10 (3.1BLN), 1.0885 (677M), 1.0900 (710M)

USD/CHF: 0.8970-80 (650M), 0.9000 (365M)

EUR/CHF: 0.9650 (240M). EUR/GBP: 0.8480 (459M), 0.8530 (229M)

GBP/USD: 1.2700 (361M), 1.2795-1.2805 (2.4BLN)

AUD/USD: 0.6615-20 (2.6BLN), 0.6630 (1.1BLN), 0.6650 (797M)

NZD/USD: 0.6100 (1BLN), 0.6200 (1.5BLN)

AUD/NZD: 1.0700 (605M), 1.0900 (2BLN)

USD/CAD: 1.3755 (200M), 1.3775 (277M), 1.3800 (751M)

USD/JPY: 156.00 (940M), 156.50 (440M), 156.80 (756M), 157.00 (841M)

157.50 (610M)

EUR/NOK: 11.458 (490M)

The inclusion of U.S. CPI in the overnight options initially led to underpricing. Traders may have been waiting for the expiry to coincide with the Fed meeting on Wednesday. With the Fed now included, the implied volatility for overnight expiry is appropriately higher. Current levels are similar to those before the May CPI, but with the added impact of the June Fed meeting. For EUR/USD, overnight implied volatility is now at 14.0, compared to 7.5 when CPI was first included and 7.5 prior. Similarly, AUD/USD overnight volatility is now at 19.25, compared to 12.0 when CPI was first included and 11.5 prior. For USD/JPY, overnight volatility is now at 16.0, compared to 13.5 when CPI was first included and 10.25 prior.

CFTC Data As Of 07/06/24

Bitcoin net short position is -1,119 contracts

Swiss Franc posts net short position of -45,763 contracts

British pound net long position is 43,210 contracts

Euro net long position is 67,870 contracts

Japanese yen net short position is -132,101 contracts

Equity fund managers cut S&P 500 CME net long position by 23,186 contracts to 954,821

Equity fund speculators increase S&P 500 CME net short position by 2,269 contracts to 332,326

Gold NC Net Positions up to $237.3K from previous $236.6K

Technical & Trade Views

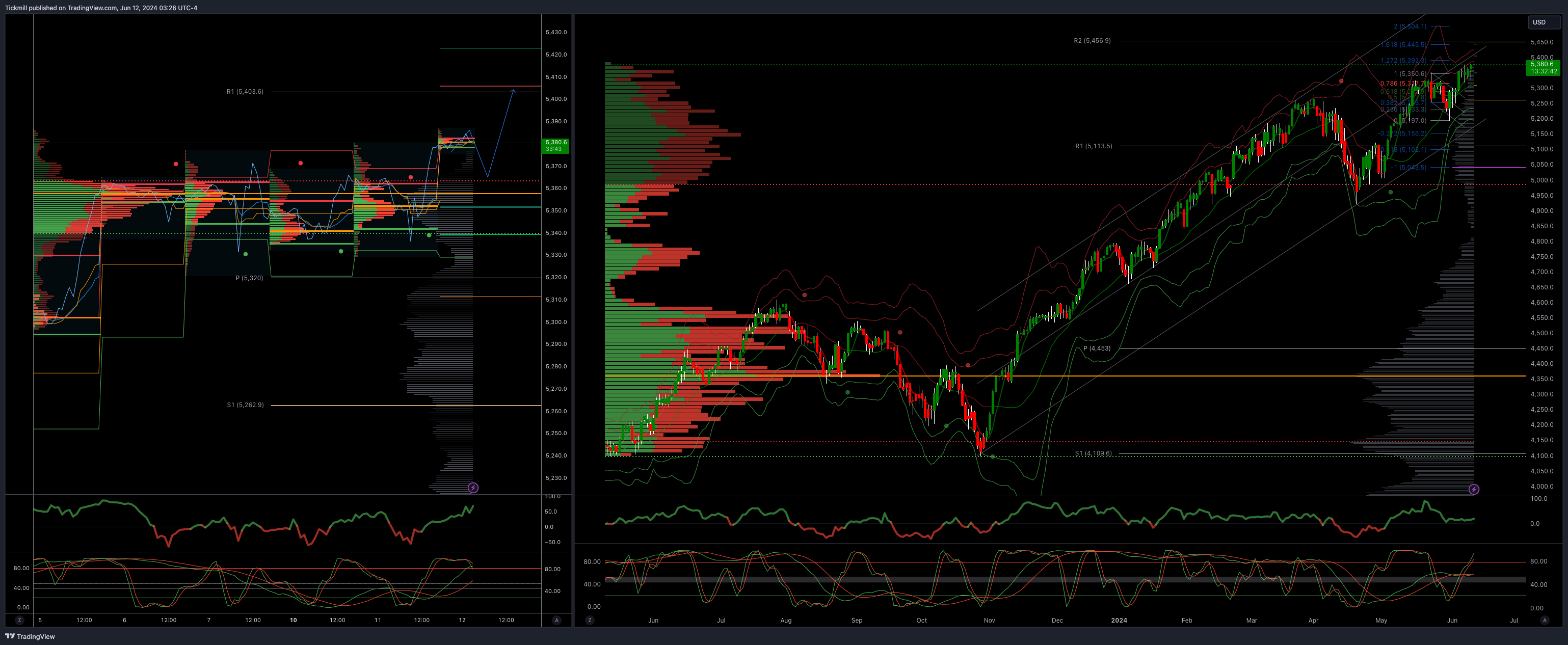

SP500 Bullish Above Bearish Below 5360

Daily VWAP bullish

Weekly VWAP bullish 5319

Below 5330 opens 5300

Primary support 5275

Primary objective is 5403

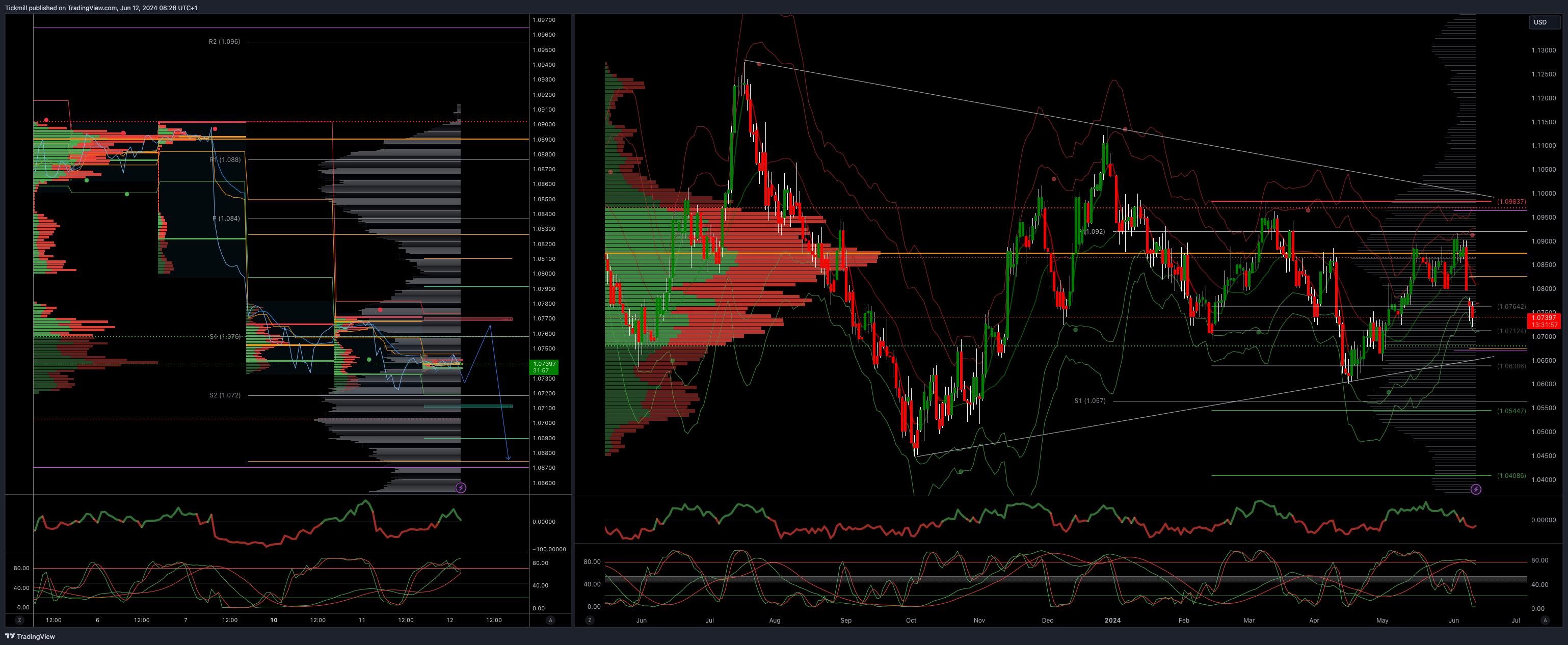

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish 1.0830

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

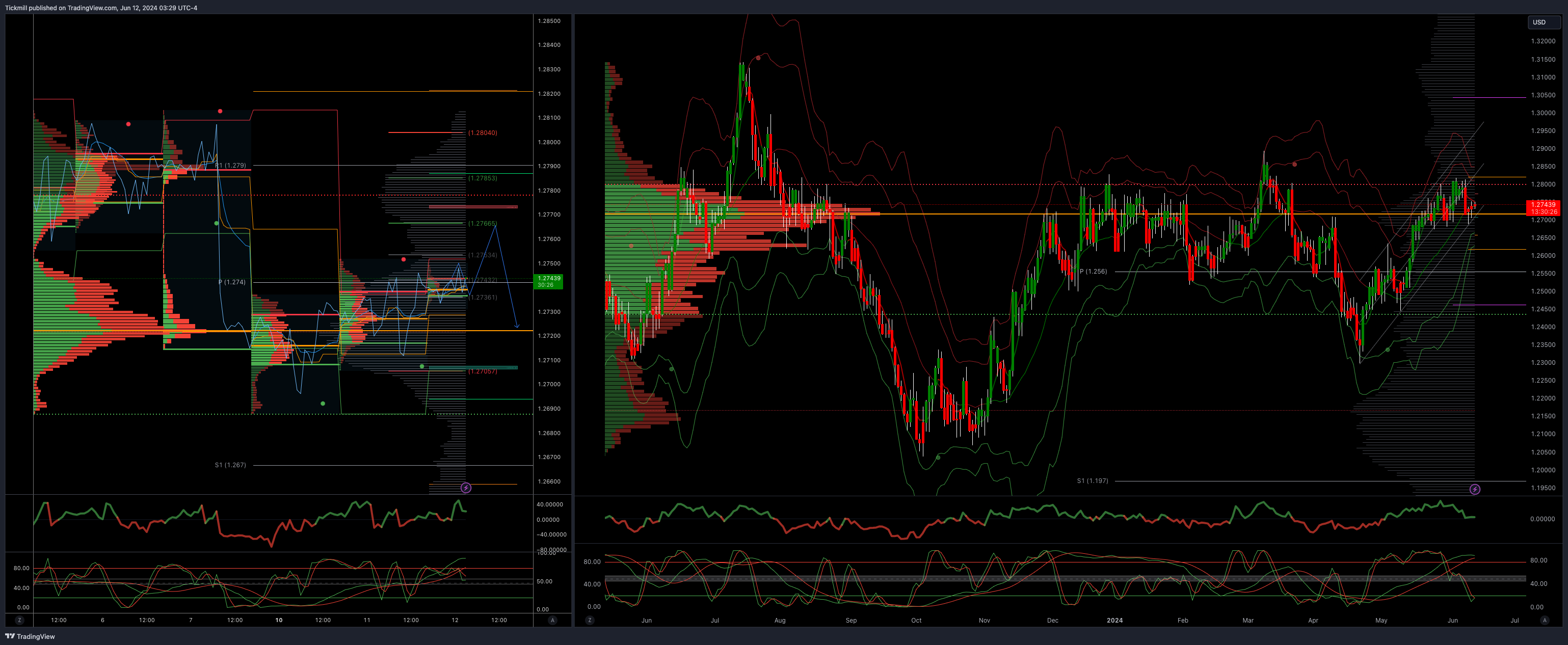

GBPUSD Bullish Above Bearish Below 1.2760

Daily VWAP bearish

Weekly VWAP bearish 1.2720

Below 1.2740 opens 1.2690

Primary support is 1.2670

Primary objective 1.2850

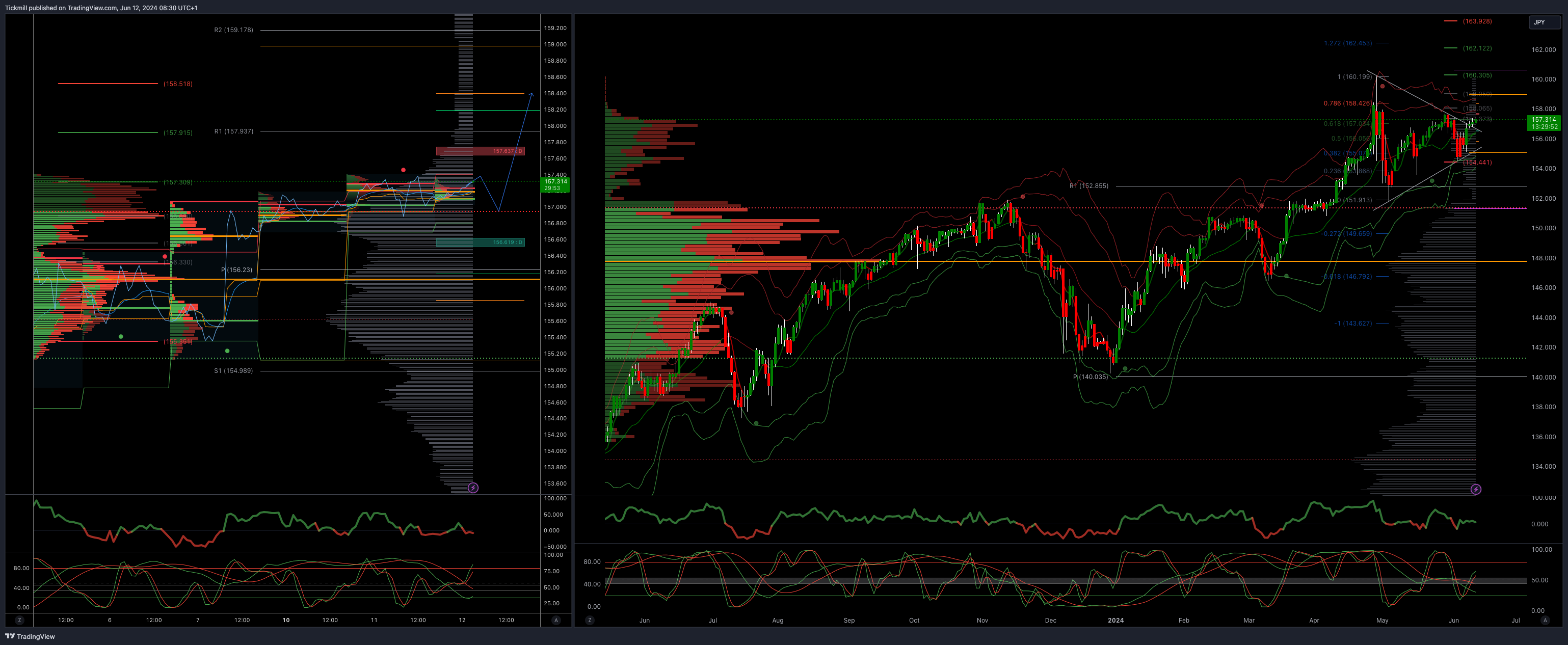

USDJPY Bullish Above Bearish Below 156

Daily VWAP bullish

Weekly VWAP bullish 156.60

Below 155.30 opens 154.50

Primary support 152

Primary objective is 160

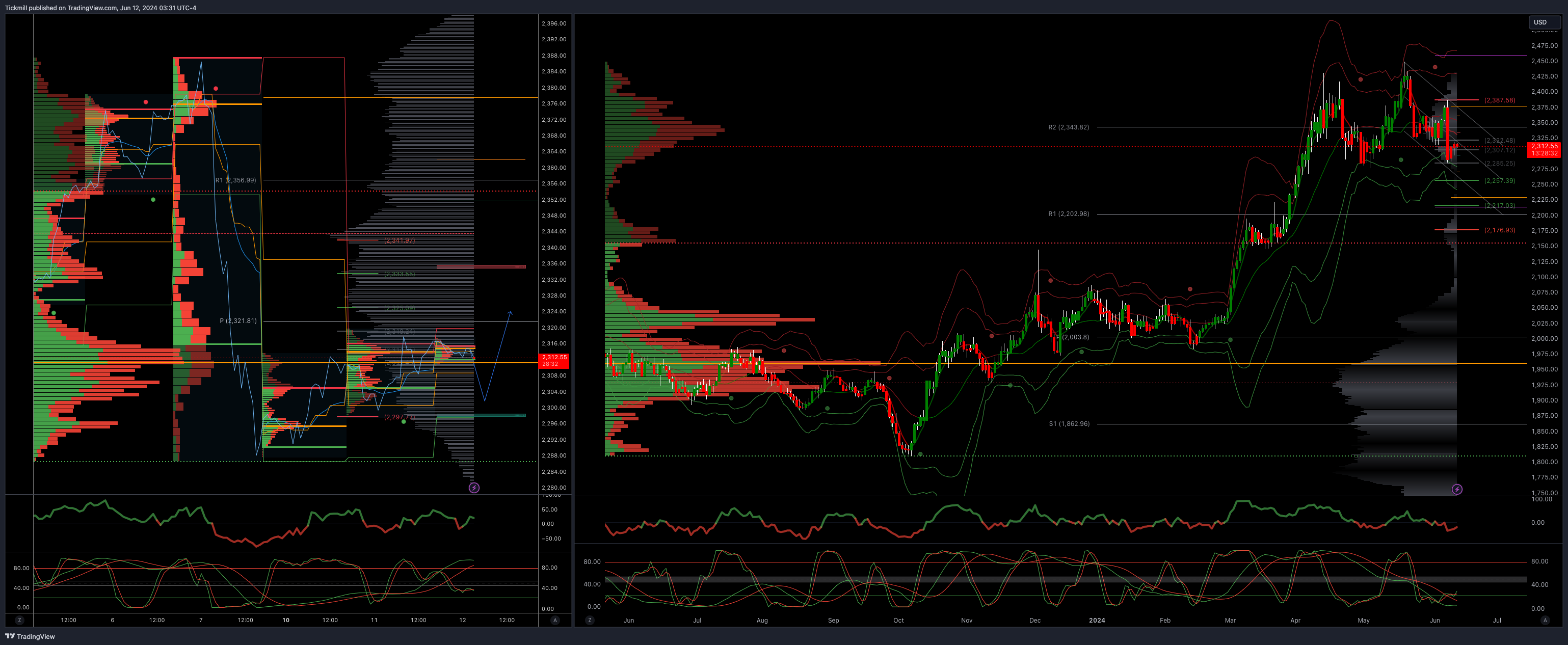

XAUUSD Bullish Above Bearish Below 2320

Daily VWAP bearish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary support 2300

Primary objective is 2262

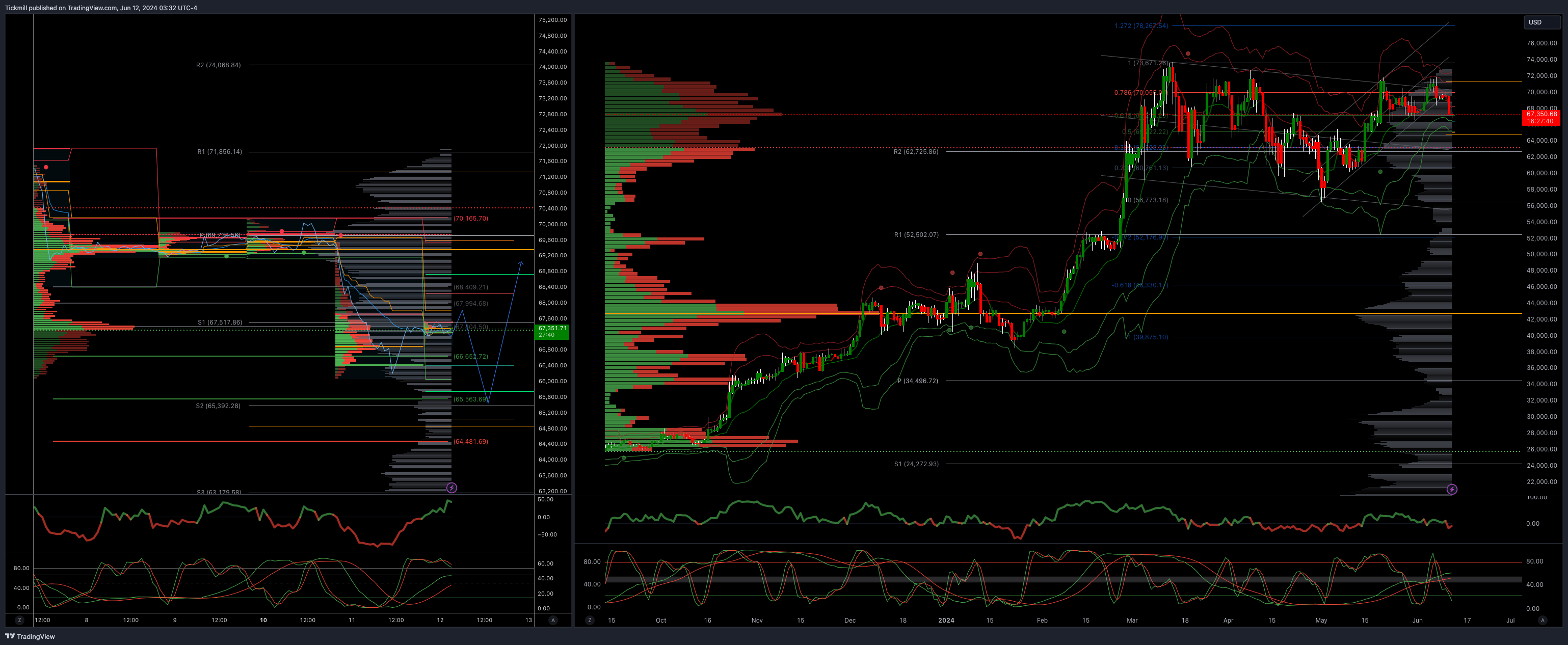

BTCUSD Bullish Above Bearish below 70000

Daily VWAP bearish

Weekly VWAP bearish 68015

Below 66300 opens 64500

Primary support is 65000

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!