Daily Market Outlook, January 3, 2024

Daily Market Outlook, January 3, 2024

Munnelly’s Market Minute…

Most Asian markets experienced declines as market sentiment echoed the downbeat performance of Wall Street, even though there was no clear reason for the negative trend. Meanwhile, Japanese markets were closed for a market holiday. Hang Seng and Shanghai Comp had mixed performance, with Hang Seng experiencing losses driven by large-cap Hong Kong stocks also listed in the US with JD.com leading the charge lower shedding over 4%. Mainland China fluctuated between modest gains and losses, supported into the close by stimulus speculation in the Chinese press.

Today sees no data of note in the UK or Europe, instead focus is firmly on the US data slate.

The publication of the minutes from the December monetary policy meeting of the US Federal Reserve. During this meeting, Fed Chair Powell suggested the possibility of US interest rate cuts in 2024. This shift towards a more dovish stance has increased market optimism for significant rate cuts this year. Investors are currently expecting a high likelihood of the first cut happening as early as March, with a projected total decrease of around 150 basis points by December. One notable aspect of the December Fed update was the apparent lack of effort to warn against what some had speculated as an excessive easing in financial conditions. Prior to the update, there were suggestions that the Fed might see recent financial market movements as an unwarranted early relaxation in monetary policy. However, both the Fed's press statement and Chair Powell's comments showed little indication of such concerns. In contrast to the December policy updates from the Bank of England and the European Central Bank, the Fed seemed to support market expectations. The minutes released today will provide further insights into whether this interpretation holds. Market participants will also be eager to find hints or clues about the potential timing of rate cuts and the criteria policymakers will consider before taking action.

In terms of additional US data releases today, the noteworthy update is the ISM manufacturing index for December. In November, it remained below the critical 50 level, indicating a contraction in activity for the 13th consecutive month. This trend is likely to have continued in December, although there may be indications of a slower pace of decline. On a positive note, the reading for the larger services sector, with the December update scheduled for Friday, remains in expansionary territory, indicating overall economic growth. Additionally, the November JOLTs survey of labour market turnover will be released, providing more details on labour market conditions after stronger-than-expected employment growth.

Overnight Newswire Updates of Note

Stocks, Bonds Drop In Tandem For Worst Start To Year In Decades

Fed’s Balance Sheet Leaps Into Spotlight After Repo Volatility

IMF Chief: Fed Securing Soft Landing, Warns Of Fragmentation

UK Executives Urge BoE To Cut Rates After Confidence Sinks Lower

China Newspaper Says More Policies To Stabilise Economy Coming

RBA Sees Living-Cost Pressure Weighing On Growth, Documents Show

Banks See Higher-Rated Bonds Beating Junk For First Time Since 2020

China’s Commodities Demand Remains Resilient Despite Factory Slump

Stocks, Bonds Drop In Tandem For Worst Start To Year In Decades

China Fortune Land’s Bond Investors Get Only Partial Payment

Samsung To Kick Off Year Of AI Phones With New Launch This Month

An Israeli Drone Kills Hamas Deputy Leader In Beirut

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD:1.0900-05 (488M), 1.0940-50 (738M) 1.0975 (230M), 1.1000 (960M), 1.1015-25 (431M) 1.1030-35 (566M), 1.1045-55 (868M) 1.1075-85 (1.81BLN), 1.1090-00 (1.11BLN)

USD/JPY: 142.00 (241M), 142.235-25 (234M)

EUR/JPY: 153.40 (432M), 159.35 (370M)

USD/CHF: 0.8430 (555M)

GBP/USD: 1.2430 (338M), 1.2660 (284M)

EUR/GBP: 0.8690 (377M)

AUD/USD: 0.6720 (527M), 0.6670-75 (368M)

NZD/USD: 0.6150-55 (561M)

Technical & Trade Views

SP500 Bullish Above Bearish Below 4730

Daily VWAP bearish

Weekly VWAP bullish

Below 4700 opens 4600

Primary support 4600

Primary objective is 4850

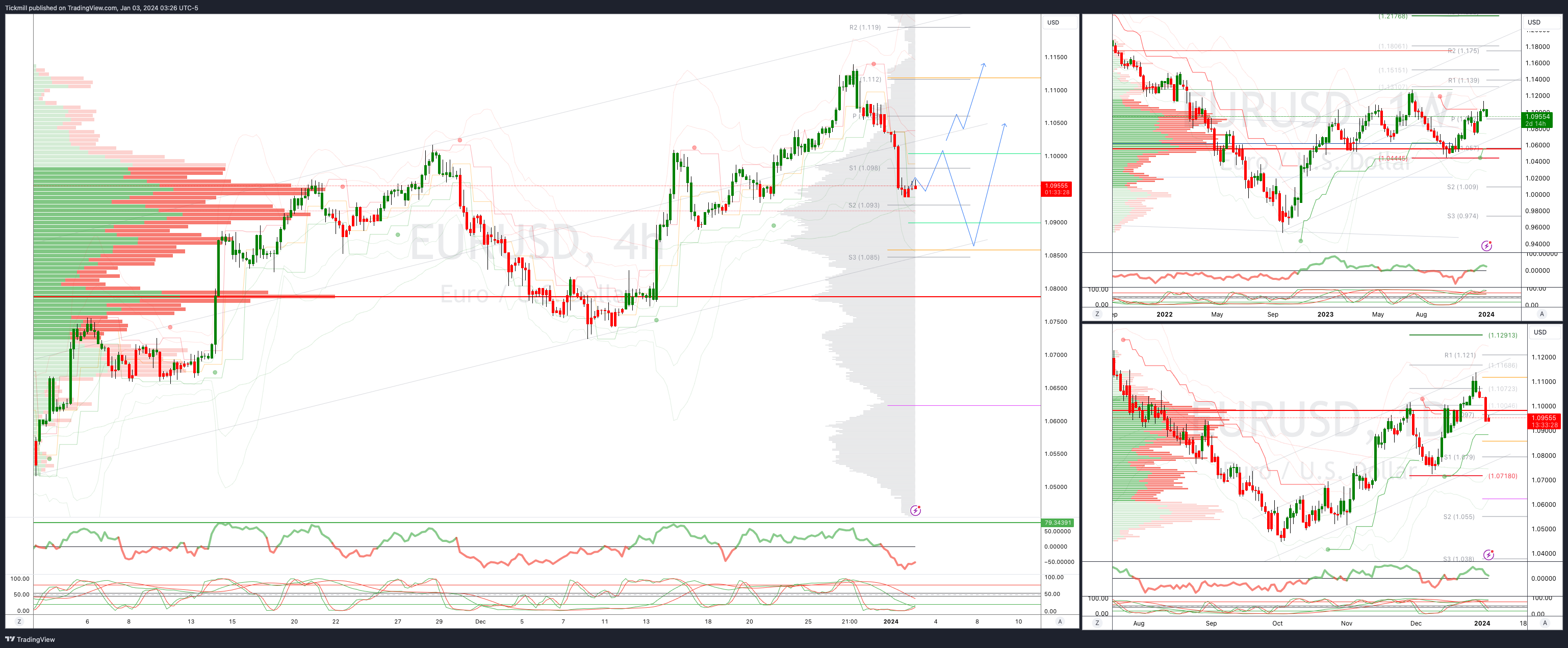

EURUSD Bullish Above Bearish Below 1.1010

Daily VWAP bearish

Weekly VWAP bullish

Above 1.1030 opens 1.1130

Primary resistance 1.1130

Primary objective is 1.0850

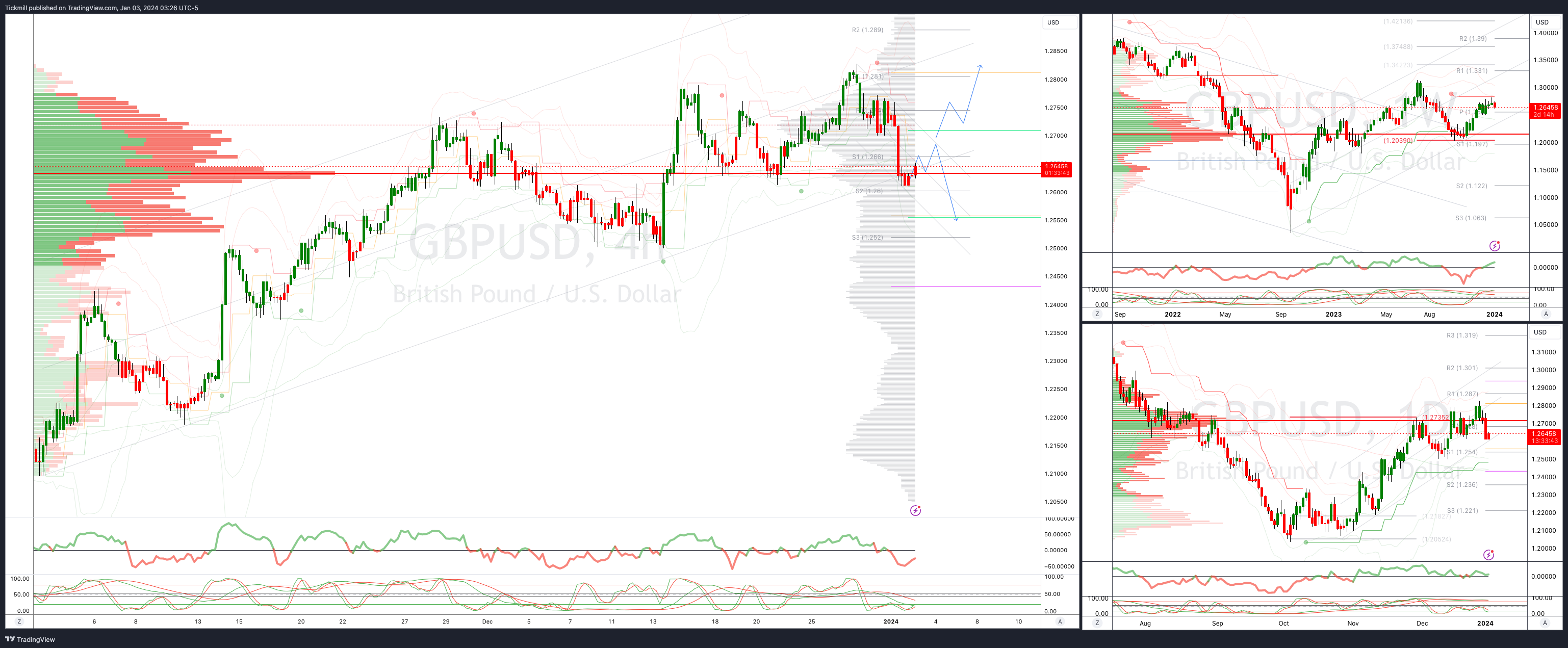

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2710 opens 1.2820

Primary resistance is 1.2820

Primary objective 1.2550

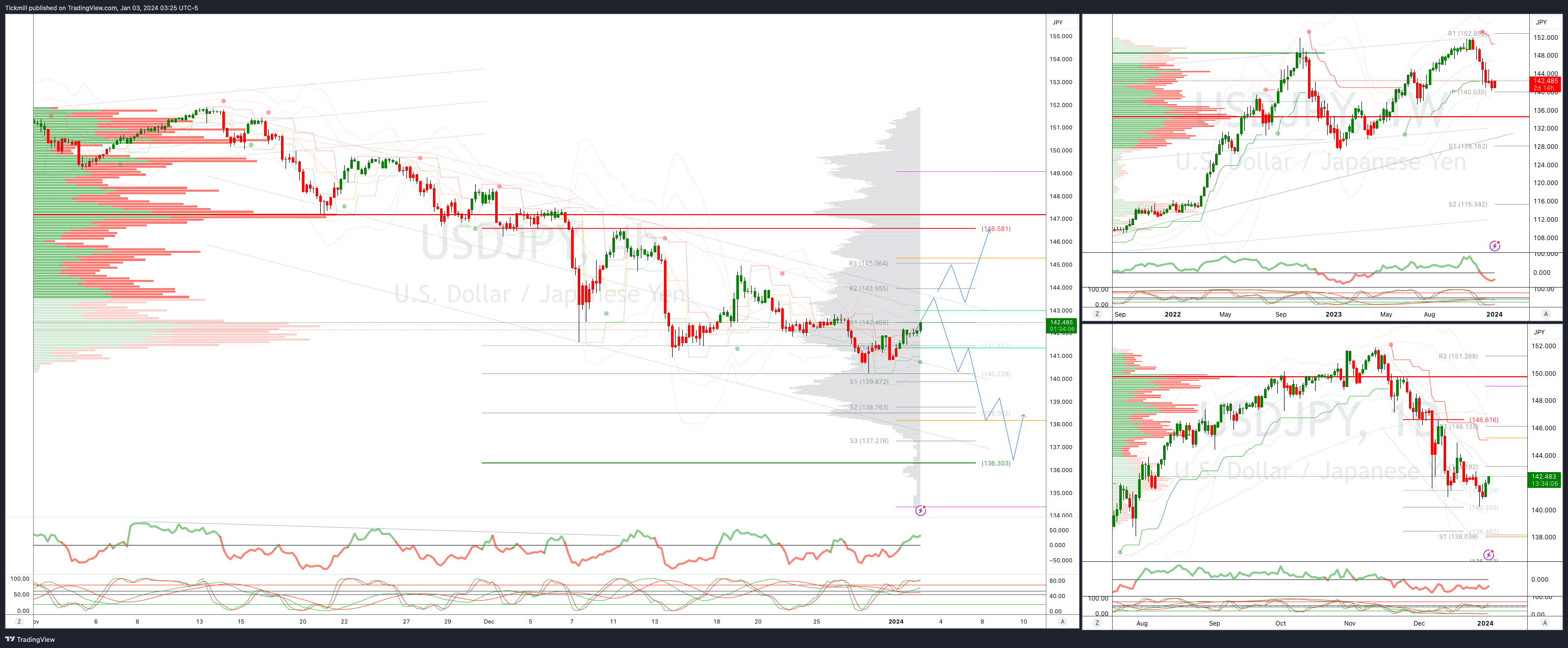

USDJPY Bullish Above Bearish Below 143.50

Daily VWAP bullish

Weekly VWAP bearish

Above 144 opens 146.50

Primary resistance 146.50

Primary objective is 136.30

AUDUSD Bullish Above Bearish Below .6700

Daily VWAP bearish

Weekly VWAP bullish

Below .6660 opens .6550

Primary support .6525

Primary objective is .6933

BTCUSD Bullish Above Bearish below 44000

Daily VWAP bullish

Weekly VWAP bullish

Below 43700 opens 42700

Primary support is 40000

Primary objective is 47000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!