Daily Market Outlook, July 2, 2021

Daily Market Outlook, July 2, 2021

Overnight Headlines

- Dollar's near-term outlook bright, but to fade in a year- Reuters poll • U.S. labor market recovery gaining steam; worker shortages an obstacle • U.S. employment likely accelerated in June as companies boost perks for workers • Vaccinations aiding jobs recovery in food, hotel sector: Fed study • U.S. House approves $715 bln infrastructure bill • U.S. CBO doubles growth forecast to 7.4%; sees slight drop in federal deficit • IMF raises U.S. 2021 growth forecast to 7%, assumes Biden spending plans pass • Foreign CB US debt holdings -$17.637 bln to $3.522 tln Jun 30 week • Treasuries -$17.402 bln to $3.081 tln, agencies -226 mln to $351.954 bln • 30 countries back global minimum corporate tax of 15% • China shares slip after Party's party, others firm ahead of U.S. jobs data • OPEC+ delays meeting to Friday as UAE objects to new oil deal • Australia to halve arrivals from overseas, offers COVID-19 exit roadmap • In boost to Starmer, Labour wins election reprieve in north England

- Looking Ahead – Economic Data (GMT) • 09:00 EZ May Producer Prices MM, 1.2% f'cast, 1.0% prev; YY, 9.5% f'cast, 7.6% prev

- Looking Ahead – Events, Auctions, Other Releases (GMT) • N/A Greece FM Christos Staikouras at Delphi economic conference • 07:00 BoS Gov Cos at Climate conference • 09:00 ECB Andrea Enria at MEF lecture • 12:30 ECB Lagarde in panel discussion • 16:10 Irish CB DepGov Donnery speaks in online event

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD 1.1750 (1.12BLN), 1.1800-05 (730M), 1.1820-25 (1.8BLN). 1.1850-55 (2.7BLN), 1.1865 (1.0BLN), 1.1875 (413M), 1.1885 (500M), 1.1890-00 (2.36BLN), 1.1915 (1.1BLN), 1.1940 1.2BLN), 1.1950 (2.5BLN)

USD/JPY 110.75-80 (1.6BLN), 111.00 (2.0BLN), 111.40-50 (1.78BLN), 111.75 (1.9BLN), 112.00 (478M)

AUD/USD 0.7400 (755M), 0.7500 (463M), 0.7540 (328M), 0.7600 (365M), 0.7625 (500M)

EUR/JPY 132.20 (420M)

NZD/USD 0.7000-10 (700M)

AUD/NZD 1.0700 (300M)

GBP/USD 1.3750 (364M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.21 Bullish above

Consolidates at lows heading into US jobs • EUR/USD opened at 1.1850 and traded in a 1.1840/52 range in Asia • Market is looking ahead to US payrolls later today for next lead • EUR/USD havering above the 76.4 of the 1.1704/1.2266 move at 1.1836 • A break below 1.1835 targets the 21021 low at 1.1704 • Market is positioned for a strong US non-farm payroll result • There is a risk that USD longs may pare back unless data beats estimates • EUR/USD trending lower with resistance at 10-day MA at 1.1902

GBPUSD Bias: Bearish below 1.4080 Bullish above.

USD belief firms, but key support holds into US jobs • +0.05% in a 1.3752-1.3774 range with plenty of interest in Asia • Economists optimistic on USD short term, but bearish later • Positive USD sentiment, with the market not yet long likely caps cable • Charts; daily momentum studies, 5, 10 & 21 daily moving averages fall • 21 day Bollinger bands slide – a strong bearish trending setup • 10 DMA capped repeatedly, and pivotal is resistance, currently at 1.3871 • 1.3756, 61.8% of the 2021 rise is proving resilient – held in Asia • Downtrend targets a test of 1.3669 double bottom in March and April

USDJPY Bias: Bullish above 108 targeting 112

Consolidates more gains, quiet pre-US NFP • USD/JPY does little in Asia, 111.54-66 EBS, consolidate o/n gains again • Little interest ahead of key US NFP/jobs report tonight, +690K eyed (median) • Massive nearby option expiries again help contain action • 111.00 strike $2 bln, 111.40-50 total $1.8 bln, 111.75 $1.9 bln • Bull coming out of hibernation again, eye 111.71 March '20 high test soon • Break projects test of 112.00, 112.23 February '20 high • JPY crosses steady too with risk more on than off, Nikkei +0.3% @28,791

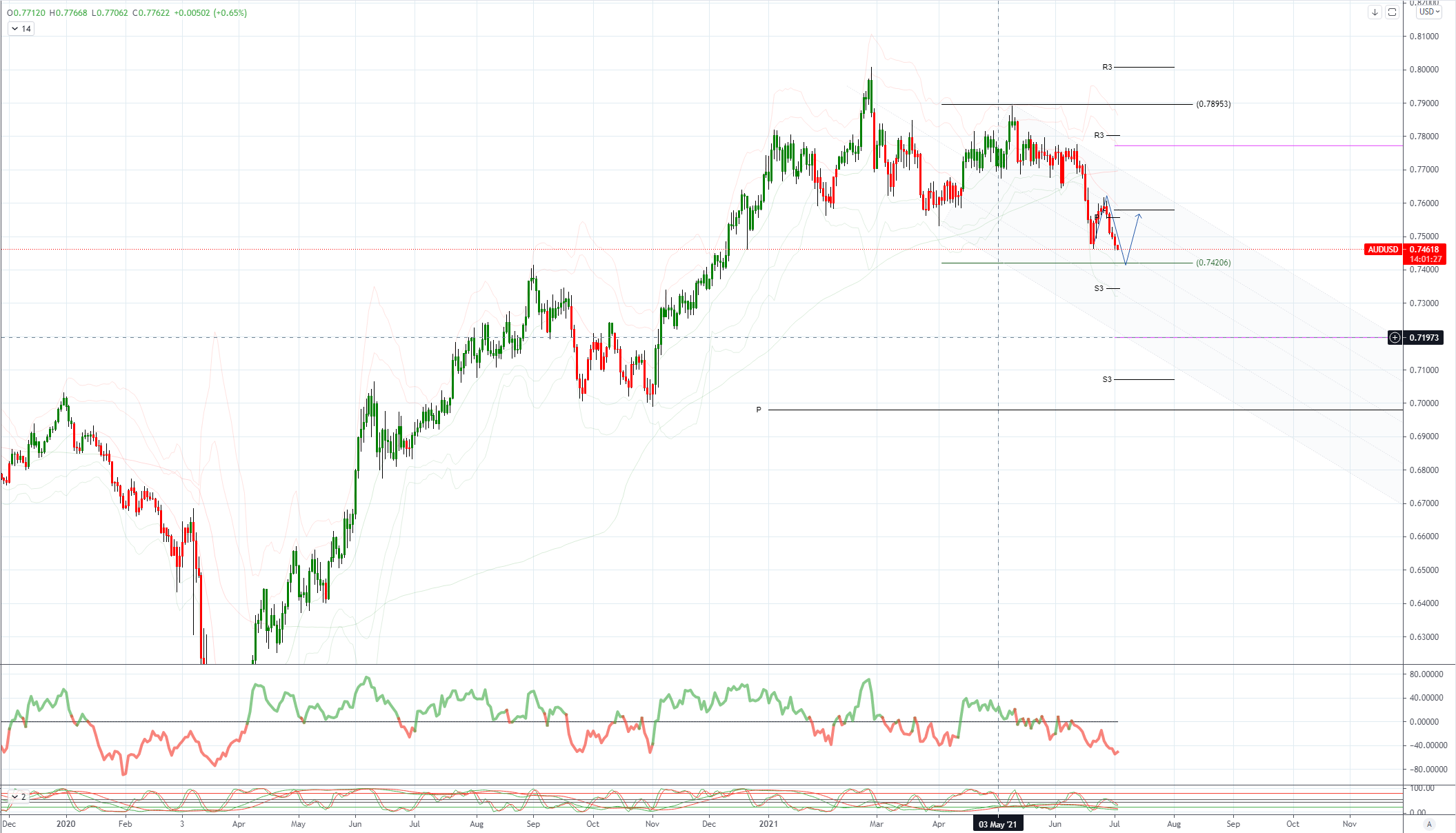

AUDUSD Bias: Bearish below .7790 bullish above

Retains heavy tone ahead of US payrolls • AUD/USD opened 0.37% lower at 0.7471 after USD moved broadly higher • In a quiet Asian session it slipped down to 0.7461 at one stage • Heading into the afternoon it is trading around 0.7465 • There isn't any support until the 61.8 of the 0.6990/0.8007 move at 0.7378 • Resistance is at the 10-day MA at 0.7536 and break would ease the pressure • AUD/USD likely to remain heavy until the US non-farm payrolls later today

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!