Daily Market Outlook, July 12, 2024

Daily Market Outlook, July 12, 2024

Munnelly’s Macro Minute…

“Nasdaq Takes A 2% Hit, In Biggest One Day Move Since Jan 2021”

Asian tech shares fell on Friday, following Wall Street's decline due to slowing US inflation. The yen was volatile. Asian technology stocks dropped by up to 3.2%, with Japan and South Korea seeing the biggest losses. The Nasdaq 100 fell 2.2% as inflation data suggested a potential rate cut, leading to an exodus from tech megacaps.. Chinese shares in Hong Kong rose on hopes of policy support from the mainland's approaching Third Plenum, with Chinese property developers seeing a rise of over 6%. Despite the setback, global equities are on track for their sixth weekly gain, driven by Fed easing expectations. Treasury yields rose after the possibility of lower US interest rates drove 10-year yields down by seven basis points. Government bonds in Australia and New Zealand rose in response. The dollar index remained stable after a significant drop on Thursday.

The yen fluctuated as the Bank of Japan conducted rate checks, leading to speculation of market intervention, as usual, officials were not forthcoming with information, but Tokyo has clearly demonstrated its ability to intervene in the market at the right time. The sudden increase in the yen on Thursday followed data showing a lower-than-expected cooling of U.S. consumer inflation in June, leading analysts and traders to initially attribute the surge to options-related activity. However, the scale and speed of the movement eventually alerted the markets to the possibility of a Japanese intervention, which was similarly reported by local media. Given that recent interventions have had short-lived effects, Thursday's move likely provided the most impact for Tokyo. The absence of authorities from the currency market after the April-May intervention had raised questions about their restraint as the yen continued to reach new lows, but Thursday's developments have once again put traders on edge. It is also timely that Japan has a national holiday on Monday, which could result in low liquidity and potentially provide another opportune moment for Tokyo to take action. The focus on the yen briefly diverted attention from the main story, which remains on rates, with a September rate cut from the Federal Reserve almost fully expected. Even Fed Chair Jerome Powell, in his recent testimony before Congress, seemed to hint at the possibility of an easing cycle beginning in September, stating that the U.S. economy was no longer overheated. Stateside, President Joe Biden faced some challenges as he mistakenly mixed up the names of Vice President Kamala Harris and his Republican rival Donald Trump, just hours after referring to Ukrainian President Volodymyr Zelenskiy as Russian President Vladimir Putin before correcting himself at the NATO summit in Washington.

Overnight Newswire Updates of Note

June Price Drop May Shorten The Fed's Last Mile On Inflation

Biden: Israel, Hamas Have Agreed To My Ceasefire Deal Framework, But Gaps Remain

UK's Starmer Urges NATO Allies To Boost Defence Spending

Japan Top FX Diplomat Says Authorities To Take Action As Needed On Yen

China Trade Balance (M/M) Jun: $+99.05 Bln

Japan’s Industrial Production (M/M) May: 3.6% (prev 2.8%)

New Zealand’s Business Manufacturing PMI (M/M) Jun: 41.1 (prevR 46.6)

Singapore Q2 GDP (Y/Y): 2.9% (est 2.7%; prev 2.7)

Ericsson Beats Estimates On Cost Cutting In Tough Market

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (1.7BLN), 1.0820-30 (1.5BLN), 1.0850 (2.4BLN)

1.0870-80 (1.1BLN), 1.0890-1.0900 (1.3BLN)

USD/CHF: 0.8900 (636M), 0.8970-80 (481M), 0.9000 (587M)

EUR/CHF: 0.9625-35 (1.8BLM). EUR/GBP: 0.8375 (300M)

GBP/USD: 1.2850 (831M), 1.2905-10 (352M), 1.2925 (215M)

AUD/USD: 0.6715 (493M), 0.6750-55 (525M), 0.6770 (590M)

0.6790-0.6800 (1.4BLN)

AUD/NZD: 1.1060 (1.2BLN), 1.1100 (503M)

USD/CAD: 1.3630 (1.1BLN), 1.3645-55 (1.6BLN)

USD/JPY: 158.80 (501M), 159.00-05 (886M), 159.30 (441M), 160.00 (1.2BLN)

AUD/JPY: 106.25 (500M), 107.50 (400M)

CFTC Data As Of 5/7/24

JPY: -184,223 contracts

EUR: -9,519 contracts

GBP: 62,041 contracts

CHF: -43,443 contracts

Bitcoin: -912 contracts

Equity fund managers cut S&P 500 CME net long position by 24,005 contracts to 953,130

Equity fund speculators trim S&P 500 CME net short position by 5,025 contracts to 293,675

Technical & Trade Views

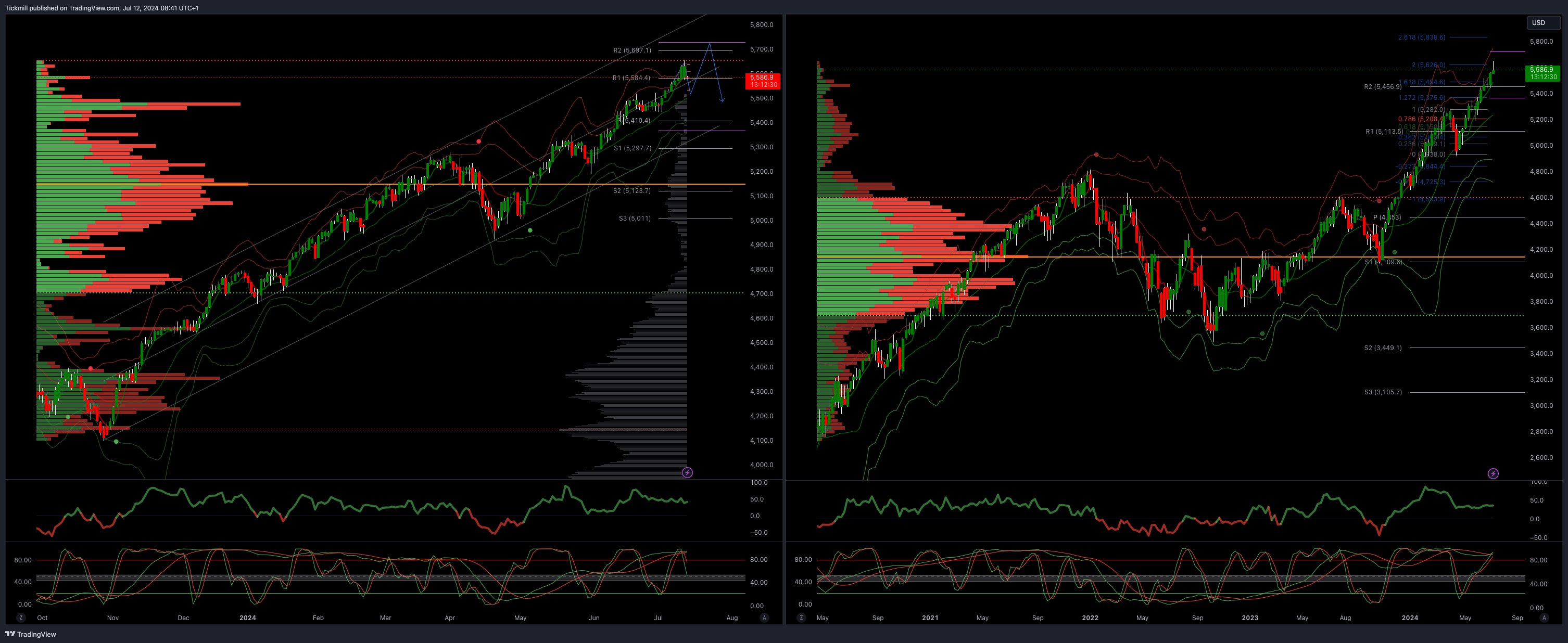

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

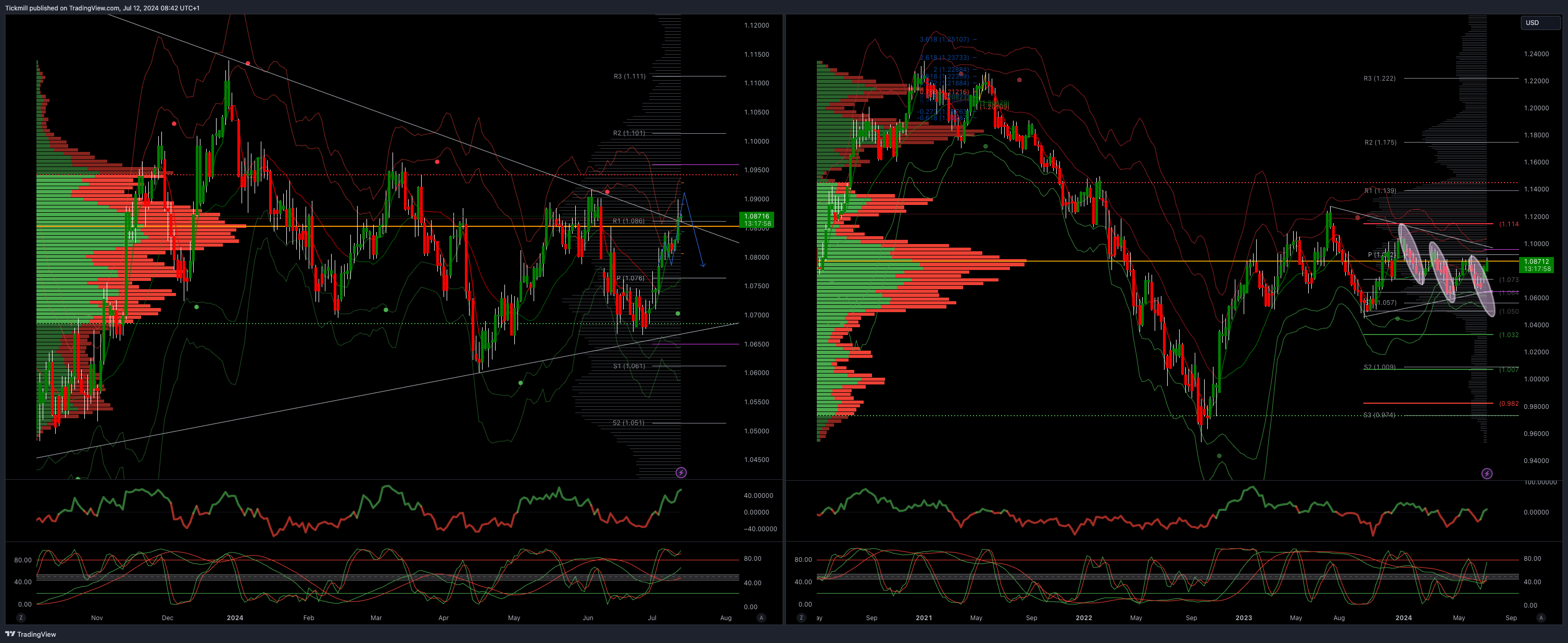

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

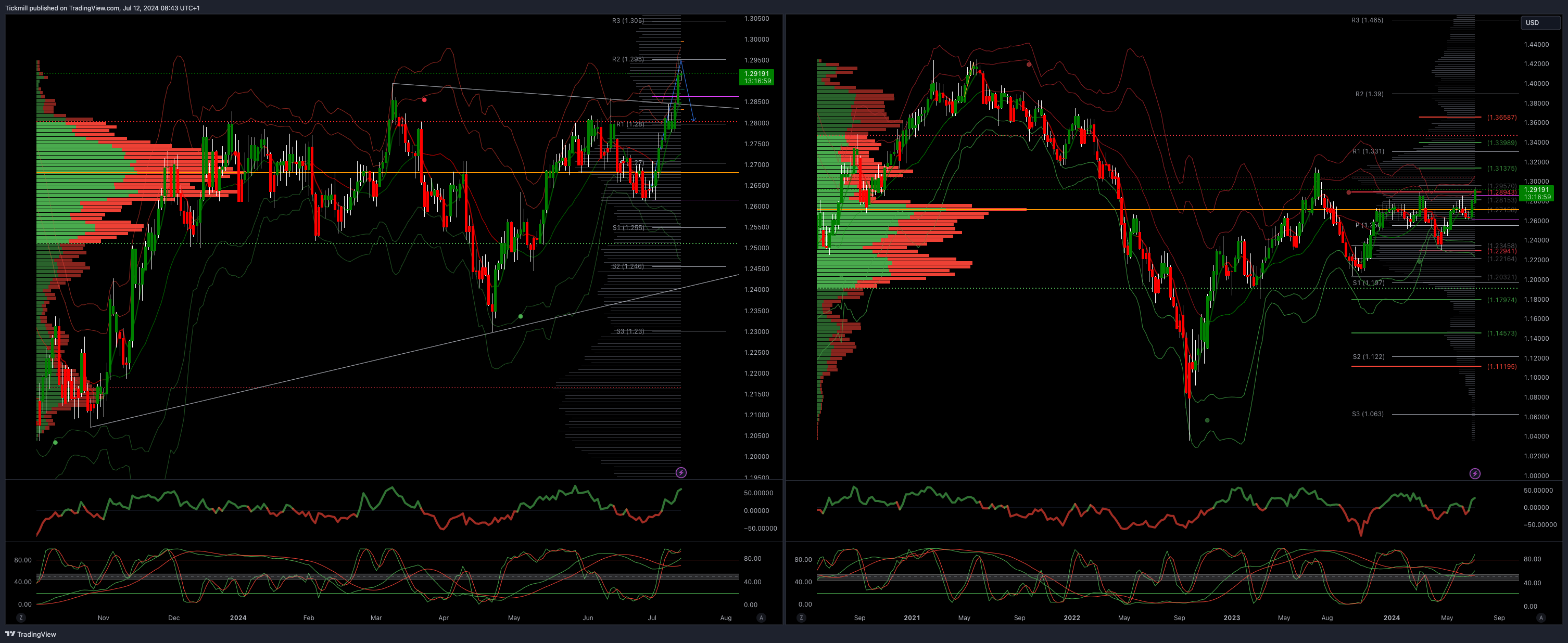

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Above 1.29 opens 1.3130

Primary resistance is 1.2890

Primary objective 1.2570

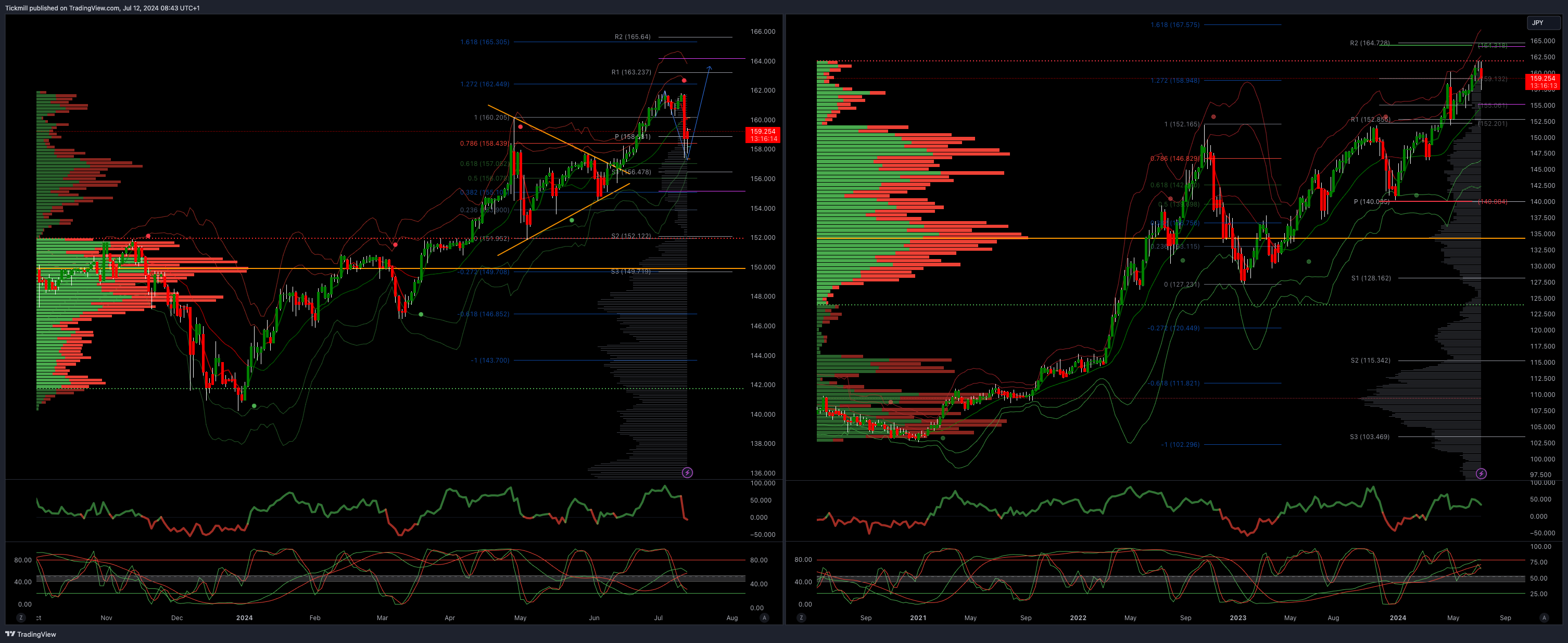

USDJPY Bullish Above Bearish Below 160

Daily VWAP bearish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 164

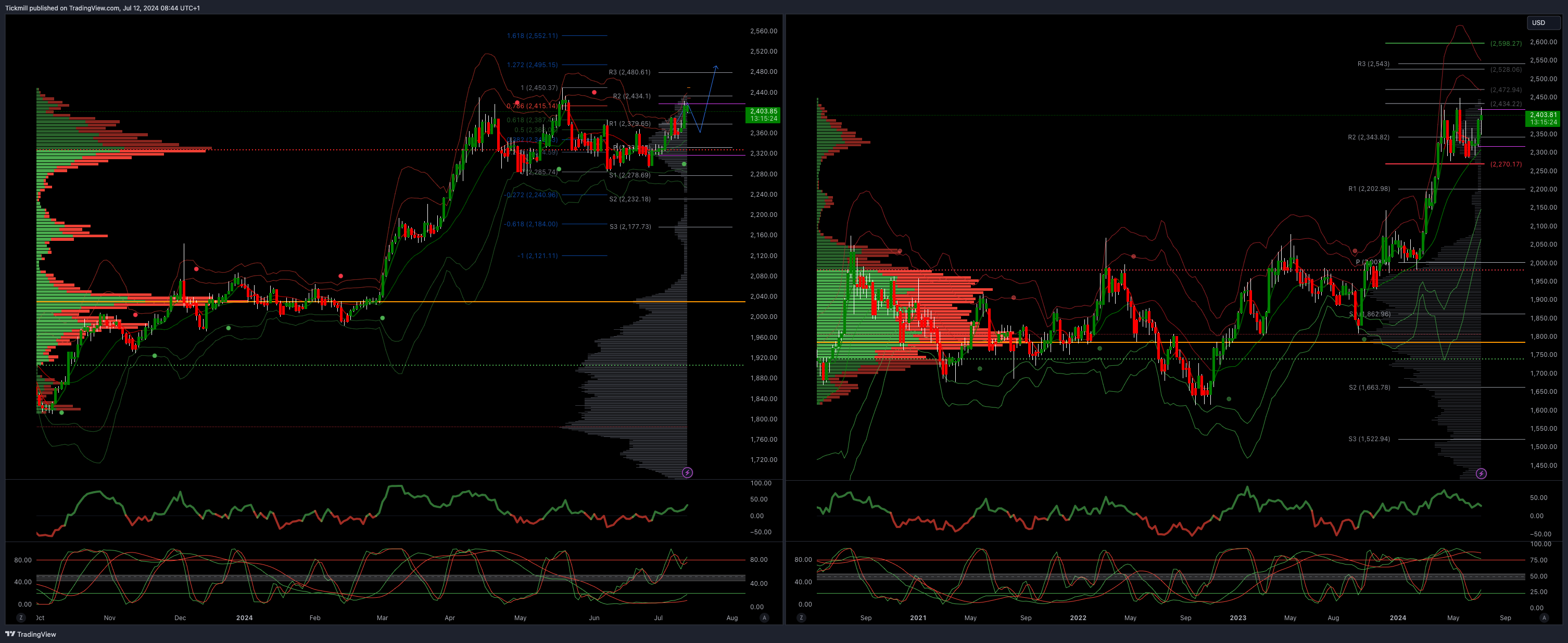

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Above 2415 opens 2495

Primary resistance 2387

Primary objective is 2262

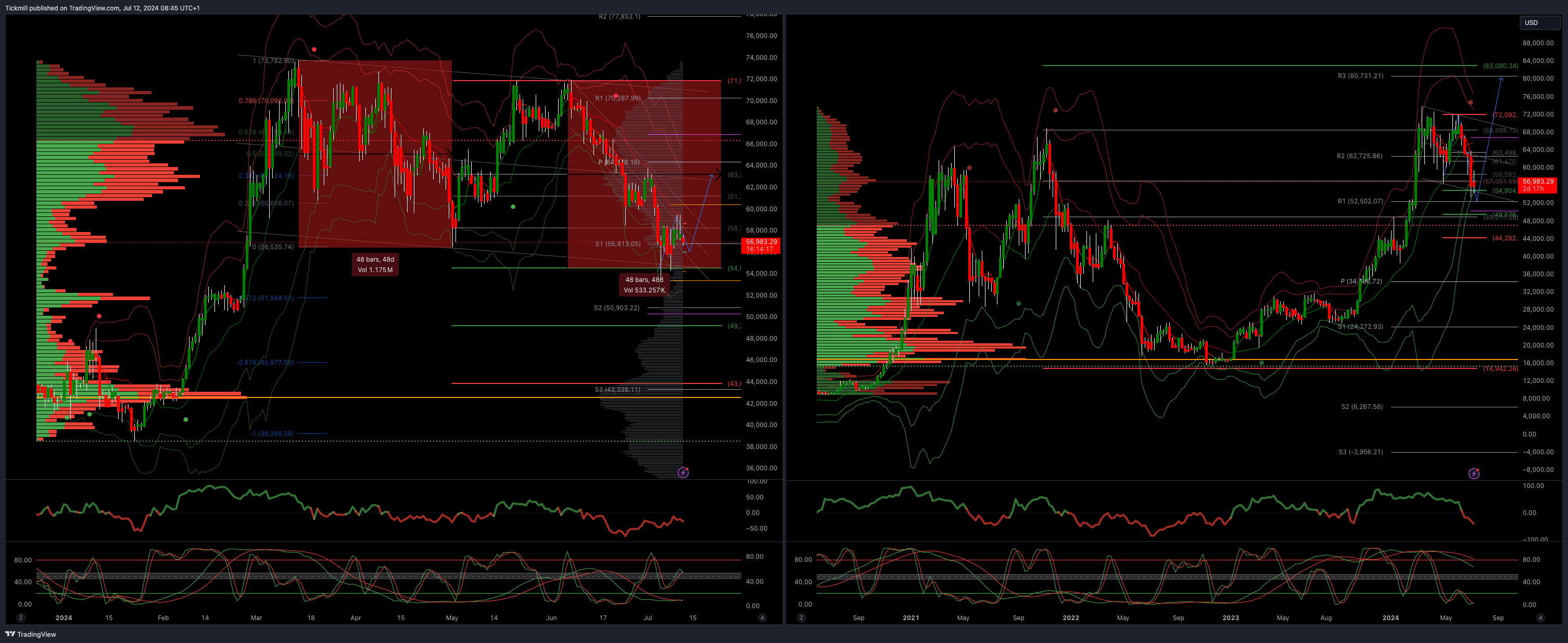

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 54500 - TARGET ACHIEVED NEW PATTERN EMERGING

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!