Daily Market Outlook, July 23, 2024

Daily Market Outlook, July 23, 2024

Munnelly’s Macro Minute…

“Market Focus Shifts To MegaTech Earnings”

On Tuesday, Asian stock markets are mostly trading higher, taking cues from positive global markets. Traders are taking advantage of the recent market slump to buy stocks at a discount, especially in the technology sector. However, they are cautious about making big moves before the release of key US inflation data later in the week. The upcoming inflation data could have a significant impact on interest rate expectations, with the US Fed widely anticipated to lower rates by a quarter point in September. In a surprise move, China's central bank also reduced its one-year benchmark loan prime rate in an effort to support its slowing economy.Asian currencies also strengthened against a weakening dollar. Following a significant tech selloff due to high valuations and sectoral rotation, markets are now pausing for breath. While the US election remains a major focus, Kamala Harris has secured enough pledged delegates to win the Democratic presidential nomination, bringing clarity to that aspect of the political landscape.

The U.S. is expected to see a rate cut in September, while a 25 basis-point cut is anticipated in October for Europe. Despite upcoming Eurozone consumer confidence figures and U.S. existing home sales, the market outlook is unlikely to change.

Traders are expected to focus on earnings reports after the market closes for Tesla and Alphabet, the first of the "Magnificent Seven" stocks to report. Tesla's profit margins are predicted to decrease, while Alphabet is expected to report a fourth consecutive quarter of double-digit revenue growth due to an increase in the advertising market. Google reversed its decision to remove user-tracking cookies from its Chrome browser, yielding to pressure from advertisers who rely on cookie data for targeted advertisements. In Europe, Louis Vuitton's earnings after the market close will provide insight into Chinese demand. Luxury stocks saw gains after surprise rate cuts in China on Monday, but the sector has been impacted by reduced spending in the world's second-largest economy. Profit warnings from Burberry and Hugo Boss, along with a 27% decline in quarterly sales in greater China at Richemont last week, have dampened hopes for a stronger second half.

Overnight Newswire Updates of Note

Citi Warns Of Euro-Yen Intervention Risk If Pair ‘Threatens’ 180

Large Deficits To Keep U.S. Debt Burden Rising After November’s Elections

Harris Campaign Secures Enough Delegates To Clinch Presidential Nomination

Biden and Harris Meeting With Israeli PM Netanyahu At White House This Week

Biden’s Withdrawal From US Presidential Race Spells New Uncertainty For Ukraine

Aussie, Kiwi Dollars Struggle On China's Rate Cuts; Dollar Adrift

Oil Steadies, Weighed Down By Predicted Surplus Amid Weak Demand

Google Abandons Plan To Remove Cookies From Chrome Browser

WIZ Walks Away From $23 Billion Deal With Google, Will Pursue IPO

Buffett's Berkshire Hathaway Drops BYD Stake To Less Than 5%

China Misses Plenum Chance To Steady Economy Before US Election

China Human Resources Ministry: China Added 6.98 Mln Urban New Jobs In H1

Japan And China Resume Strategic Dialogue After 4 Years

Japan's Liberal Democratic Party Leader: BoJ Policies Should Be Made Clearer

Japan To Impose First Sanctions On Israeli Settlers In West Bank

SEC Approves Ether ETFs As Crypto Moves Closer To The Mainstream

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD:1.0825-30(530M), 1.0875-85 (1.1BLN), 1.0900 (331M), 1.0955-60 (406M)

USD/CHF: 0.8900 (285M), 0.8955-60 (219M). EUR/CHF: 0.9650 (320M)

GBP/USD: 1.2950 (290M)

AUD/USD: 0.6750-60 (752M) . AUD/NZD: 10.75 (659M)

USD/CAD: 1.3695-1.3700 (385M), 1.3720-25 (356M), 1.3750 (219M)

USD/JPY: 155.85 (787M), 156.00 (236M), 157.00 (244M), 157.20-35 (1.6BLN)

CFTC Data As Of 16/7/24

Equity fund managers raise S&P 500 CME net long position by 19,908 contracts to 997,340

Equity fund speculators increase S&P 500 CME net short position by 28,517 contracts to 370,142

Japanese yen net short position is 151,072 contracts

British pound net long position is 132,902 contracts

Euro net long position is 24,749 contracts

Swiss franc posts net short position of -49,793 contracts

Bitcoin net short position is -579 contracts

Technical & Trade Views

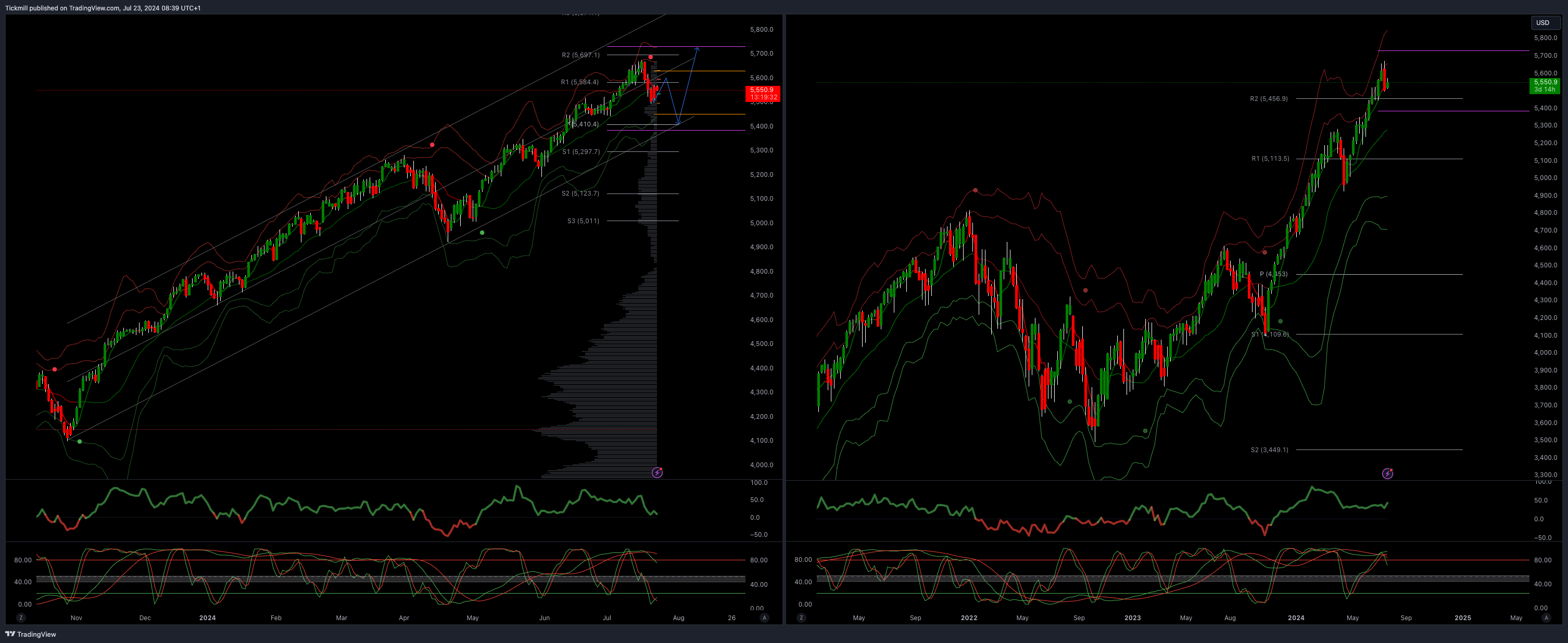

SP500 Bullish Above Bearish Below 5480

Daily VWAP bearish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

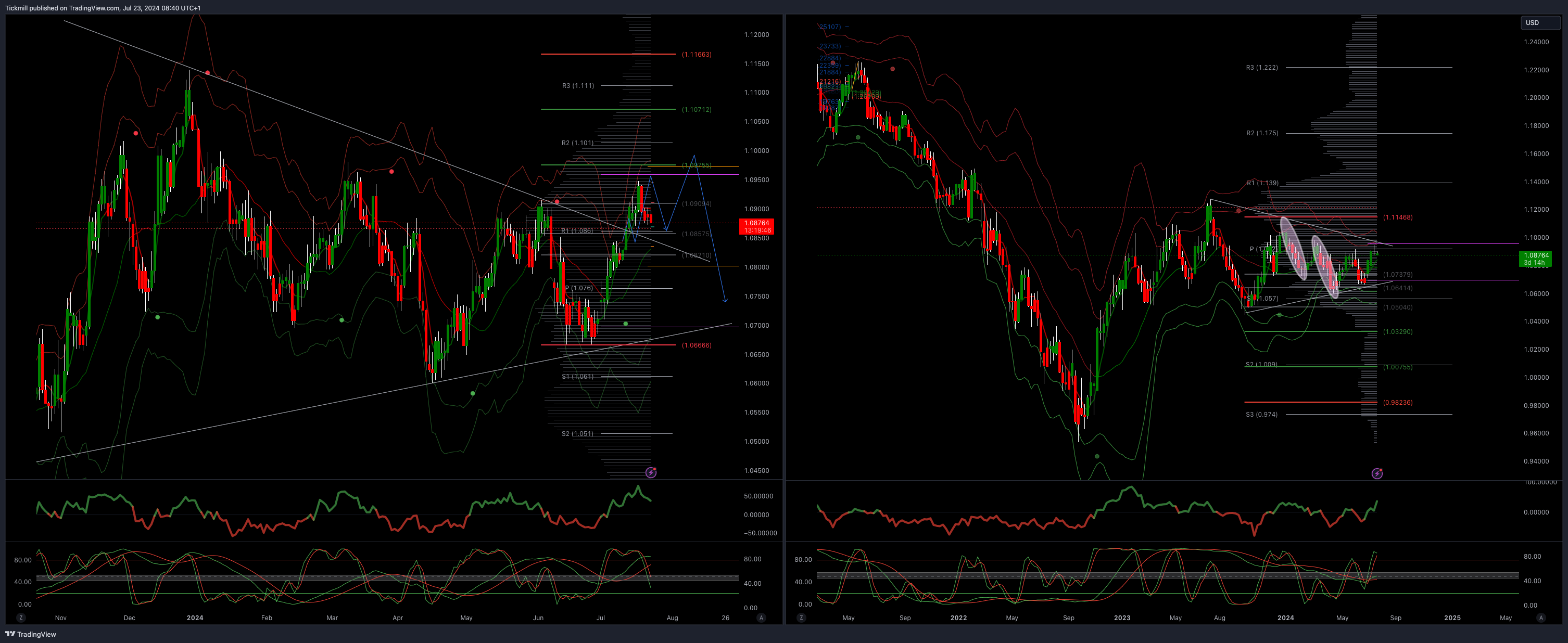

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0750

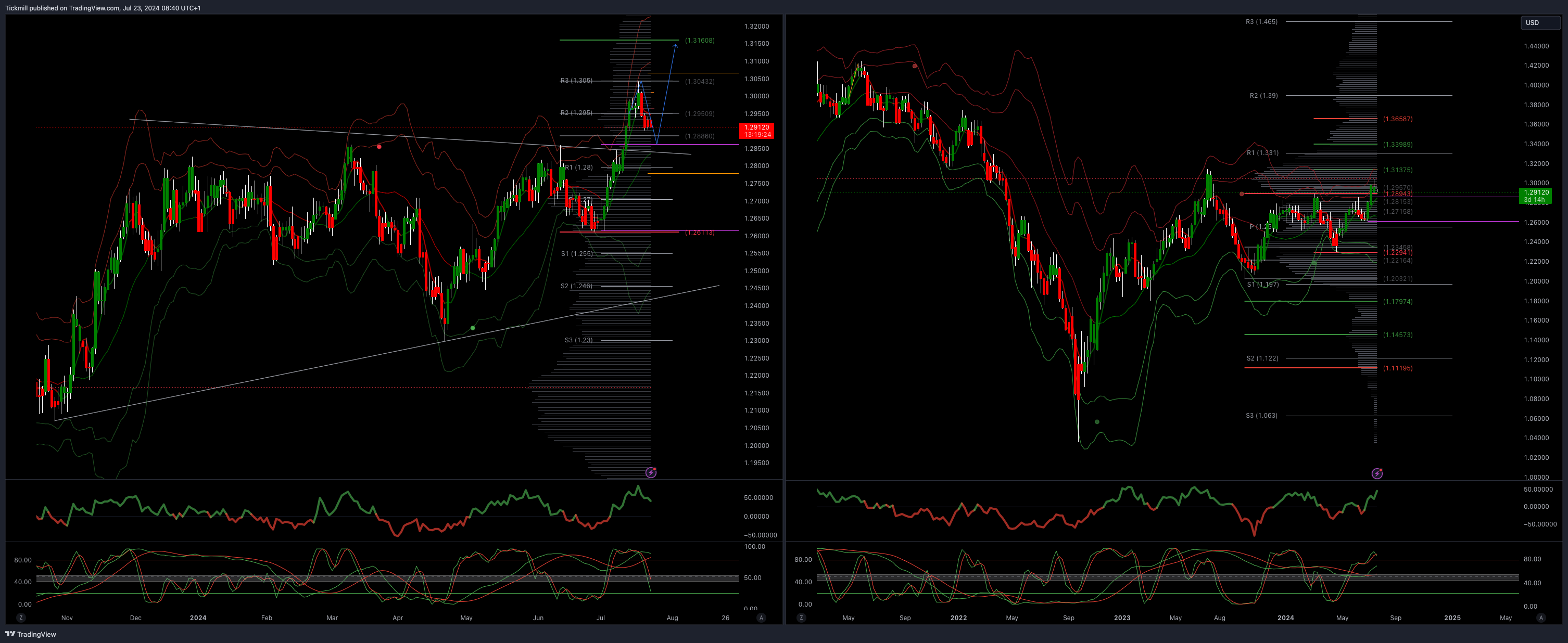

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3137/60

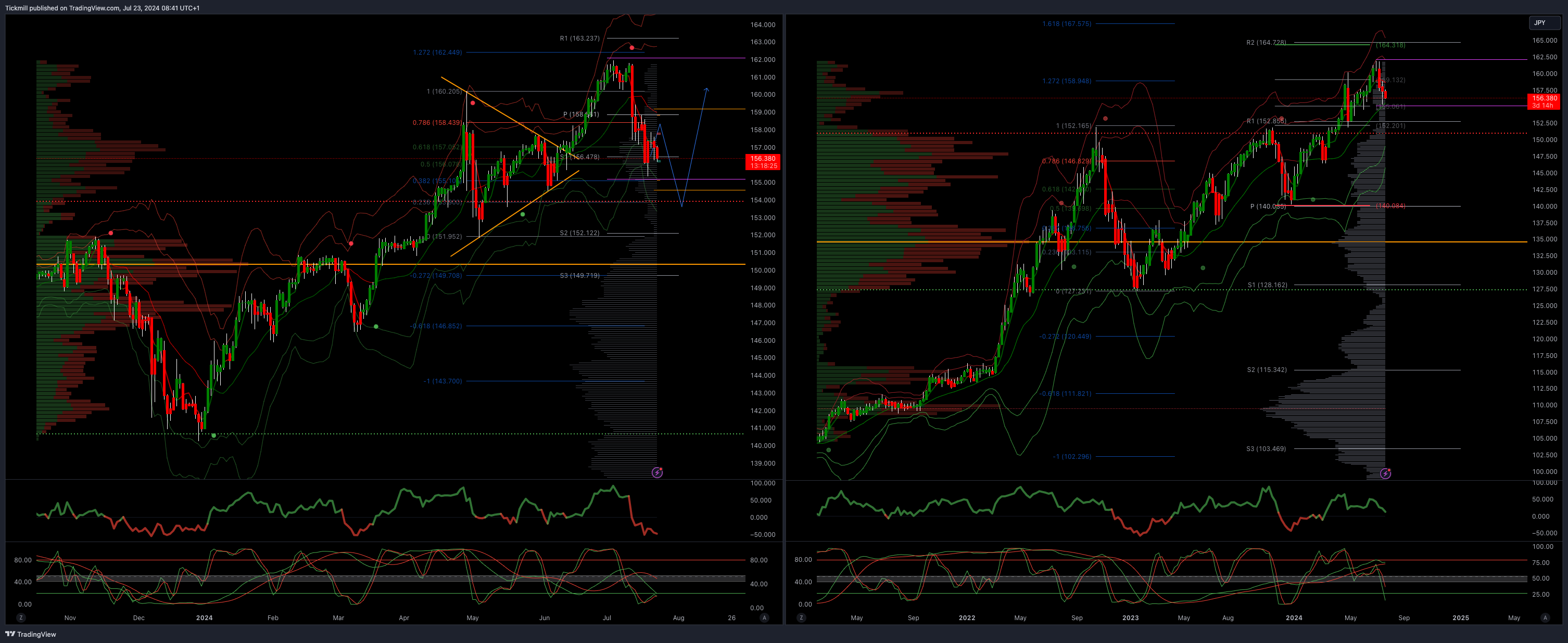

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bearish

Below 156 opens 153

Primary support 152

Primary objective is 164

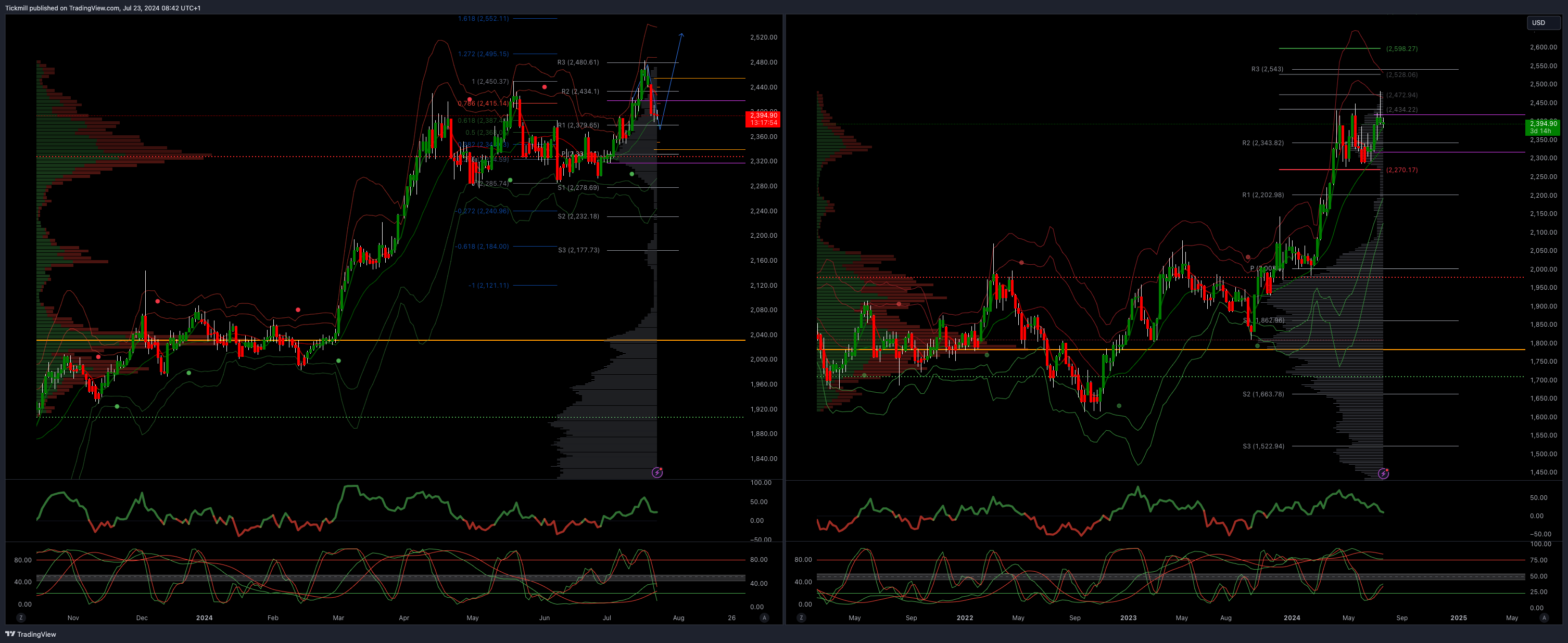

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bearish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

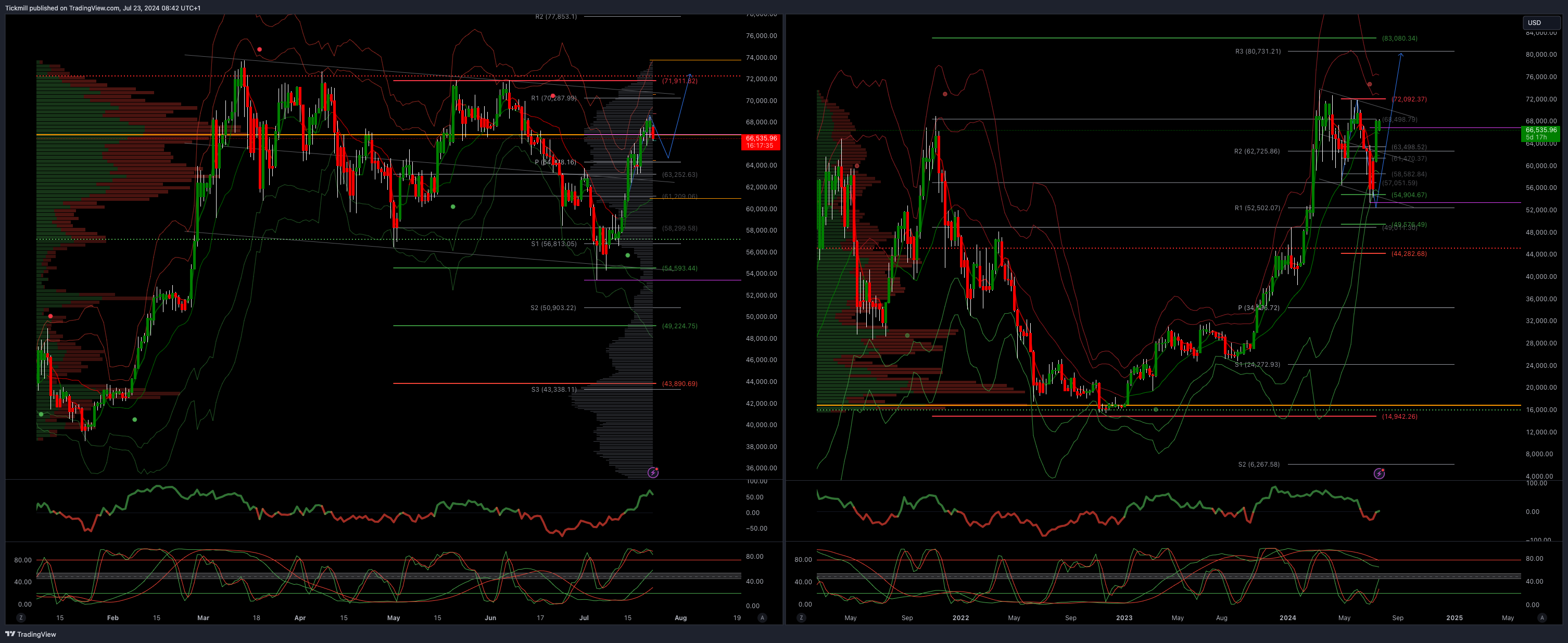

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!