Daily Market Outlook, January 19, 2023

Bad News Is Bad News After All...

Investors responded negatively to a round of weak US data yesterday, the trifecta of retail sales, industrial production and producers prices data left the markets with heightened concerns of imminent recession looming for the world's largest economy, Asian investors followed suit with Wall Street’s pullback, leading to a mixed trade in Asia overnight, the Nikkei was the underperformer as markets digested the BoJ announcement, many market participants took the view that Yield Curve Control removal is in the offing and the Yen reversed nearly all its losses, leading to the Nikkei shedding its post BoJ buoyancy trading lower on the day.

In the UK no tier one economic data of note today, UK investors focus shifts to tomorrow's retail sales and and consumer sentiment data, the data is expected to provide a further gauge as to the ongoing impact of the cost of living crisis on consumer finances, however, the winter World Cup is expected to provide a much needed boost to spending, however, it is likely that this will only be a short term relief for retailers as retail sales are expected to show a net decline for Q4 ‘22 confirming a sixth consecutive quarter of contraction, while consumer confidence may show modest improvement four the fourth month, consumer confidence is in general at historically depressed levels.

In the Eurozone investor focus will be squarely on ECB Chief Lagarde who appears at the World Economic Forum in Davos today, her speech is deemed to strike a cautious tone, with inflationary pressures remaining front and centre for the European Central Bank, ECB officials recent rhetoric as been hawkish, warning of restrictive monetary policy in play at least into the middle of this year, investors will parse Lagrade’s comments for additional confirmation of this view.

In the US Fed speakers will be closely monitored today, after yesterday's hawkish stance from Mester and Bullard, non voters in 2023, investors will pay close attention to Fed Vice Chair Lael Brainard, Brainard is thought to have a more dovish lean than her fellow non voters who spoke yesterday, markets will be keen to assess whether her support for continuing the ‘higher for longer’ approach is shifting to more of a plateau or pause strategy. On the data slate US housing starts numbers are expected to further decline, the general melee in the housing sector will likely have been compounded during the latest data period driven by significant storm disruption witnessed in the US before Christmas.

Markets-wise, investors pared exposure to risk assets yesterday, as concerns regarding a US recession took centre stage, with benchmark SP500 retreating over 1.5% on the day. Commodity markets were not immune to the derisking trade as WTICrude surrendered the $80 level to retest demand appetite at $78, Gold also lost some of its recent shine, however, the yellow metal remained supported above 1890 as bulls keep their sights on a test 1950, the Dollar continues to rotate around the 102 handle, as the Euro continues to cling to the 1.08 level on hawkish ECB rhetoric

Overnight News of Note

US Futures Flat Looks Ahead To Economic Data, Fed Speeches

Recessions Risks Knock Stocks, Speculators Drawn Back To Yen

Oil Extend Decline On US Recession Concern, Inventory Build

Gold Edges Higher As Investors Weigh Fed Slowdown Chances

Fed Policymakers Call For Further Rate Hikes To Beat Inflation

Two Fed Voters Favour Downshift To Quarter-Point Rate Hikes

Fed Beige Book Say US Price Growth Seen Moderating In 2023

Yellen, China’s Liu Seek To Ease Worry Over Economic Tension

US Energy Head Warns GOP Oil Bill Would Raise Pump Prices

China Growth Forecasts Raised Next Year As Country Reopens

BoJ May Raise Yield Cap Again By Mid-Year, Says Academic Ito

Australia Jobs Surprisingly Fall, Easing Case For RBA Rate Hike

Aussie Falters On Soft Jobs Data, Kiwi Calm After PM Resignation

New Zealand Prime Minister Ardern Reveals Shock Resignation

UK Property Market Weakest Since 2010 As Uncertainty Weighs

Global Bond Sales Surge To Record Start Of Year At $586 Billion

Apple Expand Smart-Home Line-Up, Taking On Amazon, Google

Crypto Firm Genesis Preparing To File For Bankruptcy In Days

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Options Expiration For the New York Cut 10am EST

USDJPY 127.95 ($300M) 128.12 ($876M)

USDCAD 1.3825 ($300M)

AUDUSD 0.6800 ($309M)

Technical & Trade Views

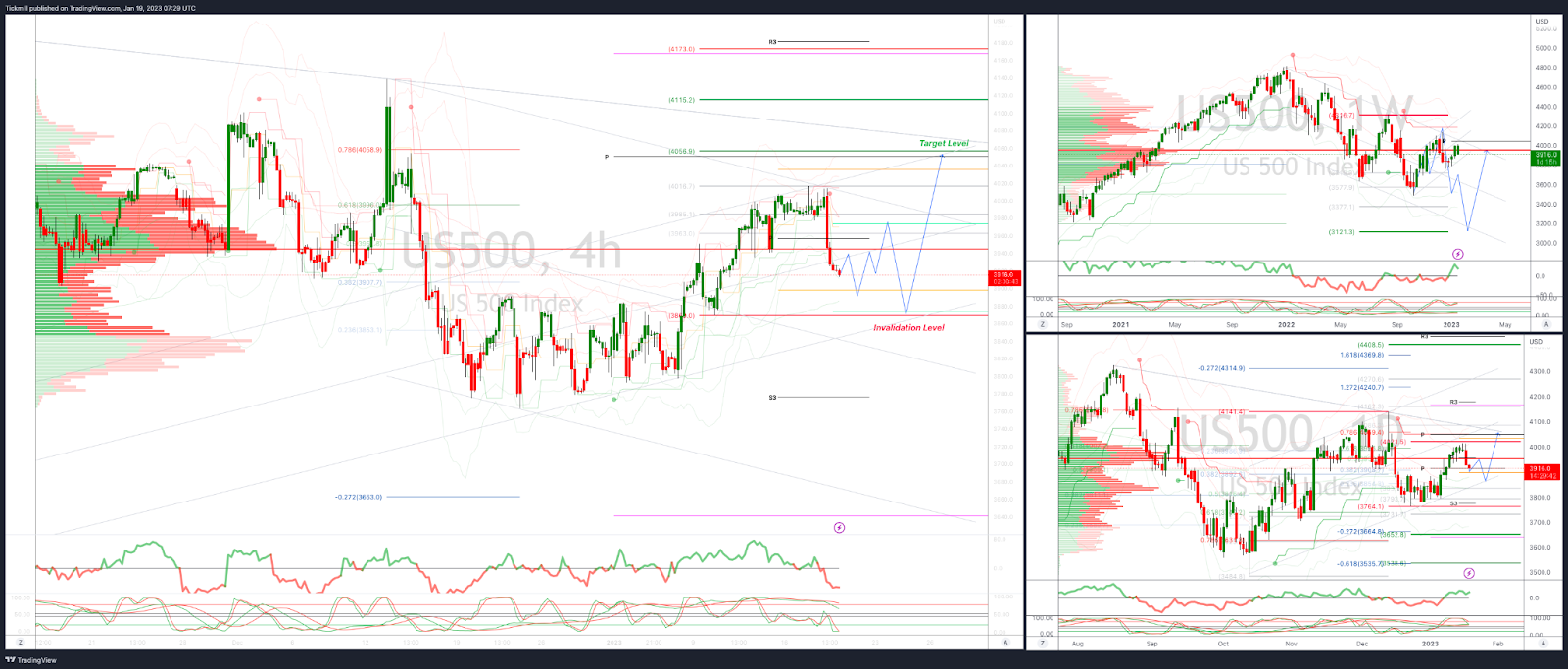

SP500 Bias: Bullish Above Bearish Below 3869

Primary support is 3869

Primary objective is 4055

Below 3840 opens 3800

20 Day VWAP bullish, 5 Day VWAP bearish

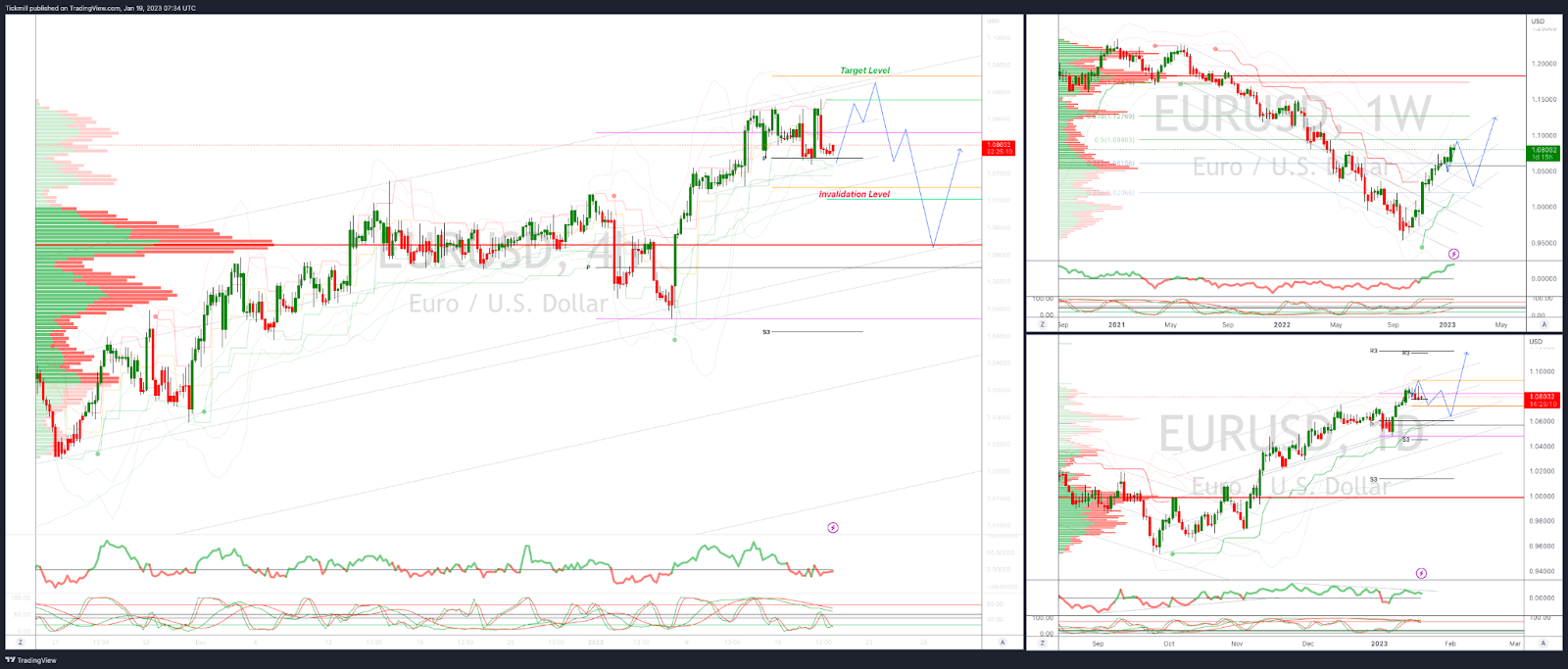

EURUSD Bias: Bullish Above Bearish below 1.0735

Primary support is 1.0735

Primary objective is 1.09

Below 1.0730 opens 1.0610

20 Day VWAP bullish, 5 Day VWAP bearish

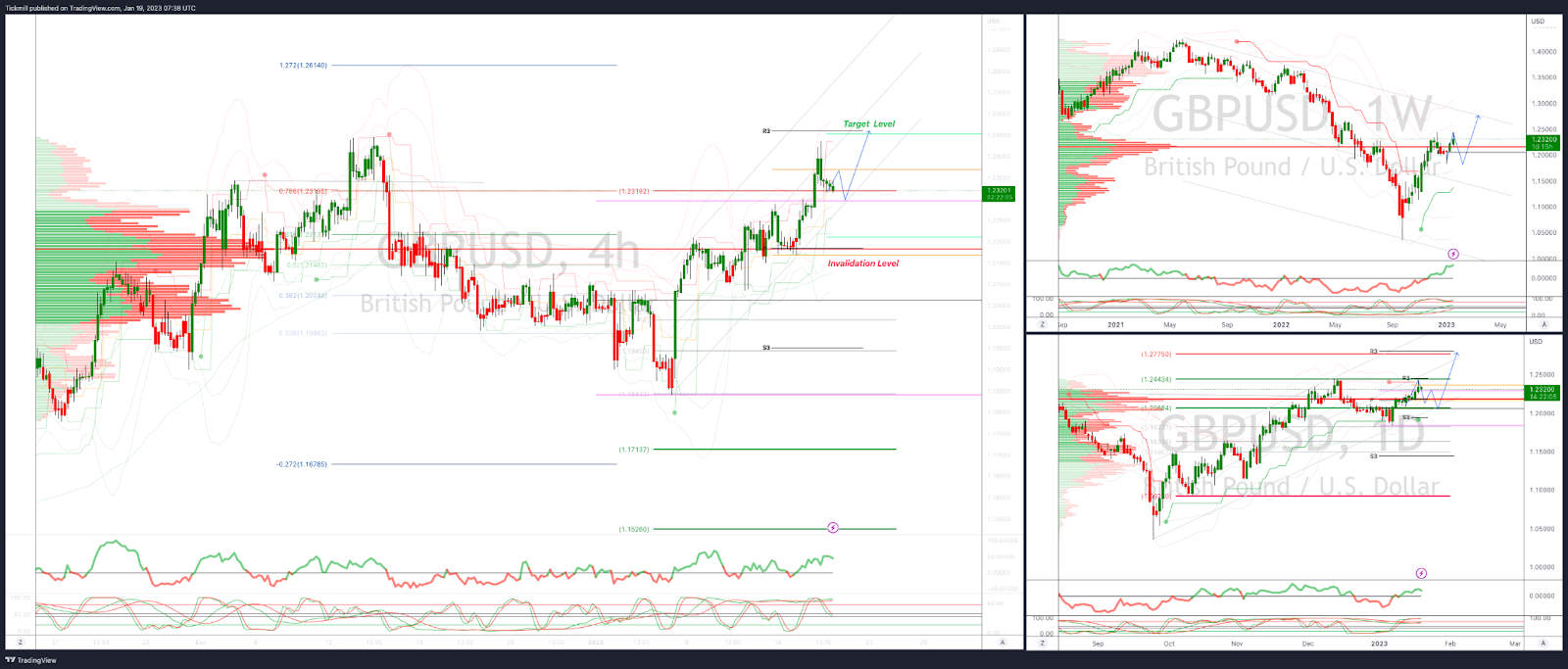

GBPUSD Bias: Bullish Above Bearish below 1.2250 -1.2370 Target Hit New Pattern Emerging

Primary support is 1.2250

Primary objective 1.2460

Below 1.2240 opens 1.2185

20 Day VWAP bullish, 5 Day VWAP bullish

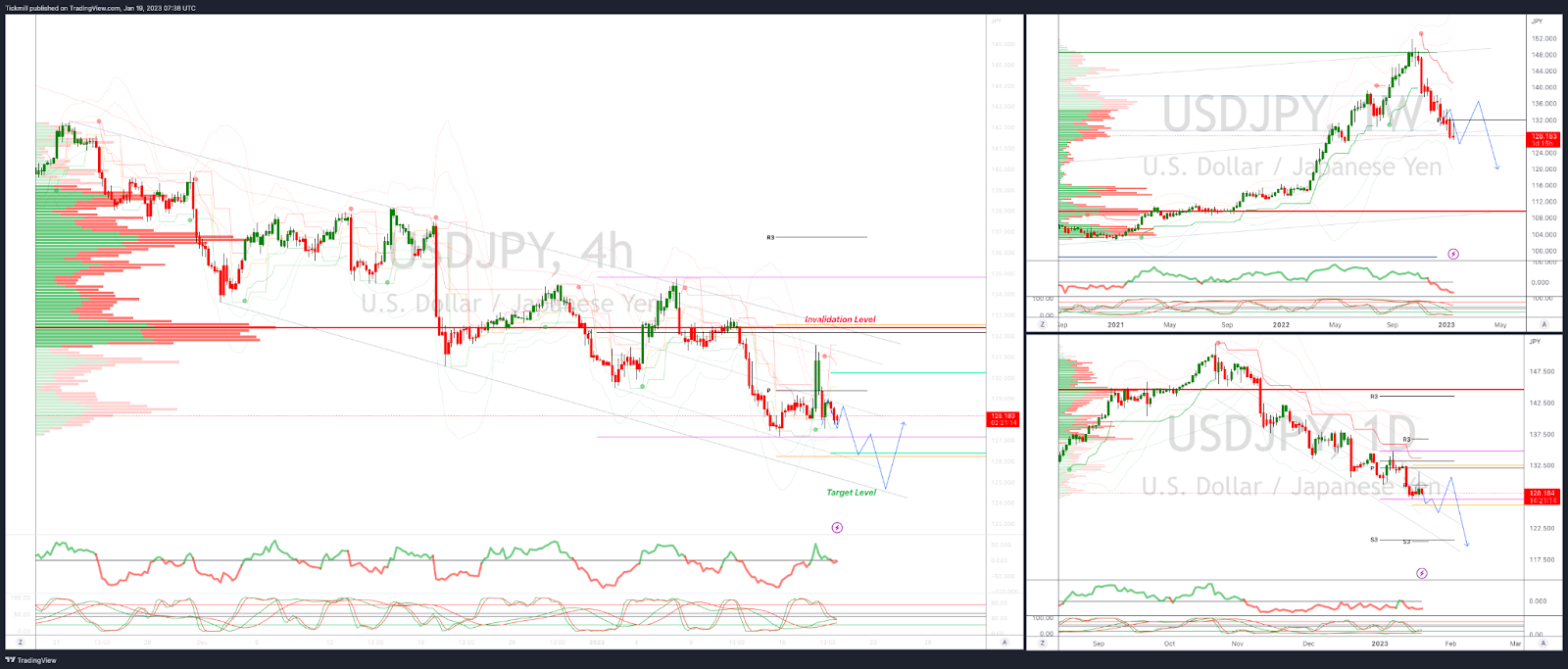

USDJPY Bias: Bullish above Bearish Below 132.30

Primary resistance is 132.30

Primary objective is 125.00

Above 133.00 opens 135.00

20 Day VWAP bearish, 5 Day VWAP bearish

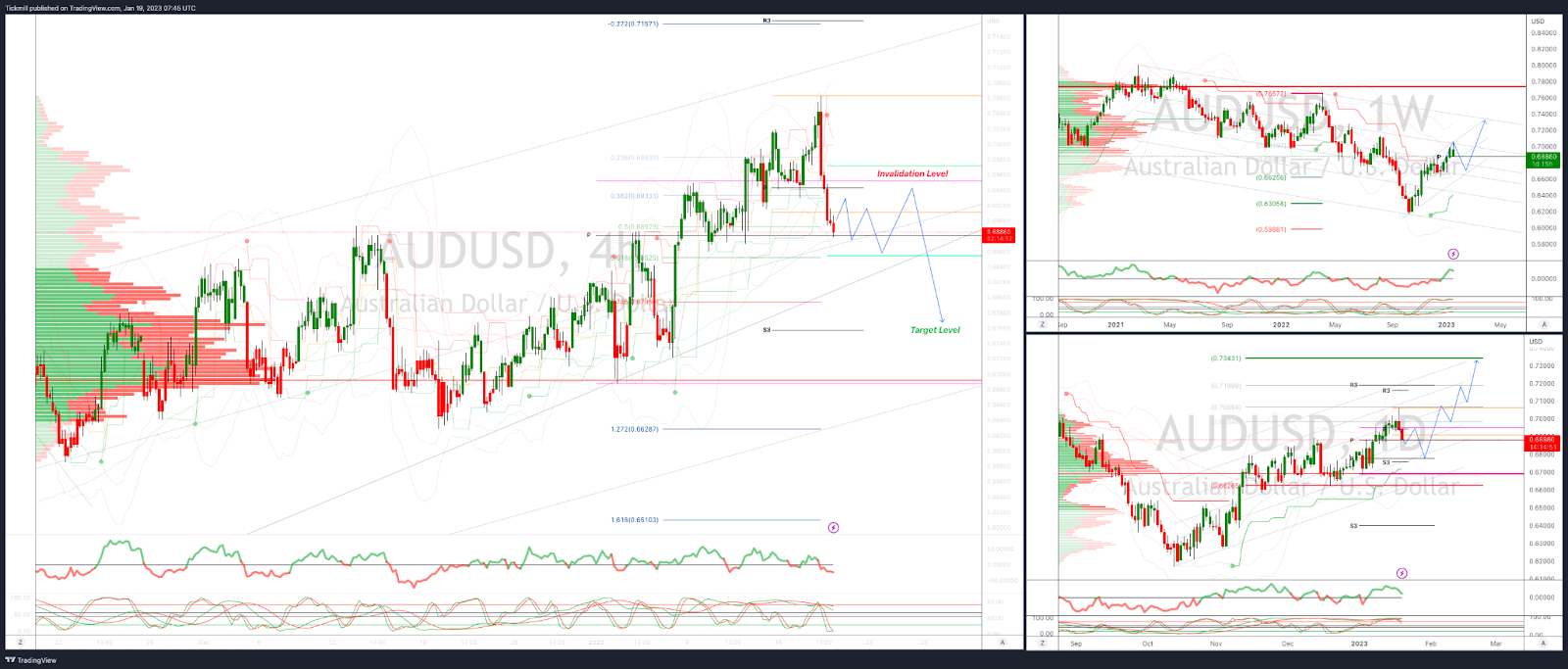

AUDUSD Bias: Bullish Above Bearish below .6950

Primary resistance is .6950

Primary objective is .6790

Above .7025 opens .7110

20 Day VWAP bullish, 5 Day VWAP bearish

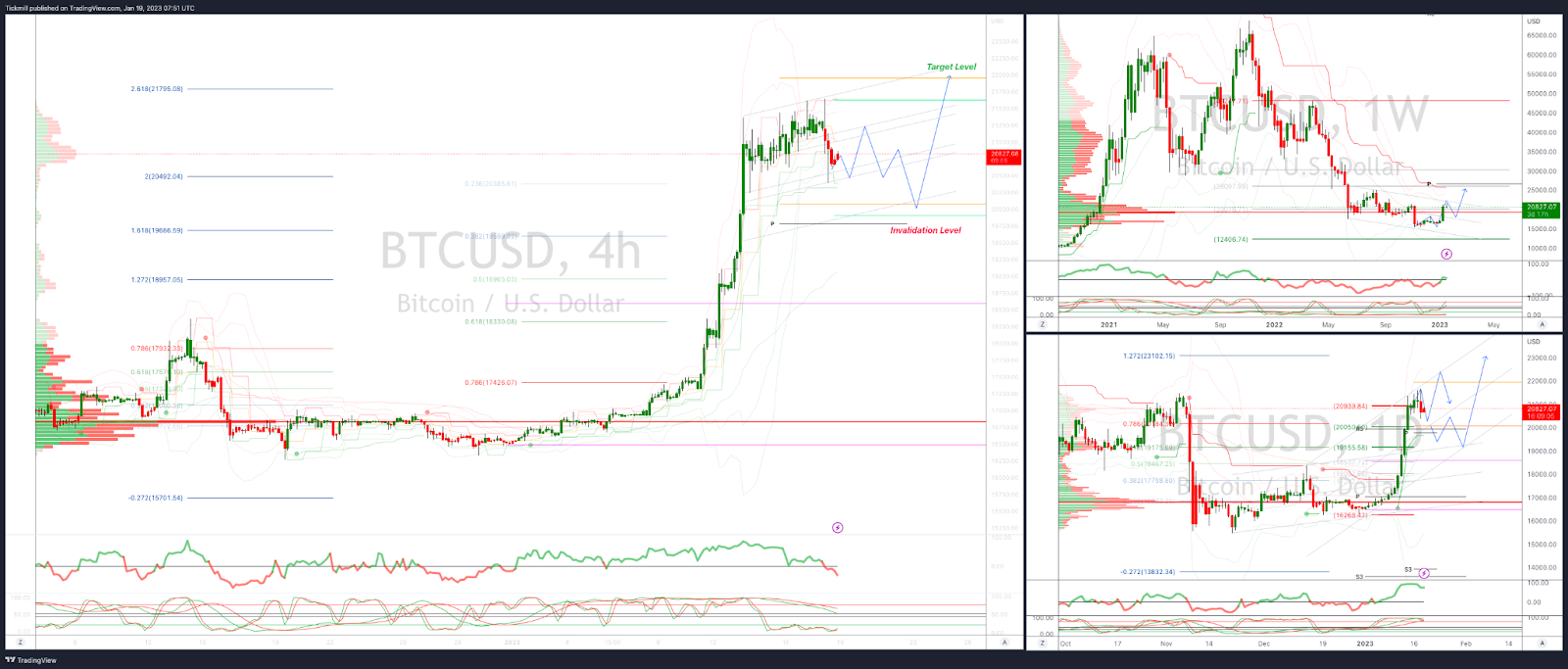

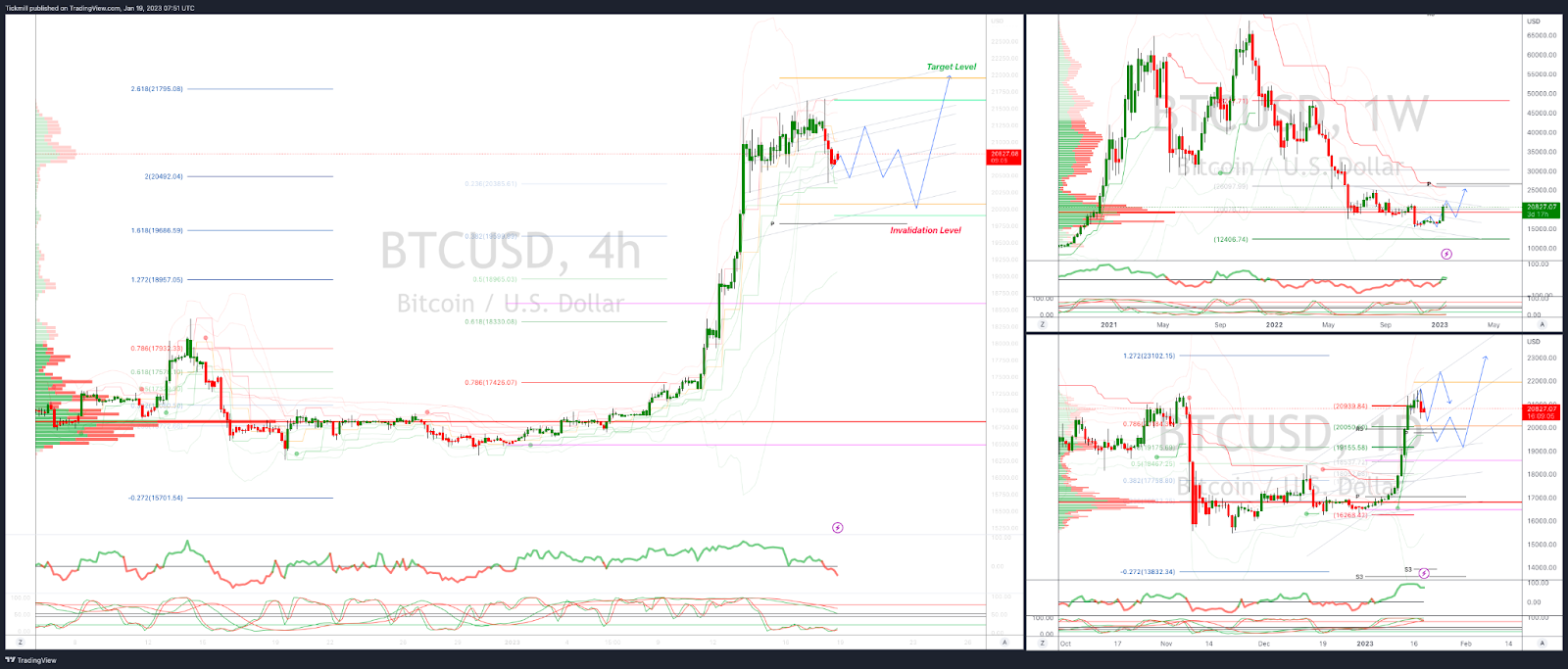

BTCUSD Bias: Bullish Above Bearish below 20000

Primary support 20000

Primary objective is 22000

Below 19600 opens 19000

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!