Daily Market Outlook, January 26, 2024

Daily Market Outlook, January 26, 2024

Munnelly’s Market Minute…“China Stimulus Bid Fades”

Asian markets have experienced broad declines following a recent period of gains. The negative sentiment follows disappointing projections from chipmaker Intel, despite a strong finish to trading on Wall Street. U.S. markets were lifted by a robust GDP report, showing annualized growth of 3.3% in Q4, further bolstering hopes for a soft landing of the economy. Overnight, Japan reported a sharper-than-expected decline in Tokyo CPI to 1.6% from 2.4%, as the Bank of Japan mulls over potential interest rate increases this year. Hang Seng and Shanghai Comp experienced fluctuations as the impact of recent Chinese support measures diminished.

In the UK, overnight release of the GfK consumer confidence index showed a positive start to the year, with the headline index improving to -19 from -22, surpassing consensus (-21). This marks the best reading in two years, propelled by recent positive news on inflation and expectations of interest rate cuts. There are no other significant UK data releases today, with markets focusing on next week's Bank of England policy update, which is not expected to change interest rates. Attention will be on any communication changes regarding potential future policy adjustments.

European markets are still digesting yesterday’s ECB policy update, which saw no change in interest rates. President Lagarde stated that the Governing Council deemed it premature to discuss rate cuts. However, markets perceived a lack of strong resistance against speculation of a possible rate cut as early as April. This contrasts recent comments indicating no rate cut before summer. ECB speakers today include Simkus, Kazaks, and Vujcic. Kazaks, a hawk, cautioned against early rate cuts.

Stateside, the December data for the US PCE deflator, the Fed's preferred inflation gauge, will be released. It has shown lower inflation trends compared to the CPI. Positive PCE inflation would boost hopes for an early Fed rate cut, despite Q4 GDP growth data surpassing expectations at 3.3% annualized growth. Headline PCE inflation is expected to rise from 2.6% to 2.7%, while the core measure is anticipated to fall from 3.2% to 3.0%, the lowest since early 2021.

Overnight Newswire Updates of Note

UK Consumer Confidence Hits Two-Year High As Inflation Cools

BoJ Saw Need In December For Debate On Future Rate Hike Pace

US Tsy Sec. Yellen: 2024 Is Going To Be A 'Very Good' Year For The Economy

Yellen Says Biden Would Seek Extension Of Some Trump Tax Cuts

WH Sullivan To Meet China’s Wang Yi To Discuss Houthi Attacks In Red Sea

China Presses Iran To Rein In Houthi Attacks In Red Sea, Sources Say

Badenoch To Challenge UK PM Over Brexit Freedoms Sacrifice For N.Ireland

UK Halts Trade Negotiations With Canada Over Hormones In Beef Ban

Biden Set To Halt Review Of Natural Gas Export Approvals On Friday

Intel Plunges After Bleak Forecast Casts Doubt On Comeback Bid

T-Mobile Earnings Miss, But Subscriber Adds Top AT&T, Verizon

Visa Profit Climbs Amid Higher Payments Volume

Capital One's Profit Drops On Higher Credit Loss Provisions, FDIC Charge

FTC Launches Inquiry Into AI Deals By Tech Giants

Nintendo’s Next Switch Coming This Year With LCD, Omdia Says

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (1.3BLN), 1.0825 (530M), 1.0850 (1.2BLN), 1.0875 (1BLN)

1.0890 (620M), 1.0925 (957M), 1.0950 (1BLN)

USD/CHF: 0.8610 (225M), 0.860 (260M), 0.8660 (359M), 0.8760 (821M)

EUR/CHF: 0.9400 (459M), 0.9425 (275M)

AUD/USD: 0.6600-05 (675M). NZD/USD: 0.6070 (220M),0.6220 (524M)

USD/CAD: 1.3390 (1.2BLN), 1.3500-10 (696M), 1.3600 (928M), 1.3620-25 (836M)

USD/JPY: 147.30 (579M), 148.00 (331M), 148.50 (321M)

One-week expiry options are influenced by the volatility risk associated with the Federal Reserve (Fed) and the Non-Farm Payrolls (NFP) report. The implied volatility for one-week options has increased after the Fed policy decision and the inclusion of NFP, but the price increase has been limited due to the recent lack of realized volatility in the foreign exchange (FX) market. The realized volatility for one-week options is significantly lower than the implied volatility in major currency pairings. Option holders are hoping for realized volatility to exceed implied volatility, and buyers are anticipating that any surprises from the Fed and NFP reports could boost FX volatility.

CFTC Data As Of 12/01/24

USD bearish decreasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

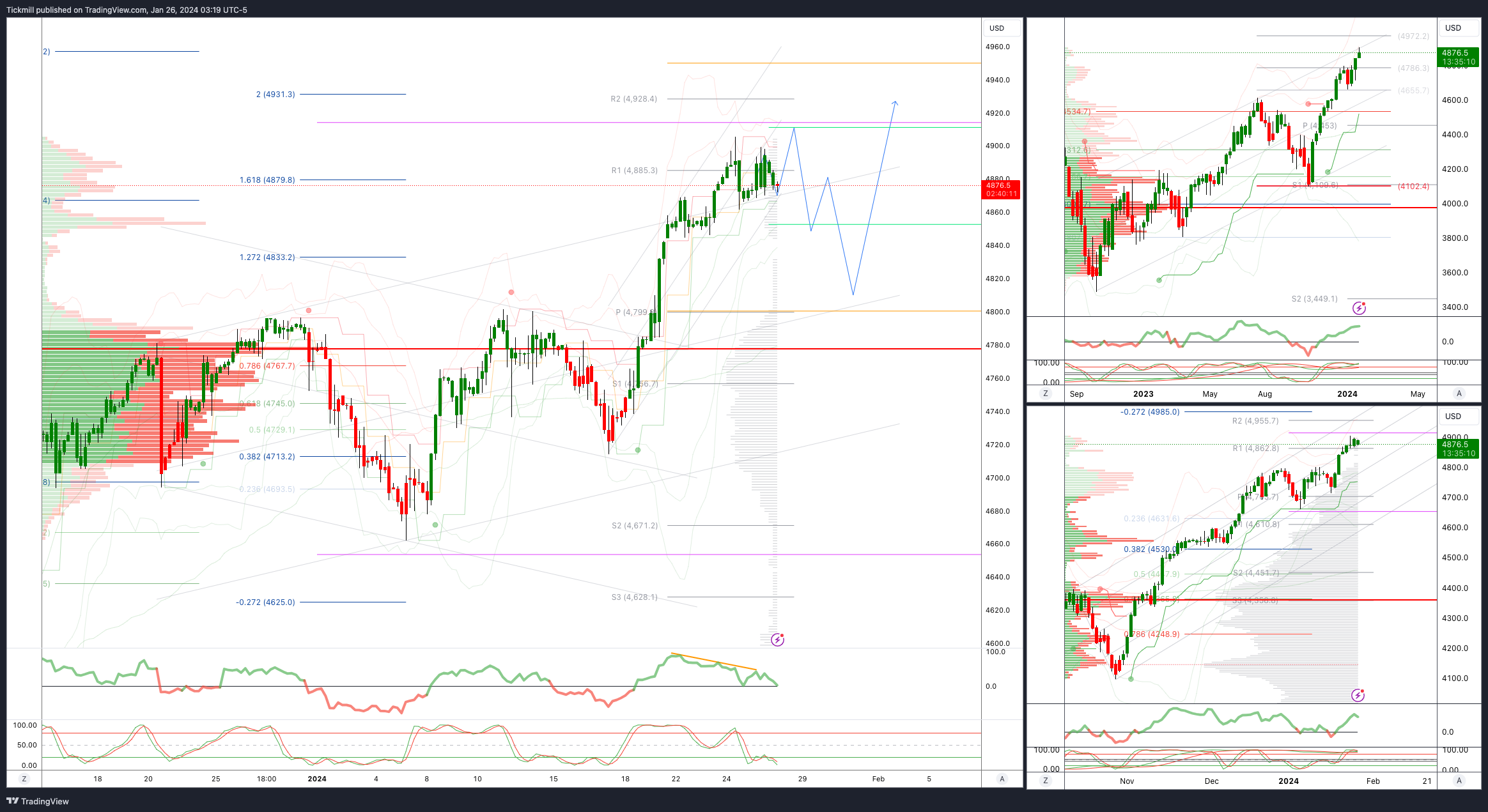

SP500 Bullish Above Bearish Below 4850

Daily VWAP bullish

Weekly VWAP bullish

Below 4800 opens 4780

Primary support 4700

Primary objective is 4910

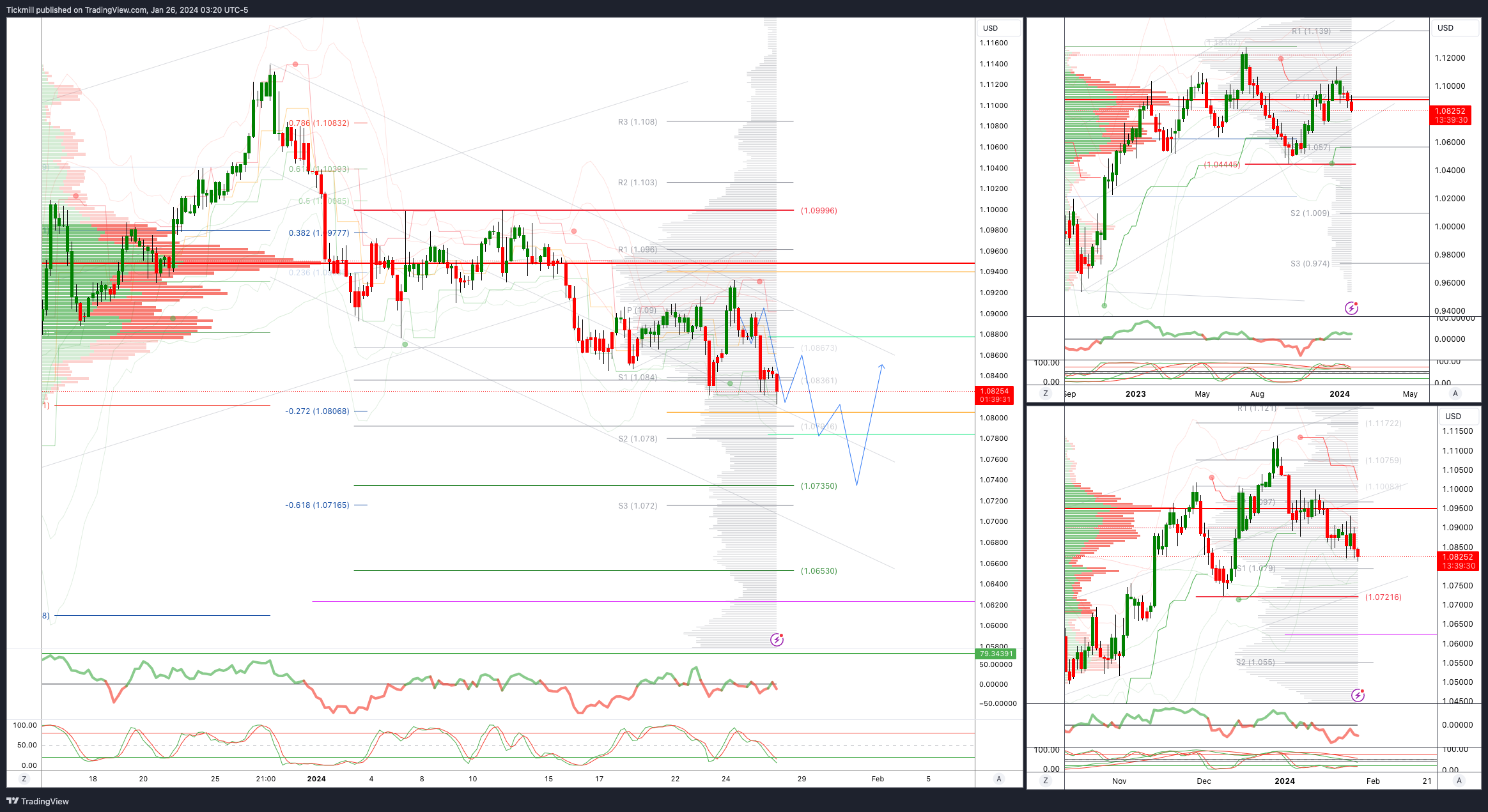

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

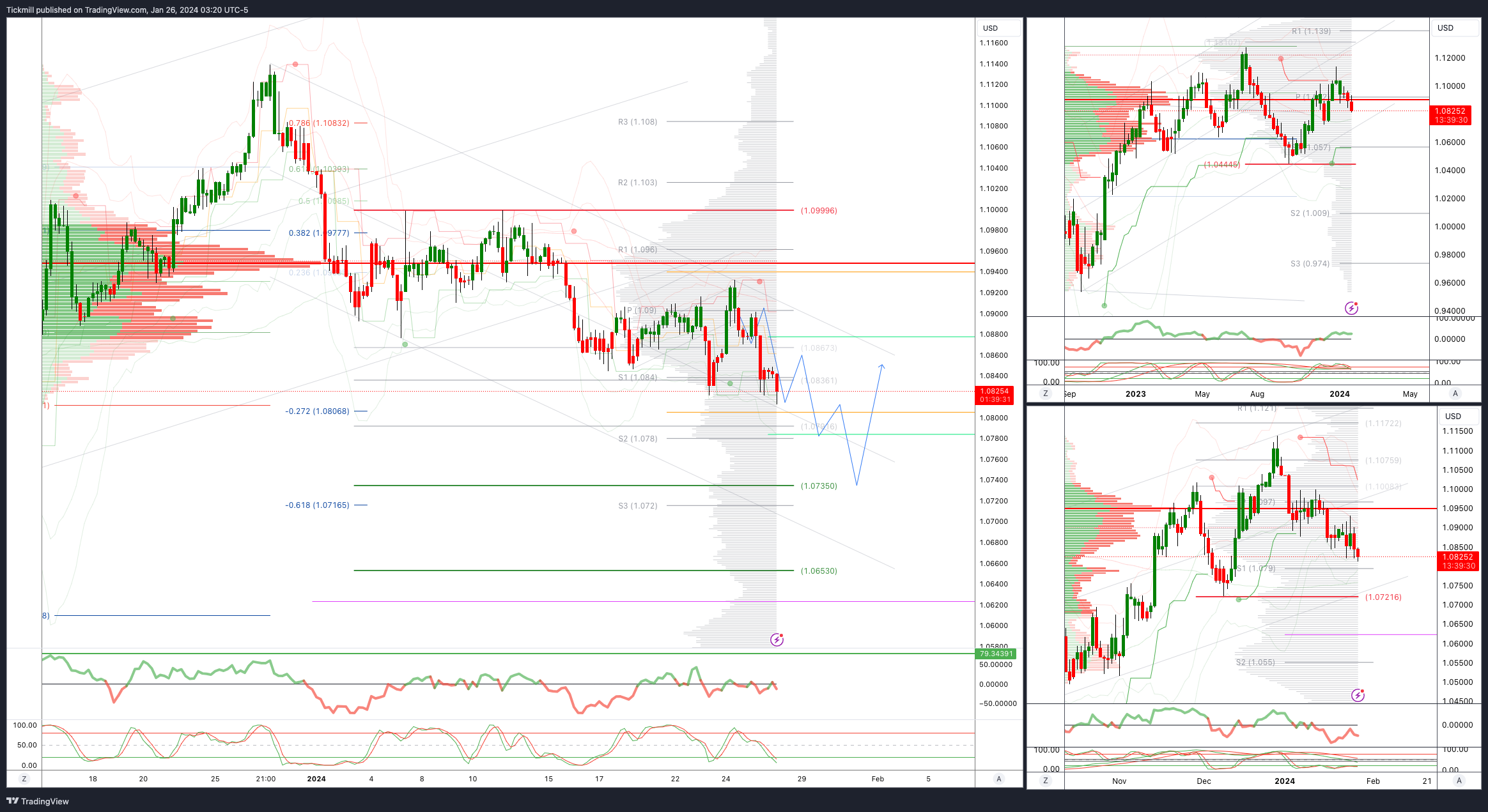

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

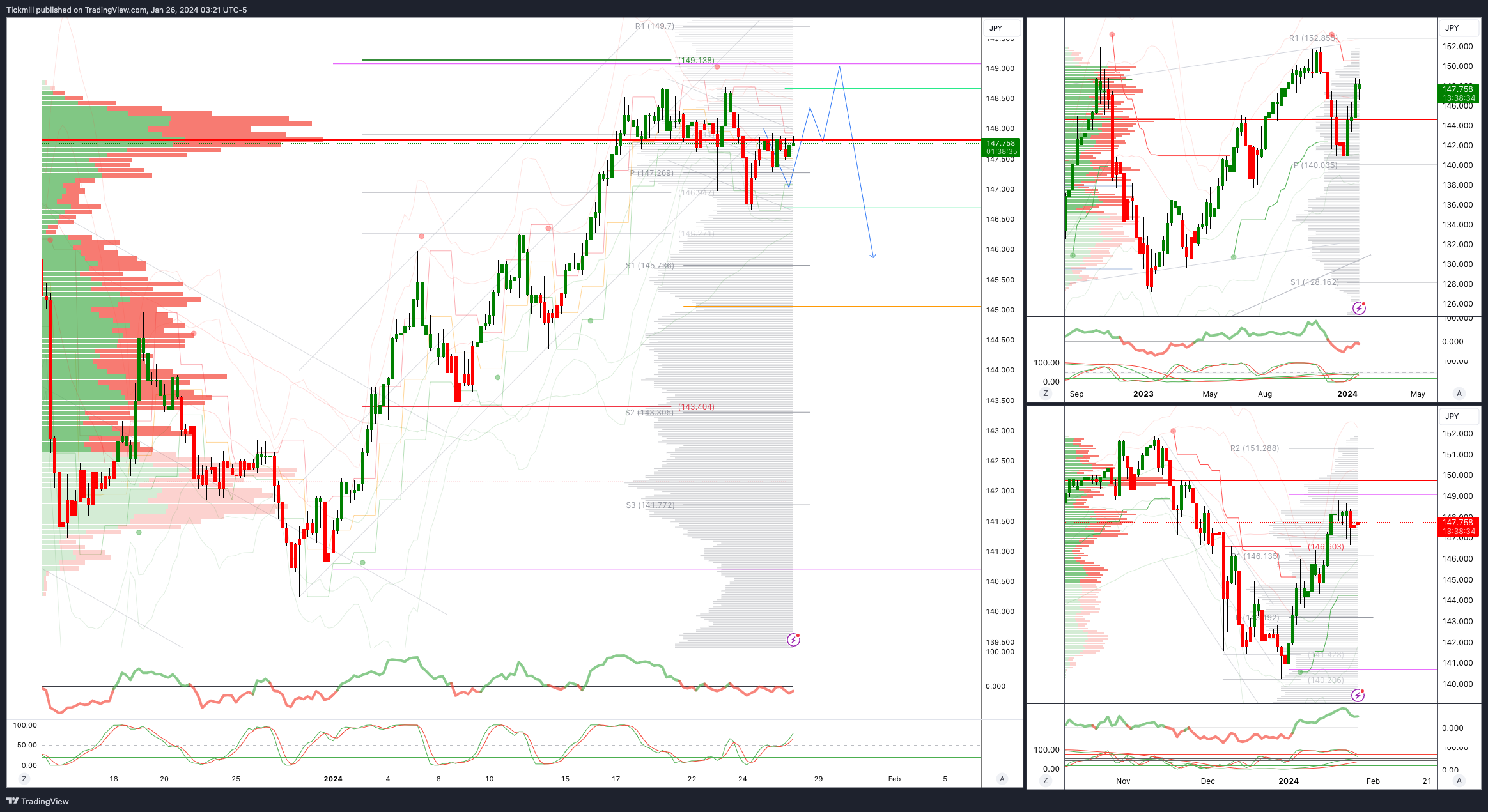

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bullish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

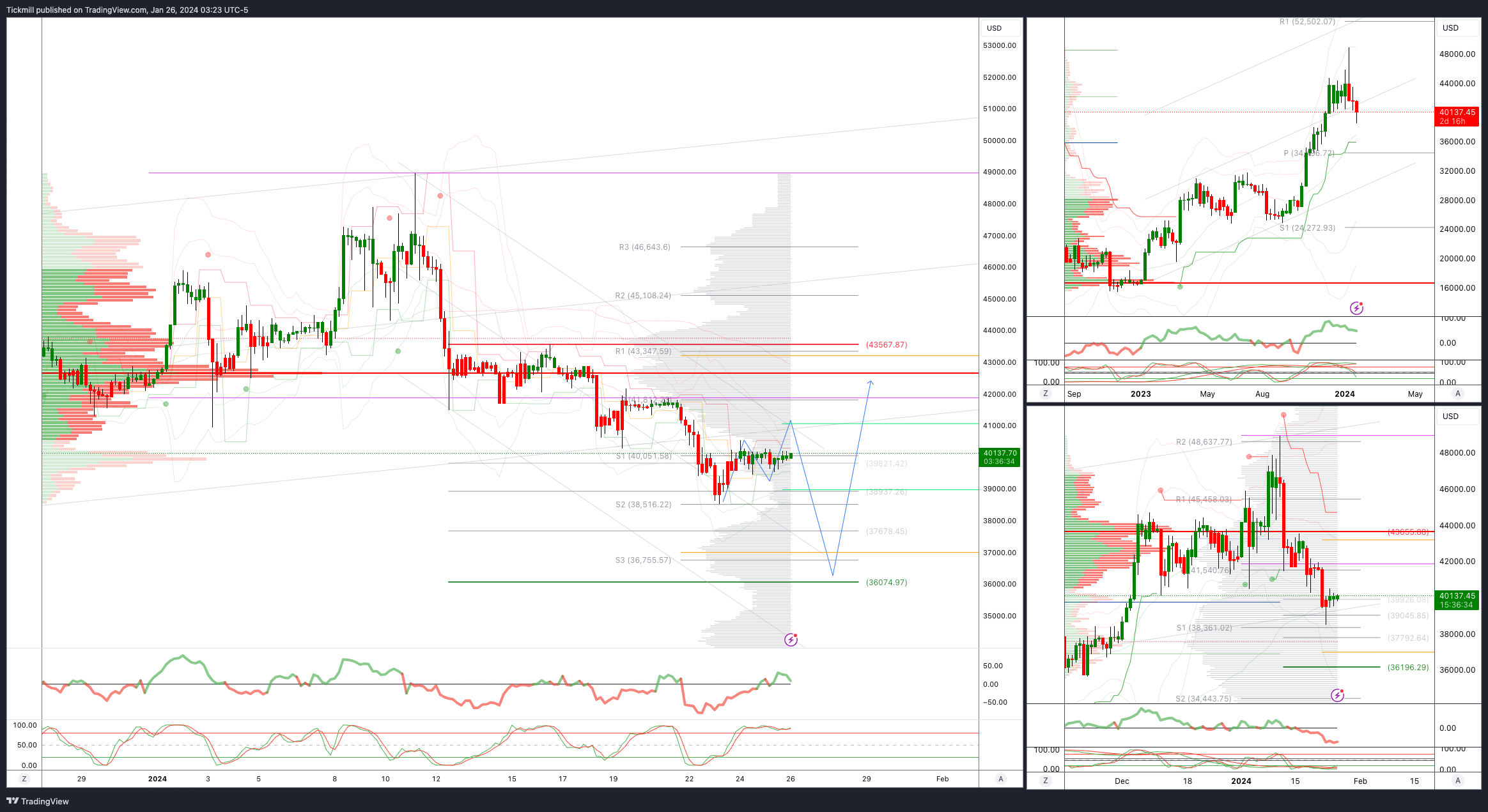

BTCUSD Bullish Above Bearish below 43600

Daily VWAP bearish

Weekly VWAP bearish

Above 43590 opens 46000

Primary support is 40000

Primary objective is 36097

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!