Daily Market Outlook, July 24, 2024

Daily Market Outlook, July 24, 2024

Munnelly’s Macro Minute…

“Earnings Disappointment Weighing On Risk Sentiment”

On Wednesday, most Asian stock markets are experiencing a decline, influenced by the negative performance of Wall Street. Traders are feeling uncertain about the market's future due to recent fluctuations and are hesitant to make big decisions before the release of important US GDP and inflation data later in the week. The Japanese stock market is showing a slight decline after a small increase in the previous session. This comes after Wall Street displayed negative trends. The Nikkei 225 is dropping below the 39,500 level as traders respond to recent business activity data. While some index heavyweights and financial stocks are weak, there are gains in technology stocks.

Luxury conglomerate LVMH's sales fell short due to restrained spending by Chinese consumers, while major U.S. tech companies Tesla and Alphabet also reported disappointing results. This is expected to make investors cautious as they await a wave of European earnings. European banks will be in the spotlight on Wednesday, with attention on whether the benefits of higher interest rates have plateaued and if recent political turmoil is affecting market sentiment. Spain's Santander, France's BNP Paribas, Germany's Deutsche Bank, and Italy's UniCredit are set to report their earnings for the April to June period, with Deutsche Bank the standout disappointment so far, with shares getting slashed in early trade. Following LVMH's announcement of a 14% sales decline in Asia (excluding Japan) in the second quarter, luxury stocks in Europe are likely to suffer. The top 10 European luxury stocks have already dropped by 2.6% in July, marking a fifth consecutive month of decline after a profit warning from Burberry last week. The technology sub-index in Europe, which has been volatile due to concerns about trade tensions impacting chip manufacturers, is expected to face pressure following Tesla's report of its smallest profit margin in over five years.

The UK's composite PMI decreased for the second month in a row in June, settling at 52.3, but still indicating some level of growth. Markets are forecasting an increase to 53.0 in July, driven by improvements in both the manufacturing and services sectors. With the election uncertainty resolved, some of the decision-making delays reported previously may now be resolving. Services PMI is expected to rise to 52.8 from 52.1, and manufacturing PMI to 51.6 from 50.9, marking a two-year high for manufacturing. However, this positive outlook may be deceptive. Anticipated impacts from shipping delays could lead to longer delivery times, artificially boosting the headline manufacturing PMI due to supply-side constraints rather than reflecting stronger demand. In the euro area, flash PMIs are likely to show a continued divergence with a contracting manufacturing sector and an expanding services sector.

Overnight Newswire Updates of Note

Keir Starmer Suspends MPs After Rebellion

Latest PMIs Review For Australia and Japan

Trump Files Complaint - Biden Giving Harris $96 Mln

US To Launch Arctic Defense Eyeing Russia, China

Tensions Between Bibi Netanyahu And Kamala Harris

China's Desire For Growth And Economic Road Map

Japan, Britain, Italy Pursue Fighter Jet Co-Development

Japan Protests Russia's Entry Prevention Of 13 Nationals

Bitcoin Conference, Trump & Harris As Speakers

Sanctions On Russian Oil May Cause Fuel Exports Cuts

XAU Gains Amid Risk-off Mood, Fed Rate Cut Bets

Alphabet Revenue Shows No Sign Of AI Denting Business

Tesla Misses Profit Estimates, Delayed ‘Robotaxi’ Launch

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0825-30 (470M), 1.0850-55 (457M), 1.0900 (574M)

1.0920-25 (491M), 1.0950 (1BLN), 1.0990-1.1000 (4.2BLN))

USD/CHF: 0.8900 (220M), 0.8925-30 (439M)

EUR/CHF: 0.9600 (201M), 0.9725 (200M). EUR/GBP: 0.8400 (530M)

GBP/USD: 1.2885 (250M), 1.2925 (261M), 1.2950 (453M)

USD/CAD: 1.3750 (532M), 1.3800 (464M)

AUD/USD: 0.6600 (1.7BLN), 0.6660-70 (905M), 0.6720 (1.1BLN)

USD/JPY: 154.95-155.00 (2.8BLN), 155.50 (825M), 156.00-05 (2.5BLN)

AUD/JPY: 105.00 (600M)

CFTC Data As Of 16/7/24

Equity fund managers raise S&P 500 CME net long position by 19,908 contracts to 997,340

Equity fund speculators increase S&P 500 CME net short position by 28,517 contracts to 370,142

Japanese yen net short position is 151,072 contracts

British pound net long position is 132,902 contracts

Euro net long position is 24,749 contracts

Swiss franc posts net short position of -49,793 contracts

Bitcoin net short position is -579 contracts

Technical & Trade Views

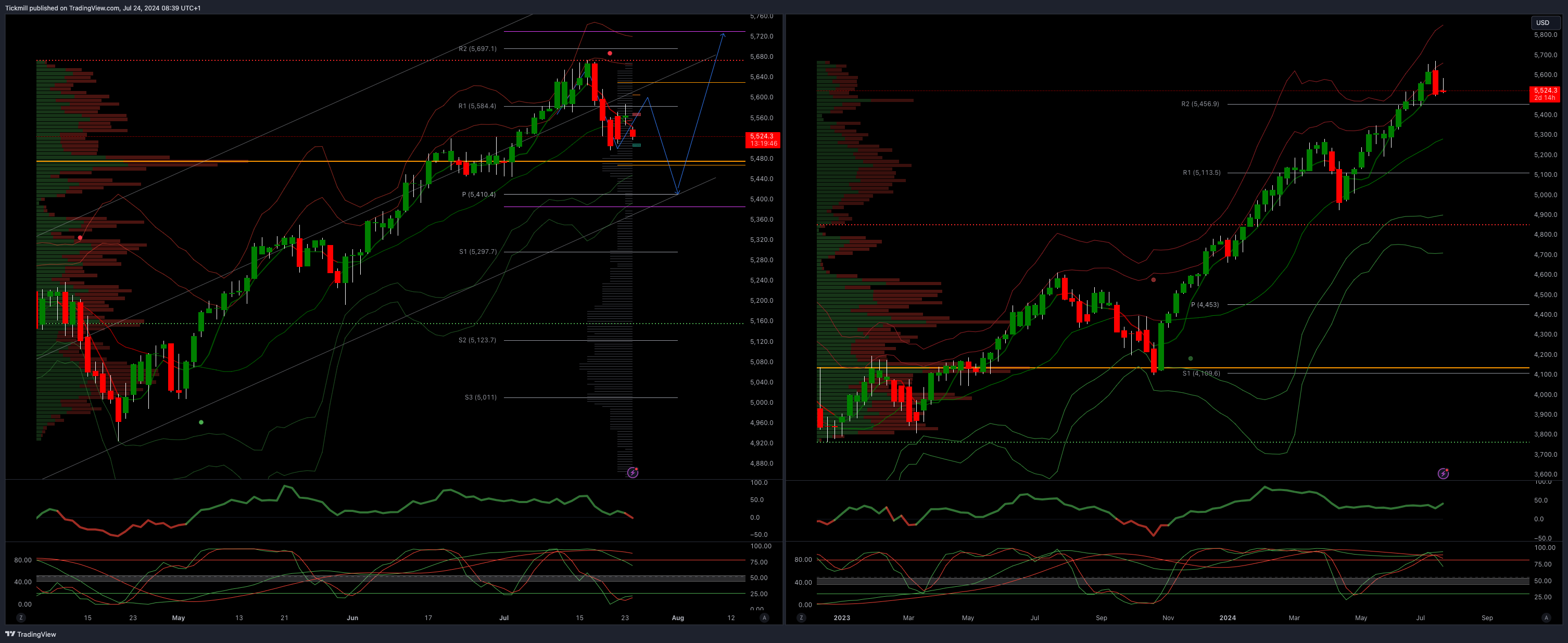

SP500 Bullish Above Bearish Below 5480

Daily VWAP bearish

Weekly VWAP bearish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

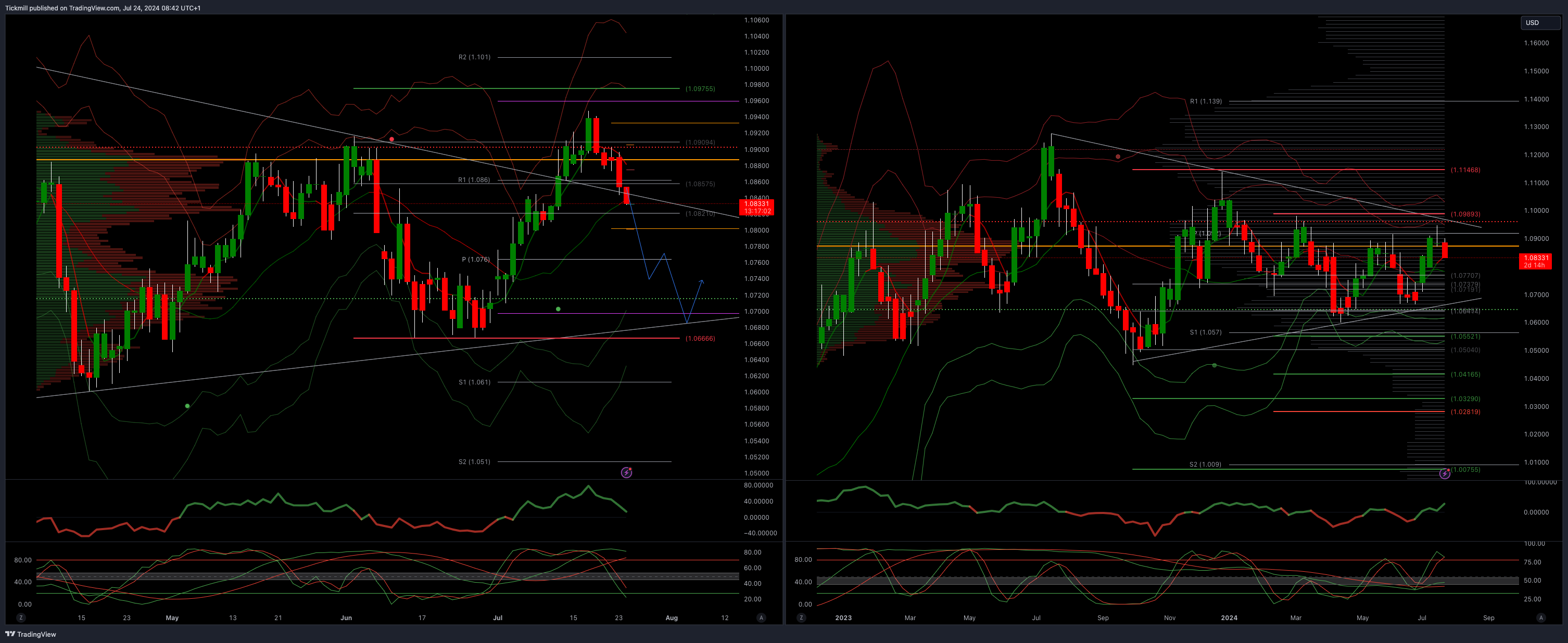

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.07

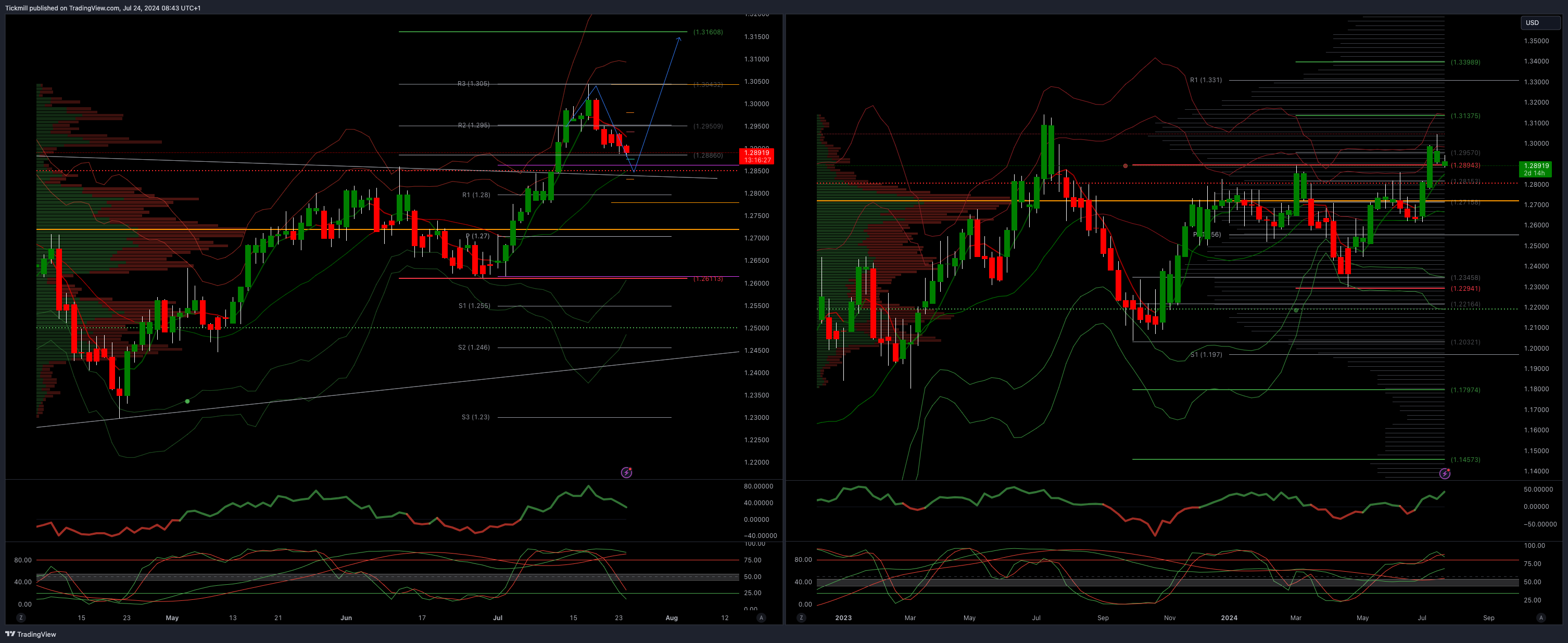

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3137/60

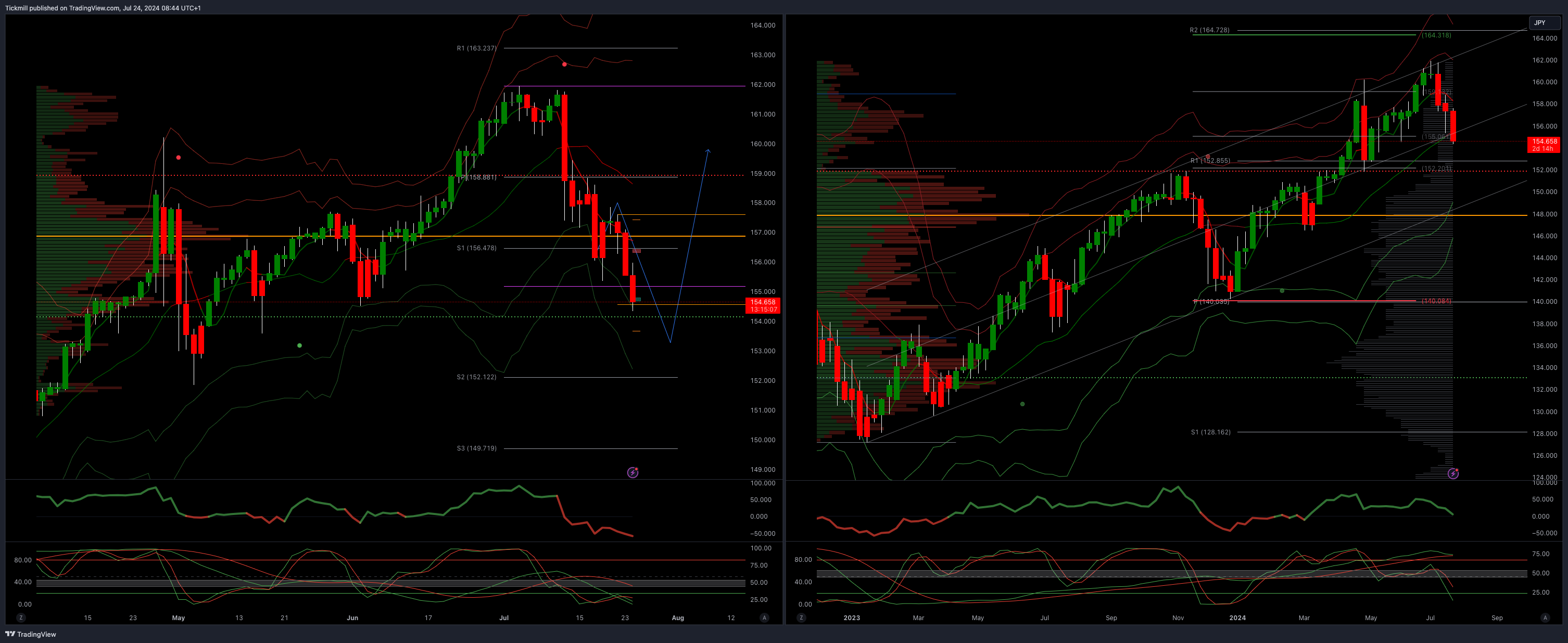

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bearish

Below 156 opens 153

Primary support 152

Primary objective is 164

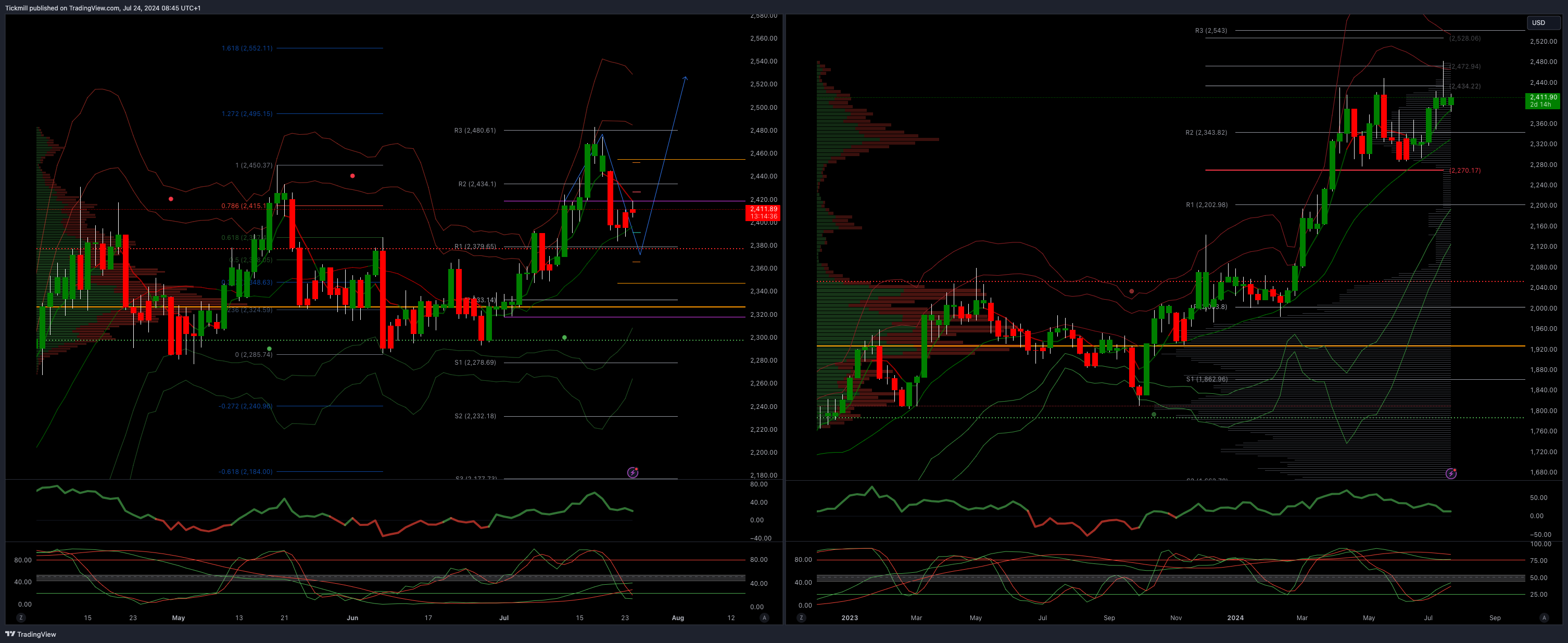

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bearish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!