Daily Market Outlook, July 1, 2021

Daily Market Outlook, July 1, 2021

Overnight Headlines

- Investors still diving into US equities with valuations at record highs – FT • BOJ Tankan -Japan business mood improves in Q2 to 2-1/2-year high as COVID hit eases • JP Q2 Tankan Big Mfg DI +14, +15 f'cast, +5 prev; Big Non-Mfg +1, +3 f'cast, -1 prev • JP Q2 Tankan Big Mfg Sept DI eyed at +13, Non-Mfg DI +3, FY ‘21/22 CAPEX +9.6%, USD/JPY 106.71 • Japanese buy net Y22.7 bln foreign stocks, sell Y1.0265 trln foreign bonds, Y110.2 bln bills June 26 week • Foreign investors sell net Y147.1 bln Japan stocks, Y281.5 bln JGBs, Y120.3 bln bills June 26 week • Japan government to judge need for stimulus with eye on economy – top spokesperson • Japanese land prices post first annual fall in 6 years in 2020 – tax agency • Japan June factory activity sees slowest growth in 4 most but well above 50, Mfg PMI 52.4, 51.5 prev • China June factory growth slows on COVID-19, supply chain snags, Caixin PMI 51.3, 51.8 f'cast, 52.0 prev • Xi warns against foreign bullying as China marks party centenary • China advances in challenge to dollar hegemony – FT • Australia May Trade Balance A$9.681 bln, A$10 bln f'cast, A$8.028 bln prev • Australian job vacancies surge to record, firms struggle to find workers • Australia's NSW state says Delta outbreak grows despite lockdown • BoE’s Andy Haldane warns over inflation complacency in parting shot – FT

- Looking Ahead – Economic Data (GMT) • 07:55 DE Jun Mfg PMI 64.9 f'cast, 64.9 prev • 08:00 EZ Jun Mfg PMI 63.1 f'cast, 63.1 prev • 08:30 GB Jun Mfg PMI 64.2 f'cast, 64.2 prev • 09:00 EZ May Unemployment Rate, 8.0% f'cast, 8.0% prev

- Looking Ahead – Events, Auctions, Other Releases (GMT) • 07:00 ECB Lagarde, Enria parliamentary testimony • 07:30 Riksbank policy announcement, Monetary Policy Report • 08:00 BOE Bailey Mansion House speech • 09:00 Riksbank Ingves press conference • 09:30 ECB Elderson at Nordic Banking Associations seminar • 10:30 BOE Woods in Q&A on climate-related financial regulation • 12:00 Irish CB DepGov Donnery speaks at online event

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD 1.1850 (202M), 1.1900 (202M) 1.1940-50 (835M)

USD/JPY 110.45-50 (310M), 110.75 (395M), 111.00 (580M)

111.40 (350M). EUR/JPY 131.25 (1.23BLN)

EUR/GBP 0.8570 (330M). EUR/NOK 10.20 (202M)

AUD/USD 0.7500 (500M), 0.7605-20 (475M)

NZD/USD 0.6900 (552M), 0.7000 (352M), 0.7200 (315M)

USD/CAD 1.2475 (320M), 1.2745 (500M)

USD/CHF 0.9200 (302M)

Technical & Trade Views

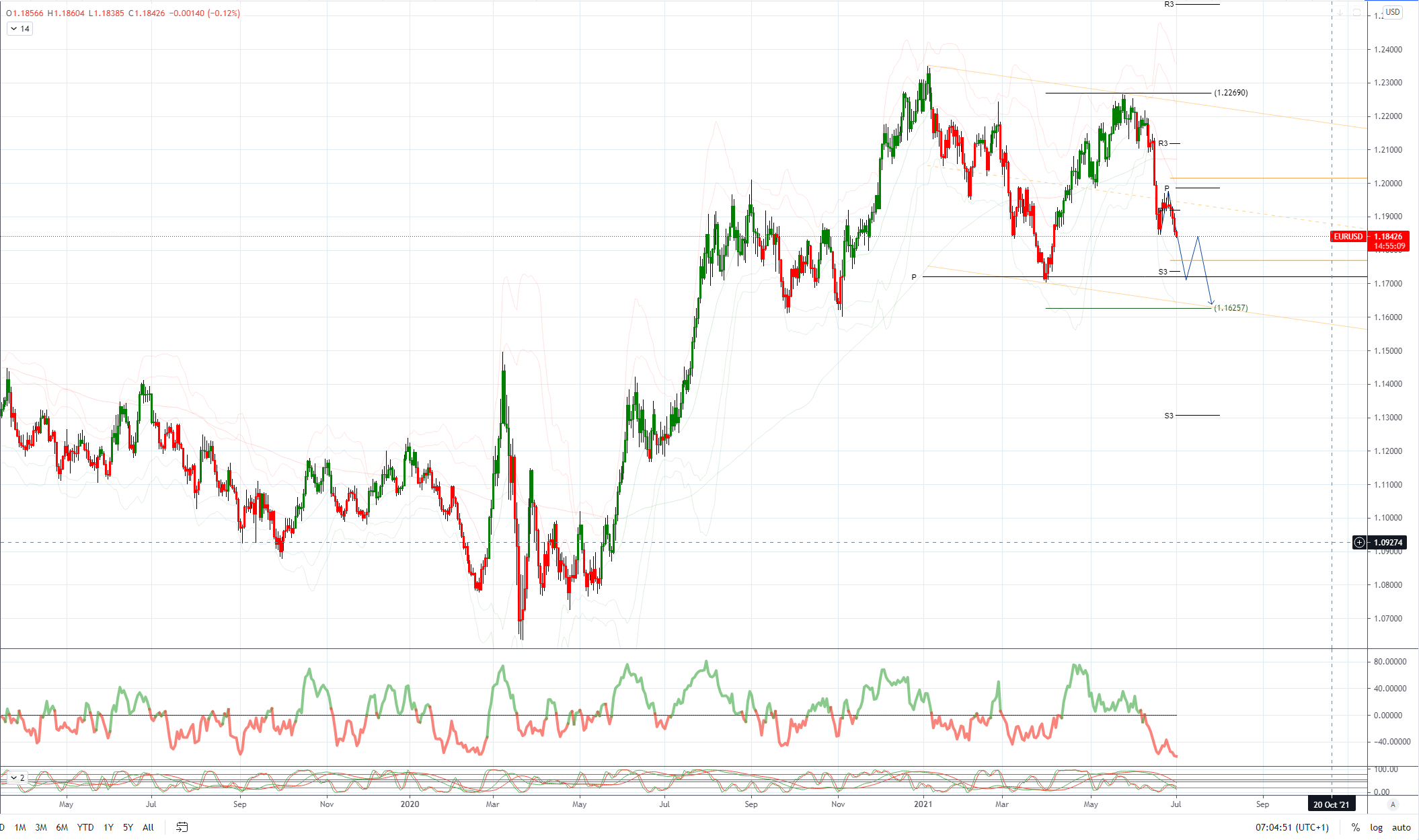

EURUSD Bias: Bearish below 1.21 Bullish above

Maintains heavy tone ahead of key support • EUR/USD opened 0.36% lower at 1.1855 after USD broadly firmed in US session • After trading 1.1860 it traded with a heavy tone through the morning • Heading into the afternoon it is at the session low at 1.1847 • Support is at 1.1845/50 where it has bottomed on three occasions • More support at the 76.4 0f the 1.1704/1.2266 move at 1.1836 • A break below 1.1835 targets the 2021 low at 1.1704 • Resistance is at the 10-day MA at 1.1905and break eases pressure • EUR/USD likely to remain offered ahead of Friday's US jobs data

GBPUSD Bias: Bearish below 1.4080 Bullish above.

Heavy with key support under pressure and USD firm • -0.1% towards the base of a 1.3812-1.3838 range with plenty of interest • UK's Sunak to sharpen City of London's competitive edge • Bank of England Governor Bailey speaks at Mansion house – text at 9am • Charts; daily momentum studies, 5, 10 & 21 daily moving averages fall • 21 day Bollinger bands slide – bearish setup suggests further losses • 10 DMA capped repeatedly, currently at 1.3879 and pivotal resistance • Downtrend targets a test of key 1.3756 support, 61.8% of the 2021 rise • Key sterling support vulnerable, as the USD climbs USD bulls run risk of U.S. jobs disappointment The U.S. dollar index's rally to a 2-1/2-month high on Wednesday, triggered in part by a better-than-expected ADP National Employment Report, could prove to be a bull trap yet again

USDJPY Bias: Bullish above 108 targeting 112

Consolidates above 111.00, JPY crosses better bid • USD/JPY consolidates gains to 111.12 overnight, Asia 111.03-16 EBS • Some bidding into Tokyo fix, eases back post-fix • Some chunky nearby option expiries help contain action • 111.00 strike $580 mln, 111.20-55 total $819 mln, larger tomorrow • Upside capped for now by Japanese exporters, option players • Bouncing US yields supportive, Tsy 10s @1.474%, Nikkei -0.5% @28,641 • Eyes on strong US NFP after strong ADP • Fed-BoJ policy divergence, US-Japan rate divergence back in play

AUDUSD Bias: Bearish below .7790 bullish above

Holds support after early dip – but remains heavy • AUD/USD opened -0.20% at 0.7499 after USD moved broadly higher • After trading at 0.7501 it slipped to 0.7485 where it ran into bids • Move lower in part due to some analysts saying RBA will push back against early hikes • Heading into the afternoon the AUD/USD is settled around 0.7490 • Support is at double-bottom formed at 0.7478 with buyers at 0.7480/85 • Break below 0.7475 targets the 61.8 of 0.6990/0.8007 at 0.7378 • Resistance is at the 10-day MA at 0.7540 and close above would ease pressure

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!