Daily Market Outlook, February 27, 2024

Daily Market Outlook, February 27, 2024

Munnelly’s Market Minute…

“US Budget Negotiations In The Spotlight”

Asian Equity Markets: Most markets in the region are higher, with Japan experiencing a smaller-than-expected fall in annual inflation, potentially signaling a rise in interest rates.

UK Economy: The UK's BRC shop price index indicates a monthly fall in food prices in February, supporting hopes of a further decline in inflation.

Bank of England: Bank of England policymaker Ramsden, who voted for no change in interest rates at the last update, is scheduled to speak. However, it's uncertain if he will address UK rates, and MPC members may wait to see the content of the upcoming Budget before commenting further on monetary policy.

Eurozone Economy: Eurozone money supply numbers for January are expected to show modest annual growth, suggesting tight monetary conditions. ECB President Lagarde typically references these figures in her post-policy meeting press conference.

US Economy: US durable goods orders are forecasted to have fallen sharply in January due to the volatile transport sector, notably weak Boeing orders. However, the 'core' number excluding transport is expected to show a third successive rise, indicating a potential leveling off of the downturn in the factory sector. Additionally, a small rise in the Conference Board’s measure of US consumer confidence is anticipated, reflecting improving sentiment about current conditions and the future environment.

US Political Scene: President Biden is scheduled to meet with Congressional leaders to discuss reaching a Budget agreement that increases spending support for Ukraine while avoiding a government shutdown. Time is running out for Congress to pass a bill to avoid a partial shutdown.

Overnight Newswire Updates of Note

Japan's Core Inflation Falls To Lowest Level In 22 Months

Japan Two-Year Yield Rises To Highest Since 2011 On BoJ Bets

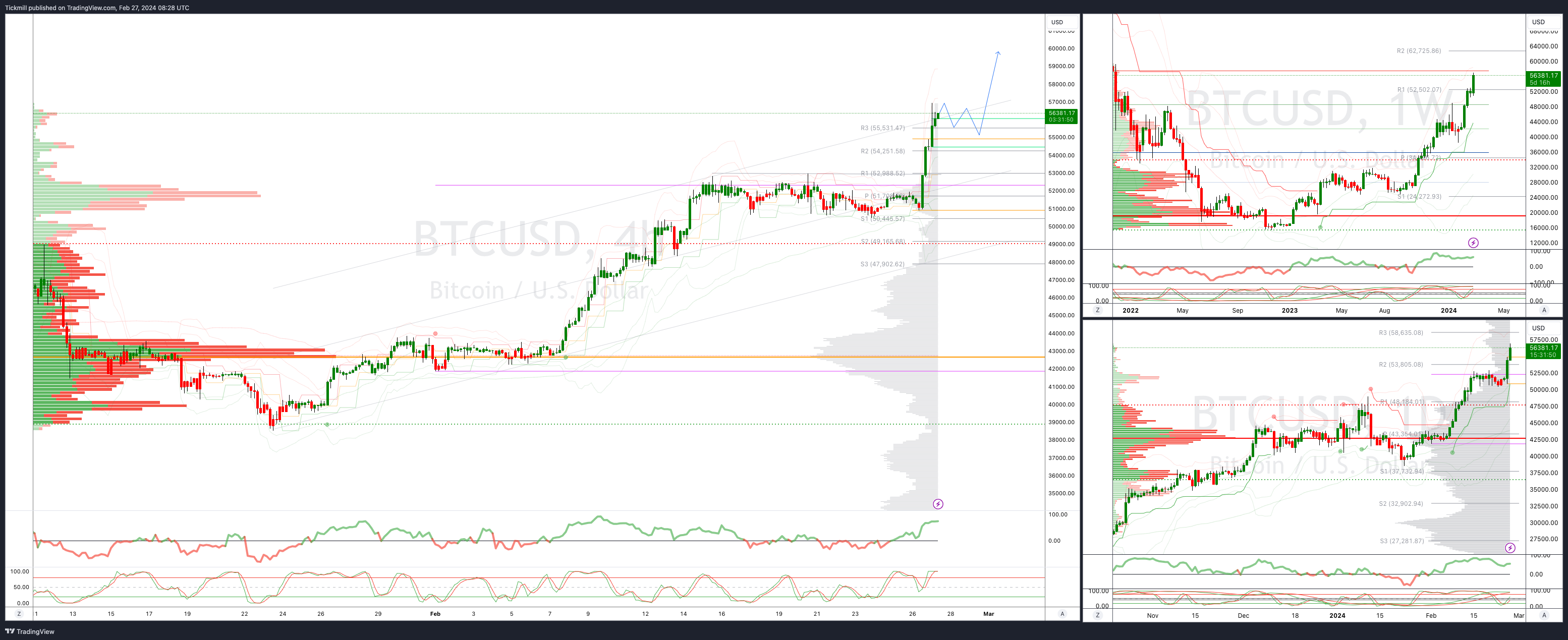

Bitcoin Tops $57,000 Price Level For First Time Since Late 2021

Fed’s Schmid Urges Patience On Cuts As Inflation Fight Continues

'Chaotic' US Congress Hurtles Toward New Govt Shutdown Deadline

Joe Biden Says Gaza Ceasefire Could Be Reached By Next Monday

UK Food Inflation Near 2-Year Low, BRC Data Shows

China Wine Tariffs Expected To Be Gone By End Of March

Japan’s FSA To Check Shortfalls In Bank Lending Standards

US Corporate Bond Sales Hit $153 Bln In February Record

Exxon Throws A Wrench In Chevron’s $53 Bln Deal For Hess

Disney’s Sean Bailey, Longtime Movie Executive, Steps Down

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0750 (EU1.22b), 1.0800 (EU1.14b), 1.0650 (EU1.06b)

USD/JPY: 150.00 ($1.2b), 150.20 ($955.5m), 151.00 ($832.1m)

AUD/USD: 0.6600 (AUD2.12b), 0.6700 (AUD1.73b), 0.6710 (AUD938.9m)

USD/CNY: 7.2000 ($499.2m), 7.5325 ($391.6m)f 6.4375 ($370m)

USD/CAD: 1.3550 ($500m)

USD/BRL: 7.8000 ($660.4m), 6.4000 ($340.1m), 5.0500 ($306.3m)

GBP/USD: 1.2650 (GBP1.01b), 1.2800 (GBP400m)

USD/MXN: 17.34 ($420.3m), 23.75 ($414.2m)

CFTC Data As Of 20/02/24

Japanese Yen net short position is -120,778 contracts.

British Pound net long position is 46,312 contracts.

Euro net long position is 68,016 contracts

bitcoin net short position is -2,098 contracts.

Swiss Franc posts net short position of -9,923 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.027 contracts to 947,280.

Equity fund speculators increase S&P 500 CME net short position by 35.358 contracts to 419,832.

Technical & Trade Views

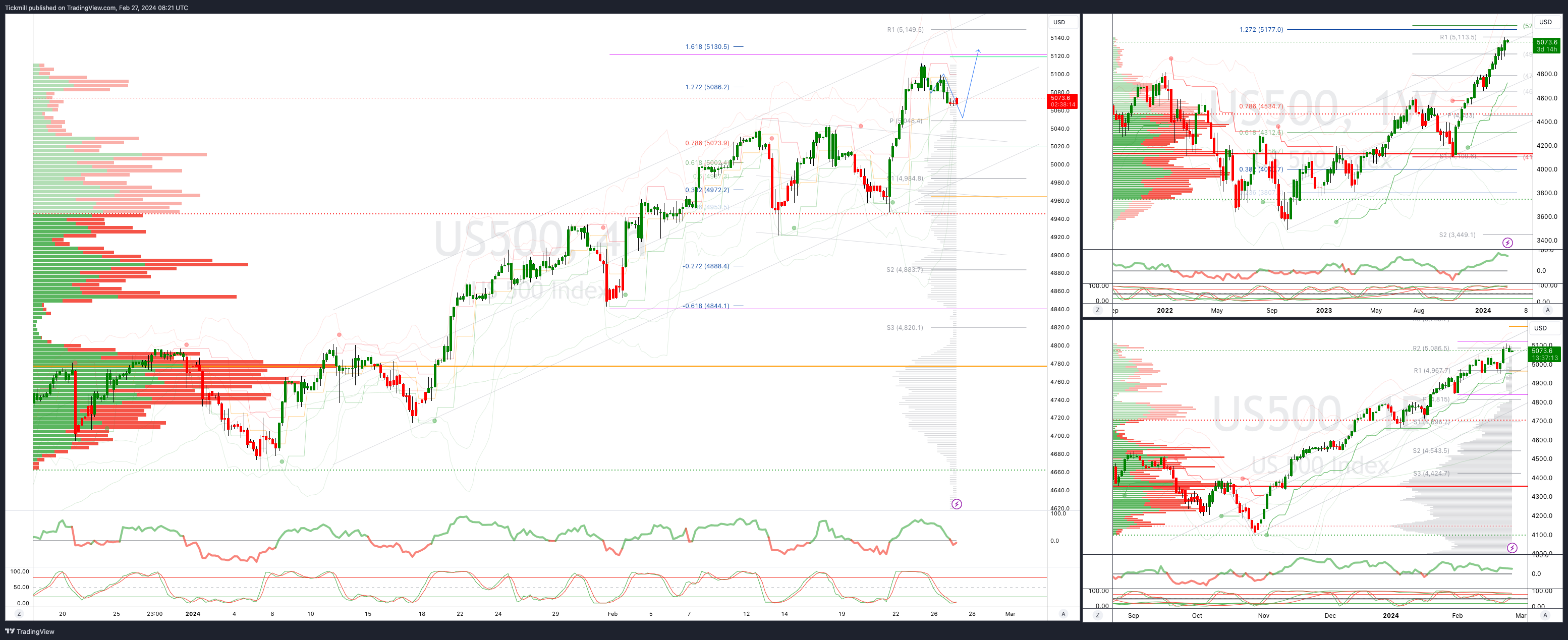

SP500 Bullish Above Bearish Below 5040

Daily VWAP bullish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 4940

Primary objective is 5120

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bullish

Weekly VWAP bullish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2830

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bullish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

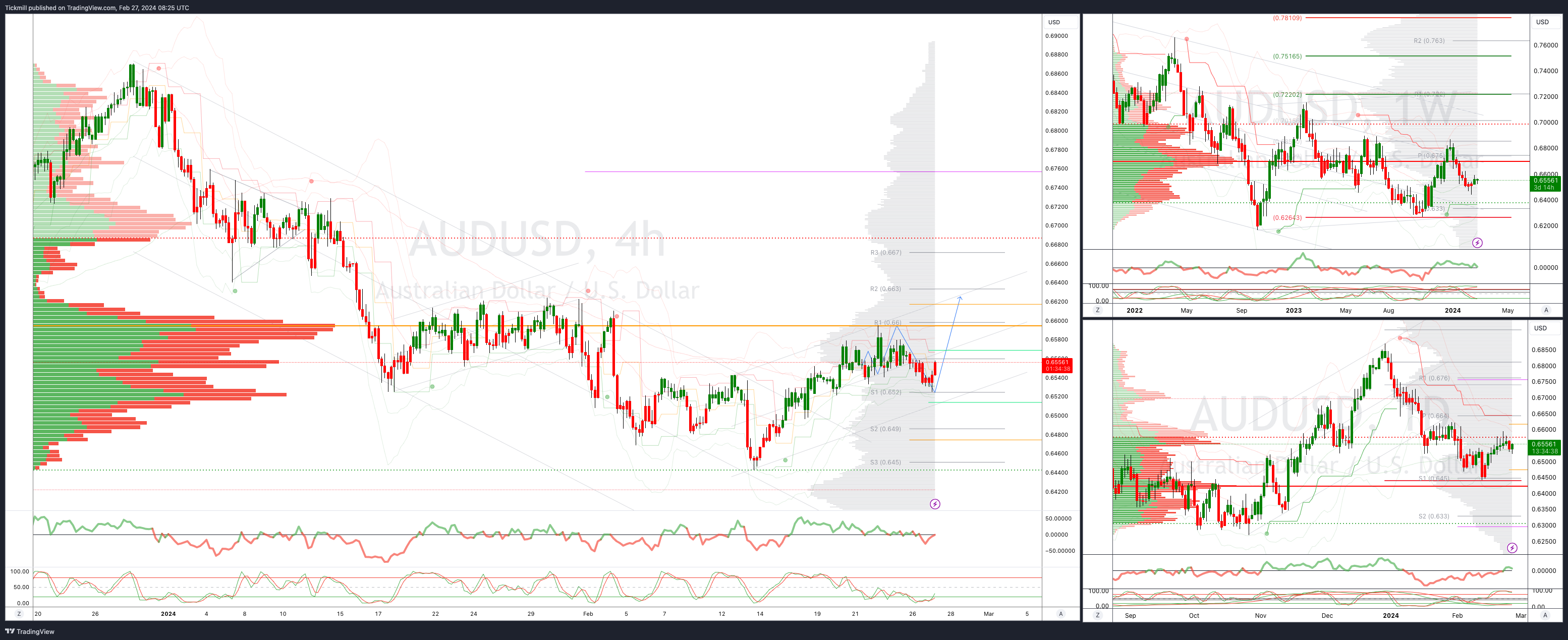

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bullish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6700

BTCUSD Bullish Above Bearish below 53000

Daily VWAP bullish

Weekly VWAP bullish

Below 50000 opens 49000

Primary support is 49000

Primary objective is 54000 - Target Hit New Pattern Emerging

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!