Daily Market Outlook, February 21, 2024

Daily Market Outlook, February 21, 2024

Munnelly’s Market Minute…

“Markets On Nvidia Earnings Watch”

This morning, Asian stock markets are showing a varied performance, with Chinese indices gaining while most others are experiencing declines. A Chinese media source reported that a key interest rate was kept unchanged this week due to concerns about its impact on the Yuan. In the meantime, Japan reported a smaller-than-expected trade deficit in January, thanks to strong exports, especially in the automobile sector, and a decrease in imports.

Today's key events include this morning's publication of UK public finance data for January, which showed a net borrowing of -£17.6bn. This amount is significantly higher than last year's figure, indicating a potential surplus due to self-assessment receipts. The Office of Budget Responsibility has stressed the importance of January data in evaluating the fiscal deficit, which could impact expectations for tax cuts in the upcoming budget. Furthermore, the CBI Industrial Trends survey for February provides insights into the factory sector, complementing tomorrow's purchasing manager’s survey. The previous month's survey revealed ongoing declines in orders, raising concerns about activity levels and potential price pressures from shipping disruptions in the Red Sea. A small increase is expected in the European Commission's consumer confidence measure for February, although it remains below late 2023 levels, likely reflecting consumer uncertainty regarding ECB interest rate cuts. Bank of England policymaker Dhingra, known for her cautious approach, is set to speak today after expressing concerns about downside growth risks during a recent testimony to a Parliamentary Committee.

Later, the minutes of the late January US Federal Reserve policy meeting will be made public. Despite mixed economic data pushing back expectations for an interest rate cut, investors are eager for insights into the Fed's position and potential reasons for rate reductions. However, markets are eagerly anticipating what could be the most significant earnings report in a long time, as Nvidia, the leading company in the AI industry, is expected to announce another exceptional quarter. Despite the stock's remarkable rise over the past year and a half due to the AI craze, investors may feel let down if the chipmaker is unable to sustain its impressive growth. Nvidia is expected to triple quarterly revenue to around $20 billion, with a focus on its forecast and China. Investors are concerned about whether its significant stock increase has reached its peak. The company's stock has risen 40% this year and 239% in 2023. Nvidia options indicate a potential 11% swing after earnings, which may impact global markets and record peaks in Europe and Japan

Overnight Newswire Updates of Note

Fed Set To Keep Shrinking B/S While Liquidity Drain Continues

US House Republicans Privately Expect Government Shutdown

US To Announce ‘Major’ Sanctions Friday Over Navalny Death

China Restricts Quant Fund Lingjun In Effort To Boost Markets

Japan Tankan Manufacturers' Gloom Rises, Adds Growth Pains

Japanese Export Growth Beats Bets, Keeping BoJ Options Open

Australia’s Wage Growth Quickens Further RBA’s Forecast Peak

Houthis Fire At Ship With Humanitarian Aid To Yemen, US Says

Hunt Weighs Plans To Spur Pension Funds To Invest In UK Assets

Bezos Finishes 50 Million Amazon Stock Sale Netting $8.5 Billion

HSBC’s Earnings Sink On $3 Billion Impairment On Chinese Bank

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0780 (EU1.59b), 1.0778 (EU872.2m), 1.0815 (EU732m)

USD/JPY: 145.00 ($1.68b), 150.00 ($1.26b), 147.50 ($1.24b)

USD/CNY: 7.5000 ($399.8m), 7.2500 ($336.4m)

USD/CAD: 1.3400 ($500m), 1.3600 ($312.5m), 1.3505 ($308m)

NZD/USD: 0.6060 (NZD700m), 0.6100 (NZD303.4m)

USD/MXN: 16.95 ($300m)

CFTC Data As Of 13/02/24

British Pound net long position is 50,472 contracts.

Japanese Yen net short position is -111,536 contracts.

Bitcoin net short position is -1,921 contracts.

Swiss Franc posts net short position of -6,014 contracts.

Japanese Yen net short position is -111,536 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.391 contracts to 930,253.

Equity fund speculators trim S&P 500 CME net short position by 39.481 contracts to 384.474.

Technical & Trade Views

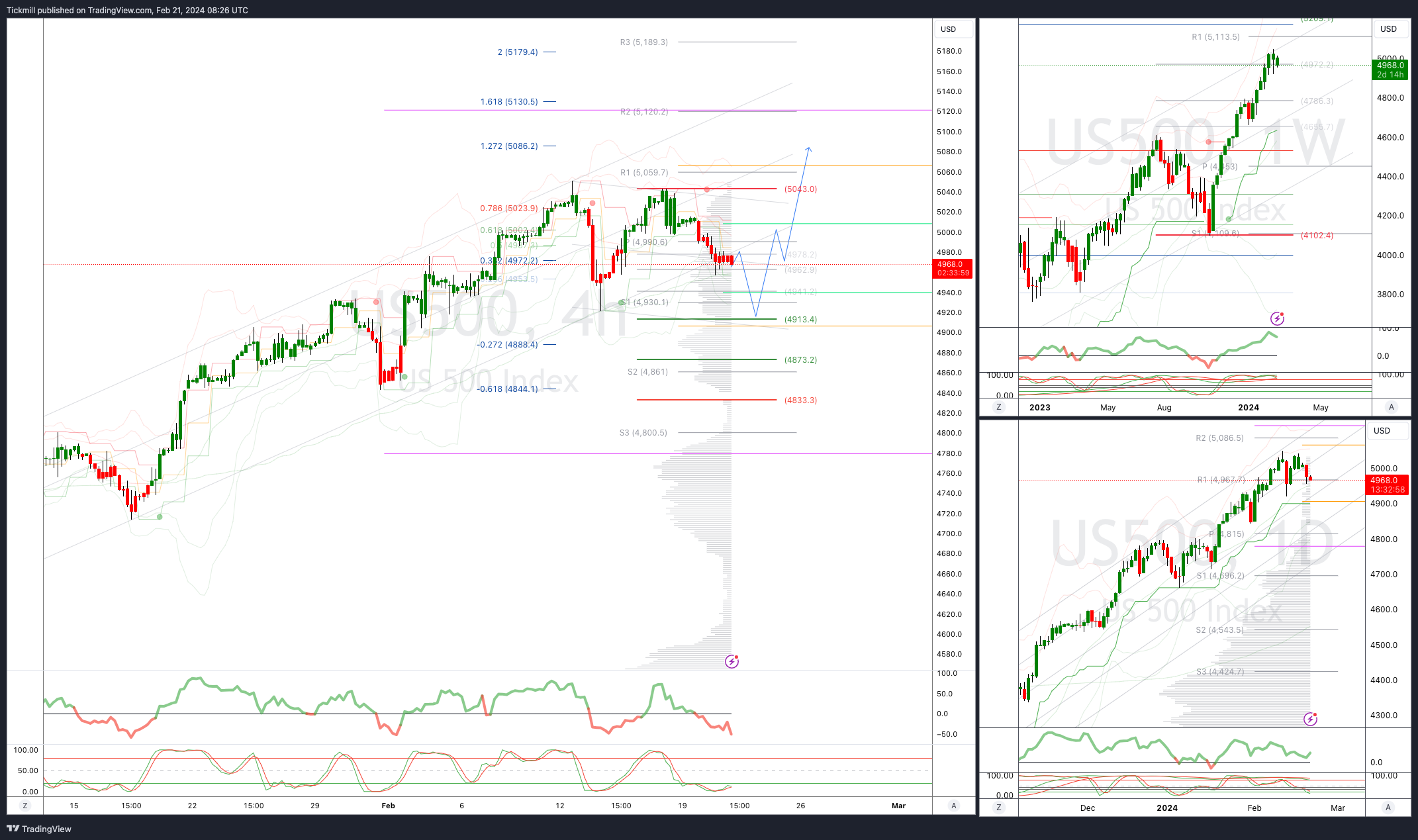

SP500 Bullish Above Bearish Below 4975

Daily VWAP bearish

Weekly VWAP bullish

Above 5043 opens 5086

Primary support 4900

Primary objective is 5120

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bullish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2429

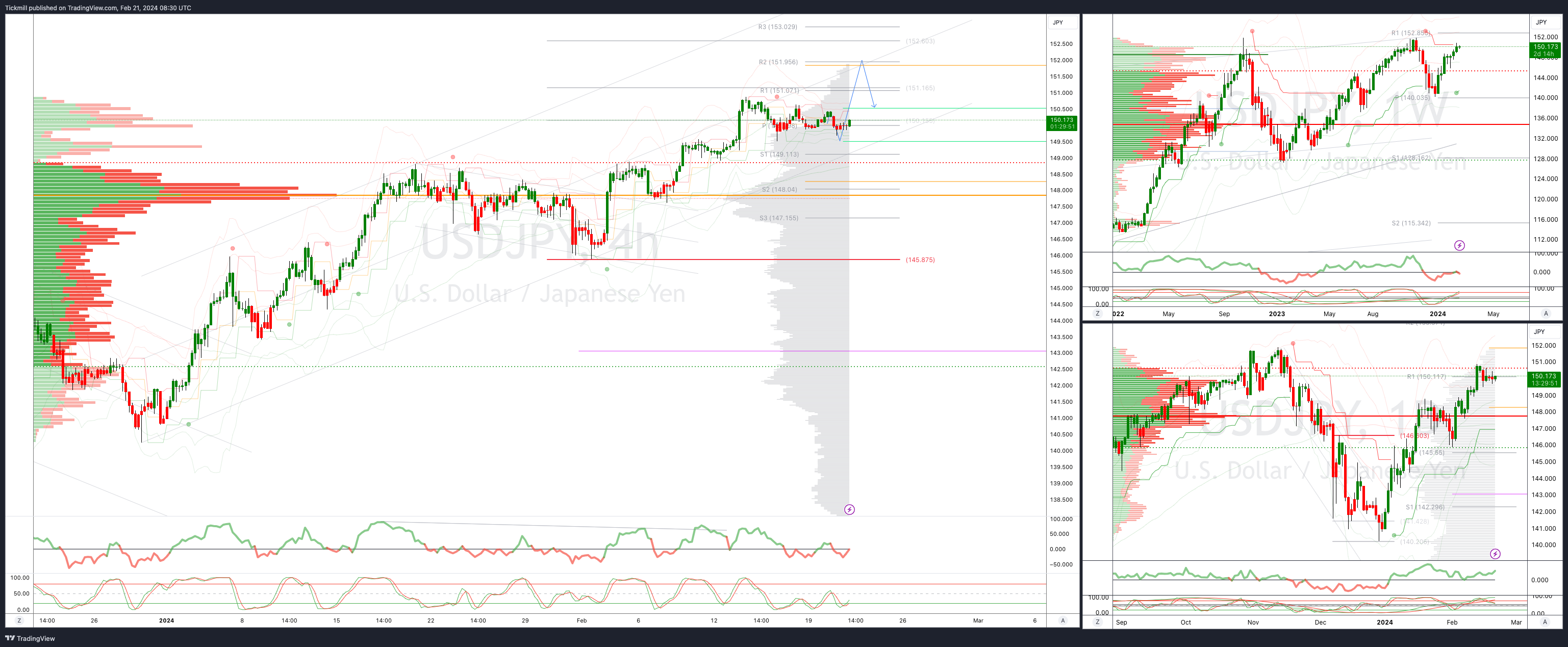

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bullish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

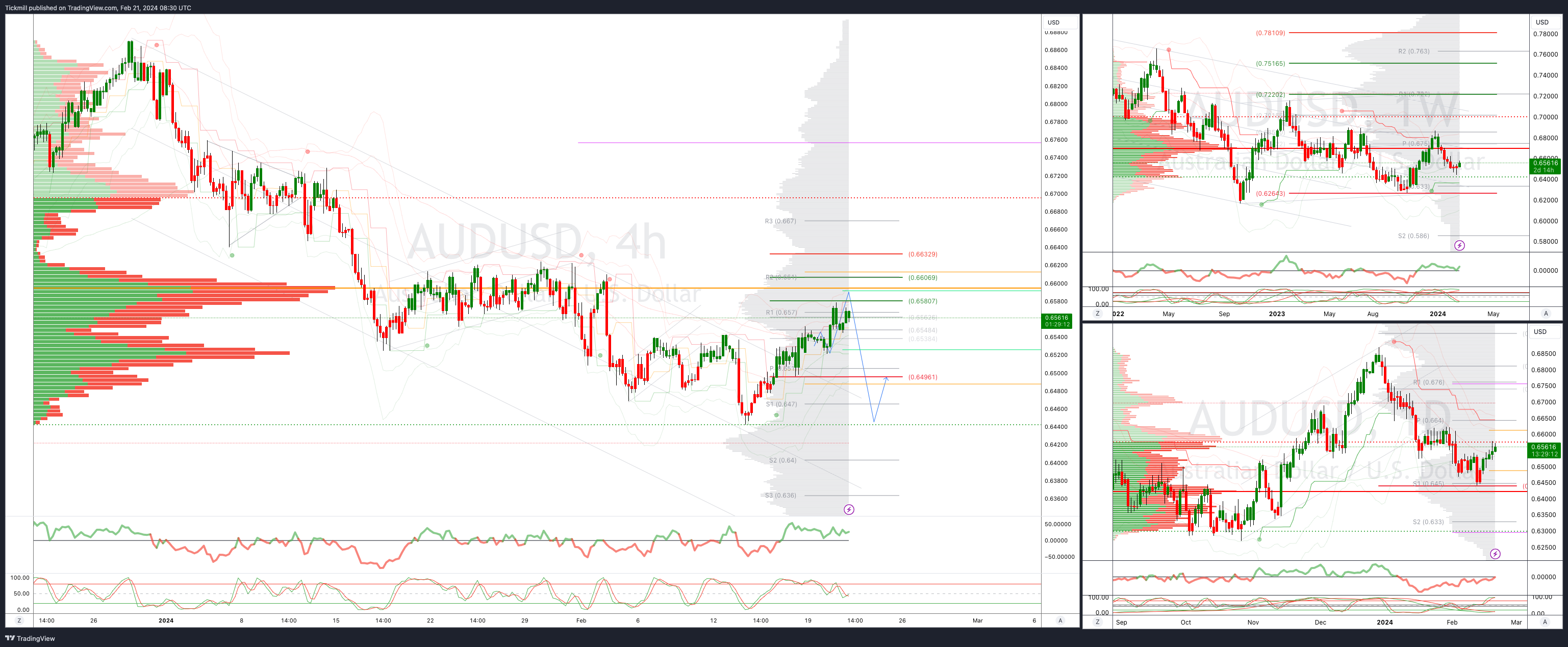

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bullish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

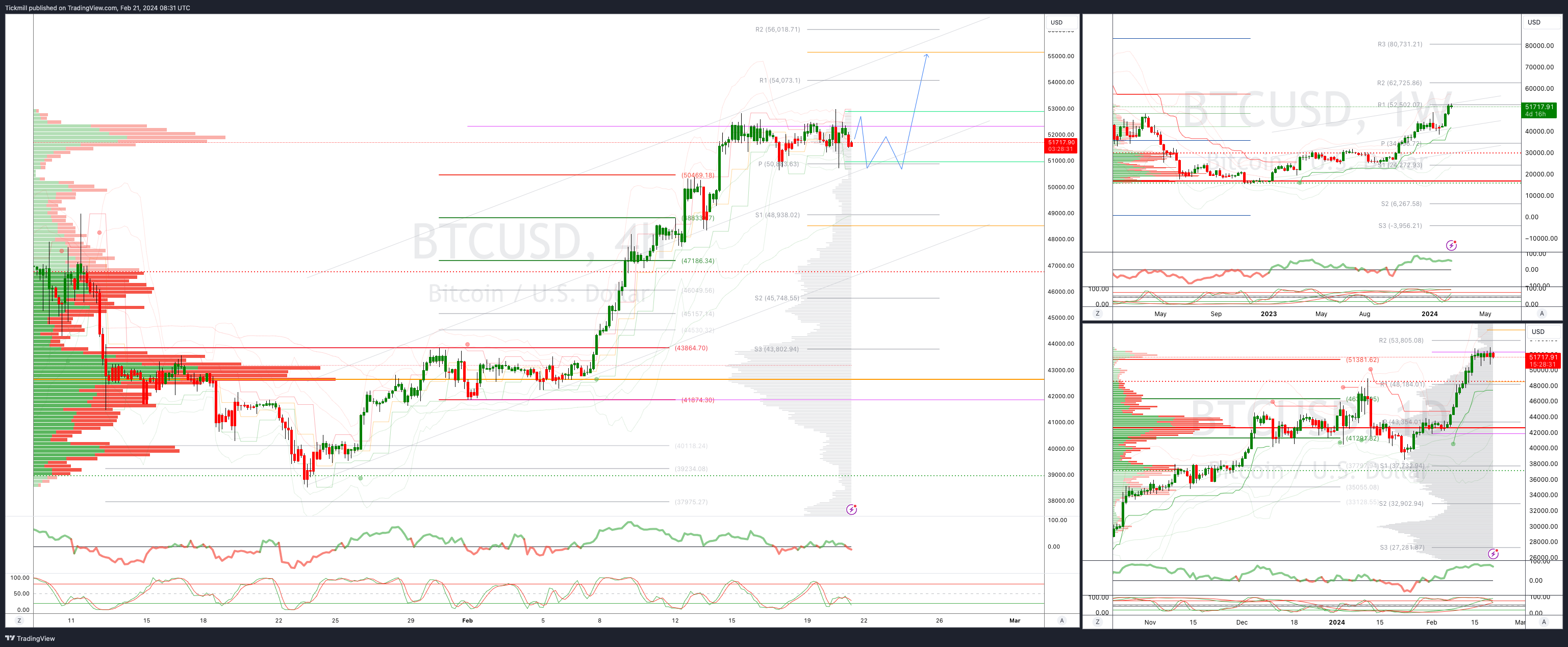

BTCUSD Bullish Above Bearish below 51000

Daily VWAP bullish

Weekly VWAP bullish

Below 48500 opens 46500

Primary support is 44390

Primary objective is 54000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!