Daily Market Outlook, July 18, 2024

Daily Market Outlook, July 18, 2024

Munnelly’s Macro Minute…

“Nasdaq Sell Off Gains Momentum On Trump Trade Concerns”

On Thursday, Asian stocks experienced a decline, driven by a widespread sell-off in the technology sector amid concerns over potential tightening of US restrictions on chip sales to China. The region saw significant losses in Japanese and South Korean stocks, with the Topix index dropping by as much as 1.5%. Tokyo Electron was particularly hard hit for the second consecutive day, experiencing an approximately 11% decline, while Taiwan Semiconductor Manufacturing also dropped by as much as 4.3%. Meanwhile, the performance of Hong Kong and mainland Chinese stocks was mixed, as US futures showed a slight increase.

The recent sell-off in the tech sector gained momentum this week following reports that the United States was considering stricter restrictions on chip exports to China. This, combined with comments on Taiwan by Donald Trump, has raised geopolitical concerns and set a negative tone for the European market hours.

The technology index for pan-European STOXX 600 is once again in focus after experiencing its largest one-day percentage drop since December 2022 on Wednesday, largely due to ASML dragging it lower. Investors in the chip industry have been cautious due to Washington's protective stance towards the U.S. semiconductor manufacturing industry, which is seen as strategically important for competing against China.

According to Bloomberg news, the U.S. has informed allies that it is contemplating the use of severe trade restrictions if companies continue to provide China with access to advanced semiconductor technology. Additionally, comments from Republican presidential candidate Trump regarding Taiwan have led to a significant decline in chip stocks, resulting in a market value loss of over $500 billion.Chip stocks have been a driving force behind this year's global share rally, propelling the Nasdaq and S&P 500 to record highs. Some analysts believe that the recent market movements are a result of investors adjusting their positions.

All eyes will be on TSMC, which is set to report earnings later on Thursday. The company's shares have dropped by more than 6% over the past two days. Meanwhile, the European Central Bank policy meeting will take center stage later in the day, with expectations for the central bank to maintain interest rates. Traders will closely watch for any comments from officials that may provide insight into future rate cuts.These comments are likely to influence the euro, which reached a four-month high on Wednesday as traders fully priced in a 25 basis-point rate cut by the Federal Reserve in September, following remarks from officials. The yen experienced volatility after reaching its highest level in six weeks on Thursday, with traders still cautious due to suspected interventions.

Overnight Newswire Updates of Note

Starmer Seeks To Start Rebuilding Relations With Europe

Rachel Reeves To Outline Rules Preventing Another Liz Truss-Style Budget

Nancy Pelosi Warns Biden Of 2024 Presidential Race Peril

US Democratic Sen. Schumer Told Biden To End His Re-Election Bid

Japan's Exports Grew For Seventh Straight Month In June

Australia Unemployment Edges Up; Amid Population And Participation Growth

Japan Arranging To Shoulder $3.3 Billion In G7 Loans For Ukraine

Oil Prices Rise On Bigger-Than-Expected Drop In US Crude Stocks

Gold Price Stays Supported At $2,450 Amid Risk Aversion, Fed Easing Bets

Warner Bros Discovery Plan Split Digital Streaming And Studio Businesses Legacy TV

Hong Kong’s Ether ETFs Face US Competition, Investors May Flock To City

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0880 (1.4BLN), 1.0895-1.0905 (3.1BLN) , 1.0915-25 (2.4BLN)

1.0930-40 (1BLN), 1.0950 (1BLN)

EUR/CHF: 0.9640 (250M), 0.9700 (655M), 0.9750 (1.1BLN)

GBP/USD: 1.2925 (575M), 1.2975-80 (1.5BLN), 1.3000 (503M)

EUR/GBP: 0.8375 (936M), 0.8400 (509M), 0.8425 (354M)

AUD/USD: 0.6720-25 (447M), 0.6735 (428M), 0.6800-05 (1.3BLN)

AUD/NZD: 1.1000 (654M), 1.1050 (224M), 1.1075 (190M), 1.1100 (280M)

NZD/USD: 0.6040 (500M)

USD/CAD: 1.3550 (1.1BLN), 1.3690-1.3700 (474M), 1.3730 (513M), 1.3750 (300M)

USD/JPY: 155.50-60 (527M), 156.00 (325M), 156.70-80 (600M)

156.95-157.00 (1.9BLN), 157.10 (400M), 158.00 (3.7BLN)

EUR/JPY: 171.50 (850M).

CFTC Data As Of 9/7/24

Japanese yen net short position is -182,033 contracts

Euro net long position is 3,623 contracts

British pound net long position is 84,690 contracts

Swiss franc posts net short position of -46,088 contracts

Bitcoin net short position is -118 contracts

Equity fund speculators increase S&P 500 CME net short position by 47,949 contracts to 341,624

Equity fund managers raise S&P 500 CME net long position by 24,304 contracts to 977,432

Technical & Trade Views

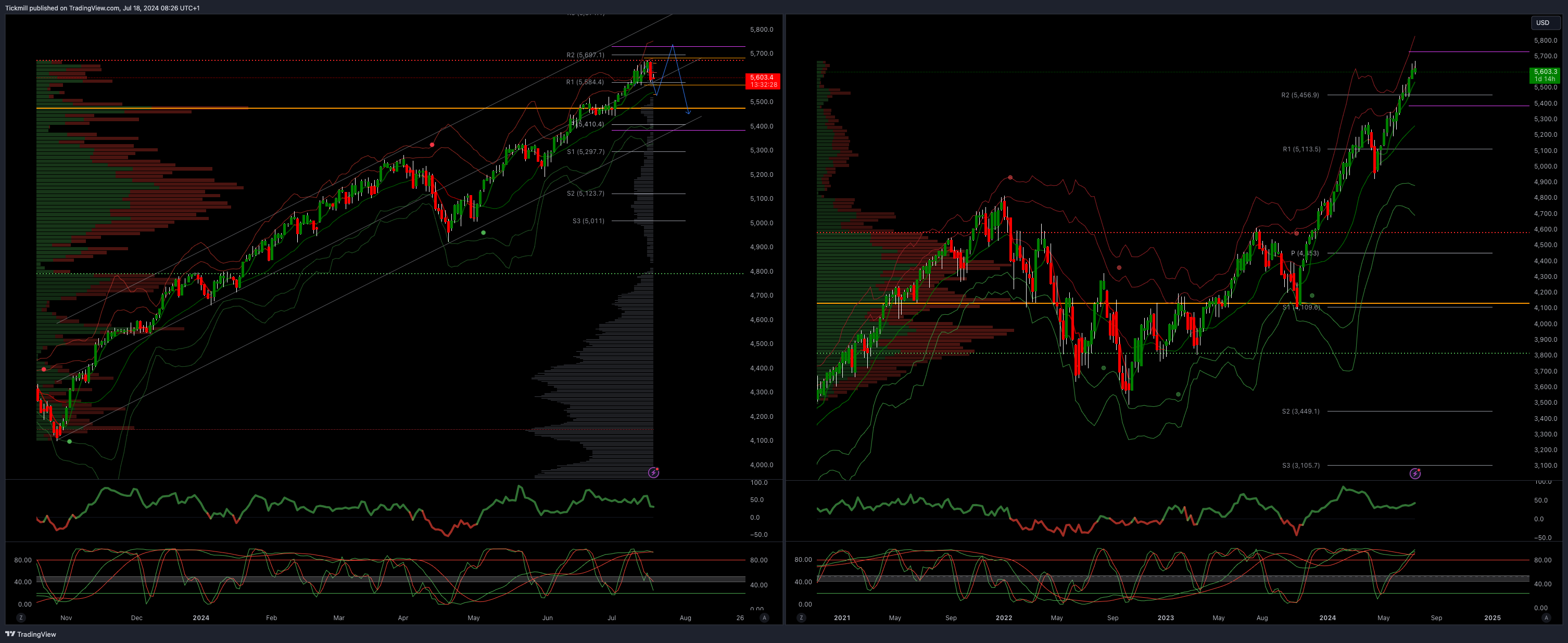

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

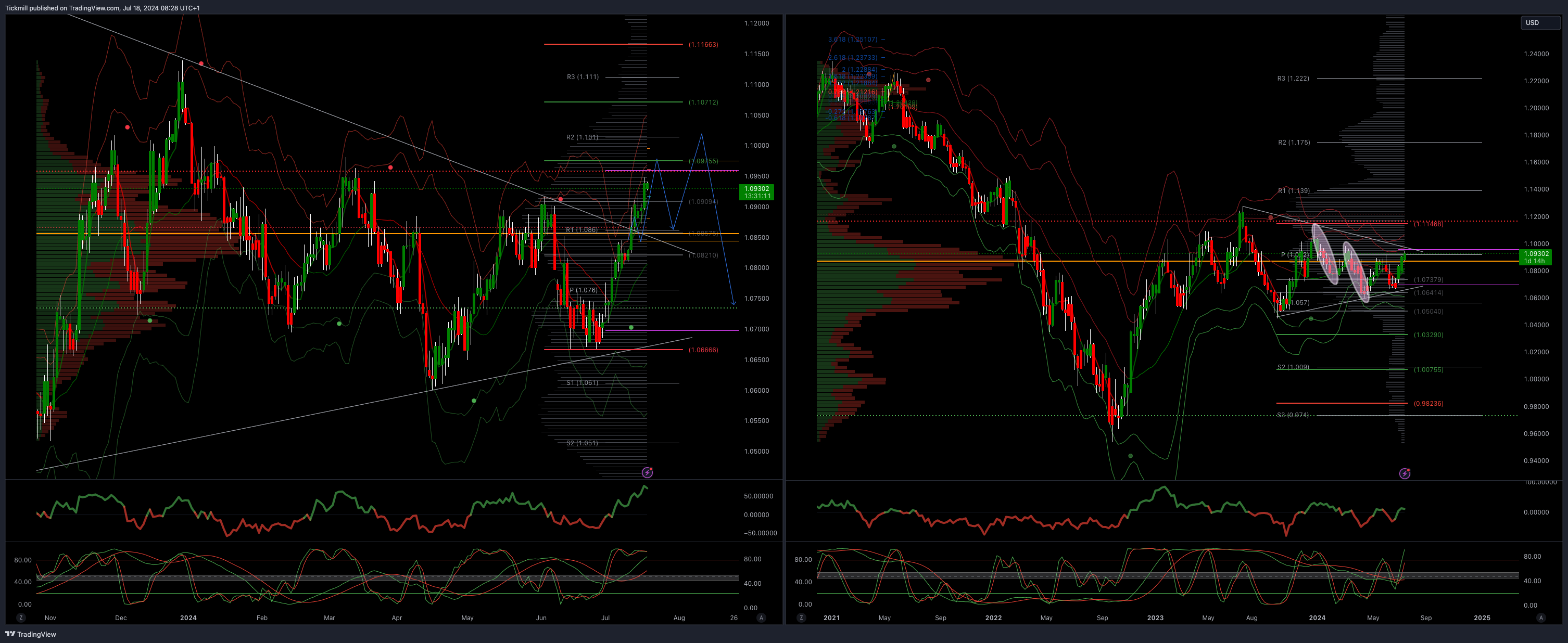

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0750

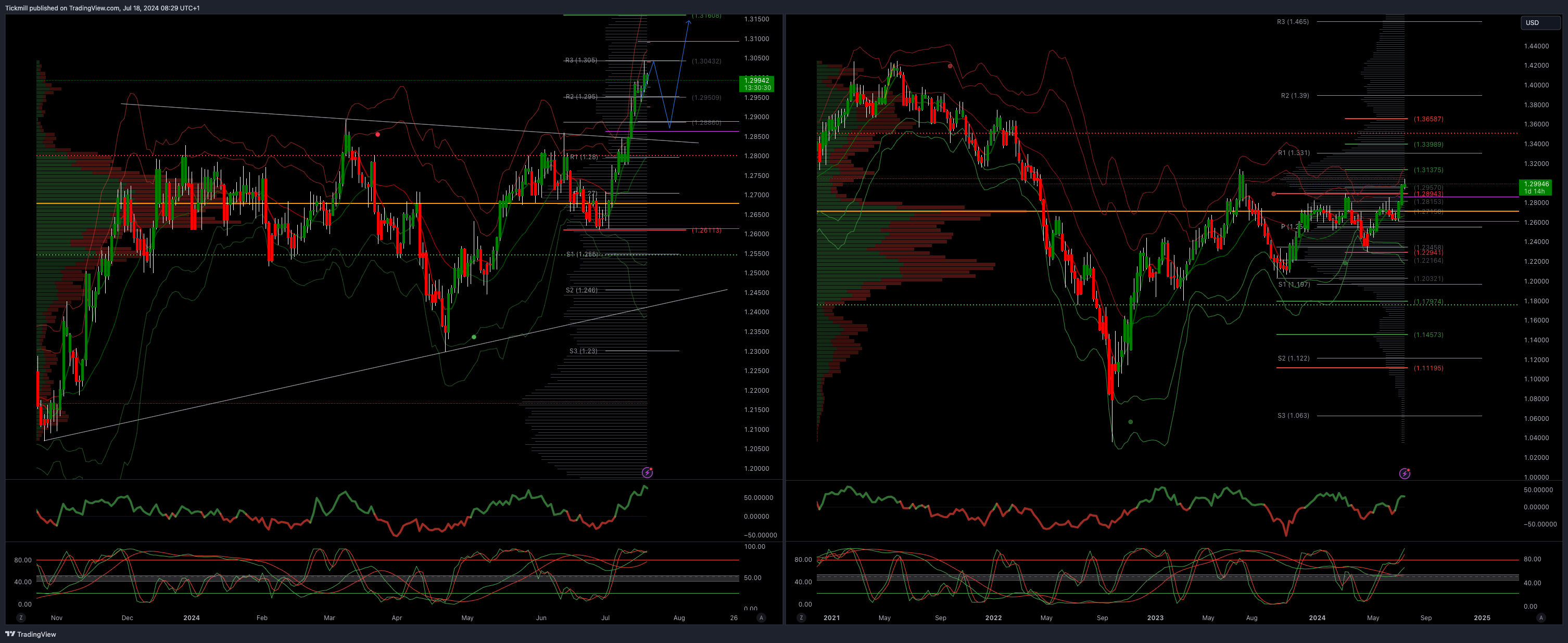

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3137/60

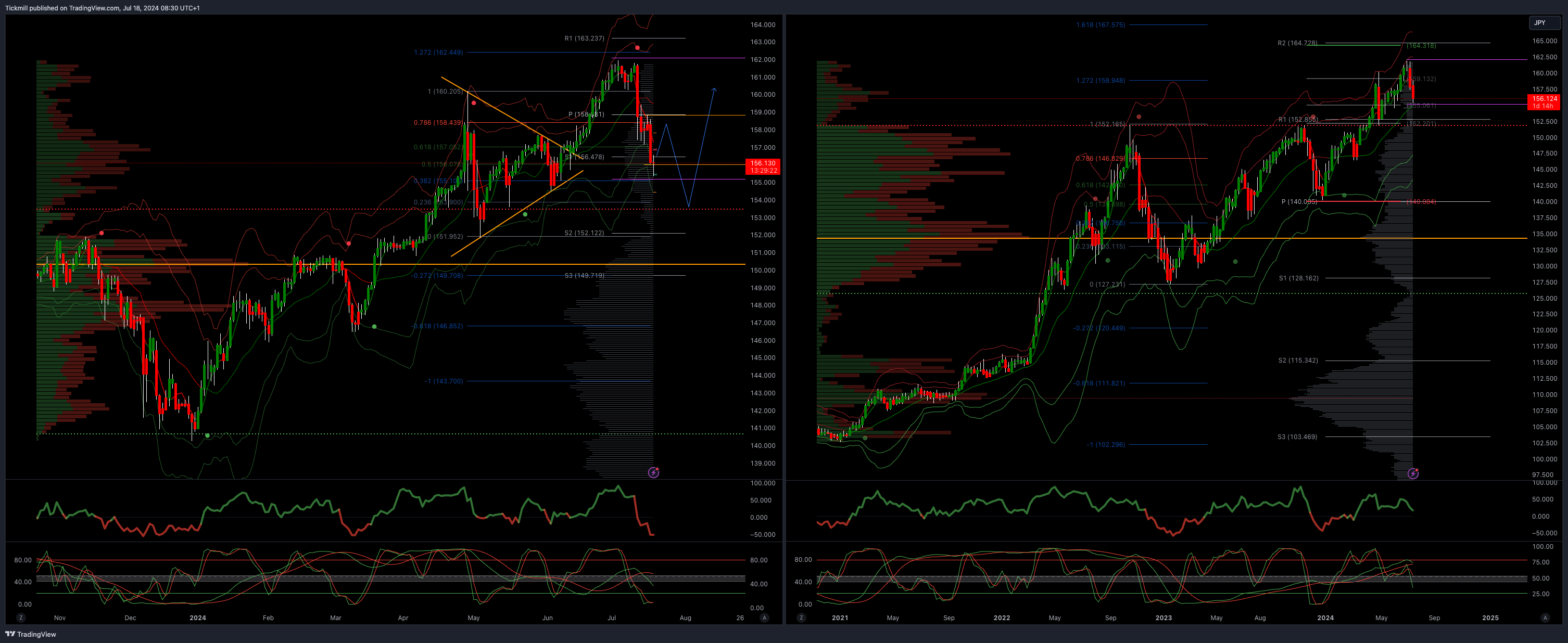

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bearish

Below 156 opens 153

Primary support 152

Primary objective is 164

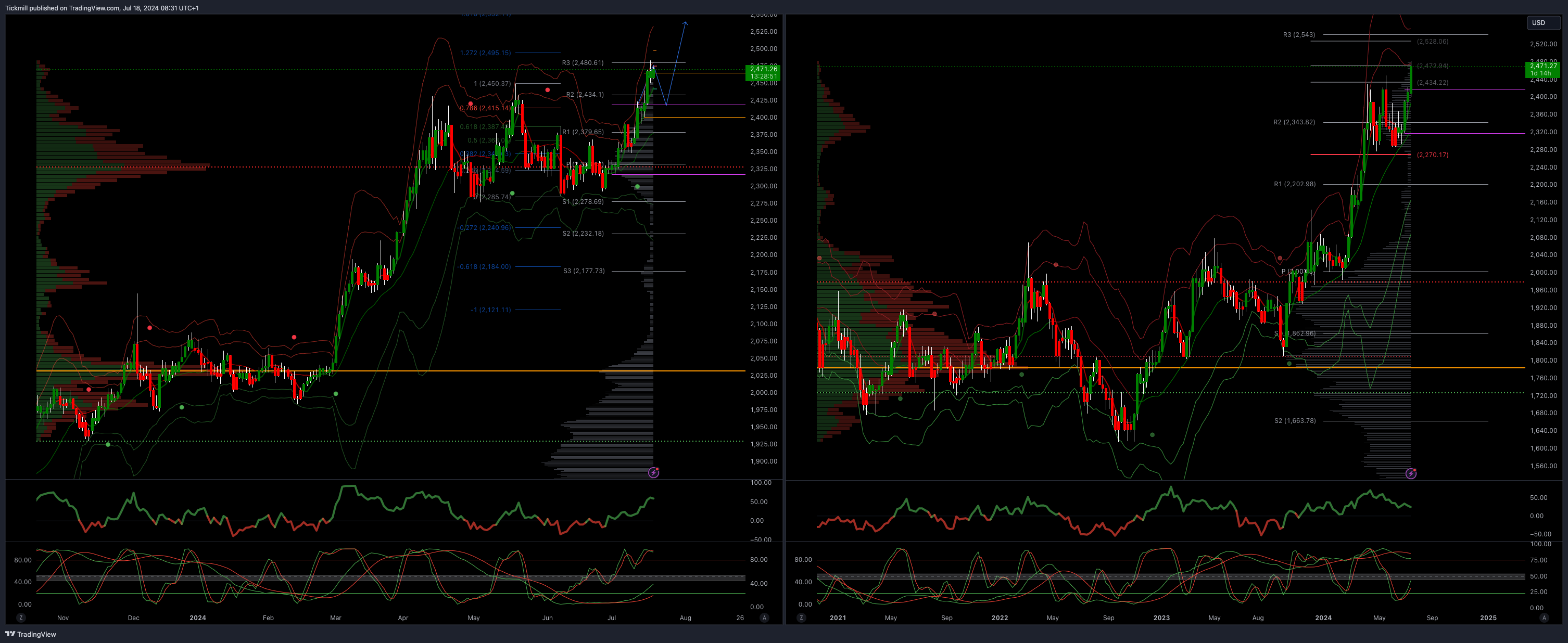

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

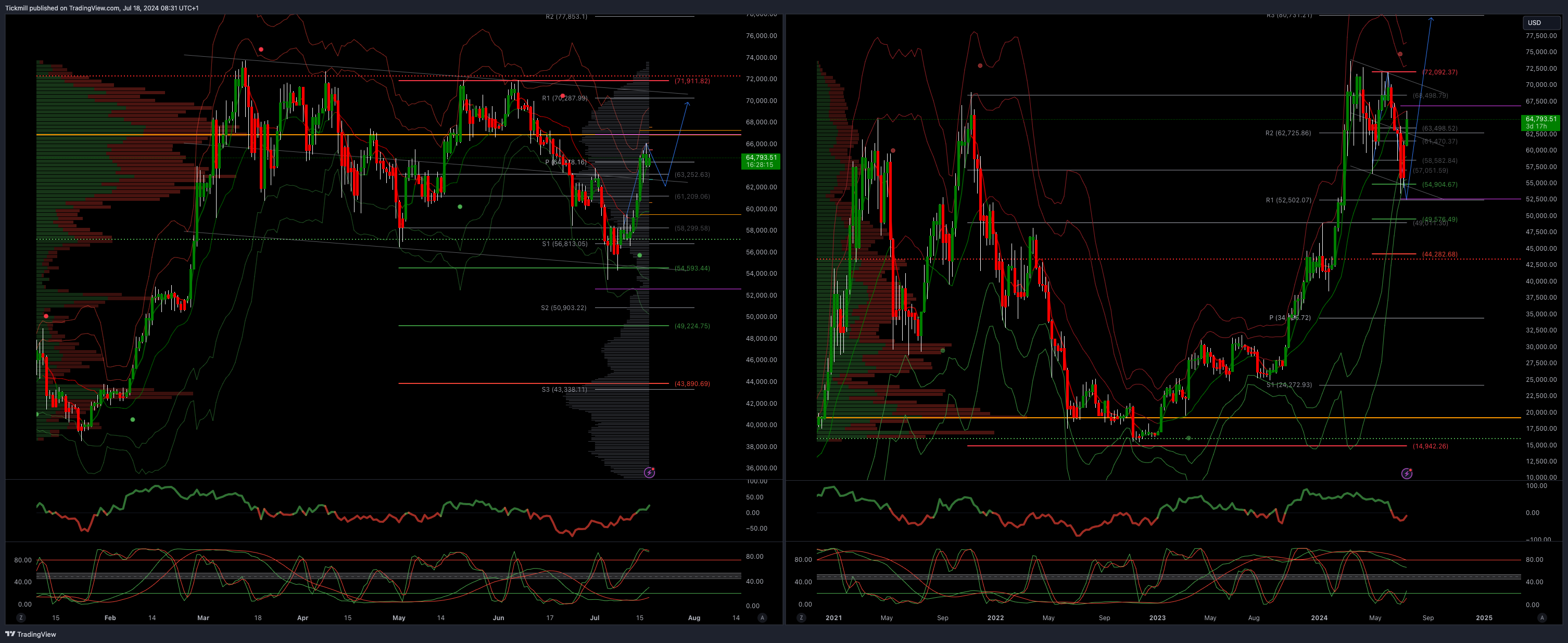

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bullish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!