Daily Market Outlook, July 28, 2023

Munnelly’s Market Commentary…

Asian equity markets traded mixed as investors were cautious and focused on the Bank of Japan's (BoJ) policy decision. The central bank kept monetary policy settings unchanged but announced a more flexible approach to yield curve control (YCC), with fixed rate operations for 10-year Japanese Government Bonds (JGB) to be conducted at 1.0%, an increase from the previous 0.50%. This move spooked markets, causing the Nikkei 225 to underperform, falling 1.7%. In contrast, the Hang Seng and Shanghai Composite recovered from early weakness and gained as China's efforts to support the housing market and tech industry boosted sentiment.

Looking ahead, there are no major data releases on the docket in the UK today. However, next week's focus will be on the Bank of England's policy decision, with expectations of at least a 25bps interest rate increase to 5.25%, and a considerable chance of a 50bp increase to 5.5%.

For the Eurozone, France reported firmer-than-predicted Q2 GDP growth of 0.5%, showing a rebound from the previous quarter. Spain also reported a rise of 0.4% for Q2. While these figures indicate a return to growth in the Eurozone, business surveys suggest weakening demand and pose downside risks for the second half of the year. Additionally, France's preliminary July CPI inflation fell to 5.0%, the lowest since February 2022, while Germany's July inflation data is still pending.

Stateside, several important data releases are expected. June personal spending is predicted to increase by 0.5%, and the PCE deflator, the Federal Reserve's preferred inflation measure, is expected to fall to 3.1% from 3.8% in May, with the core measure declining to 4.2% from 4.6%. The Q2 employment cost index will also be closely watched by the Fed as a gauge of wage pressures, with an expected rise of 1.2%q/q, matching the Q1 result. A weaker figure could increase the odds of the Fed holding rates in September.

CFTC Data As Of 18-07-23

USD net spec short grew in the Jul 12-18 period amid a $IDX 1.65% slide

EUR$ +2% in period, specs +38,670 into strength, now long 178,832 contracts

$JPY -1.05%, specs +26,943 contracts, short reduced to -90,239

GBP$ +0.77%, specs +5,666 contracts now +63,729; data pre-UK CPI Wednesday

AUD$ +1.88%, specs -5,317 now -50,401 contracts; $CAD -0.46% specs -3,923

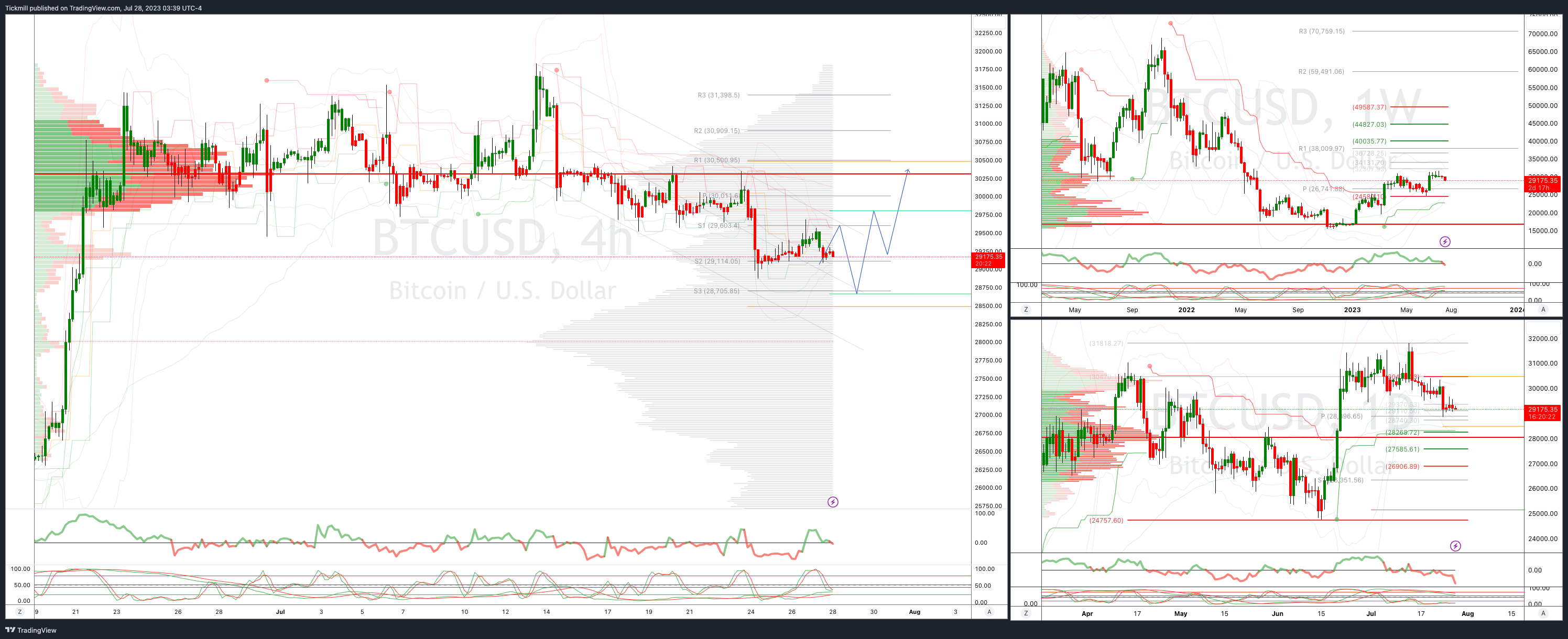

BTC -2.6% in period specs buy 694 contracts on dip, now -1,161 contracts

Note since Tuesday reporting period close the $IDX is down near 0.9%

EUR$ has dipped 0.88%, $JPY rose 2.11% after period closed leaving recent EUR & JPY buyers in the red(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900 (433M), 1.0970-80 (500M), 1.1000 (1.7BLN)

1.1020 (406M), 1.1050 (3BLN)

EUR/GBP: 0.8575 (424M). USD/CHF: 0.8650-55 (316M), 0.8675 (431M)

AUD/USD: 0.6750 (258M). USD/CAD: 1.3250 (578M), 1.3280 (1BLN)

USD/JPY: 138.00 (465M), 140.00 (322M), 140.25 (1.3BLN), 140.65 (678M)

Options Market Positioning

The overnight break-evens for EUR/USD options were perceived as costly, considering the market's expectation that the European Central Bank (ECB) would follow the Federal Reserve's path and adopt a more hawkish stance. However, those who held EUR/USD options and those who had sold EUR/USD in the cash market, as anticipated by market participants, were rewarded. The ECB's dovish shift, combined with strong economic data from the United States, led to a decline in the EUR/USD pair from 1.1150 to 1.1000. Looking ahead, month-end FX rebalancing flows are projected to be mildly USD bearish, which means they could weaken the US dollar, and simultaneously be supportive of the Euro (EUR). This could add further pressure on the USD and lend support to the EUR in the currency market.

Overnight Newswire Updates of Note

BoJ Loosens Grips On Long-Term Yields In Ueda’s First Surprise

Inflation In Japan's Capital Slows In July, Stays Above BoJ Target

China Ask Tech Giants To Present Investments In Sign Of Easing

Top China Housing Official Urge Fresh Real Estate Rescue Effort

Money-Market Assets At Fresh Record High Post Latest Fed Hike

US, Testing Xi, To Bar Hong Kong Leader From Economic Summit

Government Shutdown Threatened, Congress Departs For August

ECB Discussion Suggest Inflation Outlook Risks Seen As Balanced

UK Home Sellers More Open To Price Cuts As Costly Mortgages Hit

Turkey Erdogan Replaces Three Deputy Governors At Central Bank

Intel Shares Jumped After PC Recovery Bolsters Chipmaker Outlook

Ford Blames EV Price Fights For Slowdown In Plans To Boost Output

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

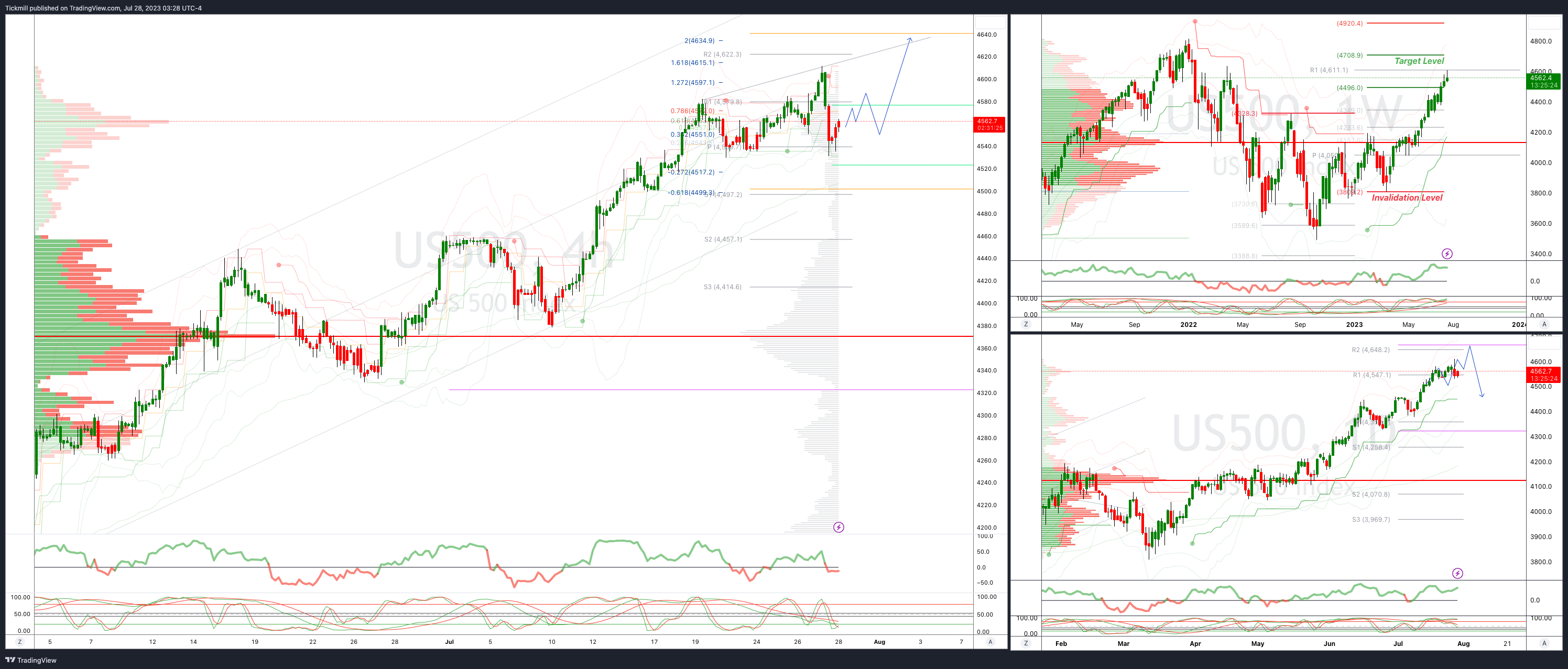

SP500 Intraday Bullish Above Bearish Below 4530

Below 4530 opens 4512

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bearish

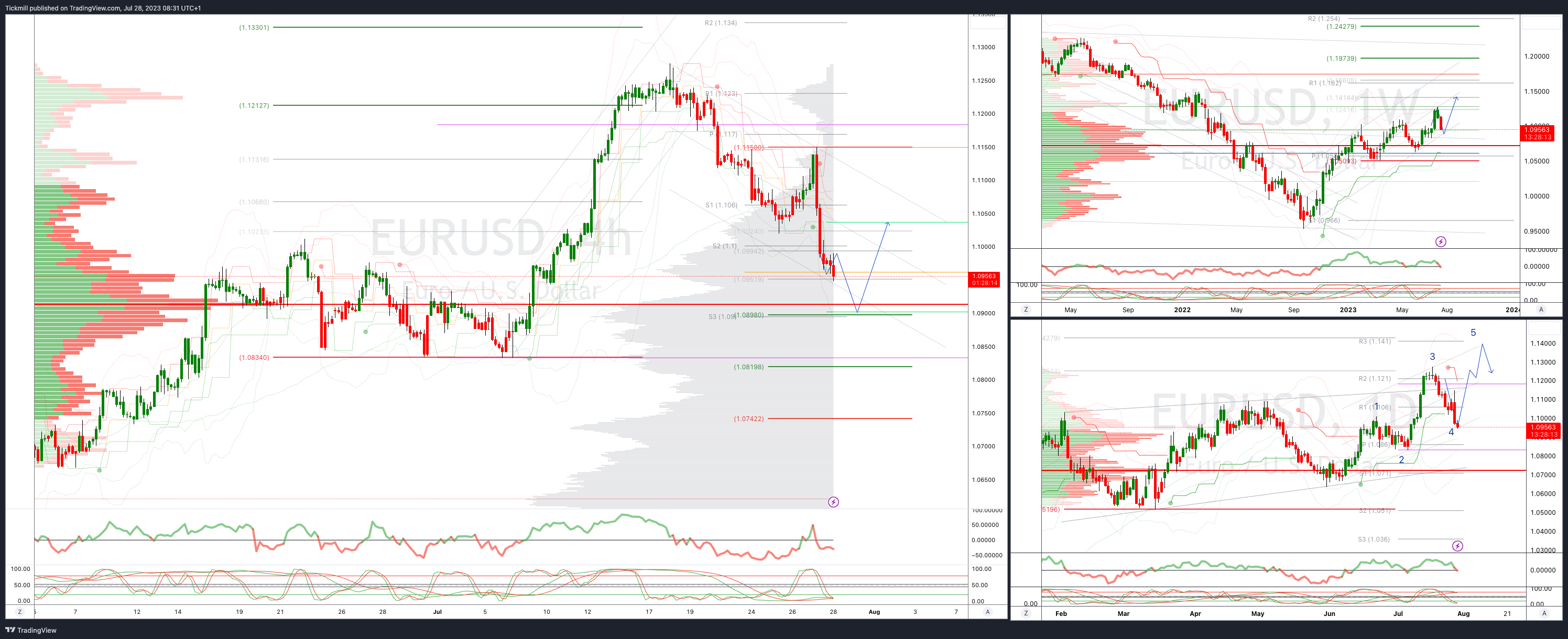

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

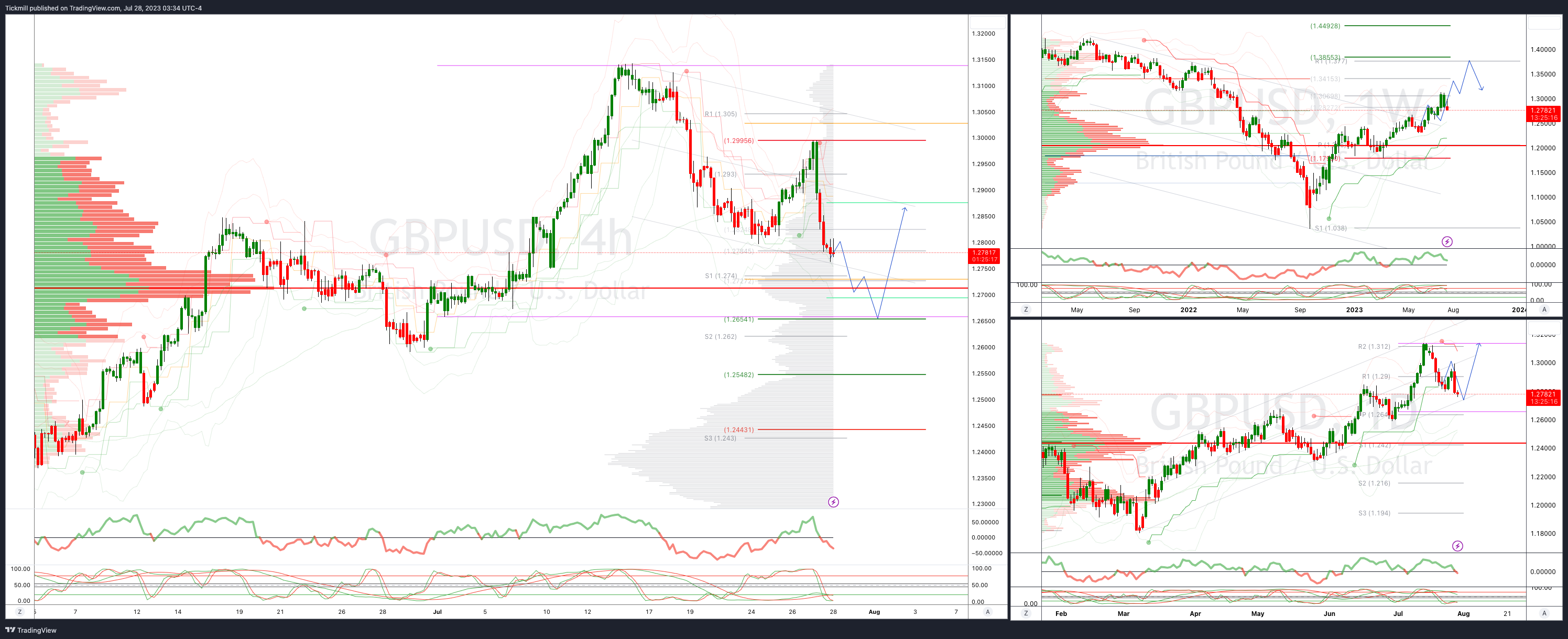

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bearish

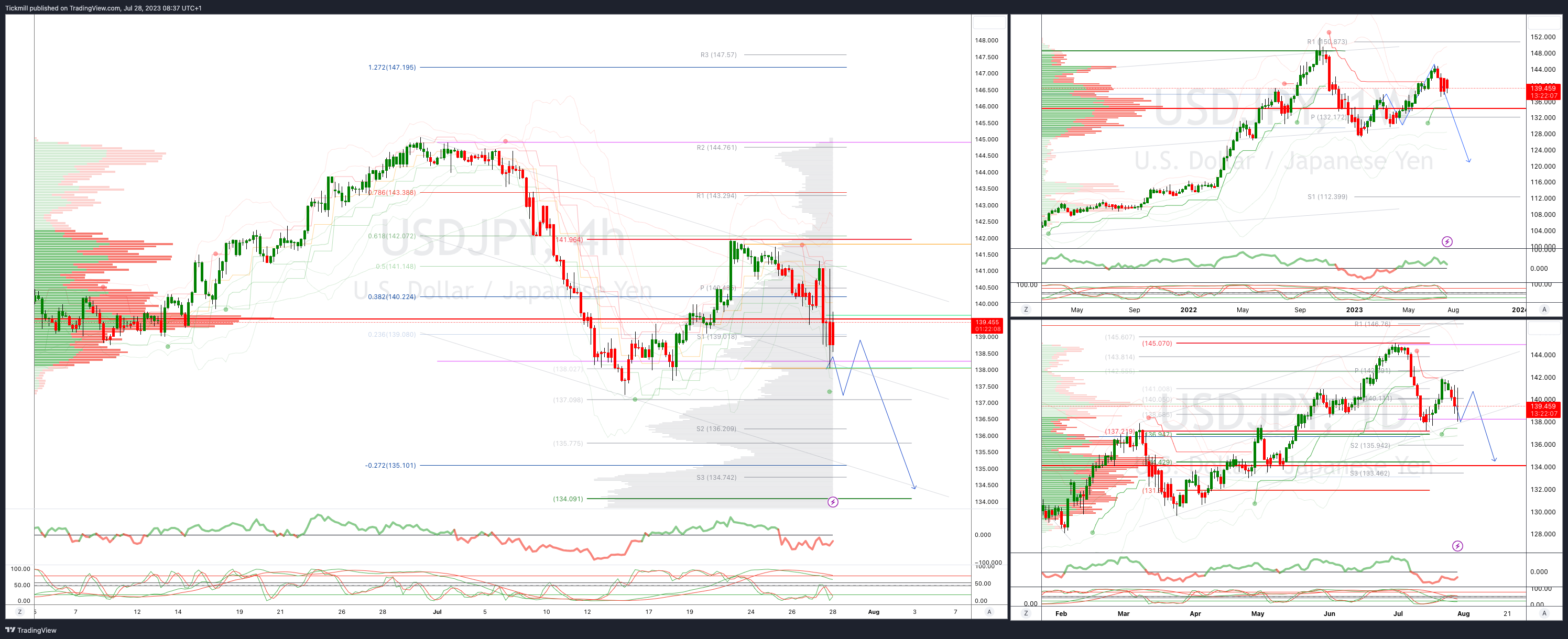

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bearish, 5 Day VWAP bearish

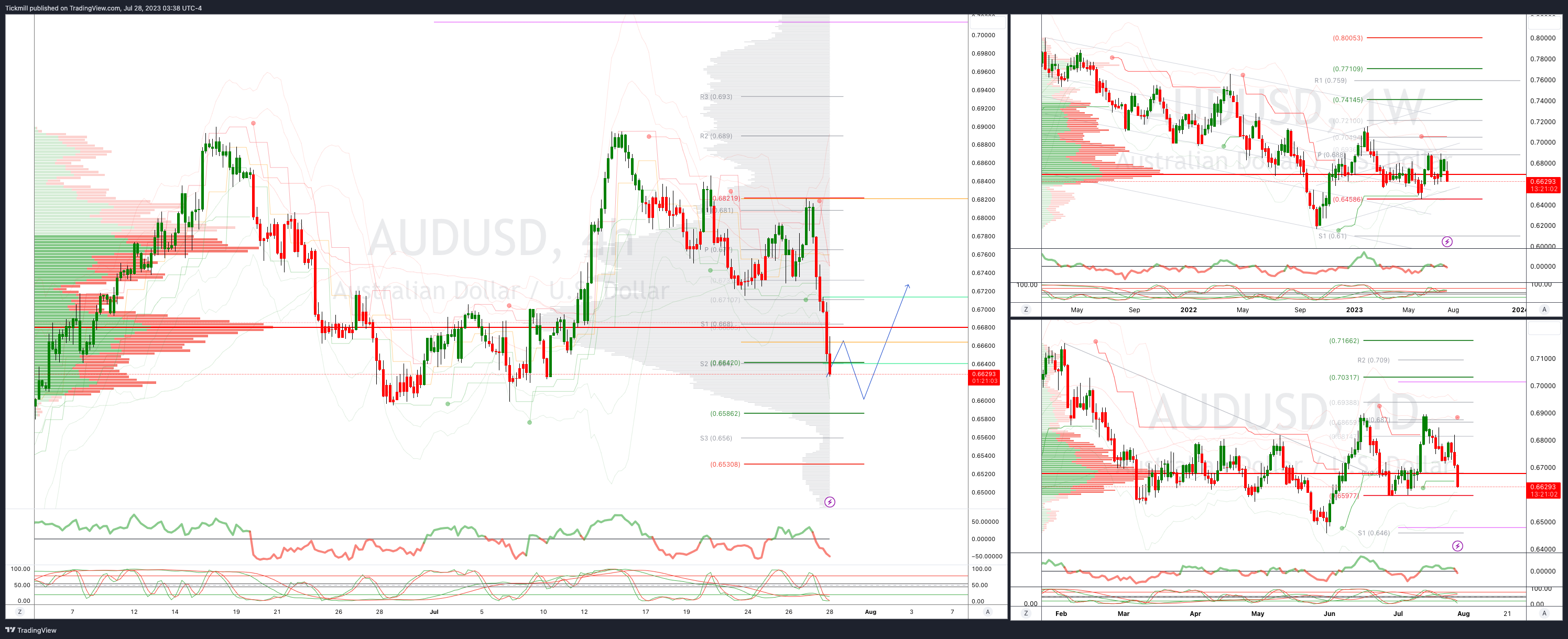

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6700

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bearsih

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!