Daily Market Outlook, February 14, 2024

Daily Market Outlook, February 14, 2024

Munnelly’s Market Minute…“US CPI Upside Surprise Leads To Selloff”

Most Asian equity indices are trading in negative territory, reflecting the downturn observed in the United States.The significant change in Federal Reserve expectations, first triggered by a strong U.S. jobs report and then reinforced by Tuesday's unexpected increase in inflation, has led to a decrease in market expectations for 2024 interest rate cuts from approximately 160 basis points at the end of last year to just under 90 basis points currently.This shift has had a ripple effect globally, with traders now anticipating only one interest rate cut from the Reserve Bank of Australia this year, compared to the previous expectation of two cuts. Furthermore, the anticipation of higher U.S. interest rates for a longer period is expected to constrain the potential for central banks in emerging markets to implement easing measures, especially those that had previously raised rates in an attempt to stabilize their currencies against a strengthening dollar.

UK January CPI held steady at 4.0%, contrary to expectations for a slight increase to 4.1%. Core inflation, excluding energy and food prices, remained at 5.1%. Higher utility and petrol prices contributed to the inflation rate, partially offset by lower food and furniture costs. A downward trend in CPI inflation is anticipated next month, aiming for the 2% target by spring. The Bank of England is likely to be cautious about premature interest rate cuts

Eurozone Q4 GDP figures are expected to confirm stagnant growth. Modest growth is forecasted for the Eurozone in Q1, with Germany expected to experience stagnation. German IFO and Eurozone flash PMI surveys will provide further insights into early 2024 economic activity. In the UK, tomorrow we are likely to see a 0.3% decline in December GDP and a 0.2% quarterly contraction in Q4 overall. BoE Governor Bailey may reiterate that any recession is likely to be shallow and emphasize reliance on positive forward-looking growth indicators.

Japan's Q4 GDP is expected to rebound with a 1.1% annualized increase following the Q3 contraction. The impact on the Bank of Japan's policy normalization decision remains uncertain, as the expected rebound may be driven by temporary factors.

Overnight Newswire Updates of Note

Japan Will Take Appropriate Actions On Forex If Needed, Kanda Says

Japan’s FinMin Suzuki: Rapid FX Moves Are Undesirable

New Zealand See’s Retail Spending Rebound In January

Germany To Lower 2024 Economic Growth Forecast, Source Says

Global Bonds Erase All Gains Since Powell’s Pivot In December

Oil Drifts Down On Sticky Inflation, Larger-Than-Exp US Crude Build

China Stocks In Hong Kong Gain, Erase Initial Post-Holiday Drop

Amazon’s Jeff Bezos Sold $4Bln In Amazon Stock Over The Past Week

AIG Earnings Beat Estimates As Firm’s Investment Income Grows

Airbnb Plans $6Bln In New Share Buybacks As It Looks To ‘Reinvent’ Itself

Lyft Shares Go On Wild Ride After An Earnings Release Error

Cairo Talks On Hostages End Without Tangible Progress

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0625 (600M), 1.0700 (1.5BLN), 1.0825 (800M)

GBP/USD: 1.2550 (550M). AUD/USD: 0.6465 (650M)

USD/JPY: 149.00 (1BLN), 150.00 (1BLN), 151.00 (900M)

On Friday, February 16, there are significant FX option strike expiries. Here are the key levels:

EUR/USD: 1.0615 (1.6 billion), 1.0670-75 (2 billion), 1.0700 (1.8 billion), 1.0750-55 (1.4 billion), 1.0800 (3.1 billion), 1.0820 (1 billion)

GBP/USD: 1.2650-60 (1.7 billion), 1.2720 (500 million)

USD/CHF: 0.8780 (800 million)

AUD/USD: 0.6400 (500 million), 0.6535 (700 million)

USD/JPY: 149.00 (1.1 billion), 150.00 (1.1 billion), 152.00 (800 million)

USD/CAD: 1.3500-05 (1.8 billion)

CFTC Data As Of 8/02/24

The British Pound had a net long position of 34,475 contracts.

The Euro had a net long position of 62,153 contracts.

The Japanese Yen had a net short position of -84,230 contracts.

Bitcoin had a net short position of -1,523 contracts.

The Swiss Franc had a net short position of -5,567 contracts.

Equity fund managers reduced their net long position in S&P 500 CME by 53,941 contracts to 912,862.

Equity fund speculators decreased their net short position in S&P 500 CME by 8,669 contracts to 423,955.

Technical & Trade Views

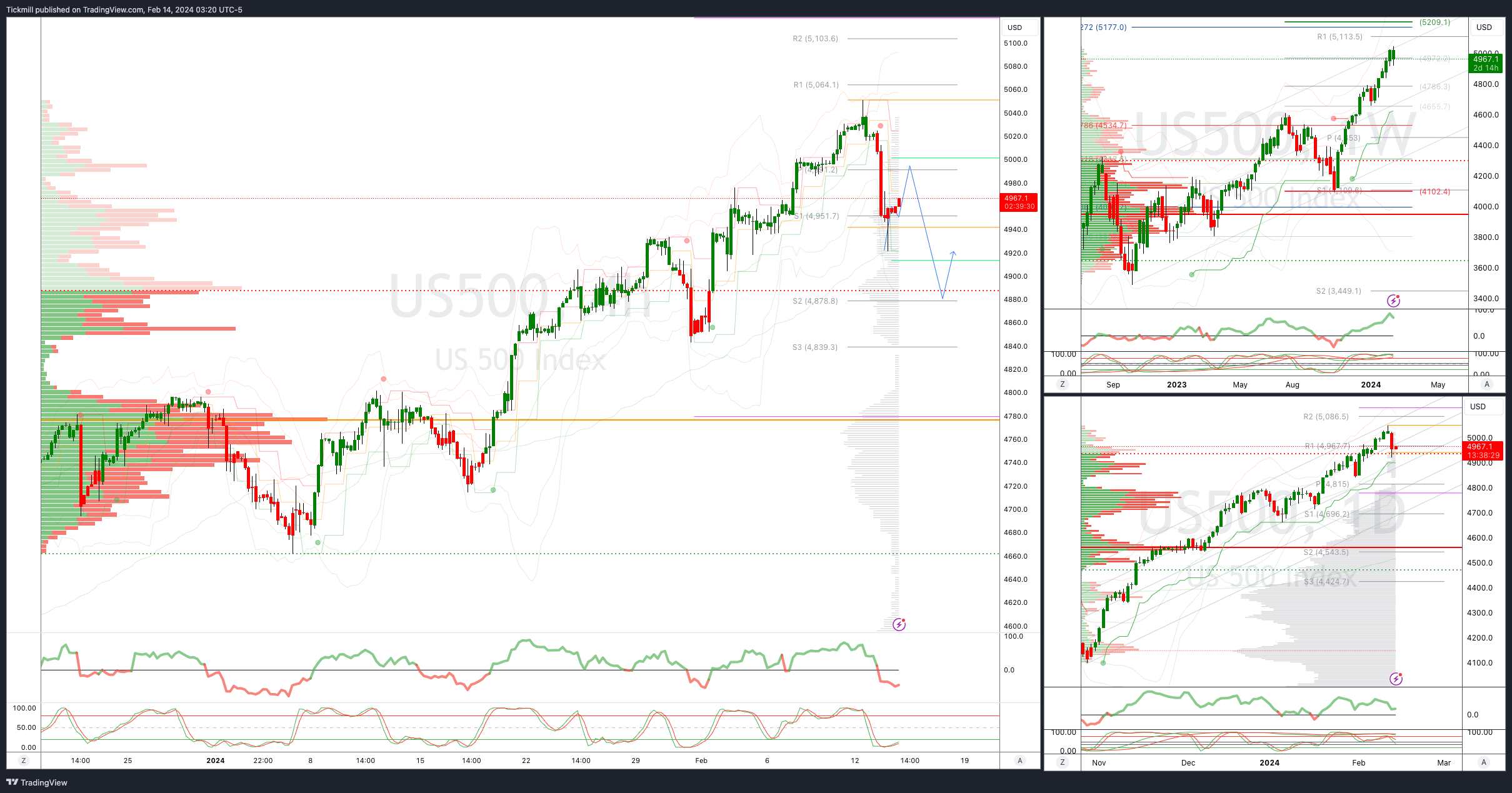

SP500 Bullish Above Bearish Below 5000

Daily VWAP bearish

Weekly VWAP bullish

Below 4920 opens 4880

Primary support 4840

Primary objective is 5060

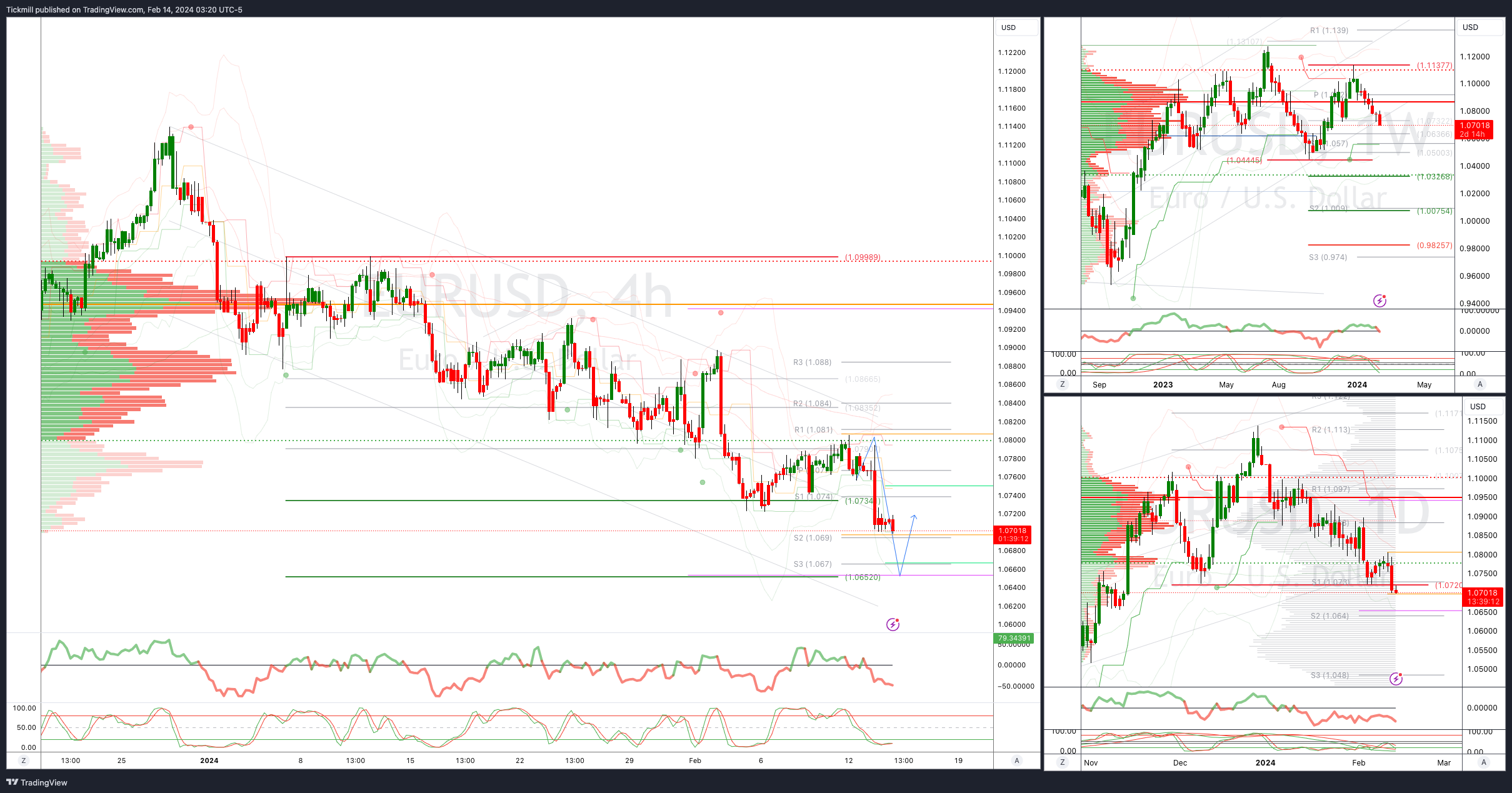

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

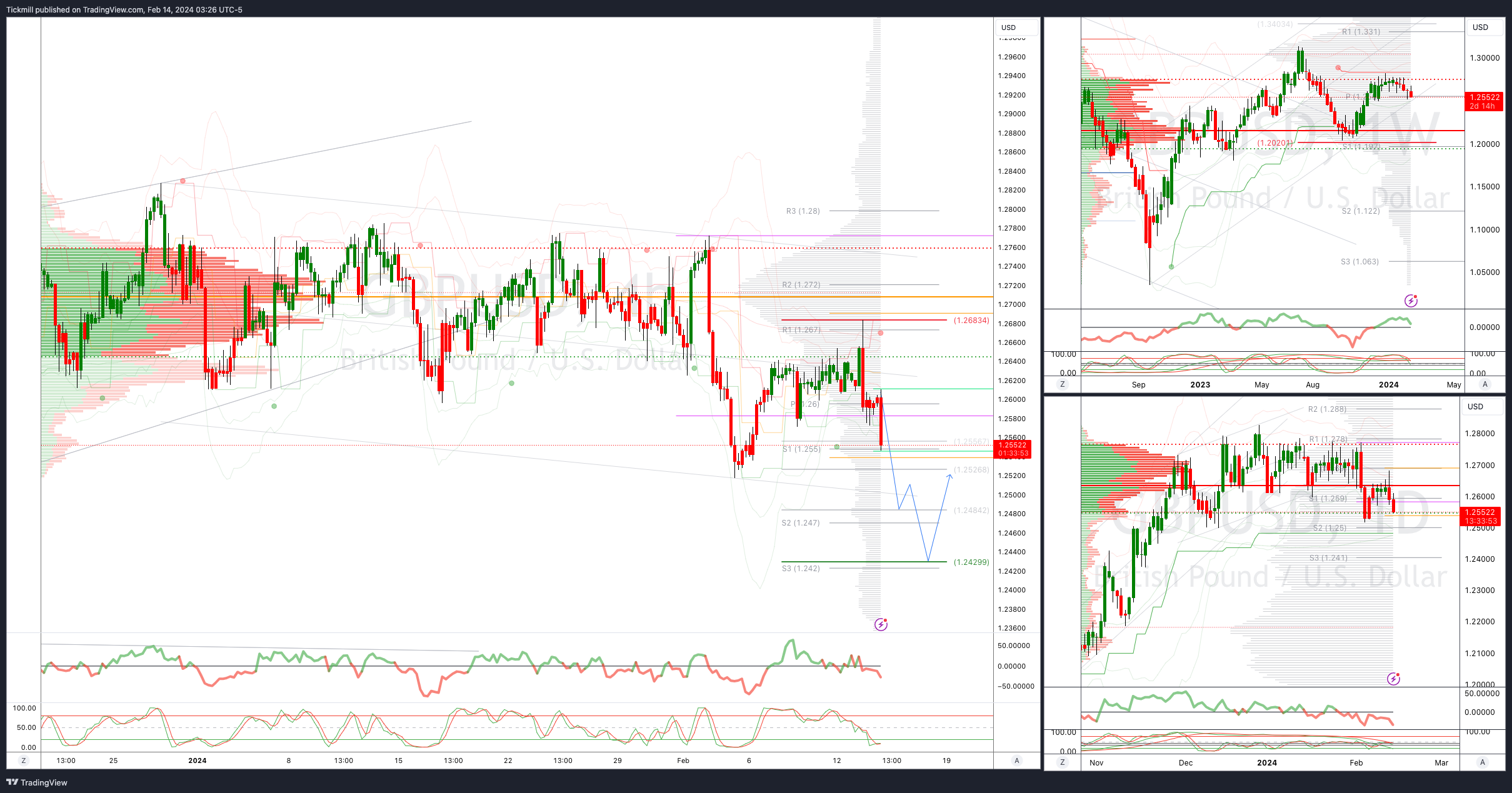

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2429

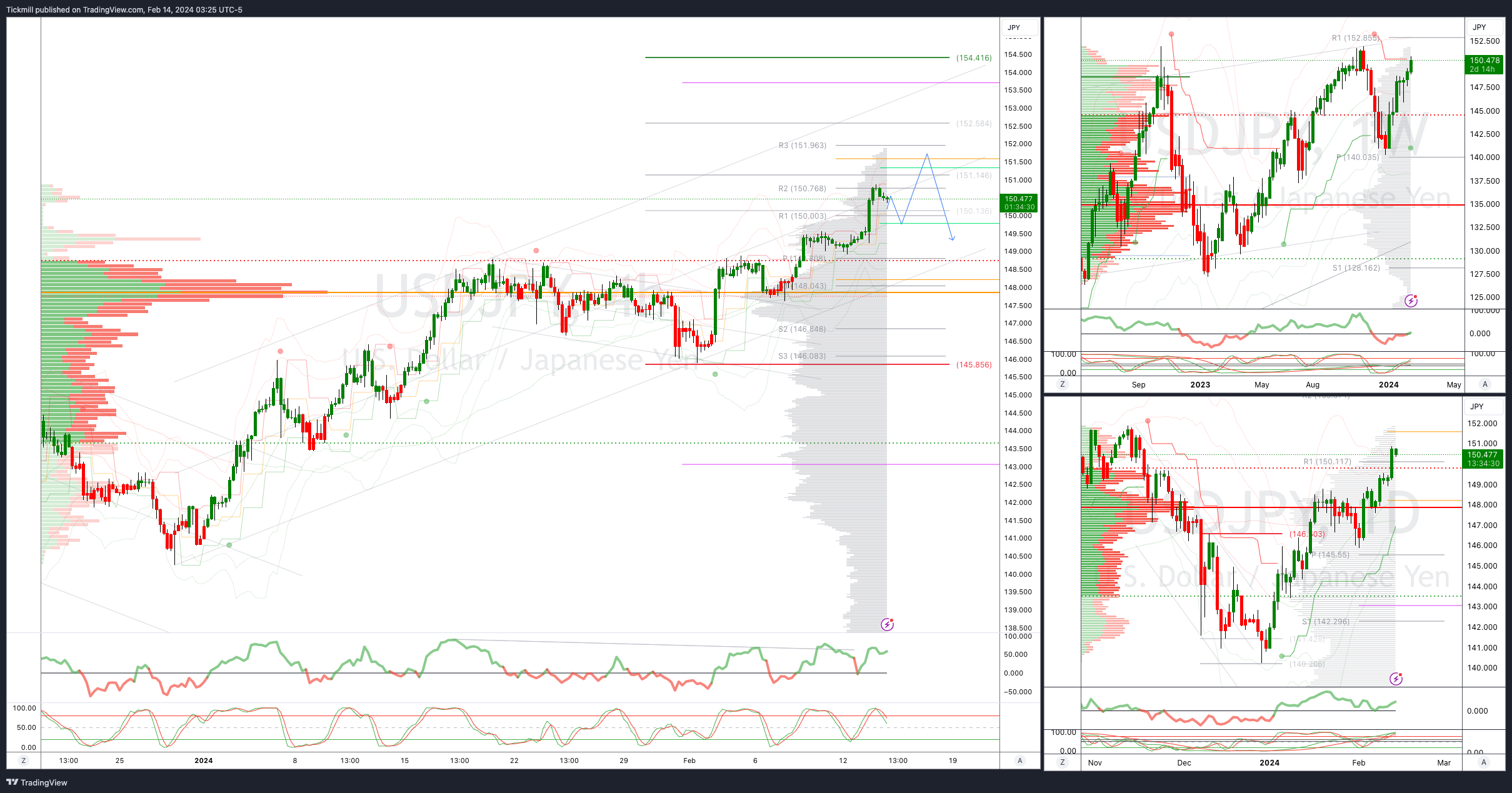

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bullish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 149.50 - Target Hit - New Pattern Emerging

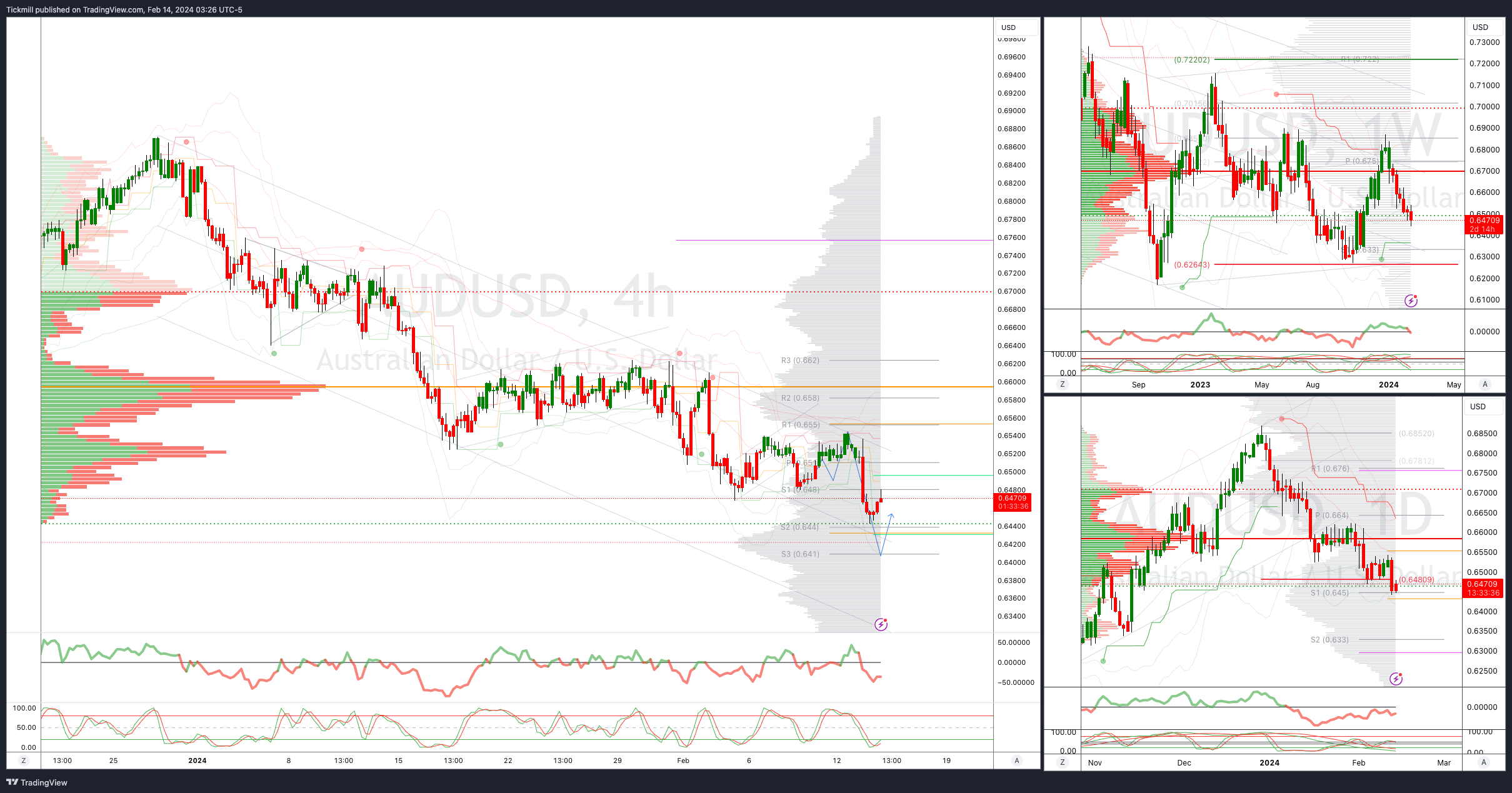

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

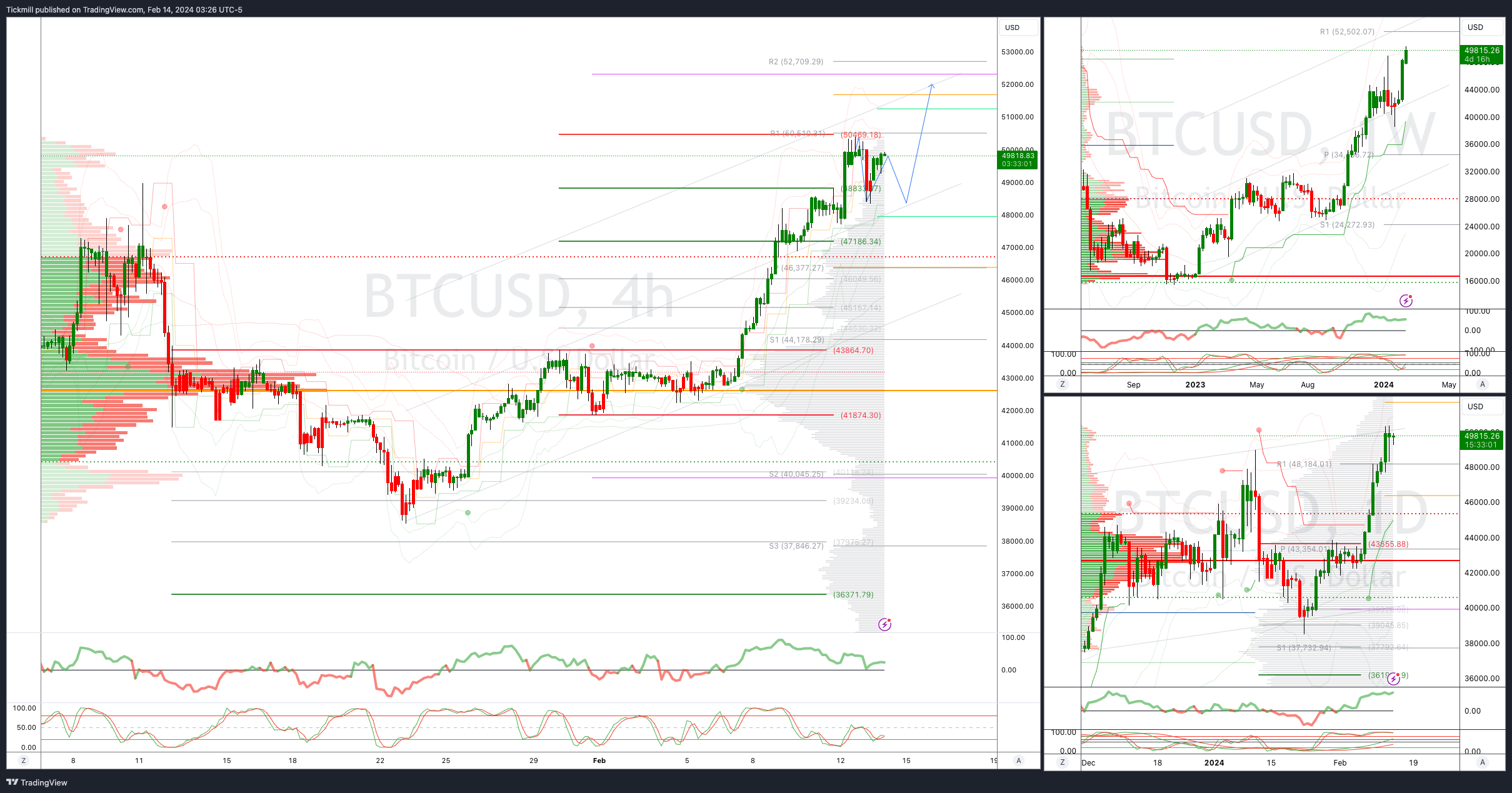

BTCUSD Bullish Above Bearish below 48500

Daily VWAP bullish

Weekly VWAP bullish

Below 46500 opens 44500

Primary support is 443900

Primary objective is 52000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!