Daily Market Outlook, July 1, 2024

Daily Market Outlook, July 1, 2024

Munnelly’s Macro Minute…

“Le Pen In The Lead In French Elections, UK Voters On Deck Next ”

The French parliamentary election showed a significant shift in politics, with Le Pen's Rassemblement National leading the first round with 33.5% of the vote, outpacing the leftist bloc and Macron's alliance. The voter turnout was notably high at 65.8%, a substantial increase from 47.5% in 2022. Le Pen's party is close to achieving a majority in the second round on July 7, with projections of securing between 230 to 280 seats in the 577-seat assembly. The final outcome will depend on candidates dropping out and whether the high first-round turnout translates into second-round votes. Markets may feel relief as the results align with pre-voting polls, but the focus is now on potential alliances and policy compromises by the centrists to win back disgruntled voters in the coming week.

The upcoming week will be filled with significant events, including elections in the UK, important data releases such as U.S. payrolls, and speeches by key figures like Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde. This is likely to lead to a volatile start to July.

The ECB Forum on Central Banking will feature speeches by Powell, Lagarde, and other ECB officials, as well as New York Fed President John Williams. The U.S. data calendar includes ISM manufacturing PMI, JOLTS job openings, ADP employment, factory orders, ISM services PMI, and the release of the June 11-12 Fed meeting minutes. Non-farm payrolls are due on Friday, with a Reuters poll predicting 195,000 headline jobs created in June and an unchanged unemployment rate of 4%.

France's legislative election may cause market volatility on Monday, especially if there is a shift to the left. In Europe, key data includes final June PMIs, flash HICP, May unemployment and retail sales, German CPI, and industrial production. The UK will hold an election on Thursday, with the Labour Party expected to win according to polls. Any reaction to a Labour government is expected to be minimal. Japan's Q2 Tankan survey is the only significant release in a quiet week for data. The Reserve Bank of Australia's June meeting minutes, as well as retail sales and trade data, are also due for release.

Overnight Newswire Updates of Note

France’s Far-Right Make Huge Gains In Nationwide Poll

China's Manufacturing PMI Remains Flat In June

Big Manufacturers' Sentiment Highest Level Since March 2022 - BoJ Tankan

South Korea S&P Global June Manufacturing PMI At 52.0 (Vs 51.6 In May)

Boeing Agrees Deal To Buy Spirit Aerosystems - RTRS

Euro, French Bonds Seen Higher Following France National Ballot

North Korea Fired A Suspected Ballistic Missile Eastward - Yonhap

Gold Holds Ground On US Rate-Cut Expectations

Australian Judo Bank PMI Mfg Jun F: 47.2 (prev 47.5 )

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0685 (1.8BLN), 1.0700 (2.9BLN), 1.0730-40 (1.2BLN), 1.0750 (572M)

1.0755-65 (806M), 1.0775 (334M), 1.0800 (363M), 1.0820 (312M)

USD/CHF: 0.8950-60 (830M), 0.9000 (267M), 0.9070 (801M)

EUR/CHF: 0.9600 (514M), 0.9725 (300M). EUR/GBP: 0.8520 (335M)

GBP/USD: 1.2620 (300M), 1.2750 (271M). NXD/USD: 0.6100 (235M)

AUD/USD: 0.6625 (329M), 0.6555-65 (280M), .6690-0.6700 (337M), 0.6750 (694M)

USD/JPY: 159.50 (1.2BLN), 160.50-55 (1BLN), 161.00 (396M)

EUR/JPY: 170.25 (250M)

CFTC Data As Of 25/06/24

Euro net short position is -8,431 contracts

Japanese Yen net short position is -173,900 contracts

Swiss Franc posts net short position of -35,057 contracts

British Pound net long position is 44,048 contracts

Bitcoin net short position is -624 contracts

Equity fund managers raise S&P 500 CME net long position by 17,079 contracts to 977,134

Equity fund managers raise S&P 500 CME net long position by 17,079 contracts to 977,134

Technical & Trade Views

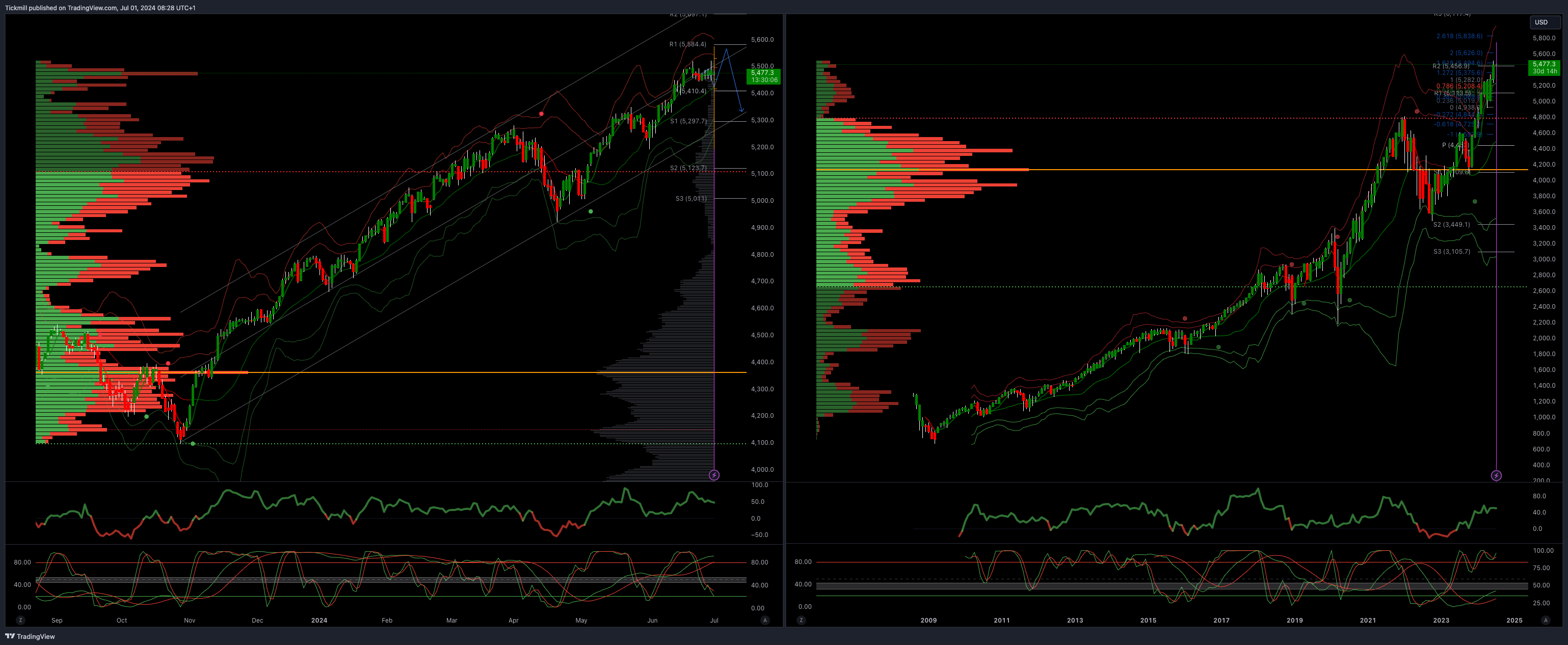

SP500 Bullish Above Bearish Below 5450

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580

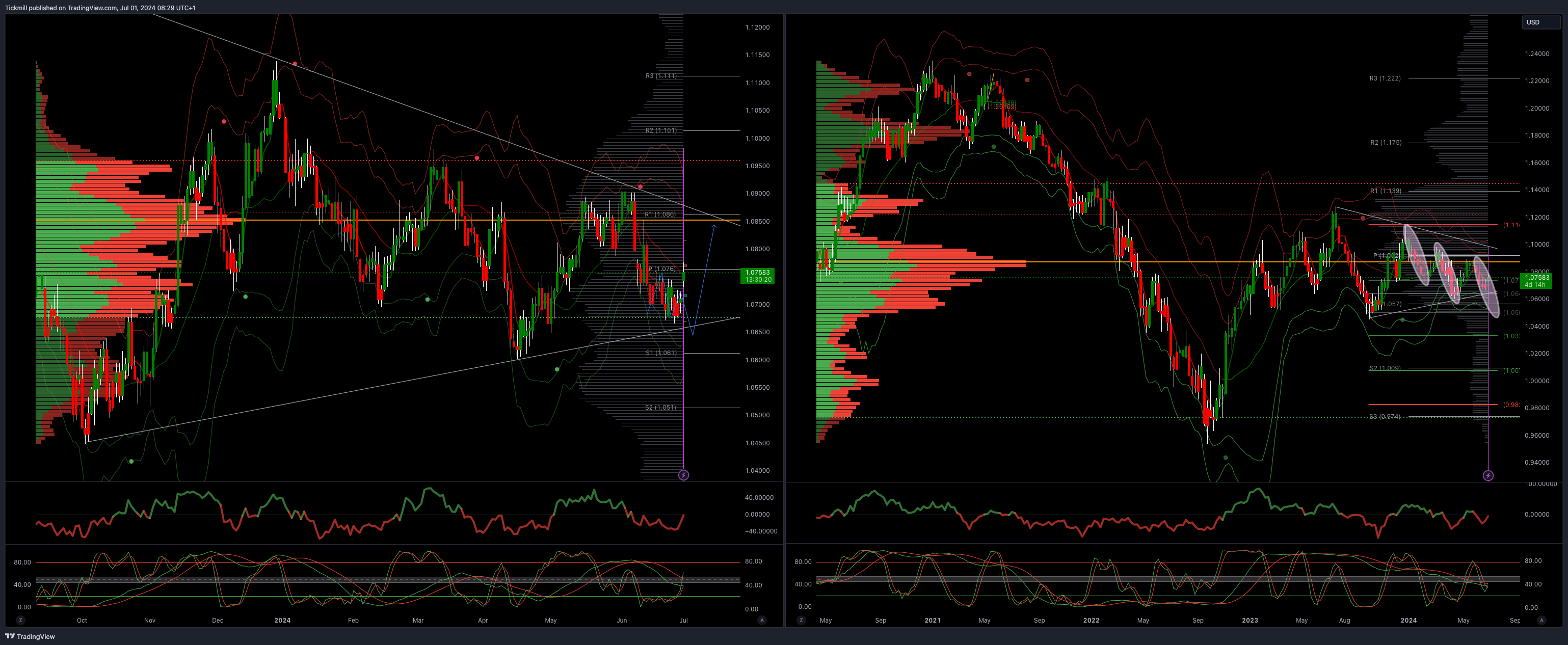

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

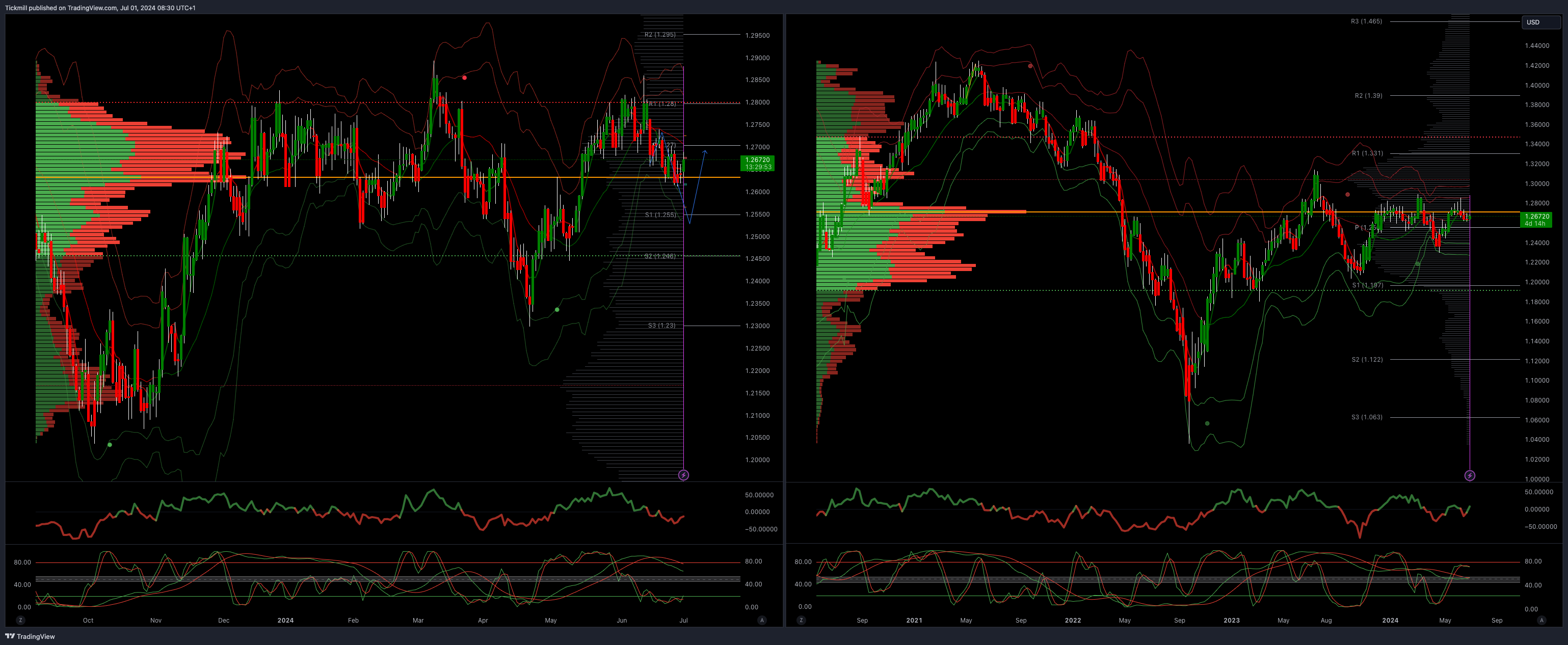

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bearish

Above 1.27 opens 1.2730

Primary resistance is 1.2890

Primary objective 1.2570

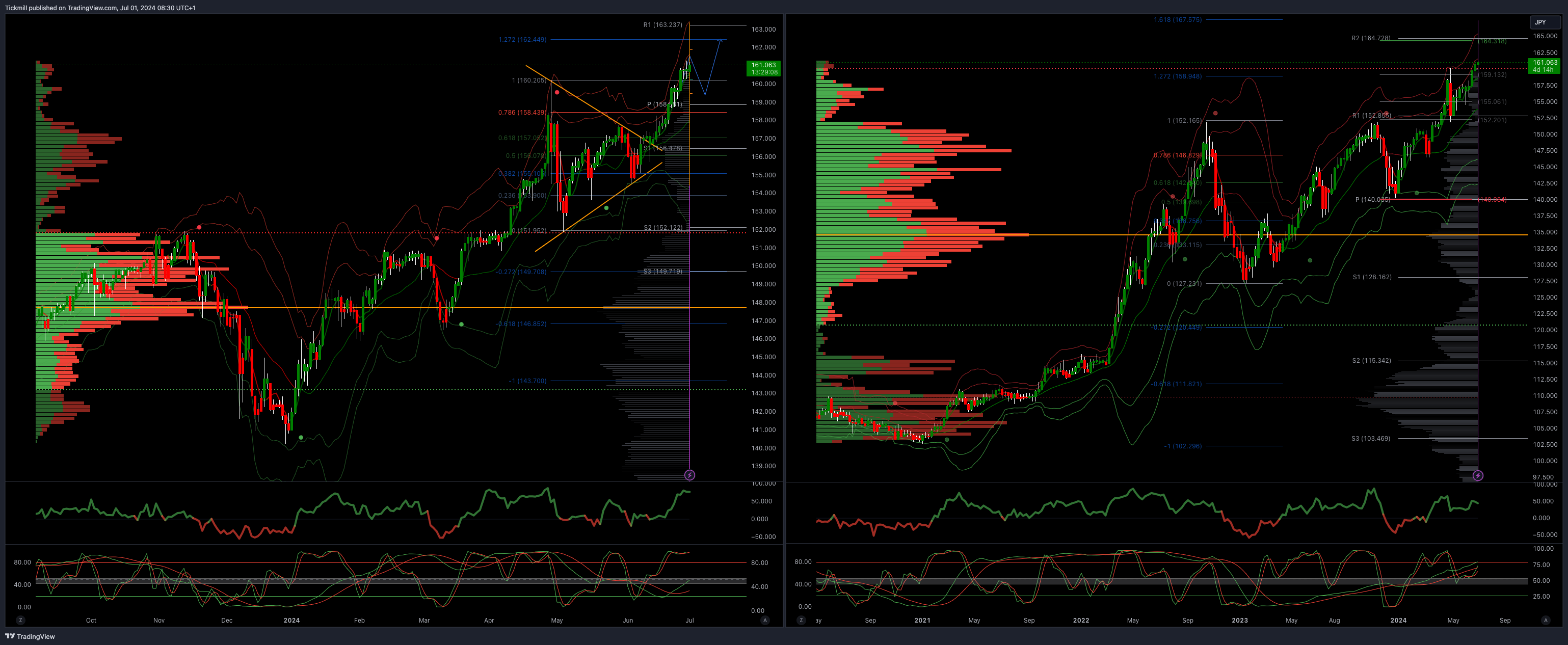

USDJPY Bullish Above Bearish Below 159.50

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160 TARGET HIT NEW PATTERN EMERGING

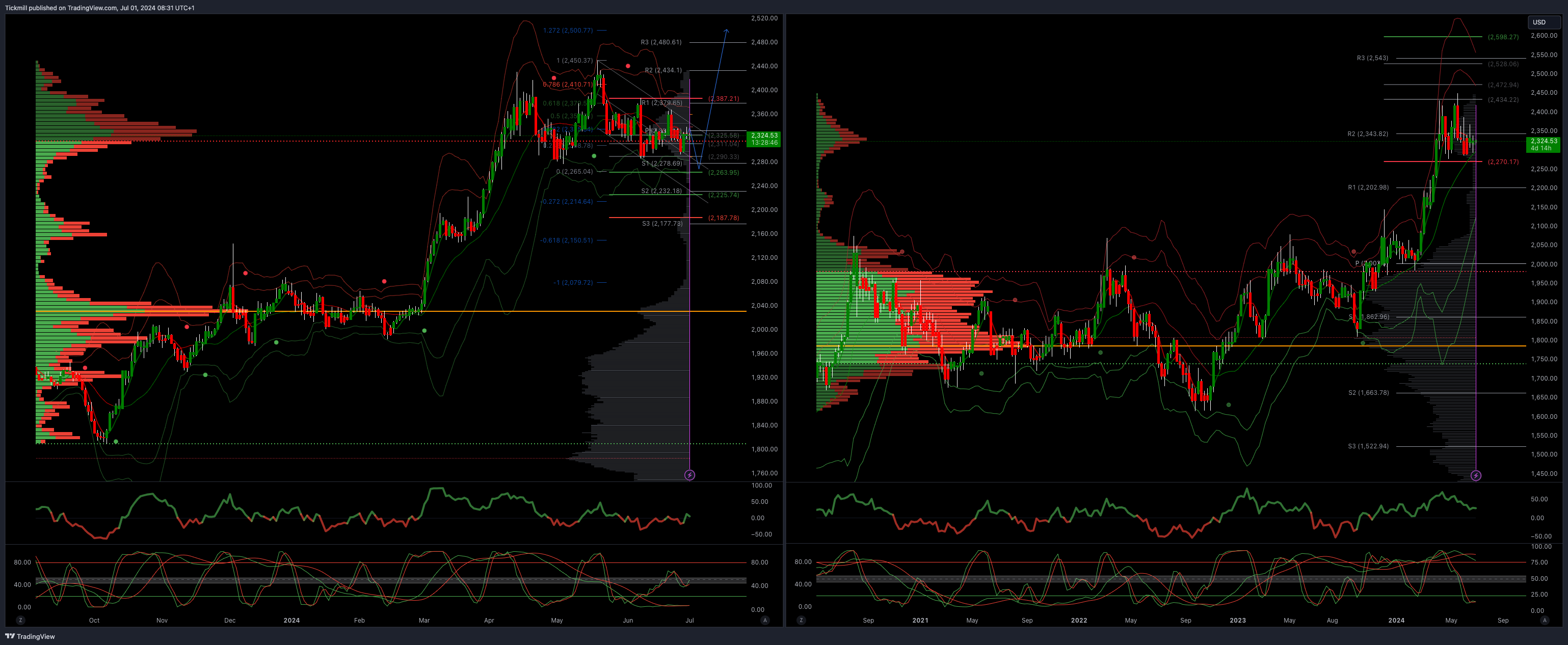

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary resistance 2387

Primary objective is 2262

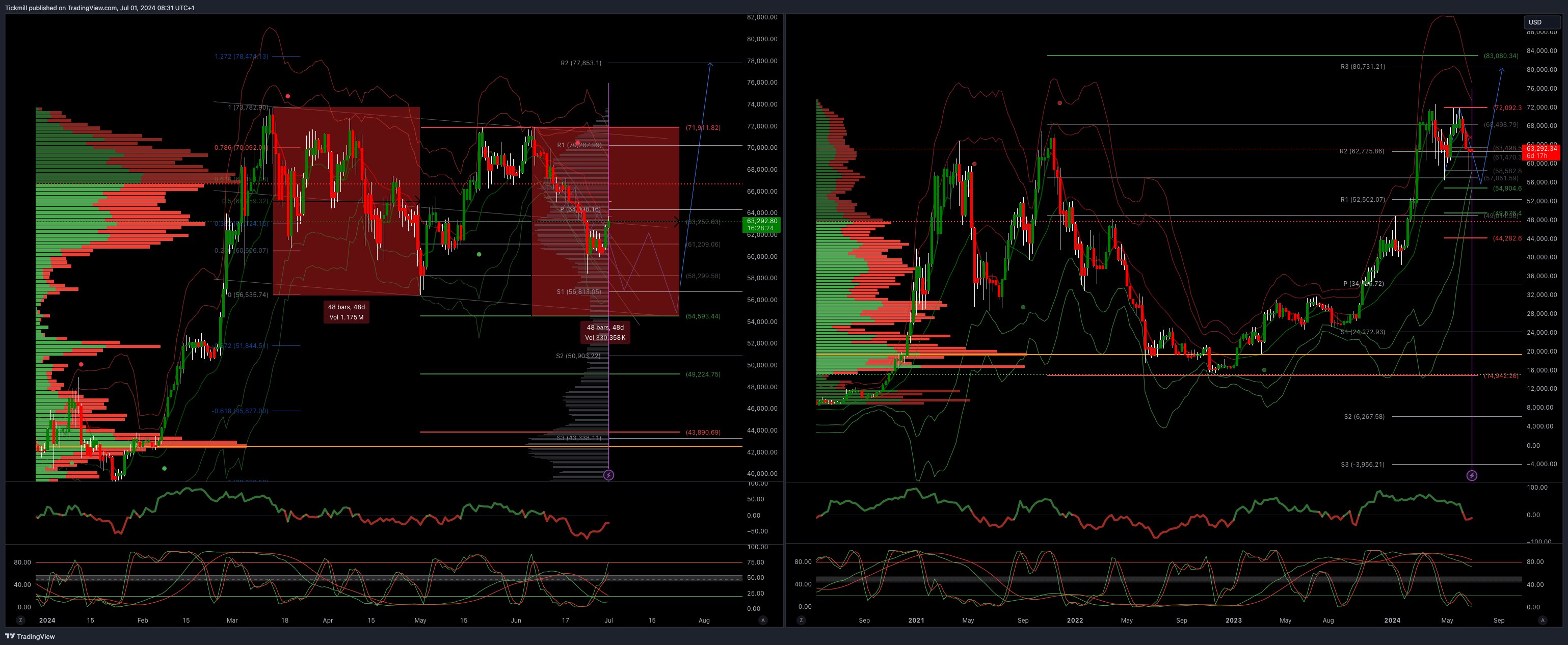

BTCUSD Bullish Above Bearish below 65840

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 64481

Primary objective is 54500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!