Daily Market Outlook, July 16, 2024

Daily Market Outlook, July 16, 2024

Munnelly’s Macro Minute…

“Markets Mull Trump VP Candidate Pick Ahead Of Retail Sales Data”

Asian stocks declined, counterbalancing the gains in Wall Street, amid speculation about Donald Trump's potential running mate J.D Vance and the resulting new trade and geopolitical concerns. The MSCI AC Asia Pacific index experienced its third consecutive day of losses, dropping by 0.2%. Hong Kong witnessed the largest decline in stocks, while certain Chinese companies continued to fall due to investor anticipation of Trump's tariffs. On the other hand, Japan's stocks rose as exporters benefited from the weakening Yen.

Jerome Powell, the Chair of the Federal Reserve, made comments that were seen as leaning towards a more cautious approach, leading to expectations of an interest rate cut in September. The possibility of Donald Trump returning to the White House has influenced trading and is on the minds of investors. Powell's remarks, possibly his last before the Fed's policy meeting, indicated that recent inflation data may lead to the inflation rate reaching the Fed's target of 2%. This has caused a shift in market expectations, with traders now anticipating a significant easing of rates. The US dollar has been fluctuating in response to Powell's comments and speculation about the impact of a potential Trump presidency on inflation and interest rates. Trump's appearance at the Republican National Convention has further fueled expectations of his victory in the November election, leading to various market movements such as surging cryptocurrencies and gold approaching record highs. In Europe, futures suggest a quiet start to trading on Tuesday, with attention once again focused on developments involving Trump and Powell. Data wise the main macro driver today will be US retail sales, with nascent signs of the consumer pulling back markets will be attentive to any further dents in the data.

Overnight Newswire Updates of Note

Starmer’s Net Zero Plan Must Not Leave Heating Out In The Cold

US Executives Plans - First-Hand Insights From China Third Plenum

How Political Turmoil In France Could Affect Asia

Hungarian PM Orban: Donald Trump Will Demand Russia-Ukraine Peace Talks

Fed's Daly: Confidence Is Growing Wining Inflation Fight

Oil Prices Ease On Demand Concerns In China

Musk Sets Set A Year-End Deadline For Progress On 4680 Battery

Samsung Electronics To Use 4nm Foundry Process For HMB4

Total Energies - Enters Partnership With SSE To Create Joint Venture

Bitcoin Surges To Two-Week High As Trump’s Election Odds Improve

Ethereum ETFs Set To Launch On Tuesday

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0845-55 (600M), 1.0875 (606M), 1.0900 (2.6BLN)

1.0905-10 (1.1BLN), 1.0920-25 (1.8BLN)

USD/CHF: 0.8900-15 (885M), 0.8950 (201M), 0.9000 (553M), 0.9030 (455M)

GBP/USD: 1.3000 (250M), 1.3090 (316M)

EUR/GBP: 0.8400 (830M), 0.8500 (1.6BLN)

EUR/SEK: 11.50 (763M)

AUD/USD: 0.6730-35 (432M), 0.6800-10 (803M), 0.6820 (200M)

AUD/NZD: 1.1050 (402M). NZD/USD: 0.6125 (293M)

USD/CAD: 1.3600 (1.1BLN) 1.3630 (560M), 1.3745 (386M), 1.3800 (2.2BLN)

USD/JPY: 158.00 (674M), 158.30 (794M), 159.00-10 (893M), 159.20 (882M)

CFTC Data As Of 9/7/24

Japanese yen net short position is -182,033 contracts

Euro net long position is 3,623 contracts

British pound net long position is 84,690 contracts

Swiss franc posts net short position of -46,088 contracts

Bitcoin net short position is -118 contracts

Equity fund speculators increase S&P 500 CME net short position by 47,949 contracts to 341,624

Equity fund managers raise S&P 500 CME net long position by 24,304 contracts to 977,432

Technical & Trade Views

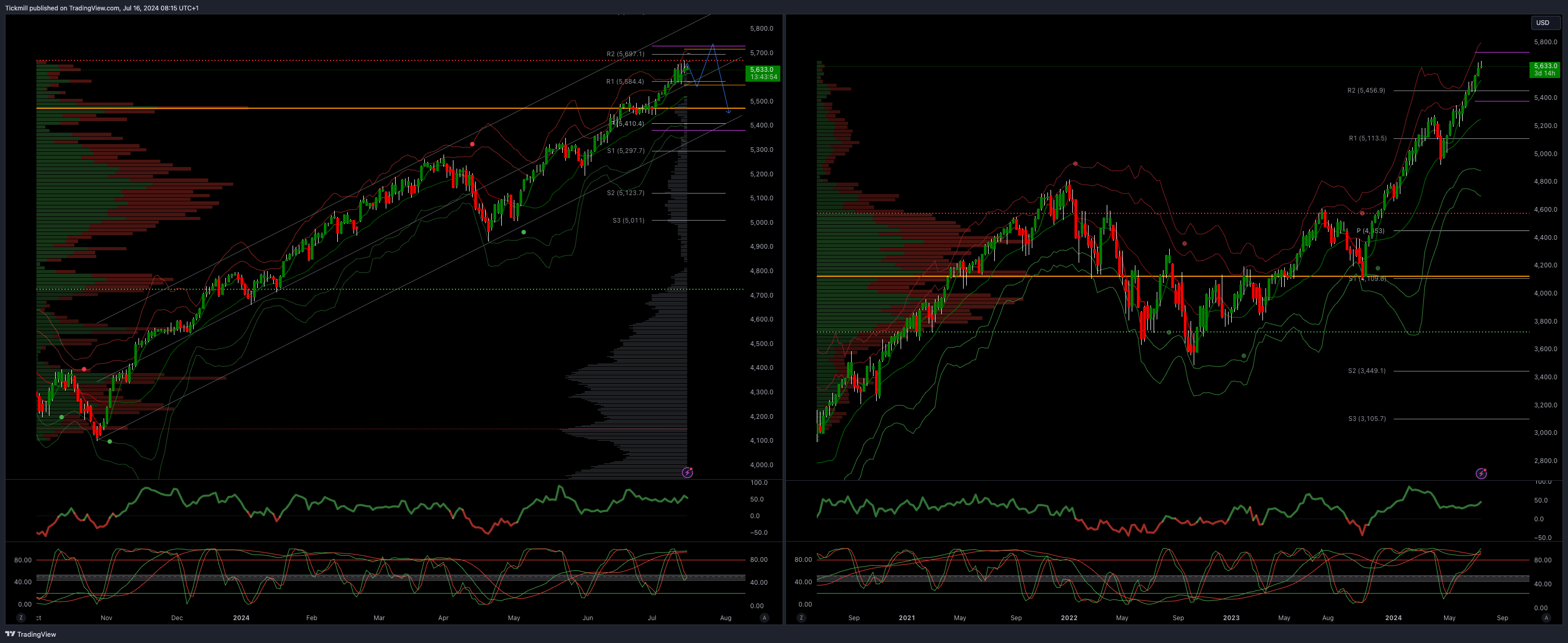

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

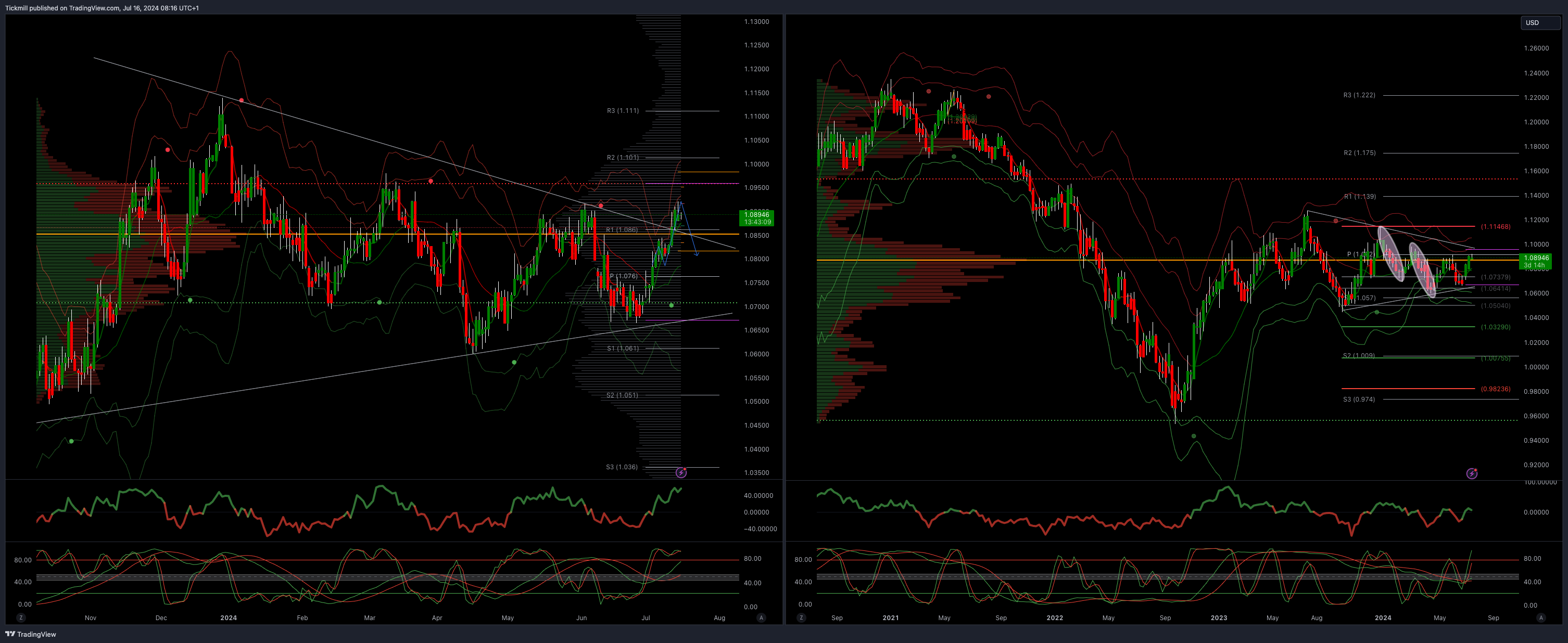

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

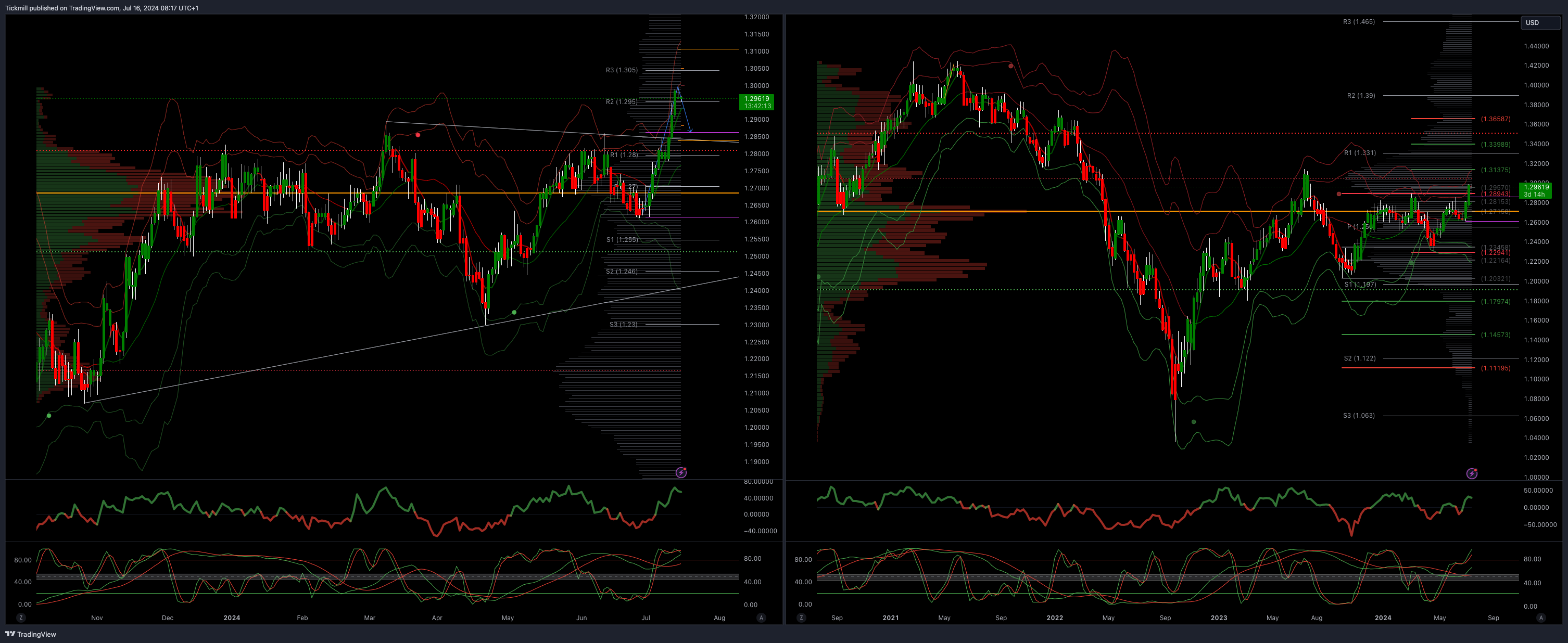

GBPUSD Bullish Above Bearish Below 1.28

Daily VWAP bullish

Weekly VWAP bullish

Above 1.29 opens 1.3130

Primary resistance is 1.2890

Primary objective 1.3130

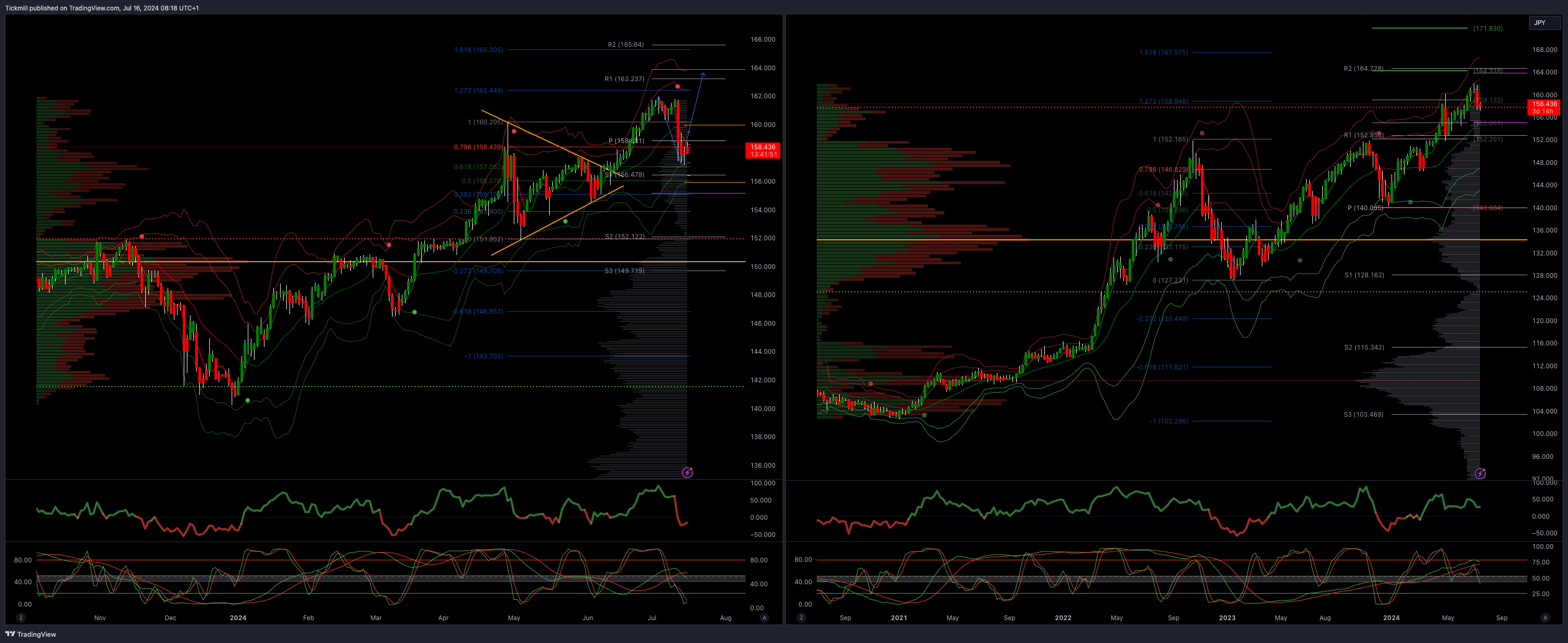

USDJPY Bullish Above Bearish Below 160

Daily VWAP bearish

Weekly VWAP bearish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 164

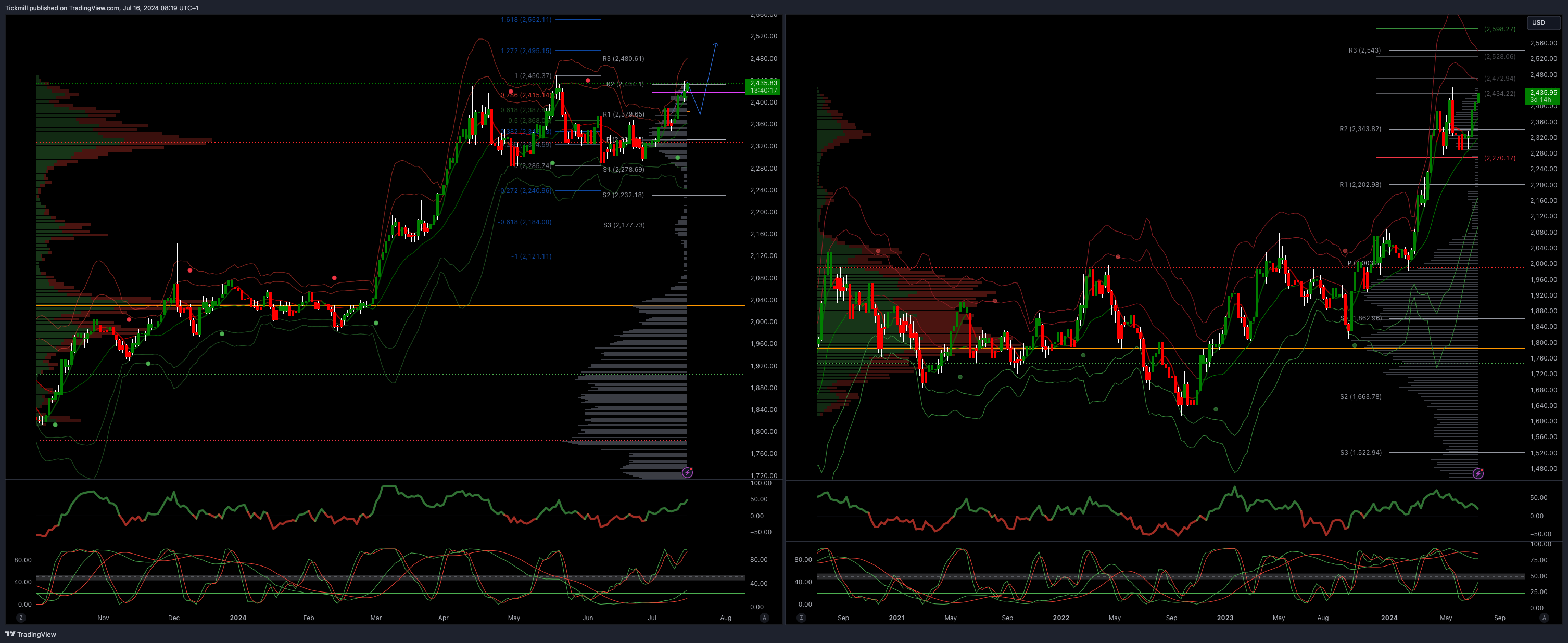

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Above 2415 opens 2495

Primary support 2300

Primary objective is 259

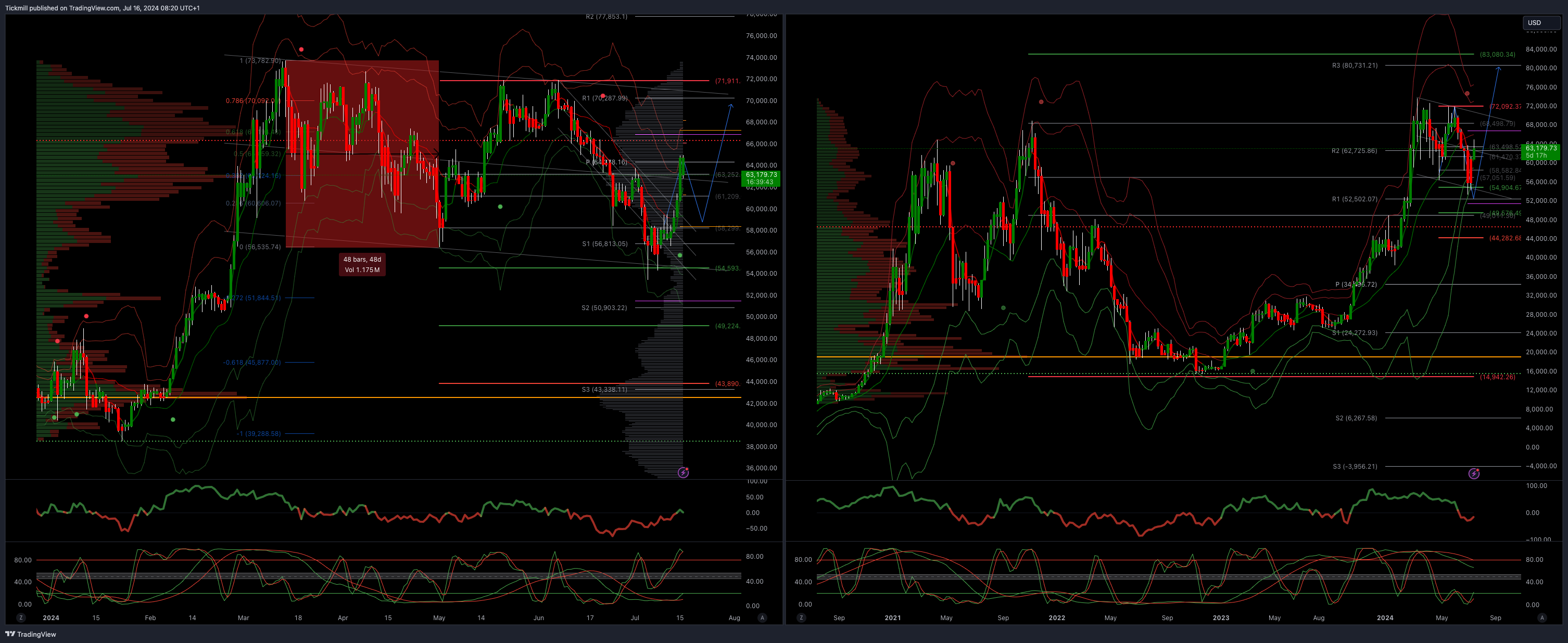

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bullish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!