Daily Market Outlook, July 19, 2024

Daily Market Outlook, July 19, 2024

Munnelly’s Macro Minute…

“Trump Accepts Nomination, Biden Reflecting On His Run”

Asian stocks and currencies dropped due to economic and geopolitical concerns, despite market optimism about interest rate cuts, a global tech outage adds to the turmoil. The MSCI Asia Pacific Index fell over 1%, its biggest weekly decline in three months. Chinese stocks in Hong Kong led the region's losses, as investors were not convinced by the Third Plenum's efforts to show the economy's potential for renewed growth. US futures rose after the S&P 500 fell for the second consecutive session on Thursday.

The past week has been turbulent for investors, with a sell-off in the tech sector due to escalating trade tensions between the US and China, uncertainty surrounding the US presidential election, and a disappointing outcome from China's third plenum. As the global economic situation becomes increasingly uncertain, interest rate expectations have taken a backseat for the time being. The recent attempted assassination of Republican presidential candidate Donald Trump may have been a sign of more market turmoil to come, as reflected in the spike in Wall Street's fear gauge, the VIX index. On Friday, Asian shares struggled, and the sell-off in technology stocks affected other sectors, with Europe also expected to open lower.

Even positive earnings and forecasts from Taiwan's TSMC were unable to alleviate investors' concerns about a potential US crackdown on Chinese chips, leading to further declines in the world's largest contract chipmaker's shares on Friday. In addition, comments from Trump suggesting that Taiwan should pay for its defense contributed to TSMC's worst weekly decline since late May, with over $61 billion wiped off its peak market value.

The cautious market sentiment on Friday provided some support for the dollar as a safe haven, distancing it from a four-month low caused by expectations of an imminent Federal Reserve easing cycle. In recent days, Fed policymakers have indicated the possibility of a rate cut in September, while the European Central Bank has left the door open for a similar move. On the other hand, the Bank of England has not yet found conditions favorable for a rate cut, and traders have reduced the likelihood of a cut in August.

Overnight Newswire Updates of Note

UK Consumers Stay Cautious As New Government Takes Office

New Law Aimed To Prevent Repeat Of Truss Mini-Budget

France’s National Assembly Elects Macron’s Choice As Its Head

Trump Accepts GOP Nomination, Bullet Wound To His Ear And Electoral Wind At His Back

Top Democrats Prepare For Campaign Without Biden

Once Defiant, Biden Is Now 'Soul Searching' About Dropping Out Of Race

Fed's Daly: 'Not There Yet' On Price Stability

US Fed Governor Bowman Comments In Prepared Speech On Bank Reform

Chinese Leaders Sticks To Painful Reform Playbook To Target Risks And Growth

China Wraps Third Plenum With Calls For Stronger Social Control And Economic Growth

Japan's Inflation Rate Rose For Second Consecutive Month In June

Japan Government Cuts GDP Growth Outlook To 0.9% From 1.3% In FY 2024

Kim Jong Un Meets Russian Vice Defense Chief In Pyongyang To Boost Military Ties

Drone Explodes In Central Tel Aviv, Killing Man And Wounding Several Others

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900-05 (1.2BLN), 1.0915-20 (586M), 1.0935-40 (471M)

1.0950 (1.2BLN)

USD/CHF: 0.8800 (1.1BLN), 0.8900 (280M), 0.8950 (662M), 0.9075 (750M)

GBP/USD: 1.2850 (645M), 1.2970-75 (564M), 1.3025 (200M)

EUR/NOK: 11.68 (525M), 11.70 (443M)

EUR/GBP: 0.8400 (176M), 0.8440 (200M)

AUD/USD: 0.6720-25 (731M), 0.6765 (1.4BLN)

NZD/USD: 0.6050 (527M)

USD/CAD: 1.3675 (402M), 1.3695-1.3705 (614M), 1.3725 (347M)

USD/JPY: 157.00 (620M), 158.00 (789M). EUR/JPY: 172.00 (205M)

CFTC Data As Of 9/7/24

Japanese yen net short position is -182,033 contracts

Euro net long position is 3,623 contracts

British pound net long position is 84,690 contracts

Swiss franc posts net short position of -46,088 contracts

Bitcoin net short position is -118 contracts

Equity fund speculators increase S&P 500 CME net short position by 47,949 contracts to 341,624

Equity fund managers raise S&P 500 CME net long position by 24,304 contracts to 977,432

Technical & Trade Views

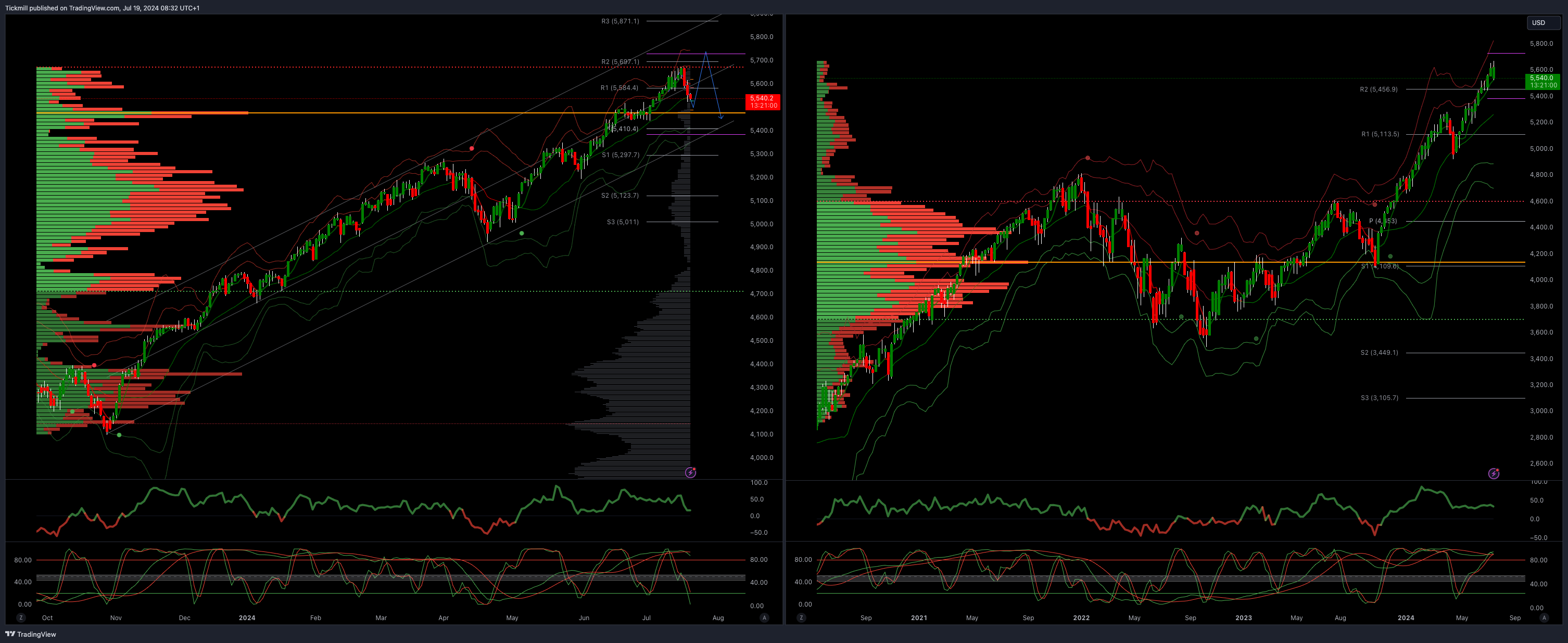

SP500 Bullish Above Bearish Below 5480

Daily VWAP bearish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

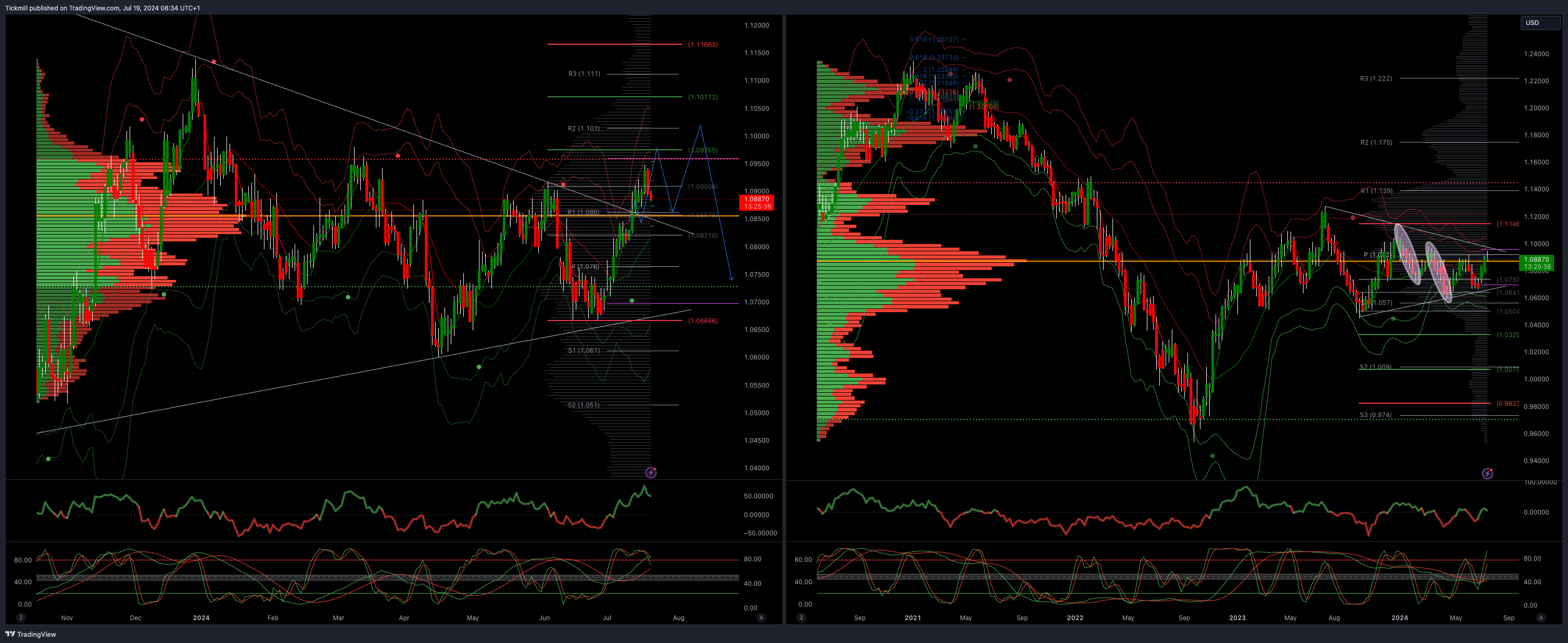

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0750

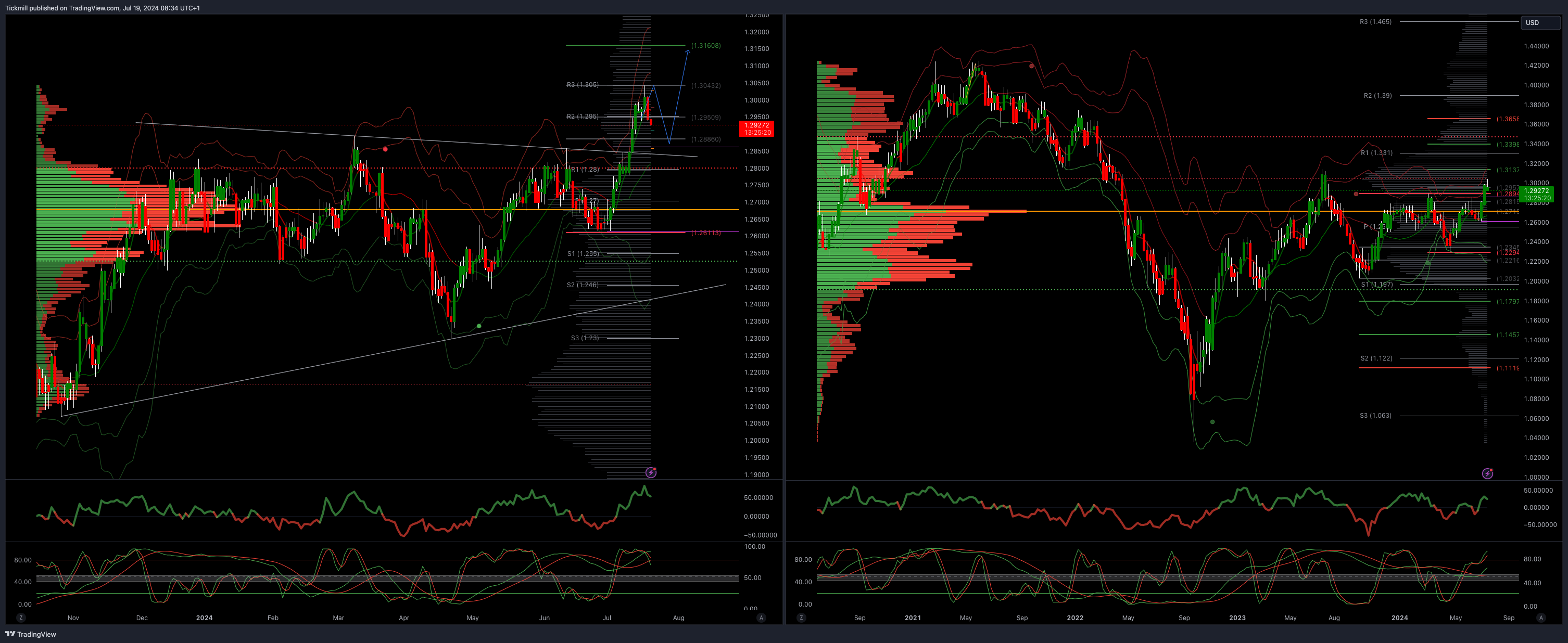

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3137/60

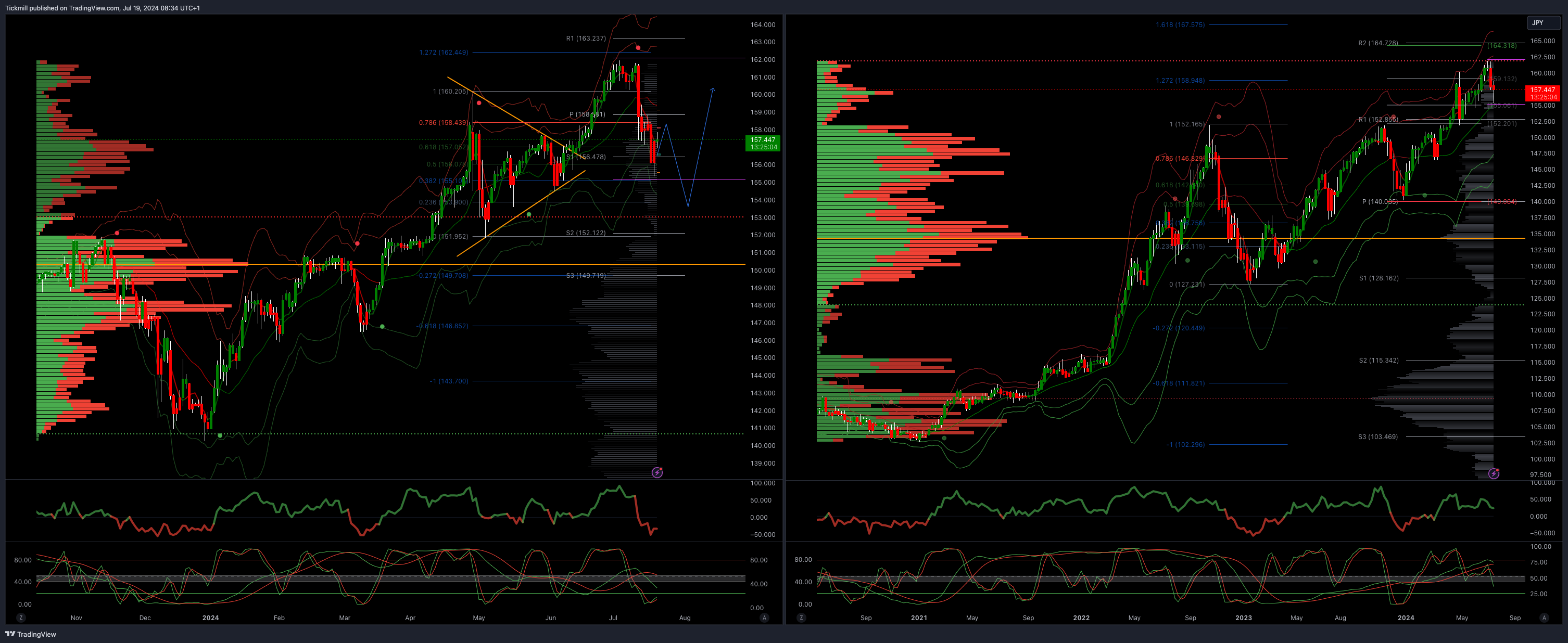

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bearish

Below 156 opens 153

Primary support 152

Primary objective is 164

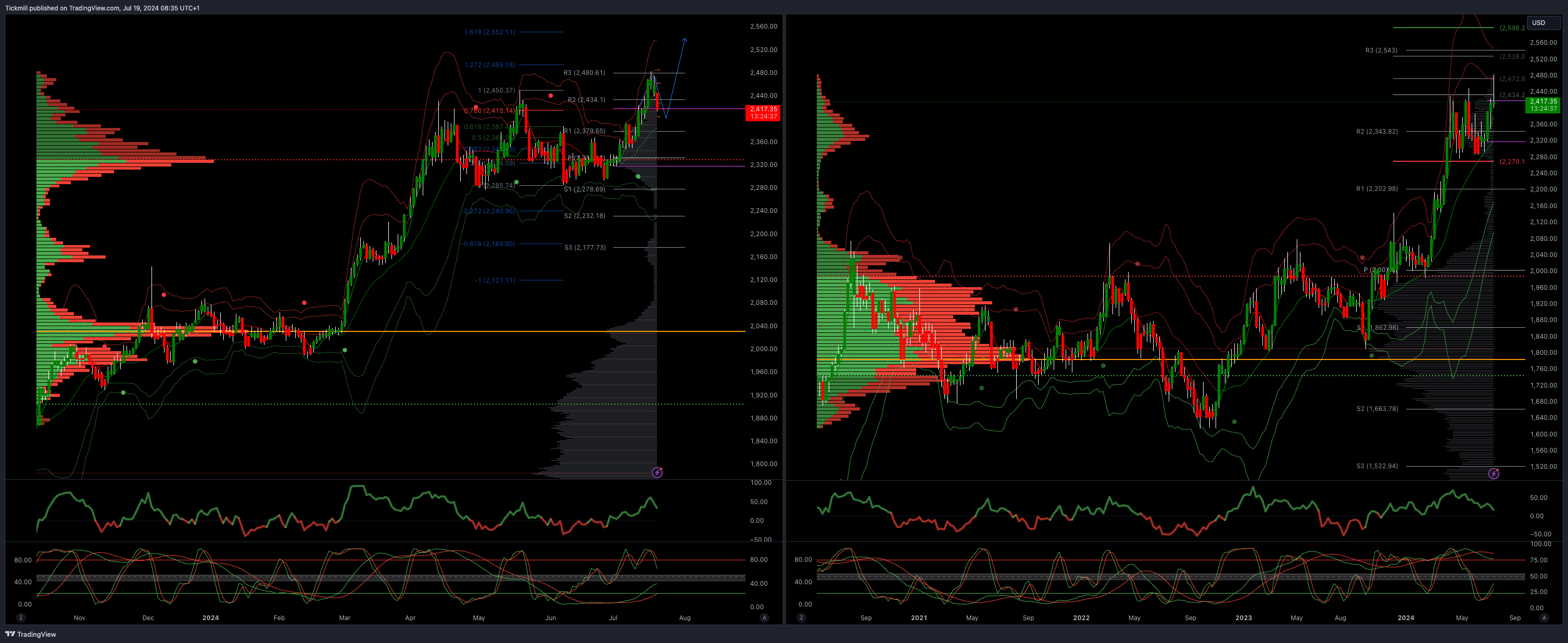

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

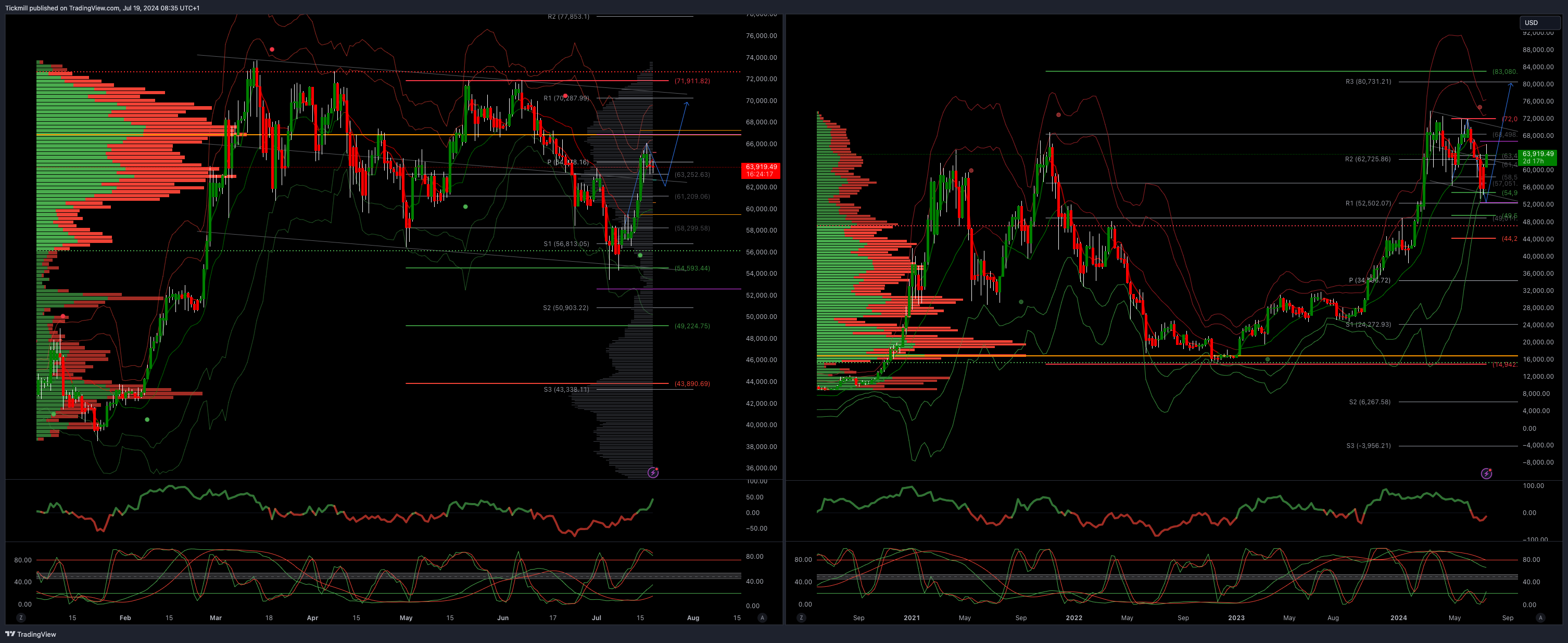

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!