Daily Market Outlook, January 5, 2024

Daily Market Outlook, January 5, 2024

Munnelly’s Market Minute…

Stocks in the Asian region ended up trading mixed as the initial optimism slowly faded, even though there were no significant developments. This occurred as investors prepared for the release of the US Non-Farm Payrolls (NFP) report and ISM Services Purchasing Managers' Index (PMI). The Nikkei 225 performed well, briefly reaching above 33.5k handle with support from the weak JPY, but ultimately closed below that level. The Hang Seng and Shanghai Composite indices experienced fluctuations between gains and losses, ultimately leaning towards a downward trend by the end of the session. This was accompanied by the People's Bank of China (PBoC) conducting open market operations, resulting in a net withdrawal of CNY 2.423 trillion throughout the week. According to Reuters' calculations, this marked the largest weekly cash withdrawal on record. This significant monetary action may have implications for the financial markets and economic conditions.

The Eurozone's preliminary flash estimate for December's Consumer Price Index (CPI) inflation is eagerly anticipated upon its release later this morning. In November, the headline measure dropped to 2.4%, marking the lowest level since July 2021. However, due to energy price base effects, specifically a significant month-on-month decline in December 2022 that is not expected to recur this time, headline inflation is projected to temporarily accelerate to 2.9%. Policymakers are likely to take comfort in the anticipated decrease in core inflation, which excludes the volatile energy and food components. The forecast indicates that core CPI is expected to decrease to 3.3% from 3.6% in November. This is likely to strengthen the belief that European Central Bank (ECB) interest rates have peaked, although policymakers will wait for further progress in inflation before considering rate cuts.

In the UK, the December construction Purchasing Managers' Index (PMI) survey is expected to indicate a slightly less severe pace of contraction. According to consensus forecasts, the headline index is predicted to increase from 45.5 to 46.1, remaining below the critical 50 threshold.

Stateside the main economic release for this afternoon is the monthly US labour market report. There are signs that the pressure in the labour market is decreasing, as evident from this week's 'JOLTS' data, which indicated a slowdown in both labour market turnover and unfilled job openings in November. Despite the overall tightening of the market, market watchers expect that there will be a solid increase of 190,000 jobs in December (consensus: 175,000), slightly lower than November's increase of 199,000 but still enough to keep the unemployment rate at a low 3.7%. Despite the tight labour market, wage growth slowed down last year, and it is anticipated that there will be further evidence of this today, with an expected decrease in annual growth to 3.9% from the previous 4.0%. Overall, the report is likely to confirm that interest rates have reached their peak, but it may not give strong reasons for an early cut by the Federal Reserve.

Additionally in the US, other releases today include the trade balance, factory orders, and the ISM services survey. For the latter, a slight increase to 52.9 in December from 52.7 is expected. Additionally, the Federal Reserve's Barkin is scheduled to speak.

Overnight Newswire Updates of Note

Cheap Costs Push Use Of Fed Term Funding Tool To Fresh Record

UK Retailers Facing Dec Disappointment As Rain Subdues Store Visits

UK Household Incomes Temporarily Boosted By Higher Interest Rates

SMMT: UK Records Best Year For New Car Sales Since The Pandemic

China Markets Are Betting Big On Further PBoC Easing This Year

More BoJ Watchers Shift Hike Forecasts, Seeing January Unlikely

Trader Makes Massive Bet Tsy’s Will Get Slammed After Jobs Report

Money-Market Fund Assets Rise To New All-Time High On Thursday

Multiple Spot BTC ETFs Will Be Approved, TechCrunch’s Sources Say

Chinese Stock Indicator With 100% Success Rate Is Flashing Buy

Huawei Teardown Shows 5nm Laptop Chip Made In Taiwan, Not China

Oil Set For Weekly Gain As Supply Risks Outweigh Weak US Demand

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0870 (440M), 1.0920-25 (402M), 1.0940 (953M), 1.0975 (306M)

USD/CHF: 0.8500 (261M), 0.8550 (200M)

GBP/USD: 1.2500 (284M), 1.2750 (263M), 1.2800 (203M)

AUD/USD: 0.6600 (473M), 0.6775 (408M). USD/CAD: 1.3300 (630M)

USD/JPY: 143.80 (490M), 144.00 (230M), 145.45 (250M), 146.00 (324M)

Technical & Trade Views

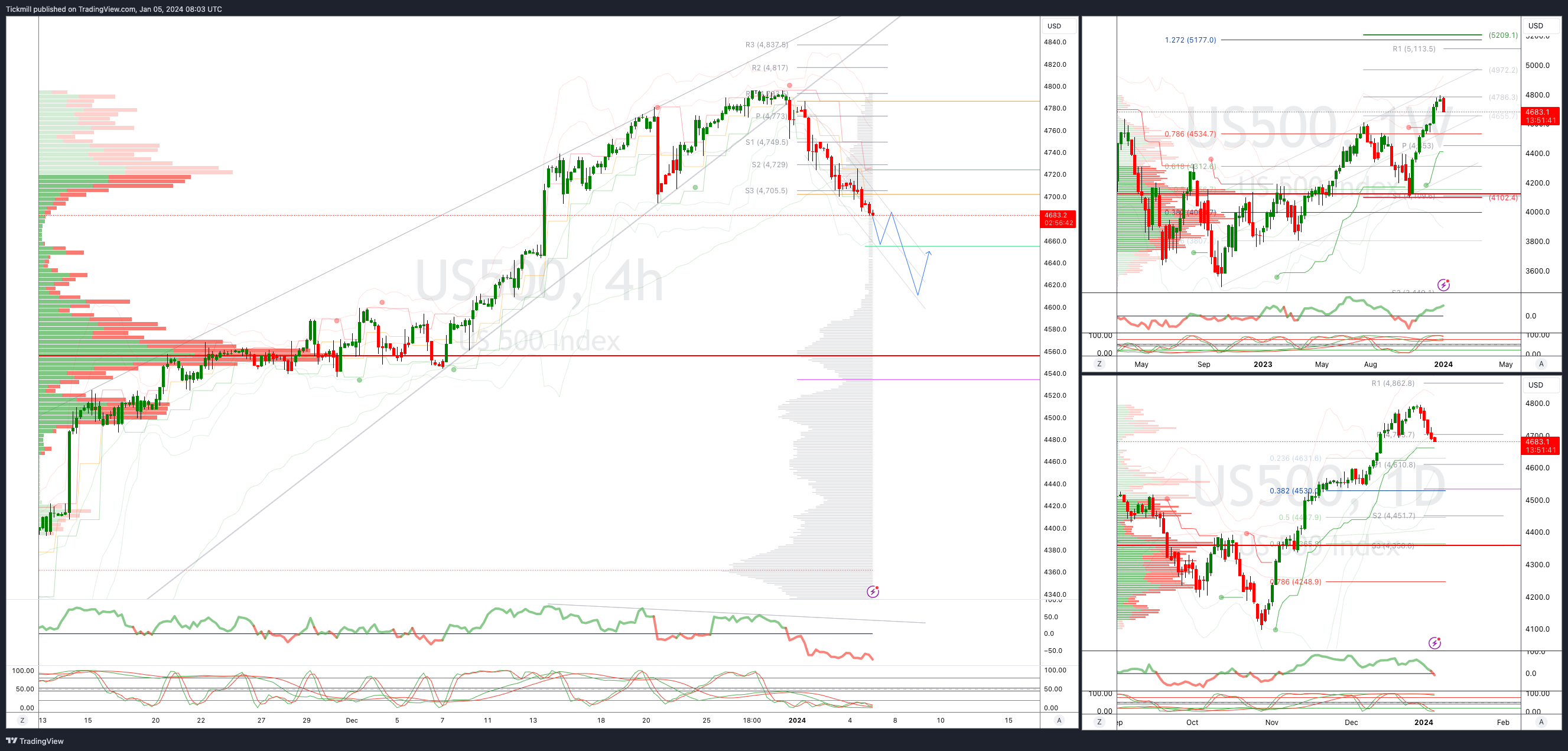

SP500 Bullish Above Bearish Below 4700

Daily VWAP bearish

Weekly VWAP bearish

Above 4700 opens 4725

Primary support 4600

Primary objective is 4611

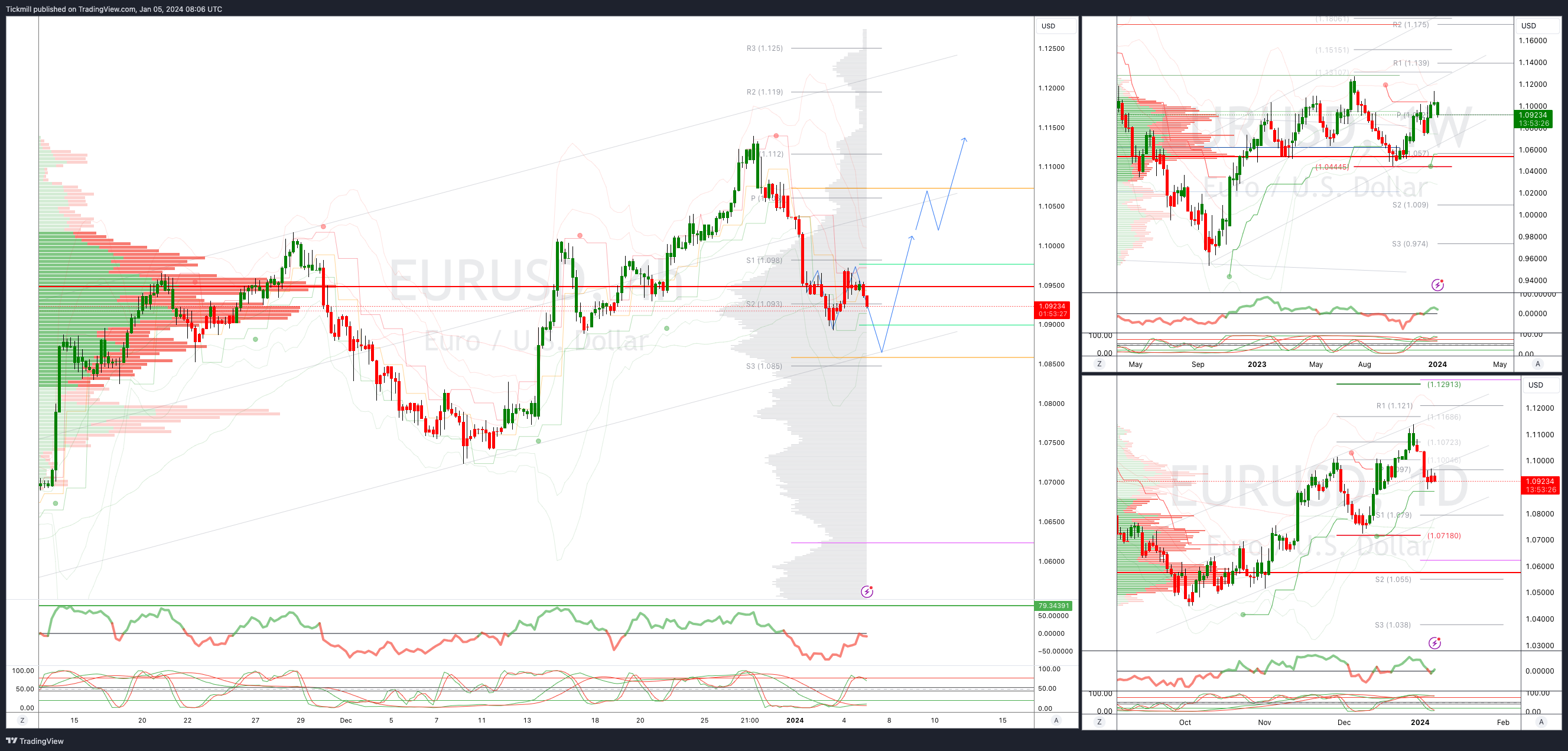

EURUSD Bullish Above Bearish Below 1.1000

Daily VWAP bearish

Weekly VWAP bullish

Above 1.1030 opens 1.1130

Primary resistance 1.1130

Primary objective is 1.0850

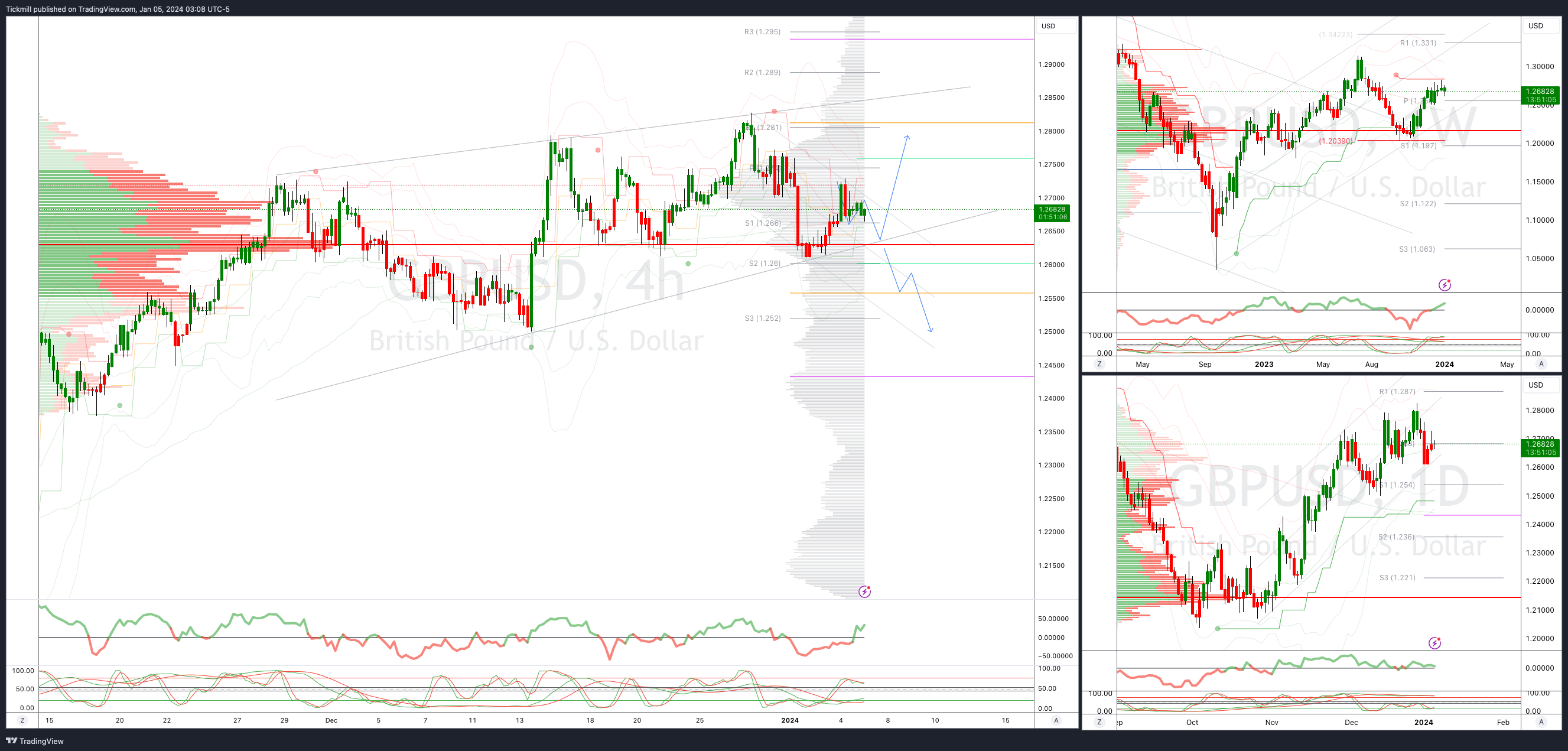

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2710 opens 1.2820

Primary resistance is 1.2820

Primary objective 1.2550

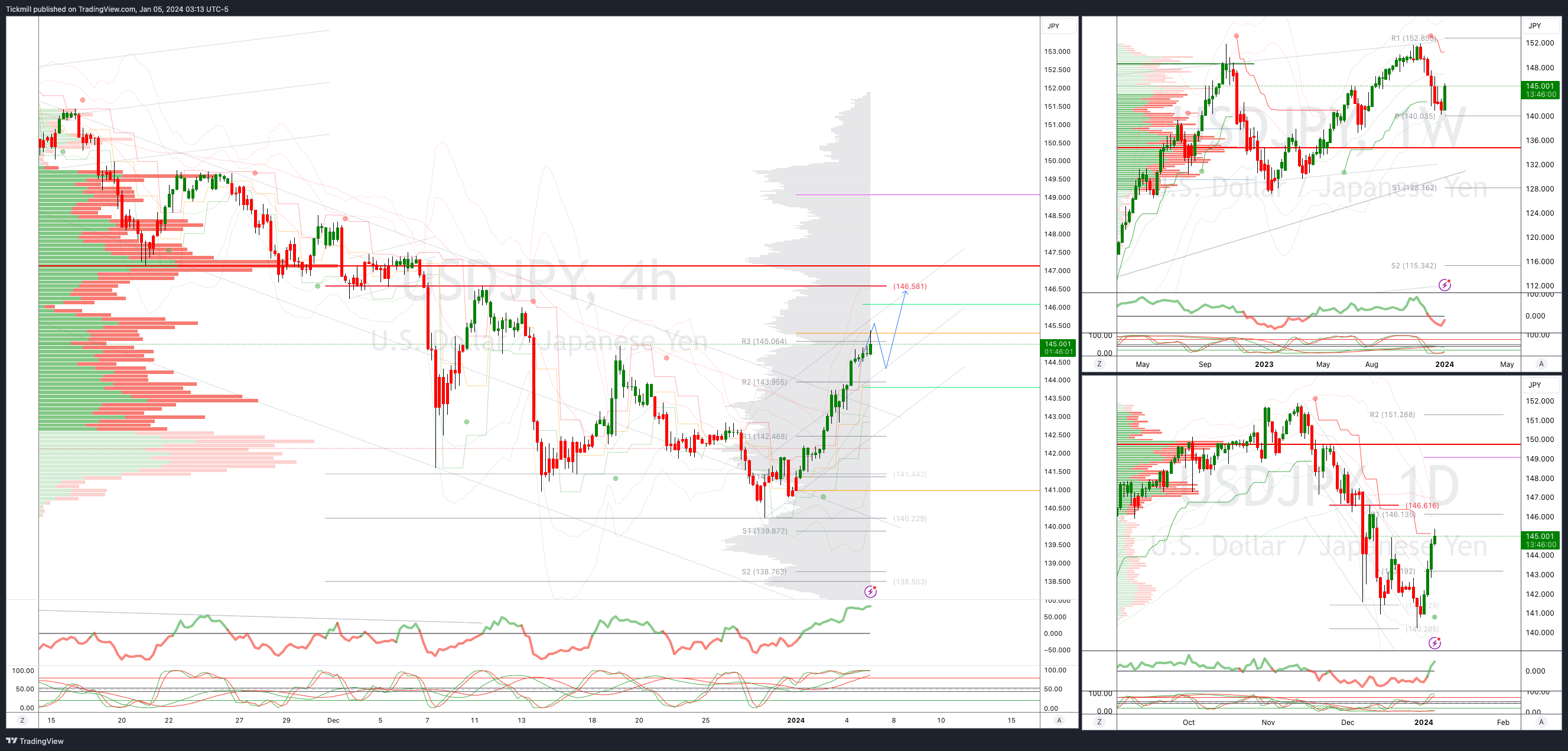

USDJPY Bullish Above Bearish Below 144.40

Daily VWAP bullish

Weekly VWAP bullish

Above 144 opens 146.50

Primary resistance 146.50

Primary objective is 146.50

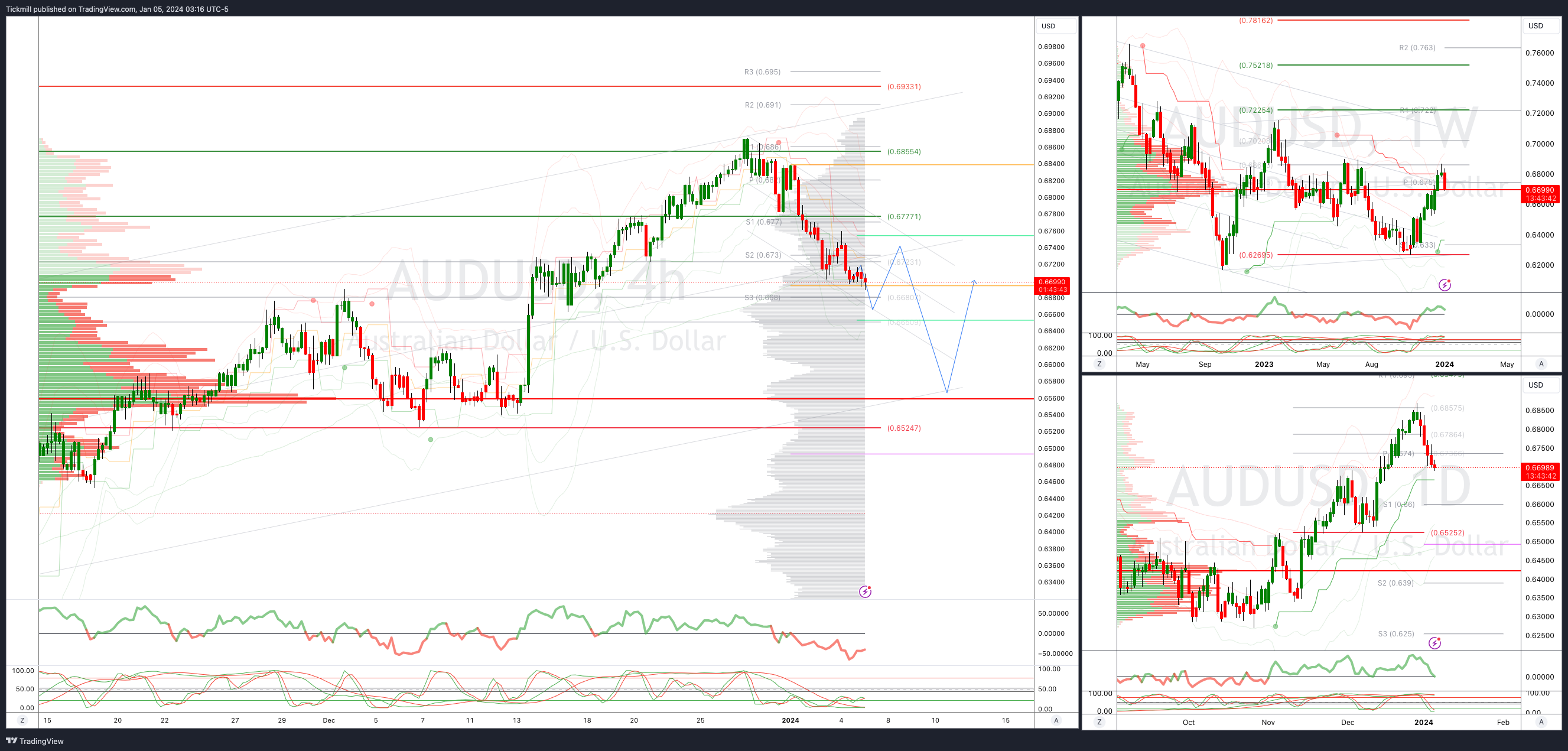

AUDUSD Bullish Above Bearish Below .6750

Daily VWAP bearish

Weekly VWAP bearish

Below .6660 opens .6550

Primary support .6525

Primary objective is .6933

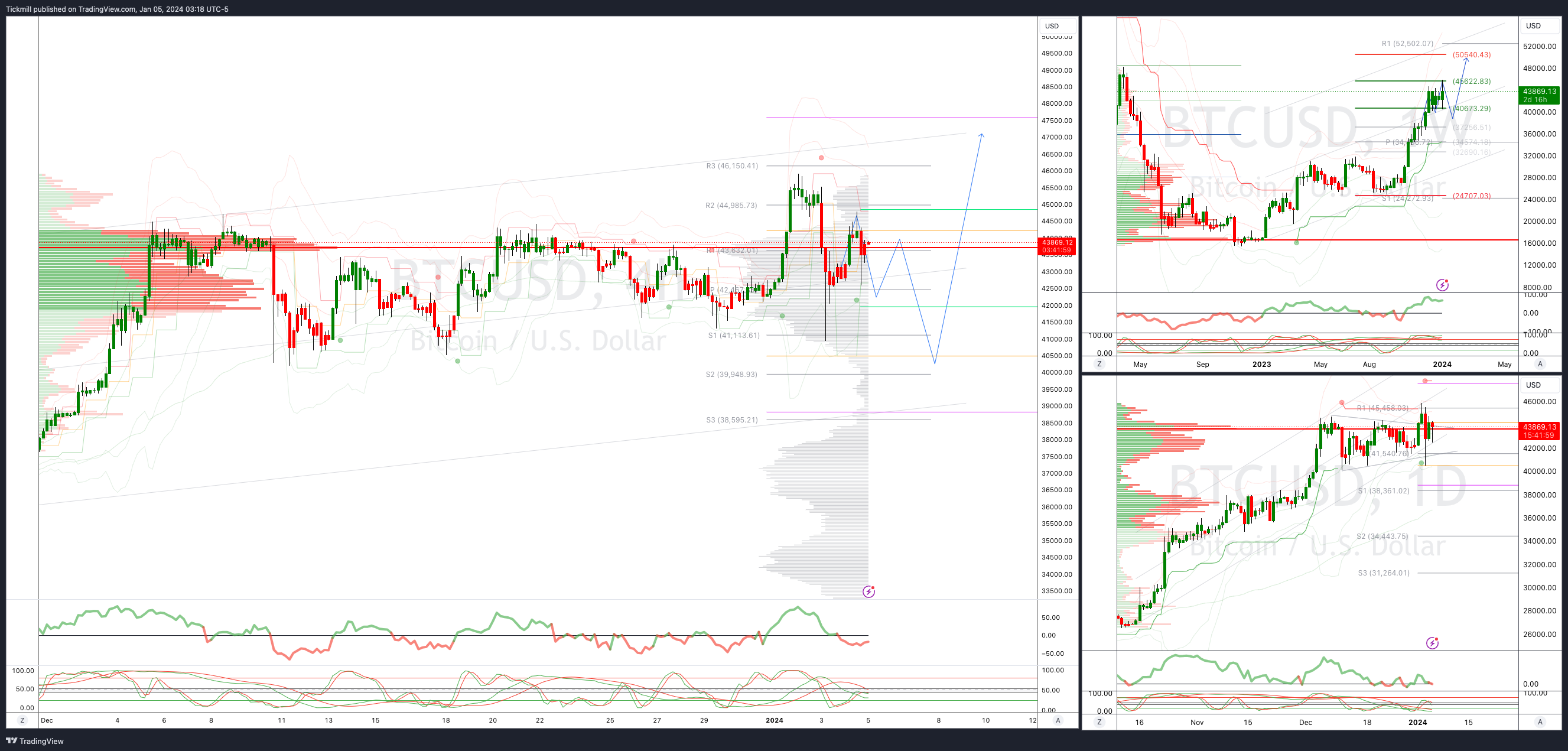

BTCUSD Bullish Above Bearish below 44000

Daily VWAP bearish

Weekly VWAP bullish

Above 45000 opens 47000

Primary support is 40000

Primary objective is 47000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!