Daily Market Outlook, July 17, 2024

Daily Market Outlook, July 17, 2024

Munnelly’s Macro Minute…

“Gold Printing Record Highs As UK Inflation Remains Sticky ”

Asian stocks rose, joining a global surge, as the anticipation of the Fed starting to reduce interest rates led to a rush into riskier sectors of the market.The MSCI Asia Pacific Index, which measures regional benchmarks, rebounded after a three-day decline following the record highs in US equities, propelling global stocks to a new peak. However, the index's earlier gains were tempered by a drop in Japanese stocks after the US cautioned its allies about stricter trade regulations in the China crackdown. Meanwhile, traders in Hong Kong and mainland China awaited further details from the Third Plenum. Risk appetite seems to have returned in Asia as concerns about geopolitical and trade threats sparked by the increasing prospects of a Donald Trump administration have eased. The optimism surrounding the Fed's potential rate cut, coupled with signs of a retail recovery in the US, has bolstered sentiment.

During the grand opening of the new parliament, King Charles of Britain will announce the agenda of Keir Starmer's Labour government, focused on rebuilding the economy amidst political turmoil. In June, there were continued concerns about the stickiness of UK inflation. Although headline inflation had returned to target the month before, the latest UK CPI report revealed a lack of improvement in the underlying measures. Unfortunately, none of the measures showed any signs of progress. The CPI remained unchanged at 2.0% year-over-year (compared to a median forecast of 1.9%), while core CPI stayed at 3.5% year-over-year and services inflation remained at 5.7% year-over-year, both slightly higher than the survey estimates.

Gold reached record highs in Asia due to increasing expectations of interest rate cuts, while Taiwan stocks were affected by Donald Trump's indecisiveness regarding the United States' dedication to the island in his comments to Bloomberg Businessweek. "Taiwan has taken away our chip business," Trump stated. "They are extremely wealthy... I don't see any difference between them and an insurance policy. Why are we doing this?" Shares in Taiwanese chipmaker TSMC dropped by 1.4%.

Overnight Newswire Updates of Note

IMF Warns Sticky Inflation Could Keep Interest Rates ‘Higher For Even Longer’

Starmer To Press Ahead With Legislation Aimed At Boosting UK Growth

Starmer To Press Ahead With Legislation Aimed At Boosting UK Growth

The IMF Upgrades Forecast For UK Economic Growth - Boost For Labour Government

UK and EU consider holding first summit to improve post-Brexit relationship

RBNZ’s Less Hawkish Stance Drags Down Kiwi, Fuels Rate-Cut Bets

Inflation outcome shores up view the RBNZ will cut by November

UK Can Adjust Public Debt Rule To Ease Impact Of BoE Losses, Say Investors

Japanese Yen Continues To Depreciate Despite Intervention Threat

Russia Plans To Make OPEC+ Compensation Oil Cuts In Warm Seasons

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (802M), 1.0880-85 (734M), 1.0890-1.0900 (1.2BLN)

1.0920-25 (901M)

USD/CHF: 0.8800 (450M), 0.8850 (500M), 0.9050-60 (543M)

GBP/USD: 1.2900 (310M)

EUR/GBP: 0.8350 (360M), 0.8400-15 (312M), 0.8450 (310M)

AUD/USD: 0.6700 (408M), 0.6750-60 (414M), 0.6795-0.6800 (410M)

AUD/NZD: 1.1050 (304M), 1.1075 (250M), 1.1150 (271M)

USD/JPY: 157.05 (751M), 158.40 (300M), 158.50 (1.3BLN), 158.60 (351M)

CFTC Data As Of 9/7/24

Japanese yen net short position is -182,033 contracts

Euro net long position is 3,623 contracts

British pound net long position is 84,690 contracts

Swiss franc posts net short position of -46,088 contracts

Bitcoin net short position is -118 contracts

Equity fund speculators increase S&P 500 CME net short position by 47,949 contracts to 341,624

Equity fund managers raise S&P 500 CME net long position by 24,304 contracts to 977,432

Technical & Trade Views

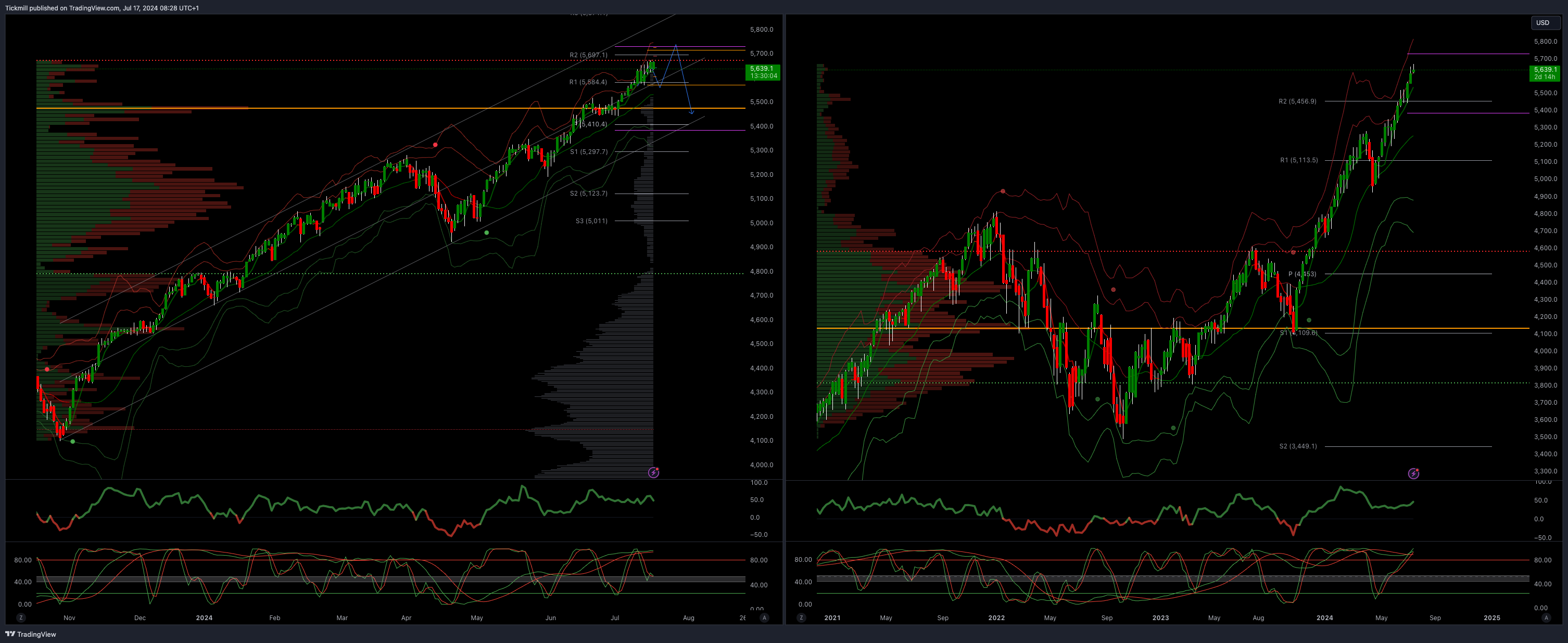

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

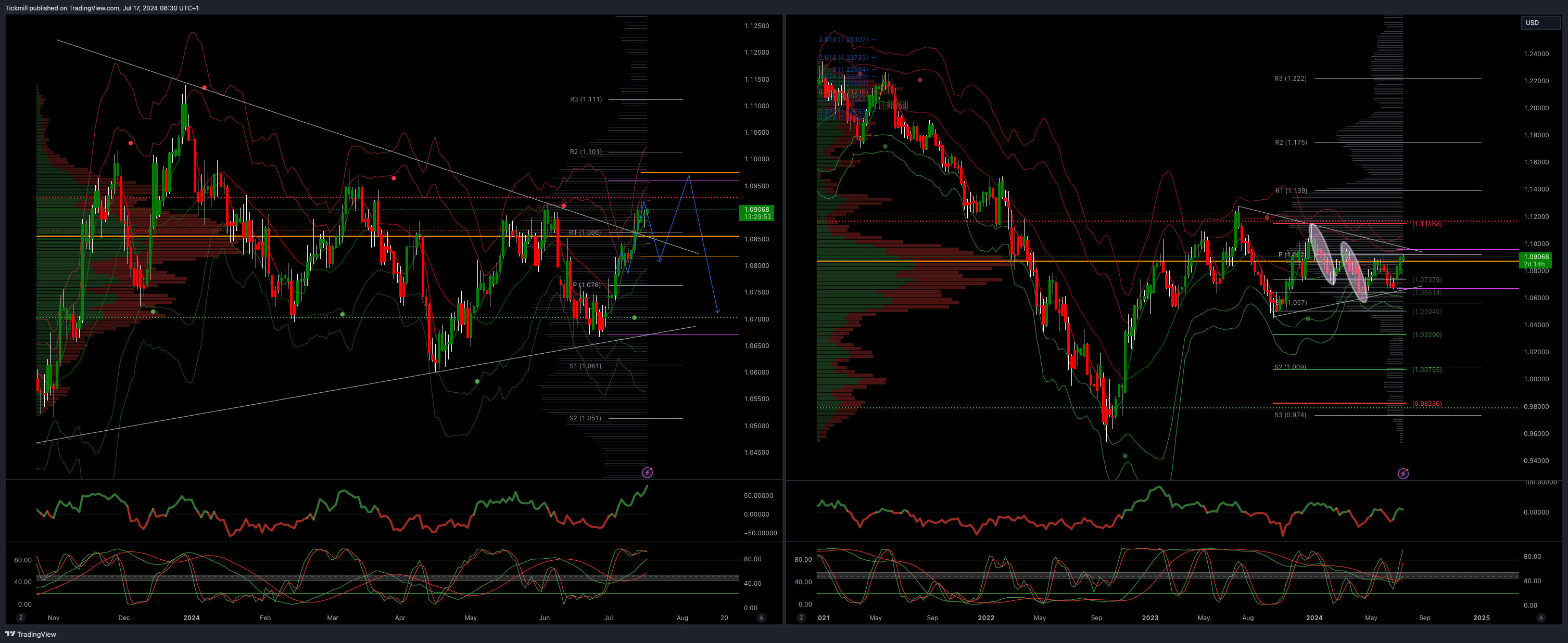

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

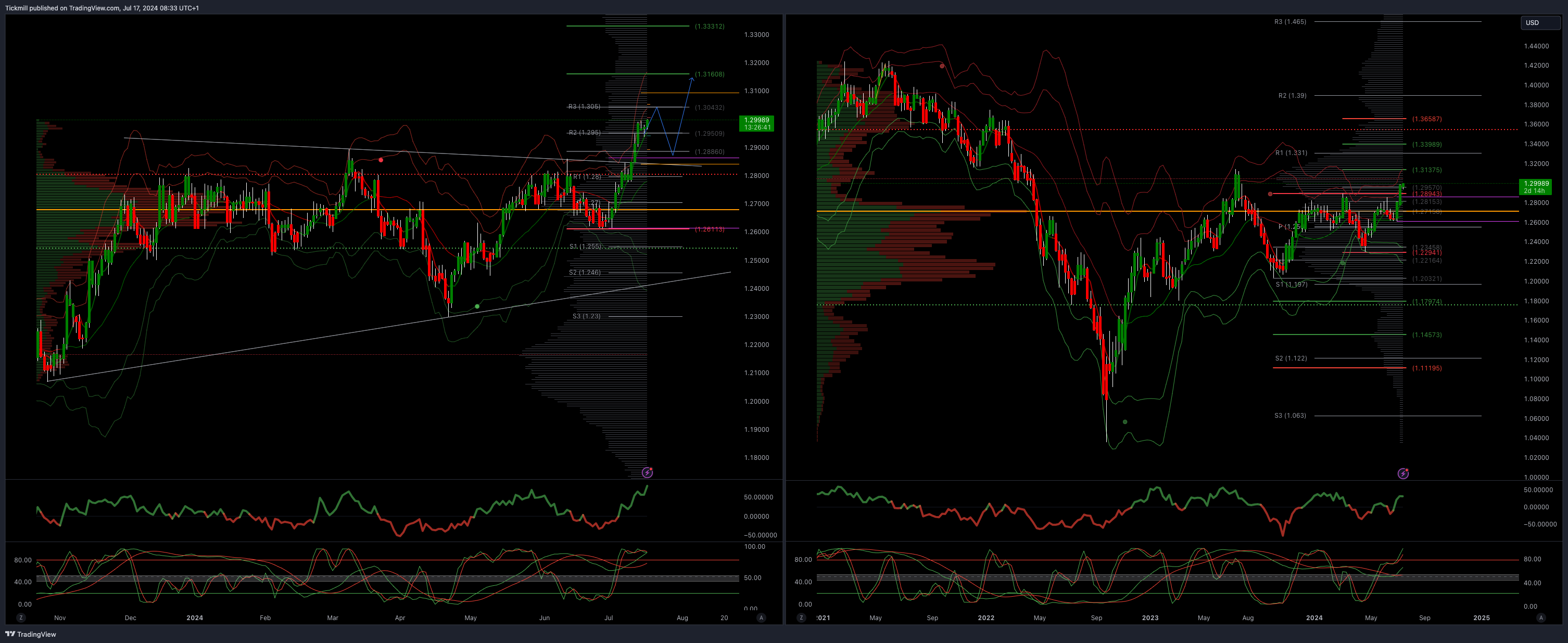

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3137/60

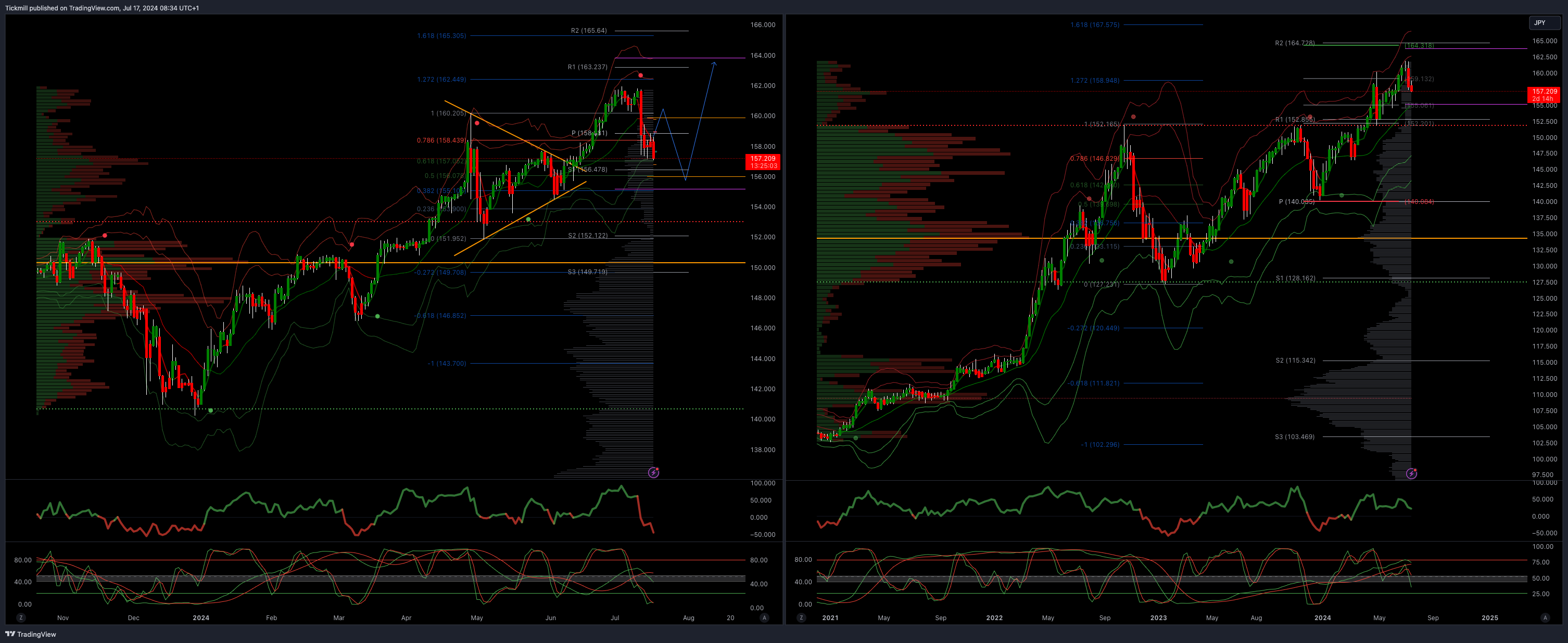

USDJPY Bullish Above Bearish Below 156

Daily VWAP bearish

Weekly VWAP bearish

Below 156 opens 153

Primary support 152

Primary objective is 164

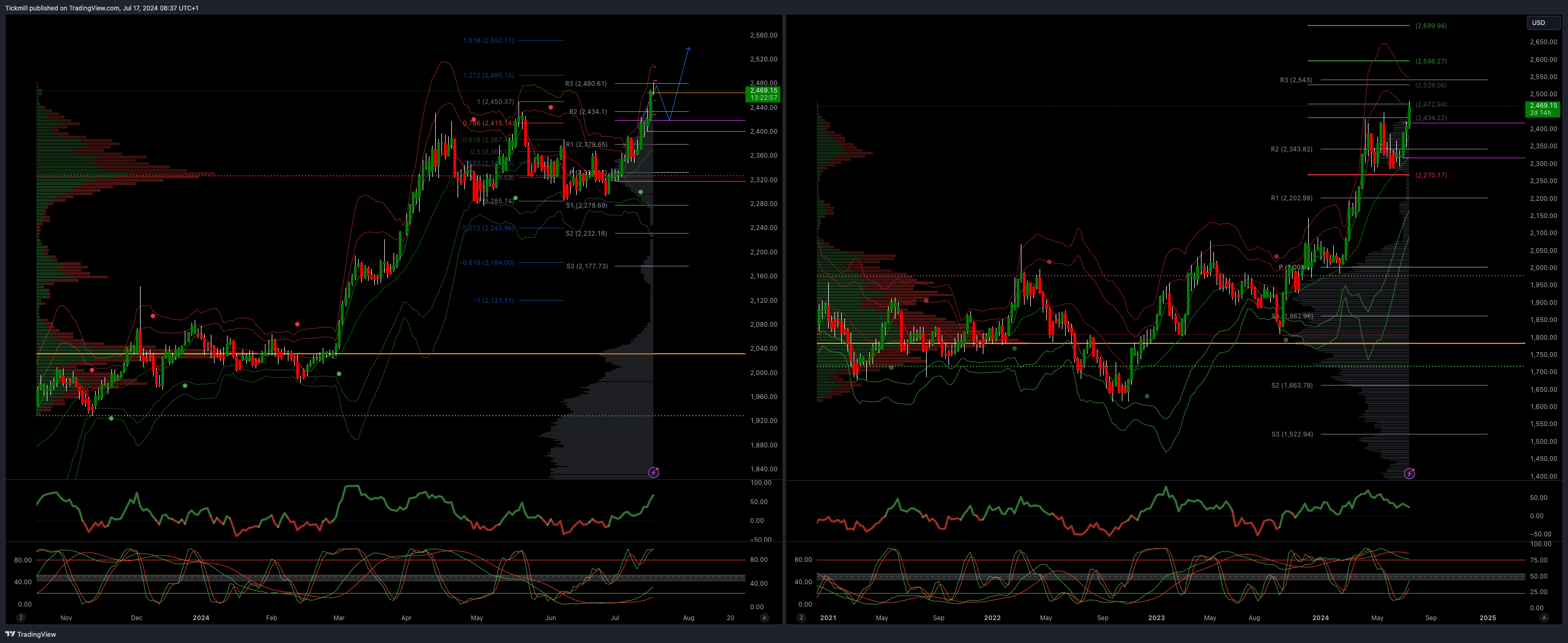

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

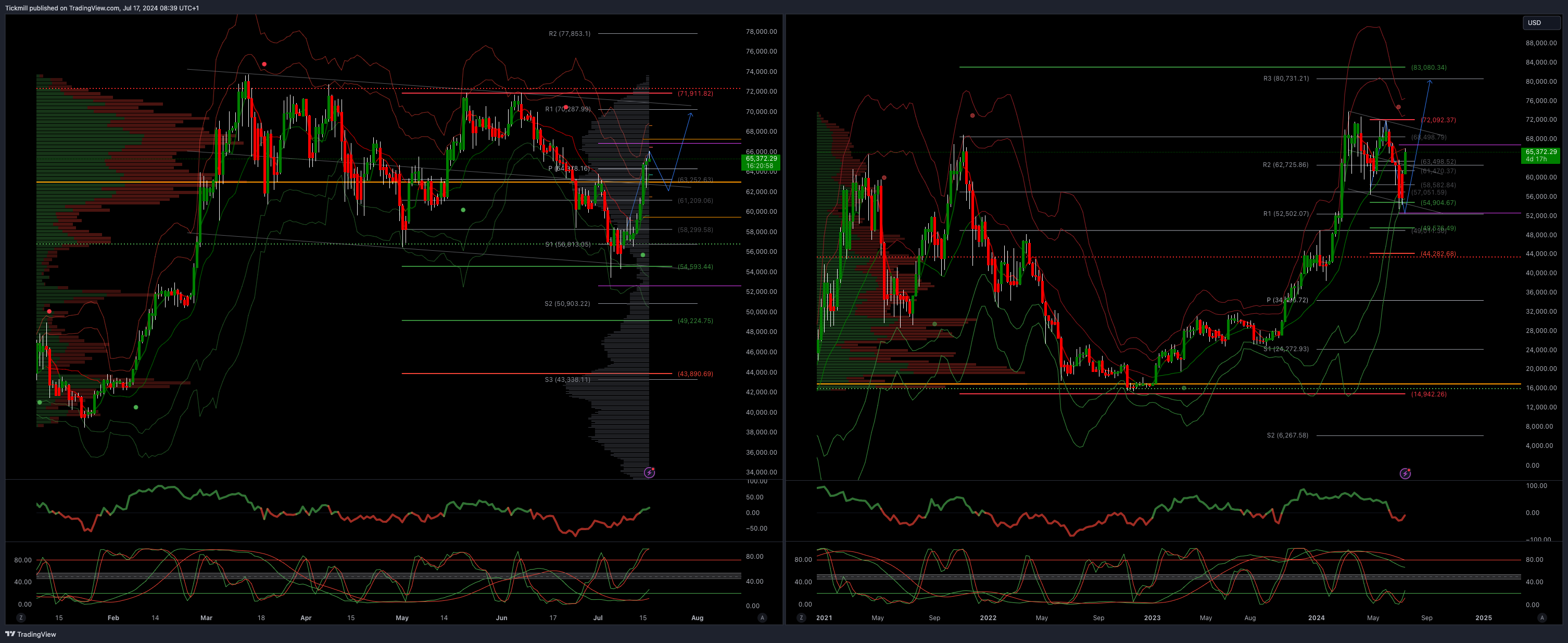

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bullish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!