Daily Market Outlook, January 16, 2024

Daily Market Outlook, January 16, 2024

Munnelly’s Market Minute…“UK Wage Dip May Provide Cover For BoE”

Asian stocks faced pressure in the absence of guidance from Wall Street, coupled with rising yields. The Nikkei 225 slipped below the 36k handle due to slightly higher yields and stronger-than-expected PPI data. Hang Seng and Shanghai Comp followed the subdued sentiment, though losses on the mainland were initially softened after a significant PBoC liquidity operation. Additionally, reports indicated that Beijing had advised some institutional investors in recent days not to sell stocks.

The latest UK labor data shows a slowdown in wage growth, with annual regular pay growth at 6.6%, down from the previous 7.2%. Uncertainties in the data have made it difficult to assess the overall state of the labor market. The Office for National Statistics plans to provide a more consistent set of series next month for better understanding. The experimental unemployment rate estimate for November remains unchanged at 4.2%. In the UK, the House of Commons is starting a two-day debate on the Rwanda Bill. Bank of England Governor Bailey will testify to a House of Lords Committee and is expected to maintain his stance on UK interest rates. The latest UK inflation data is set for release early tomorrow, with a further decline anticipated in headline and core CPI inflation rates for December. It is believed that headline inflation could return to the 2% target by spring, barring unexpected shocks.

The German ZEW survey, set to be released, will offer early insights into the Eurozone's economic strength in January. While the current conditions remained notably weak in December, the forward-looking expectations component witnessed a fifth consecutive monthly rise, reaching its highest level since March. Expectations are for another increase in the current month.

Stateside, The New York Fed's manufacturing survey for January will be closely monitored for indications of improvement following a notably weak performance in December. Meanwhile, in the United States, Congress is slated to discuss a temporary spending bill to avert a potential partial government shutdown starting the weekend.

Overnight Newswire Updates of Note

Trump Scores Easy Win In Iowa With Desantis A Distant Second

China To Reach 2023 Growth Goal As Focus Shifts To New Year

Beijing Tells Some Investors Not To Sell As Stock Rout Resumes

Japan’s Input Inflation Flatlines For Weakest Result Since 2021

Japan 4% Wage Gains To Pave For BoJ Hike, Ex-Official Says

Australia Consumer Sentiment Takes A Worse Turn In January

Sunak Signals Could Take Part In More Strikes Against Houthis

Iran Launch Missile Strikes Against Syria, Northern Iraq Targets

Oil Steady Despite Red Sea Tensions Heightening Market Risks

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900 (318M), 1.0920-25 (1.6BLN), 1.0965-75 (1.1BLN), 1.1025 (700)

GBP/USD: 1.2675 (346M), 1.2715 (331M)

EUR/GBP: 0.8595-0.8605 (478M)

AUD/USD: 0.6700-05 (480M), 0.6715-25 (635M)

NZD/USD: 0.6095 (277M), 0.6325-35 (560M)

USD/JPY: 145.50-55 (373M), 146.00 (410M), 146.80 (784M), 147.00-05 (1BLN)

EUR/JPY: 161.00 (350M)

EUR/NOK: 11.3200 (430M), 11.33 (436M), 11.40 (672M)

The stronger US dollar, comments from Feds Waller, and upcoming economic data are causing FX option premiums to rise. Feds Waller's speech and the release of US retail sales data are contributing to increased risk premium, leading to higher implied volatility for overnight option expiry. The firmer USD is also adding to the overall implied volatility.

CFTC Data As Of 12/01/24

USD bearish increasing 12,192

CAD bearish decreasing -551

EUR bullish neutral 16,243

GBP bullish increasing 1,647

AUD bearish decreasing -2,158

NZD neutral neutral -110

MXN bullish neutral 2,606

CHF bearish neutral -644

JPY bearish neutral -4,841

Technical & Trade Views

SP500 Bullish Above Bearish Below 4750

Daily VWAP bullish

Weekly VWAP bullish

Below 4730 opens 4700

Primary support 4670

Primary objective is 4830

EURUSD Bullish Above Bearish Below 1.1030

Daily VWAP bearish

Weekly VWAP bullish

Above 1.1030 opens 1.1070/80

Primary resistance 1.1130

Primary objective is 1.0850

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bullish

Above 1.28 opens 1.2870

Primary resistance is 1.2820

Primary objective 1.2580

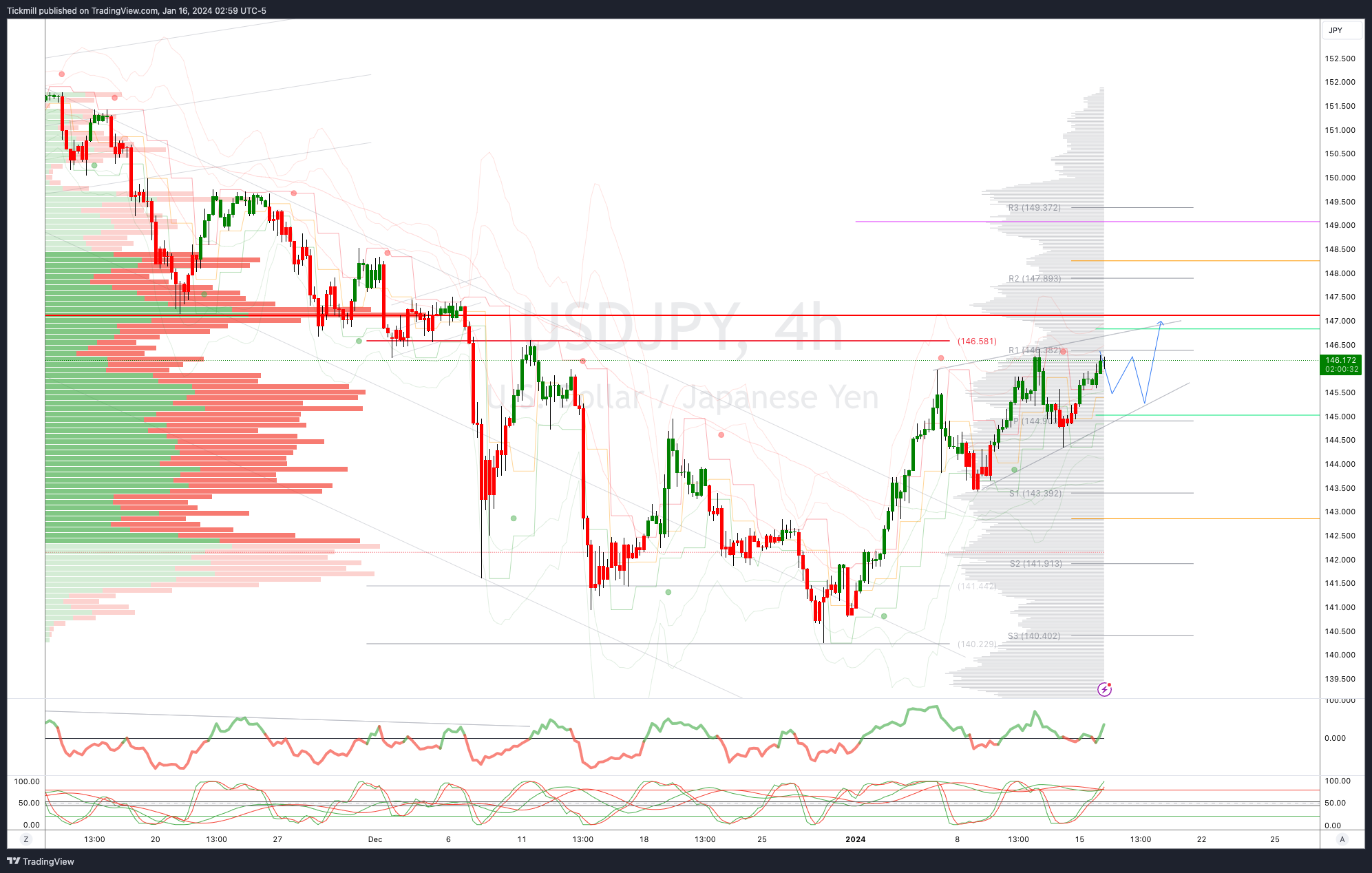

USDJPY Bullish Above Bearish Below 145

Daily VWAP bullish

Weekly VWAP bullish

Below 144.50 opens 143.30

Primary support 142.50

Primary objective is 147

AUDUSD Bullish Above Bearish Below .6680

Daily VWAP bearish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

BTCUSD Bullish Above Bearish below 45200

Daily VWAP bearish

Weekly VWAP bullish

Below 45000 opens 44600

Primary support is 40000

Primary objective is 50000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!