Daily Market Outlook, July 18, 2022

Daily Market Outlook, July 18, 2022

Overnight Headlines

- IMF To Cut Global Growth Outlook ‘Substantially’ At The Next Review

- G-20 Finance Chiefs Blame Russia As Path To Soft Landing Narrows

- Fed Preparing To Lift Interest Rates By Another 75 Basis Points: WSJ

- Biden Fails To Secure Major Security, Oil Commitments At Arab Summit

- Italian Right-Wing Parties Reject 5-Star Movement As Coalition Partner

- BoE’s Missed Inflation Aim Becomes Topic Of UK Leadership Debate

- Russia Vows To Ramp Up Military Operations As Rockets Pound Ukraine

- China Covid Cases Held Above 500 Yesterday; Shanghai In Testing Blitz

- New Zealand Inflation Outpaces Forecasts At A Fresh 32-Year High

- Oil Drops As China's Rising Covid Cases Renew Fuel Demand Concerns

- Asian Equity Markets Mostly Higher To Start The Week; Japan Closed

The Day Ahead

- Following Friday’s gains across US and European exchanges, stocks have continued to rally across Asian markets. Equities across China have risen in response to PBoC Governor Yi’s comments that the central bank will step up monetary policy support to the economy, following the weaker-than-expected Q2 GDP report. China equities, however, lag the broad pick-up across Asia as elevated Covid cases continue to weigh on sentiment.

- The prospect of aggressive monetary policy tightening by the world’s major central banks continues to be a dominant feature for global financial markets. Last week, US annual consumer price inflation increased to a fresh forty-year high of 9.1%, a stronger outturn than predicted. That boosted speculation that the US Federal Reserve could follow the Bank of Canada’s example by lifting rates by a full percentage point despite signs of moderating economic activity. The Fed will provide a policy update on 27 July, ahead of which there a few bits of data in the coming week, primarily housing- market related, that should provide some food for thought. Later today, the National Association of Home Builders (NAHB) survey for July is expected to show a further softening in sentiment. The headline index is forecast to drop to a fresh two-year low of 66 from 67 previously, perhaps weighing against the FOMC hiking rates by 100bp at its meeting next week.

- In the UK, a similar debate continues to rage with sterling money markets speculating that the Bank of England come start delivering 50bp increases in Bank Rate at its upcoming meetings, starting with the one on the 4th August. This morning, MPC member Michael Saunders – who departs the committee shortly after the August meeting – is due to speak at an event hosted by the Resolution Foundation. He is likely to reaffirm his desire for a 50bp hike at his final meeting.

- Early tomorrow morning, the latest labour market report kicks off a busy week for key UK data releases, which could prove crucial in determining whether the MPC step up their rate increases from 25bp to 50bp. Despite the slight rise in the unemployment rate in last month’s release, the UK labour market remains tight with the focus on high inactivity rates among the working-age population and unfilled vacancies at a new peak. For the three months to May, expect the unemployment rate to stay at 3.8% and underlying annual pay growth (excluding bonuses) to edge up to 4.3% from 4.2%.

CFTC Data

- IMM: USD spec long rises as EUR, JPY, GBP hit new trend lows versus dollar

- USD spec long position rose in Jul 6-12 period

- EUR slid 2.2% in period, spec -8,392 contracts now short 25,244

- JPY specs -5,553 contracts now short 59,998; $JPY +0.7% in period

- GBP$ -0.63% in period, specs -2,881 contracts now short 59,089

- Specs +6,021 AUD on RBA rate hike, CAD specs -788 ahead of BoC

- BTC specs -591 contracts, flip to short 171; BTC - 4.9% in period

- (Source:Reuters)

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9975 (452M), 1.0000 (1.12B), 1.0100 (583M), 1.0175 (753M)

Technical & Trade Views

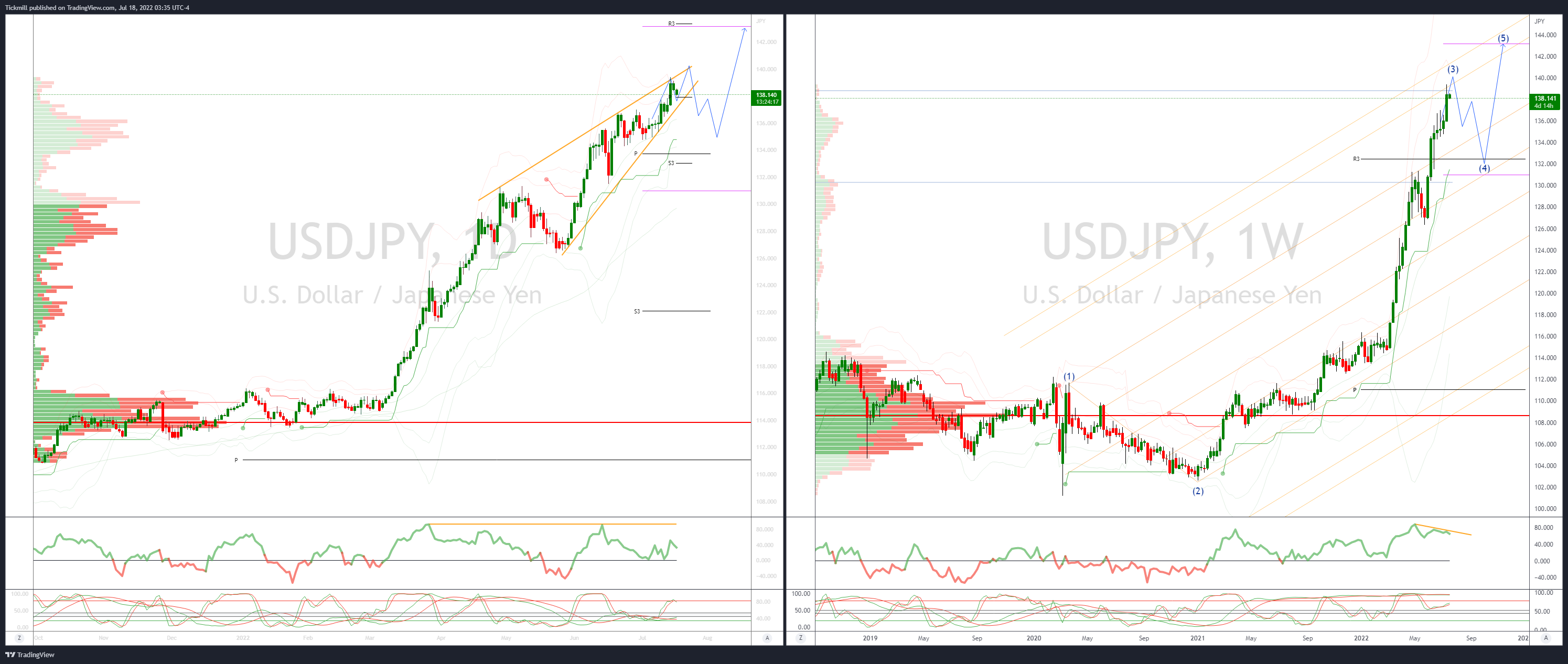

EURUSD Bias: Bearish below 1.0350

- EUR/USD up 0.15% in Asia as it continues to recover on better risk sentiment

- Waning fears of jumbo July Fed hike, easing US inflation expectations boost

- Lifted by S&P E-Mini rally of 0.4% as Fri risk recovery spills over to Asia

- Asia range 1.0080-1.01145 as traders pare euro shorts ahead of risk events

- ECB meeting, planned reopening of Nord Stream 1 gas pipeline Thursday eyed

- Resistance 1.0170-75, support 1.0075-80, 1.0045-50

- 20 Day VWAP is bearish, 5 Day bearish

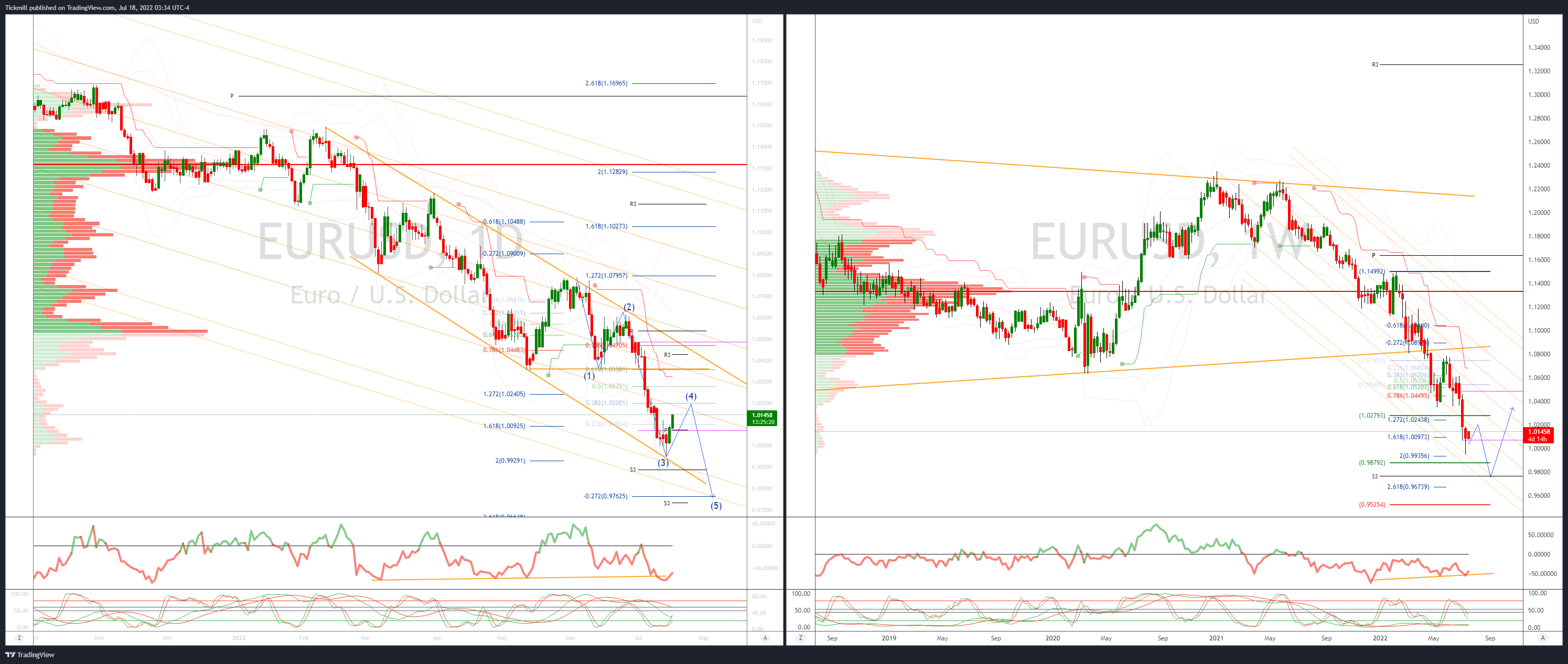

GBPUSD Bias: Bearish below 1.2150

- GBP/USD clings to gains driven by broadly weaker USD

- Last at 1.1901 from Fri close 1.1870; holding strong

- But bulls need a harder push to steer out of technical rut

- Mon close above 1.1905 negates Bollinger downtrend channel

- That would clear the way for challenge of 1.2000 psych barrier

- UK property asking prices +9.3% y/y vs +9.7% in June

- 20 Day VWAP is bearish, 5 Day bearish

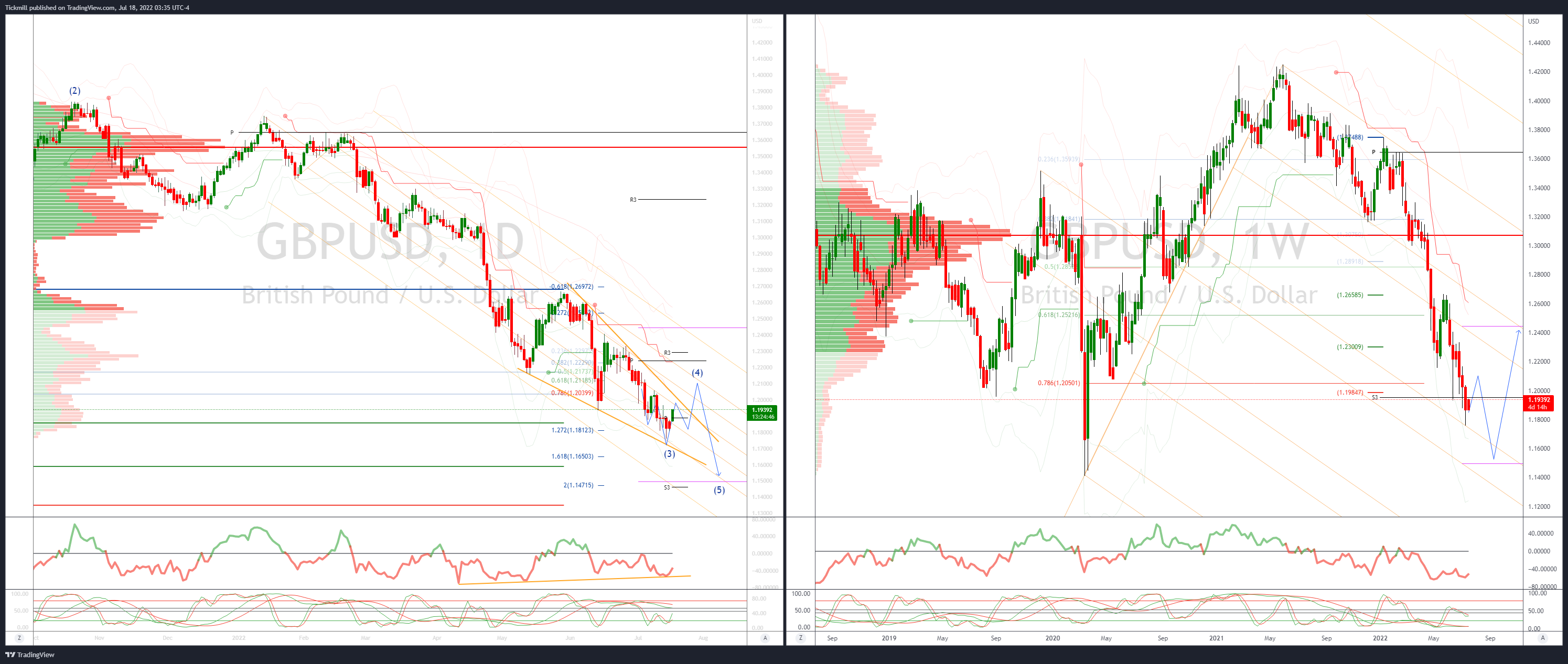

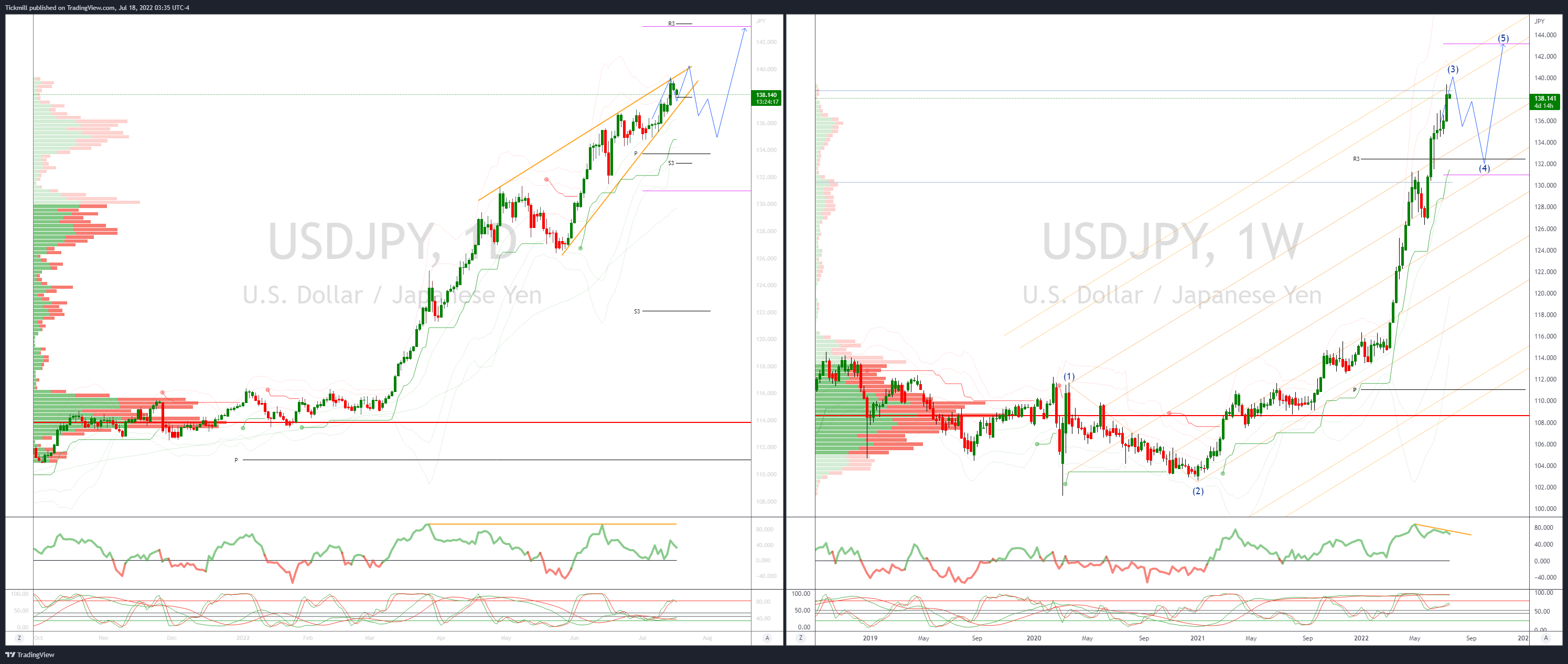

USDJPY Bias: Bullish above 134

- USD/JPY bounces to 138.37 from 138.03; still below open 138.47

- VWAP uptrend channel intact; base at 137.59

- Softer USD all around with risk-on picked up from Wall St

- But outlook hasn't changed much for USD/JPY bulls

- FOMC ahead the main focus, though 100bps hike less likely

- Japan financial markets closed Monday; S&P futures +0.4%

- 20 Day VWAP is bullish, 5 Day bullish

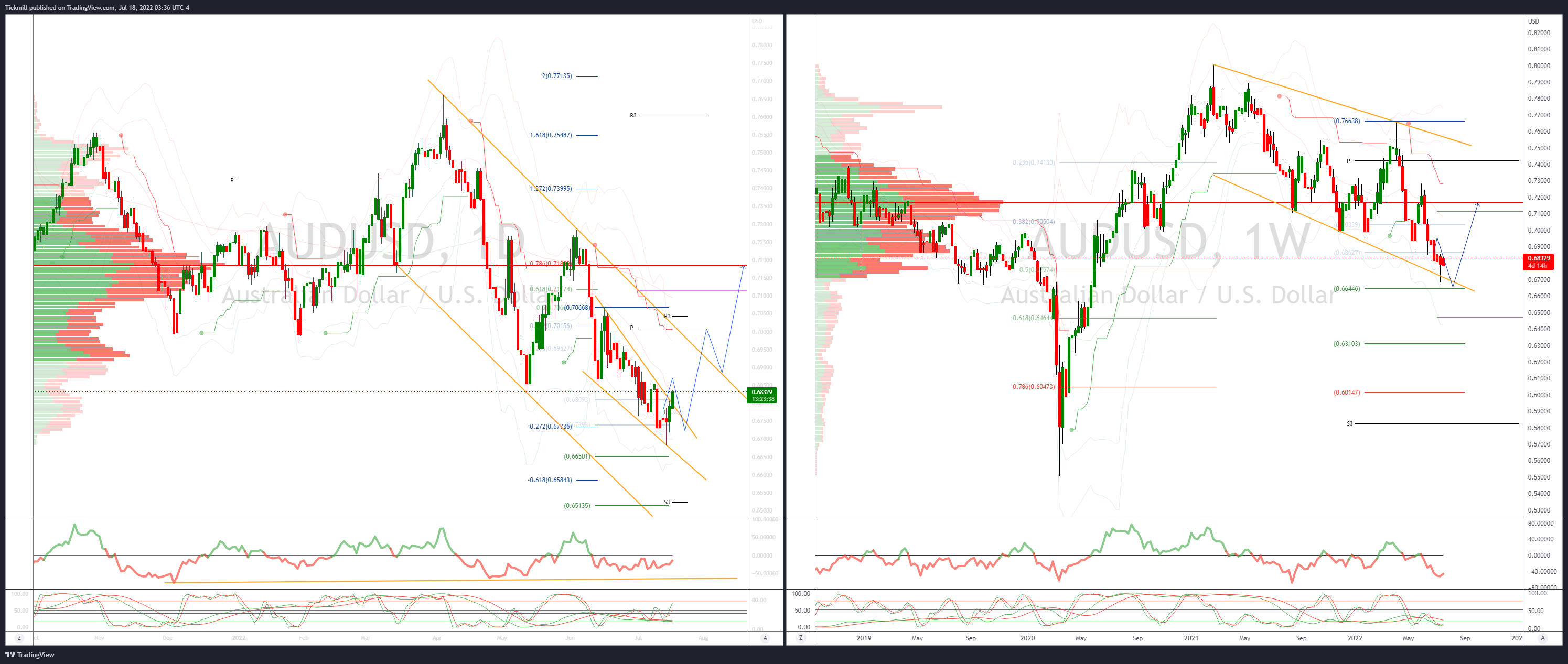

AUDUSD Bias: Bearish below .7050

- AUD/USD rallies 0.35% as Wall Street's risk recovery spills over to Asia

- Cooling Fed rate bets, easing US inflation expectations boost risk mood

- Last week's lowest AU jobless rate since 1974 sparks bigger RBA hikes talk

- NAB, Goldman Sachs, Nomura and TD Securities expect 75bps RBA hike in Aug

- Rising COVID cases in China, slowing China economy likely to limit gains

- Asia range 0.6792-0.6818; resistance 0.6830, 0.6850, support 0.6790, 0.6750

- 20 Day VWAP test underway

- 20 Day VWAP is bearish, 5 Day bearish

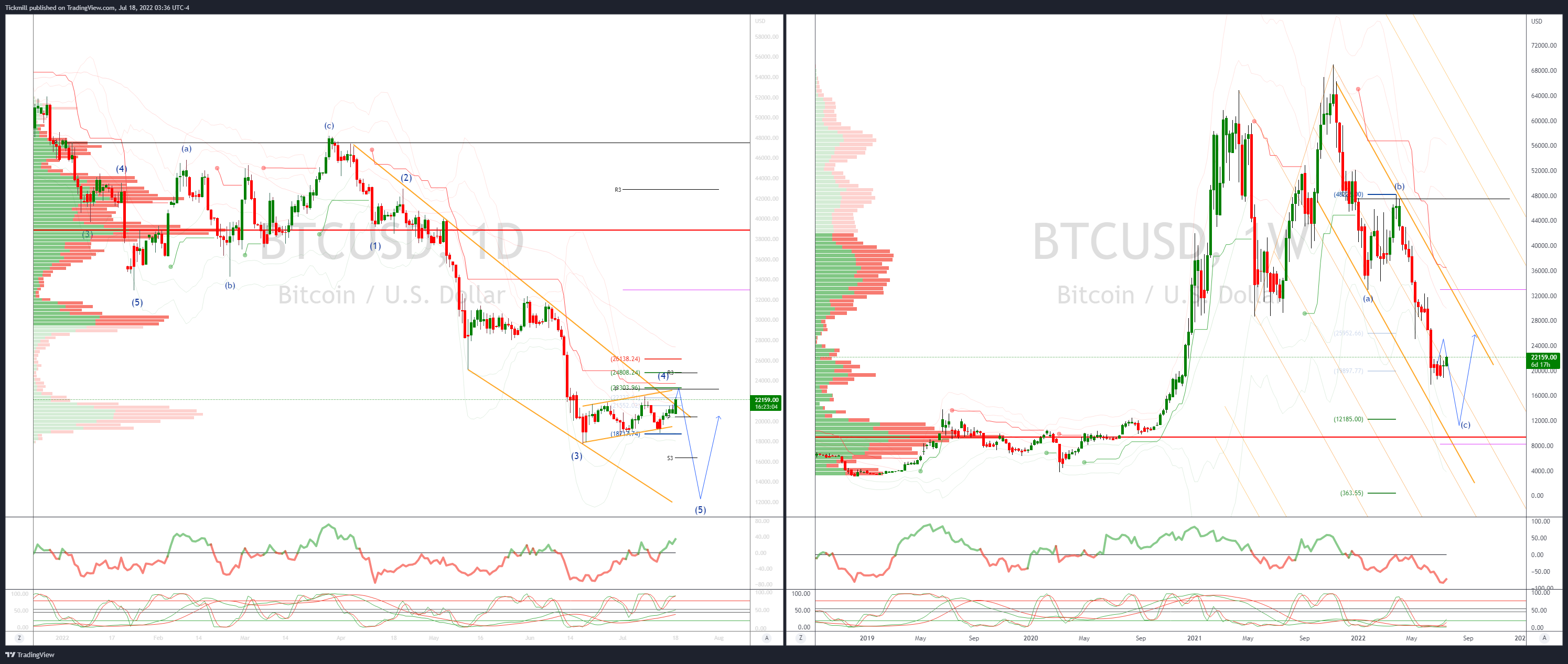

BTCUSD Bias: Bearish below 22k

- BTC recovers 22K

- Testing trend channel resistance, bargain hunting scene in nascent rally

- BTC bulls take solace from FED tempering hawkishness

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- Concerns regarding increasing Crypto player forced liquidations leave BTC vulnerable

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!