Daily Market Outlook, February 28, 2022

.png)

Daily Market Outlook, February 28, 2022

Overnight Headlines

- EU, UK, Canada, US Plan To Cut Some Russian Banks From SWIFT

- Russia, Ukraine Agree To Talks; Putin Puts Nuclear Forces On Alert

- EU Chief Von Der Leyen: The Bloc Wants Ukraine As Member

- Japan’s Jan Output Falls As Supply Snags Add To Contraction Risk

- Australia Retail Sales Rebound In Jan As Economy Weathers Omicron

- NZ PM Ardern: No More Self-Isolation For Vaxxed Travellers From Mar 3

- RBNZ: We Have More Work To Do On Rates, Too Early To Tell On Russia

- UK Business Conf 5Mth High On Trading Prospects, Economic Optimism

- Rouble, Euro Plunge After West Steps Up Sanctions; Dollar, Yen Gain

- Treasury Yields Slide As Ukraine Risks Turbocharge Haven Demand

- Oil Jumps As Traders Fear Disruption In Russia’s Energy Industry

- Saudi Crown Prince: Still Committed To OPEC+ Oil Agreement With Russia

- Asian Shares, US Futures Fall As Ukraine Conflict Deepens

The Day Ahead

- The escalating Russian offensive in Ukraine saw a fresh wave of penalties being imposed on Russia over the weekend, including banning some of its banks from the international payment system, SWIFT, while sanctions have also been placed on the Russian central bank. Risk sentiment has started the week on a soft note, with equity futures across western markets trading lower, albeit stocks across the Asia-Pacific region are mostly up at least modestly. A short while ago, the Bank of Russia hiked interest rates from 9.5% to 20% before trading in the ruble was due to begin and banned foreigners from selling securities locally. However, the currency still fell by around 8% on the open.

- Overnight, latest Lloyds Business Barometer report was released in the UK, which showed business confidence move up to a five-month high of 44 (previous: 39) reflecting strong trading prospects and optimism about the economy. Trading prospects for the year ahead climbed to the highest level since the start of the pandemic, while there was also a rise in economic optimism which reversed some of the small falls seen in recent months. The survey captured responses between 1st and 15th February, notably before the removal of various Covid restrictions across the UK’s nations, but also ahead of the latest escalation in the situation in the Ukraine.

- Current developments in Ukraine add to central banks’ current difficulties in framing policy. On the one hand the rise in energy prices and potential disruption of Ukrainian food exports are likely to push inflation even higher, strengthening the case for monetary policy tightening. However, the crisis may also pose a further downside risk for economic growth. The Bank of England, US Federal Reserve and European Central Bank all have monetary policy updates in March which, prior to this week, few central bankers have been prepared to comment on this although one ECB official has said that the Ukrainian situation may delay stimulus exit.

- Later today, the ECB’s Panetta is due to make a speech during a debate on the euro area and monetary policy outlook, while in the US, the Fed’s Bostic is due to take part in a discussion about the economy. Both of these will be watched closely for signs that either central bank might be changing direction in light of recent events.

- Data wise, today’s calendar is limited to the Spain CPI release for February, which is expected to post a sharp acceleration in inflation, while in the US, the Dallas Fed manufacturing survey is expected to have picked up this month.

CFTC Data

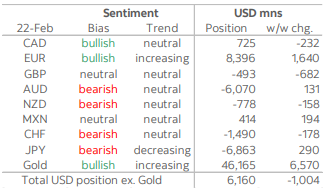

- IMM positioning and sentiment data continue to reflect a broader reining back of bullish USD sentiment, with the aggregate USD long position, reflected in exposures across the major currencies we monitor, falling for a seventh consecutive week. The bullish bet on the USD was cut by USD1bn in the data through Tuesday, mainly reflecting a more positive perspective among speculators on the EUR.

- Net EUR longs jumped USD1.6bn this week, the biggest increase since mid-January. Net EUR longs among non-commercial accounts have now regained levels last seen in July last year. But the more constructive sentiment on the EUR clearly reflects a reduction in gross EUR shorts—investors are less bearish on the EUR—rather than a rebuild of gross longs which have been trending steady to slightly lower in the past few weeks. EUR short covering has picked up since early Feb, suggesting that the potential for the ECB to move away from negative interest rates is the main motivator for this development. Markets remain skeptical that the ECB will adjust policy significantly, or at all later this year, with developments in Ukraine liable to slow growth.

- Elsewhere, investors trimmed net JPY and AUD shorts modestly (by USD290mn and USD130mn respectively), while net CAD longs were pared back a little (USD232mn), offsetting flows against the USD to some extent. Net GBP positioning tilted more bearish this week but risk here continues to pivot narrowly around neutral. Net MXN longs more or less doubled in the week to a still very modest USD414mn in total while net CHF shorts increased slightly (178mn). Net NZD shorts increased by an even smaller extent (158mn). Sentiment on these currencies remains neutral.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.1070-80 (730M), 1.1130-35 (605M), 1.1160 (575M) 1.1190-1.1200 (665M), 1.1240-50 (1.4B), 1.1300-10 (695M) 1.1345-55 (1.3B), 1.1380-90 (730M), 1.1400-10 (1.8B)

- GBP/USD: 1.3225 (395M), 1.3265 (390M).

- EUR/GBP: 0.8325 (325M), 0.8350 (255M), 0.8450 (440M)

- USD/JPY: 114.00-10 (840M), 115.10 (460M), 115.40 (1.0B)

- EUR/JPY: 129.50 (795M), 131.75 (1.1B)

- USD/CAD: 1.2800 (630M). AUD/USD: 0.7000 (375M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Steadies after early slide but remains vulnerable

- EUR/USD opened 1.1200 and was slammed down to 1.1121 in early trading

- The blocking of certain Russian banks from Swift and Putin's nuclear alert rattled markets

- The escalation of the crisis is seen as heavily impacting the EU economy

- EUR/USD filled in the gaps back to 1.1181 before selling off again

- Heading into the afternoon it is trading around 1.1150

- Support is at the Feb 24 low at 1.1106 where buyers are tipped

- A break below 1.1100 targets 76.4 of 1.0636/1.2349 at 1.1040

- Resistance is at the 10-day MA at 1.1296 and break would ease the pressure

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Lower as markets reprice escalating Ukraine conflict

- Off 0.4% in a 1.3309-1.3381 range with very heavy morning volumes

- Sold with risk as the Ukraine conflict escalates - talks today

- Britain widens Russian 'dirty money' crackdown with a new law

- Geopolitics to lead sterling and all markets, in a likely volatile week

- Charts; momentum studies, 5, 10 & 21 day moving averages edge lower

- 21 day Bollinger bands expand - signals now suggest a downtrend is live

- Targets 1.3166-75 longer term, Dec 2021 low and 38.2% 2020-2021 rise

- Close above 1.3499 61.8% February fall would end the downside bias

USDJPY Bias: Bullish above 114.50 Bearish below

- Risk mood very volatile with plenty of news on Ukraine over the weekend

- Asia indecision helps FX steady, USD/JPY 114.80-115.80 EBS, mostly @115.50

- Offers still towards 116.00, above, bids on dips to/below 115.00

- Option expiries today help anchor market, 115.40 strike $1 bln

- Nikkei down-up-down but moves limited, currently -0.3% @26,393, AXJ mixed

- E-Minis -2.6% after big Wall St rally Friday @4267.75

- US yields on some safe-haven flows, Treasury 10s @1.895% TradeWeb

- JPY crosses volatile early too on Ukraine news, also mostly in recent ranges

AUDUSD Bias: Bearish below 0.7250 Bullish above

- AUD/USD was slammed over 1.0% lower to 0.7152 after the Ukraine crisis deepened

- News of Russian banks getting blocked from SWIFT and Putin nuclear deterrent alert rattled markets

- E-mini futures opened 2.5% lower and remained pressured through the morning

- AUD/USD showed some resilience and traded back to 0.7195 to fill in gaps

- Heading into the afternoon it is settling around 0.7175

- Sellers are tipped ahead of 0.7200 with Friday's 0.7233 high resistance

- Support is at Friday's 0.7139 low and 61.8 fibo at 0.7088

- AUD/USD rallies likely to be capped by geopolitical uncertainty

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!