Daily Market Outlook, June 10, 2024

Daily Market Outlook, June 10, 2024

Munnelly’s Macro Minute…

“Markets Cautious On French Political Uncertainty ”

President Macron's announcement to hold a sudden parliamentary election in France has had a negative impact on regional market sentiment, with the euro, European equity futures, and French bond futures all trading lower this morning. This decision comes after the ruling party suffered a significant defeat in the EU Parliament elections on Sunday. The first round of the election is set for June 30th. On the domestic front, the KPMG/REC May Report on Jobs showed a further decrease in permanent placements by UK recruiters, along with reports of a sharp rise in job seekers.

The previous week's surge in world shares following rate cuts in Canada and Europe quickly came to a halt, leaving Asian stocks to struggle on Monday due to holidays in Australia, China, Hong Kong, and Taiwan. While it is highly likely that the Fed will reduce their projections for three rate cuts this year during their rate decision announcement on Wednesday, the extent of the reduction remains uncertain. Futures indicate an approximate 36 basis points of easing priced in for this year, and the likelihood of a pre-election rate cut is uncertain. In addition to the Fed, the Bank of Japan is also meeting this week, with expectations for a reduction in its substantial bond purchases. This may provide some relief for the yen, which was facing difficulties in strengthening beyond 157 per dollar against a strengthening greenback on Monday.

Today's schedule is light, with Italian industrial production and the Eurozone Sentix investor confidence survey on the agenda. Comments from ECB members Holzmann and Nagel will be monitored for clues on the timing of the next ECB rate cut, following President Lagarde’s ambiguous guidance at last week’s press conference.

In the UK, while Bank of England rate-setters will remain quiet ahead of the election, previous comments suggest that a summer rate cut is possible, depending on data. Last week’s Decision Maker Panel (DMP) report supported this, confirming the decline in UK firms’ price and wage expectations. However, official wage growth data remains above levels considered stable by the Bank of England, making a rate cut this month unlikely.

Overnight Newswire Updates of Note

Far-Right Make Significant European Parliament Election Gains

ECB’s Holzmann Says Divergence From Fed Would Fuel Inflation

Macron Calls French Legislative Elections After EU Vote Defeat

Market To Scrutinise BoJ Over Signs Of Quantitative Tightening

Japan’s Opposition Party Calls On Kishida To Hold Snap Elections

Japan’s Sputtering Economy Yet To Show Clear Signs Of Recovery

Chancellor Scholz’s SPD Suffers Record Rout In German EU Vote

Germany Warns Against Trade Barriers As EU Readies EV Tariffs

Italy’s Meloni Wins EU Vote As Far-Right Gains Across The Block

UK PM Sunak Poised To Promise Another National Insurance Cut

UK Job Market On Its Way Back After Downturn, Recruiters Say

Gantz Quits Israel Government After PM Fails To Meet Demands

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: EUR/USD: 1.0685 (1.2BLN), 1.0750-60 (1.1BLN), 1.0775 (1.1BLN)

1.0800 (1BLN), 1.0850 (834M)

USD/CHF: 0.8900 (529M),0.8920 (250M), 0.8950 (339M), 0.9000 (600M).

EUR/CHF: 0.9650 (400M), 0.9700 (705M)

AUD/USD: 0.6590-0.6600 (1.6BLN), 0.6700 (688M)

NZD/USD: 0.6150 (218M), 0.6200 (324M)

USD/CAD: 1.3625 (720M), 1.3680 (639M), 1.3750 (610M)

USD/JPY: 155.95-156.00 (801M), 156.15 (404M), 157.00-15 (700M)

158.00 (250M)

CFTC Data As Of 07/06/24

Bitcoin net short position is -1,119 contracts

Swiss Franc posts net short position of -45,763 contracts

British pound net long position is 43,210 contracts

Euro net long position is 67,870 contracts

Japanese yen net short position is -132,101 contracts

Equity fund managers cut S&P 500 CME net long position by 23,186 contracts to 954,821

Equity fund speculators increase S&P 500 CME net short position by 2,269 contracts to 332,326

Gold NC Net Positions up to $237.3K from previous $236.6K

Technical & Trade Views

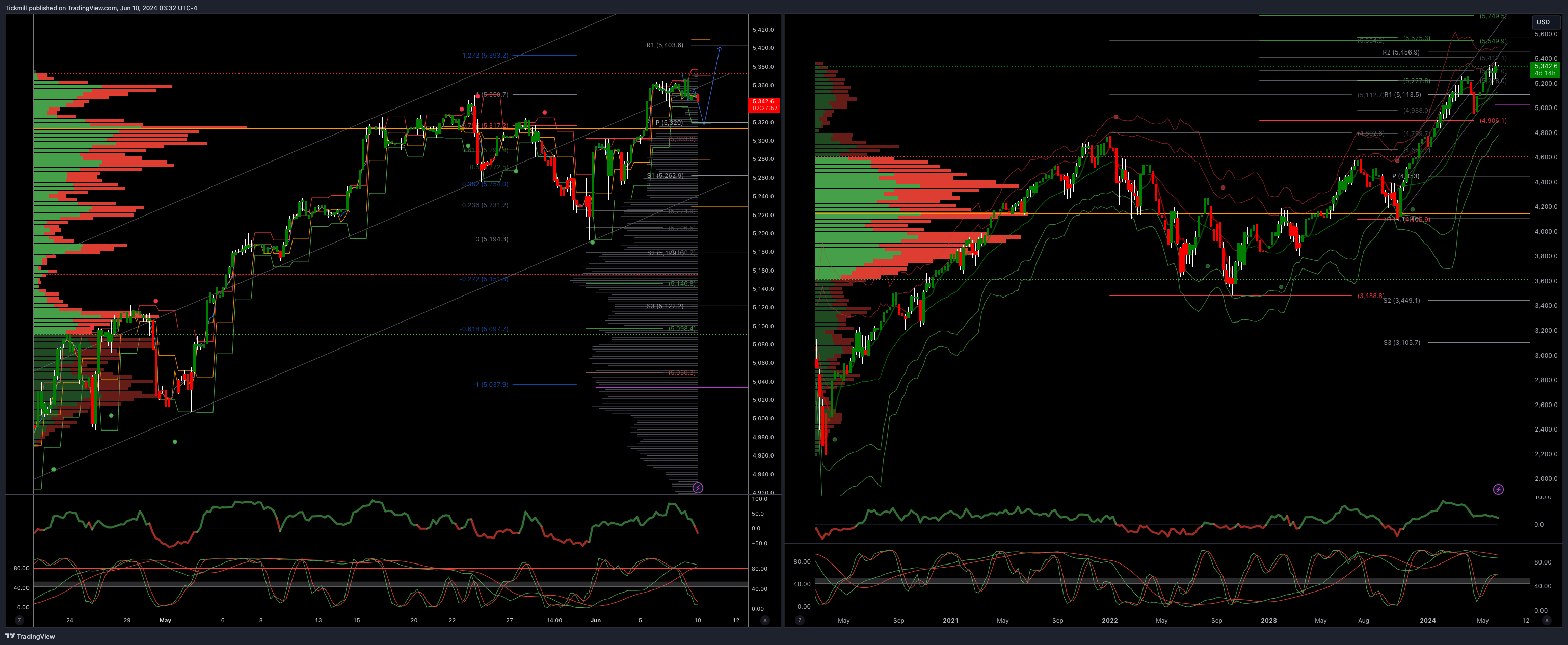

SP500 Bullish Above Bearish Below 5330

Daily VWAP bearish

Weekly VWAP bullish

Below 5330 opens 5300

Primary support 5275

Primary objective is 5392

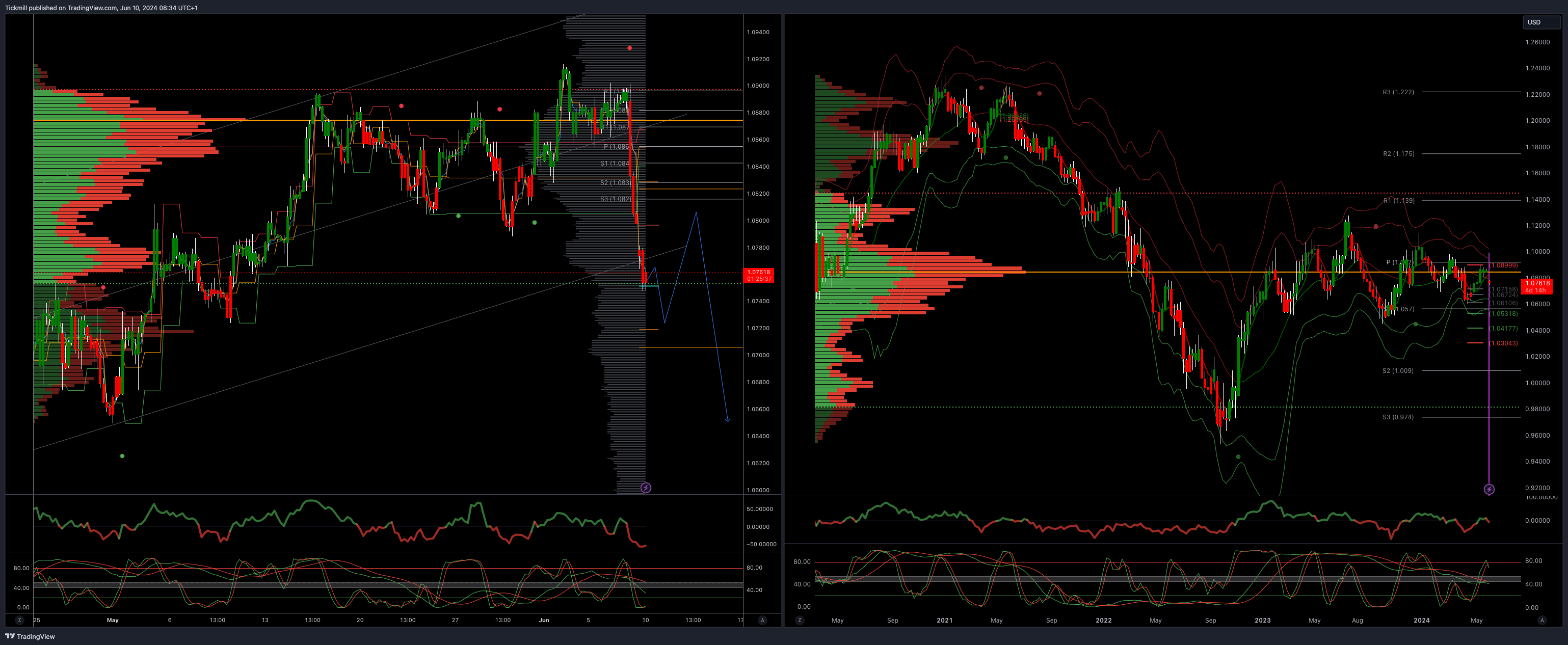

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0550

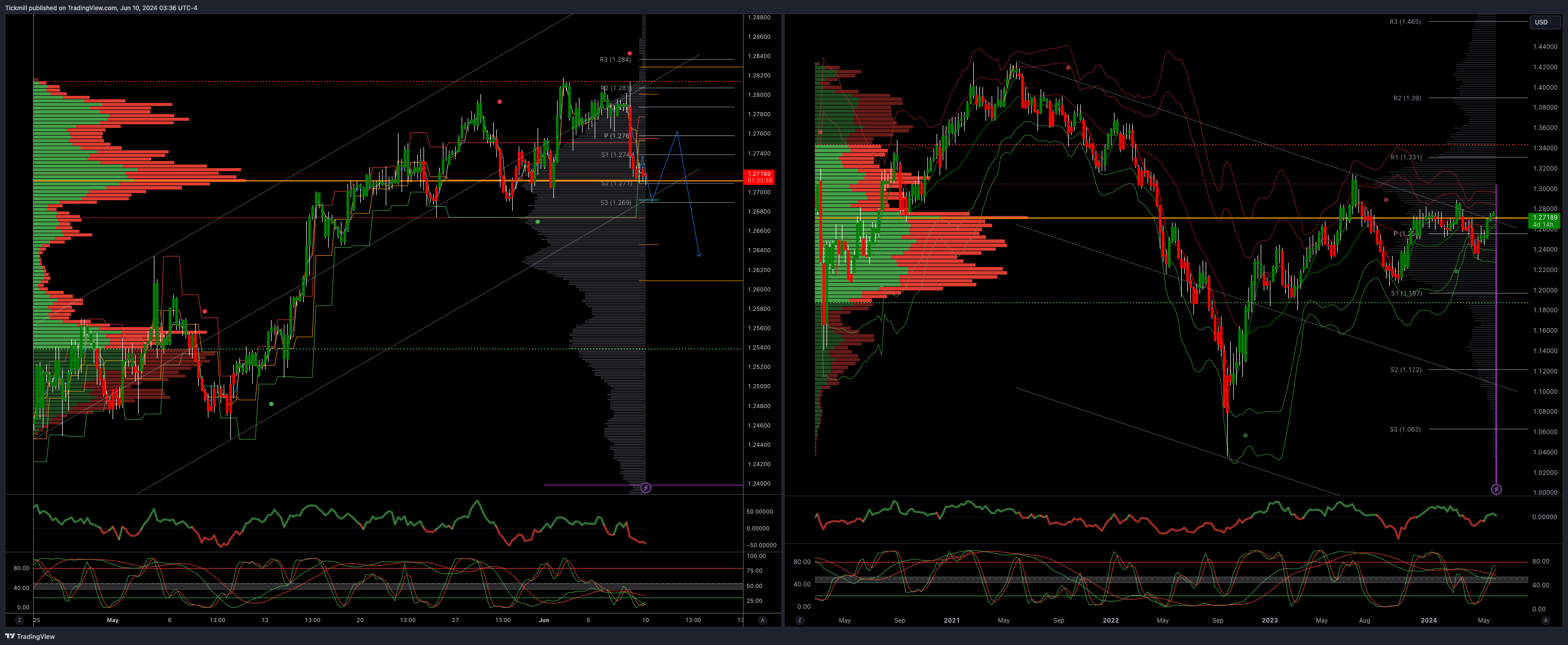

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2740 opens 1.2690

Primary support is 1.2670

Primary objective 1.2850

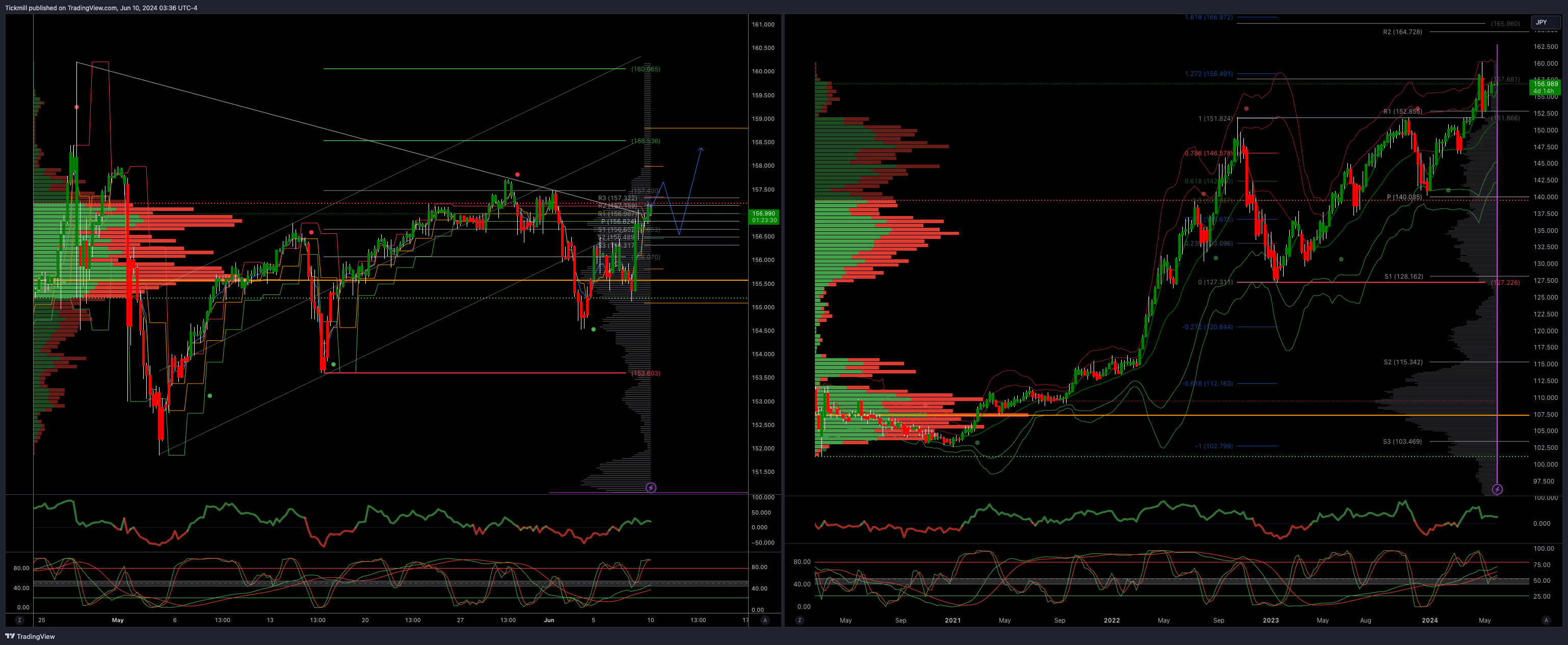

USDJPY Bullish Above Bearish Below 155.30

Daily VWAP bullish

Weekly VWAP bullish

Below 155.30 opens 154.50

Primary support 152

Primary objective is 160

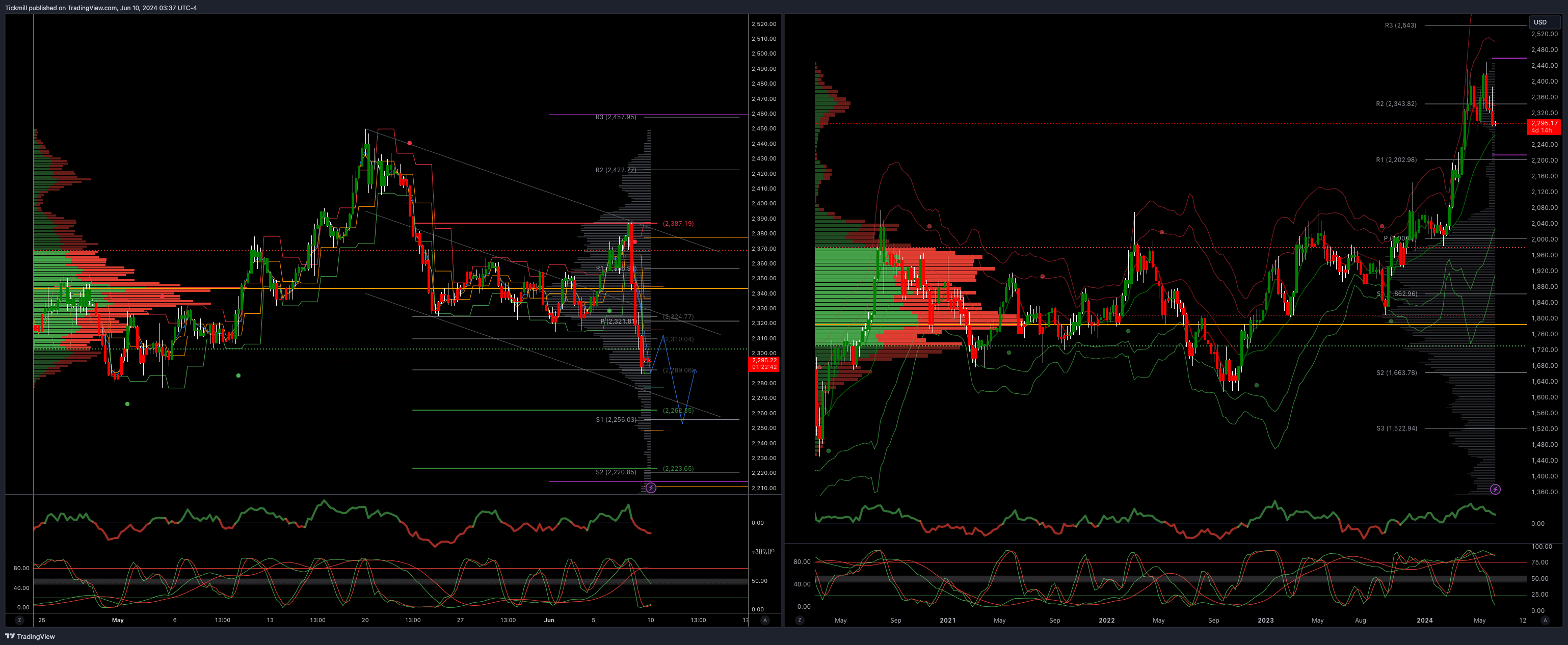

XAUUSD Bullish Above Bearish Below 2320

Daily VWAP bearish

Weekly VWAP bearish

Above 2365 opens 2390

Primary support 2300

Primary objective is 2262

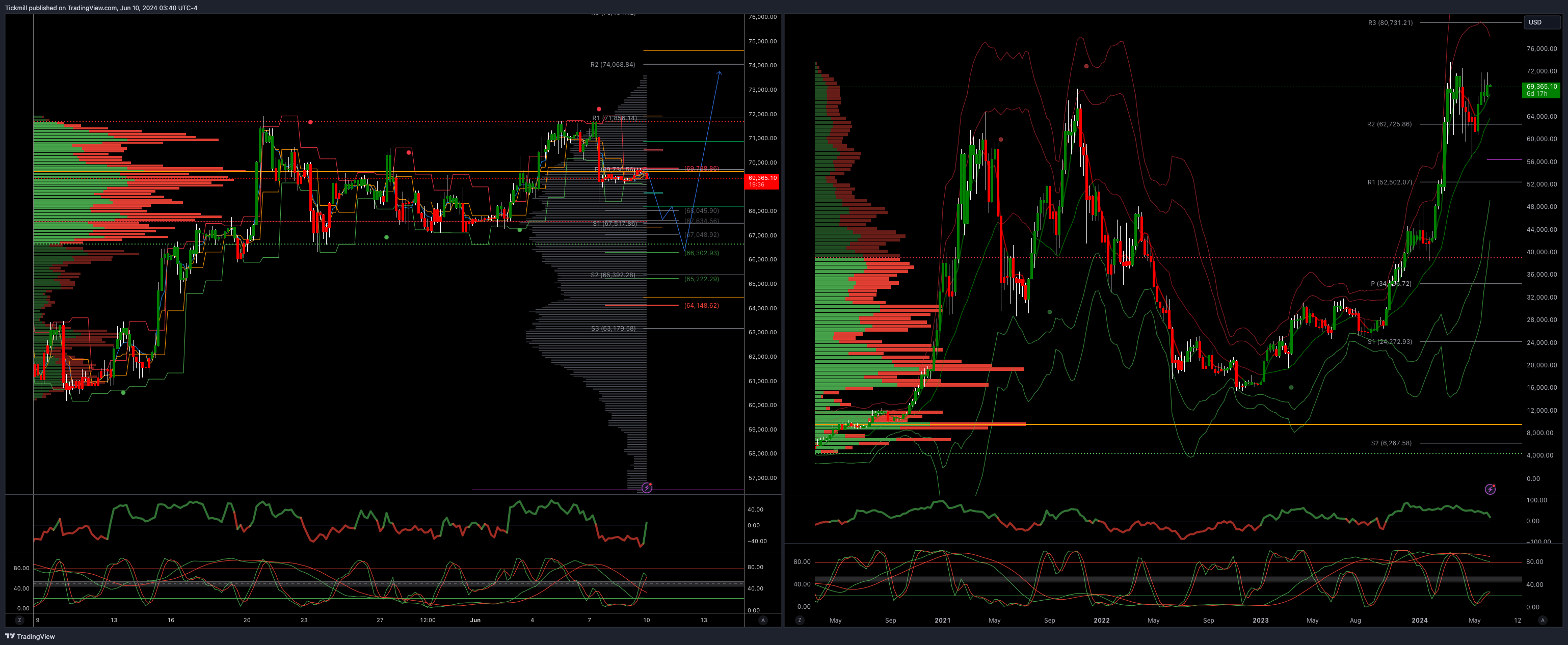

BTCUSD Bullish Above Bearish below 70000

Daily VWAP bearish

Weekly VWAP bullish

Below 66300 opens 64500

Primary support is 65000

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!