Daily Market Outlook, July 11, 2024

Daily Market Outlook, July 11, 2024

Munnelly’s Macro Minute…

“Global Markets Buoyant Ahead Of US Inflation Data ”

Ahead of the expected US consumer pricing data on Thursday, Asian stocks saw an increase, driven by a surge in the world's largest tech companies, leading to record highs in global shares.

China, Australia, and Japan all experienced stock market gains on Wednesday following a positive session on Wall Street. The decline of the Dollar against most major currencies prior to significant US inflation data suggests a potential reduction in price pressure and an increased likelihood of interest rate cuts by the Fed. Anticipation for the upcoming US consumer pricing data contributed to the rise in Asian stocks, fueled by the strong performance of the world's biggest tech firms, which propelled global shares to all-time highs. Taiwan Semiconductor Manufacturing, the exclusive supplier of Nvidia and Apple's most advanced chips, reached record highs after reporting its second-quarter revenue growth at the highest rate since 2022. Sony Group, Tencent Holdings, and Korean chipmaker SK Hynix were also key contributors to the regional stock index increase, with SK Hynix trading at its highest levels since 2000.

In May, the UK's GDP grew by 0.4% month-on-month, surpassing expectations and posing an upside risk to the Bank of England's Q2 GDP forecast. The service sector and construction contributed significantly to this growth, with retail showing a rebound from a wet April. Despite potential factors like National Insurance rate changes and erratic weather, the broader picture indicates a 0.9% GDP growth over the past three months, primarily driven by the service sector. This growth is considered above-trend. While upcoming labor market and inflation data are important for the August Monetary Policy Committee vote, recent comments from certain members suggest that the data does not support an increased probability of an early rate cut.

Since 2021, US CPI has often surprised to the upside, indicating a shift in the Fed's policy outlook. However, the recent soft news on fuel and airfares is not expected to repeat. Markets expect a slight increase in June CPI, with annual rate estimates slightly above the median forecast. While Powell is considering a potential rate cut, some argue it may be premature. The reliance on flexible prices to reduce inflation poses a risk, and more progress is needed on sticky items. Small upside surprises this month could cause uncertainty in the market regarding the timing of the first rate cut.

Overnight Newswire Updates of Note

BoK Extends Rate Freeze Into Longest Period Amid Slow Inflation, Rising Debts

Keir Starmer Eyes Quick UK-EU Pact on Defence and Security

Ukraine Is Fighting Russia With Toy Drones And Duct-Taped Bombs

Yellen, Isreal’s Katz Discussed West Bank Financial Stability

New Zealand Food Prices (M/M) Jun: 1% (prev -0.2%)

Australian CBA Household Spending (Y/Y) Jun: 4.3% (prevR 4.0%)

Japanese Core Machine Orders (M/M) May: -3.2% (est 0.8%; prev -2.9%)

Australian Consumer Inflation Expectation Jul: 4.3% (prev 4.4%)

Bank of Korea Leaves Key Interest Rate Unchanged At 3.50%

Japan’s Tokyo Avg Office Vacancies Jun: 5.15% (prev 5.48%)

Sweden PES Unemployment Rate Jun: 3.4% (prev 3.2%)

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0760-70 (3BLN), 1.0775-85 (1.4BLN), 1.0790-1.0800 (1.1BLN)

1.0805-15 (1.3BLN), 1.0845-50 (1BLN), 1.0860-65 (1.6BLN), 1.0900 (1.3BLN)

USD/CHF: 0.8935 (696M), 0.8950 (1.7BLN), 0.8975 (352M), 0.8995-0.9000 (660M)

GBP/USD: 1.2835 (222M), 1.2845-55 (407M)

EUR/GBP: 0.8425 (300M), 0.8450-60 (2.1BLN)

AUD/USD: 0.6725-30 (701M), 0.6760 (633M), 0.6775-85 (661M)

NZD/USD: 0.6125 (1.6BLN), 0.6150 (1.6BLN)

USD/CAD: 1.3620 (240M), 1.3650 (633M), 1.3775 (1.2BLN)

USD/JPY: 161.00 (1.6BLN), 161.50 (900M), 162.35 (690M)

EUR/JPY: 171.00 (400M), 174.50 (400M)

CFTC Data As Of 5/7/24

JPY: -184,223 contracts

EUR: -9,519 contracts

GBP: 62,041 contracts

CHF: -43,443 contracts

Bitcoin: -912 contracts

Equity fund managers cut S&P 500 CME net long position by 24,005 contracts to 953,130

Equity fund speculators trim S&P 500 CME net short position by 5,025 contracts to 293,675

Technical & Trade Views

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5400

Primary objective is 5700

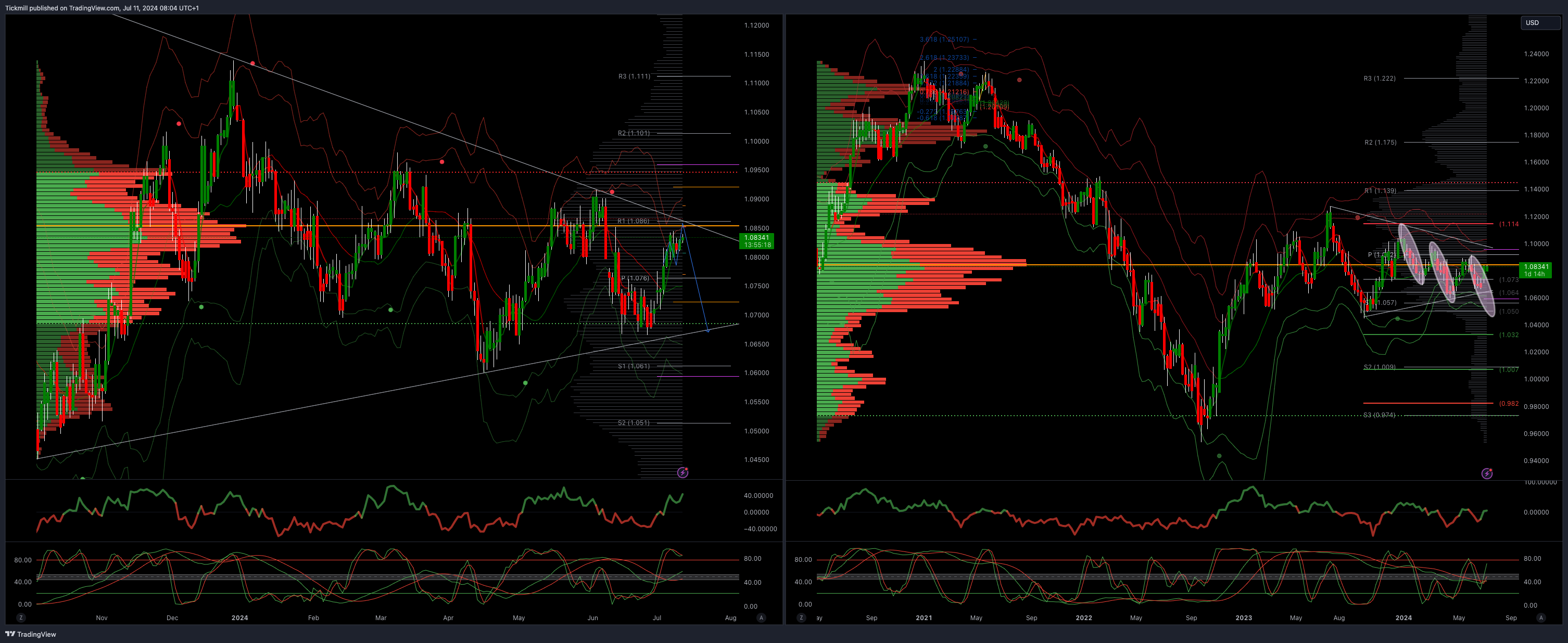

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

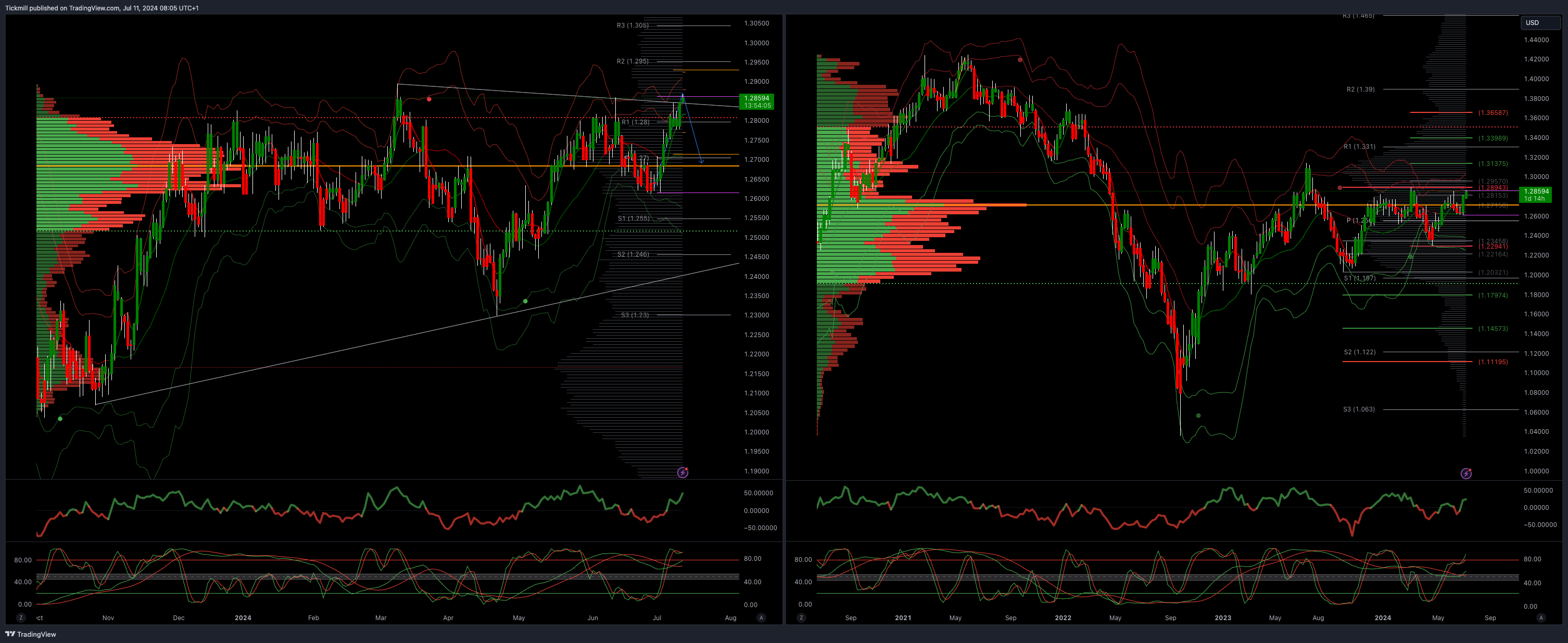

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bullish

Above 1.29 opens 1.3130

Primary resistance is 1.2890

Primary objective 1.2570

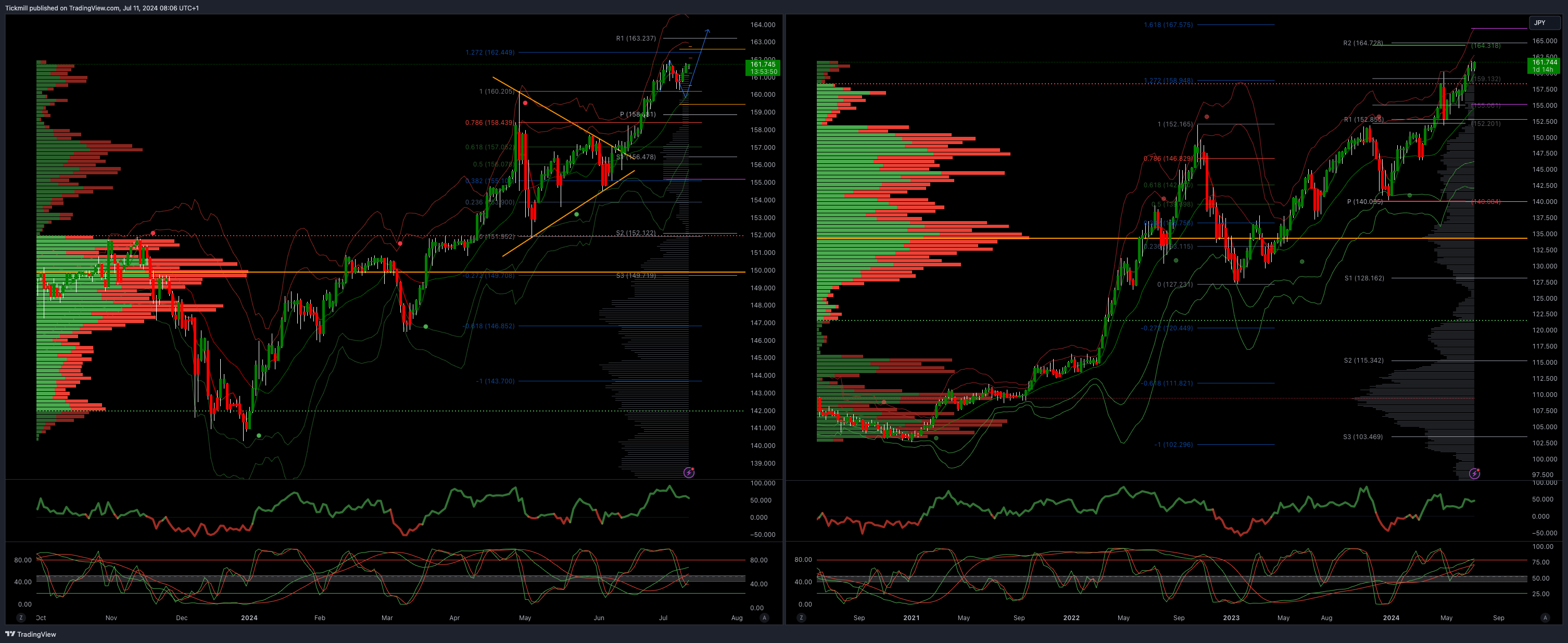

USDJPY Bullish Above Bearish Below 160

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 164

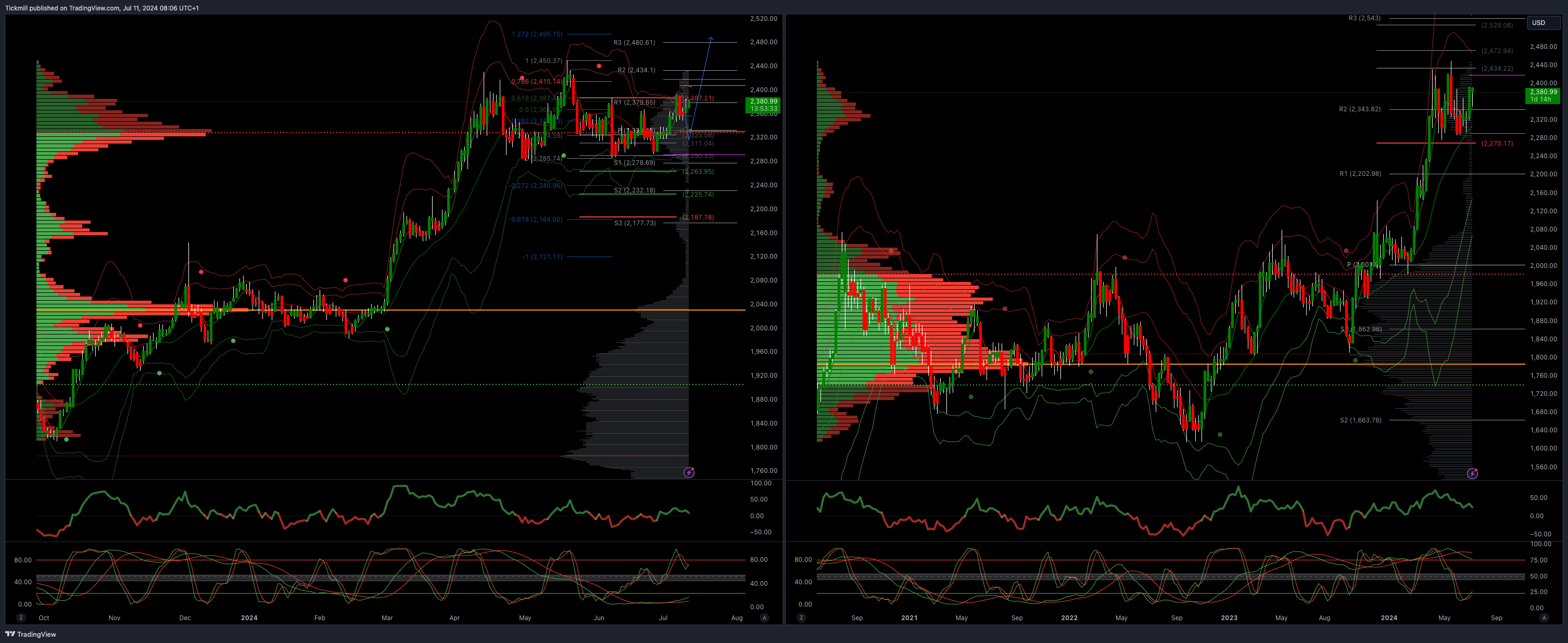

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Above 2415 opens 2495

Primary resistance 2387

Primary objective is 2262

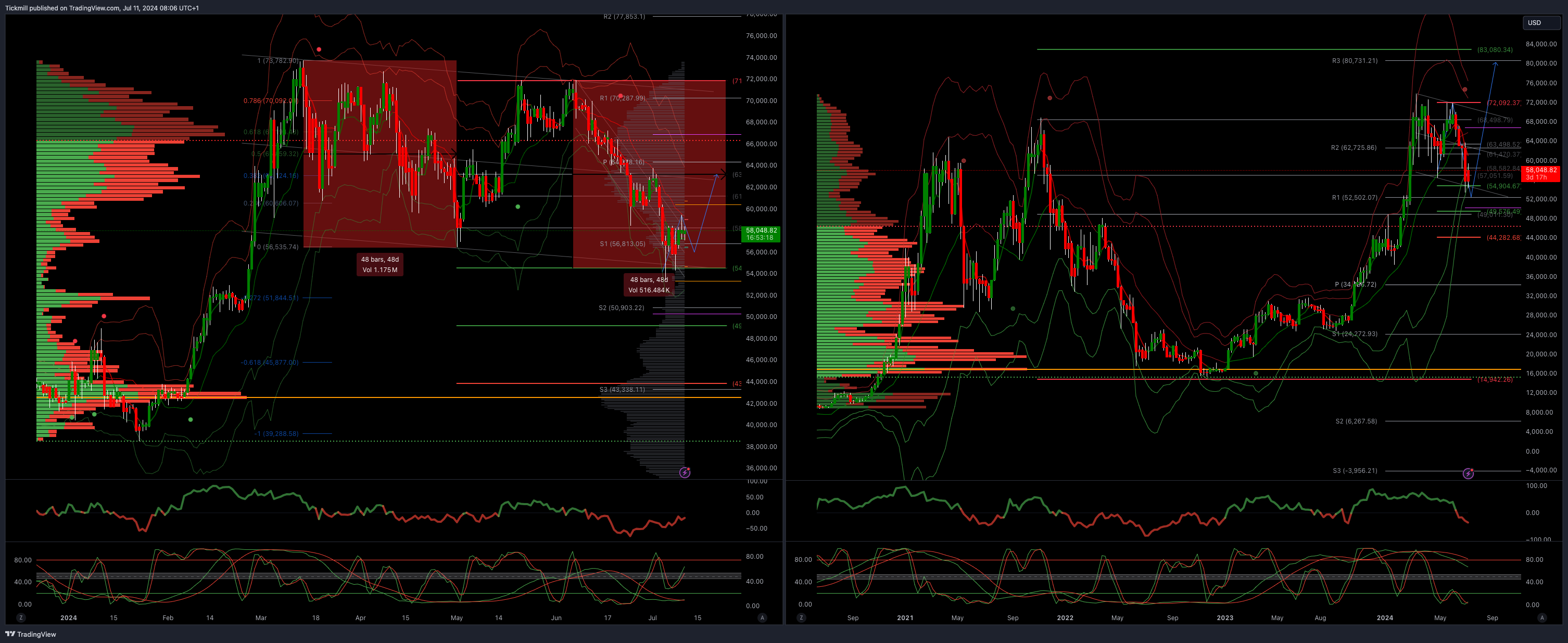

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 54500 - TARGET ACHIEVED NEW PATTERN EMERGING

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!