Daily Market Outlook, June 1, 2021

Daily Market Outlook, June 1, 2021

Equity markets across the Asia Pacific were broadly steady overnight, as inflation concerns continued to temper sentiment. As expected, the Reserve Bank of Australia left policy unchanged at its latest meeting and signalled that it would decide whether to extend its QE programme at its next meeting in July. Meanwhile, yesterday the OECD revised up its expectations for the world economy. Notably, the upward revision was led by developed economies, including the UK, which it now expects to grow by 7.2% this year, from its previous forecast of 5.1% made back in March.

Ahead of next week’s ECB policy meeting, today’s Eurozone CPI release for May will provide a timely update on inflation trends. Eurozone inflation has been rising of late and a further increase is expected in May. Indeed, already released French data showed a rise to 1.8%y/y from 1.6% previously, while yesterday’s German inflation data print showed a pick-up to 2.5%y/y from 2.0%. Expect annual Eurozone headline inflation to rise to 1.9% from 1.6% in April. That would be its highest since November 2018 and broadly in line with the ECB’s inflation target of close to but below 2.0%. However, the rise is almost solely due to higher energy prices as the core measure (excluding food & energy) is forecast to still only be 0.8%y/y from 0.7% previously. Consequently, the data may reinforce the convictions of many ECB policymakers that they are still not close to achieving their target on a sustainable basis.

Elsewhere, today’s calendar is full of a number of updates on the manufacturing sector. Both the Eurozone and UK manufacturing PMI reports are second readings that are not expected to be revised. Those first estimates were consistent with expectations that, after a fall in Q1, Eurozone and UK GDP will rebound in Q2. Less positively, the surveys also continued to point to concerns about inflationary pressures with some evidence of recruitment difficulties now adding to the previous comments about supply chain bottlenecks and higher commodity prices.

Meanwhile, in the US, ahead of Friday’s bellwether payrolls report, the manufacturing ISM report is expected to show the US economy continuing to motor ahead. The headline index is forecast to remain above 60 for a fourth consecutive month, consistent with a further solid increase in activity. Elsewhere, a number of central bank members are due to speak, including BoE Governor Bailey who is appearing at a Reuters event on “Building a Finance System Fit for a Clean, Resilient and Just Future”. However, from a monetary policy perspective, comments from US Fed members Quarles and Brainard are likely to attract more interest.

CFTC Data

Bullish EUR, GBP Sentiment Strengthens Data up to Tuesday May 25 and were released on Friday May 28.

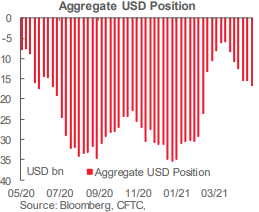

Currency traders are turning more negative on the broader outlook for the USD again. After last week’s CTFC data showed little change in the overall USD short, the data through last Tuesday showed the aggregated short position measured against the major currencies rising USD1.3bn over the week to USD16.8bn. Net gold longs rose sharply, gaining USD3.6bn to return to late February levels, in what is effectively another manifestation of broader USD bearishness.

Investors bolstered bullish bets on the EUR; gross longs rose the by around 4k contracts on the week while gross short positioning little changed from the May 18th week. The net EUR long position is now back to where it was in early March. In the GBP, net long positioning was bolstered by gross shorts covering; gross longs were little changed in the week. Net EUR longs rose USD669mn and net GBP longs rose USD504mn on the week, accounting for the bulk of the increase in the aggregate USD short position.

Investors remain largely unimpressed with commodity/high beta FX. While year to date returns for the NZD, AUD and MXN (the latter two effectively flat) have been unimpressive, all three have out-performed the EUR over that timeframe and the CAD is one of the top performers among the majors since the start of the year (+5.4%). Net positioning in the AUD, NZD and MXN was effectively flat on the week while the decent net CAD long that has developed recently saw some very light net trimming (down USD108mn) on increased gross shorting activity.

The traditional FX havens saw little change in overall positioning on the week; net JPY shorts persist, even though the JPY was little changed through the reporting week. Net JPY shorts reflect the only area of this market where sentiment is even more negative than the USD. Net CHF positioning saw some short covering in the week but the modestly bearish bias that emerged through mid-April persists.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.2150 (2.1BLN), 1.2195-1.2205 (450M), 1.2225 (504M), 1.2240 (580M), 1.2275 (1.7BLN), 1.2300 (920M)

USD/CHF: 0.8975-80 (290M)

AUD/USD: 0.7650 (363M), 0.7800 (364M)

USD/CAD: 1.2025 (350M), 1.2100 (350M)

USD/JPY: 109.00 (251M), 109.75 (325M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.2150 bullish above

EURUSD From a technical and trading perspective, the close through 1.2120 is constructive but bulls must defend 1.21 to set up a test of 1.2270/80. A close through 1.2150 would suggest a corrective phase developing.

Flow reports suggest topside offers congested through to the 1.2300 level with weak stops limited through the 1.2320 area and long term trend line around the 1.2345 area likely to see strong offers before weak stops opening the topside to further gains through the 1.2400 level.

GBPUSD Bias: Bullish above 1.4150 bearish below

GBPUSD From a technical and trading perspective, as 1.4150 now acts as support, bulls will target a test of 1.43. Only a close back below 1.4150 would concern the bullish thesis opening the window for a corrective cycle.

Flow reports suggest topside offers light through the 1.4200 level however, very few stops and stronger offers starting to appear through to the 1.4250 level and then increasing through to the 1.4310 area before weakness and stops appear for a break through to the 1.44 level before sentimental offers increase, downside bids light through to the 1.4100 level before stronger bids appear for any move beyond the 1.4050 level as congestion and sentimental levels appear.

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as 108.30 supports bulls will target 110.70’s, a closing breach of 108.30 would suggest a corrective move to test 106.30

Flow reports suggest downside light through the 108.50 before opening the market to a new test of the 108.00 level, stronger bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, topside offers through to the 110.00 level with light congestion through the figure level and weak stops possibly limited and stronger offers likely increasing on a move higher towards the 111.00.

AUDUSD Bias: Bearish below .7790 bullish above

AUDUSD From a technical and trading perspective, the breach of .7790 refocuses attention on the downside as .7820 contains upside attempts, look for a test of .7680.

Flow reports suggest topside offers into the 0.7800 area with weak stops through the 0.7820 before opening for a new run higher and strong offers likely through the 0.7840-60 area to build for the 79 cent level. Downside bids light through the 0.7750 area and stronger bids likely continue through to the 0.7700 area before weak stops appear below the 0.7680 and a stronger 0.7650 area then holds the downside

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!