Daily Market Outlook, July 29, 2022

Daily Market Outlook, July 29, 2022

Overnight Headlines

- Dollar Wallows Near 6-Week Low To Yen On View Fed To Slow Hikes

- Amazon’s Strong Revenue And Guidance Reassure Wall Street

- Apple Ekes Out Revenue Growth On iPhone Sales And Services

- Asian Stocks Mixed As China Shares Slide On Lack Of New Stimulus

- BoJ Members Warn Of Global Slowdown, Urge Stimulus Stay In Place

- Japan On Track For Modest Recovery For Now After Output Jump

- IMF Downgrades Asia Pacific Forecast As Shocks Keep Rolling

- China FX Watchdog To Step Up Monitoring Cross-Border Flows In H2

- UK Business Confidence Falls As Firms Worry About Economic Slump

- Global Bonds Surge In Best Month Since 2020 On Recession Fears

- Oil Steady As Market Weighs Tight Supply Against Recession Fears

- Citi Says Oil Market May Be Starting To Inflect To Bearish Path

The Day Ahead

- Asian equity market performance is mixed this morning despite yesterday’s rise in US equities. Futures prices point to further gains in the US today reflecting better earnings reports from Amazon and Apple. The release of US Q2 GDP figures which showed a second consecutive fall in quarterly GDP led to comments that the US is in ‘technical’ recession. However, US Treasury Sec. Yellen said that “we are not seeing a broad-based weakening of the economy.” The US and Chinese Presidents are reported to be planning a face-to-face meeting. Japan CPI inflation picked up by more than expected in July reflecting higher energy and food prices, and a weaker yen.

- The July Lloyds Business Barometer, which was released earlier this morning, showed a further fall in business confidence taking it below the long-term average. The decline was most marked for large companies and primarily reflected growing concerns about the overall economy as firms views about their own trading conditions remained relatively upbeat. Hiring intentions were also positive although they have moderated somewhat. But there is still little sign of wage or price pressures easing.

- Today’s busy data calendar includes GDP and inflation data for the Eurozone. Q2 GDP growth is expected to have slowed sharply from its pace in Q1 and, there is a case that as in the US, output may have fallen during the quarter. Annual Eurozone CPI inflation for July is expected to post a modest fall when compared to June. That is primarily due to the fall in energy prices during the month. In contrast, the ‘core’ measure is expected to pick up slightly - an indication that inflationary pressures may be broadening out. Yesterday, German CPI data for June showed an unexpected acceleration, which points to potential upside risks for today’s report. French & Spanish printss will also be released before the Eurozone numbers.

- In the UK, Bank of England money supply and bank lending data is the only release of note. They may provide new insight into the strength of the housing market and into whether consumers and businesses have raised borrowing to tide themselves through the current cost of living squeeze on incomes. However, the data will probably receive only limited market attention as the main focus is on next week’s BoE policy update.

- In the US, the June reading for the Fed’s preferred measure of consumer price inflation is predicted to record another rise, taking it even further above the Fed’s inflation target. Finally, the employment cost index, an important measure of wages, is expected to post a deceleration in Q2 but still show labour costs growing at an uncomfortably rapid pace.

CitiQuant month-end rebalancing model points to net USD selling

- Citi note that the estimated outflows from US equities make up the most of the rebalancing need in equities, followed by Japanese equities. Citi add that most other equity and bond markets may see rebalancing inflows.

- The USD sell signal strength is in line with the historical norm across all currencies other than EUR/USD. "The signal to buy EUR and sell USD is weakest at 0.7 standard deviations because good performance of Euro Area fixed income may also lead to foreign EUR selling to hedge those gains.With the exceptions of GBP and NZD, we haven’t seen significant net real money buying of other currencies in the past week, potentially suggesting little or no front loading of rebalancing trades so far"

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0050 (1.11B), 1.0125 (658M), 1.0200 (824M), 1.0205 (838M) EUR/USD: 1.0245 (1.28B), 1.0250 (1.80B), 1.0300-05 (1.30B)

- EUR/CHF: 0.9700 (702M), 0.9900 (1.0B)

- USD/JPY: 128.50 (3.23B), 130.00 (580M), 132.50 (675M))

- GBP/USD: 1.1700 (486M), 1.2100 (1.0B).

- EUR/GBP: 0.8795-0.8800 (420M)

- USD/CAD: 1.2695 (435M), 1.2830 (630M), 1.2920-30 (974M), 1.3195 (671M)

- AUD/USD: 0.6750 (401M), 0.7000 (376M)

Technical & Trade Views

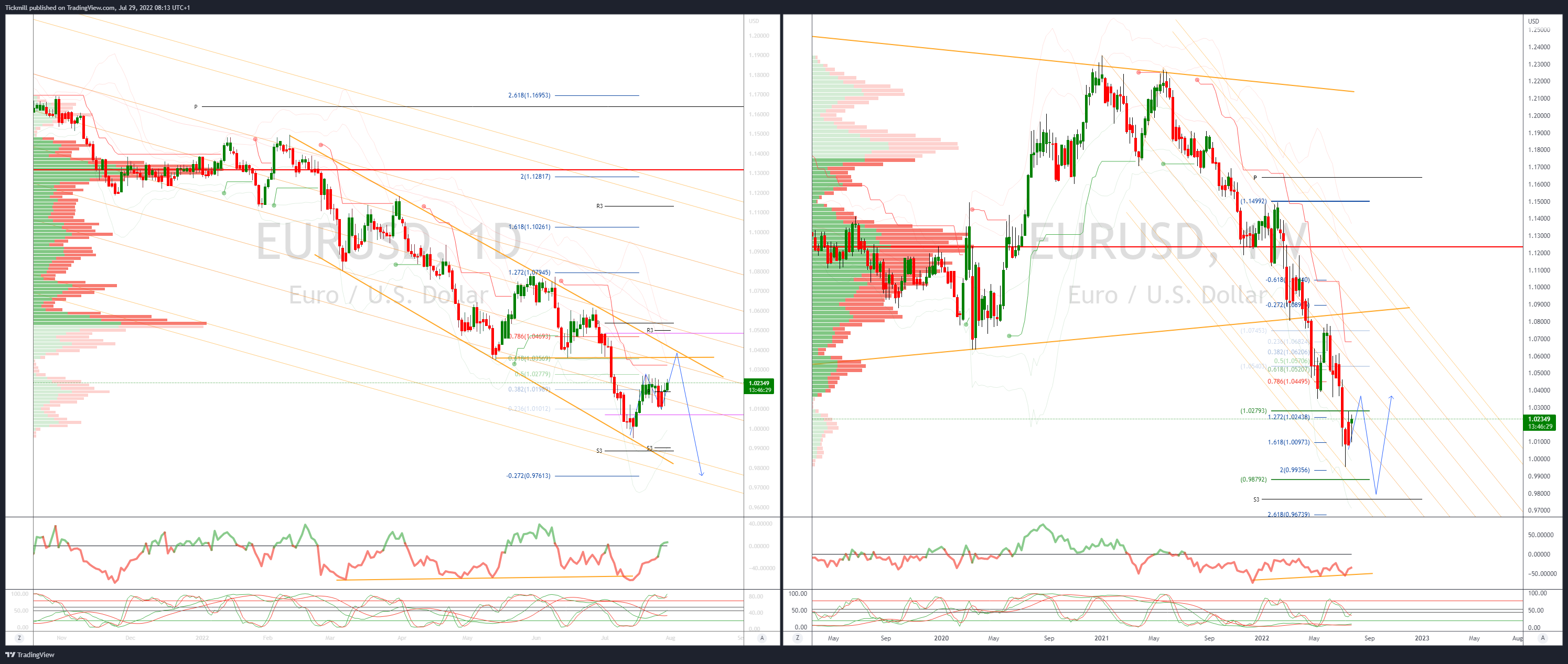

EURUSD Bias: Bearish below 1.0350

- Month end flows often lead to random moves especially in Europe

- Ukraine conflict shows no signs of a resolution

- Plenty of EZ data today with flash Q2 GDP and EZ inflation to be released

- Resistance 1.0250/60 stronger offers seen to 1.0350/60, support 1.0100-05, 1.0070-75

- 20 Day VWAP is bullish, 5 Day bullish

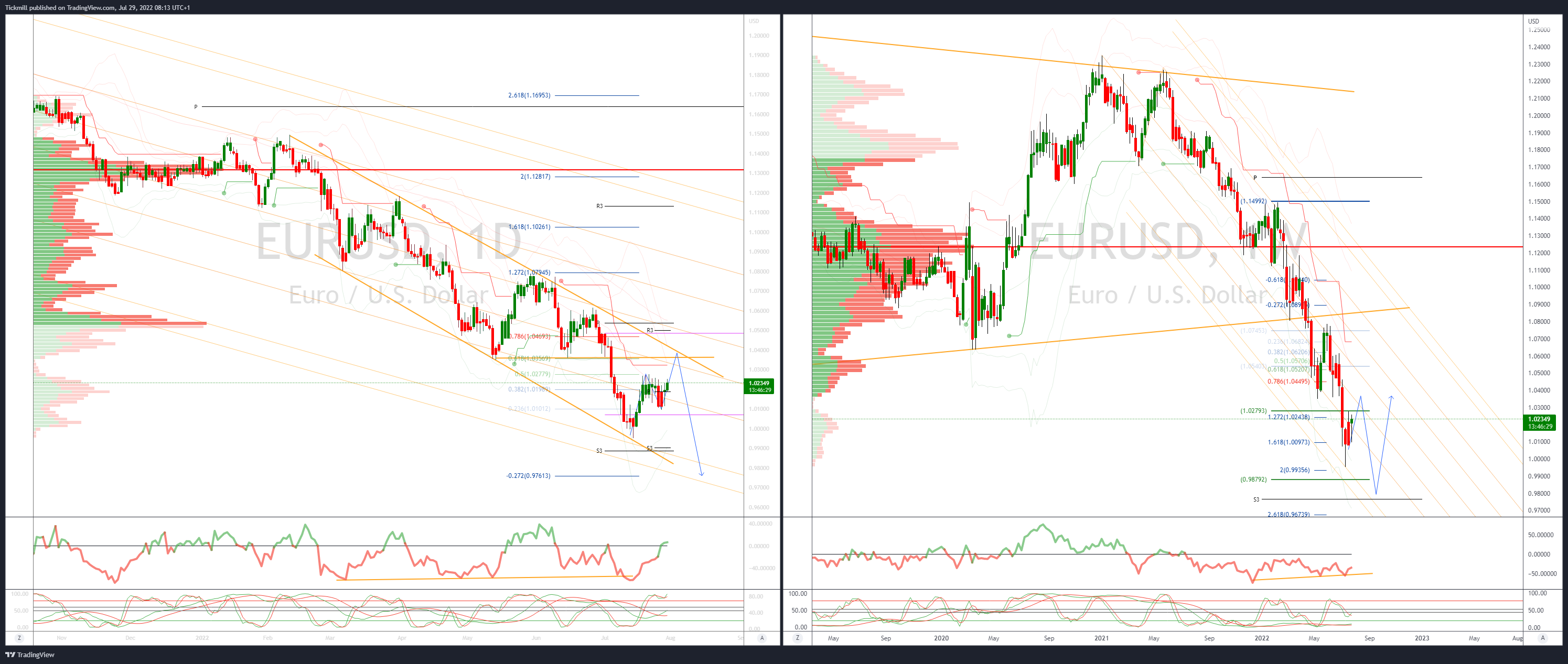

GBPUSD Bias: Bearish below 1.2280

- Inflation hits UK business confidence, lowest since March 2021

- Drawn out transition to a new PM the last thing the economy needs

- Sterling is often volatile at month end in Europe, though steady in Asia

- GBP traders unsure of +25 or +50 at Aug 4 MPC

- Offers sited at 1.2280/1.23 bids 1.2090

- 20 Day VWAP is bullish, 5 Day bullish

USDJPY Bias: Bearish below 134

- Slides in the Asian session taking out pivotal 134 support

- Move came in relatively thin, summer holiday-affected pre-weekend trade

- Stops fuelled move down, many forced to chase market lower on lack of bids

- Newly minted bears target a test of 130

- Offers see at 134

- 20 Day VWAP is bearish, 5 Day bearish

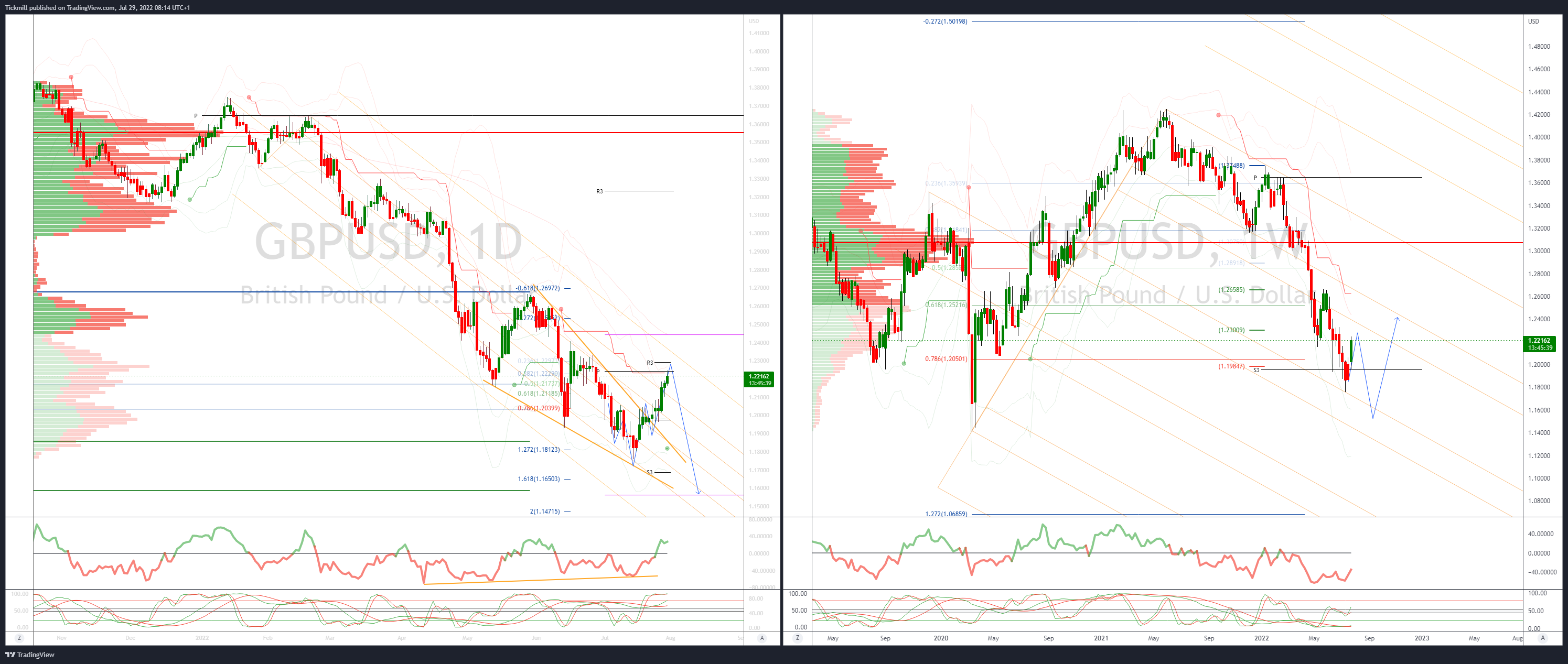

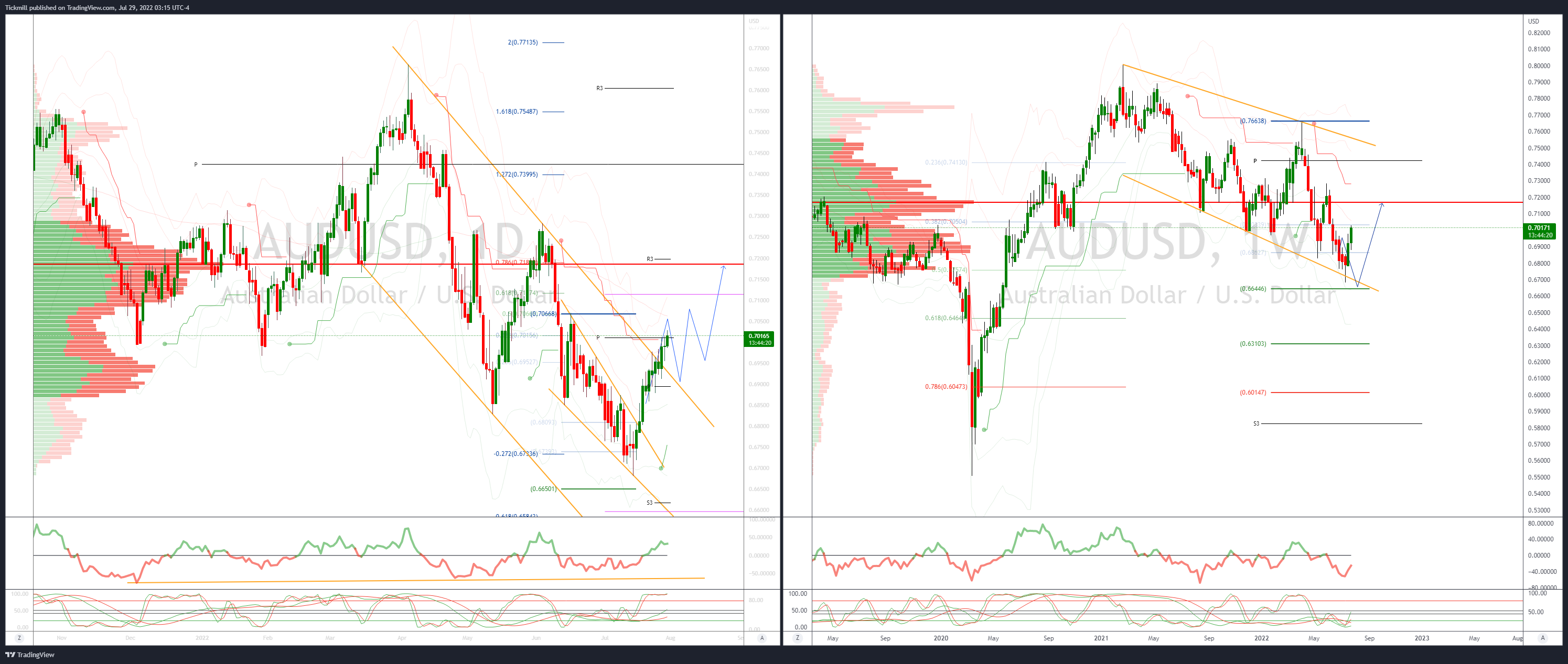

AUDUSD Bias: Bearish below .7050

- Risk assets rallied in Asia with strong after-hour results from Apple and Amazon helping

- US June PCE, Q2 employment costs will be key data risks for Friday

- Offer at .70 being eroded as price is accepted above .70 bulls target .71 test

- AUD/USD support now sited at .6950/40

- 20 Day VWAP is bullish, 5 Day bullish

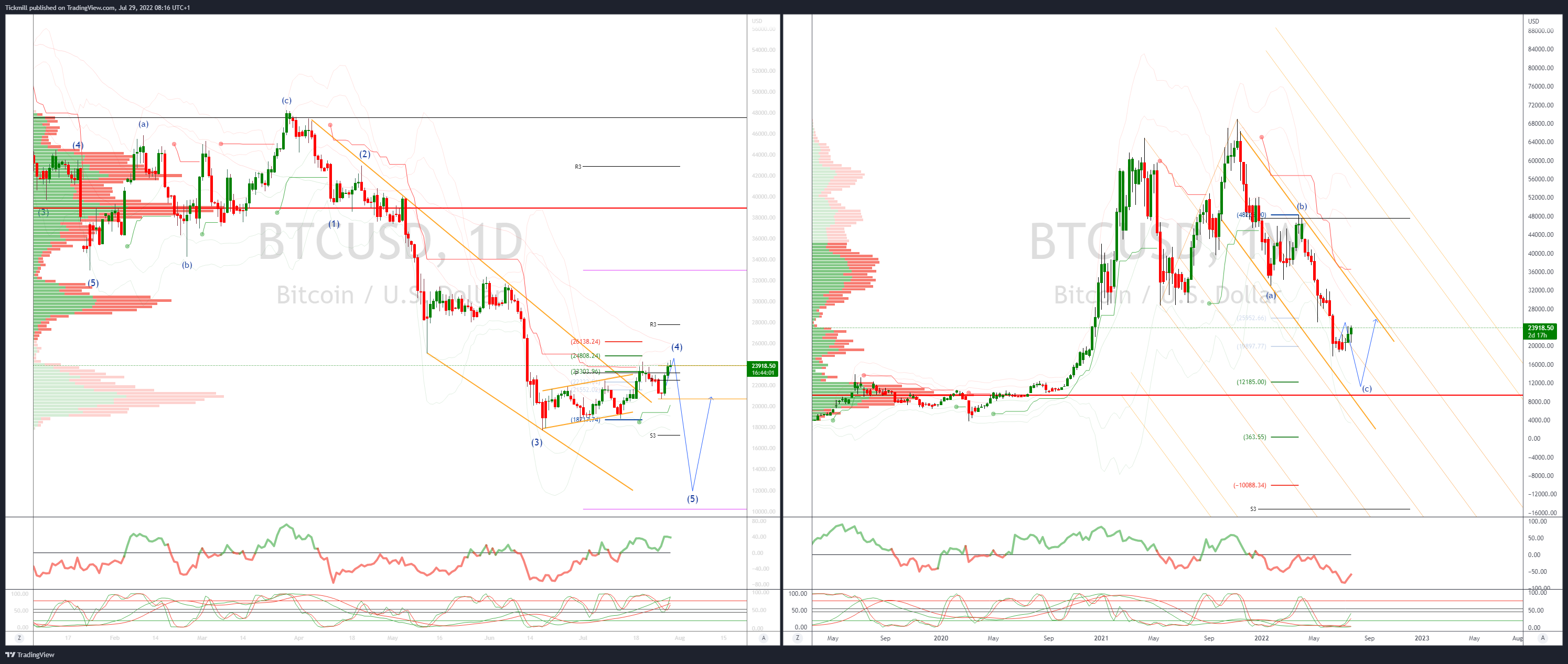

BTCUSD Bias: Bearish below 25.3K

- BTC back above 24k on improving risk sentiment

- Rally puts price back into the VWAPuptrend channel

- Southeast Asia-focused crypto exchange Zipmex filed for bankruptcy protection

- Crypto assets need new rights in law, UK legal body says

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k will be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!