Daily Market Outlook, January 29, 2024

Daily Market Outlook, January 29, 2024

Munnelly’s Market Minute…“China Winds Up Evergrande, Middle East Tensions Rise”

Over the weekend, news emerged that China's securities regulator would halt the lending of certain stocks for short selling starting today. Initially, this led to a rise in equities across China and Asia. However, optimism quickly faded, and stocks eased back, with Chinese markets mostly in the red with worries about the real estate industry front and center, as China's decision to wind up Evergrande has raised the prospect of contagion risk. Concurrently, US and European stock futures edged lower amid rising tensions in the Middle East.

Speculation surrounding the near-term trajectory of interest rates remains the primary driver of financial market movements. This week, the probability of interest rate cuts in early 2024 has been particularly volatile, initially falling but then rising again. European Central Bank President Lagarde emphasized in last Thursday’s update that decisions on interest rates were data-dependent and that the Board had not yet discussed cuts. However, markets interpreted her lack of strong pushback against suggestions of rate cuts starting in April as a signal. Consequently, expectations of a first reduction in April have risen to almost 90%. Lagarde highlighted wage trends as a key signal for when the ECB might be prepared to act, making them closely watched over the next few months.

In the upcoming week, the US Federal Reserve and Bank of England will deliver their first policy updates of the year. While no rate changes are expected, the focus will be on any signals regarding future intentions. The US economic activity remains robust, despite decreasing inflation measures, indicating a less urgent need for rate cuts. The Bank of England has been more cautious than its counterparts in signaling a turnaround in interest rate policy and is likely to reiterate its previous message. Although it may lower rates later in the year, the Monetary Policy Committee is likely to consider it too early to signal such an intention.

Ahead of these key events, today's docket lacks significant data releases. The US will see the Dallas Fed manufacturing survey for January, while Japan will release its December labor market report. Comments from ECB policymaker Guindos will also draw interest. Overnight, the British Retail Consortium (BRC) will release its January shop price index update. Following the December uptick in UK CPI, markets will closely monitor this report for confirmation of domestic disinflationary trends.

Overnight Newswire Updates of Note

China Evergrande Receives Winding-Up Order From Hong Kong Court

China Tightens Securities Lending Rule To Support Stock Market

Biden Vows To Retaliate After Strike Against American Forces In Jordan

US To Reportedly Announce Billions Of Dollars In Subsidies For Advanced Chips

Hints Of Early ECB Rate Cut Highlight Divisions In Council

ECB’s Knot Says Wage Data Needed Before Rate Move Possible

ECB’s Villeroy Says ECB Could Cut Rates At Any Time This Year

Kemi Badenoch Tells Tory Plotters To Back Rishi Sunak

Oil Jumps After Separate Attacks Escalate Middle East Tensions

China To Merge Three Major Asset Managers Into China Investment Corp

First Boeing 737 Max Jet Delivered To China Since 2019 Lands

ADM Postpones Some Exec Bonuses Amid Accounting Probe

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (631M), 1.0815-25 (617M), 1.0840-50 (851M)

1.0890-1.0900 (1.3BLN), 1.0910-10 (1BLN)

USD/CHF: 0.8750 (1.4BLN). EUR/CHF: 0.9285 (425M), 0.9450 (200M)

GBP/USD: 1.2600-15 (716M), 1.2665-70 (505M), 1.2700 (672M)

AUD/USD: 0.6570 (260M), 0.6585 (373M), 0.6630-40 (564M)

USD/JPY: 146.75 (420M), 148.50 (450M)

There are significantly fewer long positions in the EUR/USD market, but it remains the largest foreign exchange bet. Traders have reduced an $8 billion bet on the euro rising out of a total $20.5 billion wager to just $12 billion. Despite the reduction, it is still double the size of any other individual foreign exchange bet. The quieter foreign exchange markets may lead to further reduction in long positions. With fewer long positions, there is less resistance to the underlying upward trend. It is possible that the rise of EUR/USD may continue before the US begins its easing cycle in May.

CFTC Data As Of 12/01/24

USD bearish increasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

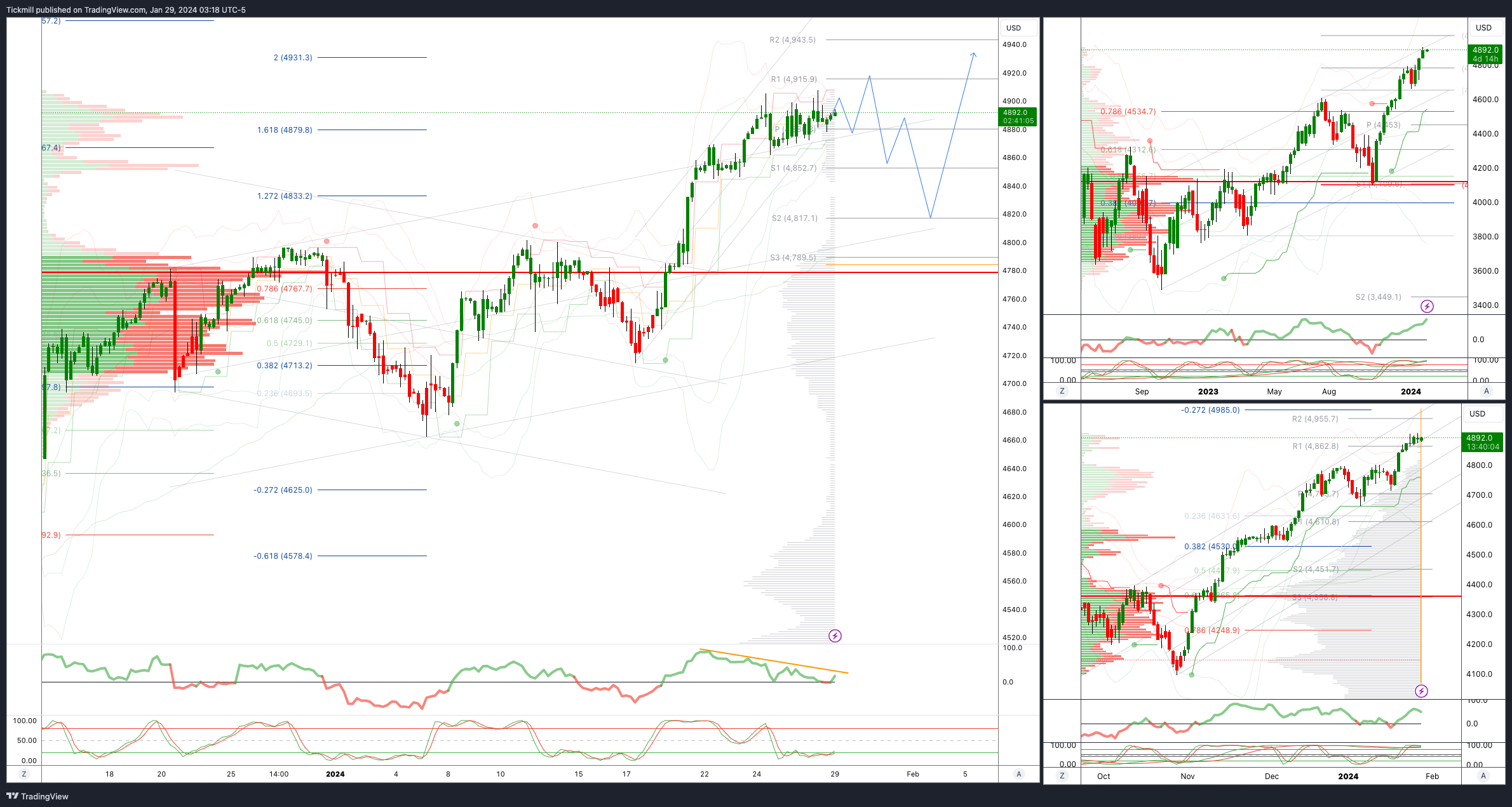

SP500 Bullish Above Bearish Below 4875

Daily VWAP bullish

Weekly VWAP bullish

Below 4800 opens 4780

Primary support 4700

Primary objective is 4910

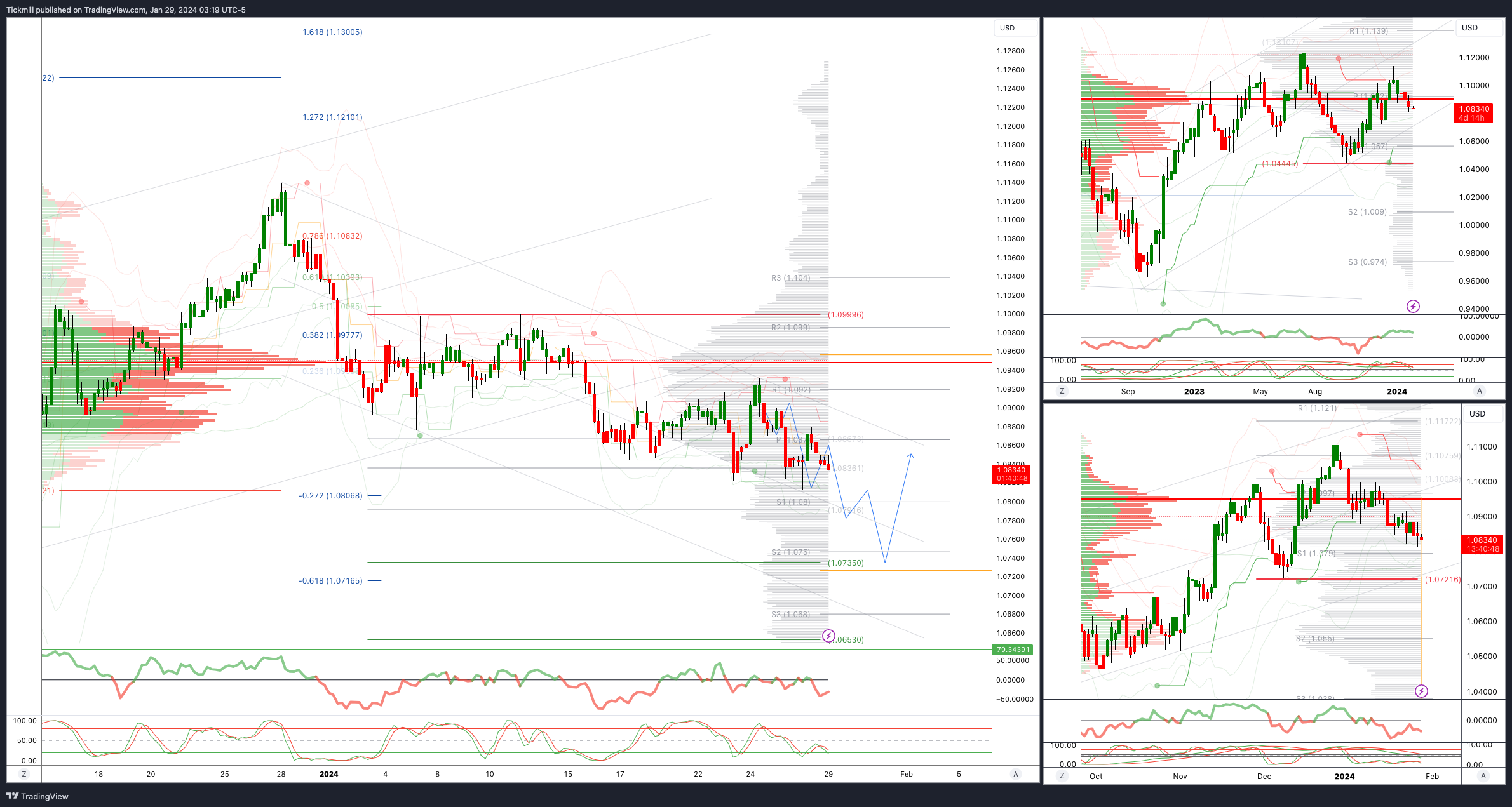

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

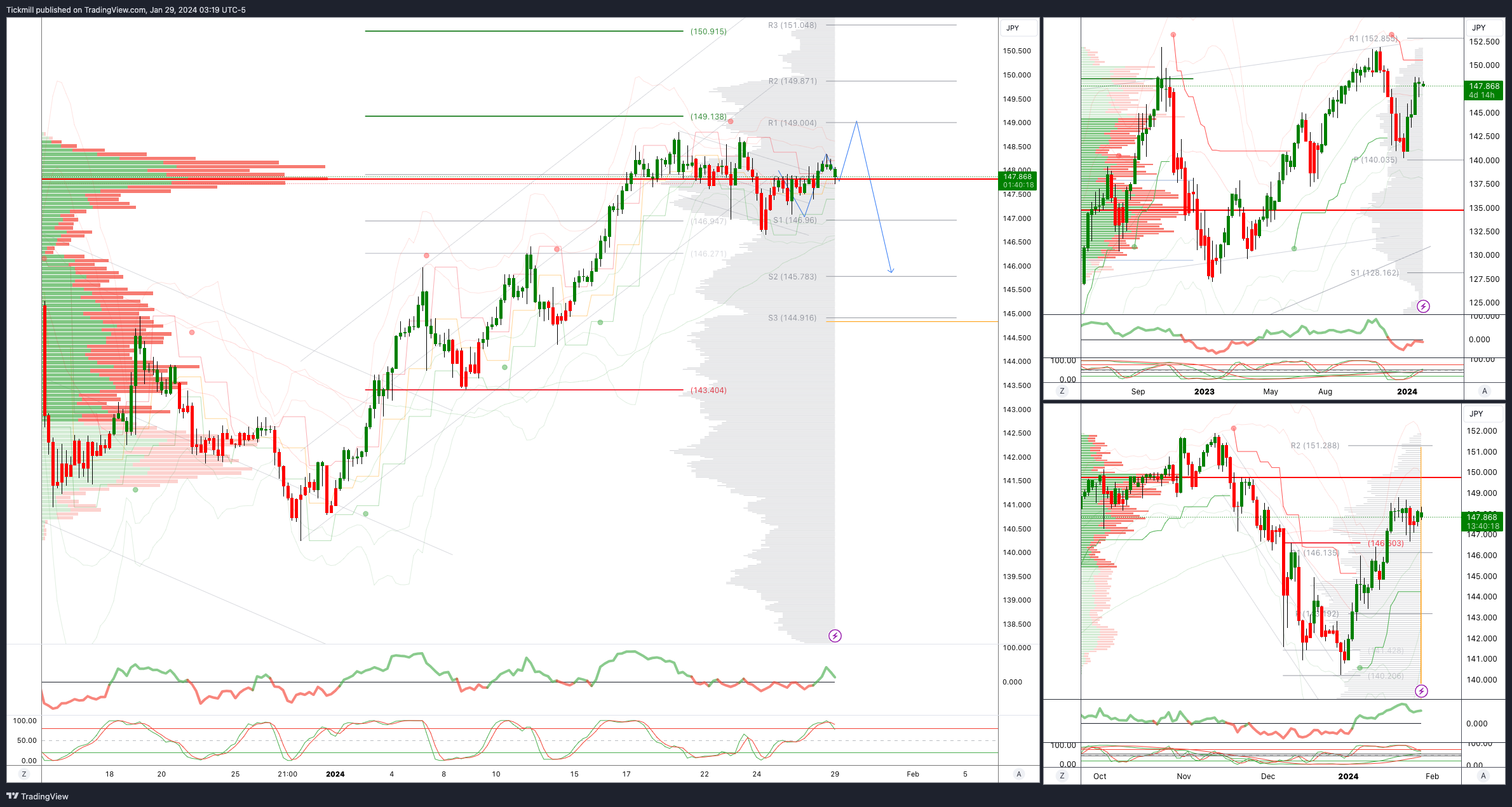

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

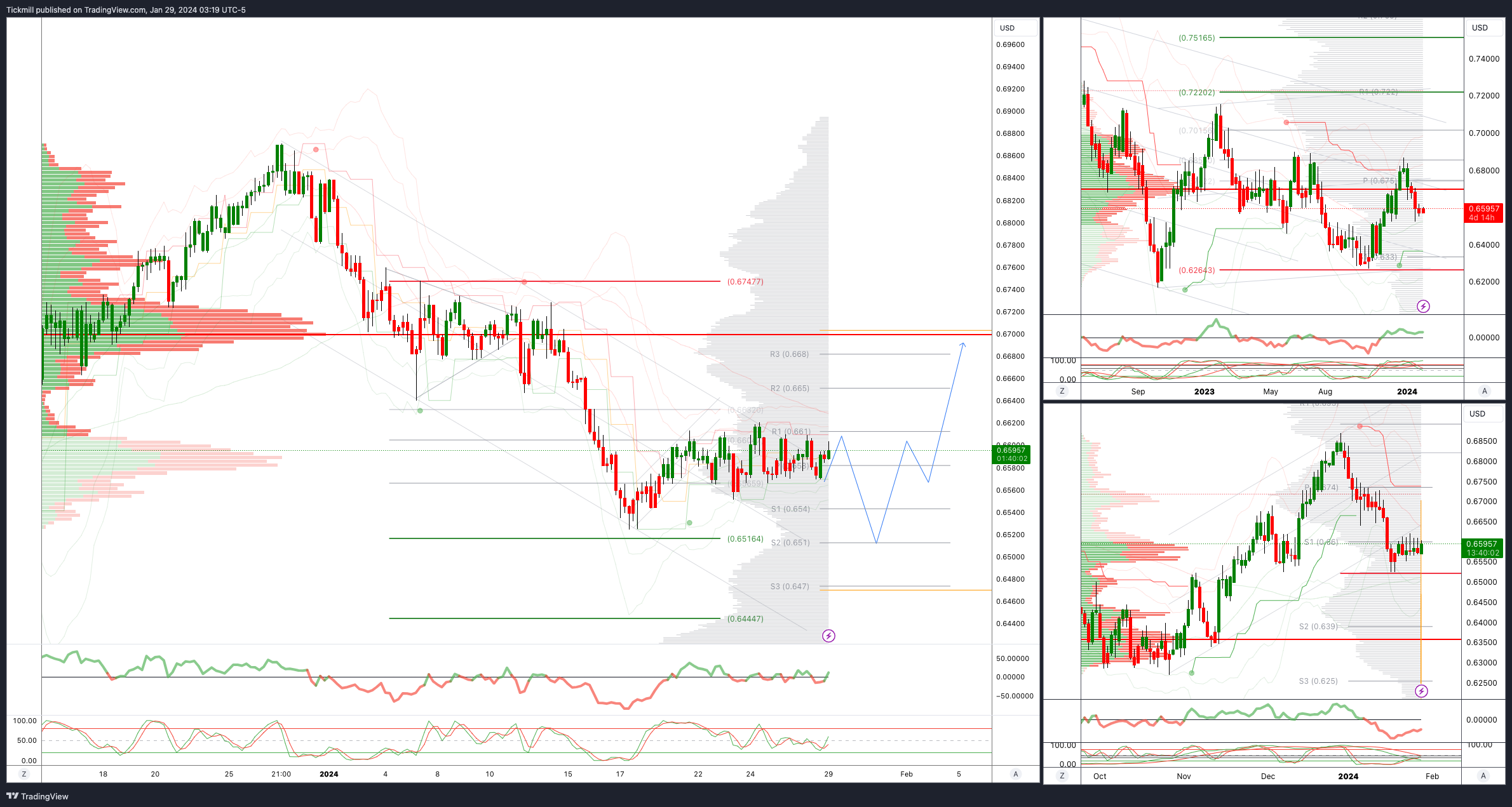

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bullish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

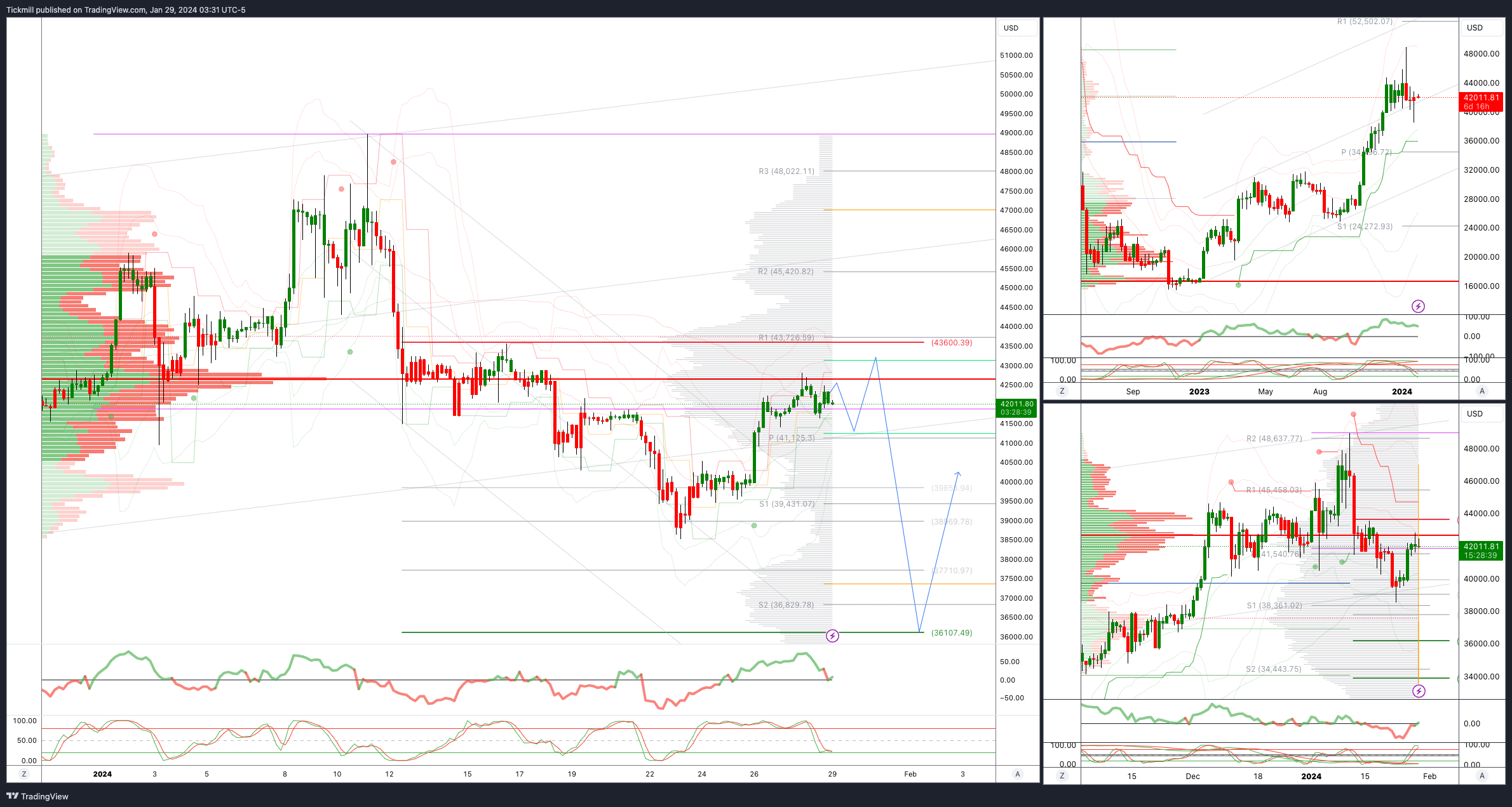

BTCUSD Bullish Above Bearish below 43600

Daily VWAP bullish

Weekly VWAP bearish

Above 43600 opens 46000

Primary resistance is 43600

Primary objective is 36097

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!